January 2026

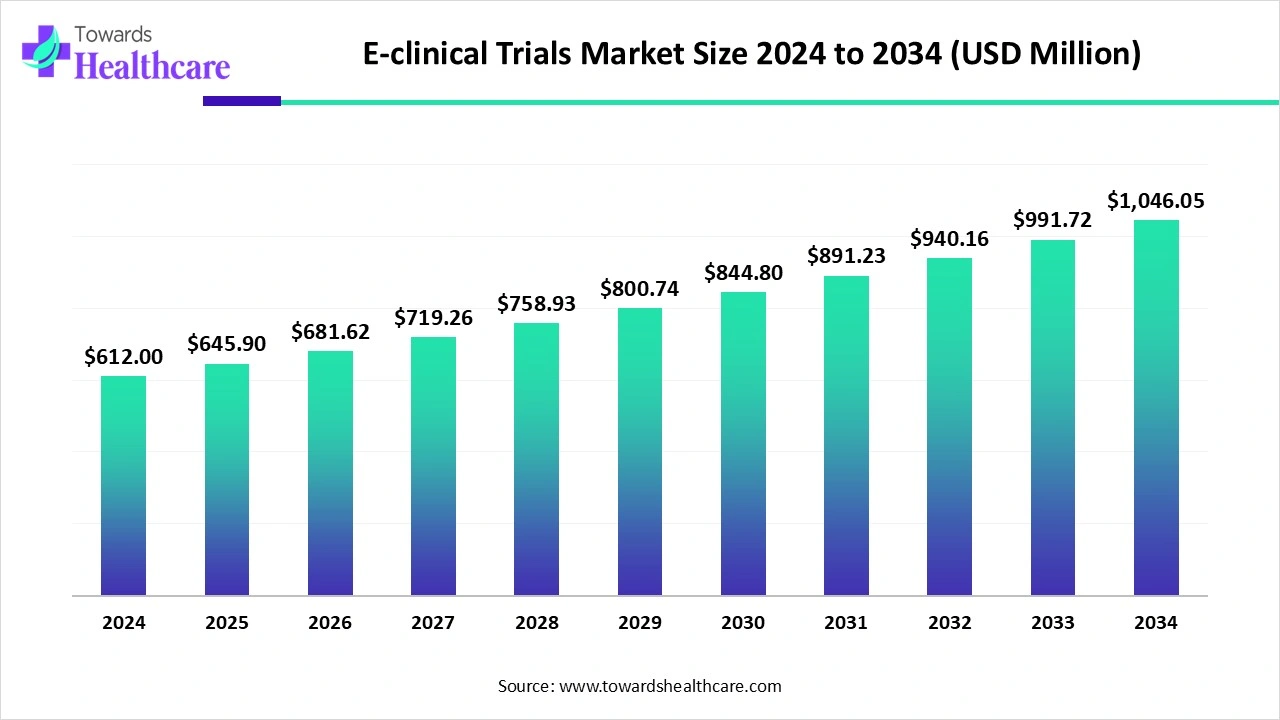

The global e-clinical trials market size is estimated at US$ 645.9 million in 2025, is projected to grow to US$ 681.69 million in 2026, and is expected to reach around US$ 1107.49 million by 2035. The market is projected to expand at a CAGR of 5.54% between 2026 and 2035.

The e-clinical trials market is expanding rapidly due to growing demand for growing demand of effective data management, real-time access, and government compliance. Increasing government support and the expansion of medical research. North America is dominated due to the presence of advanced healthcare and IT infrastructure, while the Asia Pacific is the fastest-growing region with increasing contract research organization (CROs) services.

| Table | Scope |

| Market Size in 2026 | USD 681.69 Million |

| Projected Market Size in 2035 | USD 1107.49 Million |

| CAGR (2026 - 2035) | 5.54% |

| Leading Region | North America |

| Market Segmentation | By Solution Type, By Deployment Mode, By Clinical Trial Phase, By End-User, By Region |

| Top Key Players | Medidata Solutions (Dassault Systèmes), Oracle Health Sciences, Veeva Systems, Parexel International, IQVIA, Signant Health, eClinicalWorks, Clario (ERT), Castor EDC, ArisGlobal, Medrio, Anju Software, Bioclinica, DataTrak International, MedNet Solutions, Florence Healthcare, OpenClinica, ClinOne, Verge HealthTech, TrialSpark |

The e-clinical trials market refers to technology-enabled platforms and software solutions that digitize and streamline the design, conduct, and management of clinical trials. These systems replace traditional paper-based processes with electronic data capture (EDC), clinical trial management systems (CTMS), electronic clinical outcome assessments (eCOA), randomization and trial supply management (RTSM), and fully integrated decentralized clinical trial (DCT) platforms. Key benefits include faster data collection, improved accuracy, regulatory compliance, real-time analytics, and reduced trial costs. E-Clinical solutions are used across all phases of drug and device trials by pharmaceutical companies, CROs, and academic institutions. Rising R&D expenditure, decentralized trial adoption, patient-centric recruitment methods, and increasing cloud integration drive market expansion worldwide.

For Instance,

Increasing the government support related to AI-driven clinical trials, which drives the growth of the market.

For instance,

Increasing trend of data integration, supporting faster trial planning and improving adoption of e-clinical technologies, which contribute to the growth of the market.

For Instance,

Integration of AI in e-clinical trials drives the growth of the market. AI-driven technology has transformed groundbreaking ways of collecting information, bio-simulation, and early diagnosis of disease for clinical trials. AI-based e-clinical platforms incorporate with ePRO, CTMS, RTSM, eConsent, EDC, eSource, CSR automation, eProtocol Automation, and eTMF to modernise clinical trials. AI-driven trials to take active and decisive actions to enhance patient and clinical trial results. AI-based technology is poised to transform clinical trial methodology and design, providing new opportunities for improving effectiveness, precision, and patient engagement. AI-driven technology supports in designing efficient and adaptive clinical trials by predicting various situations and optimizing resource allocation.

Increasing Growth of Decentralized Clinical Trials (DCTs)

DCTs are progressively popular for many reasons. Technological advancements ease the transfer, collection, and storage of electronic data. Both patients and providers are becoming more tech-savvy and comfortable with telemedicine. DCTs can lower long-term costs and time by reducing or eliminating the need for resources typical of traditional sites. Nevertheless, initial investments in technology and training may be required. By utilizing innovative technologies, DCTs enhance access and convenience for trial participants outside traditional clinical environments, which in turn fuels the growth of the e-clinical trials market.

Major Challenges of e-Clinical Trials

e-Clinical technologies face resistance due to the familiarity of traditional paper-based systems used in clinical trials for decades. Transitioning from paper to electronic systems involves substantial changes in trial procedures and can be difficult for professionals used to conventional methods, which hampers the expansion of the e-clinical trials market.

Recent Advancements in Big Data Technology

Big data is transforming clinical trials by tackling issues such as recruitment delays, regulatory hurdles, and capacity constraints. Its capabilities for real-time analytics, predictive modeling, and regional collaborations boost efficiency and reliability. Although challenges like data privacy and interoperability remain, new data-sharing frameworks offer a promising future for precision medicine. From patient recruitment to post-trial evaluation, Big Data is revolutionizing every phase of clinical trials, creating opportunities in the e-clinical trials market.

For Instance,

By solution type, the electronic data capture (EDC) segment led the e-clinical trials market, as this technology has transformed data gathering, providing a more efficient alternative that improves both the speed and quality of medical research. EDC in clinical trials includes replacing the outdated method of data entry with electronic systems that enable automated data collection, thereby confirming accuracy and efficiency. It offers a digital platform that streamlines the whole process.

The cloud-based subsegment is dominant in the electronic data capture (EDC) segment as cloud-based EDC systems allow real-time data sharing among the investigators, clinical staff, and other stakeholders. This confirms that it always has access to the most recent data, improving decision-making and the progress of the research.

On the other hand, the decentralized clinical trial (DCT) platforms segment is projected to experience the fastest CAGR in the e-clinical trials market from 2025 to 2034, as this type of trial offers a number of advantages to researchers, facilitating recruitment challenges, enhancing data quality, and reducing the expenses of administering the trial. DCTs can offer robust data and a huge diverse pool of participants than an outdated trial.

The telemedicine subsegment is dominant in the decentralized clinical trial platforms segment as it helps enhance access to care, particularly for patients in rural and underserved regions. Telemedicine supports improving continuity of care by offering more frequent and regular contact among patients and their care providers. It enhances patient satisfaction by offering a more convenient and targeted health experience.

By deployment mode, the web-based solutions segment held the major share of the e-clinical trials market in 2024, as incessant monitoring for chronically diseased patients, advanced quality care and feedback, lower hospitalization time, growing medical capacity, and lower medical cost. The use of web-based applications is more prevalent in clinical research and healthcare settings.

The cloud-based solutions segment is projected to grow at the fastest CAGR from 2025 to 2034, as these platforms scale simply to meet the increasing needs of clinical research. This supports teams in avoiding both overinvestment in infrastructure and shortages that occur during rapid increases in information volume. This flexibility offers organizations solutions that adapt to their particular requirements.

By clinical phase, the phase III segment led the e-clinical trials market in 2024, as phase III trials offer significant evidence of the efficacy of the drug. They support researchers in assessing the ability of the drugs to achieve the desired results in a massive patient population, by including several participants, phase III trials offer a more precise representation of the effectiveness of the drugs. Phase III trials play a significant role in the hopeful adoption of the drug by medical care providers.

The phase II segment is projected to experience the fastest CAGR from 2025 to 2034, as phase II clinical trial is conducted to assess the efficacy and safety of a novel drug or drug combination for a specific indication. Phase II trials are generally randomized, controlled research evaluating the efficacy of a drug and involve participants selected using narrow criteria, to allow close monitoring of a comparatively homogenous patient population.

By end user, the pharmaceutical companies segment led the e-clinical trials market in 2024, as e-clinical trials improve the accuracy and quality of clinical data by enabling real-time capture and rapid validation of the data. eSource confirms that data is captured directly contemporaneously. This predominantly lowers the need for physical data entry, reducing transcription errors and resulting in much higher data accuracy compared to outdated paper-based systems, which are susceptible to human error during the transcription procedure.

On the other hand, the contract research organizations (CROs) segment is projected to experience the fastest CAGR from 2025 to 2034, as integrated and interconnected clinical trials platforms provide a novel level of effectiveness, enhanced government compliance, and connectivity to CROs. The integrating system is directly linked to sponsors and CROs for real-time document and data conversion and monitoring.

North America was dominant in the market in 2024, as the growing diversity of the population profile in North America is predictable to improve clinical trials for novel or rare diseases. The increasing accessibility to oncology clinical trial sites and clinical investigators is very profitable due to the experience of clinical trials among medical professionals, medical investigators, and patient populations, which contributes to the growth of the market.

For Instance,

In the U.S., clinical trials are increasing in the U.S. due to an increasing cases of chronic diseases, growing investment from the government and private sector in R&D, and the demand for targeted medicine, which needs rigorous testing of novel treatments.

Increasing clinical trials in Canada, for instance, it captures 4% of worldwide clinical trials, it is fourth in terms of clinical trial sites, and is the G7 leader in clinical trial productivity. The Canadian population is dense in the urban areas where research clinics are situated, which increases the recruitment efforts; all these factors drive the growth of the market.

Asia Pacific is the fastest-growing region in the market in the forecast period, increasing growth of conducting clinical trials for infectious diseases, due to growing research for novel and operative therapies. The rising prevalence of disease due to the high density of the aging population, poor awareness and education, less healthcare investment, various environmental factors, and others, drives the growth of the market.

R&D processes include electronic systems that have been applied for e-clinical trial implementation procedures, like randomization and data entry.

Key Players: Syneos Health, Labcorp, and Medpace

e-Clinical trials involve the application of electronic systems for the management of data, monitoring of patients, and study design to increase efficiency and speed in the clinical trial technology, which includes phases of planning, implementation, patient recruitment, and analysis of data.

Key Players: Medidata, Oracle, and Veeva Systems

e-Clinical trials provide never-ending patient services, including the direct collection of clinical research data by electronic data collection or e-CRF, internet-driven study clinical laboratory services, and departmental supportive systems.

Key Players: IQVIA, Parexel, and ICON

In September 2025, Barry Lake, co-founder and president, RealTime-Devana, stated, Sponsors and CROs finally have access to the right data at the right time - patient screening and enrollment trends, feasibility turnaround times, contract execution speeds, and more.

By Solution Type

By Deployment Mode

By Clinical Trial Phase

By End-User

By Region

January 2026

January 2026

January 2026

January 2026