February 2026

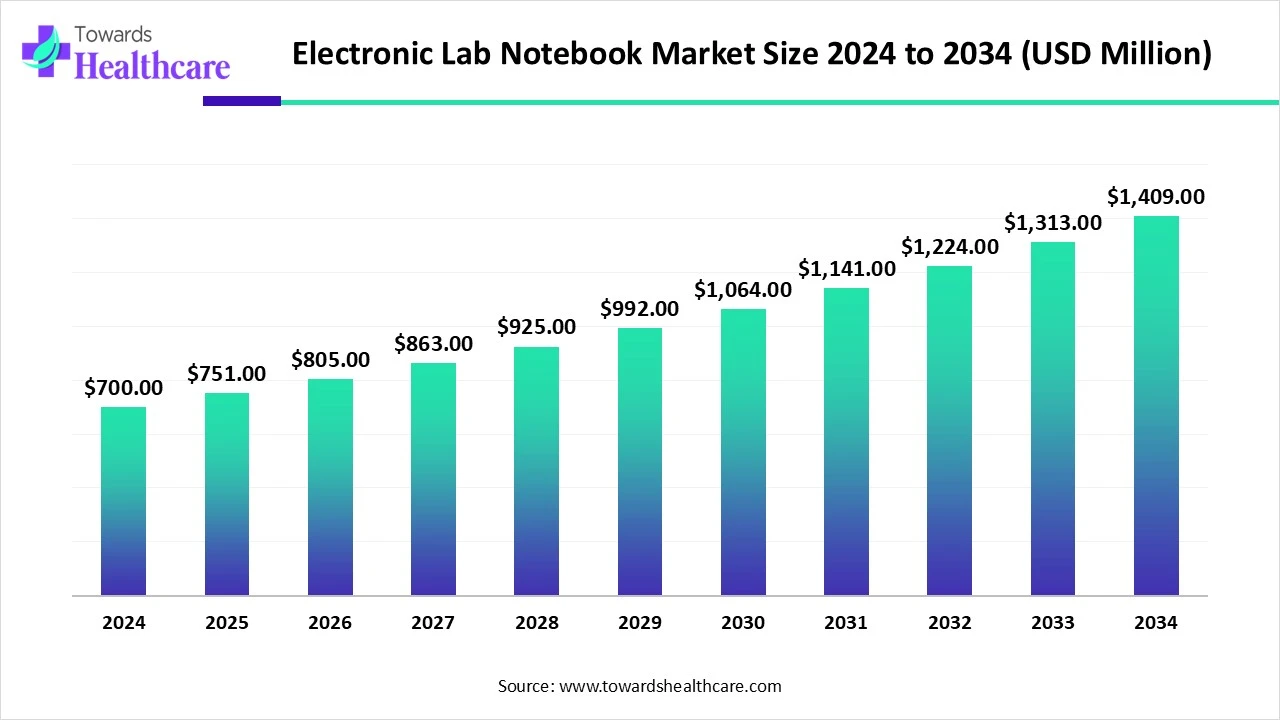

The global electronic lab notebook market size is calculated at USD 750.82 million in 2025, grew to USD 805.33 million in 2026, and is projected to reach around USD 1513.26 million by 2035. The market is expanding at a CAGR of 7.26% between 2026 and 2035.

The electronic lab notebook market is primarily driven by increasing investments in research activities and the rising adoption of advanced technologies. An electronic lab notebook (ELN) enables researchers to store and access complex research data from anywhere and at any time. Prominent players collaborate to access advanced technologies and develop innovative products. Artificial intelligence (AI) plays a vital role in automating tasks and simplifying user experience. The future looks promising, with the integration of ELN into laboratory information management systems (LIMS).

The electronic lab notebook market involves software solutions designed to replace traditional paper lab notebooks. ELNs enable researchers, scientists, and laboratory personnel to digitally document, organize, and share experimental data and protocols in a secure, searchable, and compliant environment. Key benefits include enhanced data integrity, collaboration, regulatory compliance (e.g., 21 CFR Part 11), and integration with laboratory instruments and data management systems. The market is driven by increasing R&D investments, digitization trends in laboratories, and rising regulatory demands for traceable data.

AI plays a crucial role in ELNs by introducing automation, thereby enhancing efficiency and accuracy. AI and machine learning (ML) algorithms can analyze vast amounts of data and suggest optimal formulations or process parameters. AI-enabled ELNs provide real-time updates to researchers, accelerating innovation and reducing duplicate efforts. They can automatically generate compliance documentation. They can help optimize stock levels, predict usage patterns, and suggest alternative materials based on chemical properties.

Growing Digitalization

The growing digitalization is increasing the use of various electronic systems to offer enhanced data accuracy, regulatory compliance, and traceability, which is increasing the adoption of the electronic lab notebook.

Expanding Applications

The growing applications in genomic, clinical workflows, and chemistry are increasing the use of electronic lab notebooks across pharmaceutical, biotech, food, chemical, and environmental sectors.

Increasing Innovations

To enhance the experimental planning, scalability, data interpretation, remote access, and workflow automation, the companies are integrating a cloud-based solution with an electronic lab notebook.

Growing Research Activities

The major growth factor for the electronic lab notebook market is the growing research and development activities. Researchers focus on developing novel pharmaceuticals, biologics, and medical devices to improve the quality of life of patients. Advancements in genomics, proteomics, cell culture, and synthetic biology fields simplify research activities, leading to the development of more effective products. The increasing investments by government and private organizations help conduct research activities. ELNs assist researchers in recording and storing every task and experimental data, saving a lot of time.

High Cost

ELNs have a high installation cost, and researchers also have to renew the software license annually. Many solutions have varying pricing models that encompass upfront costs, maintenance fees, subscription fees, and additional costs for customization and integration. This limits the affordability of many research institutions in low- and middle-income countries, restricting market growth.

What is the Future of the Electronic Lab Notebook Market?

The market future is promising, driven by the integration of ELN into LIMS. ELNs assist in documentation and data organization, while LIMS facilitates sample tracking and workflow automation. Integrating these software amplifies their functionalities, helping researchers in data management, traceability, and compliance. This provides real-time updates between systems, enabling lab managers to assess research progress and operational logistics. ELN and LIMS also help labs meet regulatory compliance with minimal effort. By adopting integrated software, researchers can eliminate manual errors and ensure a smooth and unified experience.

| Table | Scope |

| Market Size in 2026 | USD 805.33 Million |

| Projected Market Size in 2035 | USD 1513.26 Million |

| CAGR (2025 - 2034) | 7.26% |

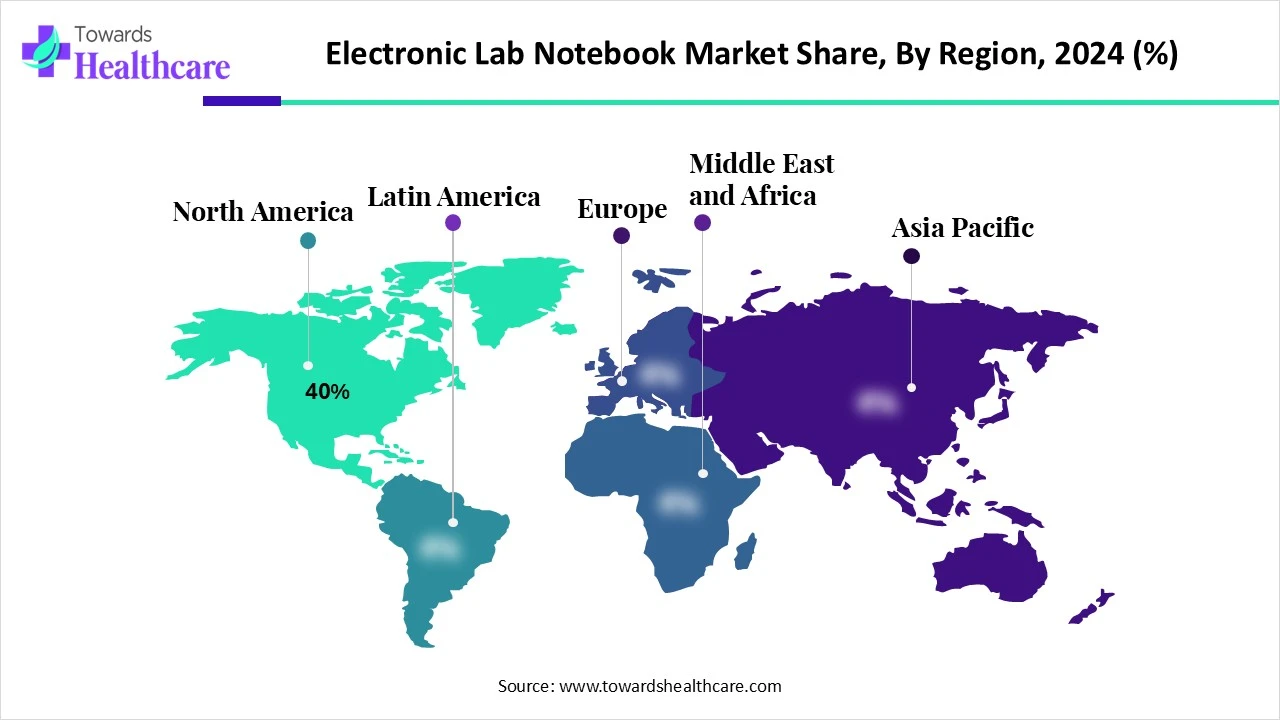

| Leading Region | North America by 40% |

| Historical Data | 2020 - 2023 |

| Base Year | 2025 |

| Forecast Period | 2026 - 2035 |

| Measurable Values | USD Millions/Units/Volume |

| Market Segmentation | By Deployment Mode, By End-User, By Region |

| Top Key Players | Thermo Fisher Scientific, PerkinElmer, LabArchives, Agilent Technologies, Dotmatics (Part of Insight Partners), Benchling, IDBS (Biovia, Dassault Systèmes), BIOVIA, LabWare, LabVantage Solutions, SciNote, Accelrys (Dassault Systèmes), Arxspan (BioBright), eLabJournal (by BioData), RSpace, OneLab (Agilent), Labfolder, ChemAxon, Eureka Informatics, ValGenesis |

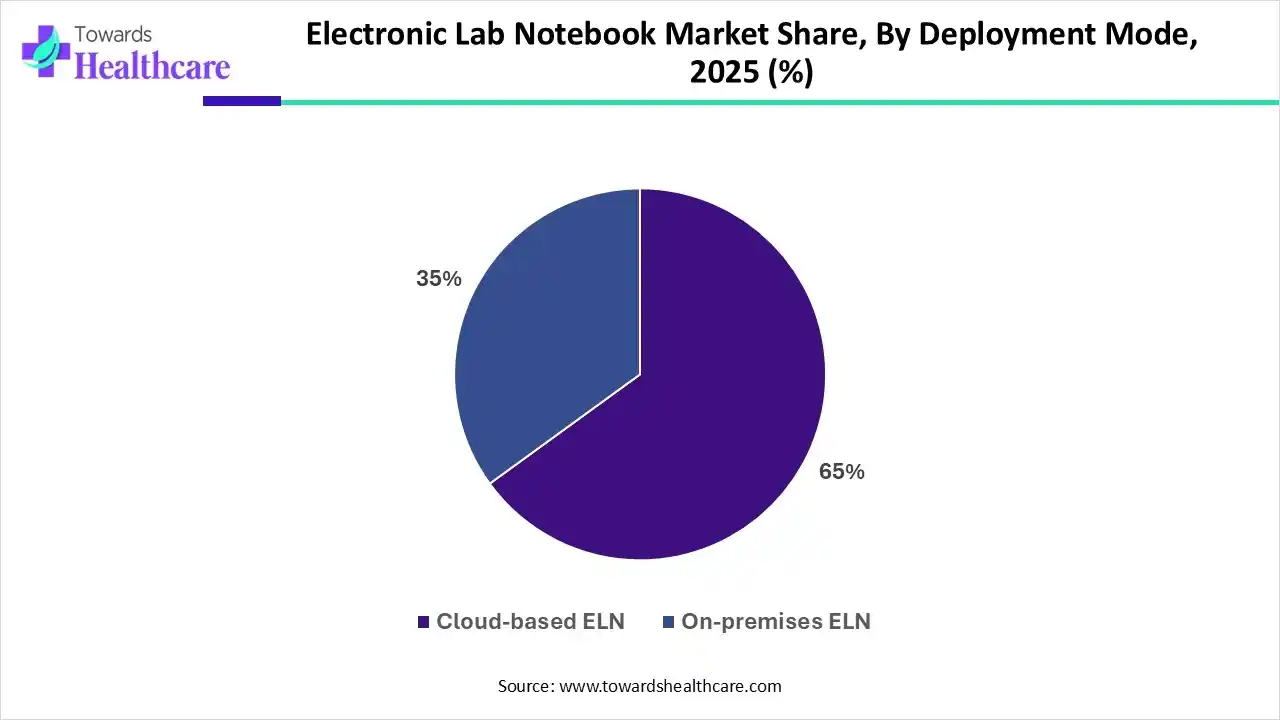

Which Deployment Mode Segment Dominated the Electronic Lab Notebook Market?

By deployment mode, the cloud-based ELN segment held a dominant presence in the market by 65% in 2025 and is expected to expand rapidly in the market in the coming years. This is due to the ability of cloud-based ELN to access data from anywhere and at any time. Cloud-based ELNs eliminate the need for a specialized infrastructure to install hardware, thereby reducing cost. They can store a large amount of data and help researchers collaborate, irrespective of geographical barriers. They offer numerous benefits, including rapid deployment, enhanced security, and budget-friendly solutions.

| Segment | Share 2025 (%) |

| Pharmaceutical & Biotechnology Companies | 48% |

| Academic & Research Institutes | 20% |

| Contract Research Organizations (CROs) | 15% |

| Chemical & Material Companies | 10% |

| Food & Beverage Companies | 7% |

How the Pharmaceutical & Biotechnology Companies Segment Led the Electronic Lab Notebook Market?

By end-user, the pharmaceutical & biotechnology companies segment led the global market by 48% in 2025. The segmental growth is attributed to the favorable research infrastructure and suitable capital investments. This enables them to adopt advanced technologies and stay competitive in the market. The growing research activities in pharmaceutical and biotech companies to develop innovative products are augmenting the segment’s growth. The increasing number of pharma & biotech startups potentiates the demand for ELNs.

By end-user, the food & beverage companies segment is expected to witness the fastest growth in the electronic lab notebook market over the forecast period. Food & beverage (F&B) companies are increasingly adopting ELNs to streamline their laboratory workflows and introduce digitization. ELN systems support throughout the entire product lifecycle, enabling F&B companies to accelerate time to market. They optimize lab processes, assist in R&D for new product discovery, and simplify quality control initiatives.

North America dominated the market share by 40%, in 2024. The availability of state-of-the-art research and development facilities, the presence of key players, and favorable government support are the major growth factors of the market in North America. Favorable regulatory policies and the rising need for digitization propel the market. The market in North America is also driven by the strong presence of major pharmaceutical giants, CROs, and academic institutions.

U.S. Market Trends

Key players, such as Thermo Fisher Scientific, Agilent Technologies, and BIOVIA, provide integrated ELN solutions to various institutions and laboratories in the U.S. Another company, SciSure, headquartered in the U.S., reports that its ELN is trusted by over 550,000 scientists, EHS, and LabOps globally in more than 40,000 laboratories. In June 2024, the Office of Intramural Research mandated the use of electronic resources to document new and ongoing research as part of the NIH IRP Electronic Lab Notebook Policy.

Canada Market Trends

In January 2025, AstraZeneca announced an investment of CAD 820 million in Canada to develop a state-of-the-art office facility in the Greater Toronto Area, Ontario. This contributes to AstraZeneca’s global ambition to achieve USD 80 billion in total revenue and to bring 20 new medicines to patients around the world by 2030.

Asia-Pacific is expected to grow at the fastest CAGR in the electronic lab notebook market during the forecast period. The rising adoption of advanced technologies and increasing R&D investments drive the market. The growing number of pharma & biotech startups and venture capital investments support the installation of ELNs. The burgeoning pharma and biotech sectors and the increasing awareness of digital products also contribute to market growth.

China Market Trends

China is emerging as a global leader in pharmaceutical innovation. China is home to more than 3,060 life sciences startups, of which 1,680 raised approximately $40.5 billion in venture capital and private equity. The Chinese pharmaceutical companies contributed to nearly one-third of the total new medicines licensed by international pharmaceutical companies in 2024.

India Market Trends

India’s BioEconomy represents a remarkable journey of innovation and growth. It generated a value of $151 billion in 2023, which is attributed to the increasing number of startups. India reported 1,776 biotech and life science startups in 2023. The Indian government’s “Promotion of Research and Innovation in Pharma MedTech sector (PRIP)” aims to transform pharma R&D with a budget of Rs 5,000 crores.

Europe is expected to grow at a considerable CAGR in the electronic lab notebook market in the upcoming period. The increasing research activities and strong adoption of ELNs in pharmaceutical hubs and academic centers boost the market. Government organizations support the development and deployment of ELNs in European research institutions and companies. They provide funding for conducting research activities and adopting digital tools in lab workflows.

Germany Market Trends

Germany has the fourth-largest pharmaceutical market in the world and is the largest European market. The German government partners with the U.S. to transform the digital economy by creating a digital ministry. It has also launched the “Strategy Paper 4.0 - Improving the General Conditions for the Pharmaceutical Sector in Germany”.

UK Market Trends

There are around 2,947 active life science companies in the UK. The UK government launched a new Life Sciences Sector Plan to strengthen the economy and modernize the National Health Service. It involves major funding, including £600 million in health data research, £650 million for Genomics England, and £354 million for Our Future Health. It aims to reduce regulatory barriers and speed up innovation.

MEA is expected to grow significantly in the electronic lab notebook market during the forecast period, due to growing R&D investments. The expanding digital lab infrastructure is also increasing its adoption rates. Their increasing applications in the healthcare, industries, and institutes are also increasing their use for various research and experimental applications, which is enhancing the market growth.

Saudi Arabia Electronic Lab Notebook Market Trends

Saudi Arabia is experiencing a growth in the laboratory digital transformation, which is increasing the use of electronic lab notebooks for data management and the enhancement of workflow efficiency. At the same time, the growing government initiatives are also encouraging their adoption and innovations.

South America is expected to grow significantly in the electronic lab notebook market during the forecast period, due to growing R&D activities. The increasing investments and growing innovations are also increasing their adoption rates, where the companies are also collaborating to develop new cloud-based solutions, encouraging their use across the healthcare sector and promoting market growth.

Brazil Electronic Lab Notebook Market Trends

The growing R&D investments and increasing innovations are increasing the use of electronic lab notebooks across Brazil. Furthermore, the growing demand for digital documentation and maintaining data integrity across various sectors is also increasing their adoption rates. Additionally, growing applications are also encouraging their use in different sectors.

| Companies | Headquarters | Electronic Lab Notebooks |

| Dotmatics | Boston, U.S. | Dotamatics ELN |

| Benchling | San Francisco, U.S. | Benchling ELN |

| Revvity Signals | Waltham, U.S. | Signals Notebook |

| IDBS (Danaher) | Woking, UK | E-WorkBook |

| LabArchives | Carlsbad, U.S. | LabArchives ELN |

| Dassault Systemes | Velizy Villacoublay, France | BIOVIA Notebook |

| Thermo Fisher Scientific | Waltham, U.S. | Labguru and Core ELN |

| LabVantage Solutions | Bridgewater, U.S. | LabVantage ELN |

| Sapio Sciences | Baltimore, U.S. | Sapio ELN |

| Agilent Technologies | Santa Clara, U.S. | Aglient ELN |

Kevin Cramer, Founder & CEO of Sapio Sciences, commented that Science-aware AI is designed to simplify the complexities of scientific research and the usage of its LIMS and ELN applications. He also said that the next generation of AI systems is seamlessly integrated into the company’s lab informatics platform, empowering scientists to collect, manage, and analyze research data with unprecedented precision.

By Deployment Mode

By End-User

By Region

February 2026

February 2026

February 2026

February 2026