February 2026

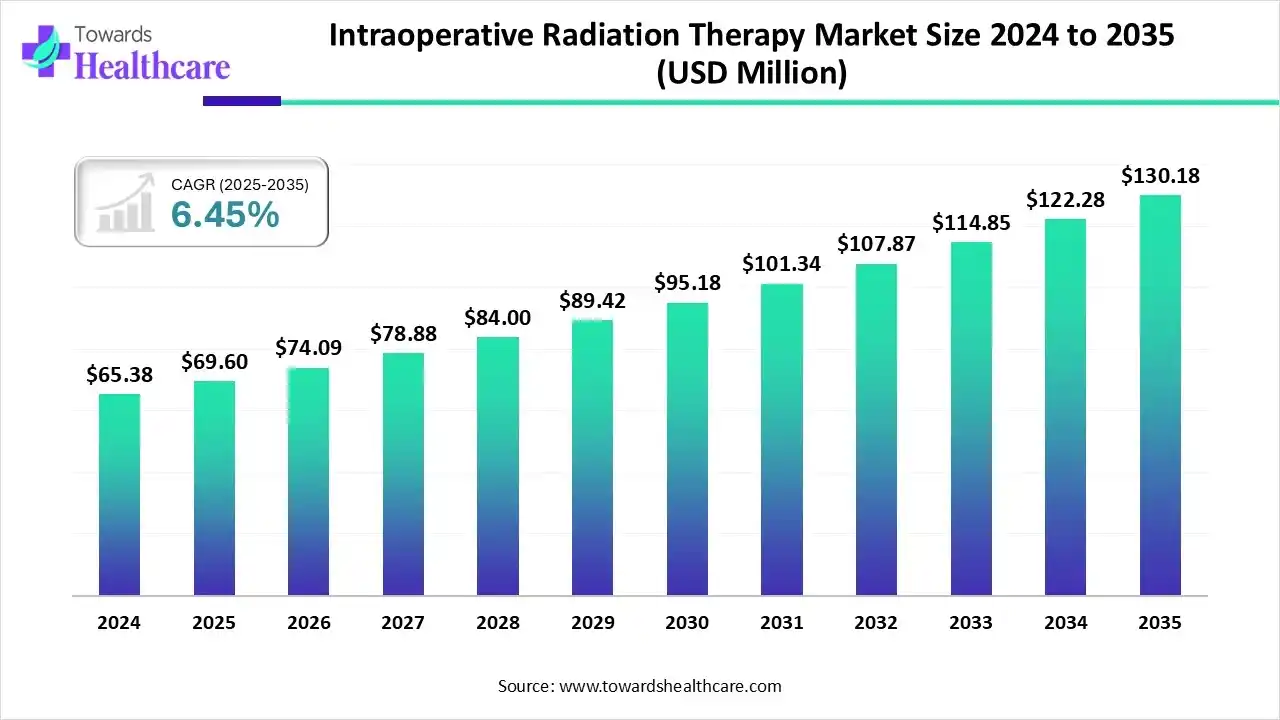

The global intraoperative radiation therapy market size is calculated at USD 69.6 million in 2025, grew to USD 74.09 million in 2026, and is projected to reach around USD 130.18 million by 2035. The market is expected to expand at a CAGR of 6.45% from 2026 to 2035.

The intraoperative radiation therapy market is witnessing steady growth driven by rising cancer incidence, technological advancements, and increasing adoption of targeted therapies. North America leads the global market due to its advanced healthcare infrastructure, strong presence of key manufacturers, and supportive reimbursement systems.

The region’s early adoption of innovative radiotherapy techniques and integration of AI-based imaging solutions further enhances treatment precision. Meanwhile, Asia-Pacific and Europe are emerging as promising regions with expanding oncology care facilities.

| Table | Scope |

| Market Size in 2025 | USD 69.6 Million |

| Projected Market Size in 2035 | USD 130.18 Million |

| CAGR (2026 - 2035) | 6.45% |

| Leading Region | North America |

| Market Segmentation | By Product & Service, By Technology, By Application, By Region |

| Top Key Players | Carl Zeiss Meditec AG,iCAD, Inc., Varian Medical Systems, Inc., IntraOp Medical Corporation, Elekta AB, Sordina IORT Technologies S.p.A., Isoray, Inc., Sensus Healthcare, Inc., Eckert & Ziegler BEBIG, GMV Innovating Solutions S.L., Xstrahl Ltd., Ariane Medical Systems Ltd. |

The intraoperative radiation therapy market is experiencing significant growth due to increasing demand for targeted, time-efficient cancer treatments, and technological advancements in surgical oncology. IORT is a procedure that delivers a concentrated dose of radiation directly to the tumor during surgery, reducing exposure to surrounding healthy tissues. This method shortens post-operative radiation sessions, speeds up patient recovery, and improves local tumor control, making it an increasingly popular choice in modern cancer care around the world.

Artificial Intelligence (AI) integration has significantly advanced intraoperative radiation therapy (IORT) by improving precision, efficiency, and personalization in cancer treatment. AI-driven imaging and analytics enable surgeons and oncologists to identify tumor margins in real time, ensuring optimal radiation dosing while minimizing exposure to healthy tissues. Machine learning algorithms support dose planning, predict treatment outcomes, and automate quality control processes, thereby reducing human error during procedures. Furthermore, AI enhances workflow integration between surgical and radiology teams, improving coordination and accelerating treatment delivery. Continuous data learning from numerous patient cases strengthens clinical decision-making, resulting in superior treatment accuracy, safety, and long-term patient outcomes. Overall, AI reinforces IORT’s position as a cutting-edge, patient-centered approach in modern oncology.

What Made Products the Dominant Segment in the Intraoperative Radiation Therapy Market?

The products segment dominated the market while holding the largest share in 2024, mainly due to the growing adoption of advanced IORT devices, equipment, and related accessories in surgical oncology. Technological innovations in mobile linear accelerators, applicators, and precision dose-delivery systems have enhanced treatment accuracy and efficiency, driving preference for product-based solutions. Additionally, hospitals and cancer care centers increasingly invest in standalone IORT equipment to ensure seamless integration into surgical workflows, reducing treatment times and improving patient outcomes. The segment’s dominance is further supported by the rising incidence of cancer and the need for targeted, intraoperative radiotherapy approaches.

The services segment is expected to expand at the fastest rate in the upcoming period due to the increasing demand for installation, maintenance, training, and consulting services associated with sophisticated IORT systems. Hospitals and cancer centers rely on expert service providers to ensure optimal performance, compliance with safety regulations, and proper staff training for complex equipment. Additionally, the rise in collaborative cancer care programs and partnerships with specialized service providers is driving recurring revenue opportunities. As healthcare providers prioritize seamless integration of IORT into surgical workflows, demand for professional services continues to expand alongside the adoption of advanced products.

Why Did the Electron IORT Segment Dominate the Intraoperative Radiation Therapy Market?

The electron IORT segment led the market in 2024 due to its excellent tissue penetration control, accurate dose delivery, and minimal radiation exposure to nearby healthy tissues. Its proven clinical effectiveness, shorter treatment time, and compatibility with mobile linear accelerators make it a popular choice among hospitals and cancer treatment centers worldwide. Their compatibility with existing surgical workflows and proven safety profile have reinforced widespread adoption, making electron IORT the preferred choice in many clinical settings.

The intraoperative brachytherapy segment is expected to grow at the fastest rate in the upcoming period due to its ability to deliver highly localized radiation directly to the tumor bed while causing minimal tissue damage. Advances in miniaturized X-ray sources, flexible applicators, and real-time imaging enhance treatment accuracy, safety, and versatility, leading to rapid adoption across various cancer types and clinical settings.

Why Did the Breast Cancer Segment Lead the Intraoperative Radiation Therapy Market in 2024?

The breast cancer segment dominated the market, holding the largest share in 2024. This is mainly because of the high global prevalence of the disease and the proven clinical effectiveness of IORT in treating early-stage breast cancer. IORT allows for single-session, targeted radiation during surgery, reducing the need for postoperative treatments, minimizing tissue damage, and improving cosmetic and recovery outcomes, which has led to its widespread adoption in oncology practices.

The gastrointestinal cancer segment is expected to grow at the fastest CAGR in the intraoperative radiation therapy market. This is driven by increasing cases of colorectal and pancreatic cancers and the effectiveness of IORT in treating complex abdominal tumors. Its capability to deliver precise, high-dose radiation during surgery improves local control, reduces recurrence, and enhances post-surgical recovery.

The endometrial & cervical cancer segment is expected to grow at a notable rate during the forecast period due to the rising adoption of IORT in treating locally advanced and recurrent pelvic tumors. Its targeted radiation delivery reduces damage to surrounding organs, improves local tumor control, and enhances treatment outcomes for patients with limited radiotherapy options.

North America dominated the intraoperative radiation therapy market by capturing the largest share in 2024, thanks to its advanced healthcare infrastructure, early adoption of surgical-radiation hybrid treatments, strong presence of key players, and favorable reimbursement systems. The region benefits from substantial healthcare expenditure and continuous investments in research and development for precision cancer treatments. Government initiatives promoting early cancer detection and advanced therapeutic options further support market growth.

The U.S. is a major player in the North American intraoperative radiation therapy market due to its advanced healthcare infrastructure, high cancer rates, early adoption of innovative radiotherapy technologies, strong presence of key manufacturers, substantial research funding, and supportive regulations that promote precision-based cancer treatments. Growing prevalence of breast cancer in the U.S. further drives this leadership. By 2025, an estimated 316,950 new invasive breast cancer cases in women and 42,170 projected deaths are expected.

Asia-Pacific is expected to grow at the fastest rate throughout the forecast period due to increasing cancer rates, expanding healthcare infrastructure, and rising investment in advanced oncology technologies. Growing awareness of targeted radiation treatments, supportive government initiatives, and collaborations with global medical device firms further boost IORT adoption in emerging economies such as China, India, and Japan. Additionally, growing awareness among physicians and patients about precision cancer therapies, combined with favorable government initiatives and public-private partnerships, is accelerating the adoption of IORT technologies across the region.

China leads the Asia-Pacific intraoperative radiation therapy market due to its rapidly expanding oncology infrastructure, rising cancer prevalence, and strong government investment in advanced medical technologies. The presence of prominent domestic manufacturers, increasing adoption of precision radiotherapy, and growing awareness of single-session cancer treatments further reinforce China’s leadership in the regional market.

The Middle East and Africa present significant growth opportunities for IORT as governments expand oncology infrastructure and private investments increase. Rising cancer rates, medical tourism hubs, and demand for single-session, resource-efficient treatments make IORT attractive. Public-private partnerships, capacity-building, training programs, and the adoption of portable, low-shielding systems accelerate clinical adoption and expand regional access to advanced intraoperative radiation care.

The growth of the intraoperative radiation therapy market in the UAE is driven by rising cancer rates, government efforts to enhance advanced oncology care, and increased investments in healthcare infrastructure. The UAE’s emphasis on medical innovation, adoption of AI-driven treatment systems, and collaborations with international cancer centers improve access, boost patient outcomes, and drive the expansion of the IORT market in the region.

Europe is witnessing an opportunistic rise in the market driven by increasing investments in advanced oncology infrastructure and the growing adoption of precision-based cancer treatments. Government initiatives supporting cancer care, coupled with favorable reimbursement policies in countries such as Germany, France, and the UK, are driving market expansion. Additionally, collaborations between hospitals and medical device manufacturers are accelerating the integration of IORT technologies. Rising awareness among oncologists and patients about the benefits of single-session radiotherapy further supports Europe’s growing market presence.

Germany is a major contributor to the European intraoperative radiation therapy market due to its well-established oncology infrastructure and strong focus on advanced cancer treatment technologies. The country benefits from favorable reimbursement policies, high adoption of precision-based radiotherapy, and significant investment in healthcare innovation. Additionally, partnerships between leading hospitals and medical device manufacturers have accelerated the deployment of IORT systems across Germany.

The market in South America is driven by rising cancer incidence, growing awareness of advanced cancer treatment options, and increasing investment in modern healthcare infrastructure. Countries in the region are expanding oncology centers and upgrading radiotherapy capabilities, which supports the adoption of IORT systems. Additionally, collaborations between global medical device manufacturers and local hospitals are facilitating technology transfer and training, further strengthening market growth.

Brazil is the major contributor to the market within South America due to its well-established healthcare infrastructure and the presence of leading cancer treatment centers. The country has a high prevalence of cancer, which drives demand for advanced radiotherapy solutions such as IORT. Additionally, government initiatives to improve oncology care and partnerships with global medical device manufacturers support the adoption of cutting-edge treatment technologies in Brazil.

The R&D stage forms the core of the IORT value chain. It involves technological innovation in radiation delivery systems, miniaturized accelerators, and applicator design. Major medical device manufacturers, research institutes, and universities such as Varian Medical Systems, IntraOp Medical, and Zeiss Group focus on improving dose accuracy and real-time imaging integration. Partnerships between hospitals and academic institutions support prototype testing, AI-assisted treatment planning, and development of next-generation devices.

After R&D, clinical validation confirms efficacy and safety. Clinical trials are usually conducted with oncology centers and regulatory authorities such as the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and the Ministry of Health, Labour and Welfare (MHLW) in Japan. These trials assess radiation dose accuracy, recurrence rates, and side effects. After successful trials, regulatory submissions, quality audits, and certification processes (ISO 13485, CE Mark) ensure compliance and allow market entry.

This stage emphasizes post-implementation efficiency and patient satisfaction. Healthcare providers, oncology hospitals, and equipment suppliers collaboratively manage training programs, installation, and maintenance services. Patient support includes education on treatment outcomes, post-surgical monitoring, and managing side effects. Organizations like the American Cancer Society (ACS), the National Comprehensive Cancer Network (NCCN), and local oncology associations play crucial roles in raising awareness, providing guidance, and improving access to IORT technologies, ensuring optimal clinical and emotional support for patients.

Corporate Information

Business Overview

Carl Zeiss Meditec AG is a leading medicaltechnology company that develops, manufactures, and markets diagnostic and therapeutic systems, with a strong focus on ophthalmology and microsurgery. Within its microsurgerybusiness scope, the company also offers intraoperative radiotherapy solutions (IORT) via its INTRABEAM® platform, enabling single-session radiation during surgery for oncology applications.

Business Segments / Divisions

The company’s revenue and operations are organized primarily into two strategic business units (SBUs):

Geographic Presence

Carl Zeiss Meditec has a global footprint. It operates in more than 50 countries, with production and R&D sites worldwide (including India and China) and major employee bases in the U.S., Japan, Spain, and France. Its distribution and service network spans Europe, the Americas, and AsiaPacific, enabling access to key oncology markets for IORT.

Key Offerings

INTRABEAM® 600 / INTRABEAM® 700: Compact intraoperative X-ray systems designed for IORT. INTRABEAM 700 features robotic-assisted precision, digital workflow architecture, and connectivity for intraoperative oncology applications (brain, breast, spinal) in surgery.

Applicators and treatmentplanning software: The system uses SMART Spherical Applicators, RFID-enabled workflow controls, and the Radiance™ planning simulation software to support intraoperative dose planning and execution.

SWOT Analysis

Recent News

In April 2025, Carl Zeiss Meditec AG obtained U.S. FDA approval for its INTRABEAM 700 platform, a next-generation IORT system for low-energy X-ray delivery during surgery.

Corporate Information

Business Overview

iCAD is a medicaltechnology company specializing in advanced cancer detection and treatment solutions. It operates primarily in two major business areas: detection (computer-aided detection/AI for imaging) and therapy (radiation therapy systems). In the IORT space, iCAD provides systems that enable intraoperative radiation delivery during surgery, most notably its Xoft® Axxent® Electronic Brachytherapy (eBx®) System, which delivers single-session radiation treatment directly in the operating room.

Business Segments / Divisions

Geographic Presence

iCAD has a global presence: its detection and therapy solutions are used in over 50 countries. It has manufacturing and R&D facilities in New Hampshire, U.S., and operations in San Jose, California, U.S. It also maintains an office in Lyon, France, to support its European business.

Key Offerings

SWOT Analysis

| Company Name | Key Offerings in Intraoperative Radiation Therapy (IORT) |

| Varian Medical Systems, Inc. (a Siemens Healthineers company) | Provides TrueBeam and Edge systems for high-precision radiation delivery; offers integrated IORT solutions with advanced dose control, imaging, and treatment planning software. |

| IntraOp Medical Corporation | Manufacturer of Mobetron, a mobile electron IORT accelerator allowing real-time radiation delivery during surgery without dedicated shielding. |

| Elekta AB | Develops radiation oncology systems and software, integrating linear accelerators and real-time imaging technologies adaptable for intraoperative applications. |

| Sordina IORT Technologies S.p.A. | Offers LIAC and LIAC HWL mobile linear accelerators designed for electron IORT; known for portability and rapid dose delivery. |

| Isoray, Inc. (now Perspective Therapeutics) | Specializes in brachytherapy-based radiation sources, including Cesium-131 isotopes, used in IORT for targeted tumor irradiation and reduced collateral damage. |

| Sensus Healthcare, Inc. | Offers compact mobile intraoperative radiation accelerators (e.g., SRT100 Vision) enabling IORT in surgical settings and ambulatory centers. |

| Eckert & Ziegler BEBIG | Manufactures IORT‑compatible brachytherapy systems, afterloaders and applicators for intraoperative radiation applications in surgical oncology. |

| GMV Innovating Solutions S.L. | Provides software and planning tools (Radiance™) for IORT, enabling preoperative and intraoperative treatment planning and imageguided radiation delivery. |

| Xstrahl Ltd. | Supplies modular intraoperative radiation systems (e.g., Xstrahl 300) used for IORT applications in tumor resection and surgical oncology settings. |

| Ariane Medical Systems Ltd. | Offers electron‑based IORT systems and accessories, focusing on enabling IORT in hospitals and surgical centers in Europe and Asia. |

The global intraoperative radiation therapy market is experiencing a paradigm shift driven by the convergence of precision oncology, rising cancer incidence, and the increasing emphasis on value-based care models. The demand for single-session, intraoperative radiation interventions is accelerating as hospitals and surgical centers seek to optimize patient throughput, reduce postoperative complications, and shorten overall treatment timelines. Advanced electron-based and low-energy X-ray systems are enabling greater procedural efficiency while simultaneously mitigating exposure risks to healthy tissue, positioning IORT as a strategic solution within modern oncologic treatment protocols.

Geographically, North America maintains a dominant market position due to its mature healthcare infrastructure, high adoption of technologically advanced radiation devices, and robust reimbursement frameworks. However, Asia-Pacific represents the fastest-growing region, driven by increasing surgical oncology volumes, growing public awareness of cancer management options, and government investments in healthcare infrastructure and radiotherapy expansion. Emerging markets in Latin America, the Middle East, and Africa present substantial white-space opportunities for device manufacturers, particularly through strategic partnerships with hospitals and expansion into ambulatory surgical centers where conventional radiotherapy capacity remains limited.

From an investment and commercialization perspective, the IORT market offers attractive growth potential across multiple vectors. Key opportunities lie in the development of compact, cost-efficient systems tailored for mid-sized hospitals, integrated imaging and radiation platforms, and service-oriented business models including software, consumables, and workflow analytics. As clinical evidence continues to validate the efficacy of IORT in breast, brain, and head & neck cancers, the market is poised for accelerated adoption, creating favorable conditions for both incumbent players and new entrants seeking to capitalize on a rapidly evolving, high-margin niche within the broader radiation oncology ecosystem.

By Product & Service

By Technology

By Application

By Region

February 2026

February 2026

January 2026

January 2026