January 2026

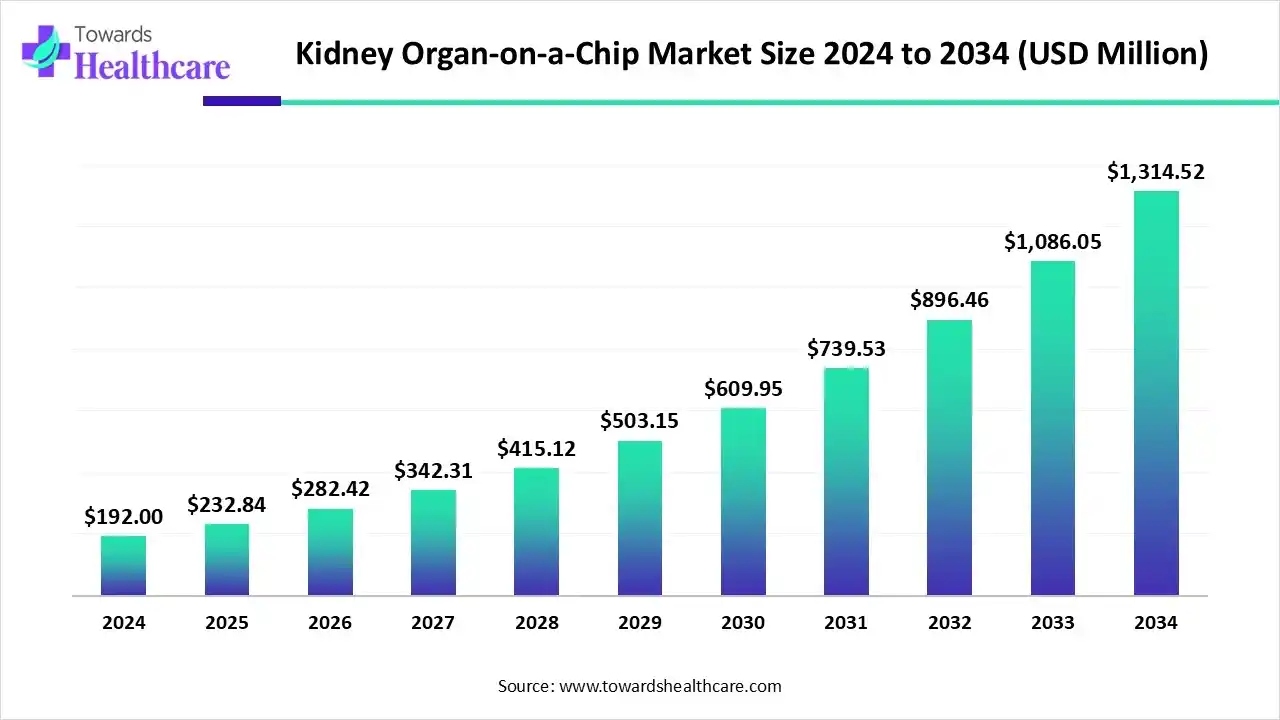

The global kidney organ-on-a-chip market size is calculated at US$ 192 million in 2024, grew to US$ 232.84 million in 2025, and is projected to reach around US$ 1314.52 million by 2034. The market is expanding at a CAGR of 21.27% between 2025 and 2034.

In 2025, various Asian countries like China & India are facing a huge rise in chronic kidney diseases, and are boosting the development of the kidney organ-on-a-chip market. Alongside, the market is leveraging innovations in 3D microfluidics and bioprinted organ chips, as well as companies emphasizing evolving new materials used in these OOC technologies. Moreover, diverse pharmaceutical and biotechnology companies are exploring applications of OOc technology in nephrotoxicity testing, biomarker discovery, disease modeling, and pharmaceutical R&D.

| Table | Scope |

| Market Size in 2025 | USD 232.84 Million |

| Projected Market Size in 2034 | USD 1314.52 Million |

| CAGR (2025 - 2034) | 21.27% |

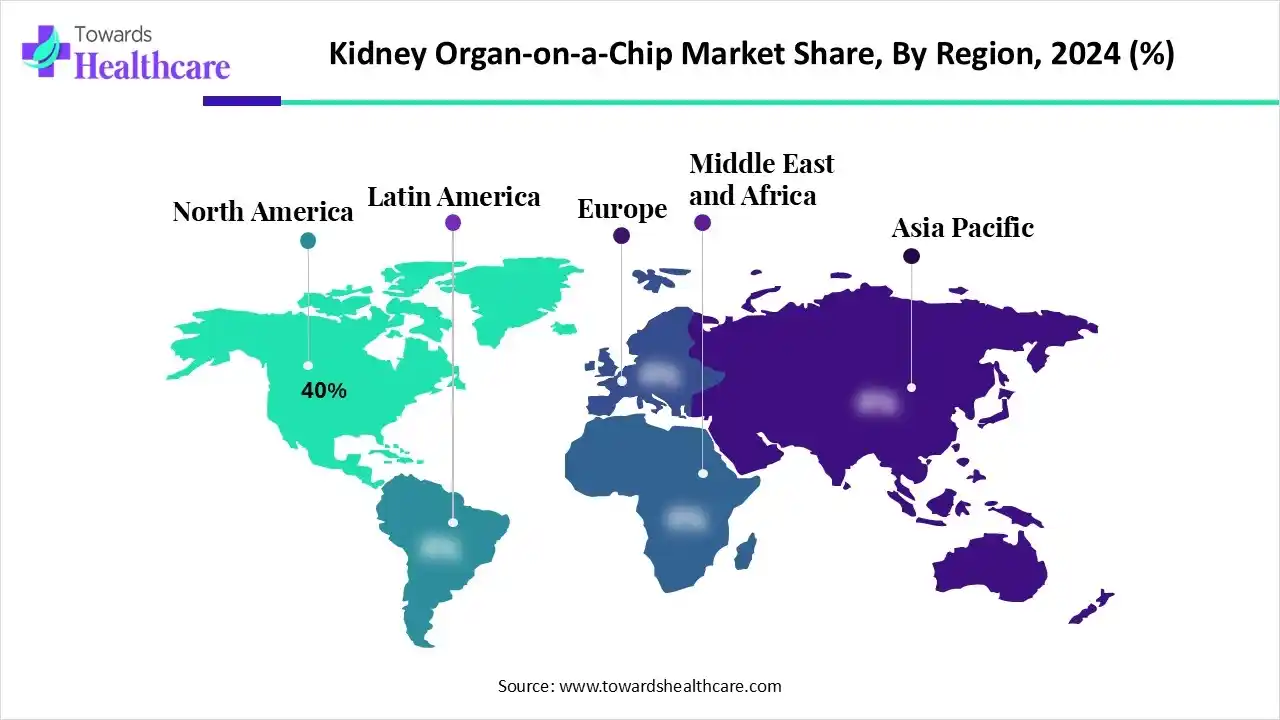

| Leading Region | North America by 40% |

| Market Segmentation | By Cell Type/Lineage, By Application, By Product & Services, By Technology/Platform Type, By End-User, By Region |

| Top Key Players | Hµrel Corporation, InSphero AG, AxoSim Inc., BioIVT, Organovo Holdings Inc., CellASIC (Merck), SynVivo Inc., Kirkstall Ltd., Harvard Wyss Institute, Chip Sourcing Technologies, Cyfuse Biomedical K.K., Taros Chemicals GmbH, AlveoliX, CN Bio Innovations, Organovo Holdings Inc. |

The kidney organ-on-a-chip market comprises microphysiological systems that replicate human kidney tissue and function on a microfluidic platform for drug testing, disease modeling, and toxicity studies. The market is driven by the increasing demand for safer and more efficient drug development, the rising prevalence of kidney-related diseases, and the need for personalized medicine solutions. These chips integrate living renal cells with microfluidic channels to mimic physiological responses, enabling more predictive preclinical studies and reducing reliance on animal models.

Key applications include nephrotoxicity testing, biomarker discovery, disease modeling, and pharmaceutical R&D. The market serves pharmaceutical and biotechnology companies, research laboratories, and academic institutions globally across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

| Government Accountability Office (GAO) | Issued a report in May 2025 highlighting the potential of multi-organ-on-a-chip systems, such as liver-kidney-intestine platforms. |

| Beijing-based National Biomedical Imaging Center | In March 2025, it announced a "digital kidney" project, powered by Cheng Heping. |

| The Central Government of India | Explored BioE3 (Biotechnology for Economy, Environment, and Employment) policy to foster the development of "New Approach Methods" (NAMs), such as organ-on-a-chip technology. |

In 2024-2025, the global kidney organ-on-a-chip market was explored with various technological breakthroughs, particularly body-on-a-chip models. For this, researchers are putting efforts into connecting multiple organ-on-a-chip systems, such as the kidney, liver, heart, and intestine, through microfluidic channels. This further fosters the study of ADME and the analysis of systemic toxicity that single-organ models cannot record. Moreover, different organizations and institutes are involved in the use of iPSCs derived from individual patients. This enables KOC technology to develop "patient-on-a-chip" models, allowing tailored drug screening and disease modeling to transform precision medicine.

In 2024, the proximal tubular cells segment led with nearly 35% share of the market. A rise in demand for more precise, human-relevant preclinical drug testing, increasing concerns over animal testing, and the expansion of tailored medicine are boosting the adoption of these cells. Nowadays, the leading companies are developing new pumpless, unidirectional flow systems, including the MIMETAS OrganoPlate UniFlow (UF), to streamline the experimental setup for examining kidney cells under controlled settings.

Moreover, the mixed/co-culture systems segment is anticipated to expand rapidly. A prominent driver is the growing need for more complex, physiologically relevant models for drug testing and disease research. Nowadays, the market is emphasizing the integration of patient-derived cells, boosted cell-cell interaction modeling, and the progress of multi-organ chips to simulate systemic disease. Many ongoing studies are promoting the use of 3D printing and hydrogel-based scaffolds in the creation of bio-mimetic environments for more efficient co-culture.

By capturing nearly 40% share, the drug discovery & development segment registered dominance in the kidney organ-on-a-chip market in 2024. The segment is fueled by the accelerating kidney disease cases, the need for more effective predictive models, and ethical preclinical testing methods. These sophisticated chips are facilitating high-throughput platforms to investigate the nephrotoxic possible of environmental pollutants and industrial chemicals, which further supports ensuring safer consumer products and preventing exposure risks.

On the other hand, the disease modeling segment is predicted to expand at a rapid CAGR in the coming era. Ongoing optimizations in organ-on-a-chip (OoC) technology, like the integration of multiple kidney components and systemic models, and the use of patient-derived cells, are offering a more accurate way to model human-specific kidney diseases like polycystic kidney disease (PKD). Recently, researchers have been working on more physiologically accurate microenvironments through advancements, especially 3D bioprinting. The market is stepping into novel kidney organoids and kidney-on-a-chip models, which have evolved from human pluripotent stem cells used in studying genetic and molecular mechanisms of PKD.

In the kidney organ-on-a-chip market, the kidney organ-on-a-chip devices segment led with nearly 45% share in 2024. Continuous innovations in microfabrication, 3D bioprinting, and integrated AI and machine learning are bolstering the development of more advanced and physiologically accurate models with higher throughput. The latest approaches in bioengineering and microfluidic design are enhancing the ability of these devices to replicate vital nephron structures and functions, like glomeruli, proximal tubules, and collecting ducts.

However, the software & data analytics segment is estimated to register the fastest growth. The rising emphasis on the importance of managing the huge amounts of data developed by these devices and accelerating their predictive capabilities is acting as a catalyst. The market is stepping into the emergence of standardized protocols and data collection for kidney-on-a-chip models, enhancing their transition from research tools to standard components in personalized medicine and regulatory toxicology.

In 2024, the 3D microfluidic platforms segment accounted for nearly 40% share of the market. The segment is mainly propelled by a rise in breakthroughs in 3D bioprinting for complex tissue models, the requirement for robust disease modeling, and nephrotoxicity prediction. Recent developments encompass organoids, which are 3D stem-cell-derived tissue structures, that are widely coupled with microfluidic chips for developing more physiologically relevant kidney models.

Besides this, the bioprinted organ chips segment will expand rapidly during 2025-2034. Certain advantages of this technology include the automation in the creation of more complex, functional, and reproducible 3D models. Major companies are exploring advances in diverse technologies, particularly maskless digital light processing, to expand the resolution, speed, and material versatility to establish more intricate micro-tissues. Also, they are accelerating the adoption of materials like polyethylene glycol diacrylate (PEGDA) and hyaluronic acid to enhance cell adhesion, proliferation, and overall chip biocompatibility.

The pharmaceutical companies segment captured approximately 40% share of the kidney organ-on-a-chip market in 2024. These companies are increasingly investing in research and development to foster the adoption of OOC technology to accelerate the effectiveness and accuracy of their preclinical testing. Furthermore, they are exploring OOC technology for the development of patient-specific kidney models applying individual patient cells, which is a robust tool for creating customized therapeutic plans. Also, they are using this technology for more accurate drug toxicity screening, precision medicine, and recognizing disease mechanisms.

On the other hand, the contract research organizations (CROs) segment will expand rapidly during 2025-2034. They are providing specialized research capabilities and specialized professionals in organ-on-chip technology and regulatory affairs, which pharmaceutical companies often lack in-house. They are leveraging excellent biomimicry through 3D bioprinting and stem cell integration, optimized high-throughput automation, and the integration of multi-organ chips to model systemic drug effects.

North America captured nearly 40% revenue share of the kidney organ-on-a-chip market in 2024. This region is widely incorporating OOC technology in the expansion of drug discovery and toxicity testing. Alongside, the FDA has implemented the FDA Modernization Act 2.0, which accelerates the OOC technology adoption. Moreover, the regional researchers are leveraging multi-organ systems by connecting kidney chips to liver chips to study nephrotoxicity.

A major growth of the kidney organ-on-a-chip market in the US is driven by a rise in emphasis on disease-specific models, like fibrosis and kidney stone formation. Moreover, the U.S. is fostering the establishment of thermoplastic and other advanced materials for microfluidic devices, which further offer biocompatibility and performance as compared to traditional materials like PDMS.

For instance,

Canada’s kidney organ-on-a-chip market is accelerating innovations in OOC technology, such as a uCR-Chip. This innovative approach is a portable, affordable diagnostic tool created to find kidney issues early. This further focuses on facilitating quicker, more tailored results, with enhanced access to kidney function tests, mainly in rural and remote regions.

In the future, the Asia Pacific is estimated to witness rapid expansion in the market. A rise in the number of chronic kidney disease cases, mainly in China and India, is boosting the demand for advanced approaches, including OOC technology. Along with this, ASAP is exploring this technology by facilitating a human-relevant method to study the nephrotoxic effects of both new drugs and environmental chemicals, with escalated safety testing. According to NIH, in 2030, the number of CKD patients will rise, whereas A 2025 study in Nephrology anticipated that Taiwan's CKD incidence will accelerate from 10.6% in 2022 to 12.4% by 2027.

The kidney organ-on-a-chip market in China is experiencing significant growth due to rising both national and local government initiatives in China. These initiatives are further fostering innovation in the biotech and regenerative medicine sectors, with funding for research institutions supporting the development and adoption of OOC technology.

For instance,

Day by day, the Indian market is putting efforts into the transformation of drug discovery and testing approaches by numerous pharmaceutical and biotechnology companies. These companies are escalating the adoption of organ-on-a-chip technology for drug discovery and toxicity screening, enabling a more precise evaluation of drug safety and efficacy.

For instance,

It mainly comprises designing organ models, fabrication, cell sourcing, system integration, and finally testing & validation.

Key Players: University of Washington and the Wyss Institute, etc.

The kidney organ-on-a-chip market fosters chip development and validation, early clinical trials for safety, and seamless and accelerated clinical trials for efficacy as compared to traditional approaches. Finally, it receives approval from the FDA.

Key Players: Nortis Bio, CN Bio, TissUse, etc.

The market is promoting future patient care with the expansion of drug development and testing, and developing models for chronic kidney disease and potential replacement therapies.

Key Players: Emulate, Bi/ond, etc.

By Cell Type/Lineage

By Application

By Product & Services

By Technology/Platform Type

By End-User

By Region

January 2026

January 2026

January 2026

January 2026