January 2026

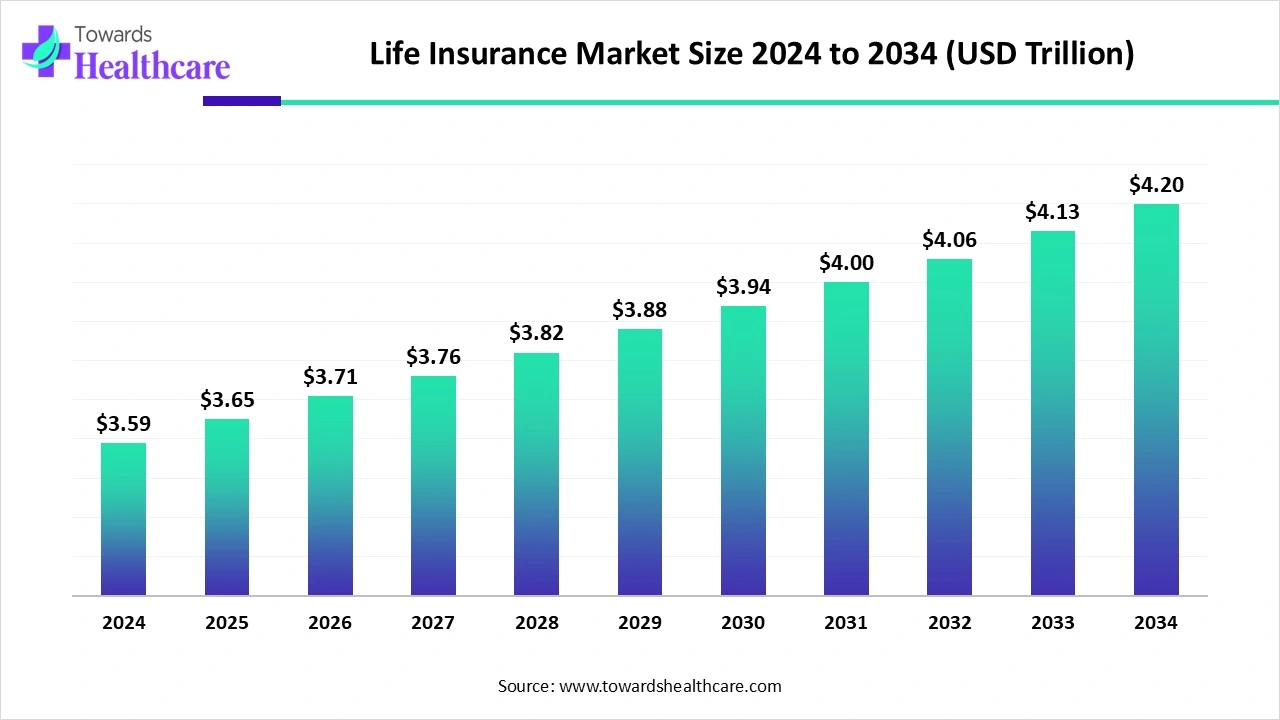

The global life insurance market size is estimated at US$ 3.65 trillion in 2025, is projected to grow to US$ 3.71 trillion in 2026, and is expected to reach around US$ 4.25 trillion by 2035. The market is projected to expand at a CAGR of 1.54% between 2026 and 2035.

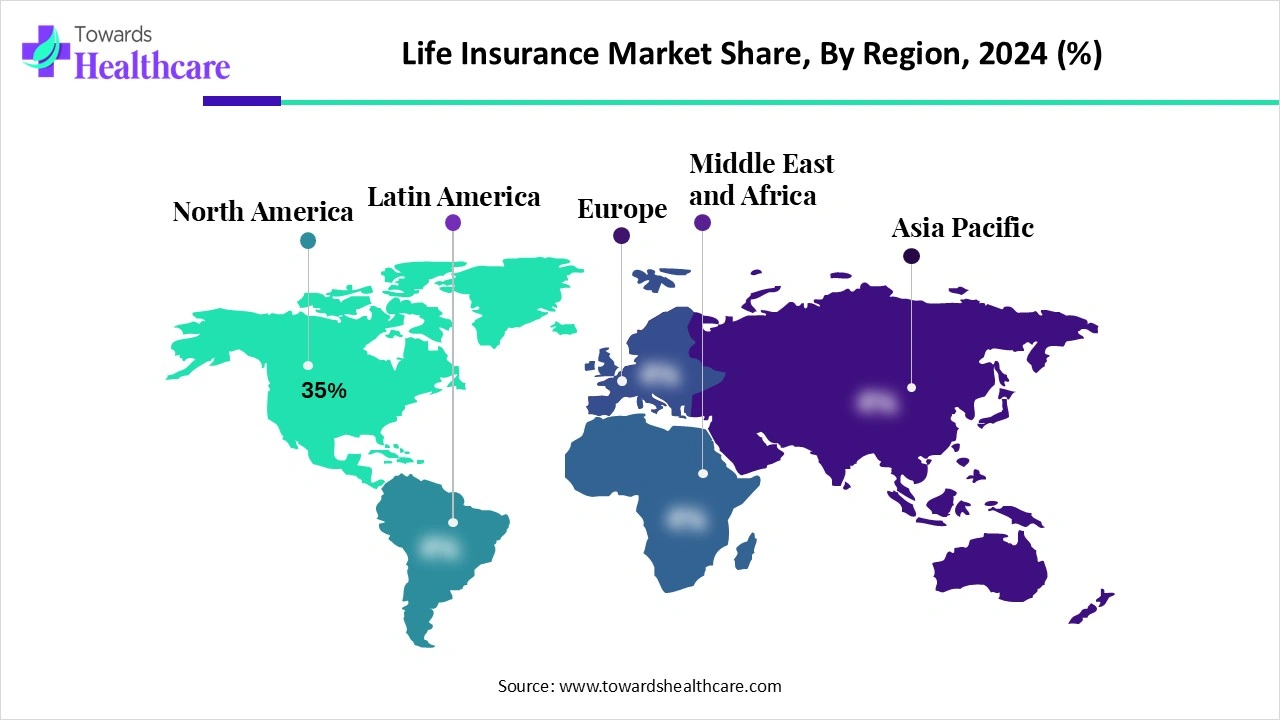

The life insurance market is expanding rapidly due to the increasing financial services industry, which offers financial protection and long-term savings services. It provides policies that pay intended advantages upon the death of the insured, with some products also including investment components. North America is dominated by increasing awareness of economic planning, while the Asia Pacific is the fastest-growing region due to a rising aging population.

| Key Elements | Scope |

| Market Size in 2025 | USD 3.65 Trillion |

| Projected Market Size in 2035 | USD 4.25 Trillion |

| CAGR (2026 - 2035) | 1.54% |

| Leading Region | North America 35% |

| Market Segmentation | By Solution Type, By Coverage Type, By Distribution Channel, By Dental Specialty, By Distribution Channel, By Region |

| Top Key Players | MetLife, Inc., Prudential Financial, Inc., Manulife Financial Corporation, Sun Life Financial, AIA Group Limited, AXA S.A., Allianz SE, Aviva plc, Legal & General Group, Zurich Insurance Group, Nippon Life Insurance, Dai-ichi Life Holdings, New York Life Insurance Company, Northwestern Mutual Life Insurance, MassMutual (Massachusetts Mutual Life Insurance Company), Guardian Life Insurance Company, China Life Insurance Company, Ping An Insurance Group, HDFC Life Insurance (India), LIC (Life Insurance Corporation of India) |

The life insurance market encompasses financial products that provide monetary protection and risk coverage against the death or disability of an insured person. Policies may offer lump-sum payouts, annuities, or investment-linked benefits to beneficiaries. Life insurance serves dual purposes: protection (family income replacement, debt coverage, estate planning) and wealth management (savings, retirement planning, tax benefits). The market is driven by rising awareness of financial planning, growing middle-class populations, digital distribution channels, and increasing demand for customized, flexible, and affordable insurance solutions.

For Instance,

Increasing government support to healthcare life insurance through providing funding and cashless treatment services, which contributes to the growth of the market.

For instance,

Growing awareness related to healthcare insurance promotes financial support and provides better health results, which contributes to the growth of the market.

For Instance,

Integration of AI in life insurance drives the growth of the market as increasing application of AI-driven technology by health insurance organizations to modernize operations, enhance the experience of consumers, and lower the risk. AI-based chatbots handle consumer queries and mechanise daily tasks, like claims processing and policy renewals for the healthcare sector. AI allows life insurers to deliver more tailored services by predicting consumer requirements. Advanced technology, such as natural language processing (NLP), enables integrated AI models to simply handle routine customer inquiries. AI-driven technology in health insurance provides a ground-breaking chance to implement no-cap health insurance, confirming unlimited coverage for patients, though managing costs and challenges for insurers, which contributes to the growth of the market.

For Instance,

Increasing Awareness of Health Insurance

Health insurance functions as a safeguard offering financial protection during unforeseen medical emergencies. It acts as a cushion for individuals and a safety net for families. Many people are unaware of this benefit, leaving them financially exposed. Increasing health insurance coverage is significant to enhance healthcare accessibility and reduce poverty, thereby supporting the growth of the life insurance sector.

Major Challenges of Life Insurance Services

The main challenge is that many people lack basic education and exposure to health insurance policies. They often save money and invest in real estate or keep savings in liquid assets. Because most individuals do not understand the benefits of having a health insurance policy, the growth of the life insurance market remains limited.

Increasing Trends of Digitization in Life Insurance

Insurers will incorporate digital health and wellness platforms to raise awareness and support individuals on their wellness journey. This might involve incentivized programs linked to the insurer’s partner to boost engagement. As policyholders become more engaged, insurers with data-driven insights can analyze customer behavior and health risks more effectively. This enables the development of more targeted products and services, creating growth opportunities in the life insurance market. These advancements are expected to foster innovation and expansion within the industry.

For Instance,

By product type, the term life insurance segment led the life insurance market, as these plans are one of the easiest ways to secure a family’s financial future and provide for an individual's absence. Term life insurance provides many benefits, ranging from its affordability to bringing a secure future for the family, among other things. Many people are opting for life cover, and term insurance is developing as one of the widespread choices.

On the other hand, the annuities and pension plans segment is projected to experience the fastest CAGR from 2025 to 2034, as it offers additional flexibility in terms of payout options. Many people make them a competitive retirement income choice. These plans are designed precisely to offer a steady cash flow of income to retired persons to let them live a stress-free and hassle-free life post-retirement. Annuities offer tax advantages, whereas pensions ensure income and share funding responsibilities between the employer and employee.

By coverage type, the individual life insurance segment is dominant in the life insurance market in 2024, as it offers a safety net against the unforeseen and thus acts as a safety tool. Whether it's loss of goods, fire, theft, healthcare emergencies, harm to permanent property, serious illness, or loss of employment, insurance covers all and any kind of challenge. It offers financial security, support to pay off arrears, helps to pay living expenses, and to pay any medical or final expenditures.

The group life insurance segment is projected to grow at the fastest CAGR from 2025 to 2034, as group life insurance is an affordable insurance choice for both employees and employers. It provides benefits to employers by enhancing employees' productivity while increasing the retention rate. In the context of employees, it offers life insurance without cost or healthcare screening. It supports increasing the confidence of the members and increasing the productivity of the group.

By distribution channel, the bancassurance segment led the life insurance market in 2024, as it is a convenient way for insurers to distribute and for customers to buy insurance products through banking channels. This provides cost advantages to both the insurer and the customer, while banks enjoy collaboration benefits, such as additional revenue streams, more customer data, and prolonged customer endurance.

The direct-to-consumer (D2C) via digital platforms segment is projected to experience the fastest CAGR from 2025 to 2034, as D2C insurance removes middlemen through purchasing insurance, which leads to reduced prices for policyholders. The DTC insurance sales model allows insurers to provide a more targeted and seamless policyholder involvement. By leveraging data and analytics, insurers better understand their policyholders’ requirements and preferences to provide them with relevant insurance products.

By premium type, the regular premium segment led the life insurance market in 2024, as it provides better financial planning. The person pays for the insurance coverage at specific time intervals for the whole policy tenure. The intervals may fluctuate from a monthly basis to an annual basis. Most individuals opt for a regular premium policy, as they automate the payments through different apps.

On the other hand, the single premium segment is projected to experience the fastest CAGR from 2025 to 2034, as single premium term insurance ensures a death benefit to the beneficiary if the insured passes away in the policy term. This assurance offers financial safety to the policyholder's family, confirming they are protected against unexpected events.

By end user, the individuals segment led the life insurance market in 2024, as this type of health insurance enables modification of policy based on factors such as age, pre-existing situations, and preferred healthcare facilities. This tailored strategy confirms that individuals get the most out of insurance coverage. Individual health insurance policies generally provide lifetime renewability, ensuring that individuals are covered well into their golden years, when healthcare requirements often increase.

On the other hand, the corporates and SMEs segment is projected to experience the fastest CAGR from 2025 to 2034, as life insurance offers financial protection for businesses and their employees through advantages such as lower out-of-pocket costs for employees, tax benefits for employers, and enhanced talent attraction and preservation.

North America is dominant in the market share 35% in 2024, due to a growing economy driven by huge productivity, a sophisticated transport infrastructure, and widespread natural resources. North Americans have the sixth-highest average domestic and employee income among OECD member states. Huge financial literacy rates play a significant role in insurance uptake, which contributes to the growth of the market.

For Instance,

The U.S. insurance industry is a vast framework intended to mitigate challenges and offer a layer of security. The U.S. has conventionally led the industry with huge premium volumes and employee numbers, as well as insurance companies. The US insurance field is the largest in the world, possessing almost 40% of total worldwide insurance premiums, which drives the growth of the market.

For Instance,

In Canada, insurance companies have a strong position, setting themselves up for long-term success in a remote-first and digital-forward environment. The developing tech trends are reforming the Canadian insurance industry for good, making space for invention and opportunities. These developments encourage insurance providers to increase their abilities and rationalise business models, which contributes to the growth of the market.

Asia Pacific is the fastest-growing region in the market in the forecast period, due to the increasing incomes and rising awareness in the industry. APAC is a hub for a mixture of mature, increasing demographic sectors and high-growth and emerging insurance, which contributes to the growth of the market.

For Instance,

China has major insurance companies that are among the major companies. A strong economy, government spending, customer awareness, and technology are driving China's growth in the insurance sector. China Life maintains a considerable nationwide service network, with 820,000 high-class agent force. Rapid advancement over the historically insufficient decades has become an essential part of both the Chinese economy, which contributes to the growth of the market.

India is the fifth-largest life insurance sector. India holds digital renovation, inclusion, and a novel role as a tech leader, confirmed by a decade of technology transformation. Strong financial growth, invention, and government support are driving the growth of the market.

Europe is expected to grow significantly in the market during the forecast period, as financial literacy is an important aspect in current economies, where planning for retirement has shifted progressively to the individual. The European insurance field is a significant sponsor of Europe’s economic growth, and it plays a significant role in protecting people and businesses and their assets, which contributes to the growth of the market.

Germany's insurance sector is developing quickly in response to ever-changing consumer prospects, government developments, and technological innovations. Health insurance in Germany is essential and provided, moreover, through statutory health insurance (SHI) or private health insurance (PHI). Increasing healthcare expenses pressures, a growing aging population, and longer lifespans, which drive the growth of the market.

In February 2025, Dadi, CEO & Founder of Qantev, stated, “By combining INSTANDA's agile product development, distribution, and policy administration capabilities with Qantev's AI claims management features, we're offering insurers a comprehensive solution that addresses both front-end and back-end challenges.”

By Solution Type

By Coverage Type

By Distribution Channel

By Dental Specialty

By Distribution Channel

By Region

January 2026

January 2026

January 2026

January 2026