January 2026

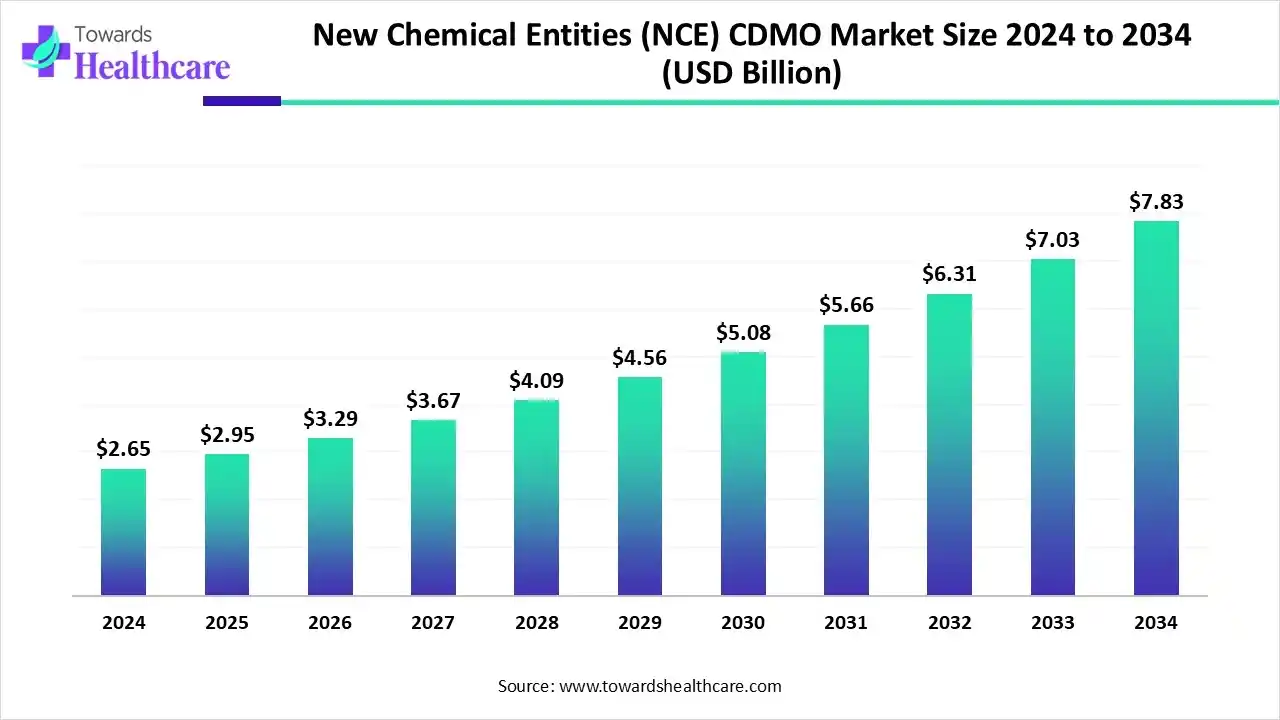

The global new chemical entities (NCE) CDMO market size is estimated at US$ 2.65 billion in 2024, is projected to grow to US$ 2.95 billion in 2025, and is expected to reach around US$ 7.83 billion by 2034. The market is projected to expand at a CAGR of 11.44% between 2025 and 2034.

The new chemical entities (NCE) CDMO market is growing because of the rising outsourcing of biotech and pharmaceutical chemicals development in process, and increasing healthcare manufacturing. North America was dominated by the presence of a strong pharmaceutical and biotech ecosystem, while Asia Pacific is the fastest growing an advanced regulatory environment and a highly skilled workforce.

| Table | Scope |

| Market Size in 2025 | USD 2.95 Billion |

| Projected Market Size in 2034 | USD 7.83 Billion |

| CAGR (2025 - 2034) | 11.44% |

| Leading Region | North America |

| Market Segmentation | By Service Type, By Compound Type, By End-User / Client Type, By Region |

| Top Key Players | Cambrex Corporation, Boehringer Ingelheim BioXcellence, PCI Pharma Services, Evonik Industries AG, AMRI (Albany Molecular Research Inc.), Fujifilm Diosynth Biotechnologies, Siegfried Holding AG, Aenova Group, Vetter Pharma International GmbH, Avara Pharma Services |

The new chemical entities (NCE) contract development and manufacturing organization (CDMO) refers to the outsourcing of drug discovery, development, and manufacturing services for novel chemical compounds by pharmaceutical and biotech companies. These services include process development, analytical testing, clinical trial material production, commercial-scale manufacturing, and regulatory support. Market growth is driven by rising R&D outsourcing, increasing complexity of NCEs, focus on cost efficiency, and demand for faster time-to-market.

For Instance,

Incorporation of AI drives the growth of the new chemical entities (NCE) CDMO market, as AI-based technology speeds up novel chemical entities discovery by analysing large biological datasets to discover new drug targets, estimating drug-target interactions, and enhancing lead compounds. It reduces the rate of disappointments and speeds the transition from discovery to clinical trials, predominantly significant in drug development.

CDMOs accept AI-driven techniques to increase effectiveness, improve quality, and lower manufacturing timelines. This technology is quickly converting the healthcare industry, emerging from drug development and discovery to personalized therapy. AI-based technology is intensely renovating drug discovery processes, potentially cultivating efficiency, reducing cost, and growing success rates, so rising applications of AI in various stages of the drug development processes.

Increasing government support for the CDMO services contributes to the growth of the new chemical entities (NCE) CDMO market.

For instance,

Increasing government schemes accelerate the growth of medical manufacturing, which drives the growth of the market.

For Instance,

| Company | Investment |

| Aragen Life Sciences | Aragen secures $100M PE investment to strengthen its CDMO capabilities in India and expand globally, accelerating drug development. |

| Advent International | Advent International is now merging the unlisted entity Cohance Lifesciences Ltd with Suven Pharma, creating one of the largest integrated CDMOs. |

In the service type, the process development and optimization segment led the new chemical entities (NCE) CDMO market, as these show hopeful results against a specific biological target that is significant in disease. Drug development is significant for analyzing each of these aspects before human clinical trials. Throughout the drug development process, it is required to establish the NCE's physical characteristics, like its chemical composition, solubility, and stability.

On the other hand, the analytical and regulatory support segment is projected to experience the fastest CAGR from 2025 to 2034, as analytical processes are used to efficiently address challenges at each step, from product advancement to final approval. These approaches confirm a product’s identity, purity, potency, and safety, giving formulators, manufacturers, and regulators the data they require to assess quality and gain product and process skills. Analytical technologies must evolve in parallel with manufacturing processes and formulation development.

By compound type, the small molecules/NCEs segment led the new chemical entities (NCE) CDMO market in 2024, as these small molecules are more likely to be absorbed, though some of them are only absorbed after oral administration if given as prodrugs. Small molecule drugs (SMDs) differ from large molecule biologics in that various small molecules are taken orally, whereas biologics generally need injection or another parenteral administration. Small-molecule drugs are also characteristically easy to manufacture and affordable for the buyer.

On the other hand, the specialty & complex NCEs segment is projected to experience the fastest CAGR from 2025 to 2034, as specialty treatments are primarily for relatively small groups of patients with relatively complex, difficult-to-manage diseases. An NCE is a drug complex with an active moiety that has never been accepted by a government authority, like the US Food and Drug Administration (FDA). NCEs enable targeted therapies that are tailored to the precise genetic profile of individual patients.

By end-user/client type, the pharmaceutical companies segment led the new chemical entities (NCE) CDMO market in 2024, as these companies generate value from novel modalities in numerous ways, by managing novel diseases, offering more efficient or convenient services. NCEs offer hope for managing diseases where present therapies are inadequate, providing novel mechanisms of action to address restrictions in existing treatments.

On the other hand, the biotechnology companies segment is projected to experience the fastest CAGR from 2025 to 2034, as these companies conduct R&D research innovation in drug development, providing novel avenues for treatment where existing therapies may be inadequate. Companies that focus on these dedicated areas frequently enjoy higher margins, superior consumer stickiness, and long-term contracts with healthcare organizations. Increasing spending in the chemical sector stocks with exposure to biotech and pharma companies.

North America is dominant in the new chemical entities (NCE) CDMO market in 2024, due to strong government support and noteworthy investment in research and development (R&D). Strong presence of major pharmaceutical and biotechnology firms, including Pfizer, Amgen, and Johnson & Johnson. A growing pipeline of targeted medicine, biologics, and complex therapies drives the growth of the market.

For Instance,

Pharmaceutical and biotech companies, predominantly small and mid-sized firms, are progressively outsourcing the development and manufacturing of NCEs to CDMOs. There is an increasing demand for CDMOs with dedicated abilities in manufacturing complex and highly potent active pharmaceutical ingredients (HPAPIs). The growing prevalence of autoimmune conditions and the incessant requirement for new chemical entities drive outsourcing, which drives the growth of the market.

In Canada, advancements in drug development systems, disposable bioreactor machineries, and AI-driven drug design are enhancing efficiency and productivity in manufacturing. Pharmaceutical and biotech organizations are progressively outsourcing research and manufacturing to leverage specialized expertise, accelerate timelines, and manage operational challenges.

Asia Pacific is the fastest-growing region in the new chemical entities (NCE) CDMO market in the forecast period, due to the affordable healthcare infrastructure, skilled workforce, and massive government support. Increasing pharmaceutical services demands, growing emphasis on R&D, and the rising trend of outsourcing drug manufacturing solutions. Massive aging patient base, growing interest in novel therapies, and an increase the demand for new chemical entities contributing to the growth of the market.

R&D of new chemical entities (NCE) CDMO, including multistep processes such as drug substance development, pre-formulation and formulation development, analytical services, regulatory and quality assurance support, and scale-up and technology transfer.

Key Players: Lonza Group AG and Thermo Fisher Scientific

Clinical trials of new chemical entities include various processes such as formulation development, production of clinical trial materials (CTM), labeling, packaging, logistics, and quality assurance.

Key Players: Catalent and WuXi AppTec

New chemical entities (NCEs) CDMOs mainly provide services to their pharmaceutical and biotech customers, not directly to patients. Its role is to develop and manufacture the drug, which is then distributed and promoted by the client company.

Key Players: Samsung Biologics and Boehringer Ingelheim

By Service Type

By Compound Type

By End-User / Client Type

By Region

January 2026

January 2026

October 2025

November 2025