February 2026

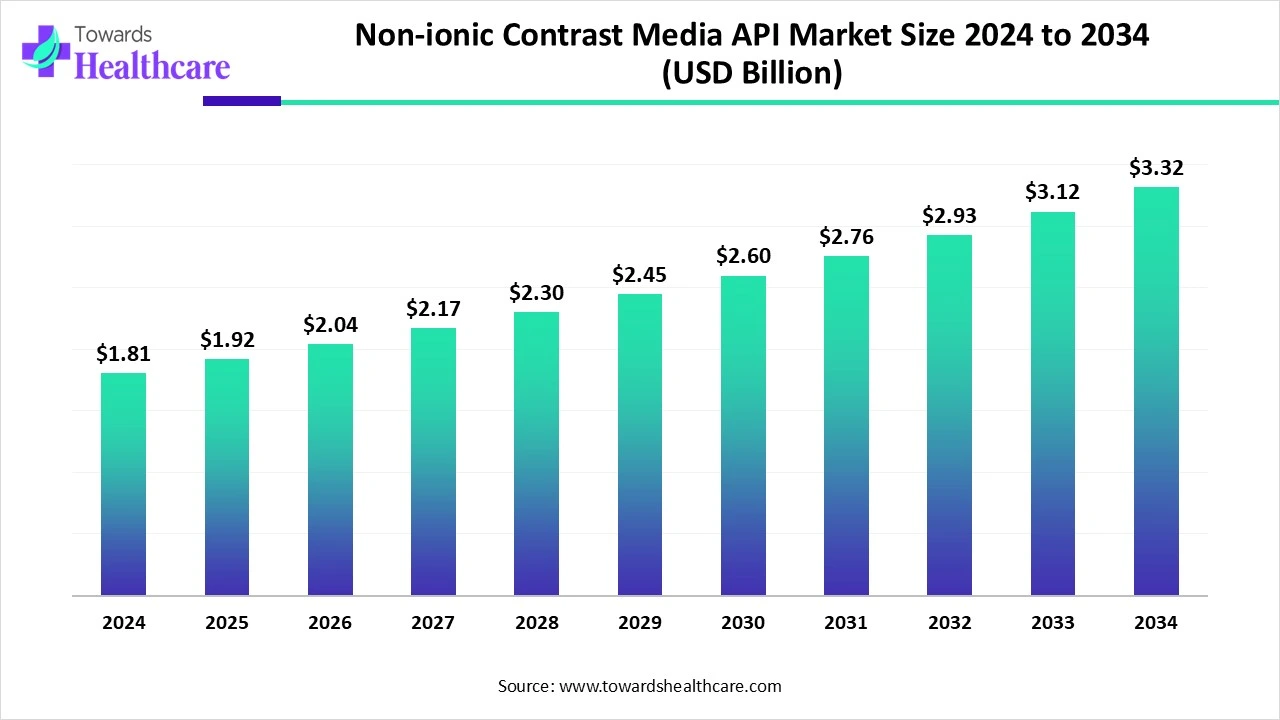

The global non-ionic contrast media API market size is calculated at US$ 1.81 billion in 2024, grew to US$ 1.92 billion in 2025, and is projected to reach around US$ 3.32 billion by 2034. The market is projected to expand at a CAGR of 6.34% between 2025 and 2034.

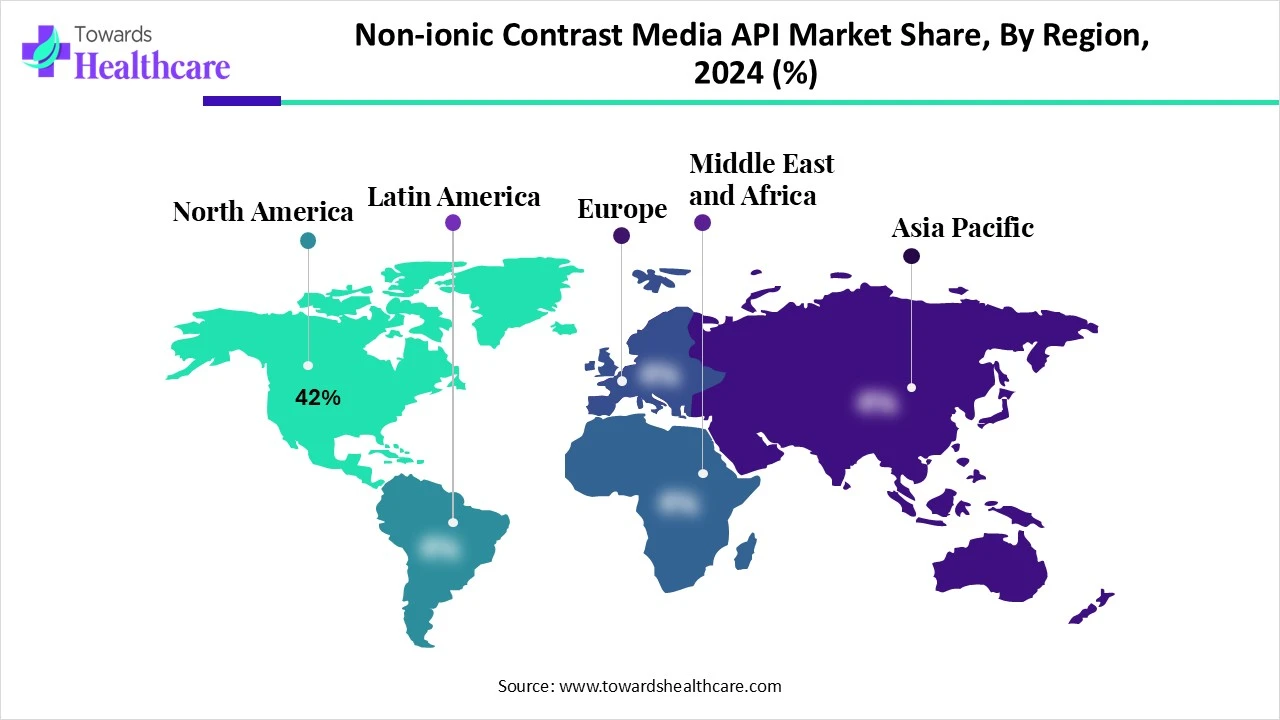

The non-ionic contrast media API market is expanding due to the increasing cases of chronic diseases and aging populations, diagnostic imaging, and growing healthcare infrastructure. North America is dominated in the market due to early adoption of advanced diagnostic imaging infrastructure, while Asia Pacific is the fastest growing, as increasing healthcare investment and rising approval of this media agent.

| Metric | Details |

| Market Size in 2025 | USD 1.92 Billion |

| Projected Market Size in 2034 | USD 3.32 Billion |

| CAGR (2025 - 2034) | 6.34% |

| Leading Region | North America share by 42% |

| Market Segmentation | By Product Type, By Imaging Modality, By Application, By End User, By Distribution Channel (API), By Region |

| Top Key Players | GE Healthcare (Iohexol), Bracco Imaging S.p.A. (Iopamidol, Iomeprol), Bayer AG (Iopromide), Guerbet Group (Iobitridol, Ioxilan), Taejoon Pharm Co., Ltd., Royal Chemists, Jodas Expoim Pvt. Ltd., Tianjin Jinhao Pharmaceutical Co., Ltd., Hengrui Medicine (Jiangsu Hengrui Pharmaceuticals), Sichuan Guoguang Pharmaceutical Co., Ltd., BeiLu Pharma (Beijing Beilu Pharmaceutical Co., Ltd.), IoTech International, Zhejiang Hisun Pharmaceutical Co., Ltd., Daejung Chemical & Metals Co., Ltd., Patheon (Thermo Fisher Scientific), Yantai Dongcheng Biochemicals Co., Ltd., Gland Pharma Limited, Ambalal Sarabhai Enterprises Ltd., Viva Biotech, Aastrid International Pvt. Ltd. |

The non-ionic contrast media API market refers to the market for active pharmaceutical ingredients (APIs) used in the formulation of non-ionic contrast agents. These contrast media are low-osmolar, water-soluble compounds primarily used in diagnostic imaging procedures such as X-ray, CT, and angiography to enhance the visibility of internal body structures. Compared to ionic contrast media, non-ionic APIs offer superior patient safety profiles, lower risk of allergic reactions, and better image clarity, making them the preferred choice in modern radiological practices. Increasing diagnostic imaging volumes, growing prevalence of chronic diseases, and advancements in imaging technologies are driving demand for high-purity non-ionic contrast APIs.

Integration of AI in the non-ionic contrast media API drives the growth of the market as AI-driven technology is currently harnessed to transform the medical imaging sector. AI-driven contrast media are very useful in pediatric imaging, like in the follow-up of metabolic diseases, demyelinating disorders, phacomatoses, and post-treatment variations. AI-based contrast media has huge potential to enhance the correctness and effectiveness of interpreting medical images such as MRIs, X-rays, and CT scans. AI has capabilities that enhance image analysis, spotting slight discrepancies and anomalies, lowering human mistakes, preserving accuracy, and mitigating the impact of fatigue or oversight. This accelerates the diagnostic process and cost-effectiveness, lowering healthcare expenses by enhancing the accuracy and efficiency of procedures.

Why Increasing Prevalence of Chronic Diseases?

The prevalence of chronic diseases is rising, largely due to factors like smoking, poor nutrition, physical inactivity, and excessive alcohol consumption. Additionally, the growing number of elderly individuals living longer will increase the burden of these diseases and boost demand for imaging services, especially angiography and CT scans. These technologies are crucial in diagnosing both acute and chronic conditions, including critical illnesses such as stroke, head injury, major trauma, heart disease, abdominal pain, pulmonary embolism, severe chest pain, and renal abnormalities. Non-ionic contrast agents like iodixanol and iohexol are favored for their safer profiles and lower risk of adverse reactions compared to ionic alternatives, fueling the growth of the non-ionic contrast media API market.

Major Challenges of Contrast Media

Adverse effects of contrast media include hypersensitivity reactions, thyroid dysfunction, and contrast-induced nephropathy, which limit the growth of the non-ionic contrast media API market.

Recent Advancements in Novel Formulation of Contrast Agents

Recent advances in contrast agent technology have resulted in new formulations, targeted agents, and better safety profiles. The development of these formulations is driven by the need for improved targeting, safety, and effectiveness. Nanoparticle-based contrast agents show significant promise for enhancing targeting and safety, as they are designed to accumulate in specific tissues or cells, providing better contrast and lower toxicity. Additionally, liposomal contrast agents are being researched for their improved stability and effectiveness. Liposomes, being biocompatible, can be engineered to encapsulate various contrast agents like iodine and gadolinium, which supports the growth of the non-ionic contrast media API market.

By product type, the iohexol segment led the non-ionic contrast media API market, due to its simplicity to use, high stability in plasma, and an excellent safety profile. It has low side effects. This supports blood vessels and body structures show up clearly on imaging tests, making it easier to see normal and abnormal tissue. Iohexol works by absorbing X-rays more than surrounding tissues. When it is injected into the body, it highlights blood vessels, tissues, or organs on a scan.

On the other hand, the iopromide segment is projected to experience the fastest CAGR from 2025 to 2035, as iopromide aids imaging internal organs, blood vessels, and other body parts during radiological examinations. It helps in accurate diagnosis by opacifying the vessels and tissues. Iopromide lets healthcare providers identify abnormalities more correctly. Iopromide injection is used to help diagnose or discover difficulties in the brain, heart, breast, head, stomach, blood vessels, and other various parts of the body.

By imaging modality, the computed tomography (CT) segment dominated the non-ionic contrast media API market in 2024, as this system provides enhanced resolution and signal, decreases the overall radiation dose, and lowers the amount of contrast agent, which poses challenges to some patients required for CT imaging. This helps make blood vessels, intestines, or other structures clear to see. Its ability to image blood vessels, soft tissue, and bone all at the same time. CT colonography, urography, and cardiovascular angiography are recently used techniques, while CT-driven biopsies and drainages have constantly lowered the requirement for more invasive techniques.

The angiography segment is projected to grow at the highest CAGR from 2025 to 2035, as it has many advantages. It achieves real-time, dynamic imaging using outdated imaging devices like X-rays or computed tomography (CT), and it provides therapeutic options at the time of initial diagnosis. Conventional angiography is invasive. Angiography is still the ideal standard in diagnosing major intravascular pathologies.

By application, the cardiology segment led the market in 2024, due to contrast media use in cardiac imaging. Coronary artery assessment is feasible by non-contrast MR angiography, which is an alternative examination in high-risk patients for the use of iodine contrast media. As the use of contrast media in heart imaging is more attractive, radiologists need to carefully consider the indication and the injection protocol of contrast media to be used, as well as the possibility of side effects.

The gastroenterology segment is projected to experience the fastest CAGR from 2025 to 2035, as gastrointestinal MRI contrast agents are helpful in some clinical scenarios for distinguishing bowel from intra-abdominal masses and other organs. The contrast agents are divided into positive agents and negative agents. It is directed orally or rectally to offer improved visualization of the gastrointestinal (GI) tract during imaging procedures. It improves gastrointestinal X-ray clarity, enhancing accuracy of diagnostic accuracy.

By end user, the hospitals segment dominated in the non-ionic contrast media API market in 2024, as contrast media are used to enhance the diagnostic value of those imaging exams. Contrast materials have a chemical structure that contains iodine, a naturally occurring chemical element. These contrast materials can be injected into veins or arteries, in the disks or fluid spaces of the spine, and other body openings in a hospital.

On the other hand, the diagnostic imaging centers segment is expected to grow at the fastest CAGR over the forecast period, 2025 to 2035, as contrast materials support distinguishing or "contrast" selected regions of the body from surrounding tissue. This helps doctors diagnose medical conditions by enhancing the visibility of particular organs, blood vessels, or tissues. The standard contrast medium should achieve a high concentration in the tissues without producing any side effects.

By distribution channel (API), the direct sales to manufacturers segment dominated in the Non-ionic Contrast Media API Market in 2024, as this channel enables consumers to purchase products directly from the manufacturer. It needs more work, and it is expensive to set up. They need significant capital investment. Manufacturers retain more control over how products are delivered by managing entirely aspects of the distribution channel.

On the other hand, the distributors/third-party API traders segment is expected to grow at the fastest CAGR over the forecast period, 2025 to 2035, as third-party APIs enable developers to leverage pre-built functionalities, saving time in development. Third-party APIs also offer affordable pricing models, allowing businesses to access moderate features instead of significant upfront costs. Many third-party APIs are intended to handle large volumes of requests and scale effortlessly as demand increases.

North America dominated the non-ionic contrast media API market share by 42% in 2024, as the use of diagnostic imaging has increased dramatically in the past decade, resulting in medical costs and medical exposure to ionizing radiation. High incidence of cancer, heart disease, and neurological conditions, which drives the demand for non-ionic contrast media API. Growing access to advanced healthcare imaging techniques like X-ray, CT, and PET/CT contributes to the market growth.

In the United States high volume of diagnostic imaging, for instance, there are 12,020 diagnostic imaging centers in the U.S. businesses as of 2023, a growth of 1.9% from 2022, which drives the market growth. The United States has an advanced healthcare infrastructure as an economic influence, and the influence of expert organizations drives the growth of the market.

In Canada, increasing government support for medical imaging was achieved as Canada's Drug Agency created the Canadian Medical Imaging Inventory (CMII) to support recent practices and advancements in the supply, technical operations, distribution, and general clinical and research use of modern imaging equipment in Canada, which contributes to the growth of the market.

Asia Pacific is estimated to be the fastest-growing non-ionic contrast media API market during the forecast period, as increasing adoption of novel imaging technologies, enhancing healthcare infrastructure, and growing focus on healthcare digitalization. In Asia Pacific, academic and most community hospitals provide 24/7 on-call radiology coverage, which raises the demand for advanced imaging technology. Medical imaging has developed quickly to play a key role in medicine by supporting the diagnosis and treatment of disease. Growing disposable incomes are also driving healthcare spending.

China's healthcare sector is experiencing huge growth, driven by rising incomes, growing health awareness, and an aging population. Radiology of China has been significantly advanced in the past two decades, and it has played a significant role in the management and treatment of diseases, which increases the demand for non-ionic contrast media API.

In India, increasing ageing population as declining fertility rates, increased life expectancy, advanced healthcare systems, and increasing chronic diseases. For instance, in India, 89% of total mortality would be intense in the 30-plus age group, driving diagnostic imaging use, which contributes to the growth of the market.

Europe is notably growing in the non-ionic contrast media API market as the presence of a strong healthcare system in this region will reorient systems to enhanced public and population health. Public health has become a government priority, rising focus on early primary care engagement to endorse healthier lifestyles, which widely adopts diagnostic imaging. The presence of leading manufacturers of contrast media, such as Bayer AG, Bracco Imaging S.p.A., and Guerbet, is increasing research on non-ionic APIs.

In Germany, the growing prevalence of age-related diseases such as cancer, diabetes, and stroke is increasing demand for contrast-enhanced imaging technology. Increasing government funding for healthcare imaging services also drives the growth of the market.

The UK has a government-sponsored universal healthcare system, which is known as the National Health Service (NHS). The NHS includes a series of publicly funded medical care systems in the UK, which increases the number of diagnostic procedures, particularly in the aging population. This drives the growth of the market.

In February 2025, Kevin O’Neill, CEO of GE Healthcare, stated, “GE Healthcare invested $138M to expand contrast media production at the Ireland site. We see improved interventional processes that need contrast to perform the procedure, and greater access to healthcare is expanding contrast-enhanced procedures.” (Source - Med Tech Dive)

By Product Type

By Imaging Modality

By Application

By End User

By Distribution Channel (API)

By Region

February 2026

January 2026

December 2025

November 2025