February 2026

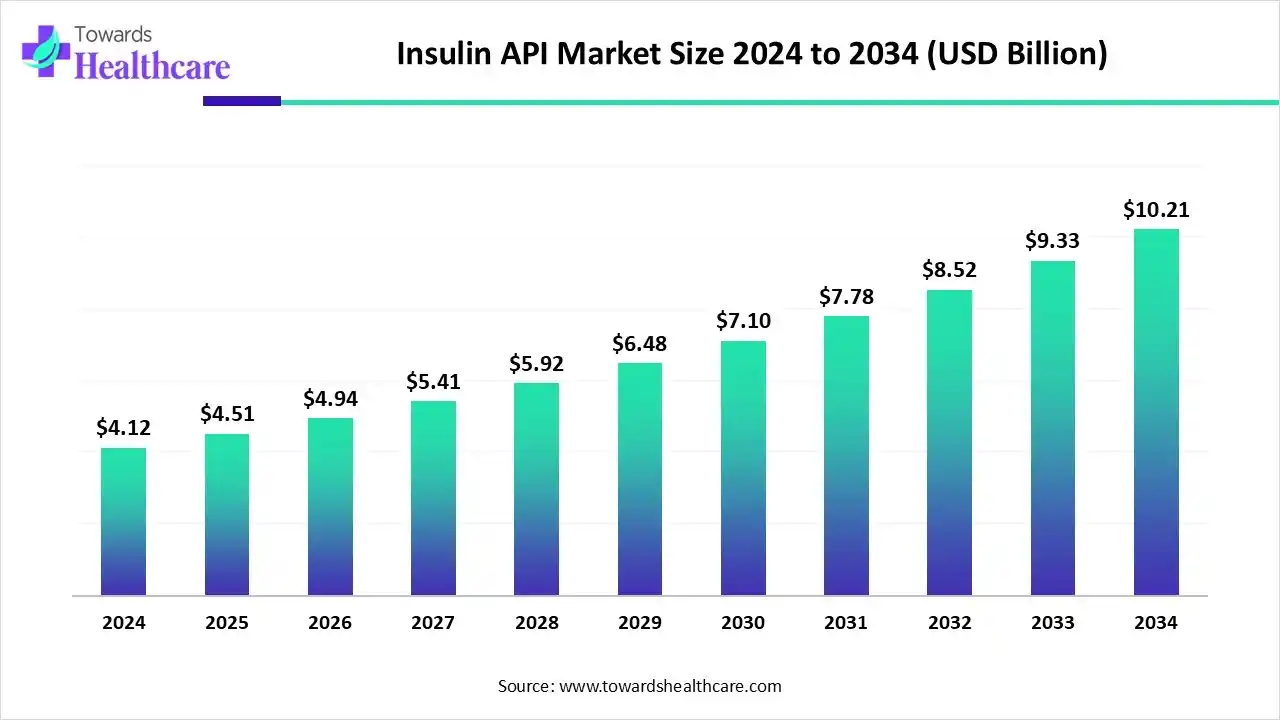

The global insulin API market size is calculated at US$ 4.51 billion in 2025, grew to US$ 4.94 billion in 2026, and is projected to reach around US$ 10.21 billion by 2034. The market is expanding at a CAGR of 9.52% between 2024 and 2034.

The insulin API market is expanding due to advances in insulin API manufacturing, including biosimilars, new drug formulations, strategic partnerships, and the involvement of leading market players. These data API platforms, such as Dexcom, Google Fit, Glooko, Tidepool, and ClinicalTrials.gov, offer interoperability, AI-driven analytics, enhanced security, and robust compliance features, supporting market growth.

| Table | Scope |

| Market Size in 2025 | USD 4.51 Billion |

| Projected Market Size in 2034 | USD 10.21 Billion |

| CAGR (2024 - 2034) | 9.52% |

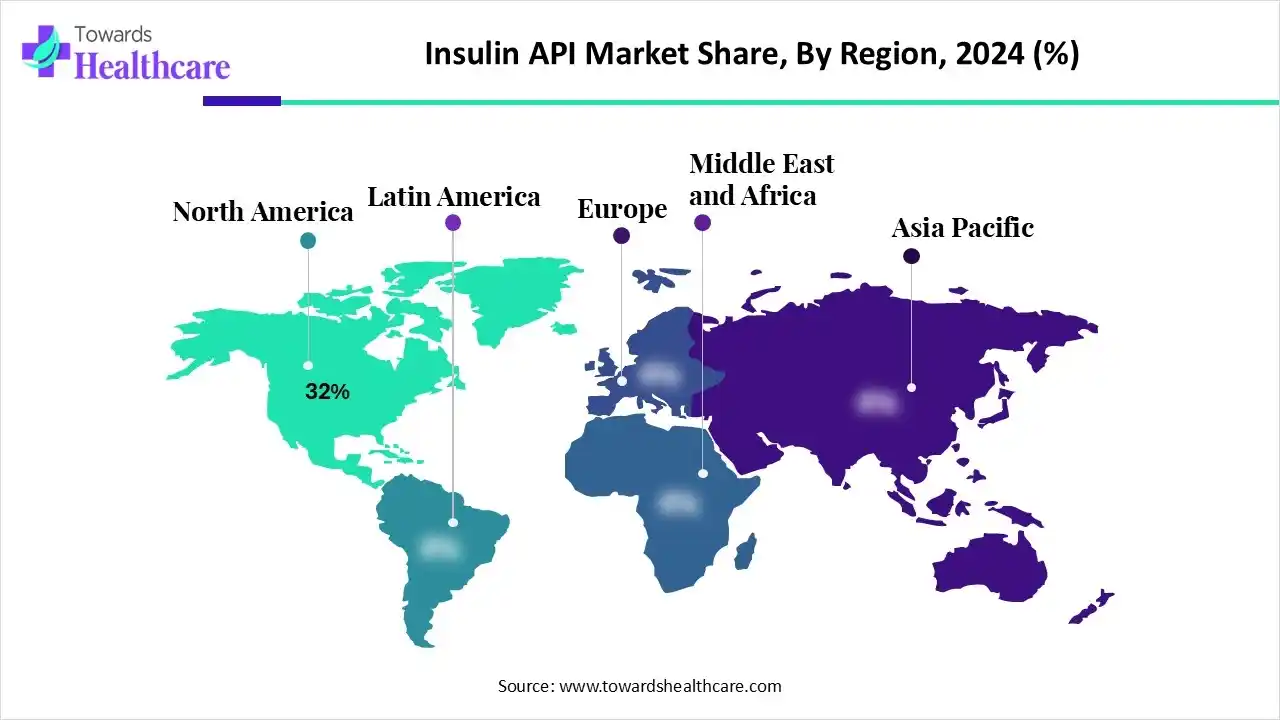

| Leading Region | North America by 32% |

| Market Segmentation | By API Type, By Product Form Supplied, By Manufacturer Type, By Application/End-use, By Region |

| Top Key Players | Novo Nordisk A/S, Sanofi S.A., Eli Lilly and Company, Biocon Biologics Ltd. (India), Tonghua Dongbao Pharmaceutical Co., Ltd.(China), Gan & Lee Pharmaceutical Co., Ltd. (China), Wockhardt Ltd. (India), Julphar (Gulf Pharmaceutical Industries), Yichang Changjiang Pharmaceutical Co., Ltd., Amphastar Pharmaceuticals, Inc,United Laboratories International Holdings Ltd. |

Biomanufacturing technology advances, increased competition, and pricing strategies are boosting the global market. The market includes the worldwide production, supply, and sale of active ingredients used in insulin formulations. These formulations include both human insulin and insulin analogs (rapid-acting, long-acting, premix) for diabetes patients. These APIs are produced either in-house by major pharmaceutical companies or by merchant/contract manufacturers and supplied to formulators.

The market is driven by rising diabetes prevalence, increased demand for insulin analogs, regional manufacturing growth (particularly in Asia-Pacific), biosimilar competition, and regulatory efforts to reduce manufacturing costs. The market is also defined by high-purity manufacturing standards, strict regulatory compliance, and a consolidated supply structure dominated by key players.

AI plays a significant role in the expansion of the market across the globe. AI-driven insulin delivery systems improve therapy outcomes and offer more effective approaches for diabetes management. AI improves the precision and adaptability of insulin delivery systems, allowing for more personalized treatment. AI/ML-based insulin optimization helps to assess the impact of standard insulin therapy on glycemic control and patient satisfaction, leading to better patient care.

How Does the Human Insulin API Segment Dominate the Insulin API Market in 2024?

The human insulin API segment dominated the market with approximately 30% share in 2024, owing to its significance in cost-effective therapies and the expansion of biosimilars. It broadens global access to diabetes care through the production of biosimilars and generics, making treatment more accessible. Advanced manufacturing techniques for human insulin API production increase efficiency and yield, supporting greater availability.

The insulin analogs API segment is expected to grow at the fastest CAGR during the forecast period, driven by next-generation API development and the integration of AI and digital health solutions. The development of glucose-responsive insulin APIs and increased production of cost-effective biosimilars lead to smart and long-lasting APIs. Government and local initiatives further expand access to insulin therapies, supporting market growth.

The biosimilar/follow-on insulin API segment is expected to grow in the coming years due to its significant role in lowering healthcare costs. It improves patient access and treatment adherence by promoting affordability and streamlining patient care processes. This reduction in overall spending drives further market expansion and accessibility.

What Made Lyophilized Insulin API the Dominant Segment in the Insulin API Market in 2024?

The lyophilized (freeze-dried) insulin API segment dominated the market with approximately 40% share in 2024, owing to its importance in manufacturing stable drug products, expanding global access, and versatility in drug formulation. Lyophilization enables the production of highly stable insulin products with a long shelf life. This supports R&D, expands the biosimilar market, and meets growing global demand.

The stabilized, formulation-ready blends for manufacturers segment is expected to grow at the fastest rate in the upcoming period due to their crucial role in improving product quality and consistency. These blends streamline manufacturing and the supply chain. They simplify production, increase efficiency, and mitigate supply chain risks, driving market growth.

The aqueous/liquid concentrated API segment is expected to grow in the coming years due to its key functions in enhancing bioavailability, improving sustainability, and advancing drug delivery. It simplifies formulation and production, enabling continuous manufacturing processes. This introduces efficient, sustainable, and technologically advanced production methods, driving market expansion.

Why Did the Large Integrated API Manufacturers Segment Dominate the Insulin API Market in 2024?

The large integrated API manufacturers (big pharma / legacy producers) segment dominated the market while holding a revenue share of approximately 35% in 2024, owing to their focus on integrating advanced technologies, sustainability, and enhanced supply chain resilience. They address global supply chain and regulatory challenges by resolving regulatory complexities. They meet high-potency API demand and enable personalized medicine, driving their market dominance.

The contract manufacturing organizations (CMOs) / CDMOs producing insulin API segment is expected to expand at the fastest rate during the forecast period due to the expansion of biologics and advanced therapies. They focus on global supply chain optimization and support the rise of smaller biotechnology firms. They drive the enhanced use of technologies and sustainability, leading to rapid market growth.

The biosimilar specialists/regional manufacturers segment is expected to grow in the coming years due to their potential in innovating manufacturing to reduce costs and drive commercialization. They build reliable and robust supply chains, fostering market expansion. They empower healthcare providers and patients by investing in educational initiatives, supporting their growth

Why Did the Finished Injectable Insulin Manufacturers Segment dominate the Insulin API Market in 2024?

The finished injectable insulin manufacturers (branded & generics) segment dominated the market in 2024, hilding a revenue share of approximately 65%, owing to their strategic focus on production, supply chain management, and expansion through biosimilars. They drive technological innovations in delivery systems and strategic mergers and acquisitions. They are experiencing a significant growth driven by supply chain resilience, digital integration, and a growing disease burden.

The R&D/clinical trial supply (early stage) segment is expected to grow at a rapid pace in the upcoming period due to the immense potential of manufacturing, sourcing, logistics, inventory management, etc. The patient-centric and decentralized clinical trials boost direct-to-patient (DTP) delivery and increased patient engagement. The advanced therapies and supply complexity are driven by biologics and gene therapies, and personalized medicine.

The biosimilar product manufacturers segment is expected to grow in the coming years due to increased patient access, reduced costs, market expansion, and strategic pipeline expansion. They advance manufacturing capabilities by leveraging technologies, embracing AI, and expanding capacity. They harmonize standards and conduct robust studies to navigate complex regulatory pathways.

North America dominated the market in 2024, capturing a revenue share of approximately 32%, owing to a favorable regulatory environment, R&D investments, increased industrial competition, and affordability initiatives. North American government initiatives focused on improving affordability and expanding insulin accessibility. There is an increased shift towards sustainable and scalable production methods through partnerships and investments in technologies. Device approvals, expanded coverage, and universal pharmacare accelerated the North American market, solidifying its dominance.

The U.S. is a major contributor to the market in Nort America. The U.S. FDA supported government actions that influence insulin APIs through approvals for rapid-acting insulin biosimilars and action on illegal APIs. The U.S. market is also driven by state-level affordability initiatives, reduced market prices, and non-profit competition. The U.S. government implemented many policies to lower insulin costs, further shaping the market.

Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period due to expanding manufacturing and biosimilars, government support, improved healthcare, and increasing affordability and access. The major initiatives implemented by many Asian Pacific countries greatly impact insulin API manufacturing and accessibility. The supportive programs boost pharmaceutical production, including API manufacturing, and address diabetes care. The World Health Organization (WHO) supports governments to enhance access to essential medicines, including insulin, in the Asia Pacific, driving market expansion.

The Indian government supports ongoing initiatives, boosts domestic production, and implements the PLI scheme, which greatly impacts diabetes treatment. It supports domestic API manufacturing and related programs, contributing to the market’s growth.

Europe is poised for significant growth in the market, driven by healthcare policies, cost-effectiveness, and a supportive regulatory framework. The European Commission and countries like France have launched government programs to advance pharmaceutical innovation and manufacturing, thereby driving the market. Insulin API programs impact the supply chain, and efforts strengthen Europe’s pharmaceutical resilience. Government and regulatory efforts focused on advancing the general API supply and diabetes care are key drivers.

Germany, home to pharmaceutical giants such as Sanofi, Eli Lilly, and Novo Nordisk, is a key player in the market in Europe. Government programs in Germany aim to foster private investment and support advancements in the industry. The German federal government has been a supporter of research projects and investments, including those by Sanofi, thereby contributing to the insulin API market.

South America is set for notable growth, fueled by the adoption of advanced insulin products, improved healthcare access, and robust manufacturing and supply chains. Government-backed initiatives have boosted national insulin and API production for the public healthcare system. Efforts for technology transfer have accelerated local insulin production. Awareness campaigns, including healthcare professional training and public outreach, inform patients about insulin access through the government healthcare system. Government support expands the market via local recombinant insulin production and advanced research projects.

Brazil has introduced new government programs and partnerships to boost domestic production of insulin and its API for the public healthcare system. The Ministry of Health leads national insulin production and has launched the Production Development Partnership (PDP) for local manufacturing of insulin glargine, impacting the market.

The Middle East and Africa are expected to experience steady growth in the coming years, driven by enhanced contract manufacturing, strategic partnerships, and local manufacturing initiatives. Both private and government efforts in the region aim to boost local manufacturing and supply of insulin APIs, addressing high diabetes rates and reducing reliance on costly imports. Key growth drivers include the rising demand for affordable and effective treatments and supply chain security. International partnerships and regulatory streamlining further propel the regional market.

Saudi Arabia is focused on localizing insulin production, including the API, and supports partnerships with major international pharmaceutical companies. This strategy expands production capacity and drives API and technology transfer, impacting the market.

The R&D process for insulin API manufacturing involves target identification and characterization, process development, analytical and quality control testing, and clinical trials and regulatory submissions.

Key Players: Novo Nordisk, Eli Lilly and Company, Sanofi, Biocon Biologics Limited, Wockhardt, Tonghua Dongbao Pharmaceutical, and Gan & Lee Pharmaceuticals.

The distribution chain for insulin API includes hospital pharmacies, retail pharmacies, online pharmacies, and direct-to-patient programs, which aim to improve supply chain and product innovations.

Key Players: Novo Nordisk A/S (Denmark), Lilly USA, LLC (U.S.), Sanofi (France), Biocon Biologics Limited (India), Wockhardt Limited (India), Biogenomics Limited (India), Boehringer Ingelheim International GmbH (Germany), and Tonghua Dongbao Pharmaceutical Co., Ltd. (China).

This stage include insulin affordability programs, digital health technology, API services, clinical practice guidelines, non-profit organizations, and government and regulatory actions.

Key Players: Novo Nordisk, Eli Lilly and Company, Sanofi, Biocon Biologics Limited, Wockhardt

Corporate Information

Business Overview

Strengths

Weaknesses

Opportunities

Threats

These are the global leaders with the largest insulin API revenues, proprietary technology platforms, and global manufacturing reach.

| Company | Key Offerings |

| Novo Nordisk A/S | World’s largest insulin and insulin API producer; vertically integrated from API synthesis to finished insulin products; major supplier of recombinant human insulin and analog APIs globally. |

| Sanofi S.A. | Strong insulin API production through integrated facilities; supplies both human and analog insulin APIs; supports third-party and biosimilar partnerships. |

| Eli Lilly and Company | Extensive insulin API capacity with established analog insulin lines (Humalog, Humulin); ongoing investments in biomanufacturing for high-purity APIs and biosimilars. |

Mid-sized contributors with regional strength, biosimilar production, and growing export footprints.

| Company | Key Offerings |

| Biocon Biologics Ltd. (India) | Major insulin API producer with recombinant human insulin and analog APIs; strong in contract manufacturing and biosimilar partnerships (e.g., with Viatris). |

| Tonghua Dongbao Pharmaceutical Co., Ltd. (China) | One of China’s leading recombinant insulin API producers; expanding global regulatory approvals and export presence. |

| Gan & Lee Pharmaceutical Co., Ltd. (China) | Produces recombinant human and analog insulin APIs; supports partnerships for biosimilar insulin products. |

| Wockhardt Ltd. (India) | Manufactures insulin APIs for global markets; vertically integrated biologics division with formulations and bulk supply capacity. |

Smaller, regional, or niche players with limited but growing insulin API activity.

| Company | Key Offerings |

| Julphar (Gulf Pharmaceutical Industries) | Regional insulin API manufacturer with vertically integrated production for MENA markets. |

| Yichang Changjiang Pharmaceutical Co., Ltd. | Chinese API supplier focusing on human insulin intermediates; scaling production for biosimilar markets. |

| Amphastar Pharmaceuticals, Inc. | U.S.-based API and finished-dose manufacturer involved in recombinant protein and insulin intermediate development. |

| United Laboratories International Holdings Ltd. | Expanding biologics capacity; supplies insulin APIs and precursors for domestic and international clients. |

By API Type

By Product Form Supplied

By Manufacturer Type

By Application/End-use

By Region

February 2026

February 2026

February 2026

February 2026