January 2026

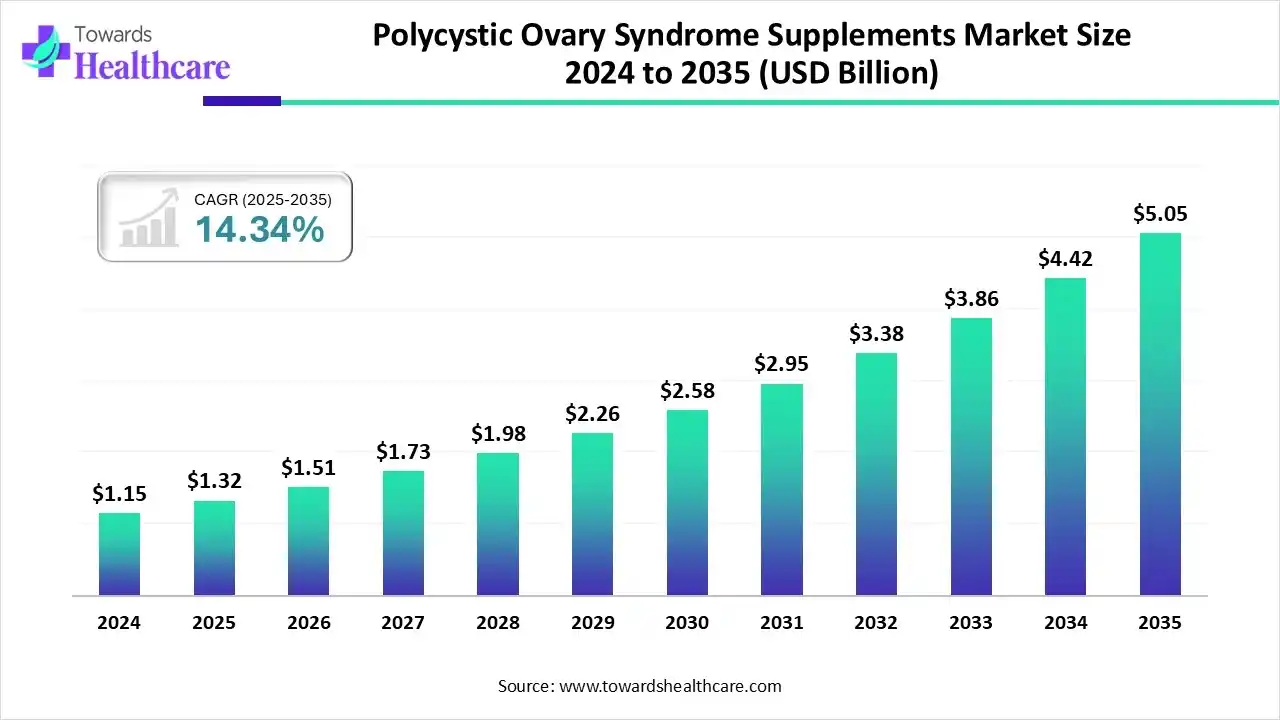

The global polycystic ovary syndrome supplements market size is calculated at US$ 1.32 billion in 2025, grew to US$ 1.51 billion in 2026, and is projected to reach around US$ 5.05 billion by 2035. The market is expanding at a CAGR of 14.34% between 2026 and 2035.

PCOS supplements help people with PCOS by filling nutritional gaps, improving insulin sensitivity, reducing inflammation, and supporting ovulation and fertility. The best supplements for managing PCOS include vitamin D, omega-3 fatty acids, myo-inositol, D-chiro-inositol, magnesium, berberine, zinc, and CoQ10. They are significantly influencing the polycystic ovary syndrome supplements market by greatly affecting the lifestyle changes of women in the patient population.

| Table | Scope |

| Market Size in 2025 | USD 1.32 Billion |

| Projected Market Size in 2035 | USD 5.05 Billion |

| CAGR (2026 - 2035) | 14.34% |

| Leading Region | North America |

| Market Segmentation | By Ingredient, By Dosage Form, By Indication, By Sales Channel, By Region |

| Top Key Players | Himalaya Wellness Company, The S’moo Co., Eu Natural, Amway Corporation, Herbalife Nutrition Ltd., GNC Holdings, LLC, Bayer AG, Nature’s Bounty Co.,Thorne HealthTech, Inc., Jarrow Formulas, Inc., New Leaf Products Ltd., SOVA Supplements Ltd. |

The polycystic ovary syndrome supplements market deals with different types of dietary supplements that help reduce PCOS-related symptoms, such as high levels of androgens, missed or irregular periods, body hair growth, acne, and weight gain. They help improve PCOS-related complications, such as diabetes, high blood pressure, infertility, insulin resistance, depression, heart disease, and sleep problems. Research and clinical studies focus on diet and supplement treatments, behavioral and educational therapies, and physical activity interventions. Personalized interventions, including various lifestyle approaches, are of great importance for the successful treatment of complex chronic conditions.

AI contributes to personalized supplementation, nutrition, and the development of new supplements. Digital health platforms like AI-powered mobile applications include tracking features such as period trackers, diet planners, and exercise trackers that offer real-time updates. They enhance self-management and patient adherence, and assist in the discovery of drugs or supplements, thereby expanding the market for polycystic ovary syndrome supplements.

How Does the Myo-inositol-based Supplements Segment Dominate the Market in 2024?

The myo-inositol-based supplements segment dominated the polycystic ovary syndrome supplements market while holding the largest share in 2024. This is mainly because of their significant impact on improved insulin sensitivity, hormonal balance, restored equilibrium, and ovulation. They decrease metabolic and cardiovascular risks and improve tolerability. They are used to regulate the menstrual cycle and increase fertility outcomes.

The micronutrient & omega-3 segment is expected to grow at the fastest CAGR in the market during the forecast period due to improved lipid profiles, reduced inflammation, and enhanced reproductive health provided by these dietary supplements. Micronutrients like chromium boost total antioxidant capacity, follicle-stimulating hormone (FSH) levels, and insulin sensitivity. They contribute to better ovarian environments and follicle development.

The herbal supplements segment is expected to grow at a significant rate over the projection period due to the increasing preference for natural and plant-based remedies among consumers seeking safer, side-effect–free options. Ingredients like cinnamon, spearmint, and fenugreek have shown potential in managing insulin resistance, hormonal imbalance, and symptoms like hirsutism, making them highly attractive for PCOS management. Additionally, growing awareness of holistic and lifestyle-based approaches to health is driving demand for herbal alternatives over synthetic supplements.

What Made Capsules & Tablets the Dominant Segment in the Market in 2024?

The capsules & tablets segment led the market in 2024, owing to the widespread availability of a range of medications in the form of capsules and tablets, such as insulin sensitizers, ovulation inducers, anti-androgens, combined oral contraceptive pills, herbal remedies, and supplements. They are essential in therapies and personalized treatment approaches. They enhance hormonal regulation, support ovulation induction, and improve insulin sensitivity.

The gummies segment is expected to grow at the fastest rate during the forecast period due to better patient compliance compared to traditional pills or powders. Gummies, as potential dietary supplements, promote more consistent intake of essential nutrients. They are advantageous because of their active ingredients, such as inositol, vitamins, and herbs.

The powders segment is expected to grow at a notable rate in the coming years due to its significant potential in traditional medical treatments. Powder formulations effectively manage the multifaceted symptoms of PCOS. There is an increasing consumer interest in protein and fiber powders to address metabolic and hormonal imbalances.

Why Did the Hormonal Regulation Segment Lead the Market in 2024?

The hormonal regulation segment dominated the polycystic ovary syndrome supplements market in 2024, owing to the growing importance of PCOS supplements in managing symptoms and reducing long-term health risks. The tailored medications and lifestyle modifications help to meet individual patient goals related to fertility or contraception. The PCOS supplements help to restore regular ovulation and menstrual cycles.

The fertility improvement segment is expected to grow at the fastest rate in the market during the upcoming period due to the increased focus on weight management, diet, exercise, and surgical interventions. Dietary supplements can boost the effectiveness of fertility medications and help restore regular ovulation. They also improve the hormonal profile for conception and enhance insulin sensitivity.

The menstrual cycle support segment is expected to grow significantly in the coming years. This is primarily due to the ability of PCOS supplements to restore menstrual regularity and spontaneous ovulation. These supplements support ovarian function and hormonal balance. They also help manage metabolic health and insulin levels.

Why Did the Online Stores Segment Dominate the Market in 2024?

The online stores segment led the polycystic ovary syndrome supplements market with the largest revenue share in 2024, owing to the convenience of home delivery and 24/7 accessibility, allowing consumers to easily compare products, read reviews, and access a wider variety of supplements. The rise of e-commerce platforms and digital marketing has increased awareness and availability of specialized PCOS supplements that may not be stocked in local pharmacies. Additionally, privacy and discretion in purchasing sensitive health-related products online make this channel particularly appealing to many consumers.

The pharmacy & drug stores segment is expected to grow at a rapid pace in the market during the studied period due to their widespread accessibility and trusted reputation among consumers seeking reliable and regulated products. These outlets offer a convenient one-stop solution for both prescription and over-the-counter supplements, ensuring authenticity and quality assurance. Additionally, increased awareness campaigns and pharmacist recommendations are driving more consumers to purchase PCOS-focused supplements through these traditional retail channels.

The hypermarket and supermarket segment is expected to experience significant growth in the near future due to increased access to over-the-counter (OTC) products. The rising preference among women for purchasing health products from brick-and-mortar stores is driven by the safety and availability of products and formulations. They compete by offering in-store promotions, product bundling, and multiple brands.

North America led the market for polycystic ovary syndrome supplements by capturing the largest share in 2024. This is mainly due to rising awareness of the long-term health benefits and a strong consumer preference for natural health supplements. The National Institute of Environmental Health Sciences (NIEHS), part of the National Institutes of Health (NIH), reviewed 25 years of data and stated that AI and machine learning have significant potential to diagnose polycystic ovary syndrome (PCOS). NIH, the medical research agency under the U.S. Department of Health and Human Services (HHS), conducts and supports both translational and clinical medical research. The NIH aims to identify causes, treatments, and cures for both rare and common diseases. It grants funding for research on the metabolic and genetic aspects of PCOS and potential treatments, including clinical trials.

The U.S. leads the market in North America. The U.S. government has played a significant role in increasing funding for women’s health research, research efforts, and public awareness. The National Institutes of Health (NIH), the Department of Defense, and the Advanced Research Projects Agency for Health (ARPA-H) have contributed to the rise in research funding for conditions like PCOS. The NIH Office of Dietary Supplements (ODS) announced a strategic plan for 2025-2029 to promote research on dietary supplements and botanicals.

Asia Pacific is expected to grow at the fastest CAGR during the forecast period due to increased focus on women’s health, preventive healthcare, and a preference for natural and herbal products. Health camps provide various services for women, including screening for non-communicable diseases such as diabetes and obesity. They also offer nutrition counseling and mental health sessions to improve the health of female patients. Companies in the Asia-Pacific region are concentrating on product innovations that are expanding the market for polycystic ovary syndrome supplements. Public health initiatives are addressing the urgent need for effective health measures and strategies.

India is emerging as a key player in the market. The Indian government’s initiatives implement integrated approaches to improve women’s health, nutrition, and non-communicable diseases. The main initiatives include the Ministry of Ayush, Poshan Abhiyaan, and Swasth Nari, Sashakt Parivar Abhiyaan. The Ministry of Ayush conducts clinical trials and develops guidelines for managing PCOS using traditional methods like Ayurveda.

Europe is projected to experience notable growth in the coming years, driven by increased availability and access to a wide range of supplements through e-commerce and direct-to-consumer channels. Ongoing research highlights the importance of prebiotics, probiotics, vitamin D, and omega-3 fatty acids in reducing inflammation, enhancing insulin sensitivity, and regulating hormone levels in women with PCOS. Public awareness campaigns aim to improve care through patient-centered research and collective involvement. The EU-funded initiative seeks to develop approved treatments for young women and adolescents with PCOS. Additionally, research projects are conducting clinical trials on new treatments.

Some of the major trends in Germany include digital health applications, pharmaceutical reforms, national nutrition guidelines, and the development of new PCOS supplements, all of which are contributing to the market's growth. The market for polycystic ovary syndrome supplements in Germany is also boosted by the integration of digital therapeutics into its healthcare system. Additionally, the German government has introduced a new performance-based reimbursement model for high-value innovative medicines.

The growth of the market in South America is being driven by increasing awareness of PCOS and its long-term health implications among women in the region. Rising adoption of lifestyle modifications and preventive healthcare, combined with a growing preference for natural and herbal supplements, is boosting demand. Moreover, expanding e-commerce penetration and improved access to pharmacies and healthcare providers are making supplements more accessible. Economic development and increasing health consciousness among women are further fueling market expansion across South America.

Brazil is a major contributor to the market within South America due to its large female population and growing awareness of hormonal and metabolic health issues. Increasing healthcare expenditure, rising adoption of preventive and wellness-focused therapies, and a strong preference for herbal and natural supplements are driving market demand in the country. Additionally, Brazil’s well-developed retail and e-commerce infrastructure makes supplements more accessible to consumers across urban and semi-urban areas. These factors collectively position Brazil as a key market driver in the region.

The Middle East and Africa are witnessing an opportunistic rise in the polycystic ovary syndrome supplements market due to increasing awareness of women’s health issues and growing demand for preventive and wellness-focused therapies. Rising disposable incomes, urbanization, and a shift toward lifestyle and diet management are encouraging the adoption of supplements for hormonal balance and metabolic health. Additionally, the expansion of e-commerce platforms and pharmacy networks is improving accessibility to both herbal and nutraceutical products. These factors are collectively creating a promising growth environment for PCOS supplements in the region.

Saudi Arabia is a major contributor to the market within the Middle East and Africa due to its high awareness of women’s health issues and increasing focus on preventive healthcare. The country’s rising disposable income, urban lifestyle adoption, and growing inclination toward natural and nutraceutical supplements are driving demand. Furthermore, well-established pharmacy chains, online retail platforms, and healthcare initiatives are improving accessibility to PCOS-focused products. These factors collectively make Saudi Arabia a key market driver in the MEA region.

The research and development process for PCOS supplements encompasses identifying effective ingredients, formulating and developing products, conducting scientific validation and clinical trials, reviewing regulatory requirements, ensuring compliance, launching products to the market, and continuing research for innovation and improvement.

Key Players: Himalaya Wellness Company, MyOva Ltd, Allara Health, Inc., The S'moo Co, NOW Health Group, Inc., etc.

In this stage, ingredients are translated into final dosage forms (capsules, tablets, gummies, powders) tailored for PCOS management (combinations of inositols + vitamins + minerals + herbal extracts). Manufacturing must ensure correct dosing, stability, bioavailability, and compliance with supplement regulatory standards.

Key Players: Theralogix (Ovasitol), Thorne Research, Pure Encapsulations, Eu Natural

Hospital pharmacies remain primary distribution channels for treatments, while retail and drugstore pharmacies are increasingly important for supplement accessibility. This stage ensures that products reach both clinical settings and general consumers effectively.

Key Players: Abbott Laboratories, Bayer AG, Teva Pharmaceutical Industries, Merck & Co., Inc., and Sun Pharmaceutical Industries.

This stage includes providing educational resources, digital and online support platforms, lifestyle and holistic programs, and product-specific assistance. Such services enhance patient engagement, adherence, and overall outcomes for individuals managing PCOS.

Key Players: Uvi Health, Oziva, Himalaya Wellness Company, MyOva Ltd, Allara Health, Inc., The S'moo Co, NOW Health Group, Inc.

Corporate Information: Headquarters: 401 E Jefferson St, Suite 108, Rockville, Maryland 20850, U.S. | Year Founded: 2002.

Business Overview

Theralogix is a nutritional science company that develops evidence-based micronutrient and supplement products, with a meaningful emphasis on women’s health, fertility, hormonal balance, and metabolic support. The brand emphasizes independent third-party testing (e.g., via NSF International) and transparency regarding ingredient composition and manufacturing standards. Theralogix’s flagship product line is the “Ovasitol” range (myo-inositol / D-chiro-inositol blends) designed to support hormonal, ovarian, and insulin/metabolic health in women with PCOS.

Business Segments / Divisions

Geographic Presence

Theralogix is headquartered in the U.S. (Rockville, Maryland). Its products are marketed primarily in the U.S., though given the global growth of the PCOS supplement market and its direct-to-consumer (DTC) e-commerce model, it is reasonable to infer some international reach (e.g., via online sales). For example, their product Ovasitol is sold online and referenced in international PCOS nutrition forums.

Key Offerings

SWOT Analysis

Recent News

In September 2024, Theralogix highlighted that over 10% of young women experience hormonal imbalances, such as excess testosterone, skin and hair issues, irregular cycles, and fertility challenges. To address these, it developed Ovasitol, which quickly became the leading inositol supplement, widely embraced by the PCOS community.

Corporate Information: Headquarters: 769 Broadway, Suite 1019, New York City, NY 10003, U.S. | Year Founded: 2020.

Business Overview

Allara Health is a telehealth and virtual-care platform built to address women’s hormonal, metabolic, and gynecologic conditions, including Polycystic Ovary Syndrome (PCOS), by combining board-certified medical providers, registered dietitians, detailed lab work (hormonal/metabolic), and lifestyle & nutrition support in a coordinated model. The company aims to fill the care gap for women who have historically faced fragmented care for chronic hormonal conditions.

Business Segments / Divisions

While Allara is primarily one integrated platform rather than multiple large divisions, key operational segments include:

Geographic Presence

Allara is U.S.–based and has expanded its service footprint across all 50 states. Although headquartered in New York, its virtual model makes it accessible nationwide, and it has established partnerships with major U.S. health insurers such as Aetna, Blue Cross Blue Shield, Cigna, Humana, and United Healthcare.

Key Offerings

SWOT Analysis

Recent News

| Company | Contribution to Market |

| Himalaya Wellness Company | Offers herbal/plant-based nutraceuticals marketed for hormonal balance and metabolic support, appealing to clean-label PCOS supplement demand. |

| The S’moo Co. | A direct-to-consumer brand focusing on PCOS-friendly supplements, digital channels, and younger demographics with convenient formats. |

| NOW Health Group, Inc. (NOW Foods) | A large global supplement company whose women’s health and inositol products help scale the PCOS supplement segment via broad retail access. |

| Eu Natural | A niche brand focused on PCOS and women’s hormonal health, leveraging transparent sourcing and online distribution to capture emerging demand. |

| Amway Corporation | Through its global directselling network, Amway extends women’s wellness supplements (including PCOS-relevant) into emerging markets and diverse consumer bases. |

| Herbalife Nutrition Ltd. | With a strong global footprint in nutritional supplements, Herbalife taps into the PCOS/women’s health segment by leveraging herbal/micronutrient blends. |

| GNC Holdings, LLC | Offers women’s health-oriented supplement lines (including ovarian/PCOS support) via omni-channel retail, helping drive accessibility and awareness. |

| Bayer AG | As a large pharmaceutical/nutraceutical company, Bayer contributes via clinicallyoriented women’s health supplements, giving credibility to the PCOS segment. |

| Nature’s Bounty Co. | Manufactures clean-label, traceable women’s wellness supplement lines (including hormonal and reproductivehealth support) that serve PCOS-relevant demand. |

| Thorne HealthTech, Inc. | Provides premium, research-driven supplement formulations (e.g., inositols, NAC) that address hormonal/metabolic aspects of PCOS and cater to discerning consumers. |

| Jarrow Formulas, Inc. | A specialist in micronutrients and botanical blends, Jarrow offers formulations that support hormone balance and insulin sensitivity in PCOS. |

| New Leaf Products Ltd. | A women’s healthfocused supplement company listed among key players in PCOS supplement market analyses, catering to specialized niche demand. |

| SOVA Supplements Ltd. | Recognised in PCOS supplement market reports as an emerging brand targeting the PCOS indication with tailored formulations and directtoconsumer models. |

The polycystic ovary syndrome supplements market is poised at an inflection point of accelerated expansion, underpinned by converging macro-trends in women’s health awareness, functional nutrition, and preventive wellness. The paradigm shift from reactive to proactive hormonal health management has redefined consumer engagement, positioning nutraceutical interventions as integral adjuncts to clinical therapy.

From a research analyst’s standpoint, the market demonstrates a compound growth trajectory, reinforced by sustained demand for inositol-based formulations, vitamin-mineral complexes, and botanical adaptogens targeting endocrine modulation. The increasing prevalence of PCOS globally, coupled with diagnostic improvements and rising consumer willingness to invest in self-directed care, creates a fertile landscape for product diversification and premiumization.

Strategically, the market exhibits favorable asymmetry on the opportunity curve, with digital health convergence (tele-nutrition, DTC supplement models, subscription ecosystems) enabling data-driven personalization. Companies integrating clinical validation with holistic, omnichannel strategies are expected to capture outsized value as the category transitions from niche nutraceutical to mainstream wellness segment.

In essence, the market represents a structurally expanding, innovation-driven opportunity space, where evidence-based formulation, regulatory differentiation, and patient-centric ecosystem integration will define long-term competitive advantage.

By Ingredient

By Dosage Form

By Indication

By Sales Channel

By Region

January 2026

January 2026

November 2025

November 2025