Postpartum Health Supplements Market Size, Key Players with Insights and Shares

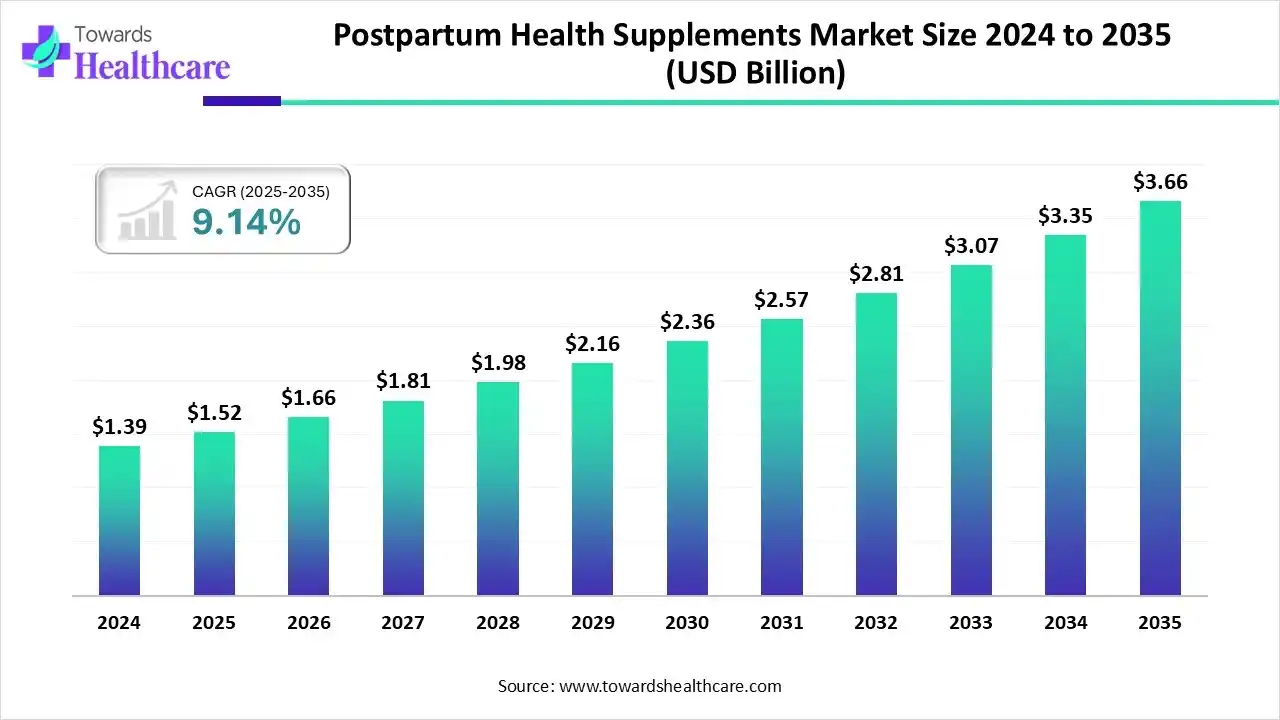

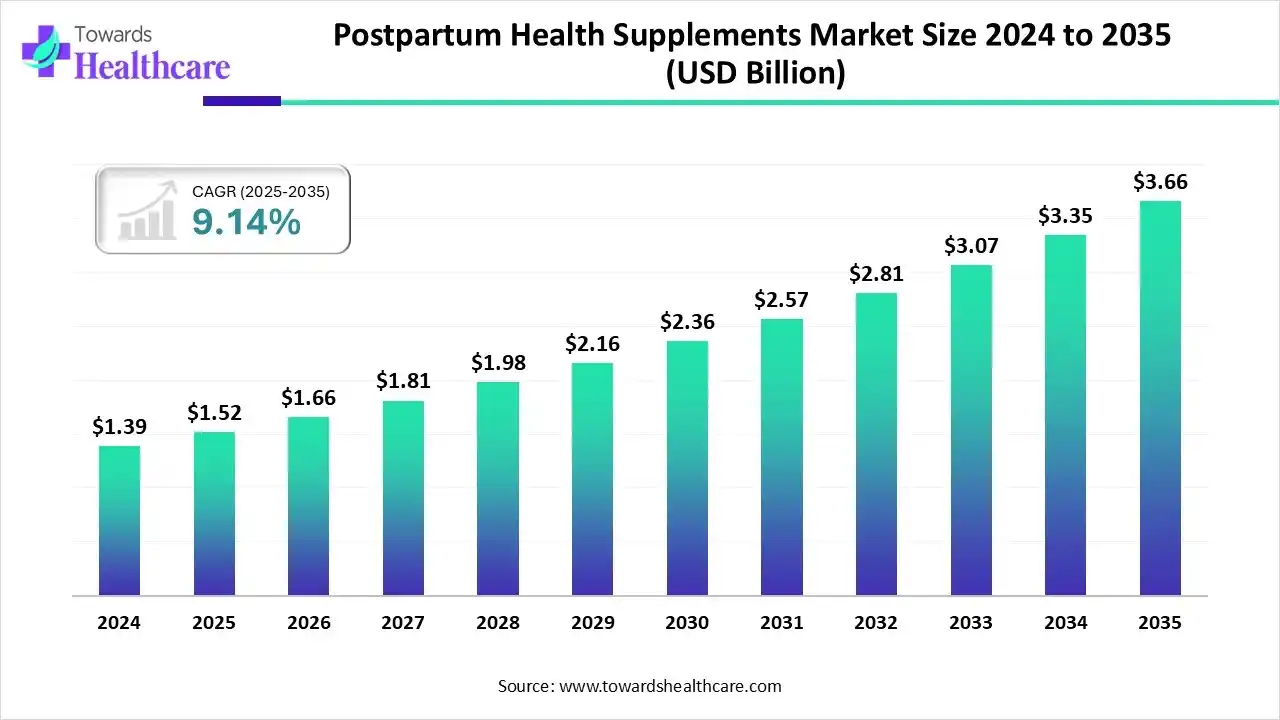

The global postpartum health supplements market size is calculated at US$ 1.52 billion in 2025, grew to US$ 1.66 billion in 2026, and is projected to reach around US$ 3.66 billion by 2035. The market is expanding at a CAGR of 9.14% between 2026 and 2035.

The postpartum health supplements market is expanding due to the increasing need for post-childbirth recovery and well-being, and the rising occurrence of disorders such as postpartum depression. North America is dominated by increasing disposable income and increasing healthcare manufacturing. Asia Pacific is the fastest growing as the growth of pharmaceutical industries and increasing healthcare startups.

Key Takeaways

- Postpartum health supplements sector pushed the market to USD 1.52 billion by 2025.

- Long-term projections show USD 3.66 billion valuation by 2035.

- Growth is expected at a steady CAGR of 9.14% in between 2026 to 2035.

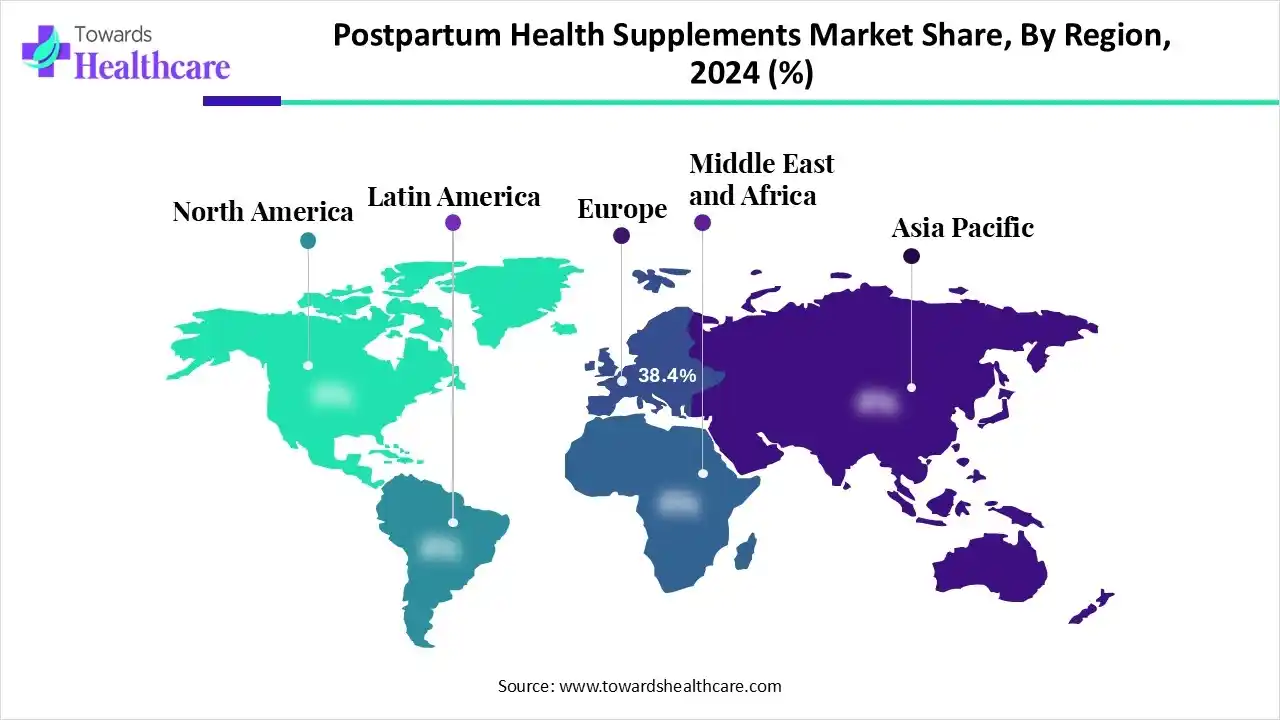

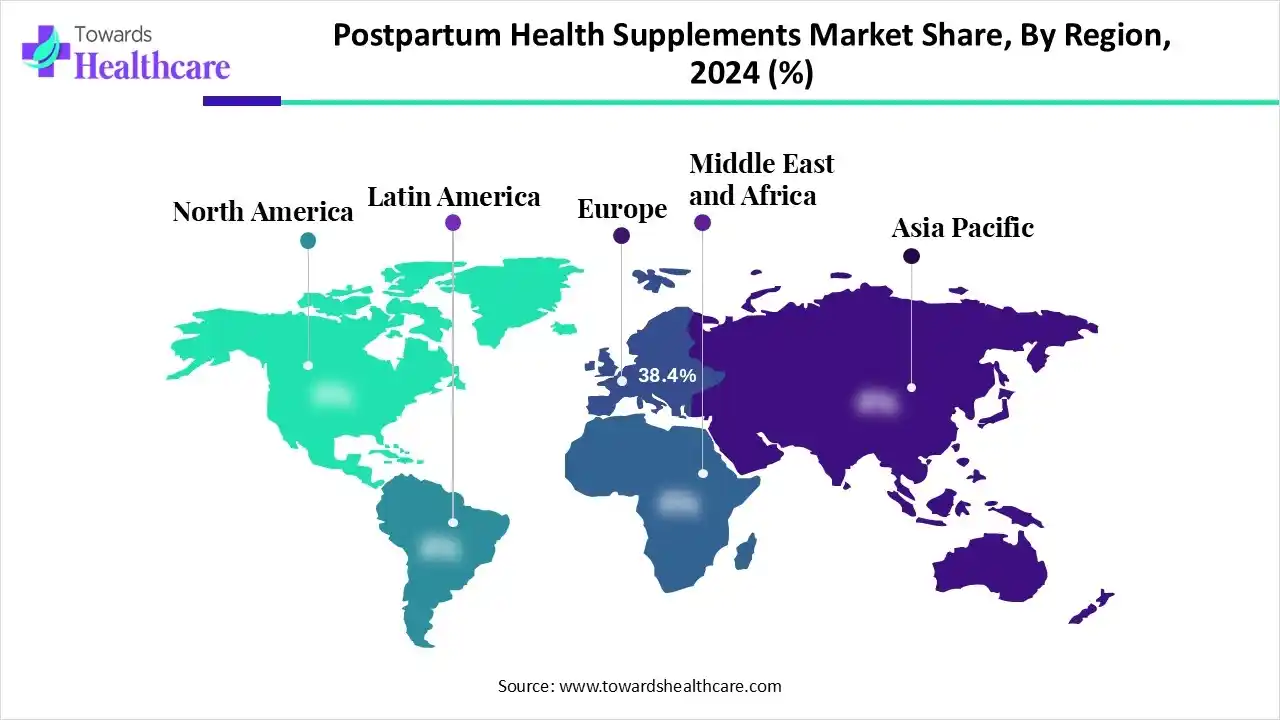

- Europe dominated the postpartum health supplements market in 2024, with a 38.4% share.

- Asia Pacific is expected to grow at the fastest CAGR of 10.4% during the forecast period.

- By product type, the vitamins & minerals segment dominated the market with a share of 32.8% in 2024.

- By product type, the probiotics segment is expected to grow at the fastest rate of 9.0% during the forecast period.

- By form, the tablets & capsules segment dominated the market with a share of 42.8% in 2024.

- By form, the gummies segment is expected to grow at the fastest rate of 8.8% during the forecast period.

- By ingredient source, the plant-based segment dominated and is expected to be the fastest growing in the postpartum health supplements market with a share of 58.4% in 2024.

- By distribution channel, the pharmacies & drug stores segment dominated the market with a share of 56.4% in 2024.

- By distribution channel, the online channels segment is expected to grow at the fastest rate of 9.2% during the forecast period.

- By end user, the lactating mothers segment dominated the market with a share of 70.8% in 2024.

- By distribution channel, the non-lactating mothers segment is expected to grow at the fastest rate of 9.4% during the forecast period.

Quick Facts Table

| Table |

Scope |

| Market Size in 2025 |

USD 1.52 Billion |

| Projected Market Size in 2035 |

USD 3.66 Billion |

| CAGR (2026 - 2035) |

9.14% |

| Leading Region |

Europe by 38.4% |

| Market Segmentation |

By Product Type, By Form, By Ingredient Source, By Distribution Channel, By End User, By Region |

| Top Key Players |

Nestlé S.A., Amway Corp., Abbott Laboratories, Bayer AG, Herbalife Nutrition Ltd., Nature’s Bounty Co., Glanbia plc, Church & Dwight Co., Inc., The Honest Company, Inc., New Chapter, Inc., Mama’s Select, Pink Stork, Pure Encapsulations, Inc., MegaFood, Pharmavite LLC |

What are Postpartum Health Supplements?

The postpartum health supplements market comprises nutritional products formulated to support mothers’ recovery after childbirth by replenishing essential vitamins, minerals, and nutrients. These supplements help address fatigue, hormonal imbalance, immune health, and lactation support. The market is driven by rising awareness about maternal nutrition, growing demand for natural and organic ingredients, and increased healthcare spending. Expanding product availability through online platforms and personalized nutrition solutions further accelerates market growth across developed and emerging regions.

Postpartum Health Supplements Market Outlook

- Industry Growth Overview: The market is expected to increase rapidly between 2025 and 2034 due to the increasing maternal health awareness, a rising demand for natural and organic products, and enhanced accessibility through e-commerce. The market is growing in maternal health awareness, with a growing demand for natural and organic products.

- Global Expansion: This market is driven by increasing awareness of maternal health, improving demand for nutritional support after childbirth, and growing disposable incomes. North America is dominant in the market due to the presence of a large population base and high birth rates.

- Startup Ecosystem: The Main aim of startups is to address the unique physical and mental health trials of the postpartum period, which often contribute to nutrient depletion, hormonal variations, and the growing demands of infant care.

How AI is Revolutionizing the Postpartum Health Supplements Market?

AI-driven technology revolutionizes postpartum care by utilizing data from various techniques, including genetic testing, fitness applications, and dietary habits, to create targeted wellness solutions. AI-driven tools assist physicians with better decisions based on inclusive data analysis. This technology creates personalized care plans for at-risk pregnancies that address the precise health profiles of mothers and their offspring, eventually enhancing results and lowering the risk of complications.

AI algorithms precisely analyze healthcare images, identifying abnormalities the human eye can’t detect. AI-driven technology is decreasing the decrease of diagnostic mistakes through advanced image analysis in ultrasound and MRI. AI is significant in improving resource allocation and workforce management in medical care settings.

Segmentation Insights

Product Type Insights

| Sub-Segment |

Share (%) |

| Vitamins & Minerals |

32.8 |

| Proteins & Amino Acids |

21.5 |

| Herbal Supplements |

18.2 |

| Probiotics |

17.1 |

| Others |

10.4 |

Explanations:

- Vitamins & Minerals (32.8%) – Lead the market as key nutrients for postnatal recovery and prevention of deficiencies.

- Proteins & Amino Acids (21.5%) – Essential for muscle repair, tissue regeneration, and energy restoration post-delivery.

- Herbal Supplements (18.2%) – Gaining traction from rising consumer preference for traditional herbs promoting lactation and hormonal balance.

- Probiotics (17.1%) – Fastest-growing (9.0% CAGR) segment supported by increasing awareness of gut and immune health benefits.

- Others (10.4%) – Include emerging niche formulations for mood enhancement and postpartum fatigue management.

Which Product is Dominating the Market?

The vitamins & minerals segment accounted for 32.8% of the postpartum health supplements market share in 2024, as vitamins and minerals are a better choice for breastfeeding mothers to confirm they are obtaining suitable nutrients. Vitamin and minerals plays a significant role in an infant’s nervous system development.

Probiotics

The probiotics segment is expected to grow at the fastest CAGR of 9.0% in the postpartum health supplements market during the 2025-2034 period, as utilization of probiotic supplements during pregnancy is harmless and plays a protective role in gestational diabetes, preeclampsia, vaginal infections, infant and maternal weight gain, and later childhood diseases. Probiotics are the advantageous bacteria living in the body that help protect against illness.

Herbal Supplements

The herbal supplements segment is expected to grow at a significant CAGR during the forecast period as herbal medicine supports the lowering of pain, different systemic symptoms, and the quality of life of patients with puerperal wind syndrome. Postpartum herbal tonics offer vital medicine to quicken healing, nourish depletion, restore energy, support rebalancing hormones, and help in the proper development of the nervous system of infants.

Form Insights

| Sub-Segment |

Share (%) |

| Tablets & Capsules |

42.8 |

| Powders |

24.6 |

| Liquids |

18.7 |

| Gummies |

13.9 |

Explanations:

- Tablets & Capsules (42.8%) – Dominate for precise dosing, convenience, and longer shelf life.

- Powders (24.6%) – Offer flexibility in dosage and easy integration with daily meals.

- Liquids (18.7%) – Preferred for quicker absorption and ease of intake among postpartum women.

- Gummies (13.9%) – Fastest-growing (8.8% CAGR) format due to pleasant taste and suitability for women avoiding pills.

Which form segment is dominant in the market in 2024?

The tablets & capsules segment accounted for 42.8% of the postpartum health supplements market share in 2024, as this form tends to dissolve quickly in the stomach, leading to rapid absorption of the active ingredients. They are easier to swallow due to their smooth exterior and absence of taste. Tablets are usually cost-effective in production, which makes them more affordable for clients.

Gummies

The gummies segment is expected to grow at the fastest CAGR of 8.8% in the postpartum health supplements market during the 2025-2034 period, as gummy vitamins offer beneficial nutrients, have a desired taste, and are simple to chew. Postnatal multivitamins are formulated to promote lactation. Mothers who have given birth but aren't breastfeeding can also benefit from gummy supplements. Power gummies are intended particularly to tackle low stamina and tiredness.

Liquids

The liquids segment is expected to grow significantly during the forecast period as liquid vitamins are micronutrients that are taken as a mouth spray, beverage, or liquid drops. They tend to be absorbed faster into the body, since they don't require to be broken down by the digestive system. Postnatal liquid with probiotics promotes a stable microbiome, supporting digestion and nutrient absorption.

Ingredient Source Insights

| Sub-Segment |

Share (%) |

| Plant-Based |

58.4 |

| Animal-Based |

25.7 |

| Synthetic |

15.9 |

Explanations:

- Plant-Based (58.4%) – Dominant and fastest-growing category due to preference for natural, vegan, and allergen-free formulations.

- Animal-Based (25.7%) – Driven by demand for protein and collagen supplements aiding tissue recovery and skin health.

- Synthetic (15.9%) – Maintains steady demand as an economical and consistent formulation option.

Which ingredient source dominated the market in 2024?

The plant-based segment dominated the postpartum health supplements market, accounting for 58.4% of share in 2024, and it is expected to grow at the highest CAGR of 8.7%. Postpartum plant-based medications, such as antimicrobial, anti-inflammatory, and immunological, show better neurophysiological activities with low toxicity. Plant-based supplements are less likely to cause allergies and adverse effects as they result from natural sources. Plant-based supplements are free from preservatives, GMOs, artificial sugars, and harmful chemicals

Animal-Based

The animal-based segment is expected to grow significantly in the postpartum health supplements market during the 2025-2034 period, as animal source foods offer a different of micronutrients that are problematic to obtain in satisfactory quantities from plant source foods alone. Animal-sourced protein foods offer important nutrients that help the growth and development of offspring, maintenance of mass of muscle mass, and function.

Distribution Channel Insights

| Sub-Segment |

Share (%) |

| Pharmacies & Drug Stores |

56.4 |

| Supermarkets/Hypermarkets |

18.7 |

| Online Channels |

15.3 |

| Specialty Stores |

9.6 |

Explanations:

- Pharmacies & Drug Stores (56.4%) – Lead the market with strong consumer trust and medical guidance availability.

- Supermarkets/Hypermarkets (18.7%) – Provide easy access and variety under one roof, boosting impulse buying.

- Online Channels (15.3%) – Growing rapidly (9.2% CAGR) with e-commerce expansion and subscription-based supplement models.

- Specialty Stores (9.6%) – Serve a niche market seeking premium or organic postpartum nutrition products.

Which Distribution Channel Dominated the Market in 2024?

The pharmacies & drug stores segment dominated the postpartum health supplements market, accounting for 56.4% of share in 2024. Buying postpartum health supplements from pharmacies and drug stores provides advantages, mainly centered on instant availability, expert guidance, and quality assurance and product authenticity. Supporting maternal health, milk production, and energy levels makes these products vital.

Online Channels

The online channels segment is expected to grow at the fastest CAGR of 9.2% in the postpartum health supplements market during the 2025-2034 period, as drugs purchased at online drug stores offer high levels of convenience, provide privacy for the buyer as well, and safeguard traditional procedures of prescribing drugs. Online pharmacy apps guarantee that customers get medical advice whenever they require it by giving them access to medical care specialists

Specialty Stores

The animal-based segment is expected to grow significantly in the postpartum health supplements market during the 2025-2034 period, as these types of stores have an advantage when it comes to training and staffing. Employees are only required to know or learn about one type of merchandise. A specialty store is a retail establishment whose main focus is on a specific product category.

End User Insights

| Sub-Segment |

Share (%) |

| Lactating Mothers |

70.8 |

| Non-Lactating Mothers |

29.2 |

Explanations:

- Lactating Mothers (70.8%) – Represent the core consumer base due to increased nutrient demand for milk production and recovery.

- Non-Lactating Mothers (29.2%) – Smaller yet rapidly expanding (9.4% CAGR) segment focusing on hormonal, emotional, and physical balance after childbirth.

Which End User dominated the Market in 2024?

The lactating mothers segment dominated the postpartum health supplements market, accounting for 70.8% of share in 2024, as postpartum health supplements are needed to meet growing nutritional requirements for the production of milk, which reduces the mother's reserves and leaves nutritional gaps in the lactating mother's diet.

Non-Lactating Mothers

The non-lactating mothers segment is expected to grow at the fastest CAGR of 9.4% in the postpartum health supplements market during the 2025-2034 period, as application of postpartum health supplements to replenish nutrients depleted throughout pregnancy and childbirth helps overall health and recovery, and addresses specific nutritional needs like calcium, iron, and B vitamins.

Regional Insights

| Sub-Segment |

Share (%) |

| Europe |

38.4 |

| North America |

27.3 |

| Asia-Pacific |

22.6 |

| Latin America |

6.1 |

| Middle East & Africa |

5.6 |

Explanations:

- Europe (38.4%) – Dominates the global market driven by high awareness, strong maternal healthcare systems, and growing adoption of natural supplements.

- North America (27.3%) – Holds significant share due to established supplement brands, high consumer spending, and focus on preventive postpartum care.

- Asia-Pacific (22.6%) – Fastest-growing region (10.4% CAGR) fueled by rising maternal health awareness and increasing disposable income in emerging countries like India and China.

- Latin America (6.1%) – Experiencing gradual adoption led by urbanization and improving distribution networks.

- Middle East & Africa (5.6%) – Smallest share but showing steady progress with expanding retail presence and awareness of women’s health nutrition.

Europe: Increasing Government Approval

Europe dominated the postpartum health supplements market in 2024 with a 38.4% share, as Europe's focus on preventive medical care led to the growing recommendation of postnatal supplements by healthcare professionals. A strict regulatory environment on product quality and safety also helps build buyer trust in postnatal supplement products, which contributes to the growth of the market.

For Instance,

- In September 2025, Biogen received European Commission approval for ZURZUVAE® (zuranolone), the first and only treatment approved for women with postpartum depression in Europe

Increasing Focus on Postnatal Mental Health in the UK

In Europe, including the UK, there is a growing culture of preventive healthcare, with healthcare professionals progressively recommending supplements for new mothers. Rising focus on postnatal mental health and breastfeeding help is contributing to the demand for multi-advantage supplements. Growing interest in herbal and organic products, as well as targeted nutrition, is contributing to the growth of the market.

Is a Large Population a Growth Factor for the Asia Pacific?

Asia Pacific is estimated to host the fastest-growing postpartum health supplements market with a CAGR of 10.4% during the forecast period, as the presence of a large population base, deep-rooted cultural traditions, increasing consumer awareness and disposable earnings, and beneficial government initiatives. Economic growth and urbanization in many APAC countries have led to higher incomes, enabling women to spend on premium and personalized health products for their newborns and themselves, which contributes to the growth of the market.

For Instance,

- In April 2025, Biometo will release two new Products into the Activated Probiotics range in Q4FY25 that is BiomeHer Pessary, featuring a clinically-trialled combination of probiotic strains shown to support healthy vaginal microbiome balance, and BiomePerinatal Probiotic, featuring a clinically-trialled probiotic strain shown to support healthy pregnancy outcomes and improve postpartum mood balance

Increasing Demand for Maternal and Postnatal Care Products in India

India accounts for around 20% of worldwide yearly births, around 25 million, creating a massive intrinsic demand for maternal and postnatal care products. National guidelines and medical care providers in India progressively recommend particular supplements, like calcium and vitamin D, for postpartum mothers.

North America: Extensive Availability of Products

North America is expected to grow at a significant CAGR in the postpartum health supplements market during the forecast period, as the extensive availability of products through varied channels, particularly the strong growth of e-commerce and online retail platforms, makes these supplements easily accessible to new mothers. This region has a mature and competitive supplement industry with many market players, from large established corporations to ground-breaking startups.

The government is increasing awareness about postpartum care.

In the U.S., there is a strong and increasing awareness among women related to the importance of nutrition during the postpartum recovery phase, not just for themselves but also for helping breastfeeding and overall well-being. Rising awareness of postpartum mental health challenges, such as anxiety and depression, has led to increased demand for supplements that support mood balance and mental well-being.

Amazon-to-Andes Postnatal Pulse

In South America, new mothers are increasingly embracing postpartum health supplements amid growing urban health awareness and e-commerce access. Brazil leads the region with expanding retail and online distribution while influencers promote nutrient formulations supporting recovery and lactation post-birth.

Brazil’s Maternal Momentum

In Brazil, the postpartum supplements scene is gaining pace, driven by heightened maternal nutrition advocacy and growing private health networks. With exclusive breastfeeding hovering around 45 % and variation among racial groups, maternal nutrition is more in the spotlight for supplement innovation.

Middle East & Africa Revitalisation Rhythm

In the MEA region, postpartum health supplements are carving out space as maternal services evolve and more women join wellness seekers. The postpartum health supplements market remains comparatively small yet premium-oriented with brands catering to recovery, hormonal balance, and immunity in the postpartum phase.

GCC Luxe Mothercare Surge

In the Gulf Cooperation Council countries, postpartum supplement demand is on the rise, tied to high-income mothers and wellness-first lifestyles. With exclusive breastfeeding rates under 30 % in some UAE studies and a strong interest in recovery and functional nutrition, the market is evolving.

Postpartum Health Supplements Market – Value Chain Analysis

R&D

The R&D process for postpartum health supplements involves research and needs assessment, detecting nutritional requirements to ensure regulatory compliance and product safety.

Key Players: New Chapter and MegaFood

Clinical Trials

The clinical trial process for postpartum health supplements includes several stages designed to ensure the product's safety and efficacy for both the mother and infant.

Key Players: Mama's Select and Pink Stork

Patient Services

Patient services processes related to postpartum health supplements focus mainly on nutritional counseling, prescribing necessary supplements, and mixing this support into a comprehensive, ongoing postpartum care plan.

Key Players: Nature's Way and Garden of Life

Company Landscape

New Chapter, Inc.

Company Overview:

- New Chapter, Inc. is a U.S.-based dietary supplement company specializing in organic, whole-food, and herbal formulations. It is recognized for its commitment to sustainability, certified B-Corp status, and focus on maternal wellness, including postpartum nutrition.

Corporate Information:

- Headquarters: Brattleboro, Vermont, United States.

- Year Founded: 1982, by Paul and Barbi Schulick.

- Ownership Type: Wholly-owned subsidiary of Procter & Gamble since acquisition in 2012.

History and Background:

- Founded in 1982 in Massachusetts, moved to Vermont in 1986.

- Acquired by P&G in 2012, becoming one of the first large supplement brands integrated into a major FMCG firm.

- In 2014 became a certified B-Corporation, highlighting its social and environmental mission.

Key Milestones/Timeline:

- 1982: Establishment of the company.

- 2003: Gained traction with herbal supplement Zyflamend.

- 2012: Acquisition by P&G.

- 2014: Certified B-Corp status.

- 2025: Implementation of the Upcycled Certified mark for fish oil lines.

Business Overview:

New Chapter operates in the nutritional supplements industry, focusing on health-through-whole-food and botanical-based products. It serves consumers seeking premium, sustainable wellness support, including postpartum women.

Business Segments/Divisions:

While detailed segmentation isn’t widely publicised, its offerings span multivitamins, minerals, herbal supplements, probiotics, and specialty wellness lines (including maternal/postnatal).

Geographic Presence:

Primarily U.S. headquartered, with international distribution via P&G’s network. Its organic and sustainable positioning supports reach into health-food retail, e-commerce, and natural channels globally.

Key Offerings:

- Multivitamins (e.g., women’s one-daily)

- Bone/plant calcium support

- Probiotics and fibre gummies

- Botanical herbal blends (e.g., Zyflamend)

- Omega-3 fish oil products (Wholemega)

End-Use Industries Served:

- Maternal health and postpartum nutrition

- General wellness and preventive health

- Nutraceutical retail and direct-to-consumer channels

- Natural/organic health-food store distribution

Key Developments and Strategic Initiatives:

- Mergers & Acquisitions: Acquisition by P&G in 2012.

- Partnerships & Collaborations: Focused on regenerative agriculture supplier partners, certified sourcing.

- Product Launches/Innovations: 2025 “Upcycled Certified” fish oil lines.

- Capacity Expansions/Investments: Investment in regenerative farming practices, zero-waste to landfill initiatives.

- Regulatory Approvals: As a dietary supplement maker, it adheres to GMPs and Non-GMO Project verification.

- Distribution Channel Strategy: Leveraging P&G’s global consumer goods channels plus natural/organic retail and online direct-to-consumer.

- Technological Capabilities/R&D Focus: R&D oriented toward organic, fermented and botanical forms; life-cycle assessment of carbon footprint.

- Core Technologies/Patents: Includes patent US for supplement with biotin, Reishi mushrooms, and algae (via P&G/New Chapter).

- Research & Development Infrastructure: Scientific advisory board, clinical research at institutions such as Columbia University and the Cleveland Clinic Foundation.

- Innovation Focus Areas: Regenerative agriculture sourcing, whole-food-based nutrient delivery, sustainable packaging, and waste reduction.

Competitive Positioning:

- Strengths & Differentiators: Certified B-Corp, strong sustainability credentials, whole-food/organic positioning, backing of P&G for scale.

- Market presence & ecosystem role: Recognised as a leader in the premium maternal/multivitamin niche and whole-food supplement category.

SWOT Analysis:

- Strengths: Strong brand reputation, organic credentials, sustainable sourcing.

- Weaknesses: Premium pricing may limit mass uptake; integration with P&G may dilute “natural” brand perception.

- Opportunities: Rising maternal/postpartum nutrition awareness globally; growth in direct-to-consumer and clean label demands.

- Threats: Regulatory scrutiny of supplements; competition from DTC disruptors and generics; supply-chain volatility for herbal/organic ingredients.

Recent News and Updates:

- In April 2025, the company launched its Upcycled Certified fish oil line.

- Employee reviews in April 2025 reflect improved culture but note limited growth opportunities.

- Recognised for sustainability and waste reduction in recent company disclosures.

Industry Recognitions/Awards:

- Certified B-Corporation status (major supplement firm).

- Recognised for regenerative agriculture sourcing and zero-waste initiatives.

- Featured in industry profiles as a leader in sustainable supplement manufacturing.

Garden of Life, LLC

Company Overview:

- Garden of Life provides whole-food, organic, vegan, and non-GMO certified nutritional supplements. It has built a strong reputation for clean-label products, including offerings tailored for prenatal and postnatal nutrition.

Corporate Information:

- Headquarters: United States (Exact city not specified in summary).

- Year Founded: [public sources vary; but notable as a supplement brand].

- Ownership Type: Private/part of broader ownership (some sources note corporate parent).

History and Background:

- Over time, the brand has emphasized certified organic, vegan, and non-GMO credentials and built credibility through third-party certifications.

- Has grown into one of the leading clean-label supplement brands focused on life-stage nutrition (pregnancy through postpartum).

Key Milestones/Timeline:

- Achieved carbon-neutral certification and introduced sustainable packaging efforts.

- Developed specialised postpartum/whole-mother nutrition formulations and expanded digital distribution, capturing ~52 % of its revenue from online channels.

- Business Overview: Garden of Life serves the nutraceutical market, focusing on maternal, prenatal, and postnatal health, as well as general wellness, sports nutrition, and clean-label supplements.

Business Segments/Divisions:

- Maternal & prenatal/postnatal supplements

- Multivitamins and minerals

- Specialty formulations (probiotics, protein powders, omega-3s)

- Sports and performance nutrition segments

- Geographic Presence: Products available in major U.S. retail chains, health-food stores, online marketplaces, with increasing international availability via e-commerce and global natural-product distribution.

Key Offerings:

- MyKind Organics Postnatal Multi (postnatal specific).

- Prenatal Gummies, omega-3 prenatal/lactation formulas.

- Whole-food multivitamins, vegan-certified complexes.

- Protein powders, greens blends, probiotics.

End-Use Industries Served:

- Maternal and postpartum nutrition

- General health & wellness

- Sports and active lifestyle nutrition

- Clean/organic supplement retail segment

Key Developments and Strategic Initiatives:

- Mergers & Acquisitions: While specific recent M&A in this niche brand has not been widely publicised, parent/ownership shifts are implied.

- Partnerships & Collaborations: Certified vegan, organic, gluten-free partnerships and third-party testing.

- Product Launches/Innovations: Noted 2024–25 launches in the postpartum segment, emphasizing wound healing care blends, clean-label botanicals.

- Capacity Expansions/Investments: Sustainability initiatives—carbon-neutral shipping, plastic reduction.

- Regulatory Approvals: Products manufactured in third-party certified facilities compliant with GMP; multiple third-party certifications.

- Distribution Channel Strategy: Mix of brick-and-mortar (grocery, pharmacies, health-food stores) and strong online presence (~52% of revenue).

- Technological Capabilities/R&D Focus: Emphasis on bioavailable nutrient forms, whole-food sourcing, and transparency in ingredient traceability.

- Core Technologies/Patents: While specific patents are not widely detailed, the brand emphasises proprietary whole-food nutrient complexes and third-party certifications.

- Research & Development Infrastructure: Internal formulation teams work with ingredient testing, third-party certifications, and clean-label transparency.

- Innovation Focus Areas: Clean-label, vegan, whole-food maternal/postnatal nutrition; sustainable sourcing; transparency and traceability.

Competitive Positioning:

- Strengths & Differentiators: Credible clean-label brand, strong certifications, wide distribution, trusted by health-conscious consumers.

- Market presence & ecosystem role: One of the top clean-label maternal supplement brands; significant online share and global reach.

SWOT Analysis:

- Strengths: Strong brand credibility, certified organic/vegan, robust digital model.

- Weaknesses: Premium pricing relative to mass-market brands; possible perception of being niche.

- Opportunities: Growing postpartum nutrition awareness globally; expansion in emerging markets; personalised subscription models.

- Threats: Competitive pressure from DTC brands, regulatory scrutiny of supplements, and ingredient supply chain risks.

Recent News and Updates:

- Healthline review (2025) emphasises Garden of Life’s carbon-neutral shipping and organic credentials.

- Market data (2025) indicates Garden of Life holds ~15.7% of the postpartum dietary supplement market.

Industry Recognitions/Awards:

- Certified B Corporation (reflecting high social/environmental standards) among supplement brands.

- Recognised in Healthline and other reviews for high-quality certifications and clean-label transparency.

Top Vendors in the Postpartum Health Supplements Market & Their Offerings

| Company |

Headquarters

|

Key Strengths |

Latest Info (2025) |

| Nestlé S.A. |

Vevey, Switzerland |

massive global presence, extensive and diverse brand portfolio |

Nestlé's Materna brand launches new nutrition solutions to support women's fertility and pregnancy. |

| Abbott Laboratories |

Abbott Park, Illinois |

diversified product portfolio across medical devices, diagnostics, nutrition, and branded generics |

Abbott Laboratories offers the specialized nutritional product SimMom Plus for use during both pregnancy and the postpartum/breastfeeding period |

| Bayer AG |

Leverkusen, Germany |

A strong focus on innovation and R&D |

In September 2025, Bayer Launches Supradyn Mom's and Supradyn Naturals Calcium+ |

| Nature’s Bounty Co. |

Ronkonkoma, New York |

strong commitment to quality and scientific research |

Nature's Bounty Prenatal supplements provide essential vitamins and minerals to support overall well-being before, during, and after pregnancy. |

| Glanbia plc |

Kilkenny. Ireland |

leading market positions in nutrition products |

Providing ingredients and solutions that support the development of postpartum health supplements for other brands |

Top Companies in the Postpartum Health Supplements Market

- Nestlé S.A.

- Amway Corp.

- Abbott Laboratories

- Bayer AG

- Herbalife Nutrition Ltd.

- Nature’s Bounty Co.

- Glanbia plc

- Church & Dwight Co., Inc.

- The Honest Company, Inc.

- New Chapter, Inc.

- Mama’s Select

- Pink Stork

- Pure Encapsulations, Inc.

- MegaFood

- Pharmavite LLC

Recent Developments in the Postpartum Health Supplements Market

- In October 2025, Progyny, Inc., a worldwide leader in women’s health and family building solutions, announced the launch of its pregnancy, postpartum, and menopause programs for global employers

- In September 2025, UnitedHealthcare today announced the launch of UHC Store, a new online shopping experience within the UnitedHealthcare® app and on myuhc.com®, now available to more than 6 million eligible UnitedHealthcare members to expand to 18 million members this year.

- In January 2025, LOLA, a pioneer in organic feminine care and reproductive wellness, today announced its expansion into postpartum care. This strategic launch reflects LOLA's ongoing commitment to supporting women through every stage of their reproductive journey with products focused on ingredient transparency.

Segments Covered in the Report

By Product Type

- Vitamins & Minerals

- Proteins & Amino Acids

- Herbal Supplements

- Probiotics

- Others

By Form

- Tablets & Capsules

- Powders

- Liquids

- Gummies

By Ingredient Source

- Plant-Based

- Animal-Based

- Synthetic

By Distribution Channel

- Pharmacies & Drug Stores

- Supermarkets/Hypermarkets

- Online Channels

- Specialty Stores

By End User

- Lactating Mothers

- Non-Lactating Mothers

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA