February 2026

The global proteomics in oncology market is on an upward trajectory, poised to generate substantial revenue growth, potentially climbing into the hundreds of millions over the forecast years from 2025 to 2034. This surge is attributed to evolving consumer preferences and technological advancements reshaping the industry.

Proteomics is essential for studying the identity, expression levels, and modifications of proteins. Proteomics in oncology helps reveal key information in mechanistic studies on tumor growth & metastasis and therapeutic targets. The basic steps of a proteome analysis include protein extraction, protease digestion, peptide fractionation, and LC-MS analysis. Proteomics is used for a wide range of purposes in cancer. Primarily, it is used to discover specific biomarkers involved in tumor growth. It also helps researchers understand the diversity of different cancers and the metastasis that occurs during cancer progression.

The rising prevalence of cancer and growing cancer research promote the market. This necessitates numerous researchers to identify novel biomarkers involved in disease progression. Several government organizations launch initiatives to reduce the burden of cancer cases in the country. Advancements in technology enable researchers to streamline the research process. The increasing number of clinical trials also contributes to market growth.

Artificial intelligence (AI) plays a vital role in improving cancer diagnosis, prevention, and treatment. AI and machine learning (ML) algorithms can analyze large amounts of patient data and can screen patients with cancer. AI can automate the entire proteomics process, reducing human intervention and enhancing efficiency. It can also facilitate the detection of complex biological structures of proteins with enhanced accuracy and precision. AI and ML can also transform the analysis of proteomics data. They can also assist researchers in developing novel personalized medicines by analyzing an individual’s proteomic and genomic profiling.

Precision Medicine

The demand for precision medicines is increasing to provide personalized treatment to patients based on their conditions. The main aim of precision medicine is to develop cancer drugs that target specific genetic mutations or aspects of a patient’s particular cancer. Proteomics enables researchers to identify the right genetic mutations and the proteins impacted by those mutations. The growing research and development activities facilitate researchers to find proteins associated with cancer and develop novel drugs based on the structure of those proteins.

Complexity of Biological Processes

The major challenge of proteomics in oncology market is the complexity of biological processes. This poses a significant challenge in proteomic investigations, making it difficult for researchers to identify the correct protein structure.

Technological Advancements

Integrating proteomics with other omics technologies enables researchers to decode metastasis, angiogenesis, and drug resistance. It also assists in the development of precision medicine with greater efficiency and reduced systemic side effects. Another important advancement in proteomics is nanopore-based proteomics. Nanopore-based proteomics is an emerging field that utilizes nanopores and tiny artificial or biological channels to analyze proteins. The growing demand for lab-on-a-chip technology fosters the use of nanopore-based proteomics. Moreover, 4D proteomics is a technique that adds a fourth dimension of ion mobility to traditional 3D mass spectrometry, such as retention time, m/z, and ion intensity.

By component, the reagents & consumables segment held a dominant presence in the proteomics in oncology market in 2024. Reagents & consumables enable researchers and healthcare professionals to perform multiple experiments/tests simultaneously. Several biotech companies offer a wide range of reagents, such as immunoassay reagents, protein microarray reagents, and chromatography reagents, to meet their experimental requirements. They are mostly preferred due to their affordability and easy availability.

By component, the software & services segment is expected to grow at the fastest rate in the market during the forecast period. The advent of advanced technologies, such as AI and cloud-based technologies, boosts the segment’s growth. Software provides advanced solutions to research problems. Integrating cutting-edge technologies in the biotech labs enables them to stay ahead of their competitors and strengthen their market position. Software and services provide relevant expertise.

By application, the cancer biomarker discovery & validation segment led the global proteomics in oncology market in 2024. Proteomics is widely used for biomarker discovery & validation. Several researchers are conducting experiments to identify novel cancer biomarkers involved in disease progression. Government organizations also launch initiatives to create awareness about early cancer diagnosis. The MarkerDB Version 2.0 database contains around 218 protein biomarkers, which are categorized into 25,760 diagnostic biomarkers. (Source - MarkerDB)

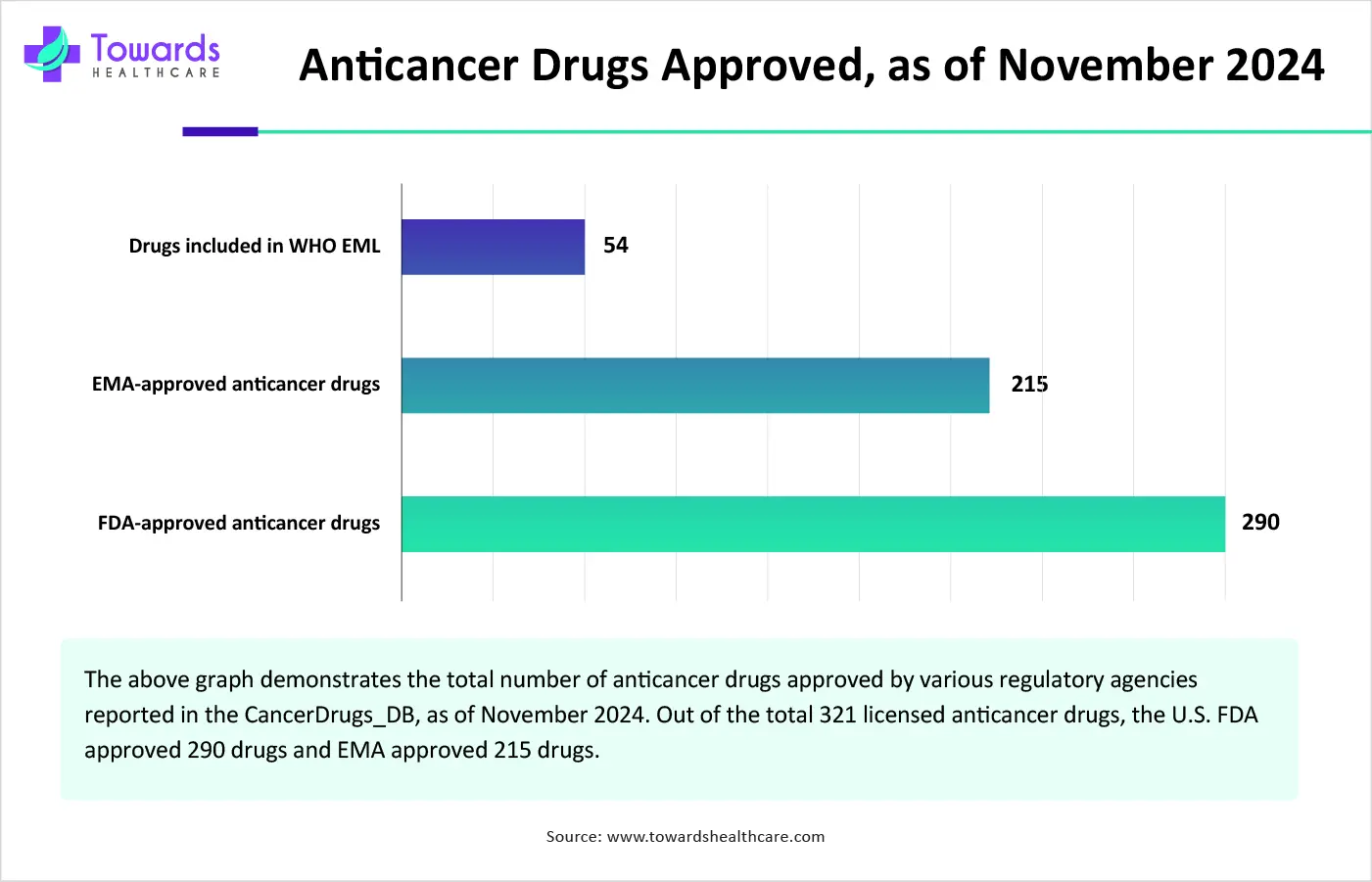

By application, the oncology drug discovery & development segment is anticipated to grow with the highest CAGR in the market during the studied years. The rising prevalence of different types of cancer and their complexity necessitate researchers to develop novel drugs. The increasing investments by government and private organizations promote drug discovery & development research. Advancements in bioinformatics help researchers develop drugs based on protein structures. The CancerDrugs_DB database reports 321 licensed anticancer drugs as of November 2024. (Source - Anticancer Fund)

By technology, the mass spectrometry-based oncology proteomics segment held the largest share of the proteomics in oncology market in 2024. Mass spectrometry (MS) is the most widely used tool for proteomics. It provides information about the molecular weight and structure of proteins involved in cancer progression. The major advantage of MS is its high sensitivity over other techniques. It is an excellent tool for confirming the presence and amount of unknown proteins in a sample.

By technology, the AI-driven proteomics for cancer drug targeting segment is projected to expand rapidly in the market in the coming years. AI and ML algorithms are increasingly adopted to revolutionize novel drug discovery research. They are used in early drug development stages to assess the binding of drugs to target proteins. AI-driven proteomics saves a lot of time and costs for researchers. It enhances the efficiency and accuracy of cancer drug targeting.

By end-use, the pharmaceutical & biotechnology companies segment registered its dominance over the global proteomics in oncology market in 2024. Pharmaceutical & biotechnology companies have favorable infrastructure and suitable capital investments. This enables them to adopt advanced technologies related to cancer proteomics. The increasing number of pharmaceutical and biotechnology companies globally and the rising investments augment the segment’s growth. The growing market competition and the increasing collaboration among key players also contribute to the segment’s growth.

By end-use, the contract research organizations (CROs) segment is predicted to witness the fastest growth in the market over the forecast period. Numerous small- and large-scale pharma and biotech companies prefer outsourcing their research and manufacturing requirements. CROs specialized in cancer proteomics have state-of-the-art facilities and skilled professionals to provide advanced solutions. They also provide customized solutions and help pharma and biotech companies increase the time-to-market approval of novel drugs.

North America dominated the market in 2024. The presence of a robust healthcare infrastructure and state-of-the-art research and development activities promotes proteomics research in North America. Favorable government initiatives and funding encourage researchers to perform cancer research and develop novel therapeutics. The rising prevalence of cancer and favorable regulatory frameworks foster the market. The increasing collaborations among academic researchers and industry players, and mergers & acquisitions activities, potentiate research progress.

A scientific paper published in the American Cancer Society journal, CA: A Cancer Journal for Clinicians, estimated that over 2 million new cancer cases will be diagnosed in the U.S. in 2025, and more than 618,000 people will die from the disease. (Source - American Cancer Society) Key players, such as Inotiv, Inc., Alamar Biosciences, and Champions Oncology, hold the major share of the market in the U.S.

In March 2025, the Government of Alberta announced an investment of CAD 800 million (USD 560 million) over eight years and collaborated with Siemens Healthineers and Alberta Cancer Foundation. The investment was made to support early detection, reduce wait times, and establish Alberta as a leader in cancer research and innovation. (Source - Siemens)

Asia-Pacific is projected to host the fastest-growing proteomics in oncology market in the coming years. The increasing geriatric population and the rising cancer cases drive the market. Numerous government and private institutions conduct conferences, seminars, and workshops to create awareness among the general public for the screening and early diagnosis of cancer. The increasing investments and collaborations also contribute to market growth. The burgeoning pharma & biotech sectors and the increasing number of pharma & biotech startups favor the market.

The Conference Index organization reported a series of conferences related to biotechnology, bioengineering, and molecular biology from September 2025 to April 2027 in China. (Source - Conference Index) China is home to more than 3,000 life science companies, employing over 270,000 people.

The Japan External Trade Organization (JETRO) announced 105 Japanese startups to the 2024 cohort of the Global Startup Acceleration Program (GSAP), bringing the number of startups to 500. The National Institutes of Biomedical Innovation, Health, and Nutrition (NIBN) formed the Laboratory of Proteomics for Drug Discovery to develop cutting-edge proteomics technology and discover new drug targets and treatments. (Source - NIBN)

Europe is expected to grow at a considerable rate in the proteomics in oncology market in the upcoming period. Several government organizations launch initiatives and support cancer research through funding. The European Union Cancer Mission aims to improve the lives of more than 3 million people by 2030 through prevention, cure, and quality of life for individuals and families affected by cancer. (Source - EU Cancer Mission) The presence of key players and growing research and development activities boost the market.

In July 2024, Amazon Web Services (AWS) announced that it will provide £8 million worth of cloud computing storage access to support the UK Biobank, the world’s leading biomedical database. The UK Biobank examines the proteomic and genomic data from half a million people simultaneously. It announced the world’s largest protein study to measure up to 5,400 proteins in each of 600,000 samples. ((Source - Queen Mary)

The France government launched the Ten-Year Cancer Control Strategy (2021-2030) to improve prevention, reduce after-effects, and improve quality of life, combat cancers with poor prognosis, and ensure that everyone benefits from progress. (Source - Sante). The increasing healthcare expenditure on cancer also governs market growth. It is estimated that from 2023-50, the burden of cancer is projected to represent 3% of health expenditure.

Brian McKelligon, CEO of Akoya Biosciences, commented that the company was delighted to be part of the MANIFEST consortium, contributing its spatial proteomics leadership and expertise to improve patient care through groundbreaking efforts. He also said that the company’s PhenoCycler Fusion and Phenolmager HT spatial proteomics platforms can identify key biomarkers, supporting the consortium’s efforts to advance personalized medicine and ensure more cancer patients benefit from immunotherapy. (Source - GlobeNewswire)

By Component

By Application

By Technology

By End-Use

By Region

February 2026

January 2026

January 2026

January 2026