February 2026

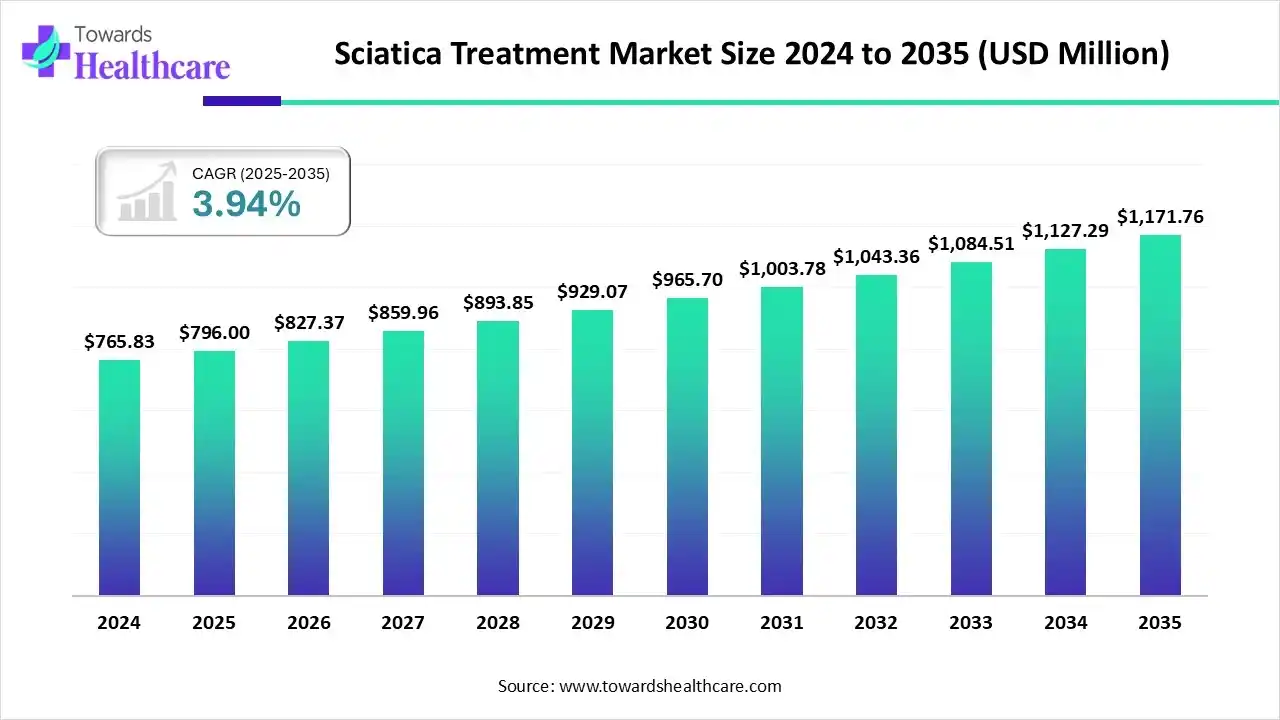

The global sciatica treatment market size is calculated at USD 796 million in 2025, grew to USD 827.37 million in 2026, and is projected to reach around USD 1171.76 million by 2035. The market is expected to expand at a CAGR of 3.94% between 2026 and 2035.

The sciatica treatment market is experiencing steady growth due to the rising prevalence of lower back and nerve-related conditions, aging populations, and increasing sedentary lifestyles. Advances in minimally invasive procedures, improved pain management therapies, and greater awareness of early diagnosis are driving market expansion. North America leads the global market thanks to its advanced healthcare infrastructure, strong presence of major pharmaceutical companies, and widespread use of innovative treatment methods and technologies focused on effective pain relief and recovery.

| Table | Scope |

| Market Size in 2025 | USD 796 Million |

| Projected Market Size in 2035 | USD 1171.76 Million |

| CAGR (2026 - 2035) | 3.94% |

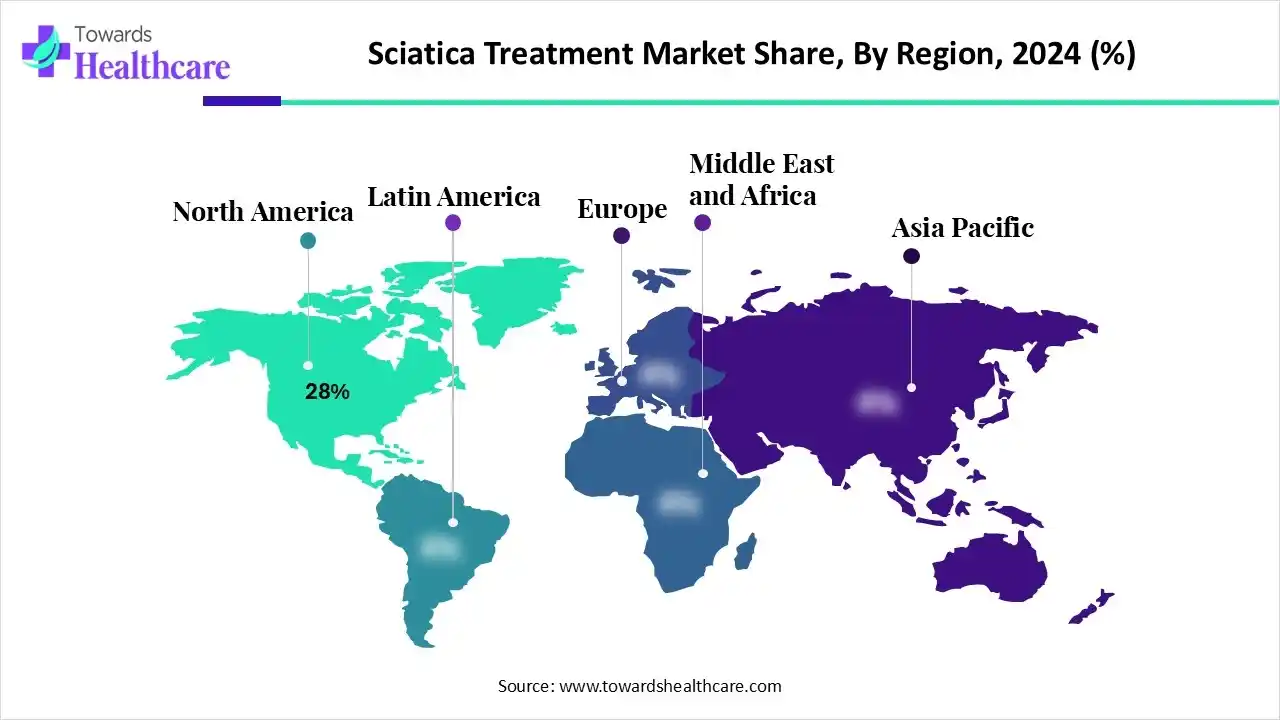

| Leading Region | North America by 28% |

| Market Segmentation | By Product Type, By Dosage Form, By Therapeutic Area / Mechanism, By Distribution Channel, By Manufacturer Type, By End-User / Customer, By Region |

| Top Key Players | Medtronic plc, Johnson & Johnson (DePuy Synthes), Boston Scientific Corporation, Pfizer Inc., Abbott Laboratories, Teva Pharmaceutical Industries Ltd., Sorrento Therapeutics Inc., Hikma Pharmaceuticals PLC, Zywave, Inc., Cigna Health Insurance |

The sciatica treatment market is fueled by the rising number of lower back pain cases caused by herniated discs, spinal stenosis, and nerve compression, along with increasing awareness of advanced pain management and rehabilitation therapies. Sciatica treatment focuses on managing and relieving pain that radiates along the sciatic nerve, typically affecting one side of the body. Treatments include physical therapy, anti-inflammatory and muscle relaxant medications, steroid injections, and in severe cases, surgical procedures. The market also benefits from technological advancements in diagnostic imaging, non-invasive therapies, and personalized medicine approaches that enhance treatment precision and patient outcomes.

AI integration significantly advances sciatica treatment by enhancing diagnostic accuracy, personalizing treatment, and improving patient monitoring. Through AI-powered imaging and predictive analytics, doctors are able to precisely identify nerve compression sites and customize therapies for individual patients. Machine learning algorithms help analyze large patient datasets to predict treatment outcomes and optimize rehabilitation plans. AI-enabled wearable devices track muscle activity, pain levels, and mobility in real time, allowing continuous monitoring and adaptive therapy adjustments.

Moreover, AI-driven virtual assistants and chatbots can guide patients through home-based exercises and medication schedules, boosting adherence and recovery. Overall, using AI in sciatica treatment promotes faster diagnosis, improved clinical decision-making, and better long-term pain management, transforming traditional care into data-driven precision therapy.

Which Product Type Segment Dominates the Sciatica Treatment Market in 2024?

The pharmaceuticals segment dominated the market with a share of 40% in 2024 due to the widespread use of pain relievers, anti-inflammatory drugs, and muscle relaxants for quick symptom management. Easy availability, cost-effectiveness, and physician preference for medication-based therapy further strengthen its dominance in the market.

The biologics & regenerative therapies segment is projected to grow at the fastest CAGR in the market during the forecast period. This is mainly due to the increasing demand for long-term, non-invasive solutions that repair damaged nerve tissues. Innovations in stem cell therapy, platelet-rich plasma (PRP), and growth factor-based treatments are fueling adoption by offering improved healing, less pain, and fewer side effects.

The interventional therapies & injectables segment is expected to grow at a notable rate in the upcoming period due to the increasing preference for minimally invasive pain management options. Procedures such as epidural steroid injections and nerve blocks provide targeted pain relief, faster recovery, and reduced dependence on oral medications, enhancing overall treatment effectiveness.

Why Did the Oral Solid Dosage Segment Dominate the Sciatica Treatment Market?

The oral solid dosage segment dominated the market with a 35% share in 2024 due to its convenience, ease of administration, and patient compliance. Tablets and capsules are widely prescribed for managing pain and inflammation associated with sciatica. Their long shelf life, cost-effectiveness, and availability of various drug formulations make them the preferred treatment option among healthcare professionals and patients.

The parenteral/injectables segment is expected to grow at the fastest CAGR during the forecast period because of its quick onset of action and effectiveness in treating severe or chronic pain. Injectable formulations, including corticosteroids and nerve block therapies, provide targeted relief, making them increasingly favored by patients who do not respond to oral medications.

The topical / transdermal segment is expanding at a significant rate in the market due to rising demand for non-invasive and localized pain relief options. Creams, gels, and patches provide targeted therapy with minimal systemic side effects, improving patient comfort and adherence, especially among those seeking alternative, self-managed treatment methods.

What Made Pain & Analgesics the Dominant Segment in the Sciatica Treatment Market?

The pain & analgesic segment led the market with a 45% share in 2024 due to the high prevalence of pain-related symptoms among patients and the fast relief these drugs provide. Popular medications like NSAIDs and opioids remain the main treatment options for effectively managing acute and chronic sciatic nerve pain.

The regenerative / biologic therapies segment is expected to grow at the fastest rate in the coming years. This is mainly due to the increasing adoption of advanced therapies that promote nerve healing and tissue regeneration. Innovations in stem cell therapy, platelet-rich plasma (PRP), and growth factor-based treatments offer long-term relief, reduced recurrence rates, and minimal side effects, driving significant clinical and research interest worldwide.

The neuropathic pain agent segment is expected to grow significantly in the near future due to the increased recognition of nerve-related pain as a major factor in sciatica. Medications such as anticonvulsants and antidepressants are being prescribed more often to target nerve dysfunction, offering better pain management, improved patient outcomes, and enhanced control of chronic sciatic nerve pain.

How Does the Retail Pharmacies / Drugstores Segment Lead the Sciatica Treatment Market?

The retail pharmacies / drug stores segment led the market with approximately 38% share in 2024. This is mainly due to the easy accessibility of over-the-counter and prescription medications in these pharmacies. Their widespread presence, convenience, and quick service enable patients to obtain pain-relief drugs and therapies efficiently, making them the primary distribution channel for sciatica-related treatments globally.

The online pharmacies / telehealth platforms segment is expected to grow at the fastest pace in the market due to increasing digital healthcare adoption and patient preference for remote consultations. These platforms offer convenience, home delivery of medications, and access to virtual specialists. Rising internet penetration and the use of chronic pain management apps further drive segment growth by enhancing accessibility and ensuring continuity of care.

The hospital pharmacies / institutional procurement segment is expected to grow at a notable rate in the coming years. This is primarily due to the rising number of hospital visits for severe or chronic cases. Hospitals provide comprehensive pain management, access to advanced therapies, and specialized care, thereby increasing institutional demand for effective sciatica medications and injectables.

What Made MNC Pharmaceutical Companies the Dominant Segment in the Sciatica Treatment Market?

The MNC pharmaceutical companies segment dominated the market with a share of 34% in 2024 due to their strong R&D capabilities, global distribution networks, and extensive product portfolios. Their continuous innovation in pain management drugs and advanced therapies ensures market leadership and widespread adoption across healthcare systems.

The biologics / regenerative therapy innovators segment is expected to grow at the fastest rate in the market, driven by increasing research into nerve regeneration and tissue repair. Startups and biotech firms are developing advanced stem cell and PRP-based solutions that offer long-lasting relief, driving rapid clinical adoption and investment in next-generation therapies.

The local / regional pharmaceutical players segment is notably growing in the market due to their focus on affordable generic formulations and region-specific therapeutic needs. These companies enhance accessibility, especially in emerging markets, by offering cost-effective pain management solutions and strengthening local distribution networks to reach wider patient populations.

Why Did the Outpatient / Ambulatory Patients Segment Lead the Sciatica Treatment Market?

The outpatient/ambulatory patient segment dominated the market, accounting for 48% in 2024, driven by growing preference for non-surgical, minimally invasive procedures with shorter recovery times. Advancements in pain management therapies, physiotherapy, and rehabilitation programs enable effective treatment in outpatient settings, reducing hospital stays and healthcare costs while improving patient convenience and satisfaction.

The hospital / inpatient care segment is likely to grow at the fastest CAGR in the upcoming period due to the increasing number of severe and chronic cases requiring surgical or intensive pain management. Advanced infrastructure, multidisciplinary care, and access to specialized medical professionals drive patient preference for hospital-based treatments and post-operative rehabilitation.

The ambulatory surgery centers / interventional clinics segment is notably growing in the market due to rising demand for minimally invasive pain-relief procedures. These centers offer cost-effective, same-day treatments with faster recovery, advanced imaging technologies, and personalized care, making them an increasingly preferred option for sciatica management.

North America dominated the sciatica treatment market while holding a 28% share in 2024. This is primarily due to its advanced healthcare infrastructure, high prevalence of back and nerve-related disorders, and strong presence of leading pharmaceutical and medical device companies. The region’s focus on technological innovation, increased healthcare spending, and adoption of minimally invasive pain management solutions further strengthen its market leadership.

The U.S. leads the North American sciatica treatment market due to its advanced healthcare infrastructure, strong presence of major pharmaceutical and medical device companies, and high awareness of pain management therapies. The growing prevalence of sedentary lifestyles, an aging population, and rising cases of chronic back pain have created significant demand for effective sciatica treatments. Additionally, ongoing R&D investments, the adoption of innovative non-invasive therapies, and widespread insurance coverage further reinforce the U.S. market’s dominance in this sector.

Asia Pacific is emerging as the fastest-growing region in the market due to its expanding patient population, aging demographics, and increasing prevalence of sedentary lifestyles that lead to back and nerve pain disorders. Rising healthcare investments, growing adoption of advanced pain management solutions, and better access to diagnostic and therapeutic facilities further drive regional market growth.

With more individuals aged 65 and older, including approximately 503 million people in this age group in Asia-Pacific in 2024, the incidence of age-related spine degeneration, nerve compression, and musculoskeletal pain increases. Older adults often need extended treatment for conditions like sciatica, which boosts demand for diagnostics, pain management therapies, and minimally invasive procedures. As life expectancy rises and support systems expand, healthcare providers and pharmaceutical companies are focusing more on tailored treatments for this demographic, fueling market growth in the region.

China leads the Asia-Pacific sciatica treatment market due to its large patient base, rapid urban growth, and increasing rates of back and nerve-related disorders. Government healthcare reforms, rising investments in pain management infrastructure, and the adoption of advanced therapies and rehabilitation technologies further reinforce China’s dominant position in the regional market.

The Middle East and Africa offer significant growth opportunities in the market, fueled by increased healthcare infrastructure investments and wider access to specialized pain management services. The rising prevalence of musculoskeletal and nerve-related conditions, along with an aging population and expanding health insurance coverage, are key drivers for future market growth.

The UAE is quickly becoming the fastest-growing country in the market within MEA, driven by strong healthcare investments, an increase in musculoskeletal disorder cases, and advanced pain management facilities. Rising medical tourism, the adoption of digital health solutions, and the presence of specialized rehabilitation centers further support the rapid expansion of the market.

Europe is experiencing significant growth in the market, driven by advancements in healthcare infrastructure, increasing awareness of chronic pain management, and rising adoption of non-invasive therapies. The region's well-established medical device and pharmaceutical sectors are fostering the development of innovative pain management solutions, including AI-based diagnostics and regenerative treatments. Additionally, favorable reimbursement policies and a strong emphasis on personalized healthcare are driving market expansion. Collaborations between European healthcare providers and global tech companies are further enhancing access to cutting-edge therapies and boosting Europe's position as a key player in the market.

Germany is a major contributor to the European sciatica treatment market, owing to its advanced healthcare infrastructure, high demand for pain management therapies, and strong presence of pharmaceutical and medical device manufacturers. The country’s emphasis on research and development, along with government-supported healthcare policies, has accelerated the adoption of innovative treatments for chronic conditions like sciatica. Germany also plays a pivotal role in driving clinical trials and integrating new technologies in pain management.

The growth of the South America sciatica treatment market is primarily supported by increasing healthcare access, rising awareness of chronic pain management, and a growing geriatric population in the region. The expansion of private healthcare facilities, along with the integration of more advanced pain management technologies, is driving market demand. Additionally, partnerships with global pharmaceutical and medical device companies are introducing innovative treatments, including minimally invasive procedures and regenerative therapies. Government initiatives aimed at improving healthcare delivery and pain management services are also contributing to the market's expansion.

Brazil is a major contributor to the market, owing to its large population, rapidly improving healthcare infrastructure, and growing demand for pain management therapies. The country is also a hub for clinical research and medical device innovation, facilitating the adoption of advanced treatments for sciatica and chronic pain. Furthermore, Brazil's expanding private healthcare sector supports the availability and accessibility of new therapies for patients.

R&D in the sciatica treatment market starts with identifying nerve pain mechanisms, drug targets, and developing innovative treatments such as regenerative therapies or advanced pain relievers. Preclinical testing involves assessing safety and effectiveness through in-vitro and animal studies. Major companies involved include Pfizer Inc., Novartis AG, Johnson & Johnson, Eli Lilly and Company, and GlaxoSmithKline, which invest heavily in neuroscience and pain management research.

After successful R&D, therapies proceed to clinical trials to evaluate safety, dosage, and effectiveness in humans through Phases I–III. Following these trials, regulatory approvals are secured from agencies such as the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and Central Drugs Standard Control Organization (CDSCO) in India. Leading clinical research organizations (CROs), including IQVIA, Parexel, and Syneos Health, assist with these stages by managing trials and ensuring regulatory compliance.

After approval, treatments proceed along patient care pathways that include therapy access, monitoring, and rehabilitation support. Hospitals, pain management clinics, and rehabilitation centers provide medical and physiotherapy services. Organizations such as the Mayo Clinic, Cleveland Clinic, Apollo Hospitals, and Johns Hopkins Medicine play important roles in patient education, medication adherence, and post-treatment recovery programs, ensuring better outcomes and long-term management of sciatica symptoms.

Corporate Information: Headquarters: Dublin, Ireland | Year Founded: 1949

Business Overview

Medtronic is a global leader in medical technologies, offering a wide range of innovative products and services that address chronic pain, including sciatica. The company is known for its expertise in minimally invasive therapies, neuromodulation, and pain management devices, with an emphasis on improving patient outcomes and quality of life. Medtronic’s products are pivotal in the field of spine health, offering innovative treatments for sciatica and other nerve-related disorders. The company also focuses on leveraging digital technologies and AI to enhance pain management capabilities.

Business Segments / Divisions

Geographic Presence

Medtronic operates in more than 150 countries worldwide, including a strong presence in North America, Europe, and the Asia-Pacific region. The company has manufacturing and R&D facilities in various global locations, including the United States, Ireland, and India.

Key Offerings

SWOT Analysis

Recent News

In January 2025, Medtronic announced 12-month data from a clinical trial (NCT05177354) showcasing the effectiveness of its Inceptiv™ closed-loop spinal cord stimulator (CL-SCS) in treating chronic low-back and leg pain. The FDA-approved device, which automatically adjusts stimulation based on spinal cord signals, is set to be featured at the North American Neuromodulation Society (NANS) 2025 meeting. The study aims to evaluate the system’s long-term efficacy in improving quality of life for patients with chronic neuropathic pain.

Corporate Information: Headquarters: New Brunswick, New Jersey, United States | Year Founded: 1886

Business Overview

Johnson & Johnson (J&J) is one of the largest healthcare companies globally, with a broad portfolio spanning pharmaceuticals, medical devices, and consumer health products. Under its DePuy Synthes brand, J&J focuses on providing orthopedic and spine solutions, including treatments for sciatica and related disorders. DePuy Synthes is a market leader in advanced medical devices, offering a comprehensive range of surgical solutions for musculoskeletal and spine-related diseases. The company is committed to providing innovative, minimally invasive treatments to help manage pain and restore mobility for patients with chronic spine issues like sciatica.

Business Segments / Divisions

Geographic Presence

Johnson & Johnson operates in over 60 countries across the globe, with significant market penetration in North America, Europe, and Asia-Pacific. The company’s DePuy Synthes division has a vast distribution network and clinical presence, providing comprehensive musculoskeletal solutions to healthcare providers worldwide.

Key Offerings

SWOT Analysis

Recent News

In August 2024, Johnson & Johnson MedTech’s DePuy Synthes launched the VELYS™ Active Robotic-Assisted System (VELYS™ SPINE), a dual-use robotics and navigation platform for spinal fusion procedures. Developed with eCential Robotics, the system received FDA 510(k) clearance and is designed for use in cervical, thoracolumbar, and sacroiliac spine surgeries.

| Vendor | Key Offerings / Highlights |

| Boston Scientific Corporation | Neuromodulation devices and pain-management solutions such as spinal cord stimulators for radicular nerve pain, including sciatica. |

| Pfizer Inc. | Pharmaceutical treatments for nerve pain, including non-steroidal anti-inflammatory drugs (NSAIDs), corticosteroids, and neuropathic pain agents for sciatica relief. |

| Abbott Laboratories | Pain-therapy and neuromodulation devices (e.g., spinal cord stimulators) that support the management of chronic back pain, including sciatica. |

| Teva Pharmaceutical Industries Ltd. | Generic drugs, including neuropathic-pain agents like gabapentin and tramadol, which are commonly used in the treatment of sciatica. |

| Sorrento Therapeutics Inc. (via subsidiary Scilex) | Innovative non-opioid therapies, such as SEMDexa™ for epidural injections, and other solutions targeting lumbar radicular pain and sciatica. |

| Hikma Pharmaceuticals PLC | Generic medications for pain relief, including treatments for sciatica and other neuropathic pain conditions. |

| Zywave, Inc. | AI-powered healthcare technology solutions to enhance patient diagnostics, rehabilitation, and pain management, including sciatica treatments. |

| Cigna Health Insurance | Pain management programs and coverage for treatments related to sciatica, including physical therapy, surgical procedures, and non-invasive therapies. |

The sciatica treatment market is poised for significant growth, driven by a confluence of rising incidences of chronic back pain and sciatica, an aging global population, and increasing awareness surrounding advanced pain management techniques. A key driver of the market’s expansion is the growing adoption of minimally invasive therapies, such as spinal cord stimulators and percutaneous procedures, which offer faster recovery times and reduced risks compared to traditional open surgeries. Additionally, the integration of neuromodulation therapies, such as closed-loop spinal cord stimulators, is revolutionizing pain management, enabling real-time adjustment to patient needs and enhancing long-term treatment efficacy.

Strategic collaborations between leading medical device manufacturers and pharmaceutical companies are further consolidating market growth, creating synergies in therapeutic innovations, and extending market reach across key geographies. Emerging markets, particularly in Asia Pacific and Latin America, are witnessing an accelerated adoption of advanced sciatica treatments due to expanding healthcare infrastructures and rising disposable incomes. The ongoing shift toward non-opioid pain management solutions, coupled with the rise of regenerative treatments, such as stem cell therapies and biologics, offers substantial untapped potential for market players.

Moreover, the growing trend of personalized medicine, powered by AI-driven diagnostics, is enabling more targeted treatment options, enhancing patient outcomes, and reducing healthcare costs. As a result, the sciatica treatment market is projected to grow robustly in the coming years, with substantial opportunities for innovation across drug development and medical devices. However, pricing pressures and regulatory hurdles related to reimbursement policies may temper growth in certain markets, requiring companies to adopt agile strategies to remain competitive in this rapidly evolving landscape.

By Product Type

By Dosage Form

By Therapeutic Area / Mechanism

By Distribution Channel

By Manufacturer Type

By End-User / Customer

By Region

February 2026

February 2026

February 2026

February 2026