January 2026

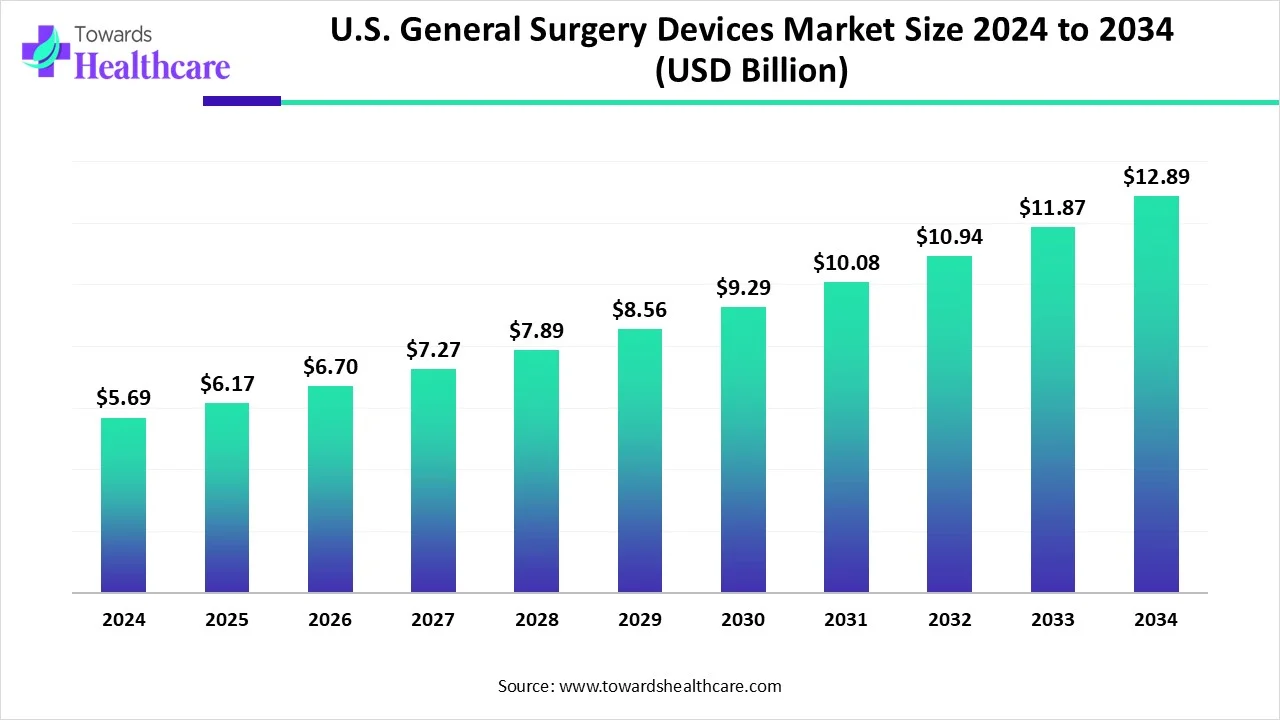

The global U.S. general surgery devices market size is calculated at USD 5.69 in 2024, grew to USD 6.17 billion in 2025, and is projected to reach around USD 12.89 billion by 2034. The market is expanding at a CAGR of 8.53% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 6.17 Billion |

| Projected Market Size in 2034 | USD 12.89 Billion |

| CAGR (2025 - 2034) | 8.53% |

| Market Segmentation | By Type, By Application, By End-use |

| Top Key Players | Johnson & Johnson Service, Inc., Conmed Corporation, B. Braun Melsungen Ag, Medtronic Plc, Becton, Dickinson and Company (Bd), Integra LifeSciences, Boston Scientific Corporation, Smith & Nephew, Integer Holdings Corporation, Cadence Inc, Olympus Corporation, Stryker, 3M Healthcare, Erbe Elektromedizin Gmbh |

The surgical medical devices are used to monitor, diagnose, alleviate, treat, or prevent any disease or injury. They can be instruments, apparatus, or implants used during the surgeries. Furthermore, the use of these surgical devices helps in improving the surgical outcomes by enhancing the performance of the surgeries. Moreover, these devices can be simple tools such as forceps or scalpels, or complex machinery such as laparoscopic equipment or surgical robots. Thus, these devices help the surgeons during the operations with enhanced efficiency and precision, which leads to improved patient outcomes.

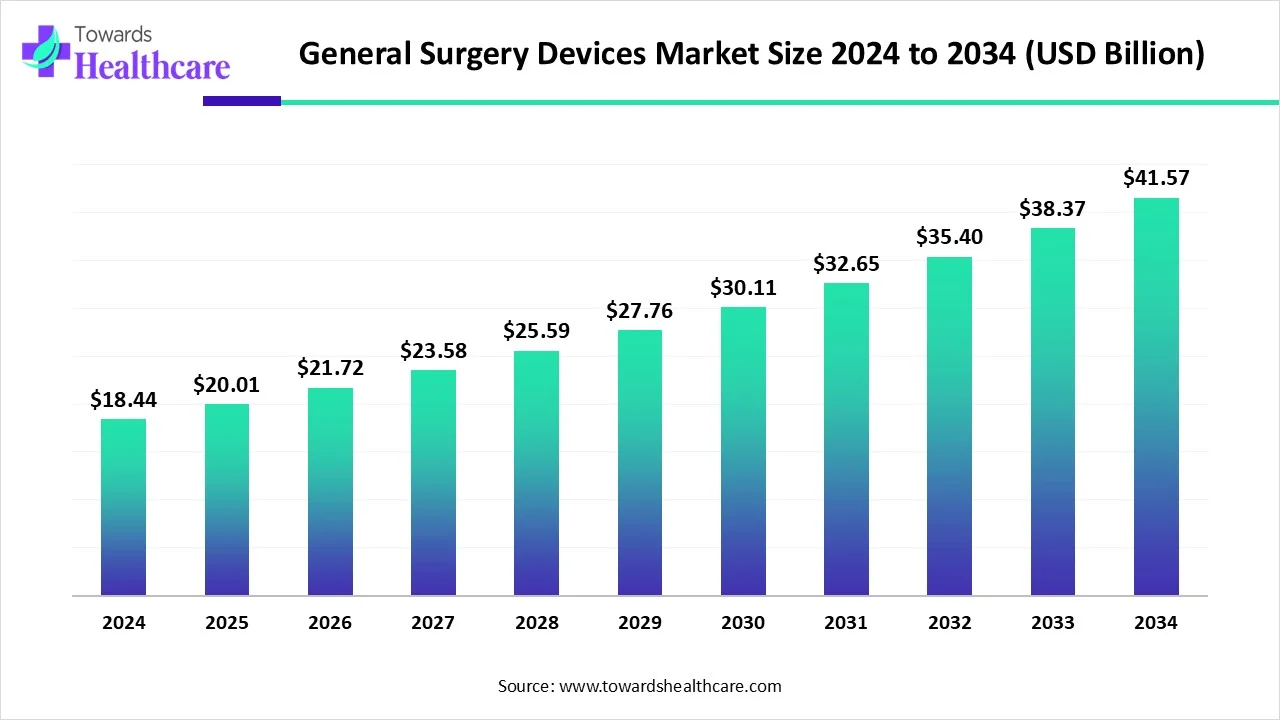

The global general surgery devices market size was valued at USD 18.44 billion in 2024 and grew to USD 20.01 billion in 2025. It is expected to nearly double, reaching approximately USD 41.57 billion by 2034. This growth reflects a steady annual increase of about 8.5% between 2025 and 2034.

The integration of AI in general surgery devices helps in transforming healthcare. The preoperative planning, intraoperative guidance, as well as postoperative care can be improved with the use of AI. At the same time, deep learning (DL), machine learning (ML), as well as robotic-assisted surgery also contribute to the AI-driven innovations used during surgeries. These innovations help in minimizing manual errors, predicting complications, as well as help in decision making depending on the data gathered and interpreted. Thus, the use of AI in general surgery devices improves patient outcomes.

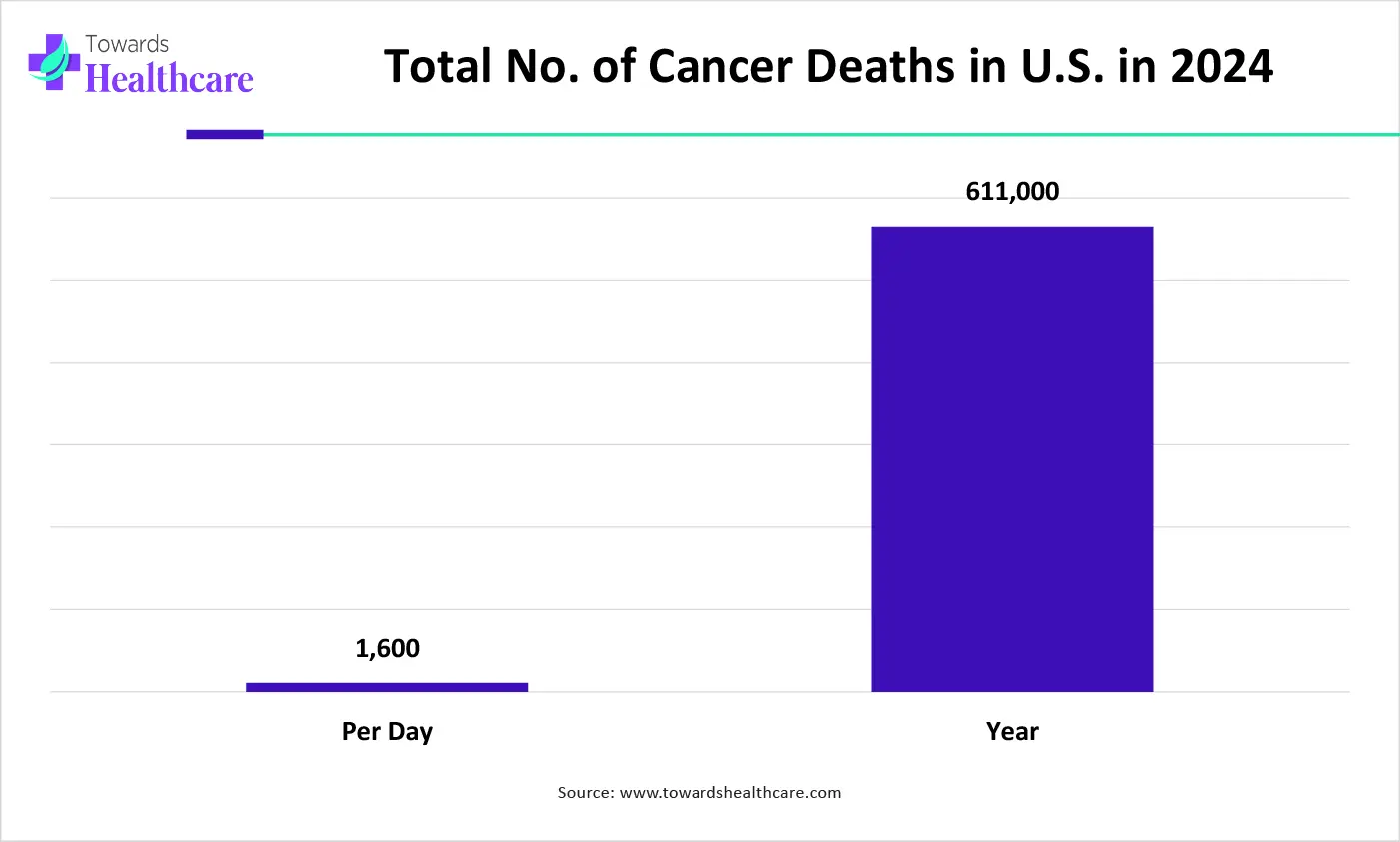

Increasing Chronic Diseases

There is a rise in the occurrence of various chronic diseases such as cancer, cardiovascular disease, diabetes, etc. These diseases increase the demand for early diagnosis as well as effective treatment and monitoring. At the same time, they also increase the need for surgeries. Hence, this in turn contributes to the rise in the use of various surgical devices for enhancing the surgical procedures, along with the patient outcomes. Furthermore, the use of these advanced surgical devices also helps in improving the accuracy as well as the speed of recovery. Thus, all these factors drive the U.S. general surgery devices market growth.

The graph represents the total number of cancer deaths in the U.S. in the year of 2024. It indicates that there will be a rise in cancer cases. Hence, it increases the demand for various surgical devices for its effective diagnosis, management, and treatment. Thus, this in turn will ultimately promote the market growth. (Source - American Cancer Society)

Strict Approval Process

During the approval process of any surgical device, strict clinical trials are conducted by the U.S. FDA. These trials take a long period, which in turn also increases the investments by the companies for conducting the trials. Furthermore, the devices developed may not always be approved, which impacts the research, as well as the innovation conducted, limiting the development of new surgical devices. Along with these factors, the complexities of trials also affect the growth of the market.

Robotic Surgeries

The diseases or injuries that require surgery are often associated with various complications, due to which the demand for robotic-assisted surgeries is increasing. With the help of robotic-assisted systems, the diagnosis as well as the monitoring of diseases are improving. At the same time, it also helps in minimally invasive surgeries, enhancing the patient outcomes as well as the accuracy of the surgeries. Furthermore, various complex surgeries are also conducted effectively with the use of these robotic-assisted systems. Thus, all these factors promote their use, as well as the U.S. general surgery devices market growth.

For instance,

By type, the disposable surgical supplies segment dominated the market in 2024. The disposable surgical supplies were single-use supplies that reduced the risk of infections within patients. Furthermore, they were affordable and convenient to use, as well as reducing the need for sterilization. Thus, it contributed to the U.S. general surgery devices market growth.

By type, the medical robotics & computer-assisted surgery devices segment is estimated to be the fastest growing at a notable CAGR during the forecast period. These devices enhance the accuracy of the surgeons, which in turn, enhances the patient outcomes. This, in turn, increases their use in complex, as well as minimally invasive surgeries.

By application type, the orthopedic surgery segment dominated the market in 2024. Due to increasing orthopedic disorders, injuries, as well as an aging population, there was an increased use of various surgical devices. At the same time, the development of new devices also contributed to the U.S. general surgery devices market growth.

By application type, the cardiology segment is anticipated to be the fastest growing during the forecast period. The use of surgical devices in cardiology applications is rising due to growing awareness as well as rising rates of various cardiological disorders. This, in turn, enhances the use of early diagnosis, monitoring, as well as treatment associated with surgical devices.

By end user, the hospital segment dominated the U.S. general surgery devices market in 2024. The hospital consisted of advanced technological surgical devices as well as skilled personnel, which improved the performance of the surgeries. At the same time, a large volume of patients with diverse diseases were effectively treated, which enhanced the patient outcomes as well as market growth.

By end user, the ambulatory surgical centers segment is predicted to be the fastest growing during the forecast period. The patients are preferring ambulatory surgical centers, due to the presence of advanced surgical devices which provide fast surgeries as well as accelerate the recovery time. At the same time, the affordability also contributes to the same.

The U.S. general surgery devices market is estimated to grow significantly during the forecast period. The U.S. is experiencing a rise in the demand for the use of various surgical devices due to increasing disease prevalence. At the same time, the adoption of new technologies is also contributing to the same. Furthermore, the well-developed healthcare sector is utilizing new surgical devices to improve the success rates of the surgeries. The use of minimally invasive surgeries, as well as robotic surgeries, is also increasing. Furthermore, the reimbursement policies are also attracting the population. Thus, all these factors promote the market growth.

By Type

By Application

By End-use

January 2026

January 2026

January 2026

January 2026