January 2026

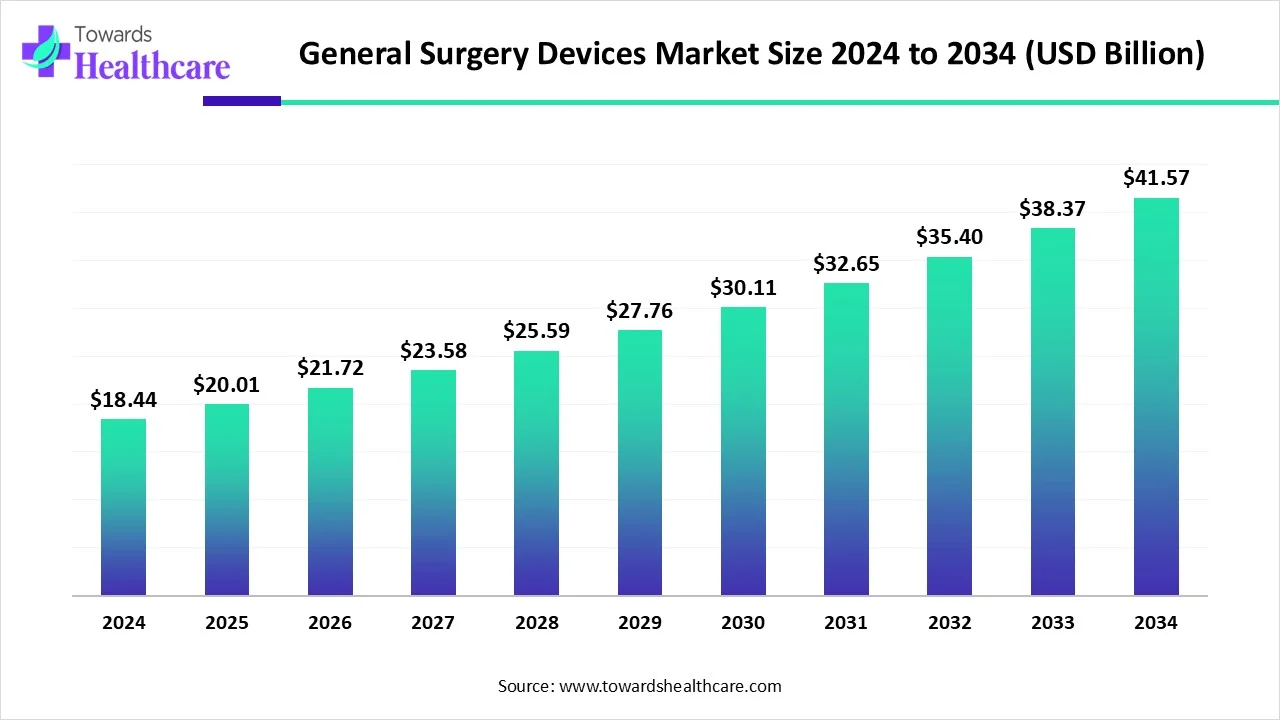

The global general surgery devices market size is calculated at USD 18.44 in 2024, grew to USD 20.01 billion in 2025, and is projected to reach around USD 41.57 billion by 2034. The market is expanding at a CAGR of 8.54% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 20.01 billion |

| Projected Market Size in 2034 | USD 41.57 billion |

| CAGR (2025 - 2034) | 8.54% |

| Leading Region | North America share by 41% |

| Market Segmentation | By Type, By Application, By End-use, By Region |

| Top Key Players | Johnson & Johnson Service, Inc., Conmed Corporation, Medtronic Plc, Integra LifeSciences, B. Braun Melsungen Ag, Smith & Nephew, Cadence Inc, Becton, Dickinson and Company (Bd), Stryker, Integer Holdings Corporation, 3M Healthcare, Olympus Corporation, Erbe Elektromedizin Gmbh, Boston Scientific Corporation |

Type of apparatus, instrument, or implants that are used in surgical procedures for diagnosis, monitoring, preventing, alleviating, or treating any injury or disease is known as a surgical medical device. They can be as simple as scalpels or forceps, or as complex as laparoscopic equipment or surgical robots. For enhancing the precision as well as surgical outcomes, these devices are essential. Furthermore, these devices are also involved in conducting minimally invasive surgeries, which helps in faster recoveries. Thus, these devices can be used in a wide range of medical conditions.

The preoperative planning, intraoperative precision, as well as postoperative care are enhanced with the integration of AI in general surgery devices. The use of AI in computer vision, robotic automation, and data analytics is improving patient outcomes, surgical accuracy, along with the reduction of human errors. Furthermore, the use of AI also increases patient safety by predicting complications with the help of electronic health records (EHRs). Moreover, the use of AI in surgical devices is also expanding surgical decision-making as well as personalized surgical care.

Growing Minimally Invasive Surgeries

As the number of surgeries conducted is increasing, the demand for minimally invasive surgeries is also rising. With the help of various new surgical devices, the application of minimally invasive surgeries is increasing. At the same time, the adoption is also growing as it provides small incisions, minimizes blood loss and pain, as well as helps in faster recoveries. Moreover, the risk of complications is also reduced by the use of devices such as laparoscopes, endoscopes, or robotic systems. Thus, all these advantages of minimally invasive surgery devices drive the general surgery devices market growth.

High Prices

The surgery devices are considered to be expensive. At the same time, their utilization requires high budgets. Moreover, for its proper and effective use, skilled professionals are also required. Thus, the developing or rural hospital is unable to adapt to these surgical devices. Furthermore, it also limits the use by the patient due to its high cost. Thus, high prices of these devices can act as a restraint for market growth.

Increasing Surgeries

The number of surgeries conducted is increasing due to the growing diseases, accidents, as well as aging populations. This, in turn, increases the need for the use of various surgical diagnostic or treatment approach devices. These devices help in identifying the condition of the patients before as well as after surgeries. At the same time, they can be used during the surgeries to enhance the surgical procedures. They also minimize the risk of complications, which in turn increases patient outcomes. Thus, all these factors promote the general surgery devices market growth.

For instance,

By type, the disposable surgical supplies segment dominated the market in 2024. This segment dominated because disposable surgical supplies decreased the need for sterilization as well as infection risks. This contributed to the general surgery devices market growth.

By type, the medical robotics & computer-assisted surgery devices segment is estimated to be the fastest growing at a notable CAGR during the forecast period. These devices are increasing the accuracy and can also be used in conducting minimally invasive surgeries.

By application type, the orthopedic surgery segment dominated the market in 2024. This is due to rising orthopedic disorders contributed to the increased orthopedic surgeries, along with the use of various surgical devices, which resulted in the market growth.

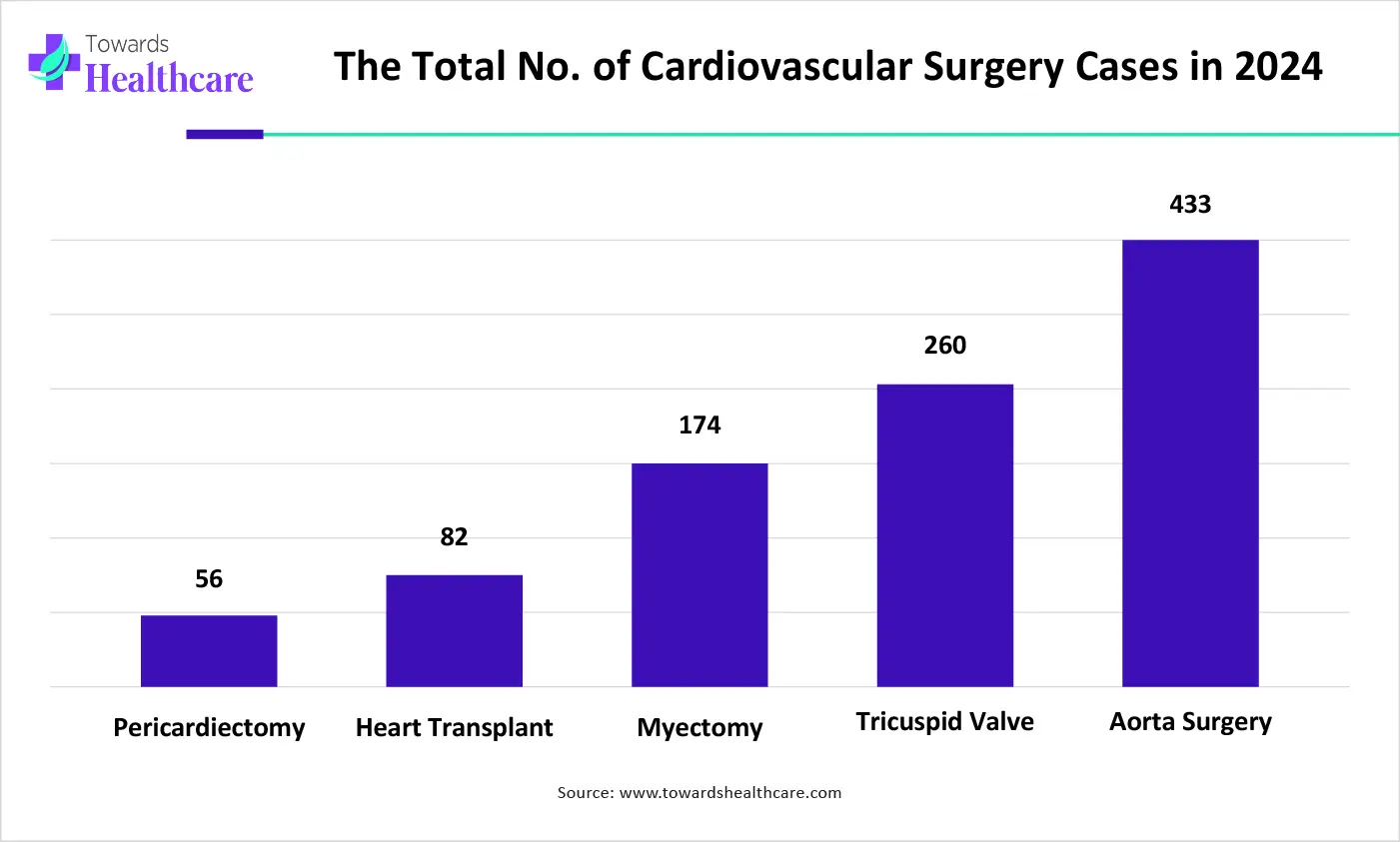

By application type, the cardiology segment is anticipated to be the fastest growing during the forecast period. The use of surgical devices in cardiology is increasing as it offers effective treatment approaches, minimizing the complexities.

The graph represents the total number of cardiovascular surgery cases in the year of 2024. It indicates that there will be a rise in cardiovascular surgeries. Hence, it increases the demand for the use of various surgical devices. Thus, this in turn will ultimately promote the market growth.

By end user, the hospital segment dominated the global market in 2024. This segment dominated because the hospitals provided various effective surgical approaches with the help of advanced devices to the large volume of patients, leading to market growth.

By end user, the ambulatory surgical centers segment is predicted to be the fastest growing during the forecast period. Various cost-effective as well as advanced surgery devices are being used by the ambulatory surgical centers, which in turn, are enhancing the patient outcomes.

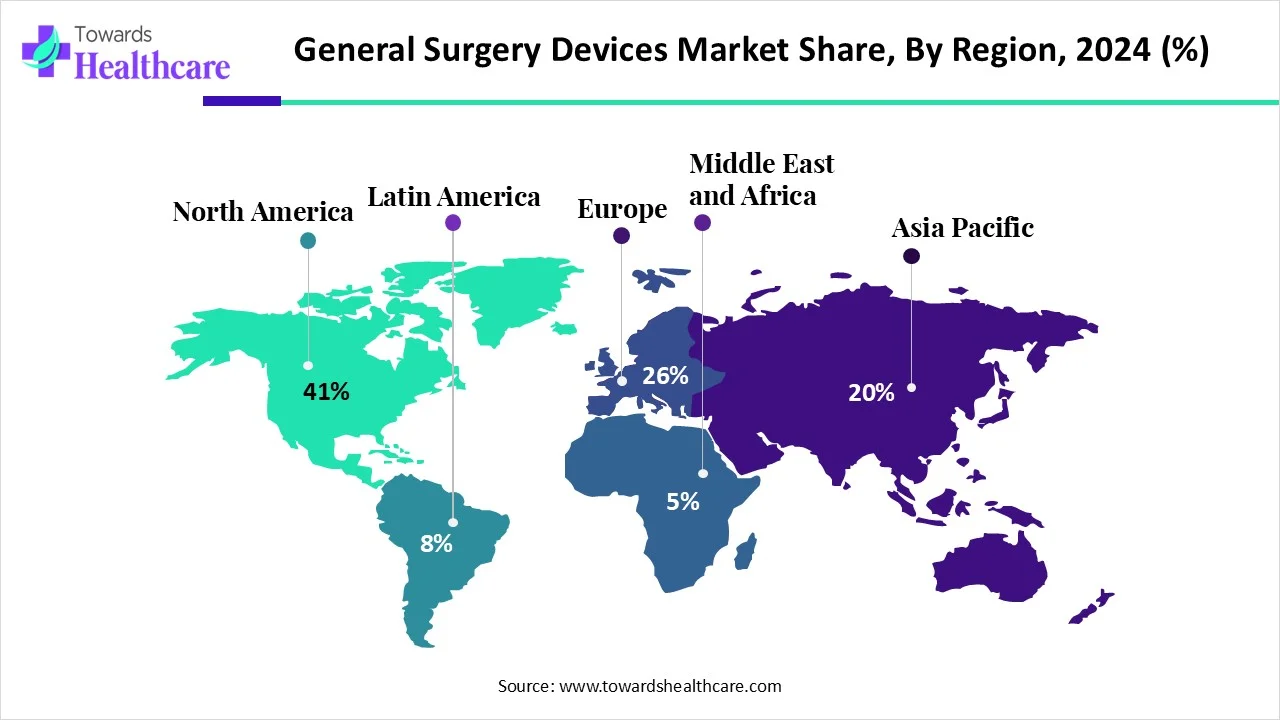

North America dominated the general surgery devices market share by 41% in 2024. The healthcare system in North America is well developed, along with the presence of advanced technologies as well as skilled personnel. This enhances the use of surgery devices in hospitals, which contributes to the market growth.

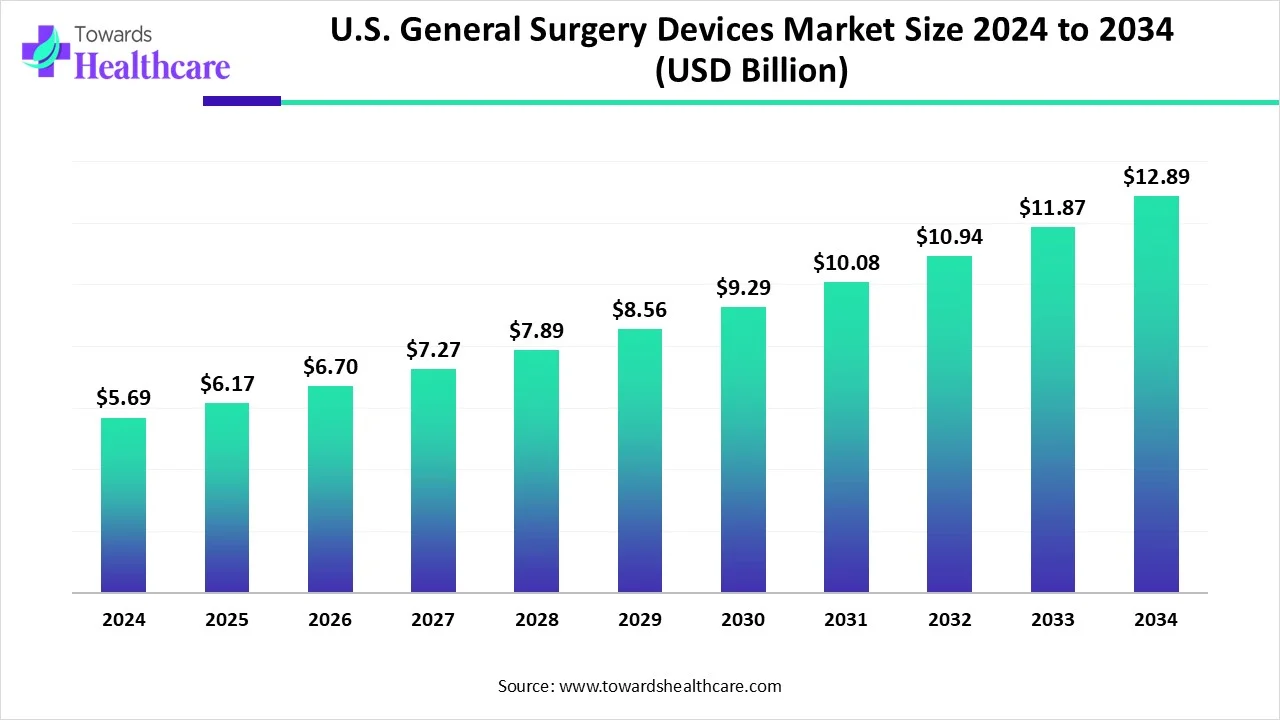

The U.S. general surgery devices market was valued at USD 5.69 billion in 2024 and grew to USD 6.17 billion in 2025. It is expected to nearly double, reaching about USD 12.89 billion by 2034, with an annual growth rate of around 8.5% from 2025 to 2034.

The healthcare sector in the U.S. is advanced. This, in turn, increases the use of various devices for improving the surgical procedures, which in turn increases the success rates of the complicated surgeries. Furthermore, new devices are also being developed for different surgeries.

The surgeries conducted in Canada are increasing, which in turn, increases the demand for surgery devices. Thus, the industries focus on its development, which further leads to various collaborations for improving the device's applications.

Europe is estimated to host the fastest-growing general surgery devices market during the forecast period. Europe is experiencing a rise in the use of various surgical devices due to their several advantages. Moreover, the government is also providing support, which enhances the market growth.

The hospitals in Germany are utilizing new surgery devices. At the same time, the development of these devices is also rising due to increasing use as well as demand. Similarly, the use of AI is also improving its applications.

Due to increasing diseases, the healthcare sector is focusing on the development as well as the adoption of surgery devices and new technologies. This all together improves the surgeries and minimizes the risk of complications.

Asia Pacific is expected to grow significantly in the general surgery devices market during the forecast period. The healthcare sector in Asia Pacific is advancing, which in turn, increases the adoption of surgery devices. Thus, this, along with the growing diseases, promotes the market growth.

The increasing diseases, as well as the adoption of new technologies in China, are enhancing the use of surgical devices. The use of the devices is enhancing the procedures, which in turn improve the patient outcomes.

The healthcare sector in India is advancing, which increases the utilization of new surgery devices as well as their development. Furthermore, their use is also increasing, which is also supported by the government investments to make them affordable.

Latin America is considered to be a significantly growing region, due to the increasing number of surgeries and the burgeoning medical device sector. The rising prevalence of chronic disorders and the growing geriatric population lead to an increasing number of surgeries in Latin America. The rapidly expanding medical tourism due to the availability of cost-effective services and innovative tools augments the market.

Americans mostly prefer Mexico for their medical treatment due to its favorable geographical location and cost-effective healthcare services. Mexico’s geriatric population is estimated to triple to 7.3 million by 2050. In 2024, the population of Mexico has increased to 130,861,007, representing a 32.7% increase from 2000.

In Brazil, approximately 50% of adults have at least one chronic disorder. Around 10 million people are thought to have chronic kidney disease. Currently, 32.3% of the total population of Brazil is between 40 and 65 years, which is projected to rise to 36.1% by 2040.

The Middle East & Africa are expected to grow at a considerable CAGR in the general surgery devices market in the upcoming period. The rapidly expanding healthcare sector and the presence of advanced healthcare infrastructure boost the market. Numerous government organizations support the development and use of advanced surgery devices through investments.

On 7th July 2024, UAE hospitals conducted a total of 118 surgeries, of which 81 were elective, 16 were urgent, and 21 were emergency surgeries. The UAE government allocated AED 5 billion budget for the healthcare sector, compared to AED 4.9 billion in 2023 and AED 4.25 billion in 2022.

The Gauteng Department of Health conducted 37,000 surgeries within a span of nine months from July 2023 to March 2024. Of these, general surgeries comprised 22,000, orthopedic surgeries comprised 8,000, and over 5,000 cataract surgeries.

By Type

By Application

By End-use

By Region

January 2026

January 2026

January 2026

December 2025