February 2026

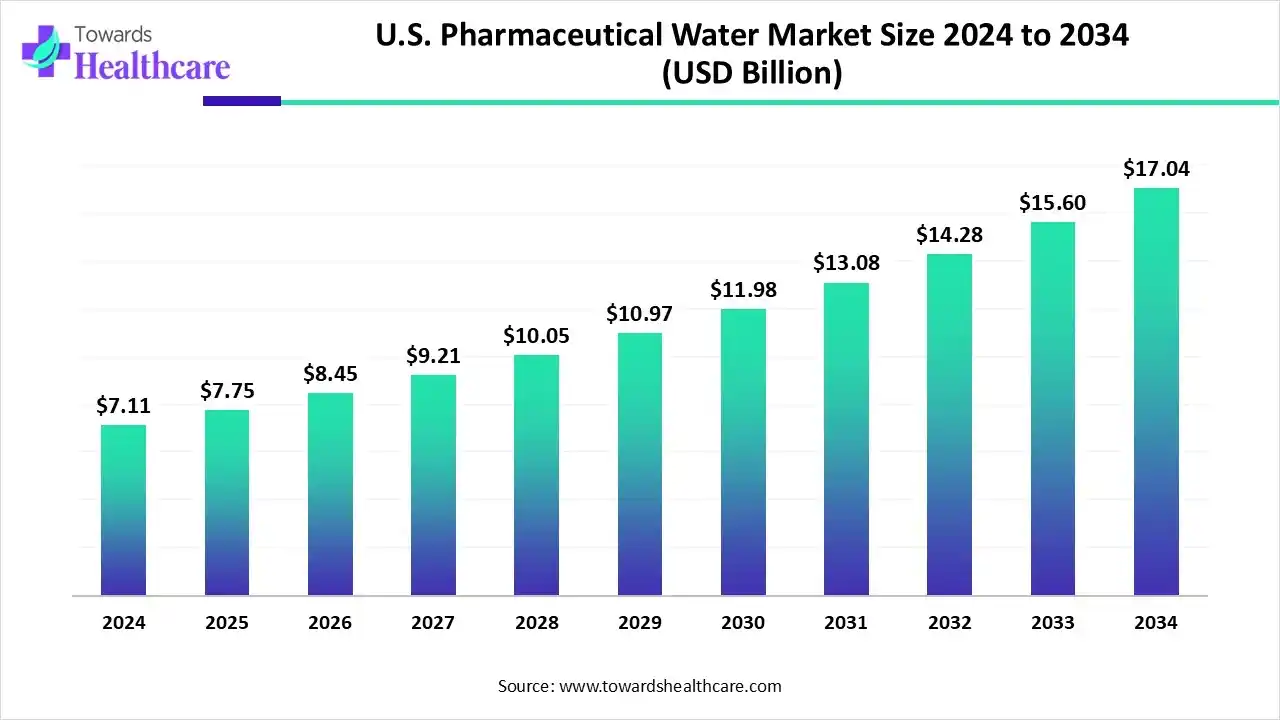

The U.S. pharmaceutical water market size recorded US$ 7.11 billion in 2024, set to grow to US$ 7.75 billion in 2025 and projected to hit nearly US$ 17.04 billion by 2034, with a CAGR of 8.94% throughout the forecast timeline.

The U.S. pharmaceutical water market is growing due to rising demand for high-purity water in drug manufacturing, biologics, and injectable therapies. Stringent regulatory standards, advanced purification technologies, and the expansion of biopharmaceutical and contract manufacturing sectors are key drivers, ensuring compliance, safety, and innovation in pharmaceutical production.

| Table | Scope |

| Market Size in 2025 | USD 7.75 Billion |

| Projected Market Size in 2034 | USD 17.04 Billion |

| CAGR (2025 - 2034) | 8.94% |

| Market Segmentation | By Water Type / Product Type, By Application / End Use, By Technology / Generation & Treatment Platform, By End User / Buyer Type, By Solution / Business Model, By Region |

| Top Key Players | Evoqua Water Technologies, Pall / Danaher, Merck Millipore (MilliporeSigma), GE Water / SUEZ WTS, Veolia / Suez, Thermo Fisher Scientific, Parker Hannifin, Grundfos, SPX Flow (APV, WFI/distillation), Dow (membranes), Ecolab, NEM (regional system integrators), Pall Corporation (filters & sterilization), Watson-Marlow / Xylem, STERIS / Cantel, Hach (monitoring instruments), Endress+Hauser (sensors), APT Water Services (validation consultancies), CDMO-focused integrators (e.g., G-CON-like firms), Large CDMOs & pharma OEMs influencing system designs |

U.S. pharmaceutical water market expansion is fueled by the growing demand for high-purity water, stringent regulatory standards, and an increase in the sterile injectables and biologics sectors. The market covers systems, equipment, consumables, services, and software used to generate, purify, distribute, monitor, and validate water that meets pharmaceutical/USP standards (Purified Water, Water for Injection (WFI), HPLC/ULC grade water, Highly Purified Water, etc.).

Pharmaceutical water is specially purified water used in drug manufacturing and research, meeting strict pharmacopeial standards for purity, sterility, and safety, essential for formulations, injections, cleaning, and quality assurance processes.

Adoption of inorganic growth strategies, such as acquisitions and strategic partnerships, enables companies to expand manufacturing capabilities and product portfolios, thereby increasing demand for high-purity pharmaceutical water systems to support biologics, vaccines, and injectable drug production.

In 2025, Cipla’s acquisition of InvaGen Pharmaceuticals expanded its U.S. manufacturing, increasing demand for high-purity Water for Injection (WFI) to support biologics and injectable drug production.

Investment and funding in advanced purification technologies, facility expansion, and R&D enable pharmaceutical manufacturers to meet stringent water quality standards, enhance production capacity for biologics and injectables, and adopt innovative water treatment systems, thereby driving growth in the U.S. pharmaceutical water market.

In 2025, strategic investments and funding significantly influenced the market. For instance, Eli Lilly announced a US$6.5 billion investment to construct a state-of-the-art biomanufacturing facility in Houston, Texas. This facility, aimed at producing the experimental weight-loss pill orforglipron, underscores the increasing demand for high-purity water systems essential for the production of biologics and injectable drugs.

AI integration can significantly enhance the market by enabling real-time monitoring, predictive maintenance, and process optimization in water purification systems. Machine learning algorithms analyze sensor data to detect anomalies, prevent contamination, and ensure consistent compliance with regulatory standards. AI-driven automation reduces human error, increases operational efficiency, and optimizes energy and water usage. Additionally, intelligent analytics support faster validation and reporting, enhancing production reliability for biologics, vaccines, and injectables, ultimately driving market growth through improved quality, safety, and cost-effectiveness.

Technological advancements and innovations in purification technologies, including reverse osmosis, ultrafiltration, electrode‑deionization, and UV sterilization, enhance water quality, reliability, and operational efficiency. These improvements support stringent regulatory compliance, enable high-purity water production for biologics and injectables, and drive growth in the market.

Energy-Intensive Processes

The key players operating in the market are facing issues due to energy-intensive processes and technology limitations. Water purification and WFI production often consume high energy, increasing operational costs.

Sustainability initiatives are pivotal in advancing the U.S. pharmaceutical water market by promoting efficient water use, reducing environmental impact, and ensuring regulatory compliance.

For instance,

The Water for Injection (WFI) dominated the market, with a revenue of approximately 79% due to its critical role in sterile injectable and biologic drug production. Its stringent purity, endotoxin-free quality, and compliance with FDA and USP standards make it essential for safe pharmaceutical manufacturing.

The highly purified water (HPW)/HPLC grade water segment is anticipated to be the fastest-growing segment in the U.S. pharmaceutical water market due to rising demand for analytical testing, laboratory applications, and biologics production, requiring ultra-pure, contaminant-free water that meets stringent regulatory standards.

The drug substance & drug product manufacturing segment dominates the U.S. pharmaceutical water market, with a revenue share of approximately 58% due to its critical need for high-purity water in formulation, sterilization, and cleaning processes, ensuring compliance with regulatory standards and maintaining product safety and efficacy.

The aseptic fill/finished pack segment is estimated to be the fastest-growing segment in the U.S. pharmaceutical water market due to rising demand for sterile injectables, biologics, and vaccines. This process requires ultra-pure Water for Injection (WFI) to maintain sterility, product safety, and regulatory compliance, driving its rapid adoption across manufacturing facilities.

The reverse osmosis (RO) + EDI segment dominates the U.S. pharmaceutical water market due to its ability to consistently produce ultra-pure water, efficiently remove impurities, and meet stringent regulatory standards for biologics, injectables, and sterile drug production.

The continuous monitoring & automation/PAT sensors segment is anticipated to be the fastest-growing segment in the U.S. pharmaceutical water market, as it enables real-time quality assurance, early detection of deviations, and strict compliance with FDA standards. By minimizing human error and enhancing operational efficiency, these sensors support reliable and cost-effective pharmaceutical water management.

The pharmaceutical & biotechnology companies segment dominated the U.S. pharmaceutical water market in 2024, with a revenue of approximately 58% due to their extensive reliance on high-purity water for drug formulation, biologics production, and sterile injectable manufacturing. Stringent regulatory compliance, advanced R&D activities, and the need for reliable purification systems further drive their leading role in market demand.

The contract development & manufacturing organizations (CDMOs/CMOs) segment is estimated to be the fastest-growing segment in the U.S. pharmaceutical water market due to increasing outsourcing of drug development and production. Their focus on biologics, vaccines, and sterile injectables requires stringent water quality standards. To meet FDA and USP regulations while serving diverse clients, CDMOs invest in scalable, flexible, and advanced purification systems.

The on-site water generation & system sales segment dominates the market, with a revenue of approximately 82% because it ensures continuous access to high-purity water, critical for drug formulation, biologics, and injectables. On-site systems reduce reliance on external supply, enhance control over water quality, and support compliance with FDA and USP standards. Additionally, they enable cost savings, operational efficiency, and scalability, making them the preferred choice for pharmaceutical and biotechnology manufacturers across the country.

The water-as-a-service/packaged sterile water segment is anticipated to be the fastest-growing in the U.S. pharmaceutical water market due to rising demand for outsourced, ready-to-use high-purity water solutions. It offers flexibility, reduces infrastructure investment, ensures regulatory compliance, and supports small-scale or emerging pharmaceutical and biotech companies in producing biologics, vaccines, and injectables efficiently and cost-effectively.

The Northeast/Mid-Atlantic region dominates the U.S. pharmaceutical water market, with a revenue of approximately 55-60% due to its dense concentration of pharmaceutical and biotechnology companies, advanced manufacturing infrastructure, and strong regulatory oversight. Its robust R&D ecosystem and high adoption of purified water systems for biologics, injectables, and sterile drug production drive consistent demand and market leadership.

The Southeast & Midwest regions of the U.S. are the fastest-growing in the pharmaceutical water market due to the expansion of pharmaceutical and biotech manufacturing facilities, favorable business and regulatory environments, and increasing investments in biologics and injectable production. Adoption of advanced water purification systems and on-site generation technologies further drives growth in these emerging hubs.

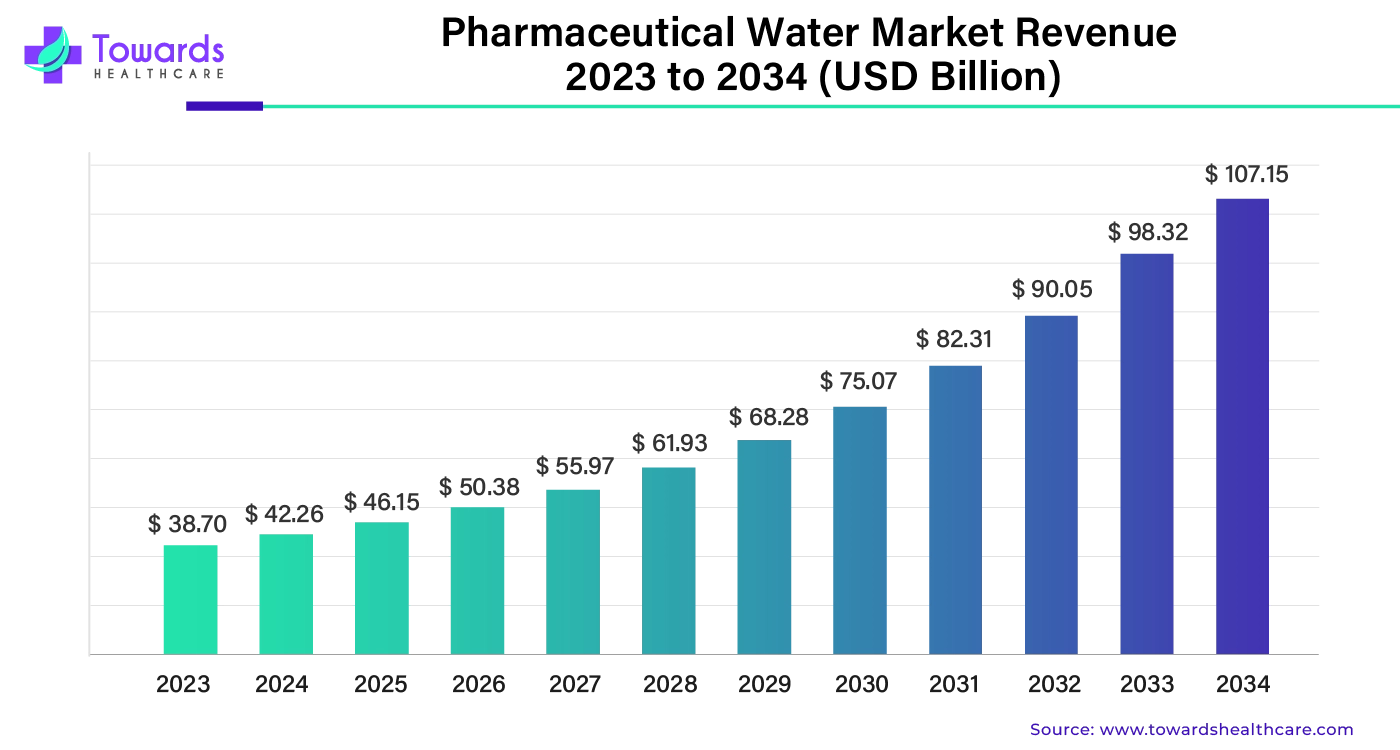

The global pharmaceutical water market was valued at around $38.7 billion in 2023 and is expected to reach $107.15 billion by 2034, growing steadily at an annual rate of 9.25% between 2024 and 2034.

Research & Development: Focuses on designing, developing, and optimizing water purification and treatment technologies for pharmaceutical applications.

Key Activities: Innovation in Reverse Osmosis (RO), Ultrafiltration (UF), Electrodeionization (EDI), UV sterilization, Water-for-Injection (WFI) generation, and monitoring systems.

Organizations:

Clinical Trial / Validation: Purified water systems must meet FDA and USP standards before use in drug production.

Key Activities:

Organizations:

Service & Support: Ensures consistent supply of high-purity water for drug production, maintenance of purification systems, and technical assistance.

Key Activities:

Organizations:

In May 2025, Anne Le Guennec, Senior Executive Vice President, Worldwide Water Technologies, stated that Veolia acquired the remaining 30% stake in Water Technologies & Solutions from CDPQ for US$1.75 billion, achieving full ownership. This strategic move is expected to yield €90 million ($102.3 million) in cost synergies by 2027. Veolia secured US$750 million in new contracts, including a $550 million deal with a major microelectronics plant in the U.S. Midwest, reflecting its expansion in the energy and semiconductor sectors.

By Water Type / Product Type

By Application / End Use

By Technology / Generation & Treatment Platform

By End User / Buyer Type

By Solution / Business Model

By Region

February 2026

February 2026

February 2026

February 2026