January 2026

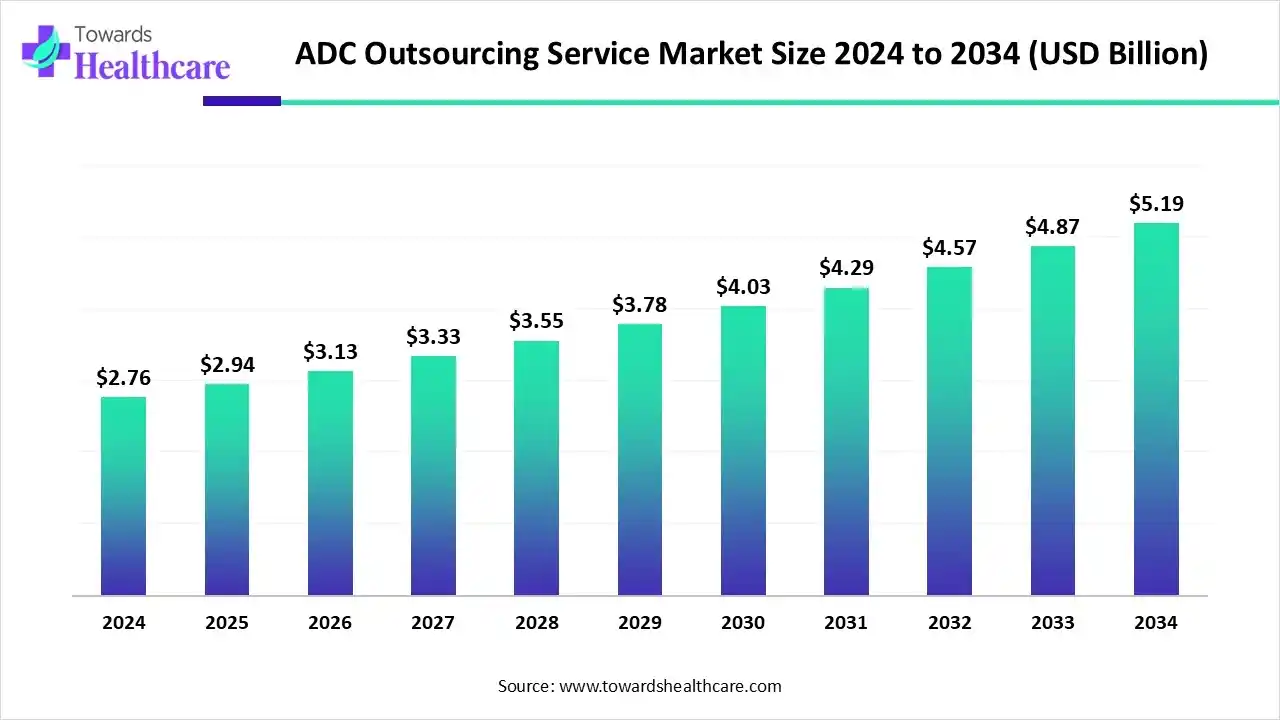

The global ADC outsourcing service market size is calculated at USD 2.76 billion in 2024, grew to USD 2.94 billion in 2025, and is projected to reach around USD 5.19 billion by 2034. The market is expanding at a CAGR of 6.52% between 2025 and 2034.

The ADC outsourcing service market is primarily driven by the rising prevalence of genetic disorders and growing research activities. Outsourcing antibody-drug conjugate (ADC) development services enables companies to expand their product pipeline and strengthen their market position. Government organizations support the development of ADCs through funding. Artificial intelligence (AI) fosters the development of ADCs, enhancing their efficiency and accuracy.

| Table | Scope |

| Market Size in 2025 | USD 2.94 Billion |

| Projected Market Size in 2034 | USD 5.19 billion |

| CAGR (2025 - 2034) | 6.52% |

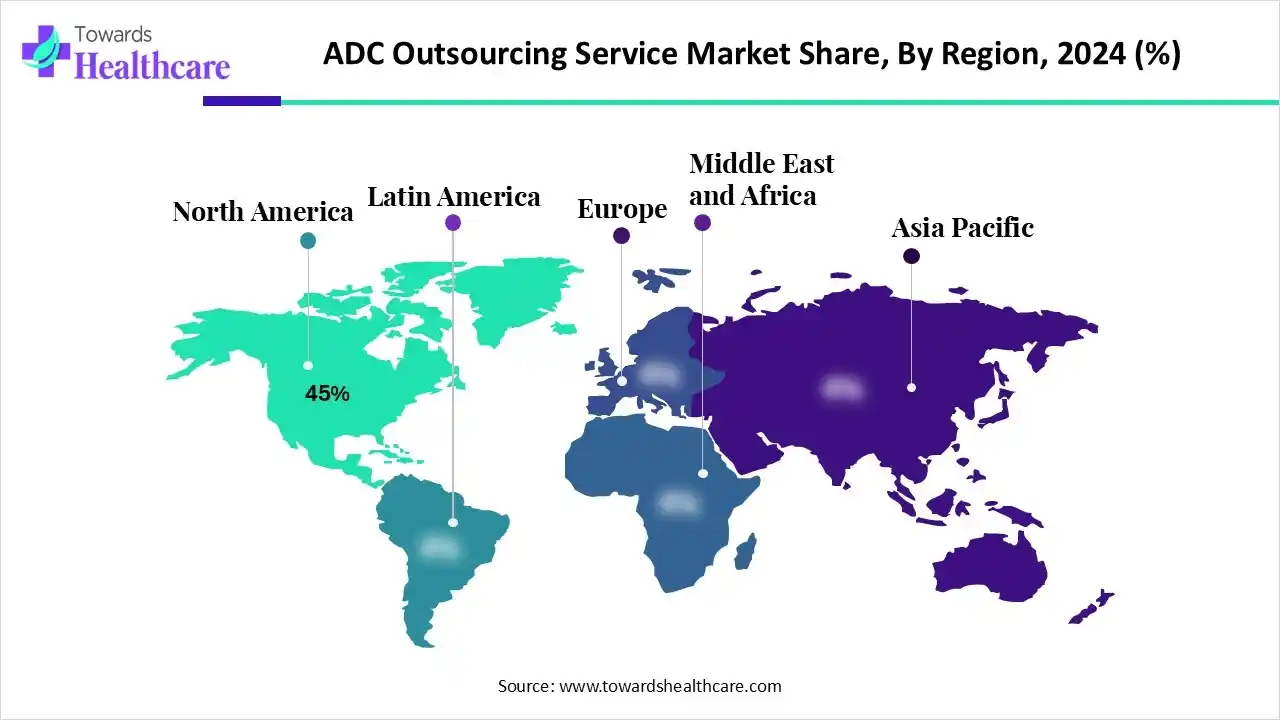

| Leading Region | North America by 45% |

| Market Segmentation | By Type, By Application, By End Service Stage, By Region |

| Top Key Players | Charles River Laboratories, IQVIA, Evotec SE, WuXi AppTec, Parexel, PPD, Inc., ICON plc, Theorem Clinical Research, Baxter BioPharma Solutions, Merck/SAFC, Piramal Pharma Solutions, Covance (Labcorp), Syngene, Lonza Group AG |

The ADC outsourcing service market is experiencing robust growth, driven by the growing demand for targeted therapeutics, strong clinical data of ADCs, and increasing investor interest. It refers to third-party contract services supporting the development and manufacturing lifecycle of ADCs. This includes conjugation, payload/linker development, analytical testing, bioprocessing, high-potency APIs (HPAPIs), fill-finish, and stability services. The market serves pharma/biotech companies seeking to leverage specialized manufacturing expertise, reduce time to clinic/commercialization, and mitigate risk and capital investment

AI revolutionizes the research and manufacturing of ADCs, leading to the development of tailored therapeutics. It assists researchers in linker-payload design and conjugation based on the stability and compatibility of ADCs. AI and machine learning (ML) algorithms can analyze vast amounts of data and streamline clinical trials by enabling real-time monitoring of patients. They can predict treatment outcomes and potential side effects, allowing healthcare professionals to make proactive clinical decisions.

For instance,

| Products | Company | Target Antigens | Approved Year | 2024 Sales ($ million) |

| Enhertu | Daiichi Sankyo, AstraZeneca | HER2 | 2019 | 3,754 |

| Kadcyla | Roche | HER2 | 2013 | 2,317 (CHF 1.99 billion) |

| Adcetris | Pfizer, Takeda | CD30 | 2011 | 1,911 |

| Padcev | Astellas, Pfizer | Nectin-4 | 2019 | 1588 |

| Trodelvy | Gilead | Trop-2 | 2020 | 1315 |

| Polivy | Roche | CD79B | 2019 | 1,300 (CHF 1.12 billion) |

| Elahere | AbbVie | FRα | 2022 | 479 |

| Tivdak | Genmab | TF | 2021 | 131 |

| Blenrap | GSK | BCMA | 2020 | 2.52 (£2 million) |

| Besponsa | Wyeth Pharmaceuticals, Inc. | CD22 | 2017 | - |

| Zynlota | ADC Therapeutics | CD19 | 2021 | 69.3 |

| Akalux | Rakuten Medical | EGFR | 2020 | - |

| Mylotarg | Pfizer | CD33 | 2000 | - |

| Aidixi | RemeGen Co., Ltd. | HER2 | 2021 | - |

| Lumoxiti | AstraZeneca | CD22 | 2018 | - |

| Lukang Satuzumab | Sichuan Kelun Biotech Biopharmaceutical Co., Ltd. | Trop-2 | 2024 | - |

| Datroway | AstraZeneca, Daiichi Sankyo | Trop-2 | 2024 | - |

By type, the CRDMO (Contract Research, Development, and Manufacturing Organization) segment held a dominant presence in the market in 2024, due to the presence of favorable infrastructure and specialized equipment. CRDMOs also possess skilled professionals to provide relevant expertise and tailored solutions to complex problems. According to Pharmaceutical Technology, about 70% to 80% of ADC developers rely on CDMOs for at least part of their production. CRDMOs can navigate the challenges of ADC production, reduce risks, and accelerate the timeline of product approval.

By application, the pharmaceutical companies segment held the largest revenue share of the market in 2024, due to a lack of suitable facilities for manufacturing ADCs. The increasing number of startups facilitates collaboration with CRDMOs. This enables them to deliver advanced therapeutics to a large patient population and strengthen their market position. Large pharmaceutical companies are pioneering the development of ADCs with a focus on treating hematologic malignancies and solid tumors.

By application, the biotechnology companies segment is expected to grow with the highest CAGR in the market during the studied years. Leading biotech companies are revolutionizing cancer care with cutting-edge ADC development. The increasing competition among key players encourages biotech companies to expand their ADC portfolio. It is estimated that over 50 global biotech companies are engaged in ADC development. Biotech companies also develop innovative platforms to accelerate the development of ADCs.

By end service stage, the conjugation & linker-payload development segment led the market in 2024, due to advancements in linker technology and expanding applications of monoclonal antibodies. Advances in linker technology lead to the development of stable ADCs in plasma, ensuring a more uniform distribution. Personalized monoclonal antibodies and more potent cytotoxic compounds are continuously developed to further improve the efficacy and potency of novel ADCs. CRDMOs offer validated payloads to expedite early-stage testing, developing customized or novel payloads based on specific clinical goals.

By end service stage, the HPAPI/cytotoxin manufacturing segment is expected to expand rapidly in the market in the coming years. The upsurge in demand for novel anti-cancer therapeutics has potentiated the need for the development of innovative ADCs. High-potency active pharmaceutical ingredients (HPAPIs) are essential for creating more potent ADCs. Currently, 40% of all APIs are highly potent, of which about 60% are indicated for different cancer types. In addition, approximately 145 companies possess the desired capabilities to offer HPAPI and cytotoxic drug manufacturing services.

North America dominated the ADC outsourcing service market share by 45% in 2024. The presence of key players, favorable regulatory policies, and the availability of state-of-the-art research and development facilities are the factors that govern market growth in North America. The rising prevalence of cancer and the growing geriatric population necessitate researchers to develop innovative drugs. Government organizations launch initiatives to create awareness among the general public about the screening and early diagnosis of cancer, enabling healthcare professionals to provide early intervention.

Key players, such as Catalent Biologics, PPD, and ICON plc., are the major companies that provide tailored ADC development services in the U.S. The U.S. conducts the highest number of clinical trials globally. Of the total 673 studies on ADCs, about 432 studies were registered from the U.S. The Food and Drug Administration (FDA) regulates the approval of ADCs in the U.S.

Canada has a strong presence of biotech companies and CDMOs to provide tailored services for ADC development. BOC Sciences, Simtra BioPharma Solutions, and Aragen Life Sciences provide ADC outsourcing services in Canada. The National Research Council Canada provides $27 million in funding each year to conduct research activities.

Asia-Pacific is expected to host the fastest-growing market in the coming years. Government and private institutions conduct seminars, workshops, and conferences to share the latest updates and train individuals for the development of ADCs. The burgeoning biotech sector and the increasing number of startups contribute to market growth. People are becoming aware of innovative and personalized therapeutics for cancer treatment. Countries like China, India, Japan, and South Korea are making significant efforts to build a robust biotech infrastructure.

China is emerging as a global hub in the biotech industry, supporting major companies like Innovent Bio, Lepu Pharma, and Jiangsu Hengrui Pharmaceuticals Co., Ltd. to develop novel ADCs. China is racing ahead of global peers in the R&D of ADC drugs and holds the largest share of the global ADC pipeline at around 42%. In addition, Chinese ADC candidates are well recognized by global companies, accounting for 40% of global ADC out-license deals 2023 YTD.

India is emerging in the field of ADC to increase access to innovative therapies to a large patient population. In October 2025, AstraZeneca Pharma received approval from the Central Drug Standard Control Organization (CDSCO) for importing, marketing, and distributing Trastuzumab Deruxtecan in India for the treatment of HER2-positive solid tumors.

Europe is expected to grow at a considerable CAGR in the ADC outsourcing service market in the upcoming period. European countries are emerging as global hubs in the development of innovative therapeutics through government support and favorable infrastructure. The increasing collaboration among key players and geographical expansion augments the market. European manufacturers are preferring domestic operations as the continent competes with Asia and the U.S., serving local people. The continent also allows foreign companies to set up their manufacturing facility, strengthening the domestic production of ADC.

Germany experiences an expanding biopharma startup ecosystem, with around 828 biopharmaceutical outsourcing companies, including Evotec, Wacker Chemie, and Pharmalog. Of these, 134 are funded, with 112 having secured Series A+ funding. As of October 14, 2025, a total of 60 clinical trials were registered on the clinicaltrials.gov website in Germany.

The UK is home to 249 biopharma outsourcing startups, including Ori Biotech, hVIVO, and BioTalent. Of these, 42 startups are funded, with 38 having secured Series A+ funding. Companies like Fleet Bioprocessing, Sterling Pharma Solutions, and Intertek are major companies that provide ADC development and manufacturing services in the UK.

By Type

By Application

By End Service Stage

By Region

January 2026

January 2026

January 2026

January 2026