January 2026

The AI imaging device market is on an upward trajectory, poised to generate substantial revenue growth, potentially climbing into the hundreds of millions over the forecast years from 2025 to 2034. This surge is attributed to evolving consumer preferences and technological advancements reshaping the industry.

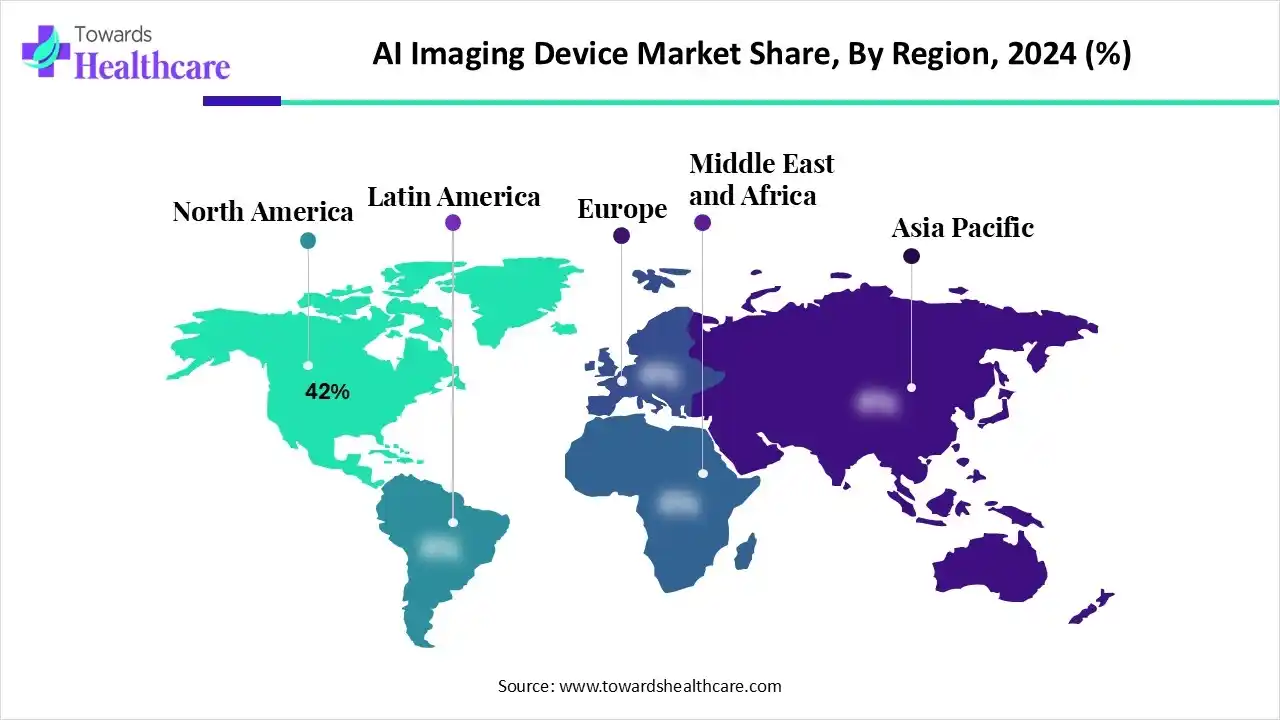

The AI imaging device market is growing because of rising demand as growing chronic diseases and limited radiologists available to treat these diseases. The technique is being combined with different healthcare imaging modalities such as MRIs, CT scans, and X-rays, to enhance diagnostic speed and assist healthcare doctors. North America is dominant in the market as AI-driven imaging devices improve diagnostic precision and efficiency, while the Asia Pacific is the fastest-growing due to technological advancements and the adoption of smarter healthcare devices.

The AI imaging device market includes diagnostic and imaging systems integrated with artificial intelligence technologies such as machine learning (ML), deep learning (DL), and computer vision to enhance image acquisition, interpretation, and diagnostic accuracy. These devices are used across radiology, cardiology, oncology, ophthalmology, and dental imaging, offering faster image analysis, improved detection accuracy, and workflow automation. The increasing burden of chronic diseases, growing imaging volumes, and rising demand for precision diagnostics are driving strong adoption of AI-enabled imaging devices across healthcare facilities worldwide.

By imaging modality, the computed tomography (CT) segment led the AI imaging device market with approximately 36% share, as CT images allow radiologists and physicians to identify internal structures and understand their shape, size, density, and texture. CT scans provide inclusive data to diagnose, create a treatment plan, and estimate major situations in adults and children. Additionally, the detailed images provided by CT scans eliminate the necessity for invasive surgery.

On the other hand, the ultrasound segment is projected to experience the fastest CAGR from 2025 to 2034, as ultrasound scans use high-frequency sound waves to make a picture of a patient’s internal body structures. Clinicians generally use ultrasound to study a growing fetus, a patient's abdominal and pelvic organs, tendons and muscles, their heart and blood vessels. Ultrasound is a non-invasive, safe, and effective imaging device utilized to diagnose and assess patients and guide suitable healthcare interventions. Ultrasound imaging is a healthcare tool that supports a physician in diagnosing, estimating, and treating various health conditions.

By application, the radiology segment is dominant in the AI imaging device market in 2024, with approximately 41% share, as artificial intelligence services predominantly advance CVD imaging by improving the visualization structures of the heart. The AI-driven radiology system is used to colorize heart chambers on grayscale echocardiography images in real-time, therefore streamlining radiology workflows. AI-driven radiology is its ability to accelerate image attainment while conserving and often improving the quality of the image. AI-based technology reduces the challenges, ensuring that anomalies are detected early and properly recognized by a physician.

The oncology segment is expected to experience the fastest growth from 2025 to 2034, as medical images such as mammograms are quickly treated with the support of AI-based technology, allowing radiotherapists to focus their time on various tasks that require their methodological decision-making. AI-based technology is applied in various ways to manufacture new treatments for cancer through novel approaches to drug discovery and design, drug repurposing, and predicting patient results for management. AI-based technology is used to enhance the integration of various data types from patients to improve medical care decision-making.

By AI technology, the deep learning (DL) segment led the AI imaging device market in 2024, with approximately 47% share, as deep learning is becoming a significant tool for supersonic image recognition with its high efficacy and precision, which efficiently enhances the analytic accuracy. Deep learning technology has attained research outcomes in the field of ultrasound imaging, such as cardiovascular, breast cancer, and carotid arteries. As compared with traditional machine learning, deep learning automatically filters features to improve recognition performance based on multi-layer models.

The hybrid AI models segment is projected to experience the fastest CAGR from 2025 to 2034, as hybrid AI enhances decision-making precision, automates multifaceted tasks, and responds more efficiently to real-time data. Hybrid AI improves explainability by combining interpretable models with more complex ones, using layered decision-making technology, and offering complementary explanations from different perspectives. Hybrid AI technology is renovating sectors by integrating machine learning and human intelligence.

By deployment mode, the cloud-based segment is dominant and fastest growing in the AI imaging device market in 2024, with approximately 64% share, as AI-driven diagnostic devices not only accelerate the interpretation of multifaceted images but also enhance early identification of disease, eventually delivering better results for patients. AI-driven image processing drives targeted treatment plans, optimizing healthcare delivery by using AI algorithms, medical images are more quickly and accurately identified than by human radiologists, leading to faster and more precise diagnoses.

By end user, the hospitals segment led the AI imaging device market in 2024 with approximately 45% share, as AI-driven technology offers opportunities to support reducing human mistakes, assist medical doctors and staff, and offer patient services 24/7. As AI-driven devices continue to develop, there is predominant to use AI even more in interpreting healthcare images, scans, and X-rays, diagnosing health problems, and creating treatment plans. AI-driven algorithms used in hospitals rapidly analyze huge amounts of imaging data, detecting patterns and irregularities that are overlooked by human eyes.

The diagnostic imaging centers segment is projected to experience the fastest CAGR in the AI imaging device market from 2025 to 2034, as AI-driven technology is specifically helpful in healthcare imaging solutions, improving processes like patient eligibility, screening, disease identification, and patient response monitoring. AI-driven systems increase quality and affordability by lowering the potential for human error, quickening processes for rapid outputs, and potentially increasing the imaging biomarkers available to assess response. AI integration during image acquisition workflows provides significant benefits to the irreplaceable human expertise needs in healthcare imaging.

North America is dominant in the market in 2024, with approximately 42% share, due to the presence of advanced healthcare infrastructure, massive medical care expenditure, and robust technology adoption in research and development (R&D). Rising government support in healthcare, for instance, in 2023, the National Institutes of Health will invest $130 million over four years, pending the availability of funds, to accelerate the widespread use of artificial intelligence (AI) by the biomedical and behavioral research communities.

In the U.S., AI is progressively integrated into different imaging technologies, including CT scans, X-rays, MRIs, and ultrasound. CT scans and deep learning were the increasing modality and technology of healthcare.

For instance,

Asia Pacific is the fastest-growing region in the market in the forecast period, as a combined medical care system offers an advantage for emerging and validating AI-driven tools. It provides the potential for assembling large, anonymized healthcare data sets from many institutions in the provinces, which is standard for training AI models. Rapid advancement in healthcare technology, remarkable government spending, a large and growing population, and strong local healthcare production ecosystems drive the growth of the market.

For Instance,

In China, the presence of advanced technology infrastructure, specifically widespread 5G network coverage, supports real-time information aggregation and the propagation of AI-driven applications in medical. The government's central data platforms and cooperative environments drive the growth of the market.

Europe is a notably growing region in the market due to the EU has established a strong regulatory environment through measures such as the Medical Device Regulation (MDR) and the AI Act. Increasing funding from both public and private organizations into AI-driven research and innovation. European initiatives such as the Horizon Europe program and the InvestAI initiative offer substantial economic support for AI-driven advancement in medical care. The EU is generating data-sharing infrastructure projects, such as the European Cancer Imaging Initiative, to offer large, quality-controlled datasets for training AI-driven algorithms.

For Instance,

In Germany, an increase in aging-associated chronic health conditions like cancer and cardiovascular diseases is increasing the massive demand for analytic imaging. Increasing initiatives from the government and strategic partnerships among the tech companies and healthcare providers are driving market expansion.

By Imaging Modality

By Application

By AI Technology

By Deployment Mode

By End User

By Region

January 2026

January 2026

January 2026

January 2026