February 2026

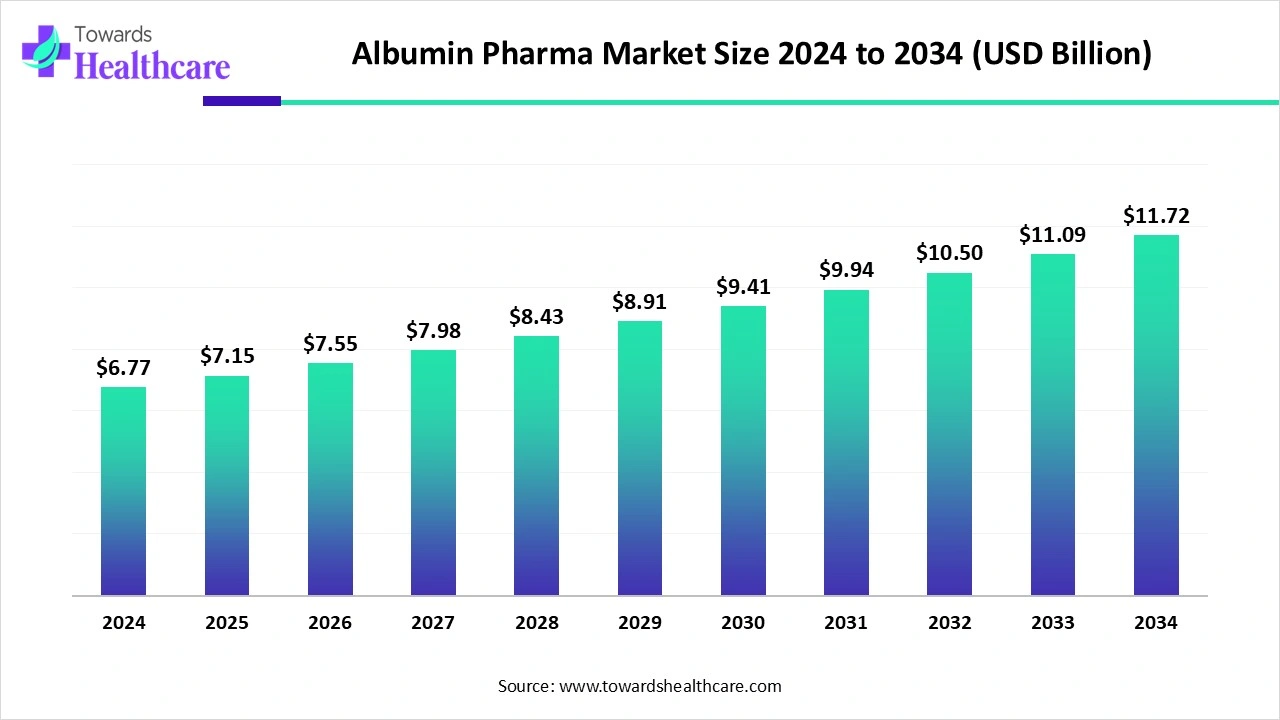

The global albumin pharma market size marked US$ 6.77 billion in 2024 and is forecast to experience consistent growth, reaching US$ 7.15 billion in 2025 and US$ 11.72 billion by 2034 at a CAGR of 5.65%.

The albumin pharma market is experiencing steady growth, driven by increasing prevalence of chronic diseases, critical care requirements, and rising demand for plasma-derived and recombinant albumin therapies. Albumin is widely used to manage hypoalbuminemia, liver and kidney disorders, burns, and fluid replacement during surgeries. North America dominates the market due to advanced healthcare infrastructure, high healthcare spending, strong biopharmaceutical presence, and widespread adoption of albumin therapies by healthcare professionals. Ongoing research, technological advancements, and supportive regulatory frameworks further reinforce market expansion globally.

| Table | Scope |

| Market Size in 2025 | USD 7.15 Billion |

| Projected Market Size in 2034 | USD 11.72 Billion |

| CAGR (2025 - 2034) | 5.65% |

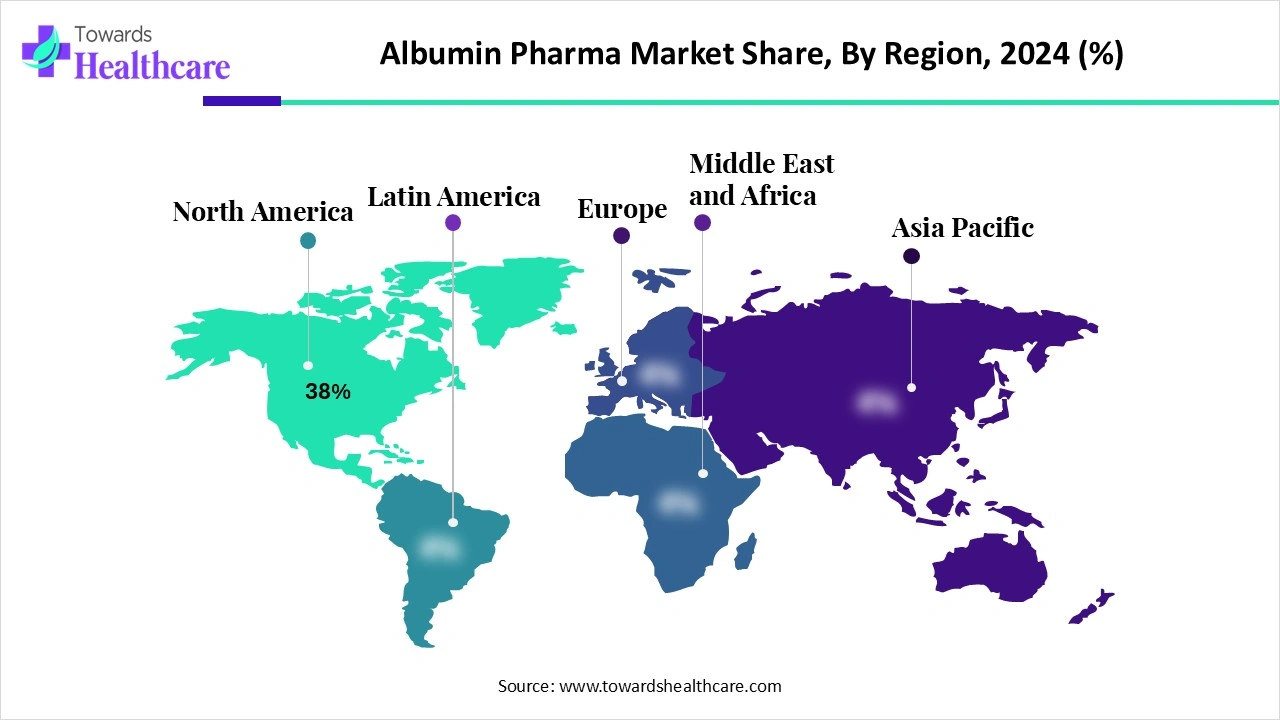

| Leading Region | North America by 38% |

| Market Segmentation | By Product Type, By Application, By Source, By End User, By Region |

| Top Key Players | CSL Behring, Takeda Pharmaceutical Company Limited, Grifols S.A., Octapharma AG, Kedrion Biopharma, Shire (part of Takeda), Thermo Fisher Scientific (recombinant albumin for biopharma use), Albumedix Ltd. (Novozymes), Baxter International Inc., Bio Products Laboratory (BPL), Sanquin Plasma Products, Hualan Biological Engineering Inc., Sichuan Yuanda Shuyang Pharmaceutical Co., Ltd., Wuhan Institute of Biological Products Co., Ltd., Shanghai RAAS Blood Products Co., Ltd., InVitria (recombinant albumin specialist), Green Cross Corporation (GC Pharma), China Biologic Products Holdings, Inc., Reliance Life Sciences (India), Apotex Pharmachem Inc. |

Albumin pharma refers to the pharmaceutical applications of albumin, a naturally occurring plasma protein essential for maintaining blood volume, oncotic pressure, and transporting hormones, drugs, and metabolites. In medicine, albumin is primarily used in its purified or recombinant form to treat conditions such as hypoalbuminemia, liver cirrhosis, kidney disorders, burns, shock, and during surgeries requiring fluid replacement. Its therapeutic benefits include stabilizing hemodynamics, improving patient outcomes, and enhancing drug delivery by binding and transporting medications. Albumin pharma encompasses both plasma-derived products and biotechnologically produced recombinant albumin, reflecting its critical role in critical care, clinical therapies, and advanced drug formulation.

Expansion in emerging markets significantly drives the growth of the albumin pharmaceutical market by increasing access to life-saving treatments, boosting production capabilities, and fostering innovation. Countries like India, China, Brazil, and Mexico are experiencing a rise in chronic diseases such as liver cirrhosis, kidney disorders, and cardiovascular conditions, leading to higher demand for albumin-based therapies. Additionally, these regions are investing in healthcare infrastructure and plasma fractionation facilities, improving the availability of albumin products.

For instance,

Rising adoption of inorganic growth strategies has significantly expanded the marketed as well as helped in the innovation of new solutions.

AI integration can significantly enhance the market by enabling more precise, personalized, and efficient patient care. Advanced AI algorithms analyze patient data to predict albumin deficiencies, optimize dosing, and monitor treatment responses in real time, reducing risks of over- or under-dosing. AI also supports drug discovery and development by identifying novel albumin formulations and improving production efficiency in recombinant albumin manufacturing. Furthermore, machine learning aids in supply chain management, ensuring the timely distribution of albumin products. By improving clinical outcomes, operational efficiency, and R&D productivity, AI integration strengthens the market’s growth potential and accelerates the adoption of albumin-based therapies globally.

Advancements in Biopharmaceutical Technologies

Advancements in biopharmaceutical technologies are significantly driving the growth of the albumin pharma market by enhancing production efficiency, safety, and therapeutic applications. The development of recombinant human serum albumin (rHSA) using microbial expression systems, such as Pichia pastoris, has improved batch-to-batch consistency and reduced the risk of pathogen transmission, addressing concerns associated with plasma-derived products. Innovations in purification techniques and formulation enhancements have led to extended shelf life and minimized adverse effects, making albumin therapies more accessible and effective. In 2025, there was a notable increase in the adoption of rHSA in cell culture media and critical care applications, highlighting its expanding role in biopharmaceutical and clinical therapies. These technological advancements are pivotal in meeting the rising global demand for albumin-based treatments.

Limited plasma supply & Risk of adverse reactions

The key players operating in the market are facing issues due to the risk of adverse reactions and limited plasma supply. Dependence on human plasma for conventional albumin production can create shortages and supply chain constraints. Plasma-derived albumin carries potential risks of infections, immunogenicity, or allergic reactions, discouraging use in some cases.

Regulatory Support and Government Initiatives

Regulatory support and government initiatives play a crucial role in driving the growth of the albumin pharmaceutical market by fostering innovation, ensuring supply chain resilience, and encouraging domestic production. Such regulatory support and government initiatives are pivotal in enhancing the accessibility and affordability of albumin-based therapies, thereby driving albumin pharma market growth.

In August 2025, the U.S. government issued an executive order to remove regulatory barriers and facilitate the restoration of a robust domestic manufacturing base for prescription drugs, including key ingredients necessary to manufacture prescription drugs. This initiative aims to strengthen the pharmaceutical supply chain and reduce dependence on foreign sources.

The human serum albumin segment dominates the market due to its widespread clinical applications, including the management of hypoalbuminemia, liver and kidney disorders, burns, shock, and fluid replacement during surgeries. Its proven safety, efficacy, and established use in critical care make it the preferred choice for healthcare providers. Additionally, ready availability of plasma-derived HSA, strong regulatory approvals, and extensive adoption in hospitals and specialty care centers reinforce its dominance, while ongoing research and technological improvements continue to enhance its therapeutic value.

The recombinant albumin segment is estimated to be the fastest-growing in the albumin pharma market due to its improved safety profile, consistent quality, and reduced risk of pathogen transmission compared to plasma-derived products. Technological advancements in microbial and cell-culture expression systems have enabled large-scale, cost-effective production. Its versatile applications in drug delivery, cell culture media, and critical care therapies further drive adoption. Additionally, increasing demand for pathogen-free, high-purity albumin in emerging markets and ongoing research into novel therapeutic uses contribute to the rapid growth of the recombinant albumin segment.

The therapeutics segment is the dominant application segment in the market due to its extensive use in critical care and chronic disease management. Albumin is widely employed to treat hypoalbuminemia, liver and kidney disorders, burns, shock, and during surgical procedures for fluid replacement. Its proven safety, efficacy, and ability to stabilize hemodynamics make it a preferred choice among healthcare professionals. Additionally, strong adoption in hospitals, advanced healthcare infrastructure, and continuous research into novel therapeutic applications reinforce the therapeutic segment’s leading position in the market.

The drug delivery & biologics segment is the fastest-growing application in the albumin pharma market due to albumin’s unique ability to improve the stability, solubility, and half-life of therapeutic molecules. Its natural binding properties make it ideal for targeted drug delivery and development of biologics, including protein and peptide therapeutics. Advances in recombinant albumin and albumin-based nanoparticle technologies further enhance efficacy and safety. Growing demand for precision medicine, novel biologics, and improved drug delivery systems accelerates adoption, positioning this segment as the fastest-growing in the market.

The plasma-derived segment dominates the market due to its long-standing clinical use, proven efficacy, and safety in treating critical conditions such as hypoalbuminemia, burns, liver and kidney disorders, and shock. Plasma-derived albumin is widely available through established collection and fractionation processes, ensuring a consistent supply for hospitals and healthcare facilities. Strong regulatory approvals, extensive adoption in critical care settings, and trust among healthcare professionals reinforce its dominant position. Additionally, continuous improvements in plasma collection and purification methods enhance product quality and reliability.

The recombinant/engineered albumin segment is the fastest-growing in the albumin pharma market due to its enhanced safety, purity, and consistency compared to plasma-derived products. Advanced biotechnological methods, including microbial and mammalian cell expression systems, enable large-scale, pathogen-free production. Recombinant albumin is increasingly used in drug delivery, biologics, and cell culture applications, supporting targeted therapies and improved patient outcomes. Rising demand for high-purity, pathogen-free albumin in critical care and research, coupled with ongoing innovation in therapeutic applications, drives rapid adoption and positions this segment as the fastest-growing in the market.

The hospitals & clinics segment dominates the market due to the widespread use of albumin therapies in critical care, surgical procedures, and chronic disease management. Hospitals provide immediate access to treatments for hypoalbuminemia, liver and kidney disorders, burns, and shock, ensuring timely administration of albumin. Strong adoption by healthcare professionals, advanced critical care infrastructure, and established supply chains reinforce its leading position. Additionally, continuous training, clinical guidelines, and trust in albumin’s efficacy support its dominance in hospitals and clinic settings.

The vaccine & biologics manufacturers segment is the fastest-growing in the albumin pharma market due to the increasing use of albumin in drug formulation, stabilization, and delivery of biologics, including vaccines, protein therapeutics, and cell-based therapies. Recombinant albumin and albumin-based excipients enhance the stability, solubility, and half-life of sensitive biologics, making them critical in R&D and production processes. Rising demand for advanced biologics, personalized medicine, and innovative vaccine platforms drives adoption, while technological advancements in albumin engineering further accelerate growth in this segment.

North America dominates the market share 38% due to its advanced healthcare infrastructure, high prevalence of chronic and critical diseases, and strong adoption of albumin therapies in hospitals and clinics. The region benefits from well-established biopharmaceutical companies producing both plasma-derived and recombinant albumin, ensuring a consistent supply and quality. Supportive regulatory frameworks, extensive research and development, and high healthcare spending further enhance accessibility and innovation. Additionally, growing clinical awareness and the presence of skilled healthcare professionals reinforce North America’s leading position in the global albumin pharma market.

The U.S. albumin pharma market is driven by the high prevalence of chronic and critical conditions such as liver cirrhosis, kidney disorders, cardiovascular diseases, and hypoalbuminemia. Advanced healthcare infrastructure, widespread hospital networks, and critical care facilities ensure easy access to albumin therapies. Strong presence of leading biopharmaceutical companies producing plasma-derived and recombinant albumin supports consistent supply and innovation. Regulatory support from the FDA, combined with ongoing clinical research and technological advancements in drug delivery and biologics, further fuels market growth. Additionally, increasing awareness among healthcare professionals promotes the timely adoption of albumin-based treatments in both critical care and therapeutic applications.

Canada’s albumin pharma market growth is supported by robust healthcare infrastructure and government initiatives promoting safe plasma collection and biopharmaceutical development. Hospitals and clinics play a central role in administering albumin therapies for burns, shock, hypoalbuminemia, and organ disorders. Rising demand for recombinant albumin in drug delivery and biologics is boosting innovation, while regulatory oversight by Health Canada ensures safety and quality. Additionally, investments in research, public awareness programs, and growing adoption of advanced therapeutics contribute to expanding the market. Strategic partnerships between local and international manufacturers further strengthen accessibility and availability of albumin products across the country.

The Asia-Pacific region is the fastest-growing in the albumin pharma market due to rising prevalence of chronic and critical diseases, expanding healthcare infrastructure, and increasing access to advanced therapies. Growing awareness among healthcare professionals, government initiatives supporting plasma collection and biopharmaceutical development, and investments in recombinant albumin production drive adoption. Rapid urbanization, rising disposable incomes, and a growing geriatric population further boost demand. Additionally, the region’s increasing participation in global clinical research and technological advancements accelerates the use of albumin-based therapies across hospitals and specialty care centers.

Key Organizations: Grifols, S.A., CSL Behring, Baxter International, Novozymes Biopharma, etc.

Key Regulatory & Clinical Organizations: U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), Health Canada, Clinical Research Organizations (CROs) such as IQVIA and Parexel

Key Organizations & Programs: Grifols Patient Assistance Programs, CSL Behring Patient Support Services, Baxter Healthcare Patient Support Programs

In June 2025, Leonard Mazur, Chairman and CEO of Citius Oncology and Citius Pharma, stated that a subsidiary of Citius Pharmaceuticals, Inc. ("Citius Pharma") declared that the FDA-approved immunotherapy LYMPHIR, which treats adults with relapsed or refractory cutaneous T-cell lymphoma (CTCL), is almost ready for commercialization. Since all significant launch-enabling activities are currently in progress, the company believes it is now operationally ready to move from a development-stage enterprise to a fully integrated commercial organization. The last preparations are underway for LYMPHIR's second-half 2025 U.S. launch.

By Product Type

By Application

By Source

By End User

By Region

February 2026

February 2026

February 2026

February 2026