February 2026

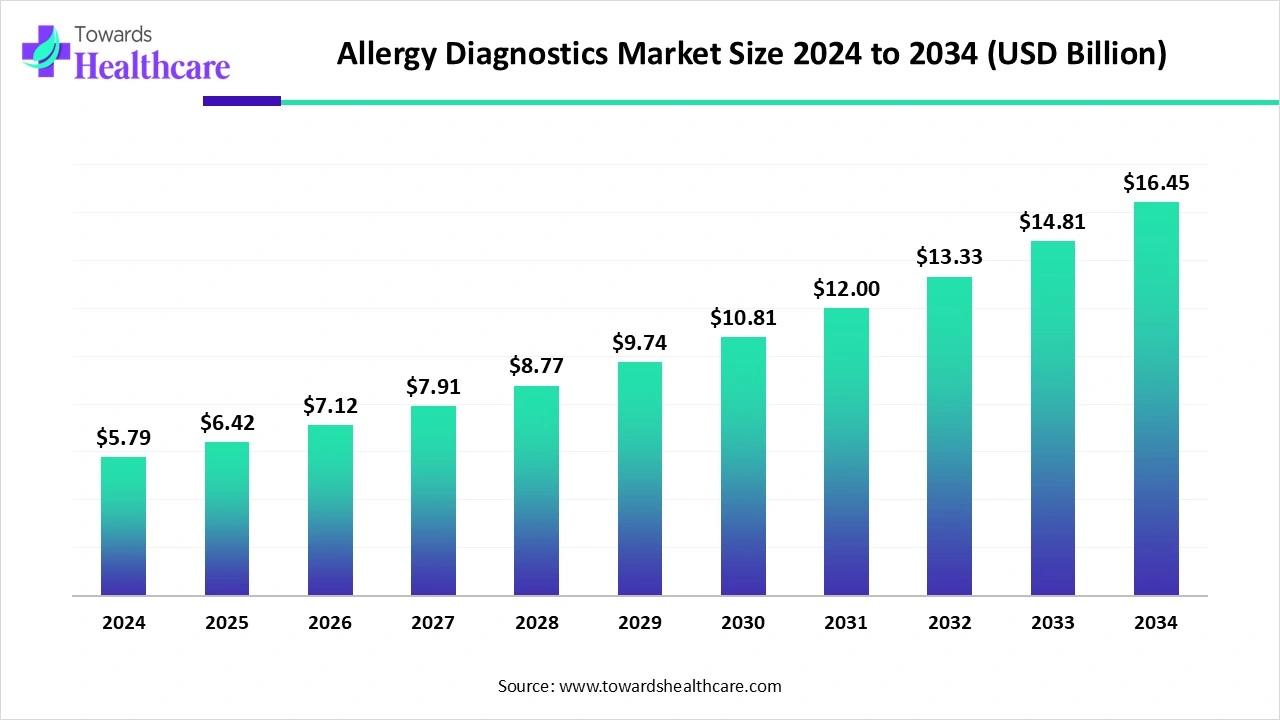

The global allergy diagnostics market size is calculated at USD 5.79 billion in 2024, grew to USD 6.42 billion in 2025, and is projected to reach around USD 16.45 billion by 2034. The market is expanding at a CAGR of 10.96% between 2025 and 2034.

The allergy diagnostics market is primarily driven by growing research and development activities and the rising prevalence of allergic diseases. Government organizations encourage the general public to screen and diagnose allergic conditions early. Healthcare organizations provide comprehensive and high-quality allergic testing to patients. Integrating artificial intelligence (AI) into allergy diagnostics enhances the efficiency and accuracy of diagnosis. The future looks promising, with advances in diagnostics and point-of-care diagnostics.

| Table | Scope |

| Market Size in 2025 | USD 6.42 Billion |

| Projected Market Size in 2034 | USD 16.45 Billion |

| CAGR (2025 - 2034) | 10.96% |

| Leading Region | North America |

| Market Segmentation | By Test Methodology/Assay Type, By Platform/Technology, By Specimen Type, By Setting/End-User, By Region |

| Top Key Players | Thermo Fisher Scientific, Siemens Healthineers, Roche Diagnostics, Abbott Laboratories, Beckman Coulter, bioMérieux, ALK-Abelló, Stallergenes Greer/Greer Laboratories, Omega Diagnostics, HYCOR Biomedical, LETI/HAL Allergy, Quest Diagnostics, LabCorp, Eurofins |

The allergy diagnostics market refers to tests, instruments, reagents and services used to detect, quantify and characterize allergic sensitization and clinical allergy including skin testing (SPT, intradermal, patch), in vitro specific IgE assays, component-resolved/molecular diagnostics, provocation tests, multiplex panels, point-of-care allergy tests, software for reporting/interpretation, and allied lab/consulting services across clinical allergy, pulmonology, ENT devices, pediatrics and primary care.

Rising Investments: Investments are raised to develop and deliver advanced diagnostics to patients globally.

Increasing Collaboration: Major companies collaborate to access advanced technologies and develop innovative allergy diagnostics. They also expand their geographical presence, serving a large patient population.

AI is reshaping allergy and immunology by integrating cutting-edge technologies to enhance patient outcomes. AI and machine learning (ML) algorithms can detect vast amounts of data and predict potential allergic reactions based on their severity. They can enable a deeper understanding of allergic diseases, enhancing accuracy and precision. Integrating AI introduces automation in diagnostics, resulting in faster results. Automated diagnostics allow healthcare professionals to provide personalized treatment to patients. AI-based wearable devices can continuously monitor health indicators in patients with chronic allergies.

Increasing Allergy Prevalence

The major growth factor for the allergy diagnostics market is the increasing prevalence of allergic reactions. Allergies are mainly caused by airborne allergens (pollens, dust mites, and molds), food allergens (peanuts, milk, and fish), and certain medications (penicillin). The different forms of allergies include allergic rhinitis, asthma, food allergy, anaphylaxis, headaches, food allergy, recurring bronchitis, and shortness of breath. The Asthma and Allergy Foundation of America (AAFA) estimated that more than 100 million people experience allergic conditions in the U.S. annually. Allergies negatively impact a person’s quality of life, affecting their sleep and mood.

Adverse Effects and High Cost

Skin tests are more prone to side effects, such as red, itchy skin in test areas. In rare cases, an allergy skin test may cause anaphylaxis shock. Additionally, skin tests are not feasible in cases of existing skin diseases. On the other hand, in vitro tests are comparatively more costly than skin tests. This limits the affordability of several people from low- and middle-income countries.

What is the Future of the Allergy Diagnostics Market?

The market future is promising, driven by the development of point-of-care (PoC) diagnostics. PoC diagnostics provides faster and more reliable diagnostic results with reduced assay time. They eliminate the need for patients to visit diagnostic laboratories or hospitals for allergy testing. Innovative PoC diagnostics are developed with enhanced sensitivity and specificity. They offer numerous benefits, including low cost and portability, facilitating on-site real-time detection with less reagent consumption. Surface plasmon resonance (SPR)-based assays are the most common methods due to their label-free, rapid, and sensitive properties.

By test methodology/assay type, the skin prick tests segment held a dominant presence in the market in 2024. This is due to the safety of skin prick tests in both adults and children. Skin prick tests are generally performed to assess hay fever, allergic asthma, dermatitis, food allergies, penicillin allergy, and insect allergy. They are used for a wide range of purposes, allowing healthcare professionals to check for immediate allergic reactions to up to 50 different substances. They are preferred due to their rapid results and cost-effectiveness.

By test methodology/assay type, the multiplex/microarray IgE panels (component-resolved) segment is expected to grow at the fastest CAGR in the market during the forecast period. The demand for IgE-based diagnostics is increasing with its ability to detect multiple allergens. Numerous tests are available that can measure individual, highly purified allergen components, which are referred to as component-resolved diagnostics. Advancements in molecular diagnostics enable professionals to diagnose allergies using multiplex bead-based platforms.

By platform/technology, the automated immunoassay analyzers segment held the largest revenue share of the market in 2024. This segment dominated because automated immunoassay analyzers enhance laboratory efficiency, increase throughput, and reduce manual errors. Immunoassay analyzers use an antibody as a reagent to detect and identify specific substances in a sample. They can process a large number of samples in a short period, decreasing turnaround time. They also provide consistent results.

By platform/technology, the lateral flow/rapid PoC sIgE tests segment is expected to grow with the highest CAGR in the market during the studied years. Lateral flow or PoC tests offer rapid and sensitive results for different allergy types. They enable patients to measure allergen components from the bedside or at home. Thermo Fisher Scientific’s specific IgE point-of-care can identify 92 to 95% of symptomatic patients sensitized to any allergens. Lateral flow or PoC tests can enable qualitative and semi-quantitative measurement of allergens.

By specimen type, the venous serum/plasma segment contributed the biggest revenue share of the market in 2024. Venous serum/plasma is primarily used as a specimen, due to the presence of IgE antibodies specific for whole allergen extracts and individual allergen components. Patients do not need to stop treatment with medicines used to treat allergies when serum is collected, as medicines do not interact with the test. The availability of the ELISA assay procedure improves the specificity of serum tests.

By specimen type, the capillary whole blood (fingerstick PoC) segment is expected to expand rapidly in the market in the coming years. The collection of capillary whole blood involves a non-invasive method for testing allergens. It eliminates the need for a skilled professional to collect blood and also enables patients to withdraw their own blood samples. The high feasibility and cost-effectiveness of collecting capillary whole blood boost the segment’s growth.

By setting/end-user, the allergy/immunology specialist clinics segment led the market in 2024. The segmental growth is attributed to the presence of a favorable infrastructure and suitable capital investment. This enables clinics to adopt advanced technological products for allergy detection. They possess skilled professionals to provide tailored care and treatment based on diagnostic results.

By setting/end-user, the primary care/pediatric clinics (PoC screening) segment is expected to witness the fastest growth in the market over the forecast period. The increasing number of patients in primary care for diagnosing allergies augments the segment’s growth. This is due to the increased accessibility to primary care clinics. Pediatric clinics have suitable equipment for diagnosing and treating various conditions of pediatric patients.

North America dominated the market in 2024. The availability of a robust healthcare infrastructure, the rising prevalence of allergies, and the presence of key players are the major growth factors of the market in 2024. Government organizations support the development of allergy diagnostics through funding. Research institutions in North America have state-of-the-art research and development facilities for the development of allergy diagnostics.

Key players, such as Thermo Fisher Scientific, Danaher Corporation, and Hycor Biomedical, deliver innovative allergy diagnostics in the U.S. The Food and Drug Administration (FDA) regulates the approval of diagnostics and allergen extracts. As of 2024, the U.S. FDA has approved a total of 19 allergen extracts.

Asthma Canada reported that 1 in 5 Canadians suffers from respiratory allergies annually. The Food Allergy Canada’s National Food Allergy Action Plan (NFAAP) helps Canadians with food allergies with its prevention, diagnosis, and treatment. The federal government invested $4.5 million over 2 years for the NFAAP.

Asia-Pacific is expected to grow at the fastest CAGR in the allergy diagnostics market during the forecast period. The increasing patient population and the rising healthcare expenditure propel the market. People are becoming aware of the early diagnosis of allergic diseases and identifying potential allergens. The rising adoption of advanced technologies and the growing demand for PoC diagnostics foster market growth.

Allergic diseases are estimated to affect around 40% of the Chinese population. Healthcare expenditure in China facilitates the use of advanced technologies for allergies. It is estimated that healthcare expenditure will reach RMB 205 trillion by 2030. China is also emerging as a global hub for clinical trials, surpassing the U.S. and Europe.

In India, about 22% of adolescents are estimated to have allergic rhinitis. India’s health spending rose to Rs 6.1 lakh crore in 2024-25, an increase from Rs 3.2 lakh crore in 2020-21, accounting for 3.8% of the GDP. Alcit India Pvt. Ltd., AllVac Pharmaceuticals, and Asian Diagnostics are the major providers of allergy diagnostics in India.

The research activities for allergy diagnostics include the development of point-of-care diagnostics, automated devices leveraged with AI, and novel assay procedures.

Key Players: Danaher Corporation, Neogen Corporation, and Siemens Healthineers

Innovative diagnostics are tested for their safety and efficacy in clinical trials. After conducting clinical trials, regulatory agencies approve a diagnostic based on its trial data.

Key Players: Boehringer Ingelheim, MacroArray Diagnostics GmbH, and Hycor Biomedical

Patient support & services refer to providing information about different diagnostic methodologies and tailored treatments, enabling patients to manage conditions and improve their quality of life.

Javier Evelyn, Founder and CEO of Alerje, commented that the partnership with MGCC represents a significant milestone in their mission to improve the lives of millions affected by allergies. He also stated that the company is poised to deliver unprecedented advancements in allergy diagnosis and management by combining the expertise of both companies.

By Test Methodology/Assay Type

By Platform/Technology

By Specimen Type

By Setting/End-User

By Region

February 2026

February 2026

February 2026

February 2026