March 2026

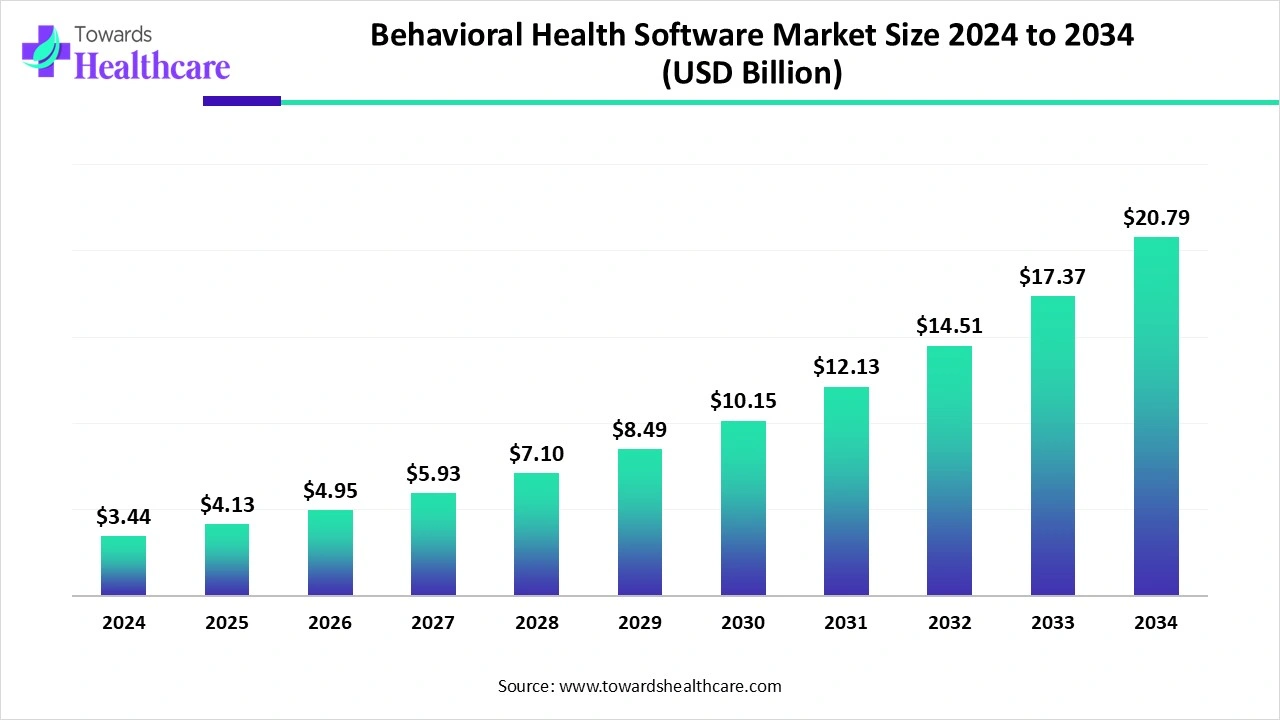

The global behavioral health software market size is calculated at US$ 3.44 billion in 2024, grew to US$ 4.13 billion in 2025, and is projected to reach around US$ 20.79 billion by 2034. The market is expanding at a CAGR of 19.85% between 2025 and 2034.

The global behavioral health software market comprises several digital approaches to the growing mental or behavioral health issues. The market is highly developing various behavioral health platforms, including EHRs, AI, and other integrated systems, as well as a broader range of advances in cloud-based solutions and hybrid models. Numerous regions’ governments are making immense progress in telehealth & patient engagement, which provides greater access to patient care, remote monitoring, and higher affordability.

| Table | Scope |

| Market Size in 2025 | USD 4.13 Billion |

| Projected Market Size in 2034 | USD 20.79 Billion |

| CAGR (2025 - 2034) | 19.85% |

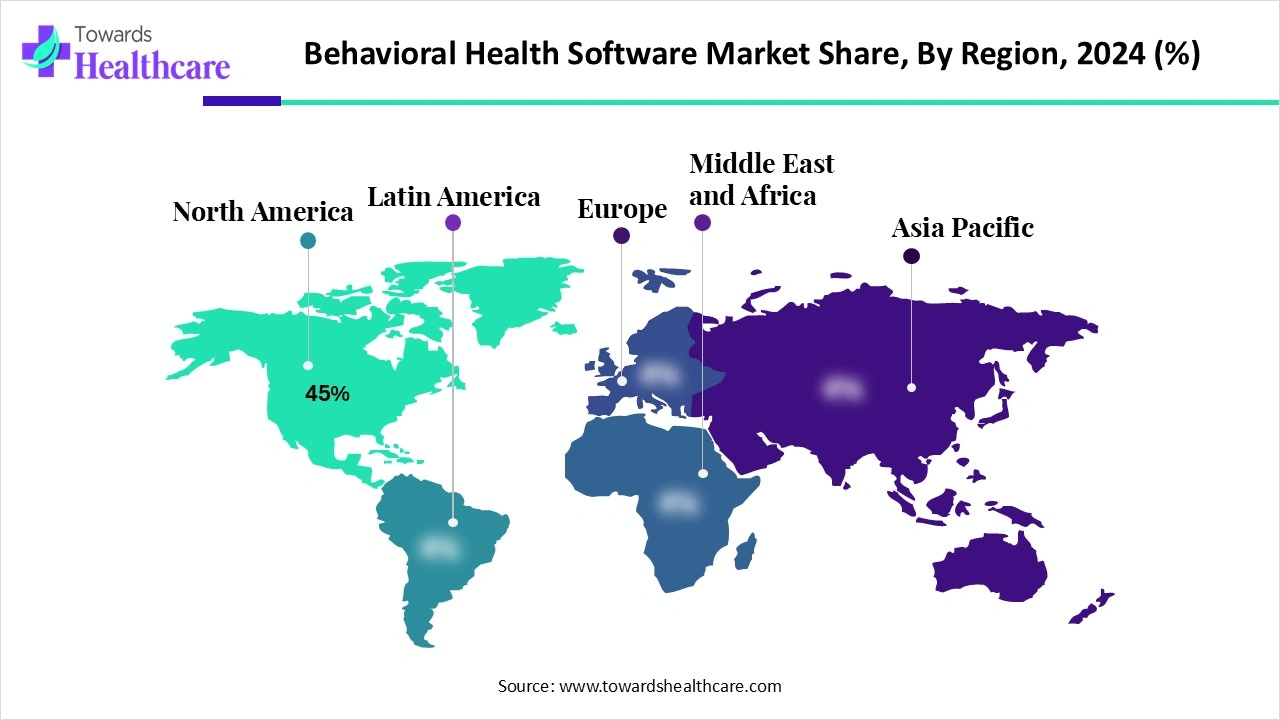

| Leading Region | North America 45% |

| Market Segmentation | By Component, By Delivery Mode, By Functionality, By End User, By Region |

| Top Key Players | Cerner Corporation (Oracle Health), Epic Systems Corporation, Allscripts Healthcare Solutions (Veradigm), Netsmart Technologies, NextGen Healthcare, AdvancedMD, Kareo, Valant Behavioral Health Software, Credible Behavioral Health (Qualifacts), Core Solutions, InSync Healthcare Solutions, Patagonia Health, Sigmund Software, DrCloudEHR, TenEleven Group, ClinicTracker, Accumedic Computer Systems, Meditab Software, BestNotes, Qualifacts Systems |

The behavioral health software market comprises digital platforms designed to support the delivery and management of mental health and substance use disorder care. These solutions integrate functionalities such as electronic health records (EHR), clinical decision support, e-prescriptions, scheduling, billing, and analytics to streamline workflows for providers, including psychiatrists, psychologists, therapists, and rehabilitation specialists. Advanced modules also include telehealth, mobile applications, and patient engagement tools that enhance accessibility of care while ensuring compliance with regulatory standards. Rising global prevalence of mental health conditions, demand for integrated behavioral and general healthcare systems, and supportive government incentives are fueling market expansion. The adoption of cloud-based platforms, hybrid models, and AI-driven analytics is reshaping behavioral healthcare delivery worldwide.

Around the globe, a rise in demand for services, the broader adoption of telehealth and remote monitoring solutions are fostering the overall market growth.

The widespread adoption of digital solutions, including respective markets, is emphasizing the analysis of complex data by using AI algorithms. This further assists in the identification of mental health conditions, while AI chatbots and virtual assistants provide immediate support, minimize clinician burden, and automate administrative tasks. The application of AI for behavioral health, aiming at automating administrative tasks, like documentation and intake, using tools such as Microsoft's Dragon Copilot.

Raised Demand for Advanced Technologies

2025’s population is seeking to adopt highly sophisticated technologies in all domains or areas, including the behavioral health software market. Primarily, the growing demand for widespread accessibility, for which telehealth and remote patient monitoring are highly employed in various behavioral cases. These approaches further allow for personalized, patient-centric treatment plans, with enhanced patient engagement. The market is driven by a broader focus on streamlining data management by using EHRs (Electronic Health Records), which supports managing patient data more effectively, optimizing care coordination, and clinical workflows.

Limitations in Expenses and System Integration

Ongoing technological breakthroughs are creating a financial hurdle for small-scale practices, community clinics, and resource-limited regions due to their need for higher expenditure. In different healthcare organizations, there is another major barrier regarding the integration of new software with their legacy systems, leading to operational disruptions and a slowdown in demonstration.

Expansion in Advanced Solutions

Day by day, around the globe, the health systems are increasingly progressing with enhanced adoption of innovative and advanced solutions, including automation in handling administrative operations, like appointment scheduling, billing, and insurance claims, freeing up clinical staff. The behavioral health software market will also present other significant opportunities, such as the adoption of cloud-based software, which will help meet the increasing demand for accessibility and efficiency. Alongside, AI and other technologies will have a prominent position in the development of screening tools and assistive diagnostic platforms.

The software segment registered dominance in the global market in 2024. The segment is propelled by its wider advantages, like minimizing the administrative burden on clinical staff by automating functions, expanding operational effectiveness, and raising access to care. These fruitful effects are mainly represented for remote and underserved populations.

Under this segment, the integrated software sub-segment held a major share of the behavioral health software market. Currently, the digital world is contributing efforts in the AI-driven ambient scribing for documentation (e.g., eClinicalWorks with Sunoh.ai), facial and voice analysis for emotional feedback, smartphone interaction analysis (like Mindstrong Health), and VR therapies for engaging environments.

Whereas, the managed services segment is predicted to grow at a rapid CAGR during 2025-2034. This segment provides seamless integration of software solutions into existing healthcare systems, specialized professional advice to assist providers in maximizing the advantages of their software investments. Recently developed models, particularly the Innovation in Behavioral Health (IBH) Model, foster integration of behavioral health into wider care systems, with major contributions of interprofessional teams to manage patients' diverse needs.

In 2024, the cloud-based segment captured the biggest share of the market. These solutions facilitate greater scalability and minimize expenditure on on-premises infrastructure, which makes them attractive to behavioral health providers. The segment also comprises the allowance for advanced analytics and real-time data processing, which accelerates disease detection coupled with precision medicine, and helps better clinical decision-making for providers. The incorporation of cloud-based solutions is boosting advanced EHR platforms for simplified operations and escalated access through telemedicine and apps to bridge gaps in underrated areas.

During 2025-2034, the hybrid segment is anticipated to expand fastest in the behavioral health software market. This mode highly supports widespread providers to measure their operations by employing cloud resources for general tasks while gaining sensitive data or mission-critical functions on-premise. Additionally, the ongoing application of AI in hybrid models, mainly with hybrid chatbots, has shown major benefits, such as minimal hospital readmissions, expanded patient engagement, and lesser consultation wait times. Furthermore, an exploration of these modes to reach rural and remote areas by connecting patients with specialists, with the use of telepsychiatry and other digital platforms, is fueling the overall progression.

The clinical functionality segment led the behavioral health software market in 2024. Involvement in handling patient records, treatment strategies, and communication for mental health and substance abuse services, with personalizable templates for different issues and HIPAA-compliant documentation, is fueling the demand for advanced software.

Under this segment, the electronic health records (EHR) sub-segment accounted for the largest share. The EHR approach is developing with comprehensive integration of Artificial Intelligence (AI), transforming features, especially automated documentation, anomaly identification in progress notes, predictive analytics for patient outcomes, and Revenue Cycle Management (RCM) optimization. Advanced EHRs are assisting in remote checkups and health sessions, with provision for access to patient information in real-time.

On the other hand, the telehealth & patient engagement segment will expand rapidly in the behavioral health software market in the coming era. Governments are stepping into the development of scalable, affordable platforms that can reach more patients and manage the expanding burden of behavioral health concerns. The rising usage of advanced wearables and sensors integrated into the Internet of Medical Things (IoMT) is promoting the collection of real-time data on sleep, stress, and physiological signs, with provision for consistent patient insights for remote monitoring and intervention. Alongside, other app-based tools and digital check-ins are encouraging raised flexibility, accessible support for patients, and assisting with mood tracking and progress monitoring.

In 2024, the hospitals segment registered dominance in the market. The segment is fueled by a greater expansion of access to care, also allowing prescription management, and facilitating virtual, immersive therapy options, such as those that apply virtual reality. Numerous companies are focusing on the emergence of platforms that offer feasible data sharing among several healthcare systems and providers, along with acquisitions, such as Netsmart's acquisition of PM to resolve data gaps. Example, like Kipu Health, is a cloud-based platform that supports managing the entire patient lifecycle and provides a patient portal with virtual care and prescription management choices.

Moreover, the behavioral health clinics segment is estimated to witness the fastest growth in the behavioral health software market during 2025-2034. A wide range of adoption of Electronic Health Record (EHR) systems, practice management, and specialized platforms integrated with AI, cloud technology, and telehealth are simplifying workflows and optimizing care in these clinics. The recent development of blueBriX is a platform that provides no-code app builders, allowing healthcare providers to personalize and merge their own apps and workflows into a central hub. Furthermore, SmartCare and Core's Cx360 EHR are established especially for the requirements of behavioral health, to offer an enterprise, single-platform solution instead of trying to connect disparate systems.

In the global behavioral health software market, North America held the largest share 45% in 2024. The combination of factors, such as the immense adoption of digital health technologies, including telehealth and EHRs, with supportive government funding and reforms, is propelling this region’s market growth. As well as the advances in AI and machine learning in healthcare, like cloud-based EHRs for private practices, are also impacting the adoption of these developing software solutions.

For instance,

The US government is emphasizing fulfilling the requirement for integrated, pervasive digital solutions, with pushing steps to ensure data security and interoperability with other healthcare systems, which is an influential driver in the behavioral health software market growth.

For this market,

Canada’s behavioral health software market is driven by the growing movement towards virtual care, which has expanded after the pandemic, enabling providers to deliver services remotely, with enhanced accessibility and convenience for patients.

For instance,

In the prospective period, the Asia Pacific will grow at the highest CAGR in the behavioral health software market. This will mainly be driven due to ongoing government initiatives by different countries, like India, China, and Australia are widely involved in mental healthcare infrastructure and boosting the adoption of digital health solutions. Besides this, the ASAP region is experiencing phenomenal technological advances, which have fueled the growth of telemedicine and online therapy platforms, making mental health support more feasible and cost-effective across the region.

The market is aiming at the development of culturally sensitive digital mental health innovations, which need co-creation and community engagement plans to ensure successful execution. Along with this, China is further expanding its various available services for online counseling, self-assessment, and commercial use, propelled by a greater smartphone penetration.

The behavioral health software market in Australia is progressing, with the participation of the Australian public health system in the widespread adoption of comprehensive EMR systems to gain a feasible information flow and integrated care. Whereas the Australian Capital Territory (ACT) has a digitally powered system where public hospitals and community health sites apply a single EMR, resulting in enhanced performance and fewer adverse events.

Europe is experiencing significant growth in the behavioral health software market due to its influential regulations and national policies for product standards and adoption rates, focused on the importance of the regulatory framework for market players. In addition, Europe’s major countries are broadly using cloud-based solutions due to their scalability and inexpensiveness, while some leaders choose private clouds to meet specific data privacy needs.

For instance,

By Component

By Delivery Mode

By Functionality

By End User

By Region

March 2026

February 2026

February 2026

February 2026