February 2026

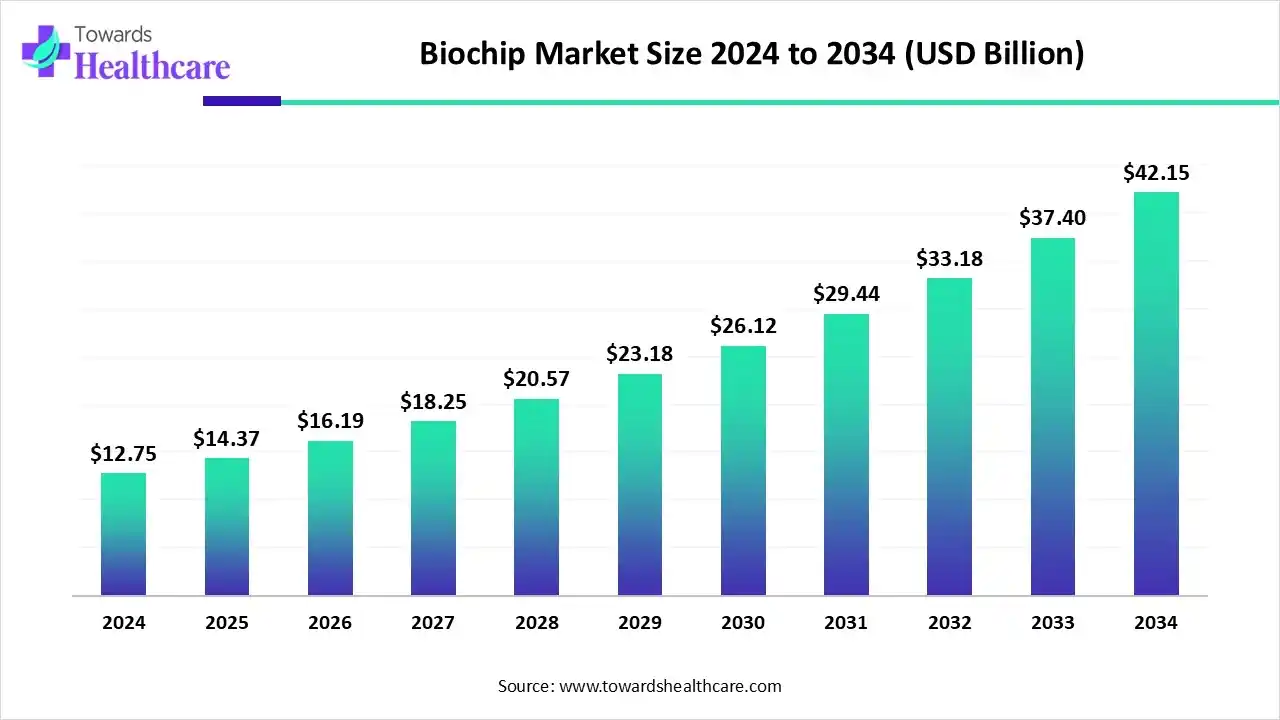

The global biochip market size is estimated at US$ 12.75 billion in 2024, is projected to grow to US$ 14.37 billion in 2025, and is expected to reach around US$ 42.15 billion by 2034. The market is projected to expand at a CAGR of 12.7% between 2025 and 2034.

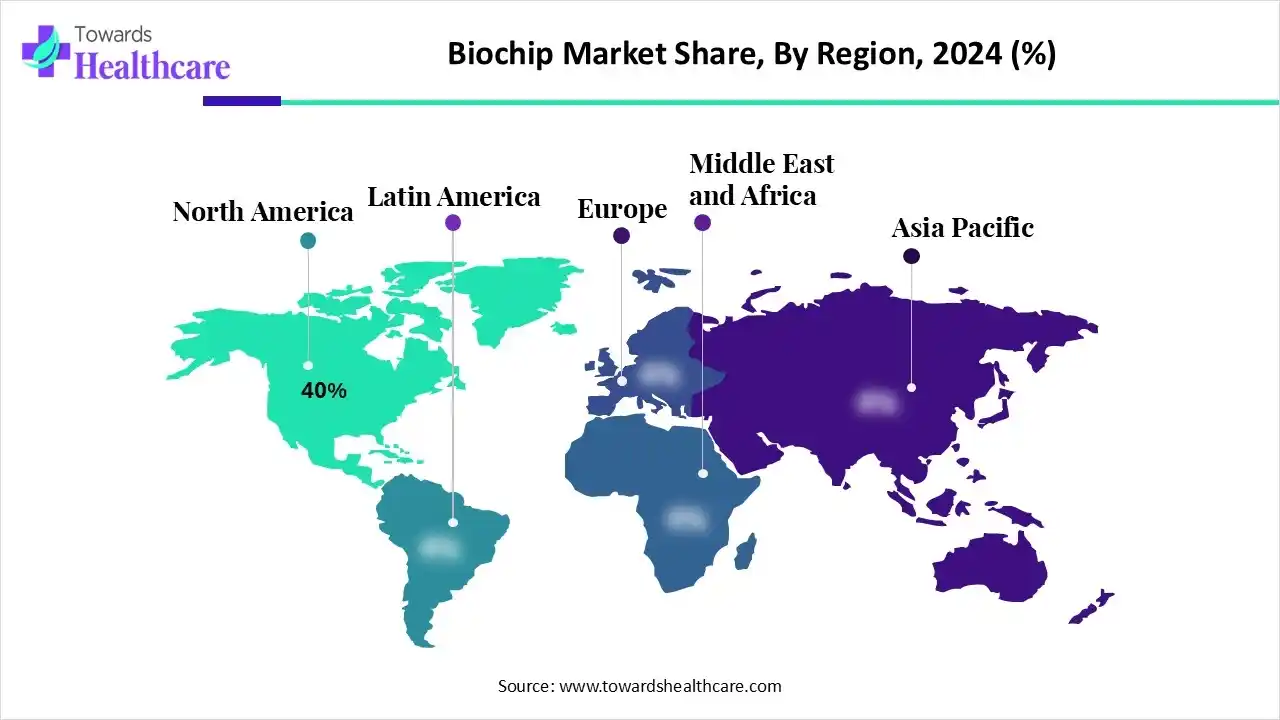

The biochip market is growing because of the increasing demand for biochips from the biotechnology, pharmaceutical, and healthcare sectors. Mainly, biochips are used for the diagnosis of disease, monitoring, targeted medicine, and drug development and manufacturing. North America is dominant in the market due to the presence of a robust life sciences ecosystem and a large patient base, while the Asia Pacific is the fastest growing due to increasing government support and adoption of advanced technology.

| Table | Scope |

| Market Size in 2025 | USD 14.37 Billion |

| Projected Market Size in 2034 | USD 42.15 Billion |

| CAGR (2025 - 2034) | 12.7% |

| Leading Region | North America by 40% |

| Market Segmentation | By Chip Type / Product, By Offering / Product Category, By Application / End Market, By Technology / Platform, By End User / Buyer, By Region |

| Top Key Players | Bio-Rad Laboratories, Danaher Corporation (Cepheid, Beckman Coulter), Qiagen, GE Healthcare / Cytiva, Fluidigm (Standard BioTools), Micronit, Abbott Laboratories, Merck / MilliporeSigma, Phalanx Biotech, NanoString Technologies, BioMérieux, LGC Group / Randox (regional niche), Siemens Healthineers, Akoya Biosciences , Numerous specialty microfluidics & startup innovators |

The biochip market is growing due to driving factors such as rising cases of chronic conditions and rising utilization of gene-based therapies. Biochips (also called biochips, lab-on-a-chip devices, microarrays, or microfluidic chips) are miniaturized devices that integrate one or more laboratory functions on a single chip-scale substrate. They enable massively parallel biochemical reactions, rapid diagnostics, high-throughput screening, genomics/proteomics assays, point-of-care testing, and sample-to-answer workflows with reduced reagent use and faster turnaround. Biochips include DNA microarrays, protein chips, tissue/cell arrays, and microfluidic lab-on-a-chip platforms used across diagnostics, drug discovery, personalized medicine, environmental testing, and research.

Incorporation of AI in biochips drives the growth of the market, as the applications of AI-driven technology to enhance the effectiveness and sensitivity of biochips enable earlier and more accurate illness diagnosis. This type of biochip represents a significant advancement in biotechnology, integrating AI-driven technology with biological analysis to enhance diagnostics, healthcare, and research. These biochips provide rapid analysis and understanding of biological samples, simplifying personalized medicine and immediate monitoring. AI-driven biochip technology provides advances in novel diagnostics and therapeutics, and it is of majorly importance in diabetes, cancer, neurological disorders, and infectious diseases. Predictive analytics in AI-biochips sheds light on precision and predictive medicine.

| Applications | Description |

| Medical diagnostics | Biochips are revolutionizing medical diagnosis by enabling faster and more accurate testing. |

| Drug discovery | The high-throughput screening abilities of biochips drastically speed up the drug development process. |

| Personalized Medicine | Biochips help determine a patient's genetic profile and how they might respond to a specific medication. |

| Environmental | Lab-on-a-chip devices are deployed for on-site monitoring to test water, soil, and air samples for contaminants, toxins, and pathogens. |

| Agricultural applications | Biochips analyze crops, monitor soil health, and identify plant pathogens. |

Increasing Applications of Biochip in Genomics

Biochips are considered genetic DNA-chips; they also interface with a broad range of biological and biochemical elements. They enable scientists to rapidly screen large numbers of biological analytes for various applications, such as disease diagnosis and bioterrorism agent detection. Extensive research has been dedicated to developing biochips for large-scale genomic, proteomic, and functional genomic analyses. These devices have transformed disease diagnostics by providing rapid, highly sensitive detection of various conditions, from infectious diseases to complex genetic disorders, driving growth in the biochip market.

High Cost Challenges of Biochip

The industry faces a challenge from high costs in developing and producing biochips. These costs come from factors like the complexity of design and fabrication, expensive raw materials and equipment, and limited scalability of manufacturing processes, all of which restrict the growth of the biochip market.

Increasing Advancement in Next-Generation Sequencing Biochip Technology

Recent progress in biochip technologies, such as next-generation sequencing (NGS), has led to significant breakthroughs in science and medicine. Since biochip technologies are integral to sequencing methods, their key advantages include scalability and high throughput. These benefits have enabled NGS to drive pioneering discoveries and innovations in healthcare. However, NGS platforms need nucleic acids to be prepared within specific concentration ranges, posing challenges for analyzing certain biological systems. To address this, biochip platforms designed for single-cell or rare-molecule analyses have been developed, offering a more convenient way to prepare nucleic acids from biological samples and opening new opportunities for the biochip market.

For Instance,

In the chip type/product, the DNA microarrays/DNA chips segment led the biochip market, with approximately 34% share, as it provides high specificity, sensitivity, and increasing throughput, as thousands of genes are analyzed instantaneously. DNA microarrays enable large-scale screening of many targets due to their high-throughput abilities. A microarray is a novel, significant tool for researching the molecular basis of interactions on a scale that is impossible to achieve using conventional analysis. Microarrays are larger for genotyping and gene expression, as they provide greater dynamic range and sensitivity, better precision, and accuracy.

On the other hand, the lab-on-a-chip/microfluidic platforms segment is projected to experience the fastest CAGR from 2025 to 2034, as these systems need less sample volumes and they perform multiple analyses instantaneously, resulting in a growing quantity and shorter time-to-result as compared to traditional processes. A lab-on-a-chip is a miniaturized tool that provides the solution for conducting multiple-sample biochemical and biological analyses in a single platform. Research on lab-on-a-chip mainly focuses on numerous applications, with human diagnostics, DNA analysis, and, to a lesser extent, chemical synthesis.

By offering/product category, the instruments & readers segment is dominant in the biochip market in 2024 with approximately 42% share, as this instrument provides important advantages by allowing rapid, high-throughput analysis of biological molecules in a miniaturized, automatic format. These advantages speed up research, enhance diagnostic speed, and simplify targeted medicine. These chips incorporate different biological elements, like DNA, proteins, or cells, onto a solid substrate for various applications in diagnostics, research, and therapeutics.

The software & data analytics segment is projected to grow at the fastest CAGR from 2025 to 2034, as this software enables the simultaneous quantitative or qualitative identification of a broad range of analytes from a single sample. It provides advantages such as quicker, cost-effective, and more efficient, leading to advanced clinical decisions. Data analytics is a fully automated random-access biochip testing stage. The machine enables any test to be performed at any time, as it is a highly multipurpose analyzer that operates any workflow.

By application/end market, the clinical diagnostics segment led the biochip market in 2024 with approximately 38% share, as biochips allow swift and precise identification of diseases, significantly lowering the time required for medical diagnoses. By analysing a patient’s biochemical and genetic data, biochips increase the development of targeted treatment plans tailored to patients' requirements. The high-throughput abilities of biochips allow research efficiency, accelerating the discovery of novel drugs and therapies.

The point-of-care testing segment is projected to experience the fastest CAGR from 2025 to 2034, as point-of-care diagnostics is an efficient alternative to reducing the load of the medical care domain. Furthermore, the features of these devices, being cost-efficient, convenient with less turnaround time, add benefits for their usage. Point-of-care testing diagnostics, biochips in the form of contracted devices, permit the fast analysis of biological samples, like saliva or blood, to identify different diseases or health situations.

By technology/platform, the microarray-based platforms segment led the biochip market in 2024 with approximately 36% share, as developments in microarray technology allow massive parallel mining of biological data, with biological chips offering hybridization-driven expression monitoring, polymorphism identification, and genotyping on a genetic scale. Microarray technology is speedily becoming an essential platform for efficient genomics research.

The microfluidics/lab-on-a-chip segment is projected to experience the fastest CAGR from 2025 to 2034, as this chip allows perturbing, culturing, and measuring cells and organisms exactly. Microfluidics scales up and increases the output of biological trials. Droplet microfluidics is predominantly significant for omics studies. Microfluidic chips are employed in nanoparticle preparation, delivery, drug encapsulation, and targeting, diagnosis, cell analysis, and cell culture.

By end user/buyer, the clinical laboratories & hospitals segment led the biochip market in 2024 with approximately 45% share, as biochips allow swift and precise recognition of diseases, significantly lowering the time required for healthcare diagnoses. Biochips enable thousands of biological reactions to be achieved at expressively low levels, lowering the time required for diagnostic tests, genetic analysis, and drug screens.

The point-of-care providers/clinic segment is projected to experience the fastest CAGR from 2025 to 2034, as this improves healthcare decision-making, enables rapid interventions, and progresses patient results in various healthcare settings. POCT shows a transformative strategy to diagnostic testing that allows healthcare benefactors, improves patient care, and enhances healthcare results. With POCT, physicians rapidly obtain the data they need to make decisions related to treatment, which can lead to advanced results for patients.

North America is dominant in the market in 2024 with approximately 40% share, due to its ownership of cutting-edge research facilities, involving top academic institutions and biotechnology organizations, that adopt a culture of invention. This has resulted in a booming ecosystem for emerging advanced biochip technologies. Increasing government initiatives, like the National Institutes of Health's "All of Us" Research Program and the "Cancer Moonshot”, drive the growth of the market.

For Instance,

Increasing demand for targeted medicine, high-throughput screening, and development in proteomics and genomics. High levels of R&D spending, both from the pharmaceutical industry and government initiatives, speed up biochip innovation and adoption. Biochip technology brings progressive testing accessible outside of outdated hospital or laboratory environments, which is significant for underserved, remote, or emergency settings.

In Canada, major biochips are intended to use materials that the body accepts, like plastic, silicon, or even bioengineered materials. Though embedding any foreign object in the body carries challenges, like tissue damage or infections. Biochips, as smart medical care devices, provide incessant monitoring of patient symptoms, which drives the growth of the market.

Asia Pacific is the fastest-growing region in the biochip market in the forecast period, due to rising medical care demands and technical innovation. Their significant advantages relate to food safety, targeted medicine, diagnostics, and farming biotechnology. Biochips allow the investigation of a person's genetic profiles and biomarkers, which is significant for modifying healthcare treatments for better patient results, which drives the growth of the market.

The research and development (R&D) of a biochip is a multi-stage process including conceptualization and design, microfabrication, surface functionalization and immobilization, sample preparation, hybridization, and finally data analysis and interpretation.

Key Players: Abbott Laboratories and Agilent Technologies

Clinical trials for the biochip market involve preclinical research, regulatory approval to begin human trials, pilot and feasibility studies, pivotal studies, and post-market surveillance

Key Players: Bio-Rad Laboratories and Illumina, Inc.

Biochips provide personalized or targeted medicine by tailoring treatments to a patient's specific genetic makeup and biological profile.

Key Players: Thermo Fisher Scientific and GE HealthCare

In September 2025, Sarah Lee, COO of MedTech Innovations, stated, “By combining our strengths, we believe we can create unparalleled efficiencies in clinical trial design and execution. We are committed to providing pharmaceutical companies the tools they need to bring their products to market faster and more cost-effectively.”

By Chip Type / Product

By Offering / Product Category

By Application / End Market

By Technology / Platform

By End User / Buyer

By Region

February 2026

February 2026

February 2026

February 2026