December 2025

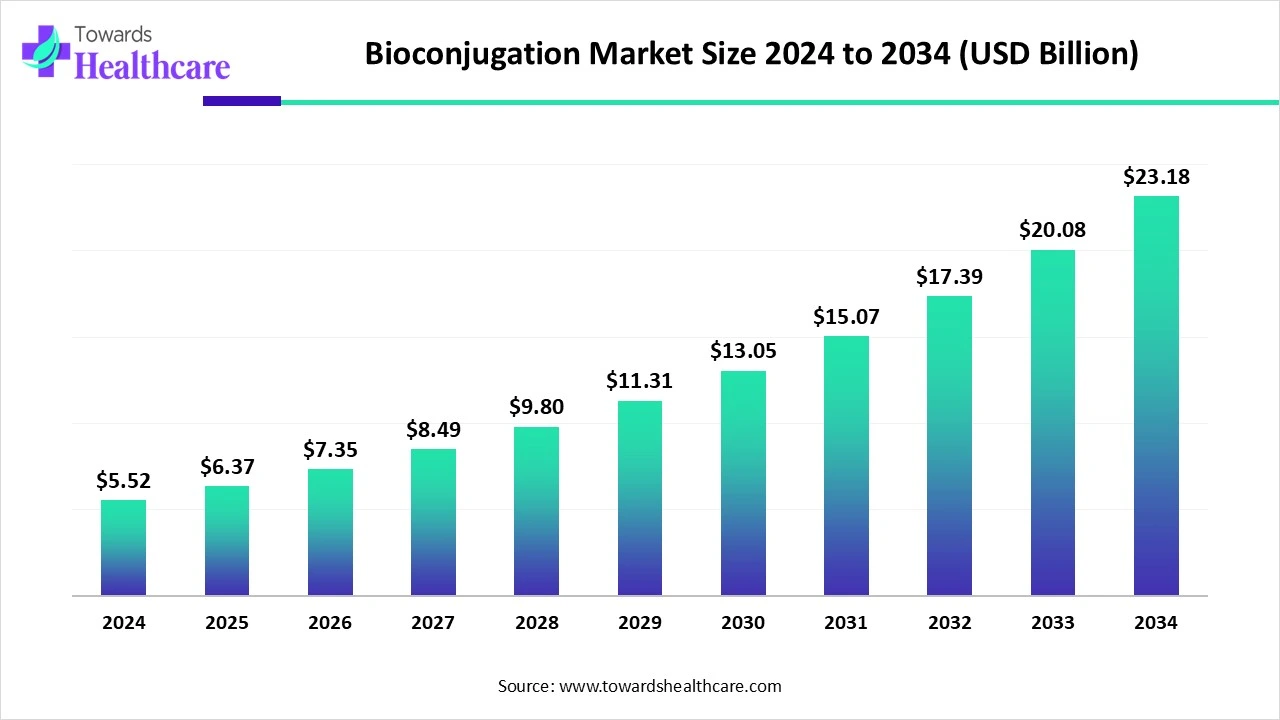

The global bioconjugation market size reached USD 5.52 billion in 2024, grew to USD 6.37 billion in 2025, and is projected to hit around USD 23.18 billion by 2034, expanding at a CAGR of 15.46% during the forecast period from 2025 to 2034.

The bioconjugation market is witnessing significant growth driven by rising demand for targeted therapies, advanced diagnostics, and personalized medicine. Bioconjugation techniques are widely used to enhance the efficacy of biologics by linking biomolecules such as antibodies, peptides, or nucleic acids to drugs, imaging agents, or other molecules.

This approach has gained traction in oncology, autoimmune diseases, and infectious disease treatment. The increasing R&D investments by pharmaceutical and biotechnology companies, coupled with technological advancements in linker chemistry and site-specific conjugation methods, are further supporting market expansion. Growing applications in antibody-drug conjugates (ADCs), diagnostics, and drug delivery systems are also key drivers.

| Metric | Details |

| Market Size in 2025 | USD 6.37 Billion |

| Projected Market Size in 2034 | USD 23.18 Billion |

| CAGR (2025 - 2034) | 15.46% |

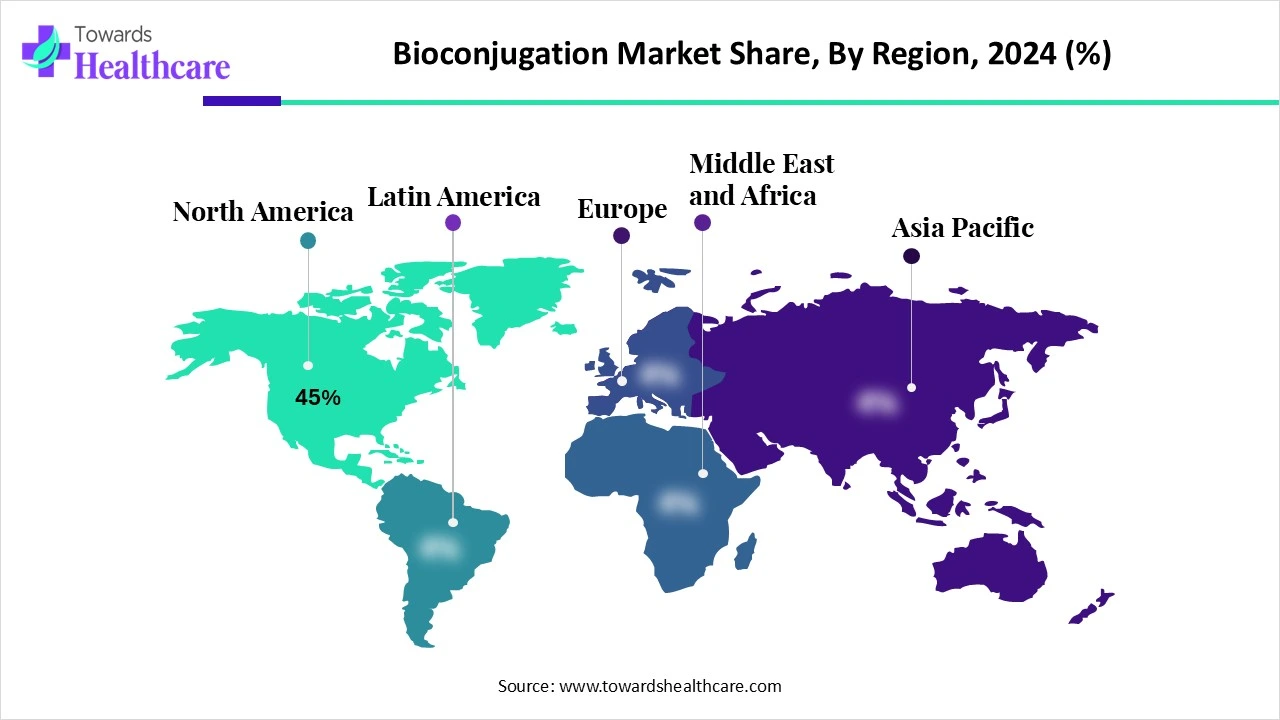

| Leading Region | North America Share 45% |

| Market Segmentation | By Product Type, By Application, By Conjugation Chemistry, By End User, By Region |

| Top Key Players | Thermo Fisher Scientific, Inc., Merck KGaA (MilliporeSigma), Creative Biolabs, Abcam plc, Sevion Therapeutics / SciClone, Biomatik Corporation, Agilent Technologies, Inc., Vector Laboratories, Quanta BioDesign, Ltd., GlyThera Ltd. (now ADC Bio), ConjuChem Inc., Innate Biologics, Levena Biopharma, Bioneer Corporation, Bioconjugate Technologies, TriLink BioTechnologies (Maravai LifeSciences), Expedeon AG, Abzena Ltd., BroadPharm, Nanosyn, Inc. |

The bioconjugation market encompasses technologies, products, and services related to the chemical or biological linking of two molecules, typically involving biomolecules like antibodies, peptides, proteins, nucleic acids, or drugs. Bioconjugation is essential in the development of antibody-drug conjugates (ADCs), diagnostic reagents, biosensors, imaging agents, and theranostics. The market is rapidly expanding due to increased demand for targeted therapeutics, precision diagnostics, and next-generation biologics in oncology, infectious diseases, and autoimmune disorders.

AI integration can significantly enhance the bioconjugation process by accelerating research, improving precision, and optimizing outcomes in drug development and diagnostics. By leveraging machine learning algorithms and predictive modeling, AI can analyze vast datasets to identify optimal conjugation sites on biomolecules, predict the stability and efficacy of bioconjugates, and reduce trial-and-error experimentation. AI tools also enable the design of more effective linker chemistries and help simulate molecular interactions to foresee potential side effects or degradation pathways.

In drug discovery, AI facilitates rapid screening of conjugate combinations, reducing the time and cost associated with laboratory synthesis. Additionally, AI-driven analytics can support real-time quality control and process automation during bioconjugation manufacturing, ensuring consistency and regulatory compliance. As a result, AI integration not only enhances the efficiency and accuracy of bioconjugation but also opens up new possibilities for personalized medicine, advanced therapeutics like antibody-drug conjugates (ADCs), and next-generation diagnostic tools.

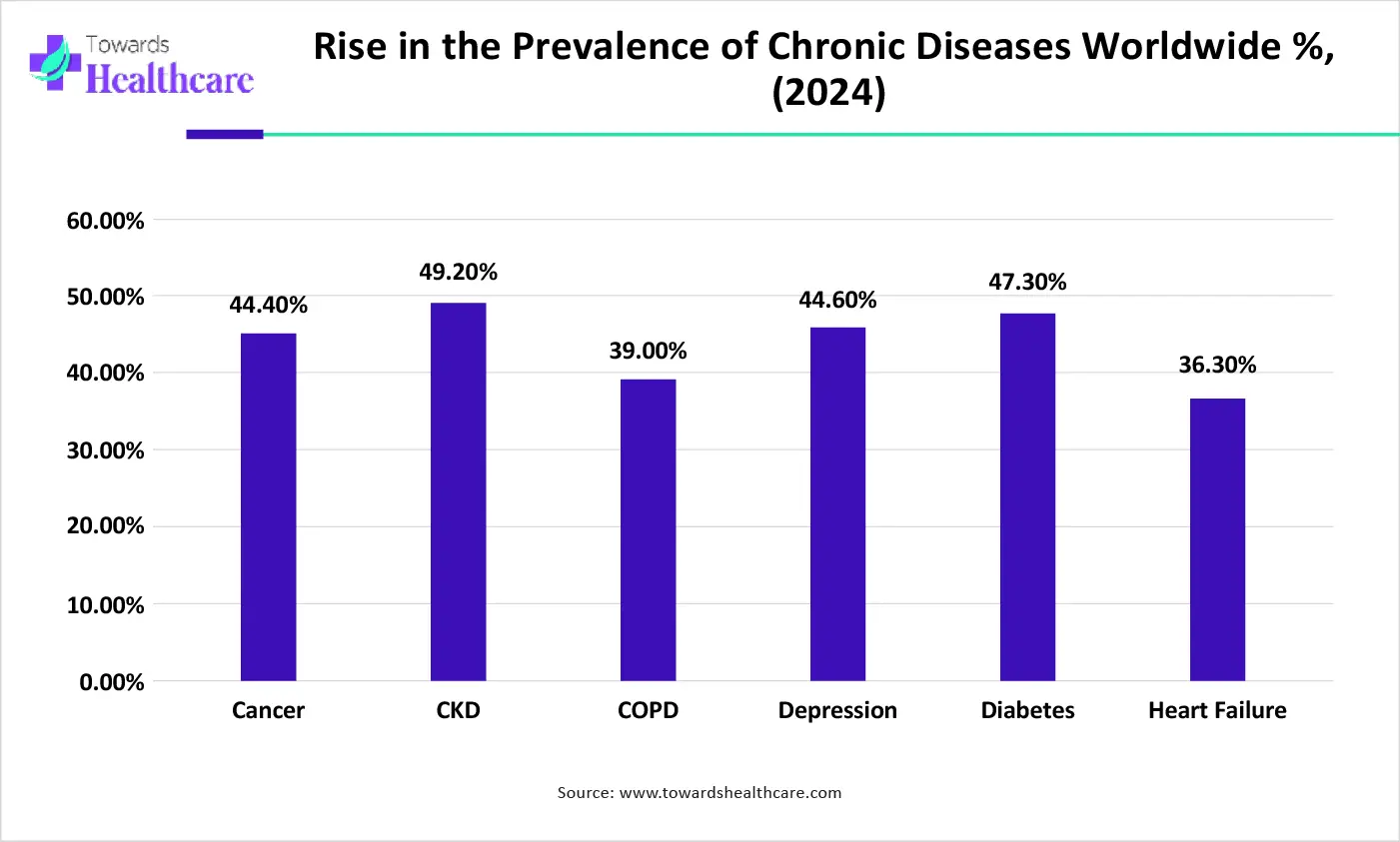

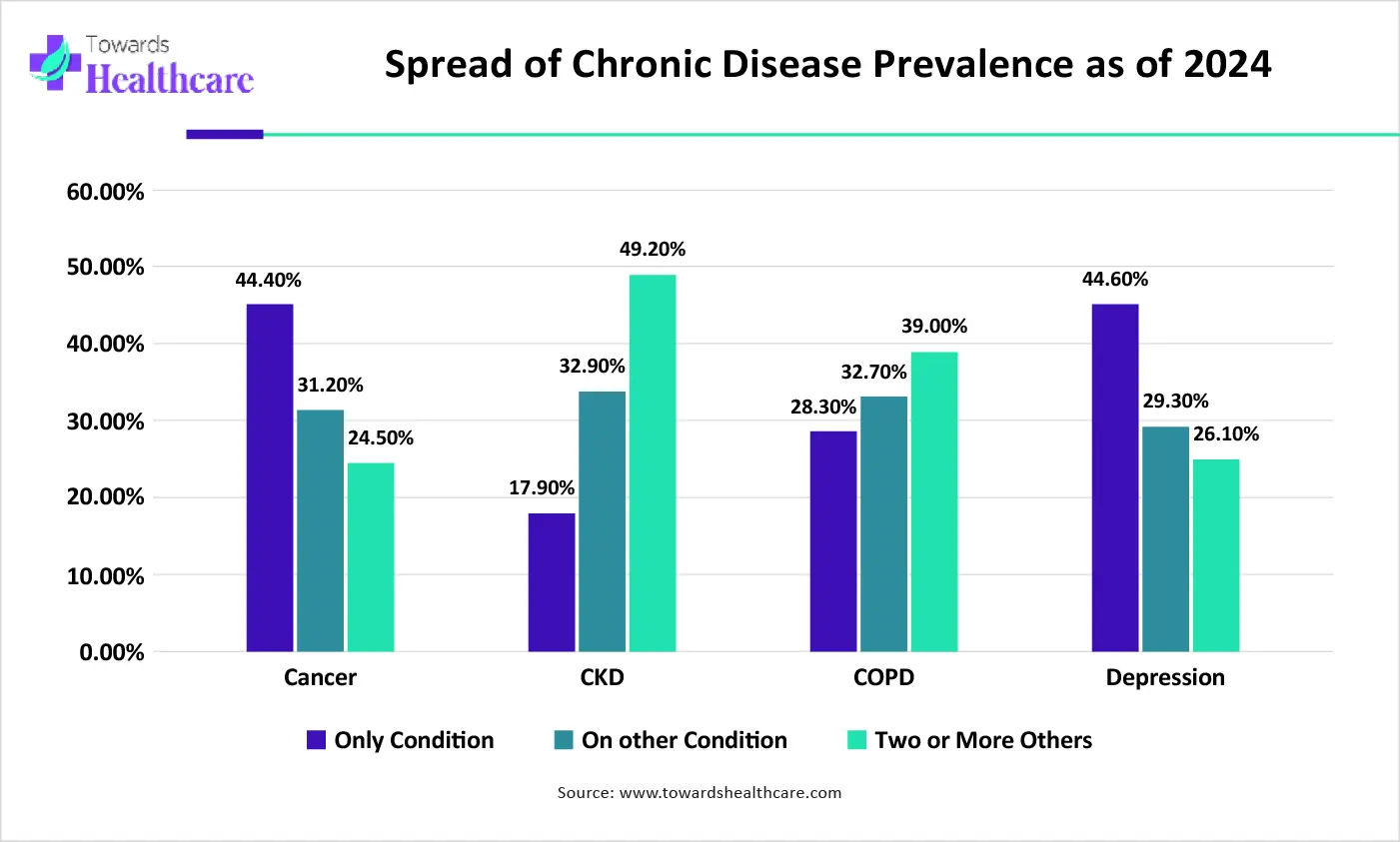

Rising Prevalence of Chronic Diseases

The increasing global burden of chronic diseases like cancer, cardiovascular disorders, and diabetes is creating strong demand for improved diagnostics and therapeutics, where bioconjugation plays a critical role. According to the World Health Organization’s 2025 Noncommunicable Disease Progress Monitor, around 40 million deaths per year are caused by the four major NCDs: cardiovascular disease, cancers, chronic respiratory diseases, and diabetes.

It has been estimated that noncommunicable diseases, cancer, chronic respiratory diseases, and diabetes cause approximately 75% of all global deaths. Diabetes prevalence globally has reached 830 million people, affecting roughly 1 in 7 adults. Chronic kidney disease (CKD) currently impacts an estimated 13.4% of the world’s population, over 800 million individuals.

Operational Scalability Issues & Reagent Availability

The key players operating in the market are facing issues due to limited reagent availability & operational scalability, which is estimated to restrict the growth of the market. Scaling up laboratory-based bioconjugation processes to commercial production while maintaining quality and consistency is challenging, particularly for customized or rare-target therapies. Specialized linkers, labeling agents, and carrier molecules are often expensive and not readily available, creating supply chain dependencies and affecting overall feasibility.

Rising Demand for Targeted Therapies

The growing need for highly selective and effective treatment modalities, especially in cancer, autoimmune, and infectious diseases, creates significant opportunities. Bioconjugation allows for the precise delivery of drugs using molecules like antibodies or peptides, minimizing side effects and improving therapeutic outcomes.

The shift toward personalized healthcare is driving demand for biomarker-specific diagnostics and treatments. Bioconjugation supports this trend by enabling the development of custom biotherapeutics tailored to individual patient profiles.

The reagents and kits segment dominates the bioconjugation market due to its essential role in simplifying and accelerating experimental workflows. These kits provide pre-optimized, ready-to-use reagents for protein labeling, antibody-drug conjugation, and biomolecule modification, reducing the time and technical expertise required. Researchers and biotech companies increasingly prefer kits for their convenience, consistency, and reproducibility. For instance, Thermo Fisher’s SiteClick and Merck’s Bioconjugation kits are widely used in the research and development of antibody-drug conjugates, diagnostics, and targeted therapies, reinforcing the segment’s leading position.

The bioconjugation services segment is the fastest-growing in the bioconjugation market due to the increasing outsourcing trend among pharmaceutical and biotech companies. These services offer specialized expertise, advanced equipment, and regulatory support, helping clients accelerate drug development while minimizing costs and in-house resource burdens. As demand rises for complex biologics like ADCs and oligonucleotide conjugates, companies such as Abzena, Creative Biolabs, and Sartorius Stedim provide end-to-end bioconjugation solutions ranging from research-scale conjugation to GMP-grade manufacturing, fueling rapid segmental growth.

The amine-reactive chemistry (NHS esters) segment is the dominant segment in the bioconjugation market due to its broad applicability, high efficiency, and ease of use. NHS esters react rapidly with primary amines under aqueous conditions, enabling stable and site-specific conjugation of proteins, peptides, and other biomolecules. This method is widely used in developing antibody-drug conjugates, protein labeling, and diagnostic assays. Its compatibility with physiological buffers and availability in commercial kits make it a preferred choice across academic, clinical, and industrial bioconjugation applications.

The click chemistry segment is the fastest-growing in the bioconjugation market due to its high specificity, efficiency, and biocompatibility. Click reactions, such as azide-alkyne cycloaddition, occur rapidly under mild conditions, making them ideal for labeling sensitive biomolecules without affecting their function. This technique is increasingly adopted in developing antibody-drug conjugates, imaging probes, and targeted drug delivery systems. Its versatility and minimal byproduct formation make it especially attractive for pharmaceutical research and in vivo applications, fueling rapid growth in clinical and research settings.

The antibody-drug conjugate (ADC) segment is the dominant segment in the bioconjugation market due to its proven clinical success and increasing number of FDA approvals. ADCs combine the specificity of monoclonal antibodies with the potency of cytotoxic drugs, offering targeted cancer therapies with fewer side effects. Their growing use in oncology has led to widespread adoption of bioconjugation techniques. Products like Enhertu, Kadcyla, and Adcetris exemplify how ADCs are transforming cancer treatment, making this segment central to bioconjugation innovation and demand.

The biosensors and biomarker detection segment is the fastest-growing application in the bioconjugation market due to the rising demand for rapid, sensitive, and specific diagnostic tools. Bioconjugation enables the precise linking of antibodies, enzymes, or nucleic acids to detection elements, enhancing the performance of biosensors in disease diagnosis. With growing applications in infectious disease screening, cancer biomarker detection, and point-of-care testing, companies like Bio-Rad and Roche are investing in bioconjugate-based diagnostics, driving accelerated growth in this high-potential segment.

The pharmaceutical and biotechnology companies segment dominates the bioconjugation market due to their extensive investment in drug discovery, targeted therapies, and biologics development. These companies heavily rely on bioconjugation techniques to create advanced therapeutics such as antibody-drug conjugates (ADCs), protein-drug conjugates, and diagnostic agents. With the growing demand for personalized medicine and precision-targeted treatments, pharma and biotech firms are using bioconjugation to improve drug specificity and efficacy.

Moreover, the rise in clinical trials and FDA approvals for bioconjugated drugs further strengthens their role as the leading end users in this market. Enhertu, an antibody-drug conjugate (ADC) developed by Daiichi Sankyo and commercialized in partnership with AstraZeneca, is a prime example of how bioconjugation is central to pharma and biotech R&D. The drug targets HER2-positive cancers and uses bioconjugation to attach a cytotoxic drug to a monoclonal antibody via a stable linker. Enhertu has received multiple FDA approvals, most recently for HER2-mutant non-small cell lung cancer (2022) and HER2-low breast cancer (2023).

The CROs (Contract Research Organizations) and CDMOs (Contract Development and Manufacturing Organizations) segment is the fastest-growing in the bioconjugation market due to increasing outsourcing by pharmaceutical and biotech companies seeking cost efficiency, technical expertise, and faster time-to-market. These service providers offer specialized capabilities in complex bioconjugation processes, including ADC development, custom synthesis, and scalable manufacturing. Rising demand for targeted therapies and biologics has led to expanded partnerships and investments in CRO/CDMO infrastructure, making this segment vital for innovation and speed in bioconjugate drug development.

North America dominates the bioconjugation market share by 45%, in 2024, due to its well-established pharmaceutical and biotechnology sectors, strong R&D investments, and favorable regulatory environment. The region hosts leading companies involved in antibody-drug conjugates, targeted therapeutics, and diagnostics, fostering rapid adoption of bioconjugation techniques. Significant funding from government agencies like the NIH and increasing clinical trials involving bioconjugated drugs further support market growth. Additionally, the presence of advanced healthcare infrastructure, rising chronic disease burden, and strategic collaborations between academia and industry drive innovation and commercialization.

The U.S. leads the bioconjugation market in North America due to its robust pharmaceutical and biotechnology ecosystem. Major players like Pfizer, Amgen, Seagen, and AbbVie are heavily invested in antibody-drug conjugates (ADCs) and other bioconjugated therapies. Continuous support from the National Institutes of Health (NIH) and streamlined FDA approval processes accelerate bioconjugation R&D. Additionally, the presence of a large number of clinical trials and strong academic-industry collaborations fuels innovation and commercial success.

Canada is witnessing steady growth in the bioconjugation space, supported by government funding for life sciences and emerging biotech clusters in Toronto, Vancouver, and Montreal. Canadian firms are increasingly partnering with global pharmaceutical companies and CROs/CDMOs to conduct research and manufacturing of bioconjugated drugs. The country’s supportive regulatory policies and skilled workforce make it an attractive destination for expanding bioconjugation capabilities.

Asia-Pacific is the fastest-growing region in the bioconjugation market due to increasing investments in biotechnology, expanding healthcare infrastructure, and growing demand for targeted therapies. Countries like China, India, Japan, and South Korea are rapidly advancing in biopharmaceutical R&D. For instance, in 2023, WuXi Biologics (China) expanded its ADC development capabilities, while Dr. Reddy’s Laboratories (India) announced strategic investments into biologics and conjugation technologies.

Japan’s Daiichi Sankyo, in collaboration with AstraZeneca, saw global success with Enhertu, an antibody-drug conjugate co-developed in Japan. The region’s growing pool of skilled professionals, favorable government policies, and rise in contract manufacturing services (CROs/CDMOs) are accelerating the development and commercialization of bioconjugated drugs, solidifying Asia-Pacific as a key growth engine in the global market.

China is a major driver in the region’s bioconjugation market due to robust government support through initiatives like Made in China 2025, which encourages biopharma innovation. Companies such as WuXi Biologics and Bio-Thera Solutions have expanded their capabilities in antibody-drug conjugates (ADCs) and other bioconjugates. China's large patient pool and accelerated clinical trial approvals further boost growth.

India is emerging as a cost-effective hub for bioconjugation research and manufacturing. Firms like Dr. Reddy’s Laboratories and Biocon are investing in bioconjugate-based therapies. The government's Biotechnology Industry Research Assistance Council (BIRAC) and growing CRO/CDMO presence make India attractive for global collaborations.

Japan has a strong biotech base and a track record of innovation in ADCs. Daiichi Sankyo’s success with Enhertu (trastuzumab deruxtecan), co-developed with AstraZeneca, has placed Japan at the forefront of ADC development. Regulatory support and strong academia-industry ties further accelerate the market.

South Korea is investing in biopharma R&D through national programs and supporting bioconjugation innovation via companies like Samsung Biologics and Celltrion. Government incentives and a skilled workforce position South Korea as a regional bioconjugation research and production hub.

Europe is witnessing notable growth in the bioconjugation market due to its strong research infrastructure, supportive regulatory frameworks, and significant investments in precision medicine and biologics. Countries like Germany, the UK, France, and Switzerland are leading in bioconjugate R&D, with institutions and companies heavily engaged in the development of antibody-drug conjugates (ADCs), biosensors, and targeted diagnostics. The European Medicines Agency (EMA) plays a crucial role in accelerating approvals for novel bioconjugated therapies.

Collaborations between academic institutions and biotech firms, such as the partnership between Lonza (Switzerland) and AstraZeneca (UK), are fostering technological advancements. The increasing prevalence of cancer and chronic illnesses is also pushing demand for more personalized treatments, encouraging the use of bioconjugation technologies across pharmaceutical and diagnostic applications in the region.

In July 2025, Thomas Eisele, Chief Operations Officer, Biosynth, stated that the company is thrilled to officially open the new expansion to their bioconjugation facility in Berlin, which represents a significant enhancement to their existing operations. This suite enables the scalable, diverse, high-quality conjugation services that their customers need to advance to the next generation of therapies. Frank Leenders, General Manager for the Berlin site, announced that the construction of their new facility, including class D and C cleanrooms, represents a natural evolution of their Berlin operation in many ways, we are growing alongside our customers.

By Product Type

By Application

By Conjugation Chemistry

By End User

By Region

December 2025

November 2025

November 2025

February 2026