February 2026

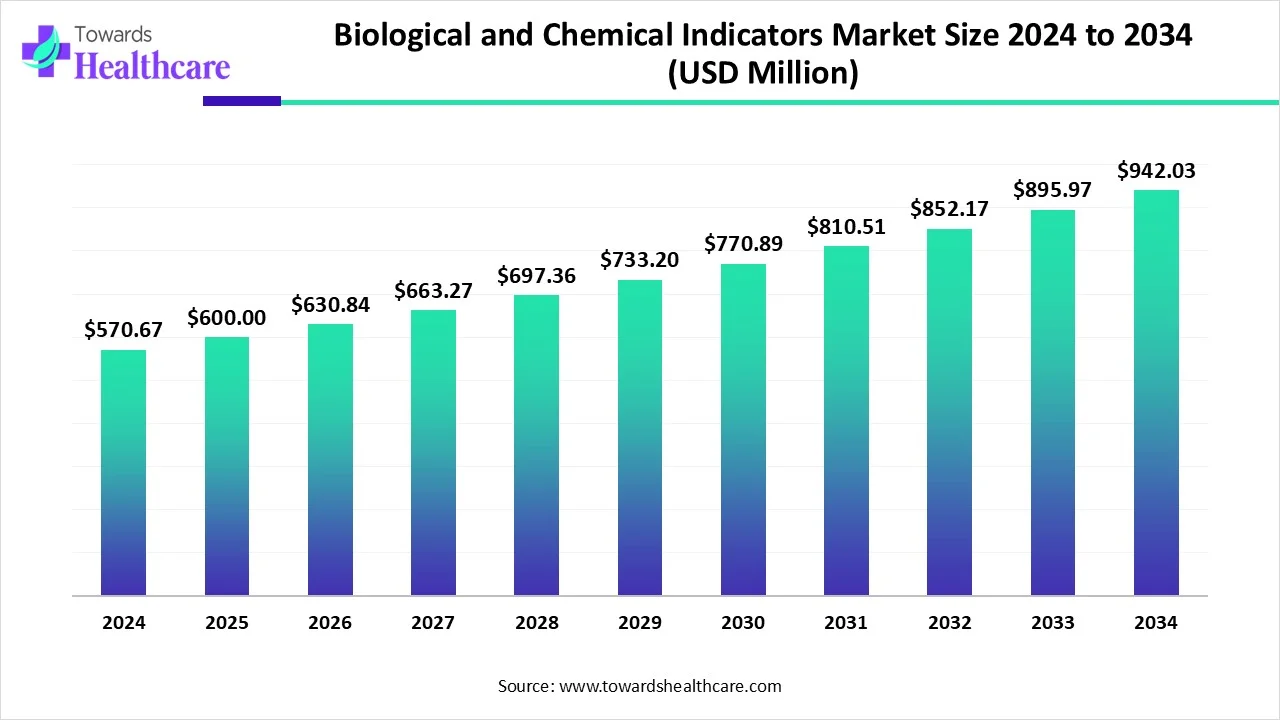

The global biological and chemical indicators market size is calculated at USD 570.67 million in 2024, grew to USD 600 million in 2025, and is projected to reach around USD 942.03 million by 2034. The market is expanding at a CAGR of 5.14% between 2025 and 2034.

The biological and chemical indicators market is primarily driven by the growing need for sterilization in various healthcare operations. The increasing number of surgeries and rising manufacturing of pharmaceutical products potentiate the demand for sterilization, thereby promoting the use of biological and chemical indicators. The future looks promising with the burgeoning biotech sector and the introduction of digitization.

| Metric | Details |

| Market Size in 2025 | USD 600 Million |

| Projected Market Size in 2034 | USD 942.03 Million |

| CAGR (2025 - 2034) | 5.14% |

| Leading Region | North America |

| Market Segmentation | By Sterilization Type, By Indicator Class, By Packaging Form, By End-User, By Region |

| Top Key Players | 3M, Aayur Lifesciences, Anderson Products, Inc., Cantel Medical Corp., Etigam BV, Medzell, Mesa Labs, Sigmaxis Innovations Pvt. Ltd., Solventum, SSI Diagnostica A/S, STERIS Life Sciences |

Biological and chemical indicators are used to monitor the sterilization processes in healthcare, pharmaceutical, and biopharmaceutical organizations. These indicators indicate the growth of microorganisms, enabling professionals to take necessary actions. Biological indicators are made of microorganisms and ensure that the chamber of the autoclave is completely saturated during the sterilization process. In contrast, chemical indicators use certain chemicals to monitor the sterilization process.

Numerous factors that govern market growth include the increasing production of pharmaceutical products, such as drugs, biologics, and medical devices. The rising number of surgeries and stringent regulatory policies boost the market. The growing research and development activities and the rapidly expanding microbiology sector potentiate market growth. The increasing investments and collaborations among key players also contribute to market growth.

Artificial intelligence (AI) can revolutionize the market by providing real-time insights into the sterilization process. AI can suggest the type of indicator to be used based on their requirements and properties. It can also suggest the quantity of indicators to be incorporated without causing any harm to the product. It can assist researchers in developing novel biological and chemical indicators, thereby producing customized indicators. AI and machine learning (ML) algorithms can enable remote monitoring of the sterilization process and alert manufacturers or healthcare professionals about any minute changes in indicators.

Increasing HAI Incidence

The major growth factor of the biological and chemical indicators market is the increasing incidence of hospital-associated infections (HAIs). HAIs are infections that occur in hospitals or other healthcare settings. They can affect both healthcare professionals and patients. They are mainly caused by central line-associated bloodstream infection (CLABSI), catheter-associated urinary tract infection (CAUTI), surgical site infections, and ventilator-associated pneumonia. According to the Centers for Disease Control and Prevention (CDC), approximately 1 in 31 U.S. patients and 1 in 43 nursing home residents contract at least one HAI daily. (Source - CDC.gov)

Cross-Contamination

The biological and chemical indicators that are used to assess sterilization conditions may interact with the sample to be sterilized. This may cause cross-contamination and degradation of the product. Thus, alternative indicators, such as radioactive indicators, are preferred to avoid cross-contamination as they do not come in contact with the sample physically, restricting market growth.

What is the Future of the Biological and Chemical Indicators Market?

The future of the market is promising, driven by the rapidly expanding biotechnology sector. This leads to growing demand for biologics, such as monoclonal antibodies, cell and gene therapy products, and vaccines. All these biologics need to be maintained in stringent sterilization conditions during their manufacturing. Manufacturers invest heavily to build state-of-the-art manufacturing infrastructure with advanced sterilization technologies. Parenteral drugs are considered to be one of the most preferred drug delivery systems. They require sterilization till they are administered into the body. It is estimated that more than 3.5 billion prefilled syringes are produced annually.

By sterilization type, the thermal sterilization segment held a dominant presence in the market in 2024. Thermal sterilization is a method of sterilizing the product using high heat. The segment dominated because of the need to assess specific parameters of sterilization. Predetermined critical parameters, such as temperature, time, and sterilant, need to be monitored and maintained during sterilization. This type of sterilization is widely preferred as it does not contaminate the product.

By sterilization type, the chemical sterilization segment is expected to grow at the fastest CAGR in the market during the forecast period. Chemical sterilization includes sterilizing a product with ethylene oxide, hydrogen peroxide, and formaldehyde. It is mostly used for thermo-sensitive samples, objects, or surfaces. It can kill all forms of microorganisms, including bacteria, viruses, and spores.

By indicator class, the biological indicators segment led the global market in 2024. This is due to the presence of viable microorganisms and their versatility. Endospores, or bacterial spores, are commonly used biological indicators. The types of biological indicators to be used depend on their resistance to the sterilization process. They provide information on whether necessary conditions were met to kill a specified number of microorganisms for a given sterilization process, providing a level of confidence in the process.

By indicator class, the chemical indicators segment is expected to grow with the highest CAGR in the market during the studied years. Chemical indicators change their physical appearance when appropriate sterilization parameters are not maintained. They are preferred over biological indicators as they can quickly identify errors and help prevent the use of improperly processed instruments in medical procedures. They also provide an idea about the proper functioning of the sterilizer. They can detect issues related to the sterilizer, such as inadequate steam penetration and temperature fluctuations.

By packaging form, the self-contained BI segment held the largest revenue share of the market in 2024. Self-contained BI consists of a durable PC vial with a cap, a crushable glass ampoule, and a disc inoculated with any BI. It is mostly used to confirm the sterilization of liquids in the steam autoclave cycle. It is used to test the worst-case locations in liquids or within the steam sterilizer. It combines a microbial spore population with a growth medium in a sealed container, eliminating the need for aseptic transfer. It minimizes the risk of contamination and derives faster results.

By end-user, the biopharma industry segment contributed the biggest revenue share of the market in 2024. The segmental growth is attributed to favorable infrastructure and suitable capital investments. This encourages biopharma companies to adopt advanced sterilization tools, potentiating the need for biological and chemical indicators. The growing demand for biologics increases their manufacturing. The increasing number of biotech startups and rising preference for CDMOs/CROs boost the segment’s growth.

By end-user, the diagnostics lab segment is expected to expand rapidly in the market in the coming years. The rising prevalence of chronic disorders necessitates that patients visit diagnostic labs for testing of their chronic disorders. These labs contain numerous instruments and medical devices for diagnostic purposes. These devices need to be sterilized again and again to eliminate infection risk among patients, facilitating the use of biological and chemical indicators.

North America dominated the global market in 2024. The increasing number of surgeries, stringent regulatory policies, and the presence of key players are the major growth factors of the market in North America. The availability of state-of-the-art research and development facilities enables researchers to develop novel pharmaceuticals and biopharmaceuticals.

Key players, such as 3M, Solventum, and STERIS Life Sciences, are the major contributors to the market in the U.S. The U.S. performs more than 51.4 million surgeries annually. The increasing hospital admissions also necessitate healthcare professionals to maintain sterility in healthcare organizations. In 2023, over 34 million people were admitted to U.S. hospitals. (Source - AHA.org)

It is estimated that more than 2.2 million surgeries are performed in Canada annually. As of March 2025, Health Canada has approved a total of 67 biosimilars for diverse diseases. This potentiates the demand for manufacturing these biosimilars, necessitating the sterilization of such products. (Source - Gabi Online)

Asia-Pacific is expected to host the fastest-growing biological and chemical indicators market in the coming years. The rising adoption of advanced technologies and growing research and development activities augment market growth. The burgeoning biotechnology sector and the increasing number of biotech startups promote the market. The increasing investments and collaborations also contribute to market growth. The availability of a suitable manufacturing infrastructure governs market growth.

China is home to more than 6,000 pharmaceutical companies. The Chinese government actively supports the manufacturing of biopharmaceuticals. It announced an investment of at least CNY 20 billion (EUR 2.6 billion) in 2023 as part of the public funding for research. It aims to position China as a global hub in the biotech sector.

According to the India Brand Equity Foundation (IBEF), India hosts a network of 3,000 domestic drug companies and more than 10,500 manufacturing units. (Source - Ibef). The Indian government has launched the “BioE3 policy” to foster high-performance biologics manufacturing in India.

Europe is expected to grow at a considerable CAGR in the biological and chemical indicators market in the upcoming period. Favorable government support for developing and manufacturing biologics through initiatives and investments propels market growth. The increasing manufacturing of biopharmaceuticals due to the growing demand for personalized medicines drives the market. The rising risk of hospital-associated infections also potentiates market growth.

It is reported that around 7.6% of all patients come in contact with HAIs in the UK. The National Standards of Healthcare Cleanliness 2025 aims to maintain environments to drive higher standards of cleanliness across the NHS, achieving better patient experience in a uniform way.

Sharon Greene-Golden, Past President of the Healthcare Sterile Processing Association (HSPA), commented on the launch of Solventum’s test pack that innovations that make every load monitoring is easier to adopt, more reliable, and faster across sterilization modalities, empowering healthcare facilities to consistently uphold the highest patient safety standards, while supporting the increasing productivity demand of modern sterile processing departments. (Source - Finance)

In June 2025, Solventum announced the launch of Attest Super Rapid Vaporized Hydrogen Peroxide (VH2O2) Clear Challenge Pack to monitor sterilization. The test pack integrates biological and chemical indicators into a single-use test pack with a transparent container. (Source - Finance)

By Sterilization Type

By Indicator Class

By Packaging Form

By End-User

By Region

February 2026

February 2026

February 2026

February 2026