February 2026

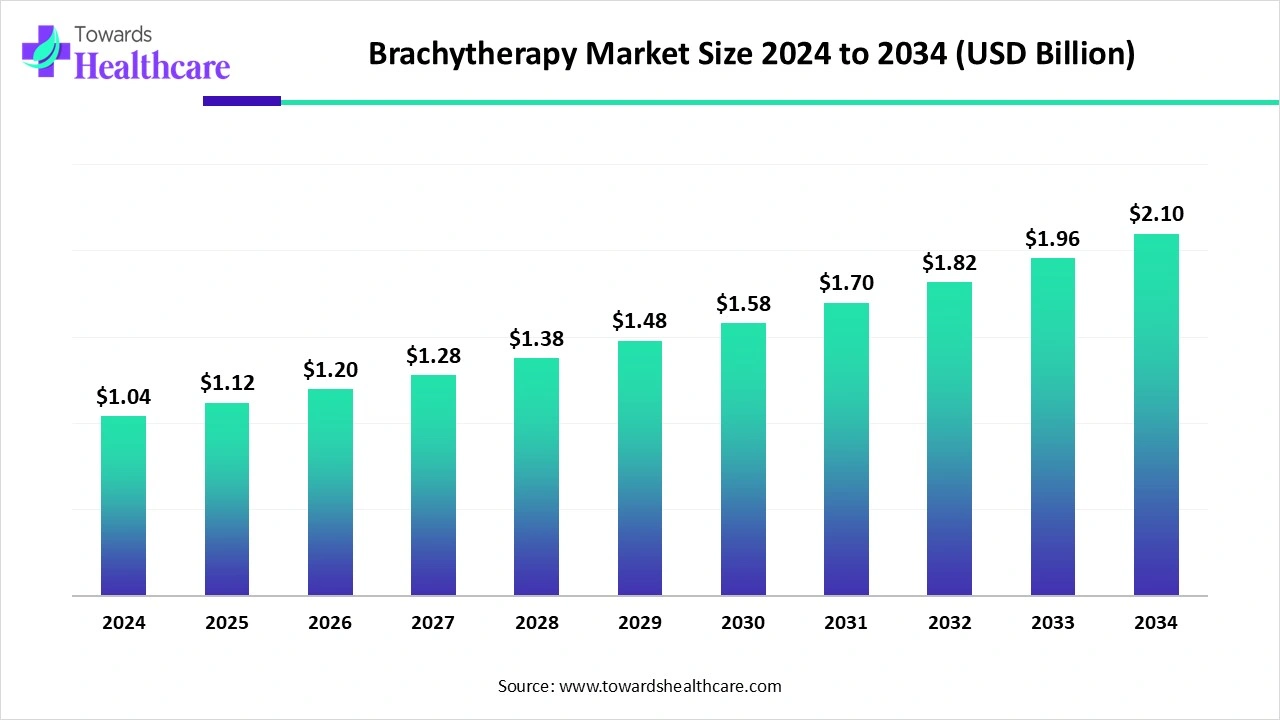

The global brachytherapy market size recorded US$ 1.04 billion in 2024, set to grow to US$ 1.12 billion in 2025 and projected to hit nearly US$ 2.10 billion by 2034, with a CAGR of 7.27% throughout the forecast timeline.

The brachytherapy market is witnessing significant growth due to the adoption of advanced imaging and treatment planning systems, which enhance precision and reduce side effects. Rising investment in cancer care infrastructure, increasing geriatric population, and expanding use of outpatient procedures are contributing factors. Additionally, collaborations between medical device companies and healthcare providers are accelerating the availability of innovative brachytherapy solutions, supporting the market’s steady global expansion.

| Table | Scope |

| Market Size in 2025 | USD 1.12 Billion |

| Projected Market Size in 2034 | USD 2.10 Billion |

| CAGR (2025 - 2034) | 7.27% |

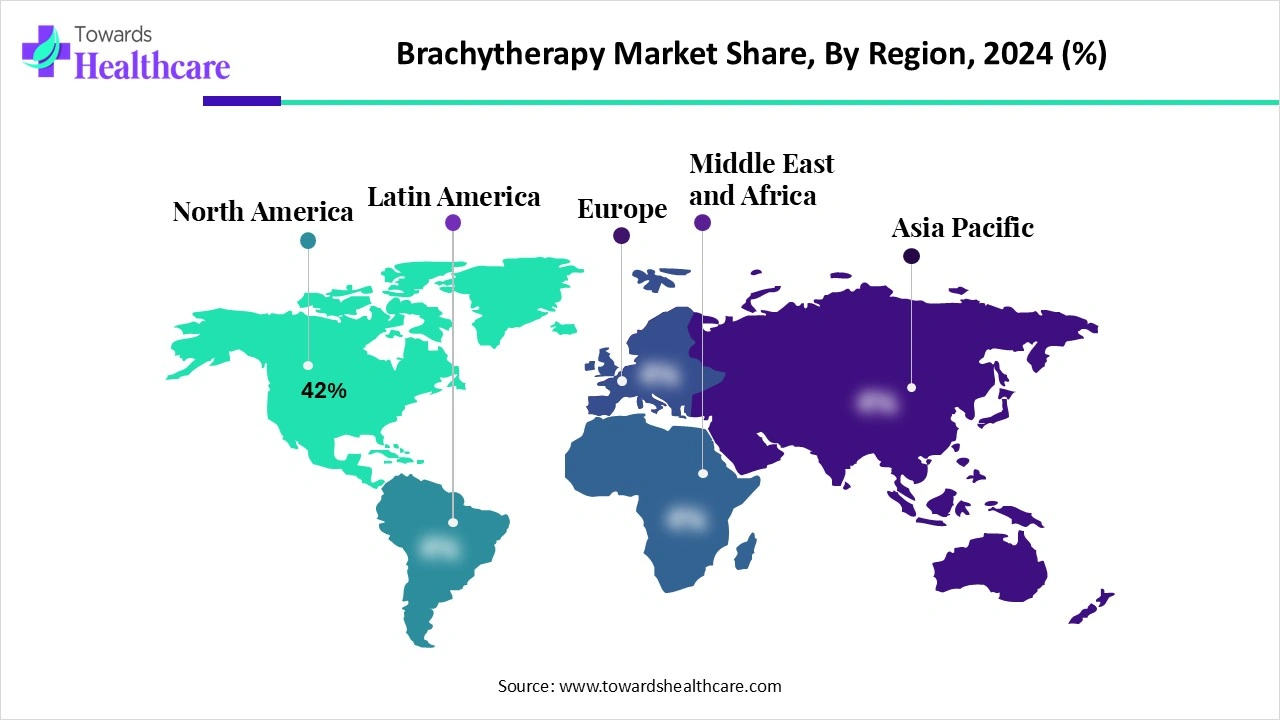

| Leading Region | North America 42% |

| Market Segmentation | By Type, By Application, By End User, By Technique, By Region |

| Top Key Players | Elekta AB, Varian Medical Systems (Siemens Healthineers), Eckert & Ziegler BEBIG, Isoray, Inc., CIVCO Medical Solutions, Becton, Dickinson and Company (BD), Theragenics Corporation, IBA Group, Accuray Incorporated, Seno Medical Instruments (brachytherapy collaborations), IsoAid, Boston Scientific Corporation (oncology solutions), Cook Medical, CR Bard (Becton, Dickinson), Qfix (oncology positioning and accessories), Mevion Medical Systems, C.R. Kennedy & Company, Radiadyne (Sun Nuclear Corporation), Xoft (A subsidiary of iCAD Inc.), IsoRay Medical (Cesium-131 brachytherapy seeds) |

The brachytherapy market consists of internal radiation therapy solutions where radioactive isotopes are placed directly inside or near a tumor to deliver localized, high-dose radiation while minimizing exposure to surrounding healthy tissues. It is primarily used in oncology treatments for prostate, gynecological, breast, and skin cancers. Compared to external beam radiation therapy (EBRT), brachytherapy offers shorter treatment times, improved precision, and reduced side effects. Market growth is driven by rising cancer incidence, technological advances in imaging-guided brachytherapy, and increasing preference for minimally invasive cancer treatments.

The brachytherapy market is evolving with a focus on personalized cancer treatment and improved patient comfort. Emerging low-dose-rate and high-dose-rate drives, along with portable treatment systems, are making therapy more accessible. Expansion into emerging economies, increased training for healthcare professionals, and rising investments in cancer research are further shaping market growth, enabling wider adoption of brachytherapy across various tumor types and healthcare settings worldwide.

Collaborations and Partnerships – Strategic alliances between device manufacturers, research institutes, and healthcare providers facilitate innovation and wider market penetration.

Technological Advancements – Innovations in treatment delivery, imaging, 3D planning, and robotic-assisted systems improve precision and outcomes, boosting market adoption.

AI can significantly impact the market by improving treatment precision, optimizing radiation dose planning, and reducing human error. Integration of AI-driven imaging and predictive analytics enables personalized therapy, enhancing patient outcomes and minimizing side effects. Additionally, AI can streamline workflow efficiency in hospitals and outpatient centers, lowering operational costs and treatment times. These advancements encourage wider adoption of brachytherapy, drive innovation in device development, and expand market potential across both developed and emerging regions.

Increasing prevalence of Cancer

The growing prevalence of cancer drives the brachytherapy market by increasing the need for diverse treatment approaches beyond conventional external radiation or chemotherapy. As cancer cases rise, healthcare systems seek cost-effective, shorter-duration therapies where brachytherapy provides an advantage. Its suitability for recurrent or complex tumors and potential for outpatient procedures further make it a preferred choice, aligning with the demand for efficient cancer management solutions and contributing to wider adoption across global oncology practices.

For Instance,

High Treatment Cost

High treatment costs restrain the brachytherapy market as they increase the financial burden on both healthcare providers and patients. Hospitals face significant expenses for installation, maintenance, and safety measures related to radioactive materials. These costs often make institutions hesitant to expand or adopt brachytherapy services. Additionally, in regions with limited reimbursement frameworks, patients may opt for more affordable alternatives, reducing the overall demand and slowing the broader acceptance of brachytherapy as a maintenance cancer treatment option.

Technological Advancement

Technological advancements create future opportunities in the brachytherapy market by enabling the development of portable and cost-efficient treatment systems that can be adopted in smaller clinics and emerging regions. Innovation in miniaturized applications, real-time dose monitoring, and cloud-based treatment planning is improving accessibility and convenience. Such progress not only broadens patient reach but also reduces operational barriers, allowing healthcare systems to integrate brachytherapy more widely and extend its use across diverse oncology settings.

For Instance,

The high-dose rate (HDR) brachytherapy segment led the brachytherapy market in 2024 as it supports flexible fractionation schedules and allows physicians to tailor doses based on tumor size and location. Its capability to integrate seamlessly with advanced imaging and planning software enhances treatment precision. Moreover, HDR systems are easier to standardize across clinics, enabling broader adoption worldwide. Growing clinical guidelines recommending HDR for multiple cancer types further strengthened its position as the leading brachytherapy modality.

The pulse-dose rate (PDR) brachytherapy segment is anticipated to record the fastest CAGR as it addresses the limitation of traditional methods by balancing treatment effectiveness with improved patient comfort. It uses reduced prolonged hospital stays, often seen with LDR, and offers smoother dose delivery compared to HDR for sensitive cases. Growing physician preference for its adaptability in head, neck, and gynecological cancers, along with increasing installation of advanced afterloading equipment, is driving its expanding role in modern cancer treatment.

The prostate cancer segment dominated the brachytherapy market in 2024 as continuous innovation in seed implants and image-guided techniques enhanced treatment precision and patient safety. Increasing preference for minimally invasive outpatient procedures in prostate cancer management also boosted adoption. Moreover, strong clinical guidance recommending brachytherapy for localized and intermediate-risk cases, along with expanding use in combination therapies, reinforced its role as the leading application area, driving the segment’s largest share in overall market revenue.

The breast cancer segment is projected to grow at the fastest CAGR as clinicians increasingly adopt brachytherapy for early-stage and recurrent cases due to its precision and ability to spare healthy tissue. Technological innovation, such as multi-catheter and balloon-based delivery systems, improves treatment flexibility and patient comfort. Rising investment in women’s health programs, expanding screening initiatives, and growing patient preference for outpatient procedures are further accelerating the use of brachytherapy in breast cancer management during the forecast period.

In 2024, the hospitals segment dominated the brachytherapy market as they provide integrated care combining diagnostics, treatment planning, and follow-up services under one roof. Their ability to invest in advanced brachytherapy equipment and maintain strict radiation safety protocols makes them preferred for both patients and clinicians. Furthermore, hospitals' collaborations with research institutions and access to a large patient base support high adoption rates, reinforcing their leading position as the primary end user segment in the global brachytherapy market.

The cancer treatment & radiotherapy centers segment is projected to grow at the fastest CAGR as more standalone and private facilities focus on providing specialized, high-precision oncology services. These centers can quickly adopt new technologies like AI-assisted planning, and HDR/PDR systems are attracting patients who prefer outpatient care over hospital stays. Increasing patient demand for convenient, cost-effective treatment and the expansion of dedicated cancer centers in emerging markets are further accelerating the segment's rapid adoption and market growth.

The interstitial brachytherapy segment led the market in 2024 as it allows flexible placement of radioactive sources within tumors, making it suitable for complex and irregularly shaped cancers. Its compatibility with advanced imaging techniques enhances treatment precision and safety. Additionally, growing physician preference for interstitial approaches in prostate and gynecological cancers, combined with established clinical guidelines supporting its effectiveness, reinforced its strong adoption, driving the segment to achieve the highest revenue share in the global brachytherapy market.

The intravascular brachytherapy segment is projected to grow at the fastest CAGR as it offers greater flexibility for targeting tumors in complex anatomical locations. Innovations in catheter-based delivery systems and real-time imaging guidance improve treatment precision and safety. Rising use in specialized cancer centers, combined with growing demand for outpatient procedures and faster recovery times, is accelerating its adoption. These factors make intramuscular brachytherapy a rapidly expanding technique within the overall market during the forecast period.

North America led the market share 42% in 2024, due to the early adoption of innovative treatment solutions and robust clinical research supporting efficacy. The region benefits from well-established cancer care networks, the availability of skilled oncologists, and extensive use of image-guided and high-precision brachytherapy techniques. Moreover, strong collaborations between hospitals, research institutions, and device manufacturers, along with growing patient demand for outpatient and minimally invasive treatments, reinforced North America’s position as the highest-revenue market globally.

The U.S. market is growing as healthcare providers increasingly adopt advanced technologies like AI-assisted planning and real-time imaging for precise radiation delivery. Expansion of outpatient cancer centers and a shift toward minimally invasive treatments are improving accessibility and patient convenience. Additionally, rising investments in oncology infrastructure, clinical trials supporting new brachytherapy applications, and patient preference for shorter, effective therapies are driving the market’s steady growth across the country.

The market in Canada is expanding as more hospitals and cancer centers adopt innovative radiation delivery systems, including portable and automated devices. Increasing focus on personalized oncology treatments and the integration of advanced planning software improves treatment accuracy and efficiency. Additionally, rising collaborations between research institutions and medical device companies, along with government initiatives promoting early cancer detection and minimally invasive therapies, are driving wider adoption, contributing to steady growth in Canada’s market.

The Asia-Pacific market is projected to grow rapidly as more private and specialized cancer centers adopt advanced treatment technologies. Rising demand for outpatient and cost-effective therapies, along with increasing availability of trained oncology professionals, is fueling adoption. Additionally, collaborations between local healthcare providers and international device manufacturers, coupled with government support for cancer screening and treatment programs, are driving market expansion, making the region the fastest-growing segment during the forecast period.

R&D- R&D in brachytherapy is advancing personalized cancer care through the use of AI, robotic systems, and advanced imaging to enhance dose precision and minimize side effects. Innovations include new radioactive isotopes, 3D-printed applicators, and intensity-modulated techniques to more accurately target tumors while protecting healthy tissue. Studies are also exploring combination therapies with chemotherapy or immunotherapy, aiming to improve effectiveness and overcome challenges like procedural invasiveness and the need for specialized clinical expertise.

Clinical Trials- Clinical trials in brachytherapy are increasingly targeting the development of advanced delivery systems, optimized treatment planning, and expanded applications for cancers such as prostate, cervical, liver, and breast. Typically led by academic institutions, these Phase 2 and 3 studies assess safety and effectiveness, focusing on improving patient outcomes while reducing side effects. Techniques like image-guided planning and high-dose-rate (HDR) brachytherapy are central to these trials, aiming to enhance precision and overall treatment efficiency.

Patient Support and Services- Patient support in brachytherapy involves thorough pre-treatment consultations with oncologists and nurses, personalized education on the procedure and potential side effects, and post-treatment guidance, including precautions around pregnant women and children. Care also includes dietary management, like a low-residue diet to ease bowel function, and the use of patient-reported outcome measures (PROMs) to track well-being, optimize recovery, and enhance the overall treatment experience.

In February 2025, Elekta unveiled an enhanced version of its Flexitron HDR brachytherapy platform, featuring a redesigned user interface and integrated real-time planning capabilities. This upgrade aims to streamline the treatment workflow, reduce potential errors, and improve overall efficiency in brachytherapy procedures. The new interface offers a logical workflow with intuitive system operation, providing more logic and fewer variables and the potential for error. Additionally, the system includes a treatment communication console that facilitates seamless interaction between clinicians and enhances the overall treatment experience.

By Type

By Application

By End User

By Technique

By Region

February 2026

February 2026

February 2026

February 2026