January 2026

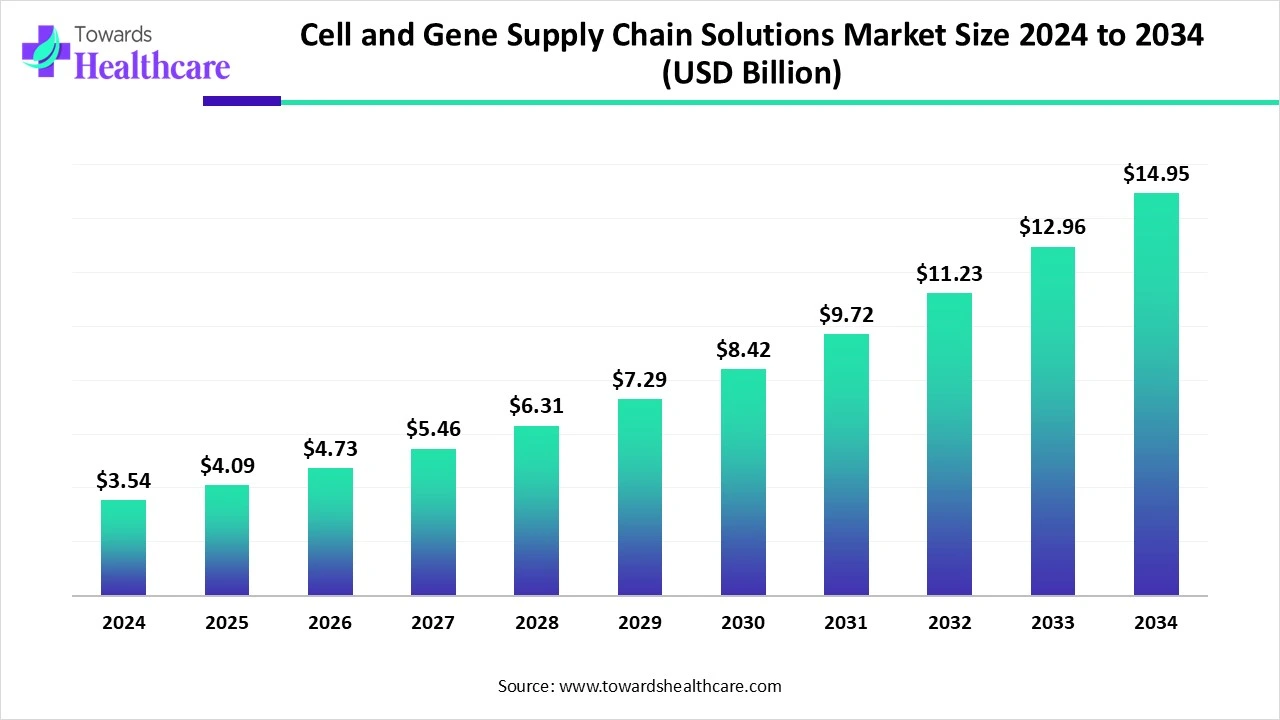

The global cell and gene supply chain solutions market size is calculated at US$ 3.54 billion in 2024, grew to US$ 4.09 billion in 2025, and is projected to reach around US$ 14.95 billion by 2034. The market is expanding at a CAGR of 15.54% between 2025 and 2034.

The pharmaceutical industry is not the only industry that uses cell and gene supply chain solutions. They are being utilised more and more in fields like biotechnology, R&D, and even agriculture, where gene editing technologies are becoming more popular. Highly specialised supply chains are required in biotechnology as a result of the use of cell and gene treatments to treat genetic abnormalities and some types of cancer.

Gene-edited animals and crops are being introduced in agriculture to increase yields and resistance to disease, necessitating the need of strong logistical systems. This wide range of uses is propelling the market's expansion as more companies recognise how crucial scalable, effective, and compliant supply chain solutions are for cutting-edge biotechnologies.

| Table | Scope |

| Market Size in 2025 | USD 4.09 Billion |

| Projected Market Size in 2034 | USD 14.95 Billion |

| CAGR (2025 - 2034) | 15.54% |

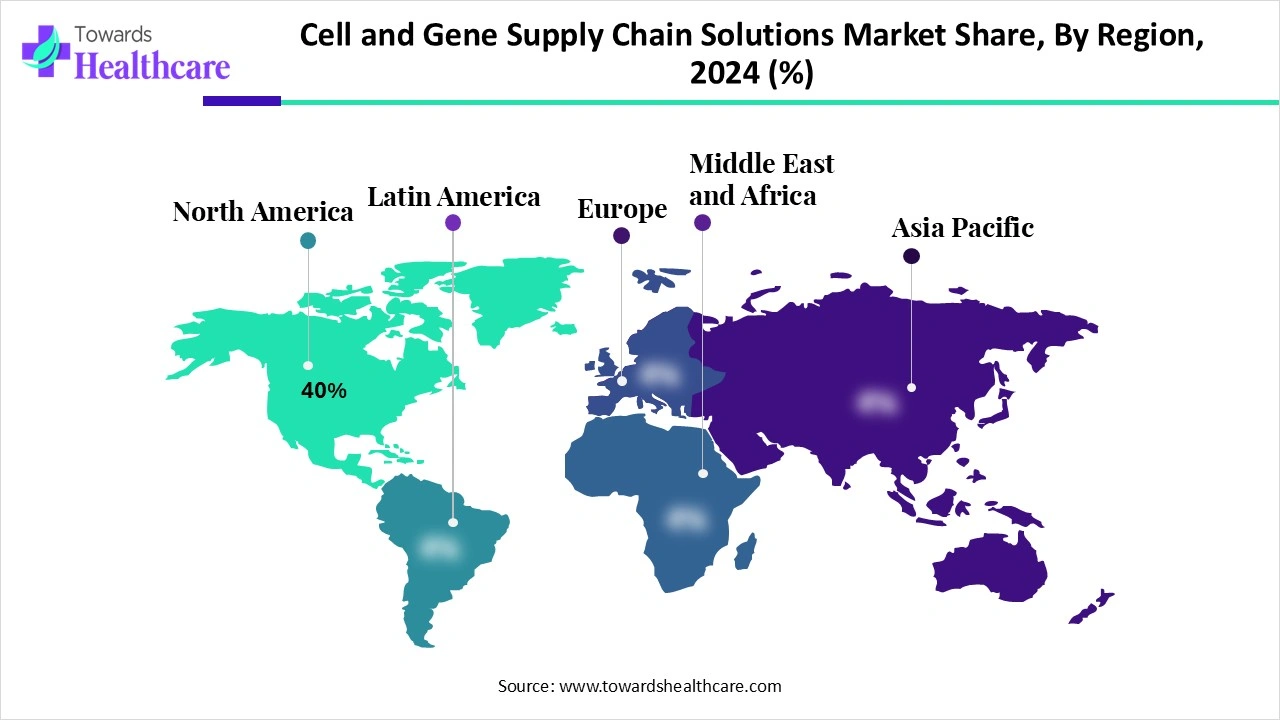

| Leading Region | North America 40% |

| Market Segmentation | By Therapy/Product Type, By Service Type/Solution, By End User, By Region |

| Top Key Players | Thermo Fisher Scientific, Lonza Group, Cryoport, Inc., Marken (part of UPS), World Courier, Xylogics, Inc., Patheon (part of Thermo Fisher Scientific), Recipharm AB, Catalent, Inc., BioLife Solutions, Inc., Acelity / KCI (3M), JN Biosciences, Envigo RMS, VWR International, PCI Pharma Services, BioStorage Technologies, GeneCure Biotech, Cryogenic Control Solutions, Paragon Bioservices, Waisman Biomanufacturing |

Rising CDMOs & CROs: Cell and gene therapies are gaining significant attention due to their potential in curing rare diseases and delivering better outcomes than other therapeutics. Due to the rising demand pharmaceutical and biotech companies face challenges in their supply chain and logistics processes. Due to this, a lot of CDMOs and CROs are entering into the cell and gene supply chain solutions market to provide supply chain solutions to pharma and biotech companies.

For instance,

Large datasets including manufacturing characteristics, quality control measures, and patient-specific factors may be processed by sophisticated machine learning algorithms to find minute patterns that affect production results. These realisations improve batch consistency, provide more accurate process control, and may lower manufacturing defects. Predictive models driven by AI can also more accurately estimate capacity needs, allowing for more effective resource allocation and fewer production bottlenecks.

Rising Demand for Personalized Medicine

An new approach to illness prevention and treatment that considers individual variances in pharmaceutical response is called personalized medicine. Powerful new discoveries and authorised therapies that are suited to certain individual traits, like a person's genetic composition or the genetic profile of their tumour, have already resulted from advancements in personalized medicine. One of the most individualised medical treatments is probably autologous cell therapy, which uses a patient's own cells to create a customised product that can only be given to the original donor.

Regulatory Compliance Challenges

In cell and gene supply chain solutions market, the CGT supply chain has particular difficulties, ranging from security and customs clearance to temperature and time management and regulatory compliance. The intricate laws controlling the transportation of CGT materials, such as GDP and IATA restrictions, must be complied with by the supply chain. This also include finishing important shipment documentation.

What are the Opportunities in the Market?

With the promise of life-altering and even life-saving outcomes for patients worldwide, cell and gene therapy ushers in a new era of medicine. Despite the particular difficulties faced by the life sciences, partners working with the industry are witnessing more development prospects as the momentum surrounding CGT continues to build through increasing investment and innovation.

By therapy/product type, the cell therapies segment captured the major revenue of the cell and gene supply chain solutions market in 2024. The FDA has expressed a focus on developing cell and gene therapies (CGT) in recent years, reflecting the industry's hope that these treatments may provide long-lasting and focused therapy choices. As of August 1, 2024, the US, EU, and Japan have authorised 13, 18, and 13 cell therapy products, respectively.

By product/therapy type, the gene therapies segment is anticipated to grow at the fastest CAGR in the cell and gene supply chain solutions market during the forecast period. Gene therapy has advanced significantly, especially in the treatment of some types of cancer, neurological illnesses, and haematological problems. A workshop entitled "Scientific Advancements in Gene Therapies: Opportunities for Global Regulatory Convergence" was held on September 4, 2024, by the FDA, the Gates Foundation, and the Reagan-Udall Foundation for the FDA (FDA Foundation). The event underlined how urgently regulatory frameworks must be changed to support gene therapy access worldwide, especially in regions with low resources like sub-Saharan Africa.

By service type/solutions, the cold chain logistics segment led the cell and gene supply chain solutions market in 2024. CGTs are novel treatments that must be handled carefully during administration, transportation, and collecting since they are very delicate. A crucial component of operationalizing cell and gene therapy (CAGT) studies is logistics management. Better equipped sites, less investigational product (IP) failures, quicker trials, and ultimately cheaper costs are made possible by the capacity to comprehensively manage the logistical and supply chain implications of CAGT.

By service type/solutions, the regulatory & compliance support segment is estimated to witness the fastest growth in the cell and gene supply chain solutions market during the studied timeframe. As CGTs have advanced, regulatory affairs' responsibility has grown to ensure that these ground-breaking treatments adhere to the strictest safety and effectiveness guidelines. Regulatory experts now supervise a far greater variety of operations throughout the gene therapy lifecycle, having previously concentrated on guaranteeing safety and effectiveness during early-stage studies. This entails directing the design of clinical trials, ensuring strict manufacturing standards, and putting post-market surveillance in place to keep an eye on long-term safety.

By end-user, the cell and gene therapy manufacturers segment held the major share of the cell and gene supply chain solutions market in 2024. Well-known companies like Bristol Myers Squibb (BMS) and Gilead/Kite have projected impressive quarterly sales for their CAR-T portfolios in 2024. There are over 345 businesses in the gene therapy industry globally, ranging from well-known pharmaceutical giants to up-and-coming biotech enterprises. Innovation is expanding therapy choices for acquired and inherited disorders as competition increases.

By end-user, the contract development & manufacturing organizations (CDMOs) segment is anticipated to grow at the highest CAGR in the cell and gene supply chain solutions market during 2025-2034. CDMOs are specialised partners that help businesses develop and produce cell and gene treatments by providing facilities, knowledge, and tools. These CDMOs help treatments for illnesses like cancer and rare genetic disorders by managing intricate processes, ranging from early process development and DNA manufacture to viral vector manufacturing and cell processing.

By technology/platform, the cryogenic storage systems segment was dominant in the cell and gene supply chain solutions market in 2024. Perhaps the most important operational component for a successful cell and gene therapy (CGT) study is temperature management. Because CGTs frequently need to be maintained at temperatures as low as -185°C, specific cold-chain equipment, infrastructure, and operating concerns are needed.

By technology/platform, the automated monitoring & tracking solutions segment is estimated to be the rapidly growing segment in the cell and gene supply chain solutions market during the predicted period. By incorporating artificial intelligence (AI), machine learning, and sensor technologies into manufacturing processes, automated monitoring and tracking systems for cell and gene therapy (CGT) improve production visibility, product quality, and safety. These technologies lower the dangers of manual handling and microbiological contamination, use wearable technology and closed systems to collect data in real-time, and offer resources for cost-cutting and process optimisation.

North America dominated the cell and gene supply chain solutions market share 40% in 2024. North America is well-suited to meet the intricate supply chain needs of cell and gene treatments because of its sophisticated infrastructure and logistical skills. Due to the region's extensive manufacturing, distribution, and transportation networks, treatments may be delivered to patients throughout the continent and abroad quickly and effectively. Additionally, North America is the global leader in biotechnology investment and innovation, with a robust ecosystem of academic institutions, research institutes, and biopharmaceutical businesses.

The main professional membership organisation for researchers, doctors, patient advocates, and other professionals interested in gene and cell therapy is the American Society of Gene & Cell Therapy (ASGCT). Q1 2025 saw the launch of 79 gene therapy studies, eight more than the previous quarter, and a total of 12 start-ups in the U.S. raised $304.3 million in seed and Series A investment. 4,418 treatments, from preclinical to pre-registration, are currently under development.

Ten gene therapy medicines are authorised for sale in Canada. Additionally, the autologous gene-edited cell treatment exagamglogene autotemcel (exa-cel), developed by Vertex Pharmaceuticals and CRISPR Therapeutics, received marketing authorisation from Health Canada in September 2024.

Asia Pacific is estimated to host the fastest-growing cell and gene supply chain solutions market during the forecast period. Clinical trials and regulatory frameworks are dominated by nations like China and Japan, while South Korea and Singapore are becoming regional centres of innovation and industry. Through increased medical tourism and public-private partnerships, emerging nations like India are also gaining traction. The environment is becoming increasingly competitive due to an increase in government investment, regulatory fast-tracking, and cross-border partnerships.

The "China Biologics Going Global Forum 2025" focused on "Going Global, Gathering Towards the Future" and was held in Shanghai on July 2, 2025. Three key characteristics have been demonstrated by China's biopharmaceuticals: the process of globalisation has been greatly expedited; the innovation and global competitiveness of foreign goods have been much improved; and the market coverage has been steadily growing.

The Indian pharmaceutical business, which is sometimes referred to as the "pharmacy of the world," is flourishing. It increased from $40 billion in 2021 to an estimated $130 billion in 2030, and by 2047, it is predicted to reach $450 billion. In addition to meeting domestic demand, the Indian pharmaceutical sector controls more than 20% of the global pharmaceutical supply chain and supplies around 60% of the global vaccine demand.

Europe is expected to grow at a significant rate in the cell and gene supply chain solutions market during the forecast period. growing biotechnology investments and encouraging regulatory measures like the European Medicines Agency's PRIME plan. Strong cooperative relationships between public and commercial organisations make nations like Germany, the UK, and France hubs for clinical trials and research. Further driving market demand is the rising prevalence of uncommon and chronic illnesses. Market access is hampered by disparate healthcare systems and reimbursement practices, though. Numerous efforts have been launched to establish an effective industrial infrastructure and standardise the regulatory environment.

In 2024, there were 187 active advanced treatment clinical studies in the UK, a 7% increase from the year before. One notable example of this is the almost 70% rise in Phase I studies, which went from 24 to 41. The information is displayed in the UK 2024 Advanced Therapy Medicinal Product (ATMP) Clinical Trials Database maintained by the Cell and Gene Therapy Catapult (CGT Catapult).

In January 2025, although cell and gene therapy is developing rapidly, the industry still uses antiquated, laborious methods for sterile processing, such as tube welding or biosafety cabinets, according to Troy Ostreng, Senior Product Manager for CPC's biopharmaceutical division. To create a sterile flow route, customers may now simply snap the connection halves together in CGT processing components that come with the MicroCNX Nano connectors. This is a significant development for applications of CGT.

By Therapy/Product Type

By Service Type/Solution

By End User

By Region

January 2026

January 2026

January 2026

January 2026