January 2026

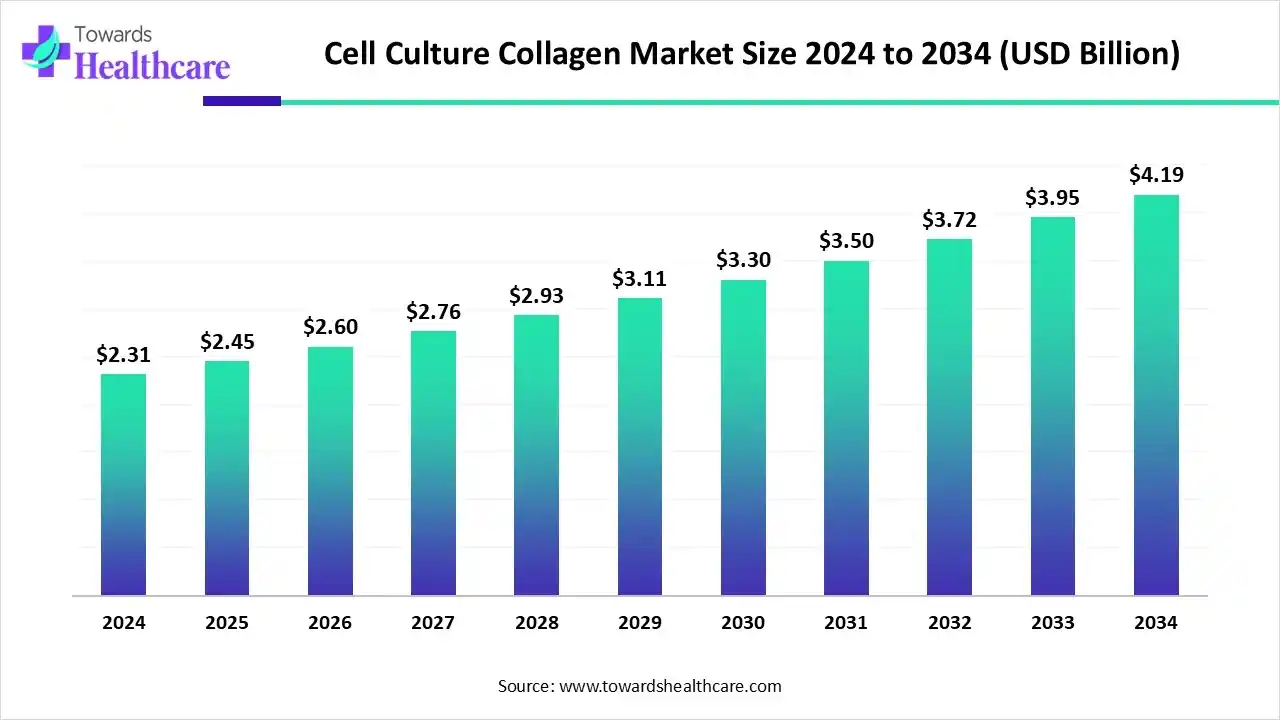

The global cell culture collagen market size is estimated at US$ 2.31 billion in 2024 and is projected to grow to US$ 2.45 billion in 2025, reaching around US$ 4.19 billion by 2034. The market is projected to expand at a CAGR of 6.15% between 2025 and 2034.

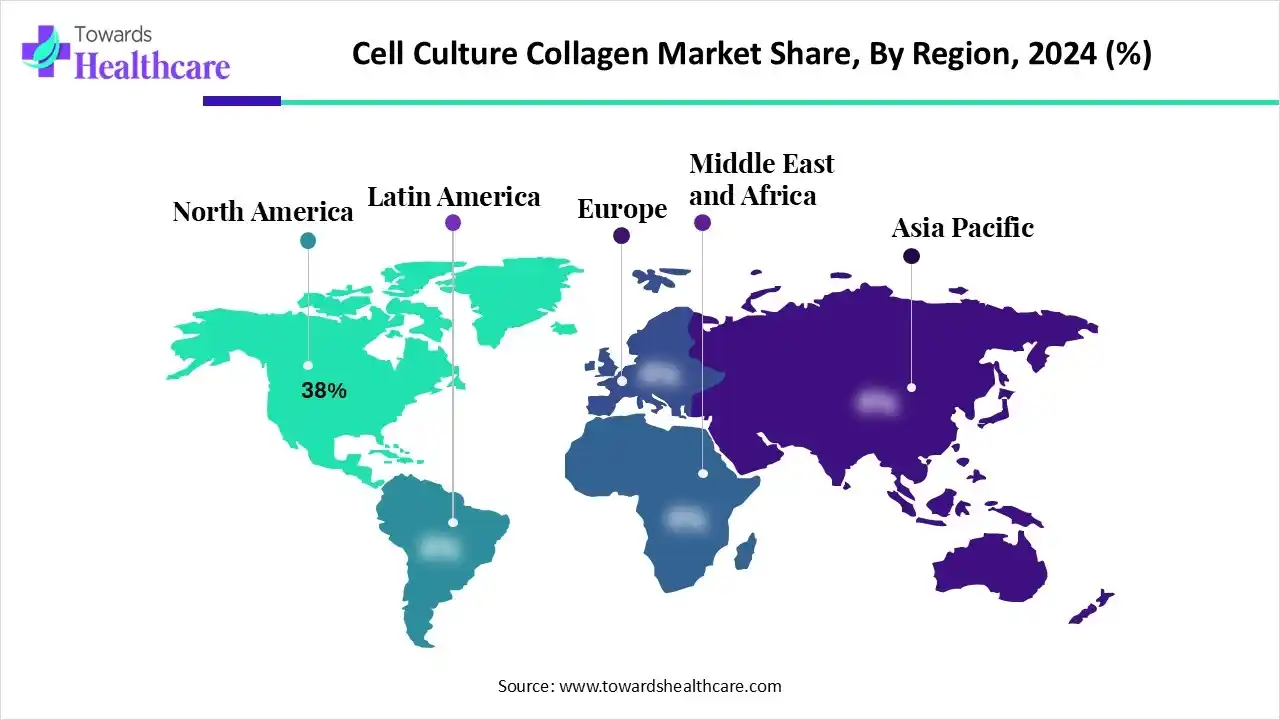

The cell culture collagen market is growing because of rising applications in tissue engineering and advancements in 3D cell culture technology. North America is dominated by a strong presence of advanced biotech and pharma infrastructure and adoption of the organ-on-chip model, while the Asia Pacific is the fastest growing as this region is cost cost-effective manufacturing hub and a rise in stem cell and tissue engineering research.

| Table | Scope |

| Market Size in 2025 | USD 2.45 Billion |

| Projected Market Size in 2034 | USD 4.19 Billion |

| CAGR (2025 - 2034) | 6.15% |

| Leading Region | North America by 38% |

| Market Segmentation | By Source, By Product Type, By Application, By Form, By End User, By Region |

| Top Key Players | Advanced BioMatrix Inc., Collagen Solutions plc (InspireMD Group), Nippi Collagen Industries Ltd. (Japan), Jellagen Ltd. (U.K.), FUJIFILM Wako Pure Chemical Corp. (Japan), Corning Incorporated (U.S.), Thermo Fisher Scientific Inc. (U.S.), Merck KGaA (Sigma-Aldrich), Cell Systems Corporation (U.S.), BioVision Inc., Rousselot (Darling Ingredients Inc.), Rockland Immunochemicals Inc., Koken Co., Ltd. (Japan), PeproTech (part of Thermo Fisher), TaKaRa Bio Inc. (Japan), AMS Biotechnology (AMSBIO), Matrix Bioscience GmbH (Germany), BioMatrix Specialty Collagen Products, 3D Matrix Medical Technology, CollPlant Biotechnologies Ltd. (Israel) |

The cell culture collagen market comprises naturally derived and recombinant collagen materials used as a substrate, scaffold, or supplement in cell culture systems. Collagen provides the extracellular matrix (ECM)-like environment essential for cell adhesion, proliferation, and differentiation, making it critical for applications in tissue engineering, regenerative medicine, drug discovery, and 3D cell culture models.

The market’s growth is driven by the rising adoption of 3D cell culture and organoid models, expansion in regenerative therapies, and the shift toward xeno-free and recombinant collagen sources for better reproducibility and ethical compliance.

Integration of AI drives the growth of the cell culture collagen market. AI-driven technology makes it easier to preserve and analyze cell cultures round-the-clock, confirming that they are evolving properly and preventing them from being damaged or contaminated during feeding. AI-based technology allows the development of methods for accelerated 3D models in ways that ensure reproducibility and consistency. Additionally, it allows researchers to detect outliers at the plate, well, or experiment level and eliminate these from the experiment completely. Recently, scientists have grown spheroids or organoids from various cell sources, with the help of AI-based technology.

For Instance,

By source, the bovine collagen segment led the cell culture collagen market with approximately 46% share, as this type of collagen offers several massive benefits, such as enhanced skin health and relief of osteoarthritis and osteoporosis issues. Major research presents that bovine collagen helps joint and muscle health, recovery from injury, enhanced strength of ligament strength, and many other advantages. Bovine collagen is a supplement made from the hide, bones, and tendons of cows.

On the other hand, the human recombinant collagen segment is projected to experience the fastest CAGR from 2025 to 2034, as recombinant collagen claims more advantages than tissue-extracted collagen, like improved standardization and tunability, and it evades issues of immunogenicity and pathogen transmission. This collagen provides outstanding biocompatibility and cell adhesion. It plays a significant role in encouraging tissue regeneration and repair, with predominant strength in wound healing, skin repair, and anti-inflammation.

By product type, the type I collagen segment led the cell culture collagen market in 2024 with approximately 52% share, as type I collagen mainly helps in the growth of skin, bones, and tendons. Type I collagen binds integrins on the cell surface. It efficiently promotes cell migration, proliferation, cellular adhesion, and differentiation of various cells, like stem cells, fibroblasts, and chondrocytes. It is the predominant collagen in connective tissues and a primary part of the interstitial matrix in different tissue types. It is one of the most useful natural materials generally used for 3D scaffolds.

On the other hand, the type II collagen & others segment is projected to experience the fastest CAGR from 2025 to 2034, as collagen peptide-type II is a supplement that helps to lower the pain and swelling in joints. It also supports in promoting the formation of soft connective tissue and reduces friction between joints. This makes physical activities easier by lowering stiffness and rigidity. Collagen type II is an important material for repairing cartilage imperfections. It serves as an ordinary and biomimetic scaffold that creates a particular microenvironment for chondrocytes and mesenchymal stem cells (MSCs).

By Application, the tissue engineering & regenerative medicine segment led the cell culture collagen market in 2024 with approximately 38% share, as collagen-based biomaterials are used to manufacture novel three-dimensional tissue-engineered nervous system models to induce 3D axonal migration and myelination of sensory or motor neurons by Schwann cells in the connective tissue. Collagen has massive potential in designing the microenvironment of myocardium, that used to maintain the transplanted cells at the infarct site, restore the strain of the myocardial wall, and improve the cell function of heart tissue regeneration.

On the other hand, the stem cell research segment is projected to experience the fastest CAGR from 2025 to 2034, as collagen offers a biocompatible and structurally supportive microenvironment that mimics the native extracellular matrix (ECM) of stem cells. Collagen is a widely distributed class of proteins in the human body. The application of collagen-based biomaterials in the sector of stem cell research. Different applications of collagen-based biomaterials have been developed for tissue engineering, goal of offering a functional material for use in targeted medicine from the laboratory bench to the patient's bedside.

By form, the liquid collagen segment led the cell culture collagen market in 2024 with approximately 45% share, as this type of collagen acts as a supplement that contains collagen proteins suspended in a liquid. Various liquid collagen supplements have purified water as their liquid component, though some contain juices or other liquids.

On the other hand, the gel/hydrogel collagen segment is projected to experience the fastest CAGR from 2025 to 2034, as collagen hydrogels provide many advantages, such as low cost, high stability, and predominant water retention strength. Additionally, it is abundant in phosphorus, nitrogen, and potassium. Hydrogels have a porous structure and a huge network of protofibrils, and collagen-based hydrogels enable cell migration and colonization, remodeling new tissue, and also support wound healing.

By end user, the pharmaceutical & biotechnology companies segment led the cell culture collagen market in 2024 with approximately 40% share, as collagen is extremely significant to pharmaceutical and biotechnology companies for its biodegradability, biocompatibility, and versatile structure. Collagen supplements are available in the form of powders and pills. They generally contain two or three amino acids. They are sold as collagen peptides or hydrolyzed collagen.

On the other hand, the other segment is projected to experience the fastest CAGR from 2025 to 2034, as collagen supplements enhance muscle mass, prevent bone loss, relieve joint pain, and improve skin health by lowering wrinkles and dryness. Much research reveals that collagen use could result in a lowering of wrinkles, regeneration of skin, and reversal of the aging of skin.

North America is dominant in the market in 2024, with approximately 38% share, due to the presence of a robust biotechnology sector, growing funding for biomedical research, and a major presence of key players. Significant investment from both public and private sources drives innovation and market growth. Growing initiatives from organizations such as the U.S. National Institutes of Health (NIH) assign billions of dollars in biomedical research, including cell-based research for chronic diseases like cancer and Alzheimer's

For Instance,

In the U.S., scientists broadly use cell culture collagen as a surface coating on labware such as flasks and dishes. This creates a more eco-friendly, adhesive environment that encourages the growth, accessory, and advancement in anchorage-dependent cells for a variety of cell-based assays. The increasing demand for biopharmaceuticals, like vaccines, monoclonal antibodies, and other therapeutic proteins, contributes to the growth of the market.

Canada is experiencing significant investment and growth in personalized medicine and stem cell development. Increasing funding from both public and private sources helps extensive research and development (R&D) initiatives. Canada is a hub of major cell culture industries, including STEMCELL Technologies, which vigorously develops and manufactures cell culture services.

Asia Pacific is the fastest-growing region in the market in the forecast period, due to this region being poised to become a cell production powerhouse, building on its success in clinical trials and biotechnology innovations. China has established itself as a manufacturing leader, and other countries such as South Korea, Singapore, and others in Asia are making strides in improving their biomanufacturing capabilities. The support of the local government and funding are significant in driving the growth of the biopharma sector, which contributes to the growth of the market.

The research and development (R&D) technology for cell culture collagen mainly includes sourcing and extraction, purification and sterilization, product formulation and characterization, and cell compatibility and functional testing

Key Players: Thermo Fisher Scientific and Corning Life Sciences

Clinical trials of a cell culture collagen involve preclinical research, safety and dosage study, effectiveness and adverse effects study, confirmation and comparison, and long-term monitoring.

Key Players: Merck KGaA and Evonik

The collagen serves as a bio-mimetic, three-dimensional (3D) environment, similar to the body's natural extracellular matrix (ECM), to support cell adhesion, growth, and differentiation.

Key Players: Collplant Biotechnologies and Chondrex, Inc.

By Source

By Product Type

By Application

By Form

By End User

By Region

January 2026

January 2026

January 2026

January 2026