March 2026

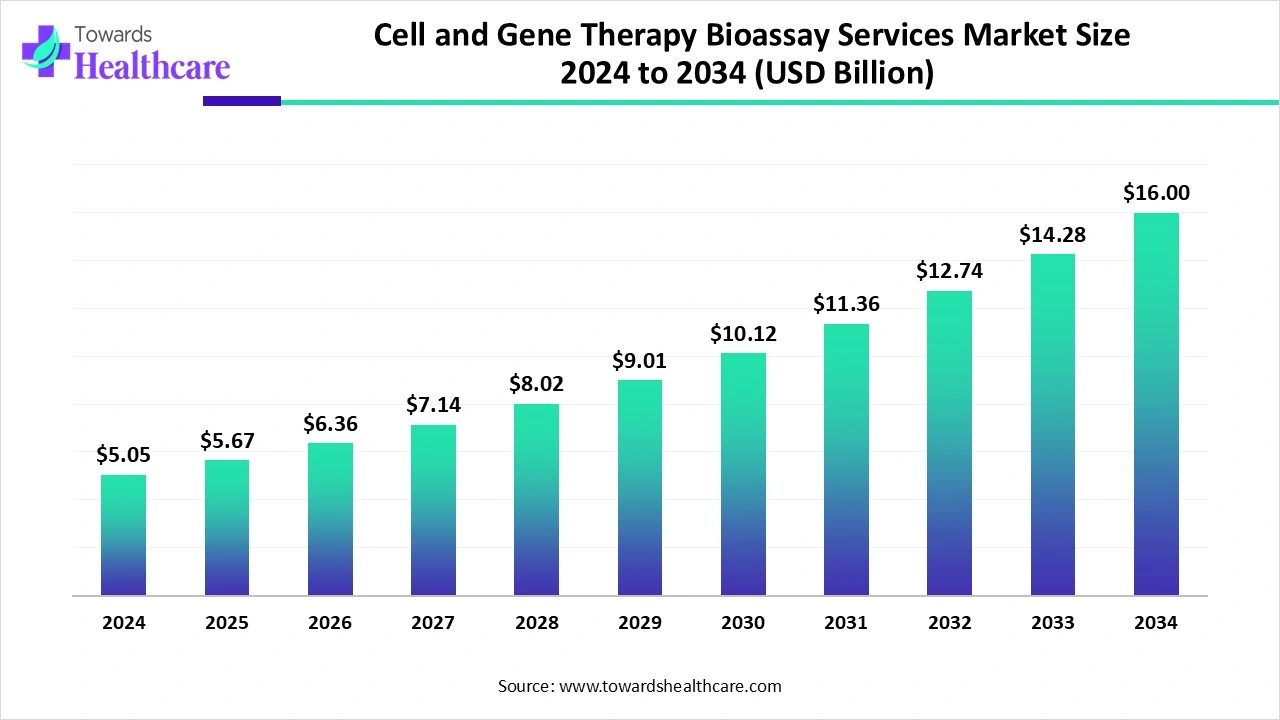

The global cell and gene therapy bioassay services market size is calculated at US$ 5.05 billion in 2024, grew to US$ 5.67 billion in 2025, and is projected to reach around US$ 16 billion by 2034. The market is expanding at a CAGR of 12.24% between 2025 and 2034.

Around the globe, there is a rise in chronic and genetic disorders, cases are widely fueling demand for advanced and more efficacious cell and gene therapies. These developing therapies are encouraging the adoption of novel and robust bioassays to evaluate a product’s safety, purity, and quality. The widespread development of CRISPR, CAR-T cells, and RNA-based treatments is assisting the growth of the cell and gene therapy bioassay services market. Furthermore, the market is expanding due to the increasing outsourcing trend and broader range of demand for customized treatments, with government initiatives, mainly in Japan and Singapore.

| Table | Scope |

| Market Size in 2025 | USD 5..67 Billion |

| Projected Market Size in 2034 | USD 16 Billion |

| CAGR (2025 - 2034) | 12.24% |

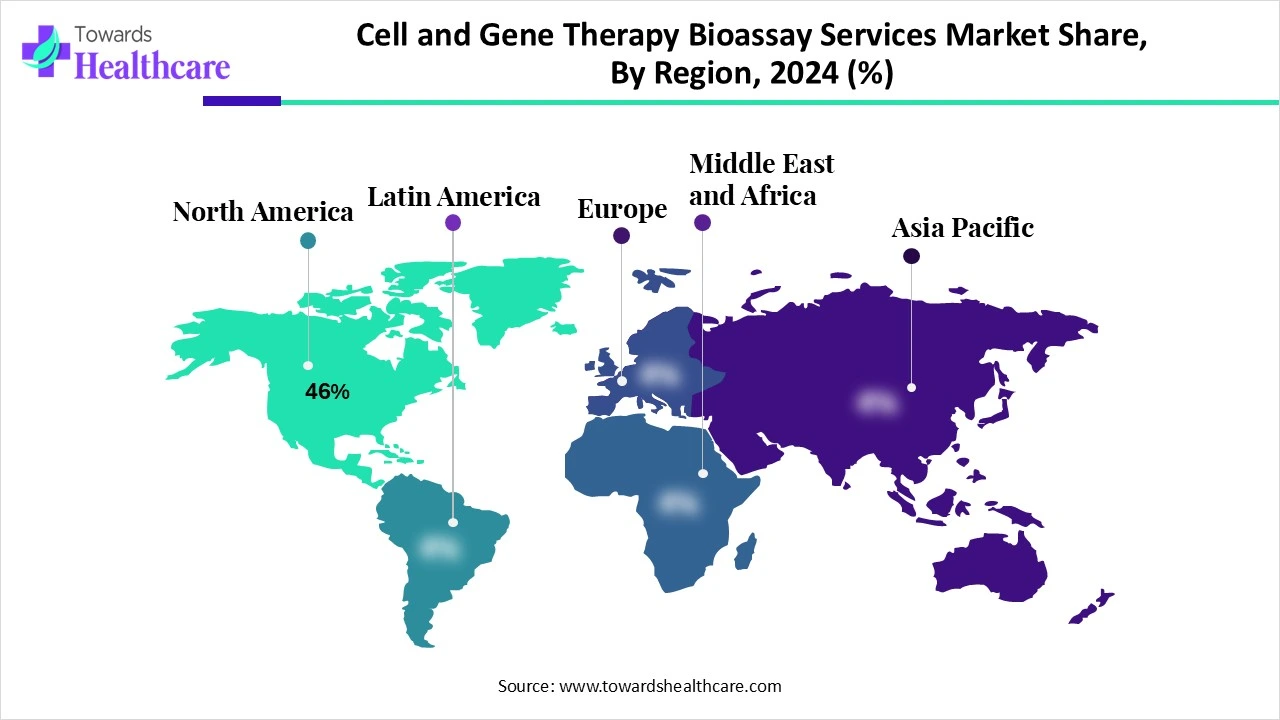

| Leading Region | North America 46% |

| Market Segmentation | By Assay Type, By Therapy Type, By Application, By End User, By Region |

| Top Key Players | Charles River Laboratories, WuXi AppTec, SGS , Eurofins Scientific , Lonza Group, PPD, BioAgilytix Labs, ICON plc , Labcorp Drug Development, QPS Holdings, Intertek Group, Catalent, Nexelis, Medpace, Covance, KBI Biopharma, Creative Biolabs, Aragen Bioscience, Alliance Pharma, Syneos Health |

The cell and gene therapy bioassay services market refers to specialized testing and analytical services that assess the safety, potency, identity, and efficacy of advanced therapies, including cell-based and gene-modified products. Bioassays are critical for regulatory compliance, batch release, comparability studies, and long-term stability assessments. These services support pharmaceutical and biotechnology companies in accelerating product development and commercialization while ensuring that therapies meet stringent quality standards for patients.

The market is focusing on specialized services to assess the potency, safety, and quality of cell and gene products, which accelerates the adoption of advanced genetic engineering approaches.

Primarily, AI-powered tools assist in the detection of therapeutic targets, designing customized protocols, monitoring patient responses, and estimating possible bottlenecks. This further supports automating complex bioassay processes, such as single-cell analysis and viral vector design. Recently, Achilles Therapeutics has merged its PELEUS platform by using AI and real-world data to determine clonal neoantigens for tailored cancer therapies, united with their VELOS manufacturing platform to produce relevant T cells.

A Surge in Outsourcing and Personalized Trend

In 2025, the global cell and gene therapy bioassay services market is experiencing major growth due to the rising outsourcing trend. This trend is accelerated through numerous pharmaceutical and biopharmaceutical companies, to access scientific expertise and advanced technologies without the requirement for extensive in-house facilities. Alongside, another emerging trend is a rise in movement towards personalized medicine, which depends on targeted and validated bioassays. These approaches are necessary for the development and manufacturing of widely tailored cell and gene products.

Barrier in Regulatory Landscape and Safety

Along with the immense progress of the respective market, there are certain hurdles limiting this progress, such as the involvement of rigorous and lengthy approval processes. These regulatory complexities generate delays and obstacles for market arrival and commercialization. Whereas, there may arise issues related to possible side effects, like off-target effects or adverse immune responses.

Enhancement in Technological Advances

The widespread adoption of highly sophisticated technologies, including CRISPR, CAR-T cells, and RNA-based treatments, is accelerating novel advances in the global cell and gene therapy bioassay services market. Along with this, researchers are expanding the applications of these technologies in inherited genetic disorders (e.g., sickle cell disease, hemophilia) and acquired conditions, such as cancers, infectious diseases like HIV, and neurodegenerative diseases. As well as there are growing opportunities to enhance in vivo gene editing therapies by using these evolving bioassay services.

In 2024, the potency assays segment registered dominance in the cell and gene therapy bioassay services market. Due to the rising regulatory demands for proven efficacy and safety, the growing pipeline of these advanced therapies is mainly boosting the adoption of these types of assays. Besides this, an increasing emphasis on precision medicine, which necessitates precise testing, and the strategic outsourcing of complex bioassay development to specialized service providers are also impacting the overall segment expansion.

However, the functional assays segment is estimated to grow at the highest CAGR during 2025-2034. This type of assay possesses several applications in the biotech area, such as evaluating novel drug compounds, understanding gene and protein function, validating the quality of cell and gene therapies, and assessing immune responses to disease and treatments. Currently, these assays are focusing on escalating high-throughput screening, reporter-gene assays, immune-monitoring techniques (such as flow cytometry and ELISpot), and biomarker integration, which are ultimately assisting the market progression.

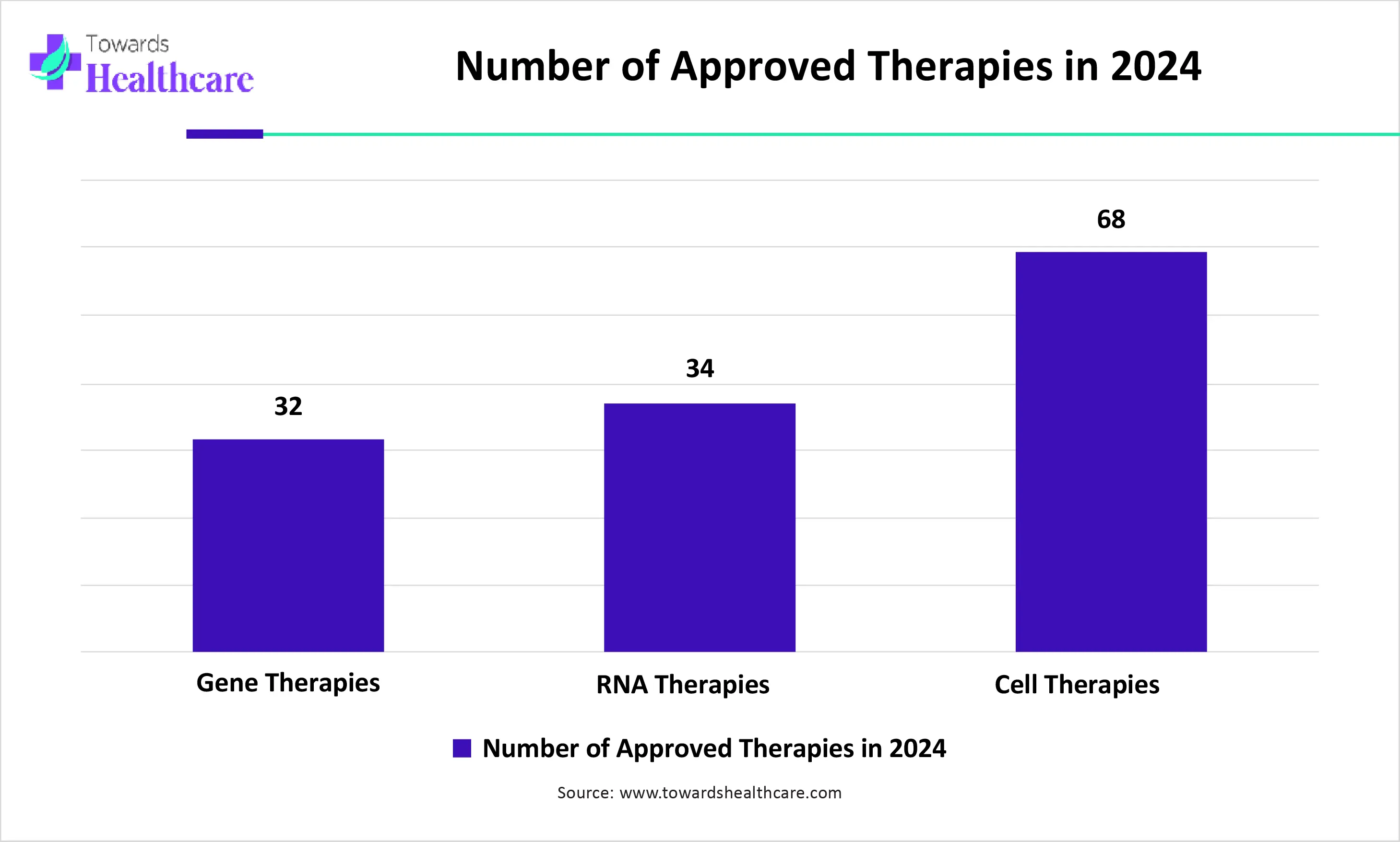

In the cell and gene therapy bioassay services market, the cell therapy segment was dominant in 2024. The segment is driven by the growing cases of genetic and chronic diseases, and the requirement for robust safety and efficacy testing needed by regulatory agencies. Nowadays, the market is adopting innovative approaches for this therapy, including advances in allogeneic 'off-the-shelf' therapies for higher accessibility, innovative CAR T-cell engineering with better targeting and metabolic reprogramming, and the application of new technologies, particularly base editing and synthetic biology.

And, the gene therapy segment is predicted to expand rapidly in the coming era. Ongoing rigorous clinical trial pipeline, extensive public and private investments, advances in gene therapy platforms, and demand for outsourcing specialized bioassay services to CROs are immensely fueling the development of gene therapy. Day by day, researchers are greatly developing highly accurate gene-editing tools, such as base and prime editors that omit DNA double-strand breaks, improving CRISPR fusion systems for larger genetic insertions, and the incorporation of epigenetic and mobile genetic element (MGE) editors for stable gene manipulation.

The clinical trials segment accounted for the biggest revenue share of the cell and gene therapy bioassay services market in 2024. A major driver of this segment is a rise in investments in cell and gene therapy research and development, which has led to the expanding pipeline of clinical trials for numerous indications, especially for rare diseases and oncology, which require extensive bioassay testing. Additionally, leading players are increasingly adopting AI/ML for data analysis, the integration of CRISPR and viral vector engineering, and putting efforts into automation and point-of-care testing via microfluidics.

The commercial manufacturing segment will register the fastest expansion during the forecast period. The wider emergence of strategic partnerships and initiatives among different pharmaceutical companies, contract development and manufacturing organizations (CDMOs), and service providers is enhancing manufacturing capacities and services. Alongside, this era is moving from clinical trials to commercial production of cell and gene therapies, which need extensive, scalable, and standardized bioassay testing to meet regulatory requirements. As well as the adoption of advanced automation and high-throughput technologies like NGS and ddPCR in optimizing accuracy and effectiveness in commercial manufacturing, it is also impacting the market growth.

In 2024, the biopharmaceutical & biotechnology companies segment held a major share of the cell and gene therapy bioassay services market. Primarily, these companies are widely relied on specialized CROs to leverage their specialized personnel and meet the demanding requirements for bioanalytical testing. Apart from this, the growing demand for advanced therapies, escalating investments, and the complex, specialized nature of bioassay services play a significant role in cell and gene therapy development and manufacturing in these leading biopharmaceutical and biotechnology companies.

Whereas, the contract development & manufacturing organizations (CDMOs) segment is estimated to register rapid expansion during 2025-2034. The segment is propelled by its provision of expertise in cGMP manufacturing processes, with other facilities and quality systems that play a vital role in passing regulatory inspections, reducing risk, and delays for commercialization. Although raised focus of CDMOs on specialized platforms for viral vector production, like Charles River Laboratories' Lentivation platform, and also emphasizing end-to-end services, mainly cold chain logistics and quality control to ensure product integrity.

North America accounted for the dominating revenue share of the cell and gene therapy bioassay services market share 46% in 2024. The market is widely propelled by the progressing single-cell multi-omics platforms for simultaneous genetic and immune analysis, as well as expansion in the demand for specialized bioanalytical testing for viral vector safety. Alongside, North America emphasized the outsourcing of these services to CROs, such as Labcorp, Charles River, and PPD, to manage spending and complexity.

For instance,

The US’s cell and gene therapy bioassay services market encompasses expanding regulatory scrutiny for strong bioanalytical data, and also shifting toward customized medicine. Whereas the complexity of these innovative therapies drives demand for specialized bioassay services

For this market,

Inclusion of technological advancements, mainly CRISPR, NGS, and flow cytometry, is increasingly boosting the need for specialized contract research organizations (CROs) in Canada’s cell and gene therapy bioassay services market.

For instance,

In the upcoming years, the Asia Pacific is anticipated to expand at a rapid CAGR in the cell and gene therapy bioassay services market. This expansion will be assisted by the presence of a favourable regulatory landscape and government incentives, especially in Japan & Singapore for biotechnology innovations. This further enhances clinical developments and bioassay validation. Along with this, a huge support of strict quality control (QC) regulations for cell and gene therapies that are required for sophisticated bioassay services is also influencing as a major driver in ASAP’s market growth.

Recently, this region has adopted the <<< GenomeAsia 1000< Project's efforts to develop a large-scale population genomic database, and the Singaporean government's robust support for CGT research is boosting the overall cell and gene therapy bioassay services market expansion.

For this market,

Primarily, the Japanese regulatory framework, evolved by the Pharmaceuticals and Medical Devices Law, which provides the commercialization of CGT products, while an enhanced focus on post-marketing surveillance ensures the continued safety of these complex treatments.

For instance,

In 2024, Europe experienced a notable expansion in the cell and gene therapy bioassay services market. This region is widely focused on developing strong potency assays that are crucial in the demonstration of a product's therapeutic activity. This further aims at immunogenicity testing to study the patients' immune responses to the various vectors and cell products. Moreover, Europe is advancing high-throughput platforms, automation, and AI-enabled analytics to streamline bioanalytical workflows, optimize throughput, and progress data interpretation.

Germany’s cell and gene therapy bioassay services market is strengthening its national strategy that is focusing on boosting the country's position as a biotech location by promoting innovation, patient well-being, and the development of cell and gene-based therapies. This strategy comprises the development of a national network to accelerate professional exchange and harmonize regulatory and organizational aspects.

For this market,

By Assay Type

By Therapy Type

By Application

By End User

By Region

March 2026

March 2026

March 2026

March 2026