January 2026

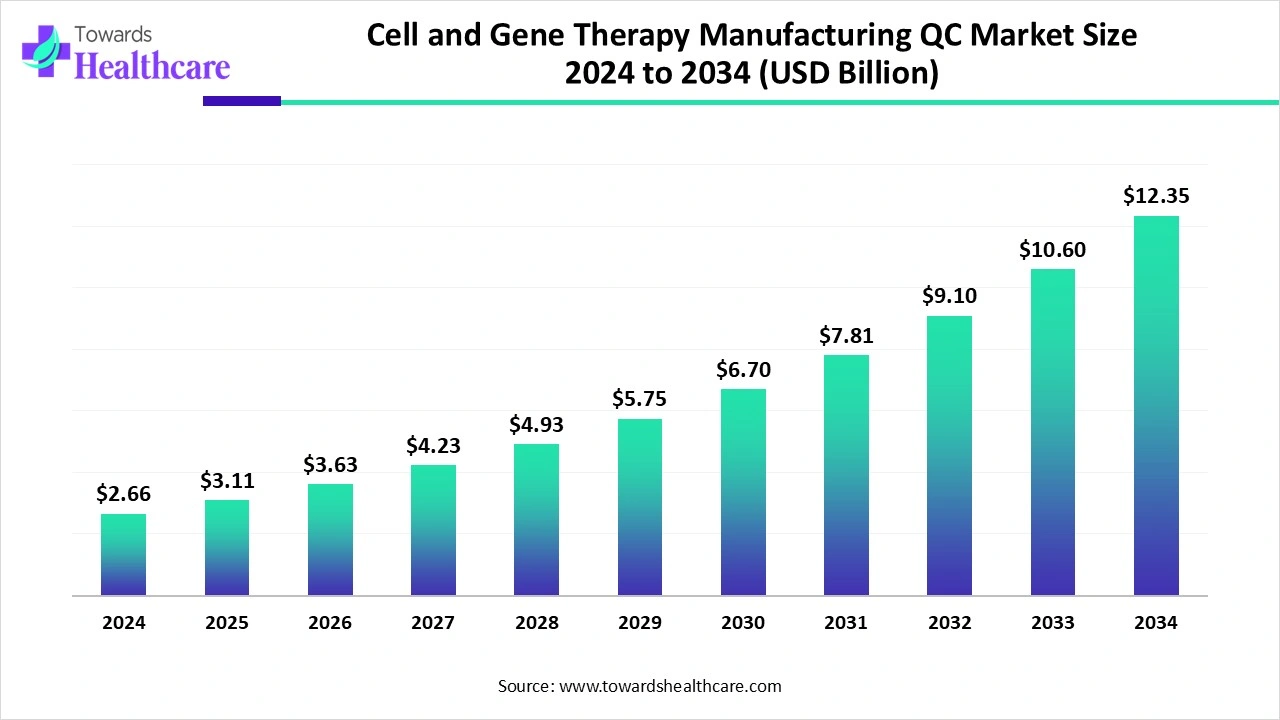

The global cell and gene therapy manufacturing QC market size is calculated at USD 2.66 billion in 2024, grew to USD 3.11 billion in 2025, and is projected to reach around USD 12.35 billion by 2034. The market is expanding at a CAGR of 16.89% between 2025 and 2034.

The cell and gene therapy manufacturing QC market is primarily driven by stringent regulatory policies and new product launches. The increasing need for personalized medicines promotes their development to provide enhanced care. Prominent players and startups collaborate with contract development and manufacturing organizations (CDMOs) to access advanced technologies and suitable manufacturing infrastructure. Artificial intelligence (AI) can automate the QC process for cell and gene therapy (CGT) products. The future looks promising, with advanced QC techniques.

| Table | Scope |

| Market Size in 2025 | USD 3.11 Billion |

| Projected Market Size in 2034 | USD 12.35 Billion |

| CAGR (2025 - 2034) | 16.89% |

| Leading Region | North America |

| Market Segmentation | By Component, By Analytical Method/Assay Type, By Process Stage/Workflow, By Therapy Type, By End-User, By Region |

| Top Key Players | WuXi AppTec, Lonza, Thermo Fisher Scientific, Charles River Laboratories, Catalent, Merck KGaA / MilliporeSigma, Eurofins Scientific, Pace, Pharmaron, BioAgilytix Labs, Avance Biosciences, SGS, IQVIA, Alcami, Solvias, Pacific BioLabs, ProtaGene / ProtaGene, Labcorp, bioMérieux, Bio-Rad, QIAGEN, AGC Biologics |

The cell and gene therapy manufacturing QC market comprises the instruments, assays, consumables, software, and outsourced services used to test, release, and monitor CGT products during process development, scale-up, and commercial manufacture. Quality control (QC) for CGT covers identity, potency, purity, sterility, viability, vector characterization (viral/non-viral), residuals (endotoxin, host-cell proteins), genomic integrity (insertion site analysis), and stability - using methods such as flow cytometry/FACS, PCR/dPCR, ELISA, chromatography, next-generation sequencing (NGS), and sterility/mycoplasma testing. Drivers include a rapidly expanding CGT pipeline, strict regulator expectations for potency/identity and biosafety, and increasing outsourcing of QC to specialized CROs/CDMOs.

Geographical Expansion: Companies expand their geographical presence to deliver their proprietary products to a diverse range of customers by complying with the regulatory standards of respective nations, fostering the cell and gene therapy manufacturing QC market.

Demand for CGT Products: The increasing demand for CGT products encourages companies to develop CGTs, providing cutting-edge personalized therapies for a wide range of diseases.

AI can revolutionize the way CGT products are evaluated through QC processes by introducing automation. Automated systems can improve the throughput and consistency of QC labs. They enhance the efficiency, reproducibility, and accuracy of QC processes, minimizing human errors. AI and machine learning (ML) algorithms can analyze vast amounts of data and aid in data analysis. Generative AI (GenAI) can improve the handling of unstructured and multimodal data, enhancing data extraction. This leads to increased throughput, reduced deviation closure time, and decreased costs.

Demand for CGT

The major growth factor for the cell and gene therapy manufacturing QC market is the growing demand for CGT products, encouraging researchers to develop innovative therapies. This also enables companies to expand their CGT pipeline, providing high-quality products. CGTs offer personalized treatment to patients by curing a disease from its root cause. They are approved for a wide range of disorders, including cancer, neurological disorders, and rare disorders. The rising prevalence of these disorders potentiates the timely supply of these therapeutics, thereby accelerating their manufacturing.

Lack of Skilled Professionals

Several companies and research institutions from low- and middle-income countries or those situated in rural areas lack skilled professionals to perform complex CGT manufacturing QC processes. Training individuals for particular processes and instruments takes time, reducing productivity.

The future of the cell and gene therapy manufacturing QC market is promising, driven by advanced QC techniques. Conventional QC techniques are time-consuming and labor-intensive processes. Novel and advanced QC techniques are developed to offer high-throughput, cost, and reproducibility. Process analytical technology, high-performance liquid chromatography (HPLC), and multiplex qPCR are some of the most commonly used QC techniques. Scientists develop novel tools and equipment to address certain bottlenecks in CGT manufacturing, thereby simplifying the task of QC analysts.

By component, the services segment held a dominant presence in the cell and gene therapy manufacturing QC market in 2024. This is due to increasing collaborations among key players and the need for faster time to market. Several companies outsource their QC services to well-equipped contract research organizations (CROs) or CDMOs to avoid in-house scale-up costs. CROs and CDMOs provide advanced and customized services to resolve complex issues related to manufacturing. CROs and CDMOs also comply with evolving regulatory policies and deliver solutions.

By component, the software & informatics segment is expected to grow at the fastest CAGR in the market during the forecast period. Advancements in technologies and the development of user-friendly software tools boost the segment’s growth. Software & informatics facilitate the analysis and storage of a large amount of data. Researchers can access their data at any time and from anywhere. Software streamlines the QC processes by reducing complexity and improving the scalability of CGT manufacturing.

By analytical method/assay type, the flow cytometry/FACS segment held the largest revenue share of the cell and gene therapy manufacturing QC market in 2024. This segment dominated because flow cytometry offers a diverse set of assays by characterizing the composition of cellular products and analyzing their potency, purity, and safety. Flow cytometry is the most widely used instrument in QC, as it enables rapid and precise data from high-throughput analysis. Fluorescence-activated cell sorting (FACS) is an advanced type of flow cytometry that allows cells to be sorted and retained.

By analytical method/assay type, the next-generation sequencing (NGS)/genomic assays segment is expected to grow with the highest CAGR in the market during the studied years. The NGS technique is used for QC and process optimization during the manufacturing and development of CGT. It can analyze the genetic profile of cells or vectors used in manufacturing, ensuring consistency and purity. The demand for NGS is increasing as it can detect unintended genomic alterations that may occur during the manufacturing process.

By process stage/workflow, the upstream process QC segment contributed the biggest revenue share of the cell and gene therapy manufacturing QC market in 2024. This is due to the ability of upstream process QC to monitor and control critical parameters during the initial bioprocess stages. This helps manufacturers and researchers make proactive decisions and also make the necessary changes before manufacturing. They assess raw materials and also verify the DNA sequence of the reagents used in gene editing labs.

By process stage/workflow, the raw material & incoming QC segment is expected to expand rapidly in the market in the coming years. Stringent regulatory processes necessitate manufacturers to conduct QC tests on raw materials to avoid contamination. CGT manufacturing does not include true purification steps, has limited clearance steps, and no terminal sterile filtration step. Thus, it requires sterile and high-quality raw materials for further bioprocessing. Detailed risk assessments are conducted to develop high-quality products.

By therapy type, the cell therapy segment accounted for the highest revenue share of the cell and gene therapy manufacturing QC market in 2024. The segmental growth is attributed to extensive cellular potency or identity testing. Cell therapy can differentiate into different cell types in the body. Cell therapies, such as stem cells and CAR-T cells, promote tissue regeneration, modulate the immune system, and reduce inflammation. CAR-T cell therapies are approved for the treatment of cancer patients in whom a transplant fails or who relapse after transplant.

By therapy type, the gene therapy segment is expected to witness the fastest growth in the market over the forecast period. The demand for gene therapy is increasing as it is a one-time treatment, rather than being delivered in doses. Gene therapy can modify the genetic information to cure rare diseases, cancer, autoimmune disorders, and neurological disorders. Apart from curing a disease, gene therapy can prevent a disease by administering it at an early stage. The need for targeted and long-lasting treatment promotes the development of gene therapy.

By end-user, the contract development & manufacturing organizations (CDMOs) segment led the cell and gene therapy manufacturing QC market in 2024. This is due to the increasing number of pharmaceutical and biotech startups and the need to expand the CGT pipeline. CDMOs have specialized infrastructure that enables advanced manufacturing and quality control services. They also have skilled professionals to provide relevant expertise for complex problems. By collaborating with CDMOs, companies can focus on product sales and marketing.

By end-user, the academic & research institutes segment is expected to show the fastest growth over the forecast period. The growing research and development activities and increasing investments by government and private organizations augment the segment’s growth. Academic & research institutes receive funding to adopt advanced technologies for CGT manufacturing QC. They conduct clinical trials to evaluate the safety and efficacy of CGT products, necessitating QC testing.

North America dominated the cell and gene therapy manufacturing QC market in 2024. The presence of key players, the availability of state-of-the-art research and development facilities, and the increasing CGT pipeline are the major growth factors for the market in North America. Favorable regulatory policies lead to the launch of new CGT products. Government organizations support the development of CGT through initiatives and funding. Countries have an expanding manufacturing infrastructure, propelling the market.

Key players, such as Thermo Fisher Scientific, Charles River Laboratories, and Catalent, either conduct CGT manufacturing activities or provide advanced QC services. The Food and Drug Administration (FDA) regulates the approval of CGTs. As of August 2025, a total of 46 CGT products were approved by the FDA. The U.S. government invested $98 million in New York’s CGT hub to support R&D.

As of 2023, 12 CGTs have been approved by Health Canada, with 75% approved between 2020 and 2023. In March 2025, the Canadian government supported OmniaBio for the expansion of its CGT manufacturing facility in Hamilton and helped OmniaBio to provide production services to companies globally, strengthening Canada’s participation in global value chains.

Asia-Pacific is expected to grow at the fastest CAGR in the cell and gene therapy manufacturing QC market during the forecast period. Countries like China, Japan, India, and South Korea have a favorable CGT manufacturing infrastructure, encouraging foreign investors to set up their manufacturing facilities. The increasing number of startups and venture capital investments favors market growth. The rising CDMO buildup and clinical activity related to CGT products also contribute to market growth. The growing demand for personalized medicines due to rapidly changing demographics facilitates the development of CGTs.

The National Medical Products Administration (NMPA) approved 11 novel CGT products in 2024. The clinical trial sector for CGT products is rapidly expanding in China, accounting for double the number of CGT studies compared to the U.S. from 2019 to 2024. There are more than 2,200 biotech companies in China as of mid-2025.

The total number of biotech startups in India increased from 5,365 to 8,531, an increase of 59% between 2021 and 2023. It is expected that the number of biotech startups will rise to 35,460 by 2030. India is the second-largest market for venture capital and growth funding in the Asia-Pacific region.

Europe is expected to grow at a notable CAGR in the cell and gene therapy manufacturing QC market in the foreseeable future. The increasing demand for personalized medicines and favorable government support augments the market. European nations have stringent regulatory policies to conduct QC tests for CGT products. The European Medicines Agency (EMA) approved around 27 CGTs as of 2024, of which 7 were retrieved from the market. The increasing investment and collaborations among key players facilitate the development of CGTs.

The UK is home to 32 MHRA-licensed GMP manufacturing facilities for advanced therapies. The increase in licensed GMP manufacturing facilities in the UK leads to a surge in 12% of cleanroom footprint and 15% of in-house quality control footprint. The UK government announced a grant of $10 million to open a facility for the development and manufacturing of new CGTs, called the Clinical Biotechnology Centres (CBC).

Fabian Gerlinghaus, CEO of Cellares, commented that the Cell Q platform enables the company to offer a real end-to-end solution for the customers, providing 10 times higher capacity and up to 50% lower batch price than the Cell Shuttle platform. He also stated that their proprietary platform technologies support the company’s mission of becoming the de facto standard for cell therapy manufacturing, thereby accelerating access for patients and meeting the total global demand for cell therapies.

By Component

By Analytical Method/Assay Type

By Process Stage/Workflow

By Therapy Type

By End-User

By Region

January 2026

January 2026

January 2026

January 2026