January 2026

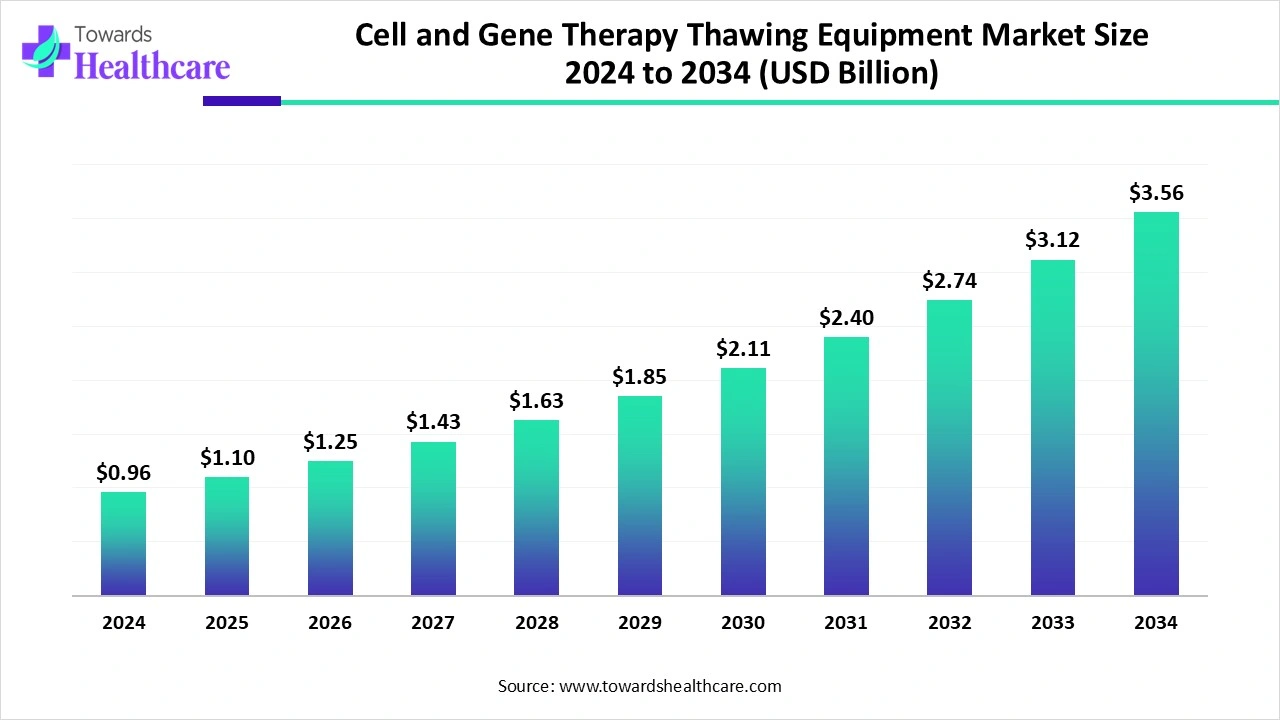

The global cell and gene therapy thawing equipment market size recorded US$ 0.96 billion in 2024, set to grow to US$ 1.1 billion in 2025 and projected to hit nearly US$ 3.56 billion by 2034, with a CAGR of 14.24% throughout the forecast timeline.

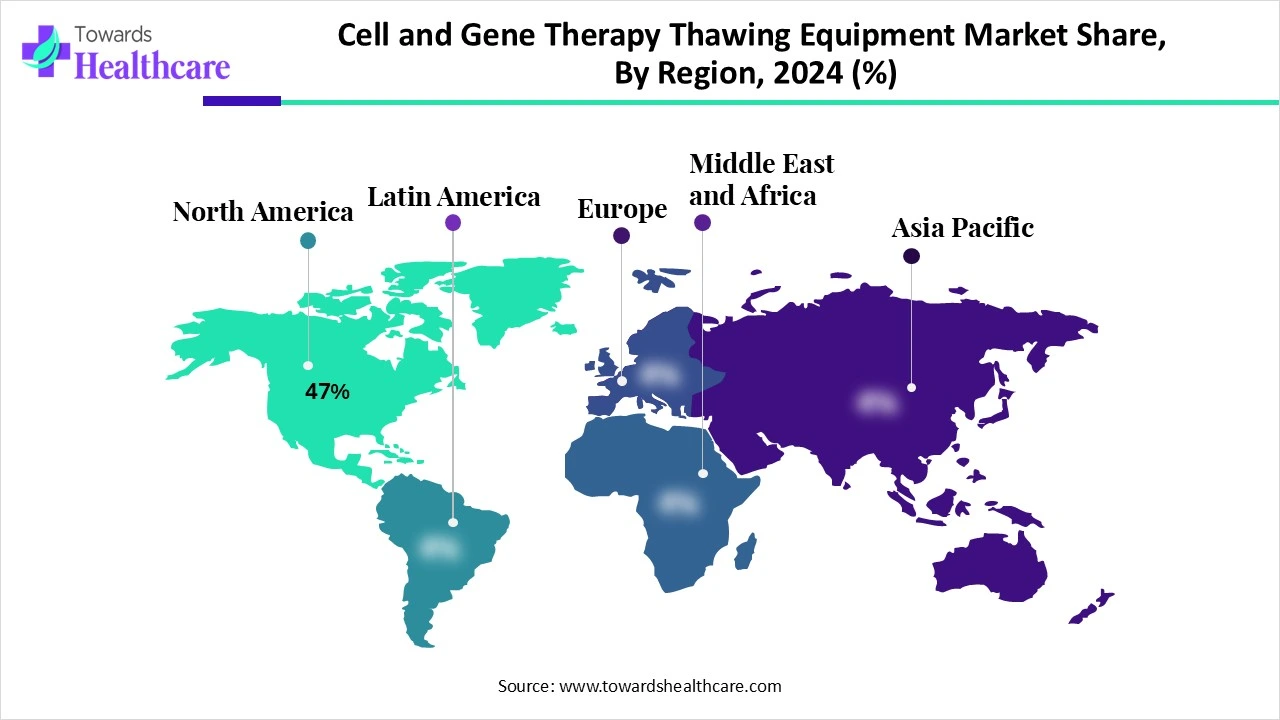

The cell and gene therapy thawing equipment market is witnessing strong growth, driven by rising demand for advanced biopharmaceuticals , increasing adoption of personalized medicine, and the need for precise handling of temperature-sensitive therapies. Thawing equipment plays a critical role in ensuring the viability and safety of cell-based and gene-modified treatments during clinical and commercial use. North America dominates the market due to well-established biopharma infrastructure, higher investments in regenerative medicine, strong regulatory support, and the presence of leading therapy developers and advanced healthcare facilities.

| Table | Scope |

| Market Size in 2025 | USD 0.96 Billion |

| Projected Market Size in 2034 | USD 3.56 Billion |

| CAGR (2025 - 2034) | 14.24% |

| Leading Region | North America 47% |

| Market Segmentation | By Product Type, By Workflow Stage, By Therapy Type, By End User, By Region |

| Top Key Players | Cytiva (Danaher), BioLife Solutions, Barkey GmbH, Sartorius AG, Thermo Fisher Scientific, Helmer Scientific, Boekel Scientific, PHC Holdings Corporation, Eppendorf AG, Azenta Life Sciences (Brooks Life Sciences), Cryoport Systems, BioCision LLC, Amerex Instruments, Glen Mills Inc., Barkey GmbH & Co. KG, Custom Biogenic Systems, Boekel Scientific Inc., Delta Development Team, Haier Biomedical, Stirling Ultracoldn |

The cell and gene therapy (CGT) thawing equipment market refers to specialized instruments and systems designed to safely and consistently thaw frozen cell and gene therapy products (such as CAR-T cells, stem cells, and viral vectors) prior to administration or further processing. Since most CGT products are stored and shipped cryogenically, thawing is a critical step that directly impacts cell viability, potency, and therapeutic efficacy. Advanced thawing systems ensure controlled, reproducible, and closed-system thawing to reduce contamination risks and variability, supporting both clinical and commercial CGT workflows.

In May 2025, Stylus Medicine, a biotech startup, raised US$85 million in funding to launch a new class of in vivo genetic medicines that address the challenges associated with the production and delivery of ex vivo gene editing therapies. The first US$40 million Series A round of funding for the company was led by Khosla Ventures and RA Capital. Together with Johnson & Johnson Innovation-IJDC, Chugai Venture Fund, and Eli Lilly, these parties also backed a US$45 million extension.

In July 2025, the Centers for Medicare & Medicaid Services (CMS) announced that 33 states, along with the District of Columbia and Puerto Rico, will join the Cell and Gene Therapy (CGT) Access Model, a daring new strategy for providing state-of-the-art treatments to Medicaid-eligible individuals with sickle cell disease. Access to transformative care has been greatly increased in participating states, which account for about 84% of Medicaid beneficiaries with the condition. This agreement is a significant victory for Medicaid to give patients new access to innovative treatments for sickle cell disease and for American patients, as stated by the U.S. Health and Human Services Secretary Robert F. Kennedy, Jr.

AI integration can significantly enhance the cell and gene therapy thawing equipment industry by improving precision, efficiency, and safety across the thawing process. AI-powered systems can monitor real-time temperature fluctuations, optimize thawing protocols, and predict potential risks of cell damage, thereby ensuring consistent product quality. Machine learning algorithms can analyze large datasets from clinical and laboratory use to fine-tune thawing conditions for different therapy types. Additionally, AI can enable predictive maintenance of equipment, reduce human error, automate workflows, and support regulatory compliance through accurate data recording and traceability.

Strong Regulatory Emphasis On Product Quality

Strong regulatory emphasis on product quality, safety, and traceability in biopharma processes drives the growth of the cell and gene therapy thawing equipment market by pushing manufacturers and healthcare providers to adopt highly reliable and standardized thawing systems. Since cell and gene therapies are extremely sensitive to temperature variations, regulators require equipment that ensures consistent thawing, minimizes risks of contamination, and preserves therapeutic potency. Compliance with Good Manufacturing Practices (GMP) and strict quality control standards encourages investment in advanced, automated thawing technologies that offer precise monitoring, digital traceability, and validated performance, thereby accelerating market adoption.

For instance,

Complexity of Operation and Limited Standardization

The key players operating in the Complexity of operation and the need for trained personnel can slow deployment and usage. Stringent regulatory requirements increase compliance costs and time for equipment validation. Limited standardization across different therapy types can make it difficult to develop universal thawing systems.

Rising Focus on Personalized Medicine

The rising focus on personalized medicine drives the growth of the cell and gene therapy thawing equipment market because personalized therapies often involve patient-specific cells that are highly sensitive to temperature fluctuations.

The growing emphasis on personalized medicine significantly influenced the demand for advanced thawing equipment in cell and gene therapy. As therapies became increasingly tailored to individual patients, the need for precise and reliable thawing systems to maintain the viability of cryopreserved cells intensified. This shift led to a surge in the adoption of thawing technologies capable of ensuring optimal conditions for these sensitive biological materials. For instance, in August 2024, Cardinal Health established an Advanced Therapy Innovation Center in La Vergne, Tennessee, highlighting the commitment of the industry to enhancing capabilities for cell and gene therapy commercialization, including the integration of advanced thawing systems to support personalized treatments.

Additionally, the U.S. FDA approval of six new gene or cell-based therapies in 2024 underscored the expanding landscape of personalized medicine. These approvals, targeting conditions such as metachromatic leukodystrophy and aromatic L-amino acid decarboxylase (AADC) deficiency, further emphasized the need for specialized equipment, including thawing systems, to ensure the safe and effective administration of these personalized therapies.

The automated thawing systems segment dominates the cell and gene therapy thawing equipment market due to their ability to provide precise, consistent, and reproducible thawing of temperature-sensitive biological materials. These systems minimize human error, reduce contamination risks, and ensure optimal cell viability and therapeutic efficacy, which are critical for both clinical and commercial applications. The growing complexity of personalized and regenerative therapies demands high-throughput, reliable thawing solutions that can handle diverse cell types and volumes efficiently. Additionally, regulatory emphasis on traceability, compliance, and standardized processes further drives the adoption of automated thawing systems, making them the preferred choice for leading biopharma companies and advanced healthcare facilities.

The water-free thawing systems segment is estimated to be the fastest-growing segment in the cell and gene therapy thawing equipment market due to its significant advantages over traditional water bath methods. These systems eliminate the risk of cross-contamination associated with water baths, where microbial growth can occur, thereby enhancing sterility and safety. They also offer precise temperature control and uniform heat distribution, which are crucial for maintaining cell viability and therapeutic efficacy. Additionally, water-free systems are easier to maintain and operate, reducing labor costs and minimizing the need for specialized training. The integration of automation and data logging features further supports regulatory compliance and standardization across clinical and commercial applications. As the demand for personalized and regenerative therapies increases, these systems are becoming essential for ensuring consistent and reliable thawing processes.

The clinical use segment dominates the cell and gene therapy thawing equipment market because these therapies are highly sensitive and require precise handling to ensure patient safety and therapeutic efficacy. Hospitals, specialized treatment centers, and clinics prioritize thawing systems that provide consistent temperature control, sterility, and traceability to comply with regulatory standards. The increasing number of approved cell and gene therapies and the growing adoption of personalized medicine further drive demand. Additionally, clinical settings benefit from automated and user-friendly equipment that reduces human error and supports efficient, reliable therapy administration.

The commercial manufacturing segment is anticipated to be the fastest-growing in the market due to the increasing scale-up of production for approved therapies and rising demand for off-the-shelf cell and gene treatments. Manufacturers require high-throughput, reliable thawing systems that maintain product quality, viability, and consistency across large batches. Technological advancements in automated and water-free thawing solutions, combined with regulatory requirements for traceability and standardized processes, further drive adoption. Expanding global commercialization efforts and partnerships between biopharma companies and equipment providers also accelerate growth in this segment.

The cell therapy segment dominates the cell and gene therapy thawing equipment market because cell-based treatments, such as CAR-T and stem cell therapies are highly sensitive to temperature variations and require precise thawing to maintain viability and efficacy. The increasing number of approved cell therapies, growing investments in regenerative medicine, and rising adoption of personalized treatments drive demand for reliable thawing equipment. Additionally, strict regulatory standards for sterility, traceability, and quality control in clinical and commercial applications further reinforce the preference for advanced thawing systems in the cell therapy segment.

The gene therapy segment is estimated to be the fastest-growing in the market due to the rapid increase in approvals and clinical trials of viral vector and nucleic acid-based therapies. These therapies are highly sensitive to temperature fluctuations, requiring precise and reliable thawing systems to maintain potency and safety. Advances in automated and water-free thawing technologies, coupled with the rising adoption of personalized and regenerative treatments, further drive demand. Increasing investments in gene therapy commercialization and global expansion efforts also accelerate growth in this segment.

The biopharmaceutical & biotechnology companies segment dominates the cell and gene therapy thawing equipment market because these organizations are at the forefront of developing and commercializing advanced therapies. They require precise, reliable thawing systems to ensure the viability, potency, and safety of sensitive cell- and gene-based products. High investments in R&D, large-scale clinical trials, and regulatory compliance drive the adoption of automated and water-free thawing technologies. Additionally, the need for standardized, traceable processes across manufacturing and clinical supply chains reinforces their preference for advanced thawing equipment.

The contract development & manufacturing organizations (CDMOs) segment is anticipated to be the fastest-growing end-user segment in the market due to the increasing outsourcing of production and scale-up activities by biopharmaceutical companies. CDMOs require high-throughput, reliable thawing systems to handle multiple client products while maintaining cell viability, potency, and compliance with regulatory standards. Technological advancements in automated and water-free thawing equipment, combined with the rising demand for personalized and regenerative therapies, further accelerate adoption, enabling CDMOs to efficiently support diverse manufacturing and clinical supply chain needs.

North America leads the cell and gene therapy thawing equipment market share 47%, driven by a robust healthcare infrastructure, substantia R&D investments, and a favourable regulatory environment. The United States, in particular, hosts numerous biotechnology firms, academic institutions, and clinical centers specializing in advanced therapies. This concentration fosters collaboration between equipment manufacturers and therapy developers, accelerating innovation and adoption of specialized thawing solutions. For instance, the establishment of an Advanced Therapy Innovation Center in Tennessee in 2024 underscores the commitment of the region to advancing cell and gene therapy commercialization, including the integration of advanced thawing systems to support personalized treatments.

The U.S. dominates the market, driven by advanced healthcare infrastructure, numerous biotechnology firms, specialized treatment centers, and strong regulatory support from agencies like the FDA. High demand for automated and water-free thawing systems ensures precision, sterility, and compliance with quality standards. In 2024, the establishment of an Advanced Therapy Innovation Center in Tennessee highlighted the commitment of the country to advancing the commercialization of cell and gene therapies, including the integration of advanced thawing equipment for personalized treatments.

The market in Canada is growing steadily, supported by active research in stem cell and gene therapies and regulatory frameworks by Health Canada that facilitate therapy development and commercialization. Collaborations between academic institutions and biotech companies drive innovation and adoption of advanced thawing systems. The focus on research, development, and partnerships positions Canada as a key emerging market with opportunities to expand the use of precise and reliable thawing equipment in clinical and commercial applications.

Asia-Pacific is expected to be the fastest-growing cell and gene therapy thawing equipment market for cell and gene therapy thawing equipment, driven by several key factors. Rapid advancements in biotechnology and regenerative medicine have led to a surge in demand for precise and efficient thawing solutions. Countries like China, Japan, India, and South Korea are investing heavily in healthcare infrastructure and research, facilitating the adoption of advanced thawing technologies. The increasing prevalence of chronic and genetic diseases further propels the need for effective therapies, thereby boosting the demand for specialized thawing equipment. Additionally, favourable regulatory environments and government support for biopharmaceutical innovation contribute to the market growth in the region. These combined factors position the APAC region as a dynamic and rapidly expanding market for cell and gene therapy thawing equipment.

The cell and gene therapy thawing equipment market in India is growing steadily due to the rising prevalence of genetic and chronic diseases that require advanced therapeutic interventions. Strong government support and regulatory frameworks are facilitating the development and commercialization of cell and gene therapies. Significant investments in biotechnology R&D, increasing clinical trials, and collaborations between academic institutions and biotech companies are accelerating the adoption of advanced thawing systems. Additionally, the focus of the country on personalized medicine, stem cell research, and expanding healthcare infrastructure is driving demand for precise, efficient, and reliable thawing equipment to support clinical and research applications.

China is witnessing rapid growth in the cell and gene therapy thawing equipment market, fuelled by robust government policies and financial incentives supporting biotechnology and regenerative medicine. The rising number of clinical trials, particularly in gene and stem cell therapies, is driving demand for advanced thawing systems that maintain product integrity and efficacy. Expanding healthcare infrastructure, technological innovations, and collaborations between research institutions and biotech firms further boost market adoption. Additionally, the growing focus on personalized medicine, regulatory support, and increased public and private investment in novel therapies are positioning China as one of the fastest-growing markets in the Asia-Pacific region.

The market in Japan is expanding steadily, driven by technological advancements in biotechnology and regenerative medicine. Government support for regenerative therapies, combined with stringent regulatory standards, ensures safety and efficacy, encouraging the adoption of precise thawing systems. Japan aging population has increased the prevalence of age-related diseases, further boosting demand for innovative therapies. Collaborations between academic institutions and industry, rising clinical trials, and the country emphasis on personalized medicine contribute to market growth. Continuous innovation in automated and water-free thawing technologies is enhancing process efficiency, positioning Japan as a significant and growing market in the Asia-Pacific region.

Typical organizations active in R&D (examples): university translational centres and hospitals (e.g., academic medical centres doing cell therapy research), equipment OEM R&D groups and engineering consultancies, biotech companies developing therapies (internal device/assay needs), and specialized test labs/CROs. Large industry names that commonly participate across device/therapy tool development include Thermo Fisher Scientific, Cytiva, Sartorius, BioLife Solutions, BioCision, plus many smaller specialized device startups.

Typical organizations involved: regulatory agencies (FDA, EMA, PMDA, Health Canada), clinical CROs and specialized cell/gene therapy CROs (ICON, Parexel, PPD, specialized academic trial networks), major clinical centres and hospitals running trials (e.g., major cancer centres), and regulatory/QA consultancies that prepare submissions.

Typical organizations/examples: specialty logistics and cold-chain providers (Cryoport, Marken, World Courier), specialty pharmacies and distributors (AmerisourceBergen, Cardinal Health, McKesson in distribution/support roles), pharma company patient support programs (therapy sponsors such as Novartis, Gilead/Kite, Bristol Myers Squibb run PSPs for approved cell therapies), and hospital infusion centres/clinical teams.

In July 2025, Adrian Stecyk, Chief Executive Officer of Myrtelle, stated that Myrtelle Inc., a trailblazing clinical-stage gene therapy business committed to transforming neurodegenerative disease treatment, declared the official start of commercial-stage production of its first-of-its-kind oligotrophic recombinant adeno-associated virus (rAAV) gene therapy product, created especially for Canavan disease (CD). This significant accomplishment brings Myrtelle treatment one step closer to the market and patients in dire need of it.

In April 2025, the current capabilities of AGC Biologics will be enhanced by the new Cell and Gene Technologies Division, which will also assist developers who require capacity, scientific capabilities, and technically skilled cell and gene CDMO operators. With a vast global development and manufacturing network spread across three regions (Milan, Italy; Longmont, CO, USA; Yokohama, Japan), the new AGC Biologics Cell and Gene Technologies Division offers unmatched support and scientific capability, while other cell and gene CDMOs are closing locations and reducing their workforce.

By Product Type

By Workflow Stage

By Therapy Type

By End User

By Region

January 2026

January 2026

January 2026

January 2026