February 2026

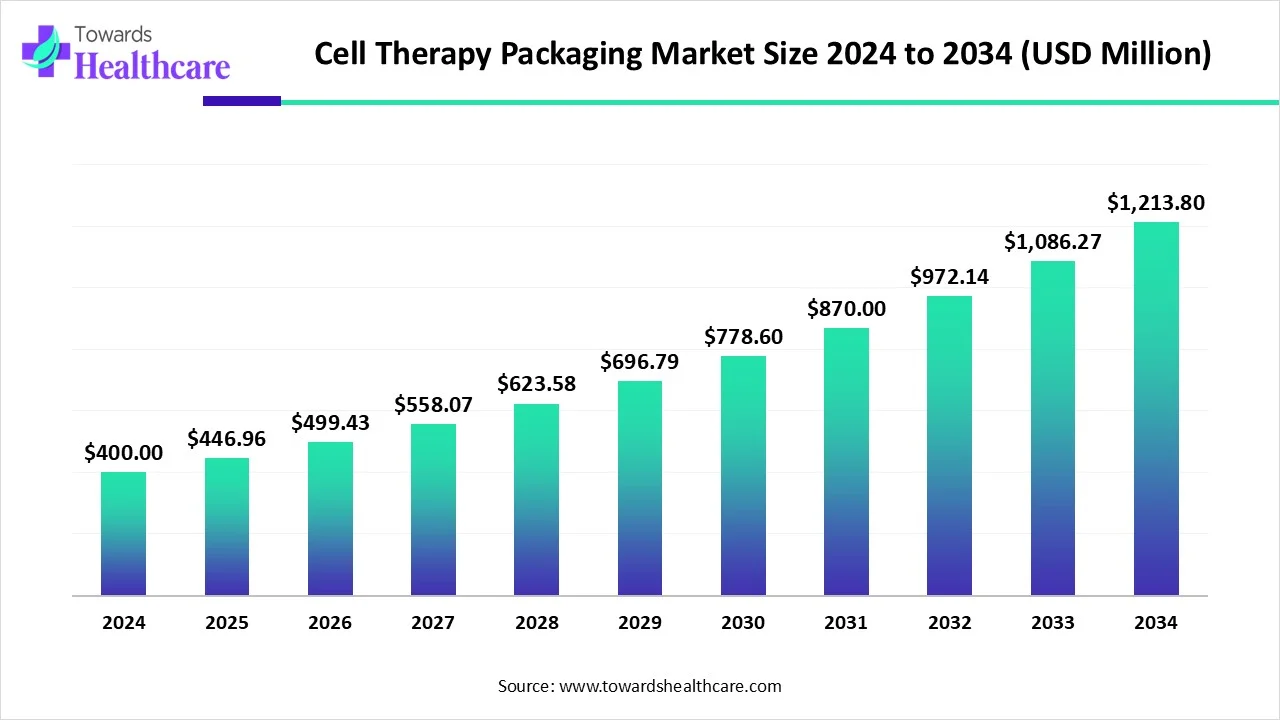

The global cell therapy packaging market size is calculated at USD 400 million in 2024, grow to USD 446.96 million in 2025, and is projected to reach around USD 1213.8 million by 2034. The market is expanding at a CAGR of 11.74% between 2025 and 2034.

Logistics firms will need to provide cutting-edge technology and creative supply chain solutions to meet the growing demand for cell therapy. The growing need for proteins that may be produced for a variety of uses, including research reagents, therapeutic proteins, and enzymes, is propelling the cell therapy packaging market. In order to maintain the integrity of their therapeutic intervention throughout storage and transportation, some developers have recently established strategic alliances with industry participants to guarantee the sterility and quality of cell treatments. Surprisingly, in order to satisfy the need for the cold chain and cryogenic environment necessary to preserve the stability of these innovative, cutting-edge treatments, service providers are gradually broadening their packaging techniques beyond the traditional packaging products.

| Metric | Details |

| Market Size in 2025 | USD 446.96 Million |

| Projected Market Size in 2034 | USD 1213.8 Million |

| CAGR (2025 - 2034) | 11.74% |

| Leading Region | North America |

| Market Segmentation | By Type of Therapy Packed, By Scale of Operations, By a Package of Engineering Design, By Regions |

| Top Key Players | Almac, Catalent Biologics, Cryoport Systems, Saint-Gobain, Thermo Fisher Scientific, West Pharmaceuticals, Yourway |

Cell therapy packaging refers to the specialized systems and materials used to safely contain, preserve, and transport live cell-based therapies. It ensures the sterility, stability, and viability of cells throughout the supply chain, complying with strict regulatory, temperature, and handling requirements essential for therapeutic effectiveness. Innovation is transforming cell therapy packaging solutions that enhance cell preservation and traceability. Developments like temperature-controlled containers, cryogenic packaging, and tamper-evident designs ensure product integrity during storage and transport. Additionally, digital tracking systems and automation in packaging processes are improving efficiency and regulatory compliance. These innovations are critical as the demand for personalized, time-sensitive cell therapies grows, driving the need for safer and more reliable packaging solutions.

AI is driving progress in the cell therapy packaging market by optimizing supply chain logistics, improving temperature monitoring, and enhancing real-time tracking of cell therapies. AI-powered systems help predict and prevent disruptions, ensuring the safe delivery of sensitive products. Additionally, AI aids in quality control by analyzing data to detect packaging flaws or deviations, thereby increasing reliability and compliance. These innovations are crucial for maintaining cell integrity and streamlining operations in a highly regulated, time-sensitive market.

Increasing Demand for Precision Medicine and Personalized Therapies

The rising demand for precision medicine and personalized therapies is a major driver in the cell therapy packaging market because these treatments require highly specialized handling, storage, and delivery solutions. Each therapy is often patient-specific, making sterility and identity throughout the supply chain. As personalized treatment grows, the a need for advanced packaging systems that can support temperature control, tracking, and regulatory compliance, ensuring safety. And effective delivery to patients.

For Instance,

High Cost and Complexity of Specialized Packaging

The high cost and complexity of specialized packaging a major restraints in the cell therapy packaging market because these therapies require stringent temperature control, a sterile environment, and traceability throughout the supply chain. Designing and producing such advanced packaging systems involves a significant investment in materials, technology, and regulatory compliance. This raises overall costs, making it less scalable, especially in emerging markets where affordability and infrastructure may be lacking.

Growing Adoption of Automation and Smart Packaging Technologies

The increasing adoption of automation and smart packing technologies presents a significant future opportunity in the cell therapy packaging market. These advanced solutions enable real-time monitoring, precise temperature control, and improved traceability, which are crucial for maintaining the integrity of sensitive cell therapies. Automation also enhances efficiency and reduces human error during packaging and logistics. As demand for personalized treatment grows, these innovations can streamline supply chains and support large-scale distribution, driving market expansion.

For Instance,

The stem cell therapy segment held the largest revenue share in the market due to the widespread use of stem cells in treating various chronic and degenerative conditions, such as orthopedic disorders, cardiovascular diseases, and neurological issues. These therapies require highly specialized packaging to maintain cell viability and sterility during transport and storage. The rising number of clinical trials and regulatory approvals further drives demand for advanced packaging solutions, boosting the market growth.

The T-cell therapy segment is projected to grow at the fastest CAGR in the cell therapy packaging market due to the increasing adoption of CAR-T and other T-cell-based immunotherapies for treating cancers like leukemia and lymphoma. These therapies require precise, temperature-controlled, and sterile packaging to preserve cell function and ensure safe delivery. Growing clinical success, regulatory approvals, and expanding research pipelines are fueling demand for specialized packaging, driving rapid growth in the market during the forecast period.

In 2024, the clinical scale segment dominated the cell therapy packaging market due to the increasing number of clinical trials for emerging cell therapies, particularly in oncology and regenerative medicine. These trials demand specialized, small-scale packaging solutions that ensure cell integrity, sterility, and temperature control. The complexity and sensitivity of handling patient-specific therapies in trial phases further emphasize the need for advanced packaging. This growing clinical activity drives higher demand and market shares.

The commercial scale segment is expected to grow at a faster CAGR in the cell therapy packaging market due to the increasing regulatory approvals and market launches of cell-based therapies. As more treatments move from clinical trials to commercialization, the need for large-scale, standardized, and compliant packaging solutions rises. This includes robust systems for cold chain logistics, tracking, and patient safety. The growing demand for personalized therapies globally is accelerating the expansion of commercial-scale packaging infrastructure.

In 2024, the primary packaging segment led the cell therapy packaging market, primarily due to its critical role in ensuring product safety, sterility, and stability. Primary packaging, such as vials, syringes, and cryo-bags, comes into direct contact with cell therapies, offering essential protection against contamination and environmental factors. Its advantages include ease of use, cost-effectiveness, and precise dosage control, making it indispensable for maintaining cell viability during storage and transportation. These factors collectively contributed to its dominant market share in 2024.

The secondary packaging segment is expected to grow notably in the cell therapy packaging market due to rising demand for enhanced protection, traceability, and regulatory compliance during transport and distribution. Secondary packaging, such as insulated shippers and multi-layer containers, safeguards primary packages and maintains cold chain integrity. With the increasing commercialization of therapies and global distribution needs, this segment plays a crucial role in ensuring product safety and regulatory approval, driving its anticipated growth during the forecast period.

In 2024, North America dominated the market due to its robust biotechnology infrastructure, substantial investments in research and development, and a favorable regulatory environment. The presence of leading biopharmaceutical companies, advanced manufacturing facilities, and supportive policies from agencies like the FDA has accelerated the commercialization of cell therapies. Additionally, the region's extensive clinical trial activities and high demand for personalized medicine have further propelled the need for specialized packaging solutions, reinforcing its market leadership.

The U.S. market is experiencing significant growth due to several key factors. These include the increasing number of clinical trials for cell therapies, particularly in oncology and regenerative medicine, and a rise in FDA approvals for such treatments. Additionally, the U.S. has established itself as a central hub for cell therapy manufacturing, supported by advanced cold chain logistics and packaging infrastructure. These developments collectively drive the demand for specialized packaging solutions, propelling market expansion.

For Instance,

Canada's market is expanding due to the country's increasing adoption of regenerative medicine, the introduction of novel platforms and technologies, and a growing number of clinical studies focused on developing cellular therapies. These factors are driving demand for specialized packaging solutions that ensure the safety, sterility, and efficacy of cell-based treatments during storage and transportation. Additionally, Canada's supportive regulatory environment and investments in biotechnology infrastructure are further propelling market growth.

For Instance,

Asia Pacific is projected to experience the highest CAGR in the market during the forecast period, driven by several key factors. These include significant investments in biotechnology and regenerative medicine, supportive government policies, and a growing prevalence of chronic diseases. Countries like India, China, and Japan are expanding their cell therapy research and manufacturing capabilities, while Singapore is emerging as a leader in R&D endeavors. This regional momentum is fostering increased demand for specialized packaging solutions to ensure the safe and efficient delivery of cell-based therapies.

The country is experiencing significant growth in cell therapy applications, particularly in CAR-T and stem cell therapies, driven by increasing clinical trials and regulatory approvals. This surge in cell-based treatments necessitates specialized packaging solutions to ensure cell viability and compliance with stringent regulatory standards. Additionally, China's investments in biotechnology infrastructure and supportive government policies are further propelling the demand for advanced packaging solutions in the cell therapy sector.

India’s market is growing due to the expanding biotechnology sector and rising government support for innovative healthcare solutions. Increasing awareness about personalized medicine and advancements in cold chain logistics are improving the safety and effectiveness of cell therapies. Moreover, the growing number of domestic biopharmaceutical companies focusing on cell-based treatments is driving demand for reliable, specialized packaging solutions to meet regulatory and quality standards.

Europe is accelerating the market through robust investments in biotechnology, favorable regulatory frameworks, and a surge in clinical trials for advanced therapies. The region's emphasis on personalized medicine and regenerative treatments has heightened the demand for specialized packaging solutions that ensure cell viability and compliance with stringent standards. Additionally, Europe's commitment to innovation and infrastructure development is fostering a conducive environment for the growth of the cell therapy packaging sector.

The country is witnessing significant growth in cell therapy applications, particularly in CAR-T and stem cell therapies, driven by increasing clinical trials and regulatory approvals. This surge in cell-based treatments necessitates specialized packaging solutions to ensure cell viability and compliance with stringent regulatory standards. Additionally, the UK's investments in biotechnology infrastructure and supportive government policies are further propelling the demand for advanced packaging solutions in the cell therapy sector.

Germany's market is expanding due to the country's strong pharmaceutical manufacturing base and focus on innovation in advanced therapies. Leading biotech hubs like Munich and Berlin are fostering R&D in cell and gene therapies, requiring high-standard packaging solutions. Moreover, Germany's emphasis on automation, sustainability in packaging, and adherence to EU regulatory compliance is driving demand for specialized packaging that ensures product integrity, safety, and efficiency in transport.

In January 2025, Immuneel Therapeutics launched Qartemi, a CAR T-cell therapy for adult B-cell Non-Hodgkin Lymphoma, offering a local and affordable alternative in India. Developed to global standards, it targets patients unresponsive to traditional treatments. The co-founders and the CEO emphasized its potential to transform cancer care by combining cutting-edge science with indigenous manufacturing, ensuring accessibility and high-quality outcomes. (Source - Express Pharma)

By Type of Therapy Packed

By Scale of Operations

By a Package of Engineering Design

By Region

February 2026

February 2026

February 2026

February 2026