January 2026

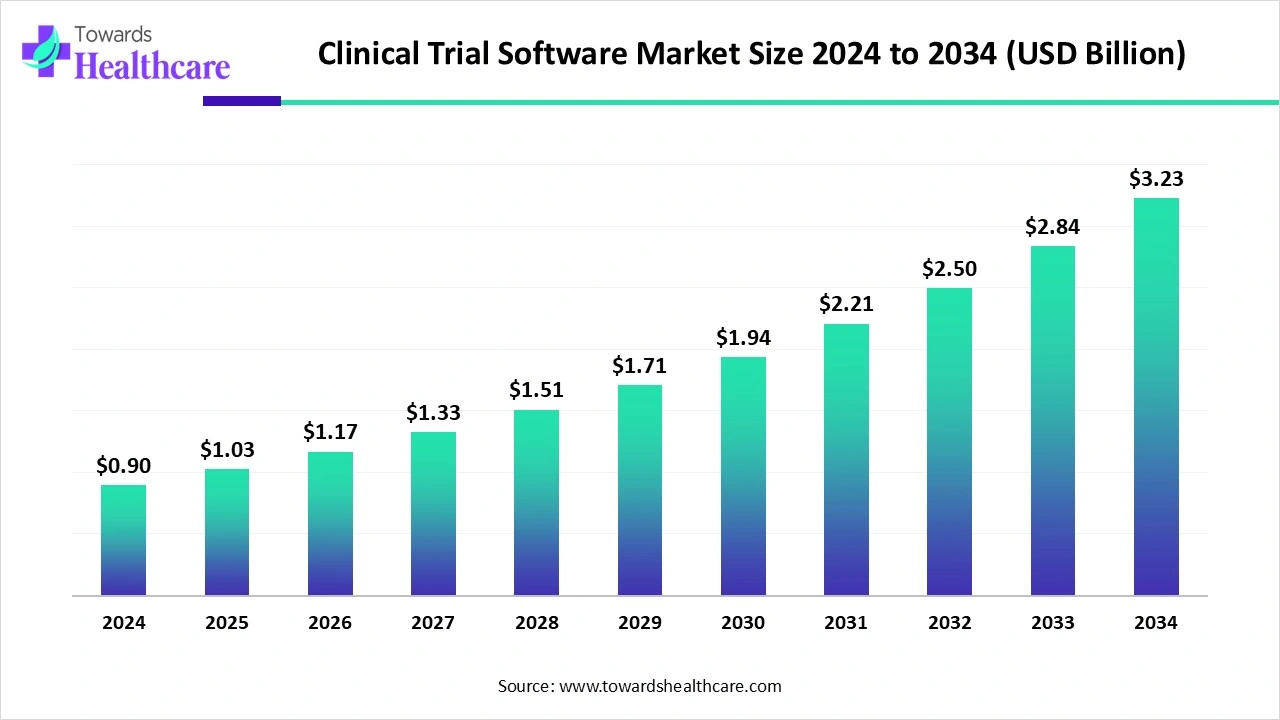

The global clinical trial software market size in 2024 was US$ 0.9 billion, expected to grow to US$ 1.03 billion in 2025 and further to US$ 3.23 billion by 2034, backed by a robust CAGR of 13.74% between 2025 and 2034.

The clinical trial software market is experiencing strong growth, fueled by the need for efficient data management, patient monitoring, and streamlined regulatory processes. Rising adoption of decentralized and virtual trials is boosting demand for cloud-based, AI-enabled platforms that improve accuracy and reduce costs. Pharmaceutical and biotech companies are increasingly leveraging these tools to accelerate drug development timelines, enhance patient recruitment, and ensure compliance, positioning clinical trial software as a vital component of modern research.

| Table | Scope |

| Market Size in 2025 | USD 1.03 Billion |

| Projected Market Size in 2034 | USD 3.23 Billion |

| CAGR (2025 - 2034) | 13.74% |

| Leading Region | North America |

| Market Segmentation | By Product / Solution Type, By Deployment Model, By End-User / Buyer Type, By Therapeutic Area (for verticalized solutions), By Region |

| Top Key Players | Medidata (a Dassault Systèmes company), Veeva Systems, Oracle Health / Oracle Clinical (InForm historically), IQVIA, Parexel Informatics / Perceptive (Parexel), Medable, Signant Health, Clario, OmniComm Systems, Castor EDC, Medrio, Viedoc, ArisGlobal, OpenClinica, eClinical Solutions |

The global market of software platforms and related services used to plan, run, monitor, manage, analyse, and report clinical trials and studies. This includes Electronic Data Capture (EDC), Clinical Trial Management Systems (CTMS), eConsent, eTMF, ePRO / eCOA, IWRS/RTSM (randomization & supply), safety/pharmacovigilance systems, decentralized trial platforms (DCT), eSource, clinical analytics & data integration/middleware, regulatory & submissions tools, patient engagement/recruitment software, and associated validation, implementation, and hosting services. Users include pharma, biotech, medical device companies, CROs, academic/academic research networks, hospitals, and regulators. Key value drivers are regulatory compliance (21 CFR Part 11 / EU Annex 11), data integrity/interoperability, trial decentralization, patient-centricity, accelerated timelines, and advanced analytics/AI.

The clinical trial software market is evolving with the integration of AI, blockchain, and cloud-based platforms to improve data security, patient engagement, and real-time analytics. Growing adoption of decentralized and hybrid models is further transforming operations, enabling faster, more efficient, and cost-effective clinical research processes worldwide.

Market Consolidation: Mergers help companies expand their market presence and reduce competition by uniting complementary strengths.

Integration of Emerging Technologies: Companies are launching platforms with AI, blockchain, and cloud capabilities to improve data accuracy, security, and scalability.

AI is transforming the market by enabling real-time monitoring of trial progress, detecting anomalies, and improving risk management. It supports adaptive trial designs by predicting dropout rates and optimizing resource allocation. Additionally, AI-driven tools enhance data integration from multiple sources, including wearables and electronic health records, allowing more personalized and efficient trial strategies while reducing operational delays and improving overall trial quality.

Growing Demand for efficient, Accurate, and Compliant Trial Management Solutions

Increasing need for efficient, accurate, and compliant trial management solutions drives market growth as pharmaceutical and biotech companies aim to simplify complex workflows and improve data integrity. Such solutions enable seamless coordination between multiple study sites, ensure proper documentation audits, and reduce the risk of protocol deviation. By enhancing transparency and operational control, these platforms help sponsors make faster, informed decisions, ensuring trials are conducted reliably, safely, and in full compliance with evolving regulatory standards.

High Implementation and Maintenance Cost

High implementation and maintenance costs act as a market restraint because deploying clinical trial software often requires specialized IT infrastructure, customization, and continuous compliance updates. Smaller organizations or sites with limited budgets may struggle to afford these investments. Additionally, integrating new software with existing legacy systems can be complex and time-consuming, increasing operational disruption. These financial and technical barriers slow adoption rates and limit the scalability of clinical trial software across diverse research settings.

Integration of Advanced Technologies

The adoption of advanced technologies offers a future opportunity in the clinical trial software market by enabling automation of routine tasks, improving data integration across multiple sites, and enhancing patient engagement through digital tools. Technologies like AI-driven risk monitoring, cloud-based collaboration, and blockchain for secure audit trails help reduce errors and operational bottlenecks. These innovations allow sponsors and research organizations to scale trials globally, accelerate development timelines, and meet evolving regulatory expectations more effectively.

How did the Electronic Data Capture (EDC) Segment dominate the Market in 2024?

The electronic data capture (EDC) segment dominated the clinical trial software market in 2024 because it enables faster data aggregation and seamless integration with other trial management tools. EDC platforms reduce operational bottlenecks, support remote monitoring, and improve collaboration among sponsors, CROs, and study sites. Their ability to handle large-scale, multi-country trials efficiently, while maintaining data integrity and audit readiness, makes EDC solutions the preferred choice, resulting in the highest revenue share within the market.

The decentralized trial platforms/remote visit tooling segment is anticipated to grow at the fastest CAGR due to the rising need for cost-effective, scalable solutions that minimize site dependency. These platforms facilitate seamless virtual collaboration between sponsors, sites, and patients, while enabling continuous monitoring and real-time data capture. Advances in mobile health technologies and increasing preference of patient for home-based participations are further fueling adoption, positioning decentralized platforms as a high-growth segment in the clinical trials software market.

The cloud/Saas segment dominated the clinical trial software market in 2024 as it allows easy integration with other digital tools and supports remote and hybrid trial operations. Its subscription-based models reduce upfront costs and IT maintenance, making it accessible for organizations of all sizes. Additionally, enhanced data backups, disaster recovery, and global accessibility make cloud solutions reliable for large-scale trials, contributing to their leading revenue share in the market during this period.

The hybrid deployments segment is expected to grow at the fastest CAGR as it combines the benefits of on-premises control with cloud-based flexibility, catering to organizations with diverse IT and security needs. This model allows sensitive data to remain on-site while leveraging cloud capabilities for scalability, collaboration, and remote access. Increasing demand for customizable deployment options, regulatory compliance, and seamless integration with existing systems is driving adoption, making hybrid solutions a rapidly expanding segment in the market.

The pharmaceutical companies segment dominated the clinical trial software market in 2024, because these firms conduct large-scale, multi-country trials that demand integrated, scalable solutions. Their focus on innovation, pipeline expansion, and faster time-to-market drives investment in advanced software for efficient trial management. Additionally, partnerships with CROs and the adoption of digital technologies to improve data accuracy, patient engagement, and operational oversight further reinforced pharmaceutical companies as the leading end user in terms of revenue share.

The biotechnology firms segment is projected to grow at the fastest CAGR as smaller and mid-sized biotechs increasingly rely on digital clinic trial software to compete with larger pharmaceutical companies. These firms prioritize flexible, cost-effective, and scalable platforms that support early-phase studies, rapid protocol adjustments, and decentralized trial design. Additionally, rising investment in innovative biologics, gene therapies, and niche therapeutic areas drives the need for advanced software solutions, positioning biotechnology companies as a rapidly expanding end-user segment in the market.

The oncology segment led the clinical trial software market in 2024 as cancer research continues to expand rapidly, with numerous early- and late-stage trials requiring sophisticated data management and monitoring tools. The complexity of combination therapies, biomarker-driven studies, and adaptive trial design increases reliance on digital platforms. Additionally, growing global innovative cancer treatments to market drive higher adoption of clinical trial software, securing the highest growth of the market.

The rare diseases & orphan indications segment is projected to grow rapidly as the number of specialized therapies and personalized treatments rises. Managing small, dispersed patient populations and complex protocols requires advanced digital tools for efficient recruitment, real-time data tracking, and regulatory compliance. Increasing government incentives, funding for orphan drug development, and collaboration between biotech firms and research organizations are further driving the adoption of clinical trial software, making this therapeutic area a high-growth segment in the forecast period.

North America led the market in 2024 as the region hosts a high concentration of contract research organizations (CROs) and technology-driven life sciences firms. Growing adoption of decentralized and virtual trials, coupled with strong venture capital funding for digital health innovations, accelerated software deployment. Additionally, collaborative initiatives between academic institutions and industry players to enhance clinical research efficiency further strengthened the dominance of North America, resulting in the largest revenue share in the global market.

The U.S. market is witnessing trends toward hybrid and fully remote trial models, driven by the need to reduce operational costs and improve patient access. Increasing focus on personalized medicine and complex therapies is boosting demand for advanced data management and analytics tools. Moreover, integration of mobile health technologies, wearable devices, and real-time monitoring platforms is reshaping trial execution, enabling faster decision-making and enhanced compliance, and positioning the U.S. as a leader in adopting innovative clinical trial software solutions.

The Canadian market is growing as pharmaceutical and biotech companies focus on accelerating drug development and improving trial efficiency. Increasing adoption of electronic data capture, remote monitoring, and decentralized trial solutions helps overcome geographic and logistical challenges. Strong collaborations between research institutions and technology providers, along with supportive regulatory frameworks, are further driving the implementation of advanced software solutions, contributing to the expanding market in Canada.

Asia-Pacific is projected to grow at the fastest CAGR as emerging markets adopt innovative clinical trial technologies to meet the rising demand for new therapies. Increasing collaborations between global pharmaceutical companies and local CROs, along with growing investment in cloud-based and AI-driven trial platforms, are fueling growth. Additionally, expanding patient access, rising awareness of digital health solutions, and government support for streamlined clinical research processes are accelerating the adoption of clinical trial software across the region.

The market in China is growing as pharmaceutical and biotech companies focus on accelerating drug development and reducing trial timelines. Increasing demand for patient-centric and virtual trial solutions, combined with the rise of AI-enabled data analytics and cloud platforms, is driving adoption. Furthermore, expanding research collaborations, rising investment in innovative therapies, and modernization of regulatory frameworks are encouraging broader deployment of clinical trial software, supporting the rapidly expanding market in China.

The market in India is increasing as more companies adopt technology-driven solutions to manage complex and multi-site trials efficiently. Increasing focus on patient-centric and decentralized trials, coupled with rising demand for real-time data access and analytics, is driving adoption. Additionally, partnerships between Indian research institutions and global pharmaceutical firms, along with improvements in IT infrastructure and regulatory support, are further accelerating the growth of clinical trial software in the country.

In 2024, Europe is expanding its market by focusing on innovation and integration of advanced technologies. Companies are leveraging platforms that support real-time monitoring, multi-site coordination, and adaptive trial designs. Growing investment in decentralized trials, partnerships between CROs and tech providers, and the need for streamlined regulatory reporting are accelerating adoption. This strategy enables faster, more efficient trials while improving data accuracy and operational oversight across the region.

The UK market is expanding as research organizations and pharmaceutical companies adopt advanced digital solutions to improve trial efficiency and reduce operational delays. Increasing use of cloud-based platforms, AI analytics, and remote monitoring tools enables faster patient recruitment and better data management. Additionally, collaborations between technology providers and clinical research institutions, along with government support for innovative trial designs, are driving the growing adoption of clinical trial software in the UK.

The market in Germany is growing as companies adopt innovative platforms to manage complex, multi-center studies efficiently. Increasing focus on patient-centric and decentralized trials, combined with the integration of AI and cloud technologies, supports faster decision-making and improved data quality. Collaborations between pharmaceutical firms, CROs, and technology providers, along with favorable government initiatives for digital health, are further accelerating the adoption of clinical trial software in the German market.

In June 2024, IQVIA launched One Home for Sites™, a new platform designed to simplify operations for clinical research sites. The platform provides a single sign-on and unified dashboard, integrating multiple software applications used in trials, reducing the time staff spend managing logins and navigating systems. This allows sites to focus more on patient care and trial management. Bernd Haas, Senior VP of IQVIA, stated that the platform addresses technology overload and helps maximize site capacity by connecting all stakeholders efficiently.

By Product / Solution Type

By Deployment Model

By End-User / Buyer Type

By Therapeutic Area (for verticalized solutions)

By Region

January 2026

January 2026

January 2026

January 2026