February 2026

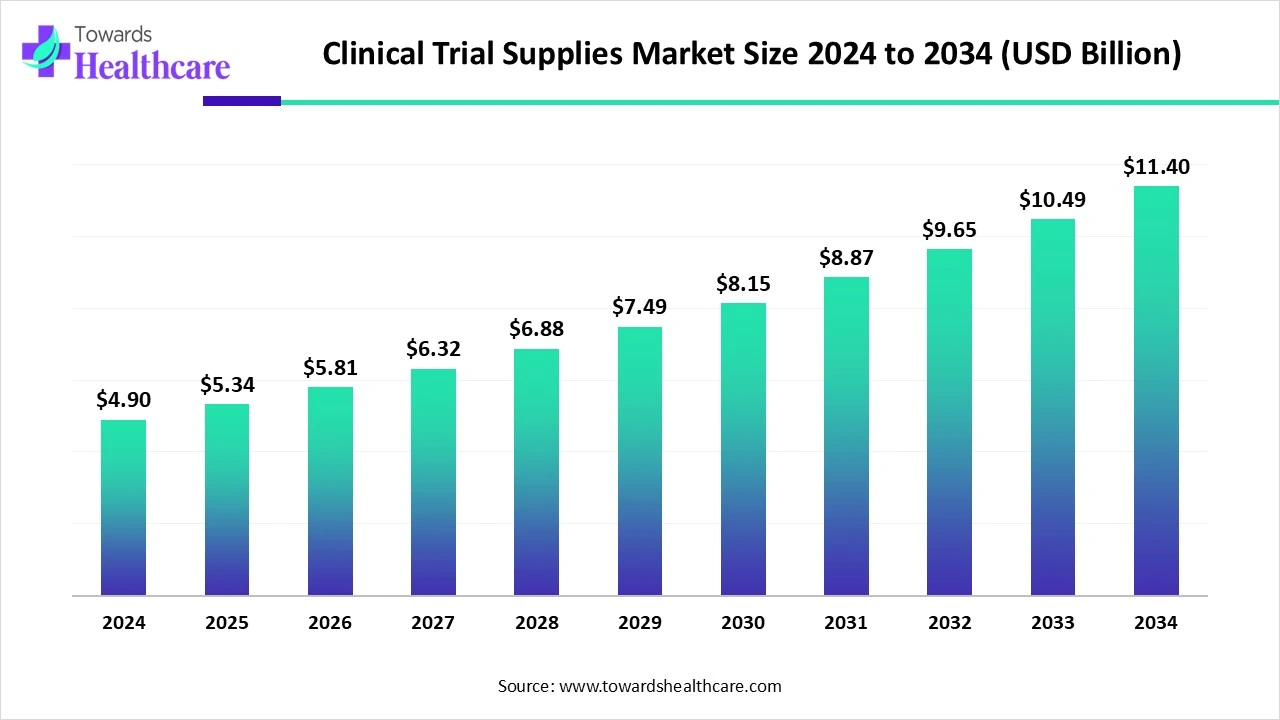

The global clinical trial supplies market size reached US$ 4.9 billion in 2024 and is anticipate to increase to US$ 5.34 billion in 2025. By 2034, the market is forecasted to achieve a value of around US$ 11.4 billion, growing at a CAGR of 8.87%.

The clinical trial supplies market is primarily driven by growing research activities, leading to the development of novel therapeutics. Government organizations support clinical trials through initiatives and funding. The collaboration among prominent players facilitates the conduct of clinical trials and access to advanced technologies. Integrating artificial intelligence (AI) in clinical trial supplies streamlines their manufacturing and supply chain. The future looks promising, with digital supply chain platforms and services for decentralized and hybrid trials.

| Table | Scope |

| Market Size in 2025 | USD 5.34 Billion |

| Projected Market Size in 2034 | USD 11.4 Billion |

| CAGR (2025 - 2034) | 8.87% |

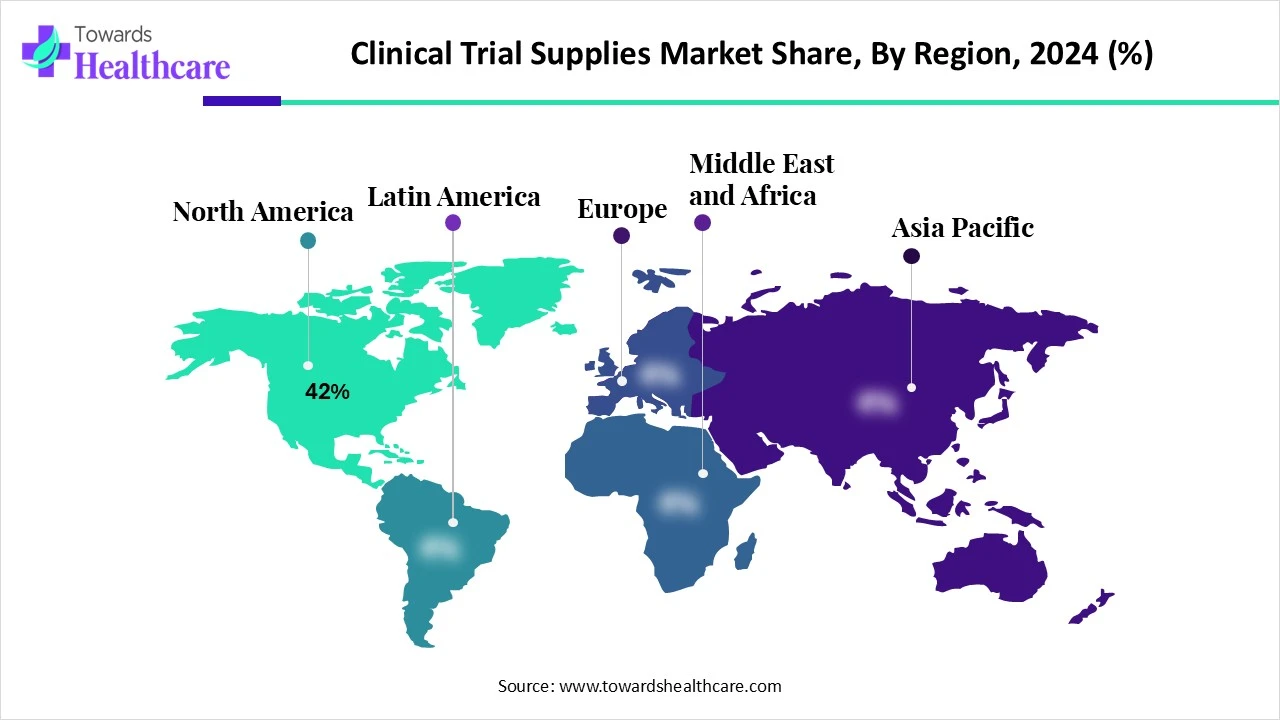

| Leading Region | North America Share 42% |

| Market Segmentation | By Product/Supply Type, By Service Type, By Trial Phase, By Therapeutic Area, By End-User/Customer, By Region |

| Top Key Players | Catalent Pharma Solutions, Thermo Fisher Scientific, PCI Pharma Services, Marken (UPS Healthcare / Marken Logistics), Almac Group, Vetter Pharma, Lonza, Recipharm, Parexel Supply & Logistics (Parexel International), IQVIA, Clinigen Group, DHL Life Sciences & Healthcare, Jubilant HollisterStier / Jubilant Pharma Services, Movianto (part of Agility), PCI / others (regional CMOs) - e.g., Sharp (CMO partners) & local specialists, Kuehne + Nagel, FedEx / FedEx Clinical Solutions, Siegfried Holding AG / specialized CMO-CTS divisions, Local & regional specialist CTS providers/depot operators |

The clinical trial supplies market covers products and end-to-end services that support the execution of clinical trials, such as manufacture, sourcing, packaging, labeling, blinding, kitting, storage, temperature-controlled distribution, depot management, comparator sourcing, returns/destruction, and related logistics for investigational medicinal products (IMPs), comparators, devices, and ancillary materials. CTS is critical to study integrity, regulatory compliance, patient safety, and timely trial execution and is a core outsourced function for pharma, biotech, and CRO-sponsored trials.

AI can revolutionize clinical trial supplies by ensuring timely delivery and reducing costs. AI and machine learning (ML) algorithms can mitigate risks such as overproduction, overstocking, and overdistribution of clinical trial supplies, enhancing efficiency and cost-effectiveness. They also empower trial sponsors to make data-driven decisions and mitigate supply chain challenges. AI can enable suppliers to design clinical trials and the supply chain effectively. The use of simulations can be powerful in accurately understanding the patient’s treatment possibilities while considering the inherent uncertainty of clinical trials.

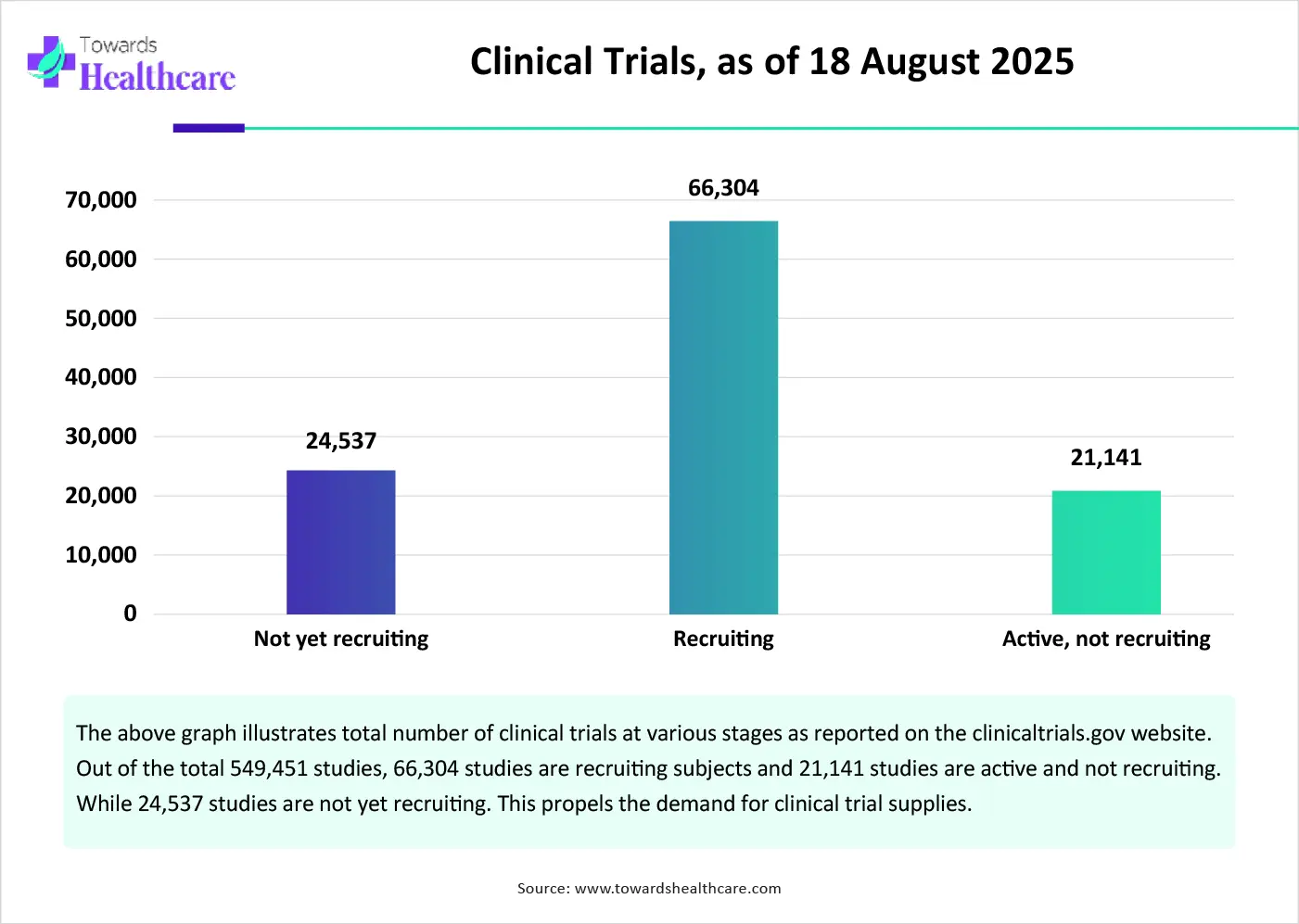

Increasing Number of Clinical Trials

The major growth factor for the clinical trial supplies market is the increasing number of clinical trials globally. Researchers develop innovative therapeutics, such as vaccines, cell and gene therapies, and monoclonal antibodies, to treat numerous disorders. They also focus on repurposing existing drugs for different disorders. This reduces the time and effort required to design and develop novel drug candidates, thereby saving costs. Apart from therapeutics, medical devices and physical exercises are also assessed through clinical trials. Regulatory agencies necessitate the conduct of clinical trials to evaluate the safety and efficacy of novel therapeutics. A total of 549,451 studies are reported on the clinicaltrials.gov website as of 18th August 2025.

Complexity in Supply Chain

Suppliers face the complexity of global import/export and customs due to certain issues, like regulatory compliance and supply chain disruptions. Several geopolitical issues also disrupt the timely supply of clinical trial products, restricting market growth.

What is the Future of the Clinical Trial Supplies Market?

The market future is promising, driven by the advent of digital supply chain platforms and services related to decentralized and hybrid trials. Digital supply chain platforms perform numerous functions, including real-time inventory tracking and predictive resupply. They can also predict expiry dates of products and send alerts to healthcare professionals. They also enable sponsors to adjust inventory flows in response to protocol changes or enrollment velocity. Additionally, healthcare professionals offer services to conduct decentralized and hybrid trials, especially for the geriatric population. They monitor patients in the comfort of their homes, as well as suppliers provide direct-to-patient shipments.

By product/supply type, the investigational medicinal product (IMP) supply segment held a dominant presence in the market in 2024. This is due to the growing need for personalized medicines and the demand for timely delivery of IMPs. The major aim of clinical trials is to assess the safety, efficacy, and dosing regimen of IMPs compared to placebos. Researchers develop numerous innovative products, such as small molecules and biologics. IMPs also include licensed drugs that are being tested against a new condition or in a new formulation or packaging.

By product/supply type, the ancillary supplies segment is expected to grow at the fastest CAGR in the market during the forecast period. Ancillary supplies in clinical trials are non-drug items and services to conduct clinical trials smoothly. These may include infusion pumps, wearable sensors, imaging modalities, diagnostic kits, and clinical supplies, such as bandages and swabs. These ancillaries are required for patient safety, data collection, and compliance with regulatory requirements.

By service type, the packaging, labeling, & blinding segment held the largest revenue share of the market in 2024. Suppliers enable packaging, labeling, & blinding of clinical trial supplies and deliver to various trial sites. Supplies must be properly packed and labeled to ensure product integrity and safety. This also helps reduce cross-contamination and product leakage. Sponsors conduct single-blind and double-blind studies to reduce bias in the outcomes of the trial data. Suppliers also facilitate blinding of IMPs and medical devices to introduce randomization in clinical trials.

By service type, the temperature-controlled storage & distribution segment is expected to grow with the highest CAGR in the market during the studied years. Temperature-controlled storage and distribution are predominantly required for temperature-sensitive products, such as vaccines, blood and blood products, tissues, certain pharmaceuticals, and reagents. These products require a constant cold chain infrastructure to distribute them. Temperature-controlled storage and distribution are essential services to ensure correct storage temperatures and transportation conditions from the manufacturing site to the clinical trial site.

By the trial phase, the phase II/III segment contributed the biggest revenue share of the market in 2024. This segment dominated because Phase II/III trials are conducted on a large scale and need to fulfill patients’ requirements. They require large amounts of clinical trial supplies and their delivery to diverse geographical locations. Suppliers simplify the task of sponsors by complying with the regulatory requirements of different countries. Phase II and III trials are conducted to determine the safety and effectiveness of an experimental drug on a particular disease.

By the trial phase, the phase IV/post-marketing studies segment is expected to expand rapidly in the market in the coming years. The increasing number of Phase IV studies is due to the growing demand for post-marketing surveillance of a medicinal product. Once a product reaches the market, it is essential to study its response on a much wider consumer base. This helps producers to study its adverse effects. As of 18th August 2025, about 34,028 Phase IV clinical trials were reported on the clinicaltrials.gov website.

By therapeutic area, the oncology segment accounted for the highest revenue share of the market in 2024. This is due to the rising prevalence of cancer and the growing research activities for developing cancer diagnostics and therapeutics. Government organizations support researchers to develop drugs and medical devices for cancer prevention, diagnosis, and treatment. Patients can get access to the latest cancer therapies through clinical trials. Additionally, healthcare professionals provide closer attention to participants than patients.

By therapeutic area, the rare diseases & orphan indications segment is expected to witness the fastest growth in the market over the forecast period. The increasing prevalence of rare disorders and their complications necessitate researchers to develop drugs for their treatment. Rare disorders are estimated to affect 3.5% to 5.9% of the total global population. Clinical trial supplies services are essential to deliver supplies to small and dispersed patient groups. About 52% of novel drugs approved by the U.S. Food and Drug Administration (FDA) in 2024 were for rare or orphan diseases, representing 26 drugs.

By end-user/customer, the pharmaceutical & biotechnology sponsors segment led the global market in 2024. The segmental growth is attributed to the growing research activities and the need for developing novel therapeutics. Pharmaceutical & biotechnology sponsors have sufficient capital investment to conduct clinical trials and collaborate with CTS. Clinical trial supply services offer end-to-end clinical trial supply support and expertise to safeguard the supply chain at every step, enabling companies to focus on product sales and marketing.

By end-user/customer, the contract research organizations (CROs) segment is expected to show the fastest growth over the forecast period. Numerous large and small-scale pharmaceutical and biotechnology companies collaborate with CROs to facilitate research, manufacturing, and clinical trials. CROs have suitable infrastructure and relevant expertise to provide solutions to complex problems. Many CROs provide integrated services, including clinical trial supplies. They offer a wide range of services, from procurement to distribution.

North America dominated the global market share by 42% in 2024. The availability of favorable clinical logistics infrastructure, the presence of key players, and large trial volumes are the major growth factors for the market in North America. Government agencies support clinical trials and research activities through initiatives and funding. The region also has a favorable regulatory framework for distributing clinical trial supplies. The presence of a robust healthcare infrastructure and strong R&D investments boosts the market.

The U.S. conducts the highest number of clinical trials in the world, accounting for 184,597 trials as of August 2025. Key players, such as Thermo Fisher Scientific, IQVIA, and Parexel Supply & Logistics, distribute clinical trial supplies in the U.S. The National Institute of Health (NIH) provides funding for basic or applied research in the U.S.

Canada captures 4% of global clinical trials, accounting for 30,748 clinical trials as of August 2025. It ranks fourth in the number of clinical trial sites and is the G7 leader in clinical trial productivity. The Canadian Institutes of Health Research (CIHR) provides $250 million in funding to reinforce Canada’s clinical trials ecosystem.

Asia-Pacific is expected to host the fastest-growing clinical trial supplies market in the coming years. The burgeoning healthcare sector, increasing number of pharma & biotech startups, and growing research and development activities drive the market. Researchers prefer conducting clinical trials in the APAC region, such as China, India, and Southeast Asia, due to improved infrastructure and affordable services. The region’s growth is also attributed to the expanded CRO presence and growth in local manufacturing and depots.

China is overtaking the U.S. in terms of the number of clinical trials conducted annually, owing to regulatory shifts, capital inflows in biotech, and a shift towards more decentralized and patient-centric models. The NIH awarded nearly $5 billion less to the U.S. institutions in the year ending June 2025, creating opportunities for the Chinese healthcare sector.

India is home to more than 3,000 pharmaceutical companies and over 10,000 manufacturing units. According to a recent survey, the annual revenue of 12% CROs was in the range of $0-5 million, and that of 22% of the CROs was in the range of $5-10 million. Also, 24% of medium-sized CROs generated an annual revenue of $10-50 million, and large-sized CROs generated $50 million of revenue.

Academic institutions and pharmaceutical companies conduct research activities to develop novel diagnostics and therapeutics, such as drugs, biologics, and medical devices, for numerous disorders.

Key Players: Novartis, AstraZeneca, Merck, and Biogen

Clinical Trials & Regulatory Approvals

Clinical trial supplies require regulatory approvals to ensure they are handled according to strict guidelines. They involve the secure and compliant management of IMPs used in clinical research.

Key Players: IQVIA, Parexel International, Cencora, and Proventa International

Clinical trial supplies provide patient support & services by delivering the right products to the right patients and at the right time to conduct clinical trials, safely and effectively.

Key Players: ICON plc, McKesson, and Pantheon Pharma Services

Sean P. Bohen, President and Chief Executive Officer of Olema Oncology, commented that the company can initiate its planned pivotal Phase 3 clinical trial, OPERA-02, for palazestrant in combination with ribociclib in frontline ER+/HER2- metastatic breast cancer. He also said that the new agreement with Novartis is a major milestone, which includes sufficient ribociclib drug supply for the planned approximately 1,000-patient trial.

By Product/Supply Type

By Service Type

By Trial Phase

By Therapeutic Area

By End-User/Customer

By Region

February 2026

February 2026

February 2026

February 2026