February 2026

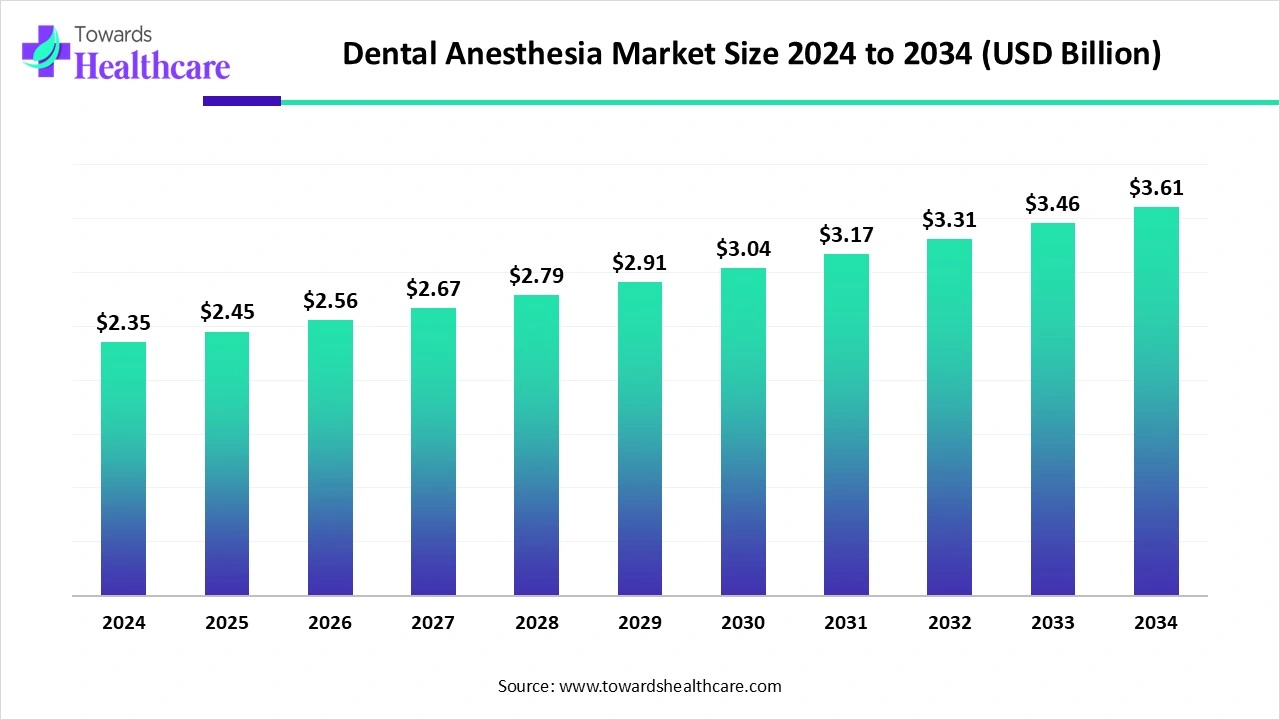

The global dental anesthesia market size marked US$ 2.35 billion in 2024 and is forecast to experience consistent growth, reaching US$ 2.45 billion in 2025 and US$ 3.61 billion by 2034 at a CAGR of 4.52%.

The dental anesthesia market is witnessing steady growth, driven by increasing awareness of oral health care, rising prevalence of dental disorders, and the expanding demand for painless and cosmetic dental procedures. Technological advancements, such as computer-controlled anesthesia delivery systems and safer anesthetic formulations, are enhancing patient comfort and treatment efficiency. North America remains the dominant region due to its advanced dental healthcare infrastructure, high disposable incomes, strong presence of key market players, and growing demand for elective and cosmetic dental treatments. Rising patient preference for minimally invasive and comfortable procedures continues to support market expansion globally.

| Table | Scope |

| Market Size in 2025 | USD 2.45 Billion |

| Projected Market Size in 2034 | USD 3.61 Billion |

| CAGR (2025 - 2034) | 4.52% |

| Leading Region | North America |

| Market Segmentation | By Product Type, By Drug Class, By Procedure, By End-User, By Manufacturing Source, By Region |

| Top Key Players | Aseptico, B. Braun Medical, Carestream Dental, Dentsply Sirona, Henry Schein, Hu-Friedy, Kerr Dental, Medline Industries, Milestone Scientific, Novocol Pharmaceuticals, Septodont, Septodont/Septodont group (regional brands and cartridges), Smiths Medical, Ultradent Products, Vatech / A-dec, Zimmer Biomet Dental / Align Technology |

Dental anesthesia refers to the use of medications to prevent pain and discomfort during dental procedures. It allows patients to undergo treatments such as tooth extractions, cavity fillings, root canals, and cosmetic or surgical procedures without experiencing pain. Dental anesthesia can be local, numbing only the specific area being treated; sedation, which relaxes the patient while keeping them conscious; or general anesthesia, rendering the patient fully unconscious for more complex procedures. Advancements in anesthetic drugs and delivery techniques have improved safety, effectiveness, and patient comfort. Dental anesthesia plays a critical role in reducing anxiety and enabling precise, pain-free dental care.

Inorganic growth strategies such as partnerships, acquisitions, and collaborations are significantly influencing the dental anesthesia market.

Integration of Artificial Intelligence (AI) can significantly enhance the dental anesthesia market by improving precision, efficiency, and patient safety. AI-powered tools can analyze patient data to predict anesthetic requirements, optimize dosage, and identify potential risks, reducing complications during procedures. AI also aids in treatment planning, enabling dentists to select the most suitable anesthesia method for each patient. Furthermore, AI-driven digital systems can monitor patient vitals in real time, enhancing procedural safety and comfort. By streamlining workflows and supporting personalized care, AI adoption not only improves clinical outcomes but also encourages greater acceptance and utilization of dental anesthesia solutions.

Expansion of Dental Clinics

The expansion of dental clinics directly influences the growth of the dental anesthesia market by increasing the availability and accessibility of advanced anesthetic procedures.

For instance,

Shortage of Trained Dental Professionals & Patient Apprehension and Fear

The key players operating in the market are facing issue due to patient apprehension and fear and shortage of trained dental professionals which has estimated to restricted the growth of the market in the near future. Compliance with safety and drug approval regulations can delay product launches and increase operational costs. Administering anesthesia safely requires skilled personnel, and a lack of trained staff can restrict market expansion. Anxiety about anesthesia or dental procedures can reduce demand.

Rising Demand for Cosmetic and Elective Dental Procedures

The rising demand for cosmetic and elective dental procedures is significantly driving the growth of the dental anesthesia market. As patients increasingly seek treatments like veneers, teeth whitening, and smile makeovers, the need for effective and comfortable anesthesia solutions escalates.

For instance,

The local anesthetic agents segment dominates the dental anesthesia market due to its widespread application, safety profile, and cost-effectiveness. Local anesthetics, such as lidocaine and articaine, are preferred for routine dental procedures like fillings, root canals, and extractions because they provide effective pain relief without inducing systemic effects. Their rapid onset and relatively short duration of action make them suitable for outpatient settings. Additionally, the availability of various formulations and concentrations allows for tailored anesthesia to meet specific procedural needs. These factors collectively contribute to the sustained dseominance of local anesthetic agents in the dental anesthesia market.

The anesthesia delivery devices segment, especially computer-controlled local anesthetic delivery systems (CCLADs), is estimated to be fastest-growing segment in the dental anesthesia market. These devices enhance patient comfort by administering anesthetics at a controlled, consistent rate, reducing pain and anxiety compared to traditional injections. CCLADs offer precise control over anesthetic volume and flow, ensuring effective numbing with minimal discomfort. Their alignment with minimally invasive procedures, combined with ongoing technological advancements improving efficiency and ease of use, is driving widespread adoption in dental practices and fueling growth in this segment.

The amide local anesthetics segment dominates the dental anesthesia market due to its safety, effectiveness, and versatility in various dental procedures. Amide anesthetics, such as lidocaine, articaine, and mepivacaine, offer rapid onset, predictable duration, and minimal systemic toxicity, making them ideal for routine treatments like fillings, extractions, root canals, and cosmetic procedures. Their chemical stability and lower risk of allergic reactions compared to ester anesthetics enhance their clinical preference. Additionally, wide availability, cost-effectiveness, and extensive clinical experience allow dental professionals to tailor anesthesia to patient needs, reinforcing the continued dominance of amide local anesthetics in dental practices globally.

The long-acting and buffered formulation segment is anticipated to be fastest-growing in the dental anesthesia market due to their enhanced efficacy and patient comfort. Buffered local anesthetics, achieved by adjusting the pH of the solution, result in a faster onset and reduced injection pain compared to non-buffered solutions. Studies have shown that buffered anesthetics are more effective, particularly in achieving profound anesthesia in pulpally involved teeth, with a 2.23 times greater likelihood of success. Additionally, long-acting formulations like bupivacaine provide extended pain relief, reducing the need for postoperative analgesics. These advancements align with the growing demand for efficient and patient-friendly dental procedures, driving the adoption of these formulations in clinical settings.

The routine restorative & endodontic procedures segment is the dominant segment in the dental anesthesia market due to its widespread application and essential role in daily dental practice. Procedures such as fillings, crowns, bridges, and root canals are common and often require effective pain management to ensure patient comfort and procedural success. Local anesthesia is predominantly used in these procedures, allowing for painless removal of decay and preparation of the tooth structure. The frequency and necessity of these treatments contribute to the sustained demand for dental anesthesia, reinforcing its dominance in the market.

The implantology and periodontal surgery segment is estimated to be fastest-growing in the dental anesthesia market due to several key factors. Advancements in dental implant technology and surgical techniques have increased the complexity and frequency of these procedures, necessitating effective anesthesia solutions. The rising prevalence of periodontal diseases and tooth loss among aging populations has further driven demand for implant and surgical interventions. Additionally, innovations in anesthesia delivery systems, such as computer-controlled local anesthetic delivery devices, have improved patient comfort and procedural efficiency, contributing to the growth of this segment.

The general dental practices / private clinics segment is the dominant segment in the dental anesthesia market due to several key factors. These settings handle a high volume of routine procedures, such as fillings, cleanings, and extractions, which require effective pain management. The widespread adoption of local anesthetics in these practices ensures patient comfort and procedural efficiency. Additionally, the increasing number of solo dental practices globally contributes to the growth of this segment, as more practitioners establish independent clinics, leading to a higher demand for dental anesthesia solutions.

The hospital dental departments & ASCs segment is anticipated to be fastest-growing segment in the dental anesthesia market due to several key factors. ASCs are experiencing significant growth, driven by the increasing demand for outpatient services, enhanced operational efficiency, and technological innovations. These centers offer cost-effective alternatives to traditional hospital settings, attracting patients seeking same-day discharge procedures. Additionally, advancements in anesthesia techniques and the adoption of enhanced recovery after surgery (ERAS) protocols contribute to improved patient outcomes and satisfaction, further fueling the growth of this segment.

The branded pharmaceutical manufacturers segment dominates the dental anesthesia market due to its strong focus on research and development, high-quality product offerings, and established brand trust among dental professionals. These companies produce well-recognized anesthetic agents with consistent efficacy, safety, and regulatory compliance, which encourages adoption in dental practices, hospitals, and surgical centers. Additionally, branded manufacturers often provide training, support, and promotional programs to ensure correct usage, further strengthening their market position. Their ability to innovate and maintain high standards reinforces the dominance of branded products in dental anesthesia globally.

The contract manufacturers / CDMOs for cartridges & disposables segment is estimated to rapid growth due to several key factors. The increasing demand for single-use, disposable dental cartridges enhances infection control and patient safety. Technological advancements in manufacturing processes have improved the efficiency and cost-effectiveness of producing these disposable devices. Additionally, the rise in dental procedures, particularly in outpatient settings, has driven the need for reliable and sterile delivery systems. These factors collectively contribute to the expansion of the contract manufacturing segment in the dental anesthesia market.

The North American region dominates the dental anesthesia market due to several key factors. Technological advancements in dental diagnosis and anesthesia delivery systems have enhanced procedural efficiency and patient comfort. The rising incidence of dental problems, coupled with a growing elderly population requiring specialized dental care, has increased demand for dental procedures. Additionally, the expansion of dental care services and a surge in the number of dental clinics have further fueled market growth. Increased dental care expenditure and public awareness of dental disease treatment also contribute to the region's market leadership.

The U.S. dental anesthesia market is driven by the rising demand for cosmetic, restorative, and reconstructive dental procedures, along with increasing use of general and local anesthesia. Advanced dental technologies, including computer-controlled anesthesia delivery systems, enhance procedural efficiency and patient comfort. A robust healthcare infrastructure, widespread dental insurance coverage, and strong regulatory support facilitate the safe and effective administration of dental anesthesia, reinforcing the country’s leadership in adopting innovative anesthesia solutions and supporting market growth.

Canada’s dental anesthesia market growth is supported by an aging population and the increasing number of dental procedures requiring effective pain management. Local anesthesia remains the most widely used option due to its safety and reliability. The adoption of advanced anesthesia delivery systems and the accessibility provided by the healthcare system further drive demand. Increased patient awareness about pain-free dentistry and the preference for minimally invasive procedures contribute to the expansion of dental anesthesia services across the country.

The Asia-Pacific region is the fastest-growing market for dental anesthesia, driven by several key factors. Rapid urbanization and increasing disposable incomes in countries like China and India have elevated demand for dental services, including cosmetic and restorative procedures. A growing middle class is prioritizing oral health, leading to greater adoption of dental treatments. Advancements in dental technologies and the expansion of dental networks have improved accessibility and efficiency. Additionally, rising awareness of oral hygiene and government initiatives to promote dental health contribute to the region's robust market growth.

In August 2025, Gregory T. Lucier, Chairman of the Board stated that the Dentsply Sirona company appointed Daniel Scavilla as CEO effective August 1, 2025. Scavilla has a background with Globus Medical, and is expected to help with strategic execution and possibly more M&A activity. Along with that, Dentsply Sirona reaffirmed its financial guidance for Q2 2025 and reported preliminary net sales of about US$935-936 million. These results were seen positively by the market.

By Product Type

By Drug Class / Active Ingredient

By Procedure / Clinical Indication

By End-User / Setting

By Manufacturing Source

By Region

February 2026

February 2026

February 2026

February 2026