February 2026

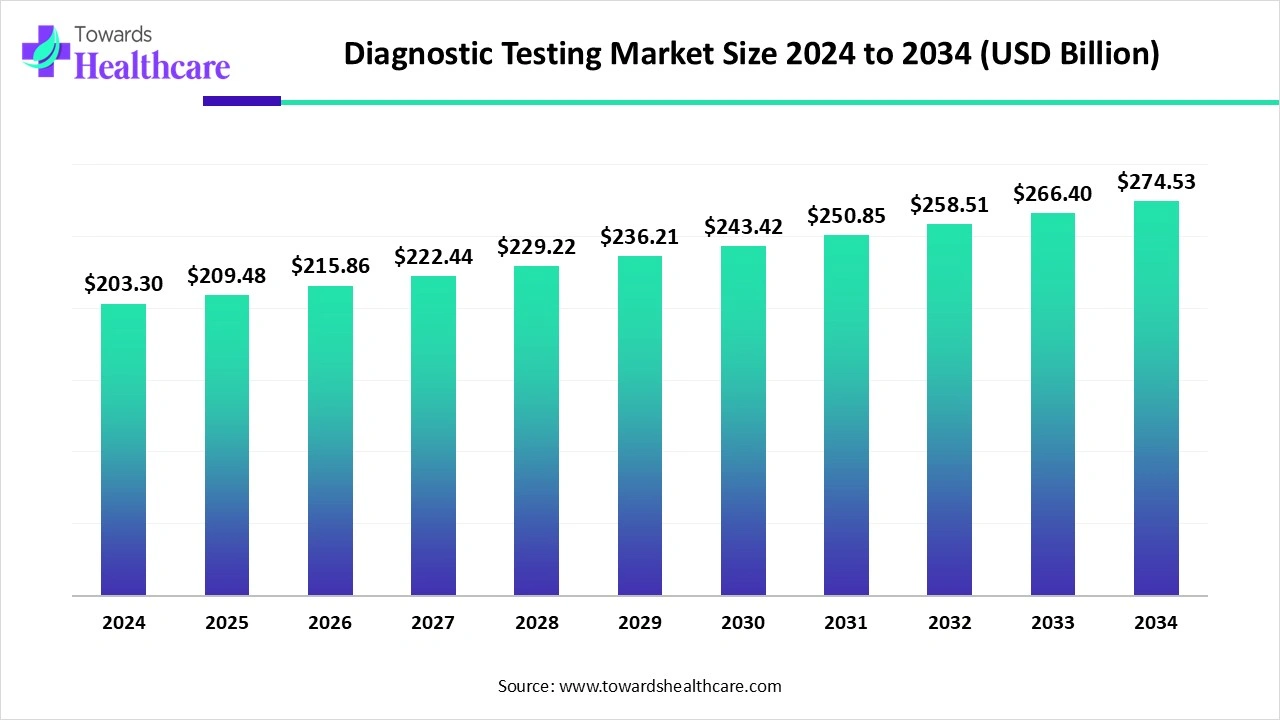

The global diagnostic testing market size reached US$ 203.3 billion in 2024 and is anticipate to increase to US$ 209.48 billion in 2025. By 2034, the market is forecasted to achieve a value of around US$ 274.53 billion, growing at a CAGR of 3.04%.

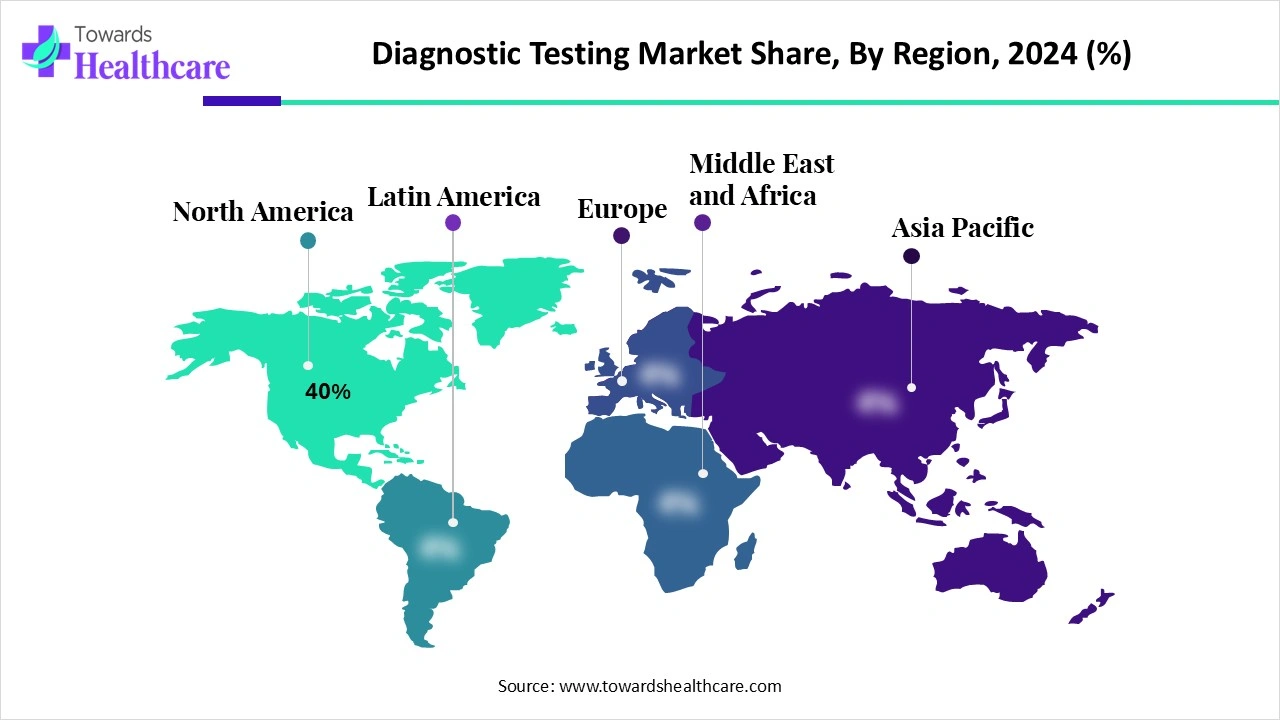

The diagnostic testing market is witnessing strong growth, driven by increasing prevalence of chronic and infectious diseases, rising demand for early and accurate diagnosis, and advancements in molecular, genetic, and point-of-care testing technologies. North America dominates the market due to advanced healthcare infrastructure, high healthcare spending, and strong adoption of innovative diagnostic solutions. Supportive government regulations, widespread insurance coverage, and growing awareness of preventive healthcare further strengthen the region’s leadership, while ongoing R&D and public-private partnerships continue to propel the development and accessibility of advanced diagnostic testing.

| Table | Scope |

| Market Size in 2025 | USD 209.48 Billion |

| Projected Market Size in 2034 | USD 274.53 Billion |

| CAGR (2025 - 2034) | 3.04% |

| Leading Region | North America by 40% |

| Market Segmentation | By Test Type, By Technology, By Disease Area, By End User, By Region |

| Top Key Players | Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Danaher Corporation (Cepheid, Beckman Coulter), Thermo Fisher Scientific, Bio-Rad Laboratories, QIAGEN N.V., Quest Diagnostics, Laboratory Corporation of America (LabCorp), PerkinElmer (Revvity), Agilent Technologies, BD (Becton, Dickinson and Company), Illumina, Inc., Hologic, Inc., Myriad Genetics, Inc., Exact Sciences Corporation, Sysmex Corporation, BioMérieux SA, ARUP Laboratories, Invitae Corporation |

Diagnostic testing refers to medical procedures and laboratory analyses used to detect, diagnose, and monitor diseases, conditions, or infections in patients. These tests can include blood tests, urine tests, imaging, molecular diagnostics, genetic testing, and point-of-care assays, providing critical information for accurate medical decision-making. Diagnostic testing enables early detection of diseases, guides treatment plans, monitors therapy effectiveness, and helps predict disease progression. Advances in technology, such as high-throughput sequencing, immunoassays, and digital diagnostics, have improved speed, accuracy, and accessibility.

Telehealth and Remote Monitoring: Telehealth and remote monitoring are significantly driving the growth of the diagnostic testing market by enhancing accessibility, efficiency, and patient engagement.

Adoption of Inorganic Growth Strategies: The adoption of inorganic growth strategies, such as mergers and acquisitions, drives the diagnostic testing market by expanding technological capabilities, market reach, and service offerings.

Growing Patient Awareness

Growing patient awareness and the focus on preventive healthcare are key factors driving the diagnostic testing market. Increasing health consciousness and lifestyle-related risks are motivating individuals to prioritize regular health check-ups, early detection, and proactive disease management. As more patients actively seek diagnostic testing services, healthcare providers and laboratories experience increased demand, which accelerates the adoption of advanced diagnostic technologies, expands testing capabilities, and drives overall growth in the market.

For instance,

Limited Healthcare Infrastructure & Data Privacy

The key players operating in the market are facing issues due to data privacy and limited healthcare infrastructure. Limited healthcare infrastructure in rural and underdeveloped regions restricts access to testing services. Data privacy and security concerns related to patient information in digital and AI-driven diagnostics.

Advancements in diagnostic technology are significantly driving the growth of the diagnostic testing market by enhancing accuracy, speed, and accessibility. In September 2025, the launch of the Core Metabolic Lab at Kasturba Medical College (KMC), Manipal, exemplifies this trend. Equipped with a state-of-the-art Liquid Chromatography Tandem Mass Spectrometry (Triple Quadrupole) platform, the lab aims to deliver gold-standard diagnostics for inborn errors of metabolism (IEMs), including preventable childhood diseases and adult metabolic disorders. This facility enhances clinical research and operates as a collaborative initiative between the departments of pediatrics and biochemistry at KMC.

Such technological innovations improve diagnostic accuracy, reduce turnaround times, and expand testing capabilities, particularly in specialized areas. By integrating advanced platforms, healthcare providers can offer more precise and timely diagnoses, thereby improving patient outcomes and driving the overall growth of the diagnostic testing market.

The clinical chemistry tests segment dominates the market due to its wide application in detecting metabolic disorders, liver and kidney function, and cardiovascular diseases. Their routine use in hospitals and laboratories, coupled with technological improvements ensuring accuracy and efficiency, makes them essential for early disease detection and patient management.

The molecular diagnostics segment is estimated to grow at the fastest rate in the diagnostic testing market due to its ability to detect diseases at a genetic and molecular level, enabling early and highly accurate diagnoses. Growing demand for personalized medicine, rising prevalence of infectious and genetic disorders, and advancements in technologies like PCR and next-generation sequencing further fuel its adoption. In addition, its critical role in oncology, infectious disease testing, and precision healthcare supports its rapid growth and increasing integration into clinical practice.

The laboratory-based testing segment dominates the market due to its high accuracy, reliability, and ability to handle large testing volumes across diverse disease areas. Laboratories are equipped with advanced technologies, skilled professionals, and standardized procedures, ensuring precise results that support effective clinical decision-making. Additionally, the rising prevalence of chronic and infectious diseases has increased demand for comprehensive diagnostic services, which are best managed in centralized labs. Their critical role in routine health check-ups and specialized testing further strengthens their dominance.

The point-of-care testing segment is anticipated to be the fastest-growing segment in the diagnostic testing market due to its ability to deliver rapid, accurate results at or near the patient’s location. Its convenience, reduced turnaround time, and growing use in emergency care, home settings, and remote areas make it vital for timely clinical decisions and treatment.

The infectious diseases segment dominates the market due to the high global burden of illnesses such as influenza, HIV, tuberculosis, and emerging viral outbreaks. Increasing demand for early detection and rapid testing solutions has made infectious disease diagnostics essential for effective treatment and containment. Continuous innovations, including molecular and rapid antigen tests, further enhance accuracy and speed. Additionally, government initiatives and public health programs focusing on infection control and surveillance strengthen the adoption of diagnostic testing in this segment, ensuring its dominance.

The oncology segment is estimated to be the fastest-growing in diagnostic testing, driven by rising cancer prevalence and demand for early detection. Advances in molecular diagnostics, liquid biopsies, and genetic profiling support precise diagnosis and personalized treatment. Expanding targeted therapies and research initiatives further accelerate adoption, making oncology a rapidly expanding market segment.

The hospitals & clinics segment dominates the market due to their comprehensive infrastructure, advanced technologies, and accessibility to a wide patient base. These facilities offer a broad range of routine and specialized tests, ensuring timely and accurate results. Hospitals and clinics are primary healthcare touchpoints, handling large patient volumes daily, which drives high demand for diagnostic services. Additionally, their integration of laboratory services with patient care enables efficient diagnosis, treatment planning, and monitoring. Growing investments in hospital-based diagnostic capabilities further strengthen their dominance in the market.

The home & point-of-care users segment is anticipated to be the fastest-growing in the diagnostic testing market due to rising demand for convenient, rapid, and accessible healthcare solutions. Patients increasingly prefer self-testing and near-patient testing for chronic conditions, infectious diseases, and wellness monitoring. Technological advancements in portable devices, smartphone integration, and user-friendly kits enhance accuracy and reliability. Additionally, the growth of telehealth services and increased focus on preventive healthcare further support adoption. This shift empowers patients, reduces hospital visits, and accelerates timely decision-making, driving segment growth.

North America dominates the market share 40% due to its advanced healthcare infrastructure, strong presence of leading diagnostic companies, and high adoption of innovative technologies such as molecular diagnostics, AI, and point-of-care testing. The region benefits from significant healthcare spending, favourable reimbursement policies, and robust research and development activities. Additionally, the rising prevalence of chronic and infectious diseases, along with growing awareness of preventive healthcare, fuels demand for diagnostic services. Government initiatives supporting early detection and precision medicine further strengthen North America’s leadership in the market.

The U.S. leads the diagnostic testing market with advanced healthcare infrastructure, widespread adoption of molecular and genetic testing, and strong investments in R&D. High prevalence of chronic and infectious diseases, combined with favourable reimbursement policies and integration of AI-driven diagnostics, ensures the country’s strong dominance and continuous market expansion.

Canada’s diagnostic testing market is supported by universal healthcare access, a growing focus on preventive care, and increasing adoption of advanced diagnostic technologies. Government initiatives promoting early detection and screening programs, particularly for cancer and infectious diseases, strengthen demand. Collaboration between public healthcare systems and private players further fuels growth.

The Asia-Pacific region is the fastest-growing in the diagnostic testing market due to rising healthcare investments, improving infrastructure, and growing awareness of early disease detection. The increasing prevalence of chronic and infectious diseases drives demand for advanced diagnostics. Governments across countries like China, India, and Japan are actively supporting screening programs and precision medicine initiatives. Additionally, the expansion of private laboratories, the adoption of innovative technologies, and the rising affordability of healthcare services enhance accessibility. Together, these factors create a favourable environment for rapid growth in diagnostic testing across the region.

In August 2025, Audra Jones, Senior Vice President, North America, QuidelOrtho, stated that in order to increase access to high-quality diagnostic testing in community and rural hospitals across the United States, QuidelOrtho Corporation has started a Certified Analyzer Program. The program provides certified VITROSTM analyzers that provide award-winning service, quality results, and proven reliability at a fraction of the cost, and is specifically designed for clinics, physician office labs, and small hospitals with fewer than 100 beds.

By Test Type

By Technology

By Disease Area

By End User

By Region

February 2026

February 2026

February 2026

February 2026