February 2026

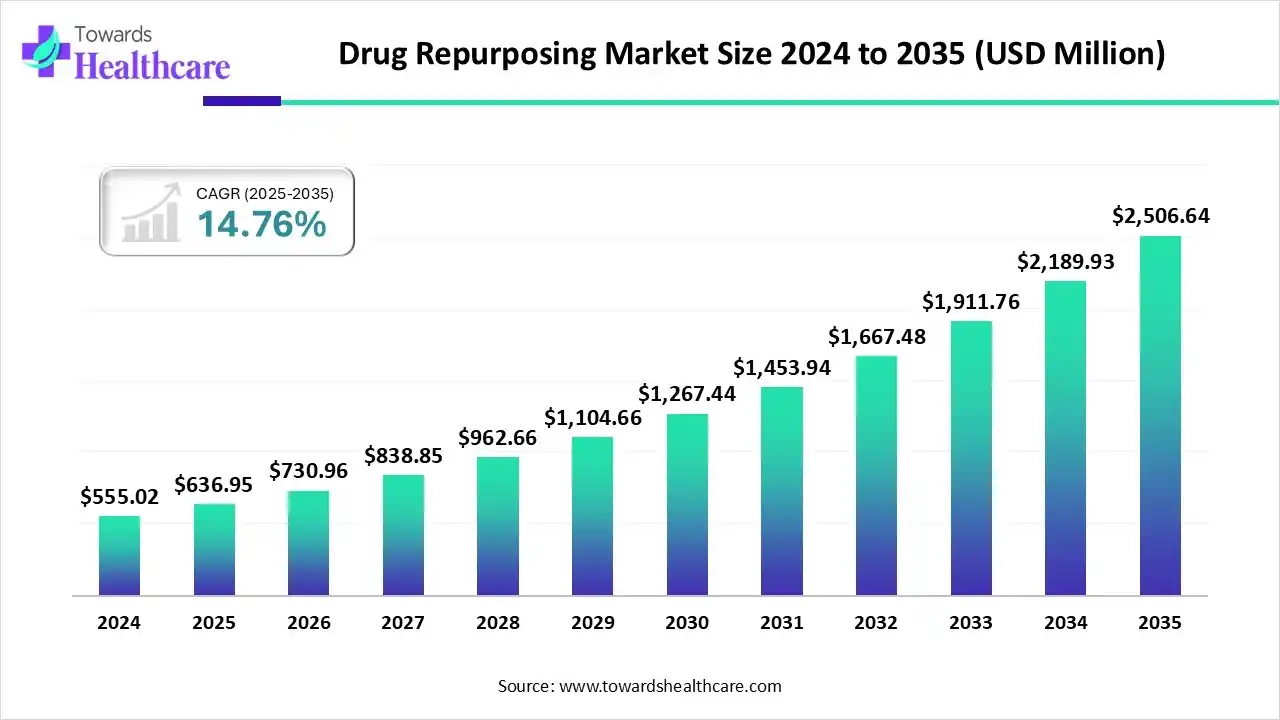

The global drug repurposing market size is calculated at US$ 636.95 million in 2025, grew to US$ 730.96 million in 2026, and is projected to reach around US$ 2506.64 million by 2035. The market is expanding at a CAGR of 14.76% between 2026 and 2035.

An immense growth in rare and chronic diseases, like cancer, neural disorders, and other diseases, is fostering groundbreaking developments in the discovery of new applications of existing drugs. Alongside, the drug repurposing market is promoting the use of AI, ML, and deep learning algorithms for studying complex biological databases. However, the emergence of 3D cell culture models, HTS, GNNs, and other novel approaches is expanding the drug development processes especially for biologics and small molecules.

| Table | Scope |

| Market Size in 2025 | USD 636.95 Million |

| Projected Market Size in 2035 | USD 2506.64 Million |

| CAGR (2026 - 2035) | 14.76% |

| Leading Region | North America |

| Market Segmentation | By Type of Approach, By Therapeutic Area, By Drug Molecules, By Region |

| Top Key Players | Excelra, Fios Genomics, Lantern Pharma, Inc., Novartis AG, Paradigm Biopharmaceuticals Ltd, Predictive Oncology, Segue Therapeutics, LLC, Sosei Group Corporation, Teva Pharmaceutical Industries |

The respective market is exploring diverse strategies to determine novel applications of existing investigational drugs. The global drug repurposing market is primarily fueled by a rise in the requirement for quicker, affordable drug development, breakthroughs in AI and bioinformatics, as well as a rising shift towards the extension of the value of existing assets from different companies. Along with AI and ML approaches, researchers are developing knowledge graphs (KGs) and graph neural networks (GNNs), which will assist in organizing complex biological data. Besides this, GNNs support screening of large drug databases and predictions of possible new targets.

| Drug Name | Originally Used for | Approved for |

| Tirzepatide | Type 2 diabetes | Obstructive sleep apnea |

| Nogapendekin alfa inbakicept-pmln | Non-alcoholic steatohepatitis (NASH) | Primary biliary cholangitis |

| Bumetanide nasal spray | Edema | Edema (fluid buildup) associated with congestive heart failure, liver, or kidney disease |

The global drug repurposing market is widely approaching highly sophisticated technologies, like AI, ML, and other deep learning solutions. Whereas, they are fostering the contribution of gen AI & large language models (LLMs), which allows faster hypothesis development with the analysis of huge biomedical literature, patents, and clinical records for revealing hidden linkage between drugs and diseases. However, advanced HTS, such as the application of organoids and 3D cell cultures, are offering more physiologically relevant models for testing large compound libraries, accelerating predictive power.

Which Type of Approach Led the Drug Repurposing Market in 2024?

In 2024, the disease-centric segment accounted for the largest share of the market. The segment is driven by greater expenditure and delayed timelines of conventional drug discovery, and the increasing need for treatments for rare and neglected conditions. The leaders are uncovering AI integration in clinical, genetic, and epidemiological information, and establishing foundation models for "zero-shot" therapeutic estimations on new diseases.

Target-Centric

The target-centric segment will expand significantly in the coming era. This eventually encourages the discovery of existing drugs’ targets, which are related to a new disease, like the tyrosine-protein kinase ABL in Parkinson's disease. This further explores new potentials for repurposing. Also, the market is increasingly relying on AI for virtual screening, the analysis of gene expression, and building large-scale networks.

Why did the Same Therapeutic Area Segment Dominate the Market in 2024?

The same therapeutic area segment held a dominant share of the drug repurposing market in 2024. This approach minimizes spending and time as compared to novel drug development, due to a known safety & efficacy drug profile. The current advances are stepping into the integration with other plans, like the use of nanotechnology for optimizing the delivery of repurposed drugs, mainly in cancer therapy.

Different Therapeutic Area

In the coming years, the different segments are predicted to expand notably. This mainly facilitates a practical solution for diseases with certain efficacious treatment options, and increased concerns in traditional drug development processes. Ongoing efforts are impacting the combination of drug repurposing with immunotherapy for creating efficient combination therapies for diverse diseases.

Which Drug Molecules Dominated the Drug Repurposing Market in 2024?

In 2024, the biologics segment accounted for the biggest share of the market. The segmental growth is propelled by the growing requirement for novel treatments for chronic, rare, and complex diseases, advancements in biotechnology, and strategic alliances within the industry. These leading companies are bolstering detailed biological pathway models and executing both serendipitous and mechanism-based discoveries, especially repurposing a diabetes drug for cancer treatment.

Small Molecule

During 2025-2034, the small molecule segment is anticipated to register lucrative expansion. Involvement of repurposing for small molecules leverages rigorous safety and toxicity testing in early clinical trial phases or the history of their clinical application. Nowadays, researchers are working on the detection of small-molecule drugs that can be repurposed for targeting DNA repair pathways, such as a new plan for cancer therapy, including spironolactone.

In 2024, North America held the largest share of the market. This expansion is mainly driven by the presence of advanced research infrastructure, supportive regulatory landscapes, with expedited approval for repurposed drugs. Alongside, this region is promoting robust partnerships among AI startups, research centers, and large pharmaceutical companies for evolving repurposed drugs for different diseases.

For instance,

As mentioned above, the region is highly implementing a robust regulatory framework, especially the US FDA, which has offered simplified pathways, like the 505(b)(2) application process, to enable implementation of existing non-clinical and clinical data, with lowered need for extensive new trials. Besides this, the incorporation of non-profit initiatives, like the contract empowered by the US Advanced Research Projects Agency for Health (ARPA-H) to Every Cure, facilitates major funding and support for repurposing research.

Asia Pacific is anticipated to register the fastest expansion in the drug repurposing market in the studied years. The possession of a vast pharmaceutical hub and the continuous innovations in R&D activities are imposing the latest developments in the respective market. Moreover, the ASAP companies are seeking to adopt a more affordable and quicker solution than the conventional drug development.

For instance,

For highlighting the concerns regarding the multi-component nature of TCM, Chinese researchers are applying well-sophisticated preclinical validated models, including 3D bioprinting and organoid models (e.g., gut-liver-brain organ-on-a-chip systems), for more precise efficacy and safety testing than traditional 2D cultures or animal models. The recent regulatory reformation includes the "Three-Combinations" policy, to enable the growth of new indications for TCM formulas that rely on a combination of TCM theory, clinical experience, and real-world evidence (RWE), instead of just traditional Randomized Controlled Trials (RCTs).

Europe is experiencing a notable growth in the drug repurposing market. In this era, the market is exploring the EU-funded REMEDi4ALL project for developing a platform for drug repurposing. Furthermore, the European Medicines Agency is expanding its pilot program on scientific advice for repurposing and revisions to the EU pharmaceutical legislation to encompass pathways for non-profit organizations to submit evidence for new uses of authorized medicines.

Inclusion of those drugs having a crucial portion (at least 5%) of their clinical trials in this region, which might have received higher feasibility in pricing and reimbursement policies, acts as a significant catalyst.

For instance,

Rising public–private collaborations and expanded pharmaceutical manufacturing in Brazil and Chile are fueling regional drug repurposing. Governments fund translational research centers and biomanufacturing parks, accelerating affordable therapeutic innovation and local clinical trials.

Argentina’s Regulatory Leap Forward

Argentina’s 2024 deregulation reforms simplified approval pathways for repurposed drugs. Coupled with growing domestic API production, universities and biotech startups are advancing oncology and rare-disease repurposing studies under streamlined ethical review systems.

MEA’s Pharma Localization Drive

Middle Eastern and African nations are investing in domestic drug manufacturing through technology-transfer partnerships. Egypt, Saudi Arabia, and South Africa are emphasizing repurposing to reduce import dependency and strengthen regional health resilience.

UAE’s Biotech Innovation Vision

The UAE’s Ministry of Health and Dubai Science Park initiatives promote repurposing through AI-based screening platforms. New GMP-certified facilities and government R&D grants enhance production agility and foster precision-medicine-focused repurposing pipelines.

This leverages the identification of candidate drugs (through computational or experimental methods), evaluation of their potential in preclinical models, the conduct of clinical trials, and finally, post-market monitoring.

Key Players: BenevolentAI, Recursion Pharmaceuticals, and Healx, etc.

This includes testing of existing drugs for new uses, often fast-tracking them by studying their known safety profiles, and ultimately getting approved by various regulatory bodies.

Key Players: Brigham and Women's Hospital, Karolinska Institutet, etc.

The market provides innovative treatments to patients with rapid and more cost-effective results by determining new uses for existing drugs.

Source- Bristol Myers Squibb (BMS), Cipla, Dr Reddy, etc.

Company Overview:

Description: A research-based biopharmaceutical company focused on developing and commercializing advanced therapies in areas of high unmet medical need. Its substantial portfolio of existing small molecules and biologics positions it strategically for drug repurposing efforts, especially in immunology and oncology.

Corporate Information:

History and Background:

Background: Formed to focus on proprietary pharmaceuticals, inheriting a rich pipeline and portfolio from Abbott Laboratories. Drug repurposing is a key strategy for life-cycle management and pipeline expansion, leveraging the known safety profiles of existing compounds.

Key Milestones/Timeline:

Business Overview:

Focus: Discovery, development, manufacture, and commercialization of innovative medicines. Drug repurposing is integrated into the R&D strategy to accelerate development timelines and reduce risk, especially in complex diseases.

Business Segments/Divisions:

Pharmaceutical products: Focused on therapeutic areas including immunology, oncology, neuroscience, and eye care.

Allergan aesthetics: Products and services related to medical aesthetics.

Geographic Presence:

Global: Operations and sales in over 70 countries worldwide.

Key markets: United States (largest market), Europe, and other international regions.

Key Offerings:

Core repurposed potential: Leveraging established drugs like Humira (adalimumab) and compounds from its pipeline for new indications.

Therapeutic focus: Immunological diseases (Crohn's disease, psoriatic arthritis), oncology, and neuroscience disorders, where repurposing can address unmet needs.

End-Use Industries Served:

Key Developments and Strategic Initiatives:

Strategic focus: Accelerating the use of artificial intelligence (AI) and data convergence to speed up drug discovery, including the identification of repurposing candidates.

R&D investment: Increased adjusted R&D investment to $10.8 billion in 2024.

Mergers & Acquisitions:

Recent focus: Acquisition of Cerevel Therapeutics and Immunogen (completed 2024) to bolster neuroscience and oncology pipelines, which also opens up new compounds for potential repurposing strategies.

Partnerships & Collaborations:

Academic/biotech collaborations: Engagements to leverage external data, genomics, and translational medicine expertise for drug discovery and repurposing insights.

Product Launches/Innovations:

Innovation focus: Advancing combination therapies in its pipeline, such as risankizumab (skyrizi) combinations for inflammatory conditions, representing a form of repositioning for existing assets.

Capacity Expansions/Investments:

2025 investment: $195 million investment in its North Chicago API manufacturing plant for expanding U.S. production capacity.

Regulatory Approvals:

2024 approvals: Continued expansion of indications for key immunology drugs (e.g., Skyrizi for ulcerative colitis, Rinvoq for pediatric patients), representing successful life-cycle management and indication expansion (a form of repurposing).

Distribution Channel Strategy:

Technological Capabilities/R&D Focus:

Core Technologies/Patents:

Research & Development Infrastructure:

Infrastructure: Global R&D centers with capabilities in high-throughput screening, translational medicine, and clinical development.

Innovation Focus Areas:

Competitive Positioning:

Position: A top-tier biopharmaceutical company globally. Strong market leader in immunology and oncology. Drug repurposing is a key tool for extending the value of its diversified portfolio.

Strengths & Differentiators:

Market Presence & Ecosystem Role:

Role: Major innovator and producer of specialized medicines. A significant end-user of drug repurposing technology for life-cycle extension and pipeline acceleration.

SWOT Analysis:

Recent News and Updates:

Press Releases:

Industry Recognitions/Awards:

General: Consistently recognized as a top global pharmaceutical company for r&d investment and innovation.

Company Overview:

Description: A focused, innovative medicines company with a powerful research-driven pipeline. Drug repurposing is a crucial part of its strategy to deliver high-value medicines faster by leveraging existing compounds across its core therapeutic areas.

Corporate Information:

History and Background:

Background: Formed from the merger of two long-standing chemical and pharmaceutical companies. Following the 2023 spin-off of Sandoz (generics/biosimilars), Novartis is now a pure-play innovative medicines company, intensifying its focus on breakthrough R&D and new technology platforms, which include advanced methods for drug repurposing.

Key Milestones/Timeline:

Business Overview:

Focus: Delivering high-value, innovative medicines to address high disease burden across four core therapeutic areas. Drug repurposing is supported by a large small-molecule and biologics library and is a cost-effective way to accelerate treatments.

Business Segments/Divisions:

Innovative medicines: This is the sole focus post-Sandoz spin-off, covering its branded pharmaceuticals.

Geographic Presence:

Key Offerings:

End-Use Industries Served:

Key Developments and Strategic Initiatives:

Mergers & Acquisitions:

Recent focus: Value-creating, bolt-on acquisitions and early-stage deals to strengthen the pipeline, including in radioligand therapy (RLT) and AI capabilities relevant to discovery and repurposing.

Partnerships & Collaborations:

Academic/industry alliances: Network of over 300 academic and 100 industry alliances for mutual scientific interest, including repurposing collaborations (e.g., AI-driven drug discovery partnerships).

Product Launches/Innovations:

Innovation focus: Advancing its pipeline of over 30 potential high-value new medicines. Emphasis on life-cycle management for key brands through indication expansion (repurposing).

Capacity Expansions/Investments:

R&D investment: Ongoing significant investment in R&D, including advanced platforms (XRNA, RLT) and enhanced technical capabilities (e.g., si/XRNA manufacturing).

Capital allocation: Balanced approach with investments in organic business, including R&D and capes.

Regulatory Approvals:

2024 approvals: Reached key innovation milestones, including Scemblix FDA accelerated approval for 1L Ph+ CML-CP and Kisqali EC approval for hr+/her2- stage II and III EBC (expanded indications).

Distribution Channel Strategy:

Technological Capabilities/R&D Focus:

Core Technologies/Patents:

Research & Development Infrastructure:

Infrastructure: Global biomedical research centers. Streamlined development portfolio with increased focus and enhanced competencies post-Sandoz spin-off.

Innovation Focus Areas:

Competitive Positioning:

Position: Among the top global innovative medicines companies. Strong financial base and a focused strategy on breakthrough science. Its deep expertise across multiple therapeutic areas and technology platforms gives it a strong advantage in drug repositioning.

Strengths & Differentiators:

Market Presence & Ecosystem Role:

Role: Global leader in innovative pharmaceuticals. Active in shaping the future of medicine through investment in new modalities and efficient drug discovery/repurposing models.

SWOT Analysis:

Recent News and Updates:

Press Releases:

2024: Multiple media releases detailing strong financial results, positive clinical trial data, and regulatory approvals across its core therapeutic areas.

Industry Recognitions/Awards:

Key Companies and Their contributions and offerings

By Type of Approach

By Therapeutic Area

By Drug Molecules

By Region

February 2026

February 2026

February 2026

February 2026