February 2026

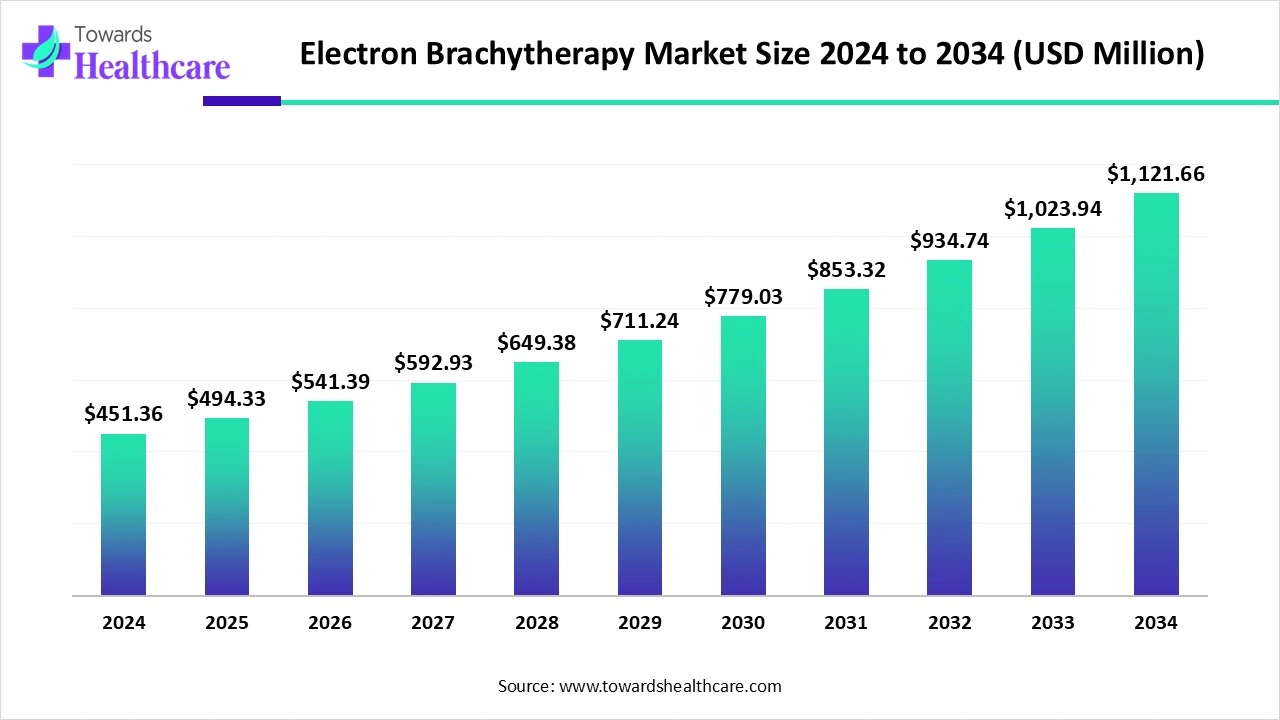

The global electron brachytherapy market size is calculated at US$ 451.36 million in 2024, grew to US$ 494.33 million in 2025, and is projected to reach around US$ 1121.66 million by 2034. The market is expanding at a CAGR of 9.52% between 2025 and 2034.

Rising cancer incidence rates and growing desire for minimally invasive therapies are driving the electronic brachytherapy market. Effectiveness and patient outcomes are being improved by developments in AI-driven precision medicine, imaging, and treatment planning. The growth of cancer centres, government assistance, and advantageous reimbursement practices all contribute to the market's uptake. Demand is also increasing as electronic brachytherapy is becoming more widely recognised and accepted as a localised cancer treatment.

| Table | Scope |

| Market Size in 2025 | USD 494.33 Million |

| Projected Market Size in 2034 | USD 1121.66 Million |

| CAGR (2025 - 2034) | 9.52% |

| Leading Region | North America |

| Market Segmentation | By Application, By Technology/Product Type, By End-Use Setting, By Distribution Channel, By Region |

| Top Key Players | Xoft (iCAD, Inc.), Carl Zeiss Meditec AG, Elekta AB, Varian Medical Systems (Siemens Healthineers), IntraOp Medical Corporation, Isoray Medical, Eckert & Ziegler BEBIG, Sensus Healthcare, BEBIG Medical, Hologic Inc., ViewRay Inc., Zeiss Group, Theragenics Corporation, Best Medical International, Mevion Medical Systems, RadiantBMT, C4 Imaging, IBA Group, RefleXion Medical, Accuray Inc. |

The electron brachytherapy market refers to the niche segment of radiation therapy where a miniature electronic X-ray source is placed close to or within a tumor site, replacing traditional radioisotope-based brachytherapy. Unlike Iridium-192 or Cesium-based sources, electron brachytherapy uses low-energy X-rays, reducing radiation safety challenges, eliminating the need for heavy shielding, and offering portability. It is primarily applied in dermatology (non-melanoma skin cancers), breast cancer IORT (intraoperative radiotherapy), gynecological cancers, and other localized malignancies. Adoption is influenced by demand for safer, more convenient, and cost-efficient alternatives to isotope-based brachytherapy.

Government awareness programs: Governments are taking initiatives to create awareness about radiotherapy. This will ensure more and more people will get access to radiotherapy.

AI has been used in nearly every stage of electron brachytherapy treatments, from making decisions to finishing the course of treatment. By decreasing human mistake and saving time in some areas, the application of AI has improved efficiency and accuracy. In addition to its direct application in electron brachytherapy, AI also advances modern radiology and related fields, which can influence treatment choices and outcomes.

Rising Cancer Cases are Expanding the Electron Brachytherapy Market

The International Agency for Research on Cancer (IARC) and the World Health Organisation (WHO) estimate that by 2030, there would be nearly twice as many cancer cases and deaths globally, with 21.7 million cases and 13 million deaths. The use of electronic brachytherapy has become more popular. These small X-ray sources can be employed outside of the conventional radiotherapy department since they are portable and operate at low kilovoltage energies (<100 kV), which reduces the need for shielding.

Side Effects of the Therapy can Reduce the Usage

Local skin responses include redness, itching, discomfort, and swelling can result with electron brachytherapy. Fatigue and, depending on the treatment site, bowel problems (diarrhoea, irritation) or urine problems (frequency, urgency) for prostate cancer are additional possible side effects.

Rising Demand for Targeted Therapies

The increasing emphasis on precision therapy for the treatment of medical disorders is anticipated to create potential prospects for the worldwide electron brachytherapy market. A crucial element of precision medicine is targeted medical treatments, which allow for the targeting of certain characteristics in malignant cells while reducing their negative effects on healthy cells. According to research, patients who receive targeted therapy report fewer side effects and an improved response.

By application, the skin cancer segment held the major share of the electron brachytherapy market in 2024. The WHO estimates that more than 1.7 million additional cases of melanoma and NMSC will be diagnosed worldwide in 2025. Approximately 80% to 85% of NMSC instances are CC, and 15% to 20% are SCC. Compared to BCC, SCC exhibits a greater propensity for metastasis.

By application, the breast cancer segment is estimated to grow at the highest rate during the upcoming period. For women worldwide, breast cancer (BC) is the most prevalent form of cancer and the primary cause of cancer-related mortality. The International Agency for Research on Cancer estimates that 675,493 to 694,633 women worldwide lost their lives to breast cancer in 2020, with an age-adjusted incidence of 13.6 per 100,000. It is predicted that by 2040, the number of new instances of breast cancer might reach over 3 million per year, with 1 million fatalities per year, due only to population increase and an ageing population.

By technology/product type, the dedicated electron brachytherapy systems segment led the electron brachytherapy market in 2024. These systems, including the Esteya (Elekta) and Xoft Axxent systems, provide quicker treatment, lower radiation exposure for personnel, less need for shielding, and adaptability for a range of diseases, including gynaecological cancers, early-stage breast cancer, and non-melanoma skin cancers.

By technology/product type, the intraoperative radiation therapy (IORT) systems segment is anticipated to witness the highest rate during the forecast period. Soft-tissue tumours, recurrent colorectal malignancies, recurring gynaecological cancers, and a wide range of intra-abdominal tumours have all shown promise with IORT. Because the whole course of radiation therapy may be completed during surgery, it has recently become a desirable therapeutic option for certain early-stage breast cancers.

By end-use setting, the dermatology clinics & ambulatory centers segment was dominant in the electron brachytherapy market in 2024. The diagnosis, treatment, and prevention of skin malignancies such as melanoma, basal cell carcinoma, and squamous cell carcinoma are the areas of expertise for a cancer dermatology clinic. These clinics also treat adverse effects from various cancer treatments that affect the skin. Mohs surgery, immunotherapy, and sophisticated diagnostic methods are frequently included in services.

By end-use setting, the hospitals & cancer centers segment is anticipated to be the fastest-growing during 2025-2034. With an emphasis on early detection, diagnosis, therapy, and long-term care, skin cancer clinics and hospitals offer a comprehensive approach to managing skin cancer and skin health. They give patients access to skilled medical professionals and clinical teams who provide prompt, precise treatment for a variety of skin cancer issues.

By distribution channel, the direct equipment sales segment led the electron brachytherapy market in 2024. A key element of a medical product manufacturer's go-to-market strategy is its distribution network. To guarantee that consumers have quick, easy access to products, businesses may decide to collaborate with commercial healthcare distributors. Others could decide to distribute directly to their clients who are healthcare providers, handling the logistics, distribution, and storage of the products.

By distribution channel, the leasing/pay-per-use models segment is estimated to grow at the highest rate during the forecast period. By enabling clients to pay for a good or service according to its actual usage or a predetermined access duration, as opposed to outright ownership, leasing and pay-per-use (PPU) models provide flexibility. In contrast to traditional leasing, which entails fixed recurring payments for an asset, PPU models directly tie costs to use, offering a more flexible method of resource access and expenditure management.

North America dominated the electron brachytherapy market in 2024. brought on by a high cancer rate and a well-established healthcare system. The area benefits from large market participants as well as substantial investments in medical research and development. Trends in this area include improvements in electronic brachytherapy technology and an increasing need for less intrusive treatment choices. Furthermore, attractive reimbursement regulations and encouraging government efforts are fueling industry expansion. Additionally, rising healthcare professionals' understanding of and acceptance of cutting-edge cancer treatment options is driving demand.

In 2025, there are projected to be 618,120 cancer-related deaths and 2,041,910 new cancer diagnoses in the United States. In 2025, an estimated 14,690 children and adolescents between the ages of 0 and 19 will be diagnosed with cancer, and 1,650 will die from the disease.

The lives of Canadians and the country's healthcare systems are significantly impacted by cancer. An estimated 45% of Canadians will be diagnosed with cancer at some point in their lives, according to earlier projections. In Canada, both new cancer diagnoses and cancer-related fatalities are rising as the population ages and expands.

Asia Pacific is estimated to host the fastest-growing electron brachytherapy market during the forecast period. The predicted rise is mostly due to the high illness burden and growing awareness among the target demographic. Furthermore, the market is anticipated to benefit from the introduction of several electron brachytherapy methods in emerging nations like India.

Miniaturised X-ray sources, customised applicators for different body parts, sophisticated imaging and treatment planning software, clinical trials to prove safety and effectiveness, and patient follow-up procedures and long-term results for various cancer types, including skin and breast cancer, are all part of the research and development of electron brachytherapy.

Clinical studies for Electron Brachytherapy (EBT) include phases to examine safety and efficacy, need clearance from the Institutional Review Board (IRB), and attempt to establish evidence for new delivery technologies and applications, such as for gynaecological and skin malignancies. This study results led to regulatory clearances, which guarantee that the EBT system and its use fulfil stringent requirements for patient care and device performance prior to broad clinical use.

Providing post-treatment care, such as managing side effects and potential activity restrictions, obtaining consent, explaining the procedure, providing post-treatment instructions, including displaying a treatment information card for radiation monitoring and offering advice regarding contact with pregnant women or children, and ensuring patient comfort with sedation if necessary are all examples of patient support for electron brachytherapy.

In April 2024, according to Prof. Frank Verhaegen, chairman of Maastro's Physics Research Division, an invention like a novel brachytherapy applicator will only be valuable if radiation oncologists can utilise it in as many clinics as feasible. We have years of experience with Varian equipment and applicators, and it takes specialised knowledge to turn this concept into a commercially viable applicator that satisfies legal criteria and can be produced in large quantities.

By Application

By Technology/Product Type

By End-Use Setting

By Distribution Channel

By Region

February 2026

February 2026

February 2026

February 2026