Europe Central Lab Market Size, Top Key Players with Segment Insights

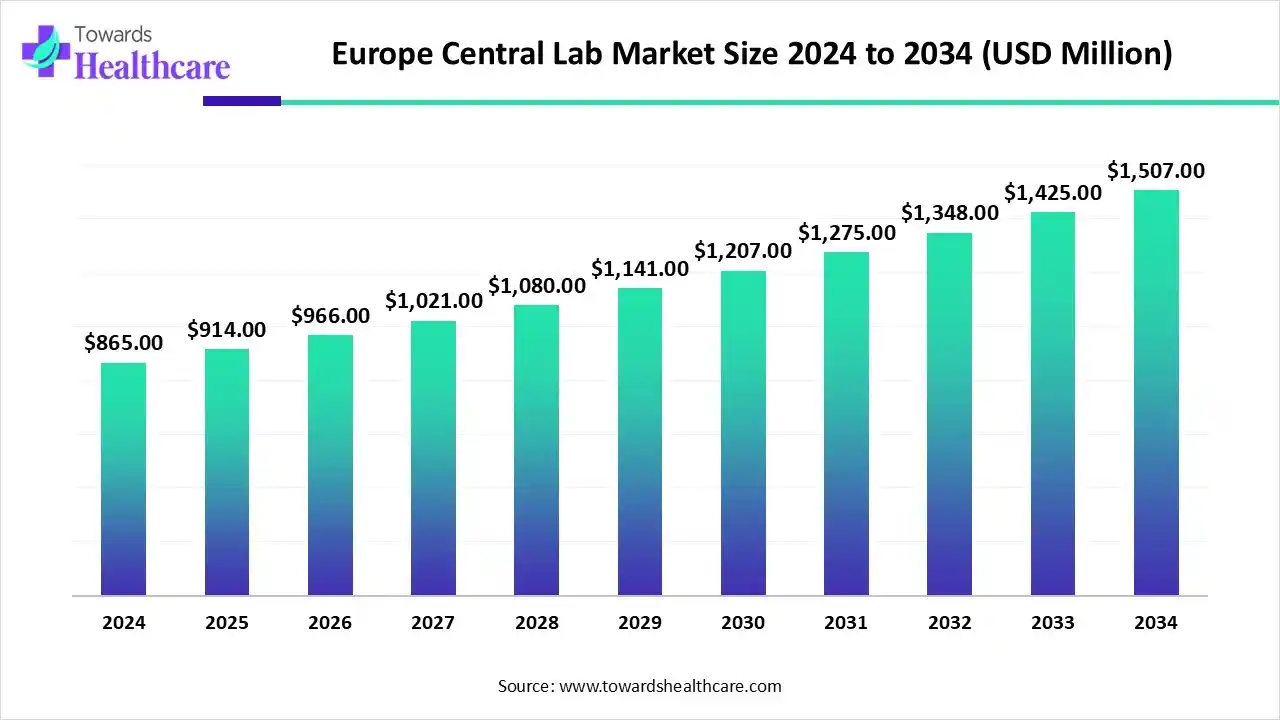

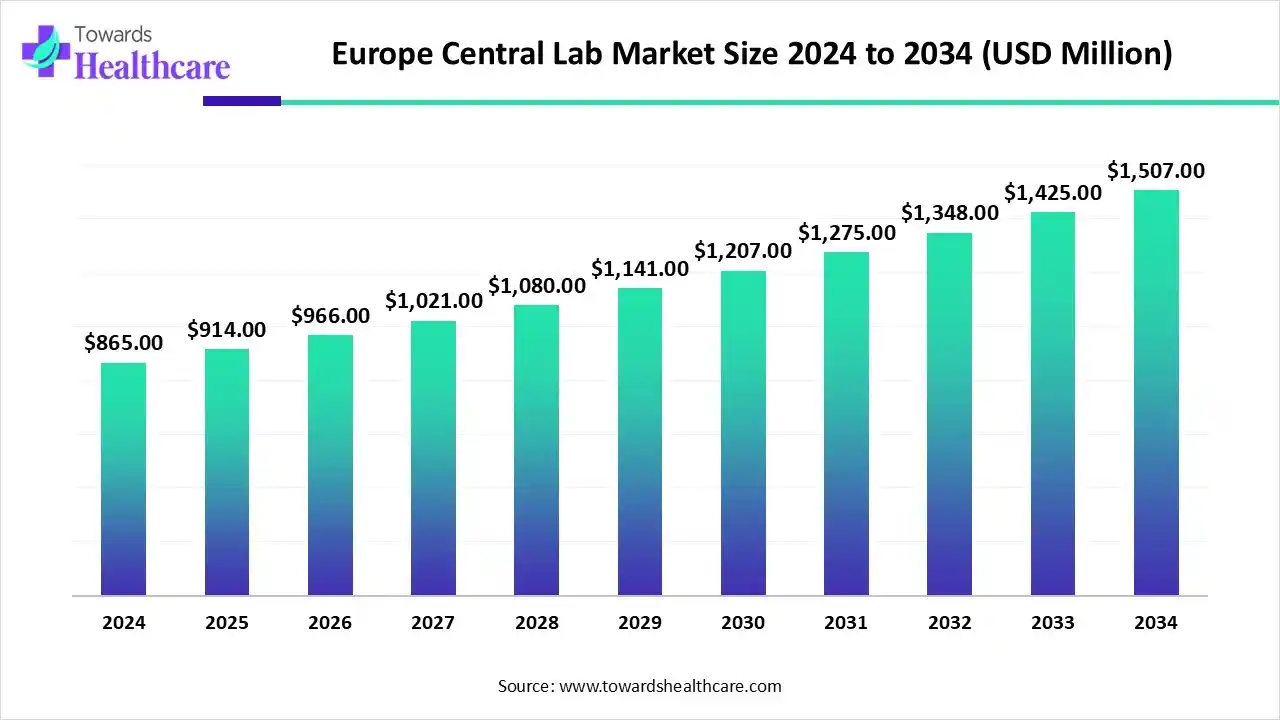

The Europe central lab market size was reported at US$ 865 million in 2024 and is expected to rise to US$ 914 million in 2025. According to forecasts, it will grow at a CAGR of 5.71% to reach US$ 1507 million by 2034.

The Europe central lab market is experiencing significant growth driven by the rising number of clinical trials, expanding biopharmaceutical research, and increasing adoption of advanced diagnostic technologies. Strong regulatory support, robust healthcare infrastructure, and growing demand for personalized medicine further accelerate market expansion. Additionally, collaborations between CROs and pharmaceutical companies enhance efficiency, data accuracy, and overall quality of clinical research across the region.

Key Takeaways

- Europe central lab sector pushed the market to USD 865 million by 2024.

- Long-term projections show USD 1507 million valuation by 2034.

- Growth is expected at a steady CAGR of 5.71% in between 2025 to 2034.

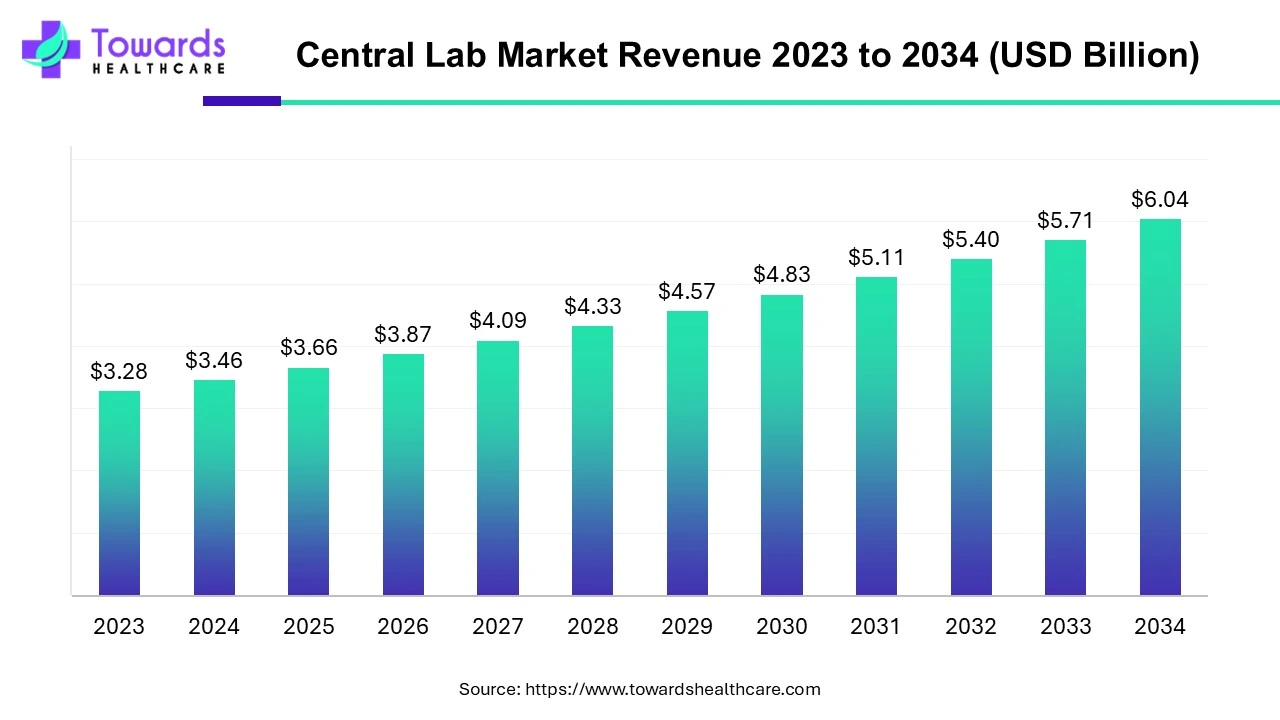

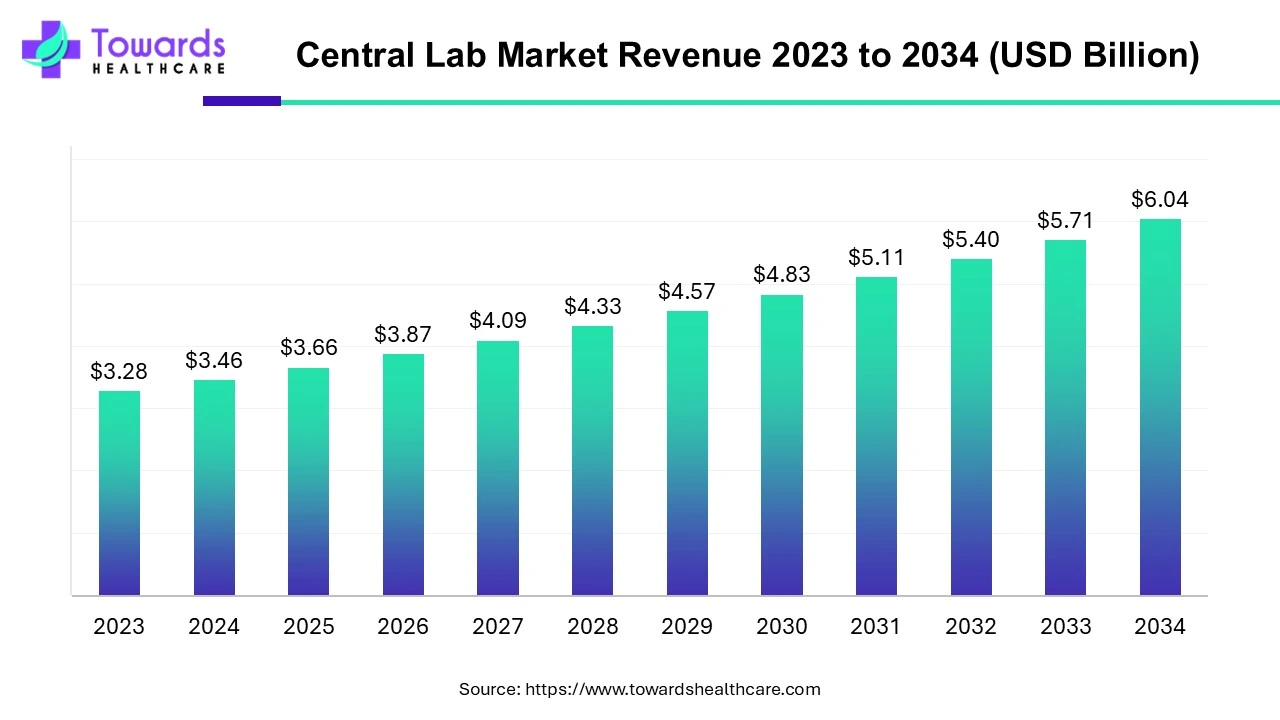

- The global central lab market is set to grow from USD 3.46 billion in 2024 to USD 6.04 billion by 2034 at a 5.71% CAGR.

- Western Europe dominated the Europe central lab market with a revenue share of approximately 60% in 2024.

- Eastern Europe is expected to grow at the fastest CAGR in the market during the forecast period.

- By service type, the biomarker services segment held the largest market share of approximately 38.44% in 2024.

- By service type, the genetic services segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By laboratory type, the hospital-based laboratories segment led the market with the largest revenue of approximately 45% share in 2024.

- By laboratory type, the independent and reference laboratories segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the drug development-related services segment held the highest Europe central lab market share of approximately 40% in 2024.

- By application, the cell and gene therapy-related services segment is expected to grow at the fastest CAGR in the market during the forecast period.

Key Indicators and Highlights

| Table |

Scope |

| Market Size in 2025 |

USD 914 Million |

| Projected Market Size in 2034 |

USD 1507 Million |

| CAGR (2025 - 2034) |

5.71% |

| Market Segmentation |

By Service Type, By Laboratory Type, By Application, By Region

|

| Top Key Players |

LabConnect, Medicover Integrated Clinical Services, Versiti, Pacific Biomarkers, CIRION BioPharma Research, Frontage Laboratories, Quest Diagnostics, Charles River Laboratories, Sonic Healthcare, Unilabs, SCM BIOGROUP, MLM Medical Labs, Q2 Solutions, Nelson Labs, Centogene

|

What is Europe Central Lab?

The Europe central lab market is growing due to increasing clinical trial activities, research expansion, and rising demand for advanced diagnostic and analytical services. The market comprises centralized laboratory facilities that provide comprehensive services to support clinical trials, diagnostics, and research activities across European countries. These labs offer a range of services, including genetic testing, biomarker analysis, microbiology, anatomic pathology, and specimen management to pharmaceutical, biotechnology, and healthcare organizations.

The market is growing due to a surge in clinical trials, advancements in diagnostic technologies, increased outsourcing by pharmaceutical companies, and strong regulatory frameworks supporting biopharmaceutical research and precision medicine development across the region.

Europe Central Lab Market Outlook

- Industry Growth Overview: The market is witnessing steady growth driven by rising clinical research activities, technological advancements, increased outsourcing, and strong regulatory support promoting efficient, high-quality laboratory services for clinical trials.

- Sustainability Trends: Sustainability trends in the Europe central lab market include adopting energy-efficient technologies, digital data management, eco-friendly lab practices, reduced waste generation, and sustainable sourcing to minimize environmental impact while enhancing operational efficiency.

- Major Investors: Key investors in the market include Labcorp, Eurofins Scientific, IQVIA, Syneos Health, and PPD, along with biotech firms and venture capital groups supporting clinical research infrastructure and innovation.

How Can AI Affect the Market?

AI adoption in the Europe central lab market is boosting operational efficiency through smart automation, advanced pattern recognition, and intelligent workflow management. It enables enhanced risk assessment, predictive maintenance of lab equipment, and optimized resource utilization. Furthermore, AI supports multi-omics data analysis, faster protocol development, and improved patient stratification in clinical trials, fostering innovation and cost-effectiveness while ensuring compliance with evolving regulatory standards across Europe.

What are the Government Initiatives in the Europe Central Lab Market in 2024?

- In September 2025, EuroHeartPath is an IHI project aiming to improve cardiovascular care across Europe by optimizing the full patient pathway from early detection to treatment and prevention. Focusing on heart failure, atrial fibrillation, ventricular fibrillation, and coronary disease, it analyzes practices in 45 hospitals across 15 countries. By leveraging data, technology, and collaboration with healthcare professionals and patients, the project seeks to establish best practices, enhance outcomes, and strengthen health system efficiency.

- In September 2025, IMI projects INNODIA and INNODIA-HARVEST tested anti-thymocyte globulin (ATG) in children and young adults with new-onset type 1 diabetes, identifying the minimum effective dose. The treatment was most effective in children aged 5–9, preserving beta cell function.

Government and Private Investment

| EU Research Funding |

€500 million |

| Biopharmaceutical Acquisitions |

$3.1 billion |

| Individual Company Investment |

€300 million |

| Venture Funding |

$6.05 billion |

Segmental Insights

How does the Biomarker Services Segment dominate the Europe Central Lab Market in 2024?

In 2024, the biomarker services segment dominated the market with the revenue shares of approximately 38.44%, because of rising adoption of precision diagnostics and the need for reliable predictive and prognostic tools in drug development. Enhanced demand for companion diagnostics, integration of multi-omics approach, and growing collaboration between biotech firms and contract research organizations also contributed.

The genetic services segment is projected to grow rapidly as healthcare providers increasingly integrate genomics into routine diagnostics and treatment planning. Expanding applications in pharmacogenomics, prenatal screening, and rare diseases research, along with collaborations between biotech firms and laboratories, are fueling demand. Additionally, technological advancements in high-throughput sequencing are decreasing the costs of genetic testing, and supportive regulatory frameworks for precision healthcare are driving accelerated adoption of genetic services, making it the fastest-growing segment during the forecast period.

Why Did the Hospital-based Laboratories Segment Dominate the Europe Central Lab Market in 2024?

The hospital-based laboratories segment commanded the largest revenue share of approximately 45% as these labs offer comprehensive services, from routine diagnostics to specialized testing, ensuring continuous patient care. Their ability to handle complex tests, provide immediate results, and support integrated clinical research drives demand.

The independent and reference laboratories segment is projected to grow rapidly as healthcare providers increasingly rely on external labs for specialized and complex testing that in-house facilities cannot efficiently handle. Expansion of diagnostic networks, adoption of advanced automation, and the ability to deliver faster, scalable, and flexible testing solutions drive this growth.

How does the Drug Development Related Services Segment Dominate the Europe Central Lab Market?

In 2024, the drug development-related services segment dominated the market with the revenue shares of approximately 40% as pharmaceutical and biotech companies increasingly sought specialized lab support for accelerating compound screening, toxicology studies, and formulation testing. Growing emphasis on innovative therapies, regulatory compliance, and cost-efficient outsourcing solutions further fueled adoption.

The cell and gene therapy-related services segment is projected to grow rapidly as pharmaceutical and biotech companies increasingly rely on external labs for scalable manufacturing, characterization, and analytical support of advanced therapies. Rising approval of innovative gene and cell-based treatments, expanding research in immunotherapy, and the need for specialized regulatory-compliant testing solutions are driving demand.

Regional Insights

The Europe central lab market is expanding as healthcare providers and research institutions focus on improving diagnostic accuracy and operational efficiency. Rising government funding for clinical studies, growing use of automated and high-throughput laboratory technologies, and increased demand for specialized testing services are key drivers. Moreover, the integration of digital health tools, data analytics, and cross-border collaborations in research and drug development further accelerates market growth across the region.

How is Western Europe contributing to the Expansion of the Europe Central Lab Market?

Western Europe led the market with the revenue shares of 60% in 2024 as a result of its robust network of independent and reference laboratories, high demand for specialized diagnostic and analytical services, and growing focus on precision medicine. The region’s strong collaborations between research institutes and pharmaceutical companies, coupled with increasing outsourcing of lab services and adoption of innovative technologies, reinforced its market leadership, enabling Western Europe to secure the largest revenue share during the year.

Eastern Europe is projected to register the fastest growth due to its emerging biotechnology and pharmaceutical sectors, increasing demand for specialized testing services, and rising focus on precision medicine. The availability of skilled professionals, lower operational costs, and expanding networks of independent and reference laboratories attract global clinical research investments. Furthermore, growing participation in multinational clinical trials and the adoption of digital and automated lab solutions are accelerating market development, positioning Eastern Europe as a key growth region during the forecast period.

Global Central Lab Market Growth

The global central lab market is valued at USD 3.46 billion in 2024 and is projected to reach USD 6.04 billion by 2034, growing at a CAGR of 5.71% during the forecast period. This growth is driven by increasing investments in R&D and a rising demand for clinical trials.

Europe Central Lab Market Value Chain Analysis

Regulatory Approvals

- Central labs in Europe must meet regulatory standards to obtain approval.

- Key regulations include the In Vitro Diagnostic Medical Devices Regulation (IVDR) and Clinical Trials Regulation (CTR).

- Compliance with country-specific requirements in each EU member state is also mandatory.

- Adhering to these regulations ensures quality, safety, and reliability in laboratory operations and clinical trial support.

Clinical Trials

- Clinical trials in the EU are regulated under a single framework and managed via the Clinical Trials Information System (CTIS).

- CTIS provides a unified platform for submitting applications, assessments, and ensuring transparency and safety.

- Centralized clinical labs play a key role by offering standardized, high-quality lab services across multiple trial sites.

- They ensure accurate results and regulatory compliance, supporting efficient conduct of clinical trials throughout Europe.

Patient Support and Services

- Central laboratories in Europe primarily support clinical trials by providing essential analytical and logistical services.

- They assist investigator sites and specialized programs to ensure smooth trial operations.

- Patient-facing services are generally handled by CROs or pharmaceutical sponsors, complementing the labs’ support role.

- This structure ensures accurate testing, efficient trial management, and enhanced patient support throughout the study.

Top Vendors and their Offerings

- Eurofins Scientific- Eurofins Scientific provides a wide range of laboratory services, including analytical testing, clinical diagnostics, food and environmental testing, and specialized services for pharmaceuticals, supporting quality, safety, and regulatory compliance globally.

- SYNLAB Group delivers extensive lab services, including routine and specialized diagnostics, pathology, genetic testing, and clinical trial support, catering to hospitals, clinics, and biotech companies while ensuring high-quality, accurate, and efficient results.

- Cerba Research- Cerba Research provides specialized clinical trial support, offering laboratory testing, sample management, data analysis, and regulatory-compliant services, enabling efficient study execution and reliable results for pharmaceutical, biotechnology, and medical research organizations.

- Labcorp Drug Development- Labcorp Drug Development provides end-to-end clinical research solutions, including specialized laboratory testing, sample logistics, patient support services, and analytical reporting, helping pharmaceutical and biotech companies streamline drug development and optimize trial efficiency.

- ACM Global Laboratories- ACM Global Laboratories provides specialized lab solutions for clinical trials, including advanced analytical testing, data management, and patient sample logistics, enabling pharmaceutical and biotechnology companies to achieve precise, reliable, and timely research outcomes.

Top Companies in the Europe Central Lab Market

- LabConnect

- Medicover Integrated Clinical Services

- Versiti

- Pacific Biomarkers

- CIRION BioPharma Research

- Frontage Laboratories

- Quest Diagnostics

- Charles River Laboratories

- Sonic Healthcare

- Unilabs

- SCM BIOGROUP

- MLM Medical Labs

- Q2 Solutions

- Nelson Labs

- Centogene

Recent Developments in the Europe Central Lab Market

- In October 2024, Thermo Fisher Scientific and PPD expanded their European operations, providing advanced laboratory solutions for molecules, biomarkers, and innovative therapies through technologies like chromatography, flow cytometry, and molecular genomics.

- In May 2024, Labor Dr. Wisplinghoff and LabConnect formed a strategic alliance to provide high-quality central lab services in Europe. Combining Wisplinghoff’s testing expertise with LabConnect’s clinical trial support, the partnership offers comprehensive solutions for global trials.

Segments Covered in the Report

By Service Type

- Genetic Services

- Genotyping

- Gene Expression Analysis

- Next-Generation Sequencing (NGS)

- Whole Genome/Exome Sequencing

- Biomarker Services

- Pharmacodynamic Biomarker Testing

- Predictive Biomarker Testing

- Diagnostic Biomarker Testing

- Microbiology Services

- Bacterial Testing

- Viral Testing

- Fungal Testing

- Anatomic Pathology/Histology

- Tissue Biopsy Analysis

- Immunohistochemistry (IHC)

- Histopathology

- Specimen Management & Storage

- Biobanking

- Sample Logistics & Tracking

- Cold Chain Storage

- Special Chemistry Services

- Clinical Chemistry

- Immunoassays

- Toxicology Analysis

By Laboratory Type

- Independent and Reference Laboratories

- Hospital-Based Laboratories

- Nursing and Physician Office-Based Laboratories

By Application

- Drug Discovery Related Services

- Target Identification & Validation

- Preclinical Screening

- Lead Optimization

- Drug Development Related Services

- Clinical Trial Sample Analysis

- Pharmacokinetics/Pharmacodynamics

- Biomarker Validation

- Bioanalytical and Lab Chemistry Services

- Chromatography & Spectrometry

- Immunoassays & ELISA

- Toxicology Testing Services

- In Vitro Toxicology

- In Vivo Toxicology

- Cell and Gene Therapy Related Services

- Viral Vector Testing

- Cell Characterization

- Gene Editing Analytics

- Preclinical and Clinical Trial Related Services

- GLP-Compliant Testing

- Data Management & Reporting

- Other Clinical Laboratory Services

- Specialty Diagnostics

- Companion Diagnostics

By Region

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway