February 2026

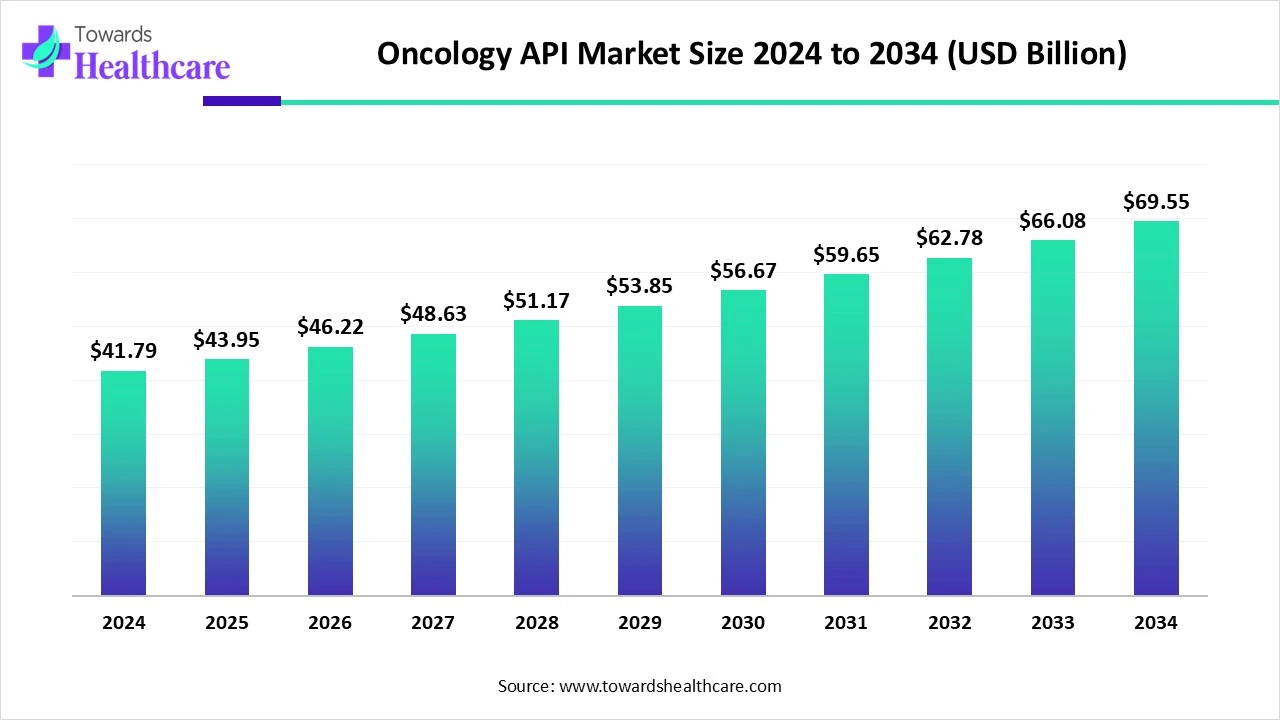

The global oncology API market size is calculated at USD 41.79 billion in 2024, grew to USD 43.95 billion in 2025, and is projected to reach around USD 69.55 billion by 2034. The market is expanding at a CAGR of 5.24% between 2025 and 2034.

The oncology API market is primarily driven by the increasing prevalence of cancer and growing research and development activities. The growing demand for affordable medicines potentiates the development of generic medications for treating various cancer types. Government organizations launch initiatives to promote screening and early diagnosis of cancer, enabling healthcare professionals to provide customized therapeutics. Artificial intelligence (AI) helps researchers design and develop innovative oncology APIs. High-potency APIs (HPAPIs) present future opportunities for market players.

| Table | Scope |

| Market Size in 2025 | USD 43.95 Billion |

| Projected Market Size in 2034 | USD 69.55 Billion |

| CAGR (2025 - 2034) | 5.24% |

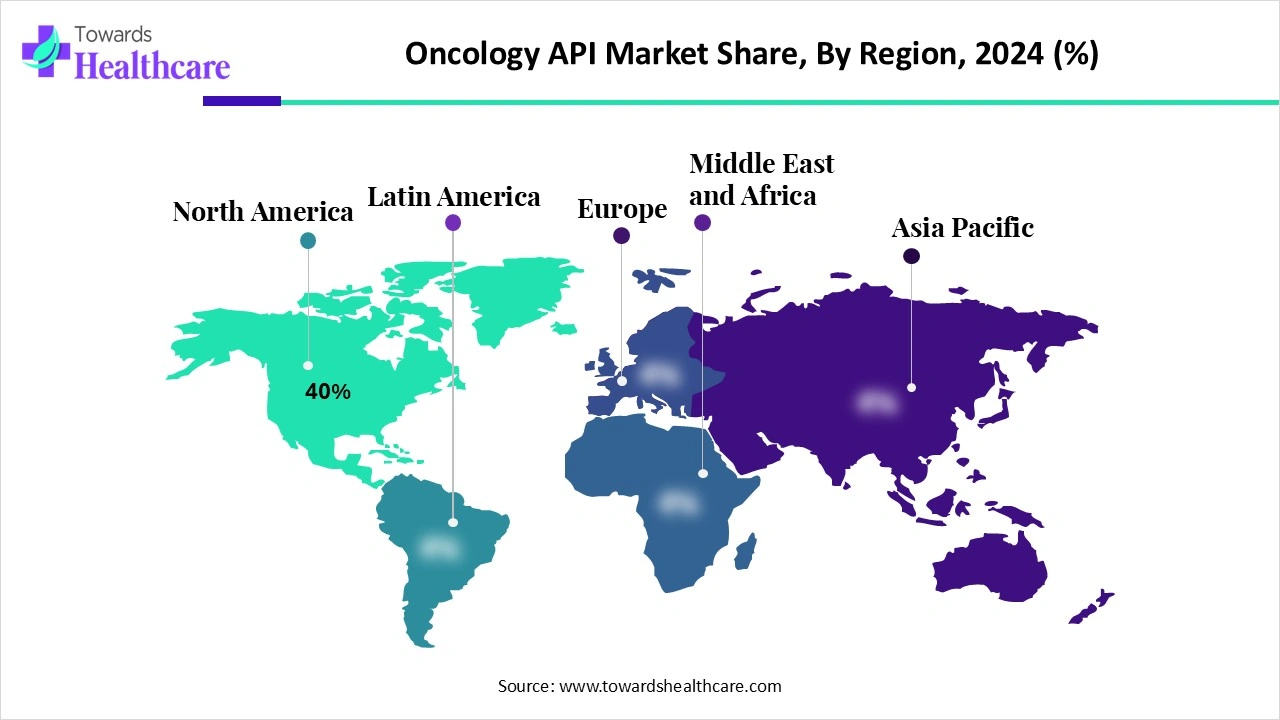

| Leading Region | North America 40% |

| Market Segmentation | By Product Type, By Drug Class, By Manufacturing Type, By Formulation Use, By Distribution Channel, By Region |

| Top Key Players | Pfizer Inc., Novartis AG, Bristol-Myers Squibb, Roche Holding AG, Merck & Co., Inc., AstraZeneca PLC, Johnson & Johnson (Janssen Pharmaceuticals), Eli Lilly and Company, Amgen Inc., Sanofi S.A., Teva Pharmaceutical Industries Ltd., Dr. Reddy’s Laboratories, Cipla Ltd., Sun Pharmaceutical Industries Ltd., Aurobindo Pharma, Lupin Pharmaceuticals, Biocon Ltd., WuXi AppTec, Lonza Group AG, Samsung Biologics |

The oncology API market refers to the global industry involved in the production and supply of active drug substances used in cancer treatment medications. Oncology APIs form the therapeutic backbone of chemotherapeutics, targeted therapies, immunotherapies, and hormone-based cancer treatments. These APIs can be either synthetic chemical APIs or biologic APIs (large molecules), depending on the drug mechanism.

Growth is driven by the rising global cancer burden, increasing demand for affordable oncology drugs, expansion of generic oncology APIs post-patent expiry, and heightened R&D in innovative targeted molecules. Regulatory compliance, cost-efficient manufacturing, and high-potency API (HPAPI) capabilities are key competitive factors in this market.

Expanding Geographical Presence: Key players install their manufacturing facilities in different nations to deliver high-quality APIs to customers from the respective regions.

FDA Approval: The U.S. Food and Drug Administration approved API manufacturing facilities to ensure they comply with stringent safety standards.

AI can transform the development and manufacturing of oncology API by introducing automation. It helps researchers in designing novel oncology drugs to provide personalized treatment based on patients’ conditions. It can predict the treatment outcomes of a disease, enabling healthcare professionals to make proactive decisions. AI and machine learning (ML) algorithms can streamline the manufacturing process of oncology API by enhancing efficiency and reproducibility. This reduces manual errors and detects potential defects in manufacturing. AI and ML can lead to high-quality APIs with timely distribution.

Generic Drugs

The major growth factor for the oncology API market is the growing demand for generic oncology drugs. Cancer poses a significant economic burden on the healthcare sector, potentiating the need for affordable medications. Generic drugs are widely preferred due to their high affordability and easy availability. Researchers develop generic alternatives after the expiry of a patent. Generic APIs demonstrate similar bioavailability, offering comparable therapeutic efficacy. They are used to develop more affordable cancer drugs, reducing the financial burden on patients.

The table below shows a list of some oncology drugs whose patents are to expire within five years. The increasing number of drugs with patent expiration promotes the development of more generic alternatives.

| Drug Name | Indication | Manufacturer | Patent Expiry Year |

| Prolia/Xgeva | Secondary bone cancer | Amgen | 2026 |

| Ibrance | HR-positive and HER2-negative breast cancer | Pfizer | 2027 |

| Keytruda | Melanoma, non-small cell lung cancer, and head and neck cancer | Merck & Co. | 2028 |

| Opdivo | Different cancer types | Bristol Myers Squibb | 2028 |

| Seglentis | Chronic lymphocytic leukemia, small lymphocytic lymphoma, and follicular lymphoma | Secura Bio, Inc. | 2030 |

Supply Chain Disruptions

The demand for oncology APIs is increasing with the rising prevalence of cancer globally. Certain factors, such as geopolitical issues and increased transportation costs, disrupt the supply chain of oncology APIs. A disrupted supply chain leads to drug shortages followed by shortage of an active ingredient.

What is the Future of the Oncology API Market?

The market future is promising, driven by the increasing development of HPAPIs. The demand for HPAPIs is increasing as it enables the production of targeted cancer therapies with high efficiency at lower doses. They also result in reduced adverse effects by providing targeted treatment. Peptide APIs are examples of HPAPIs that have emerged as a promising avenue in cancer therapy. Pharmaceutical companies are also adopting cutting-edge HPAPI manufacturing techniques and investing in advanced containment solutions to ensure safe and efficient production.

By product type, the synthetic oncology APIs segment held a dominant presence in the market in 2024. This is due to the need for small molecules as therapeutics and advancements in synthetic technologies. Synthetic oncology APIs act through various mechanisms of action to provide the desired anti-cancer effect. The evolution in synthetic methodologies of small molecules, with new equipment and green chemistry procedures, boosts the segment’s growth. The advent of parallel synthesizers and other tools accelerates the synthesis of complex APIs.

By product type, the biologic oncology APIs segment is expected to grow at the fastest CAGR in the market during the forecast period. Biologic oncology APIs are used for the production of numerous biologics for targeted treatment. They lead to more enhanced efficiency with reduced systemic side effects. Immunotherapy-based APIs can modulate the immune response to detect, attack, and eliminate cancer cells. Other examples of biologic oncology APIs include monoclonal antibodies, fusion proteins, and cell and gene therapy.

By drug class, the chemotherapy APIs segment held the largest revenue share of the market in 2024. This segment dominated due to the ability of chemotherapy APIs to combat cancer cell proliferation. Researchers develop a multi-target API to enable the drug molecule to target multiple proteins simultaneously. Chemotherapy APIs can also alleviate symptoms caused by tumors. They can also shrink tumor cells before surgery or radiation, reducing the overall time required for surgery.

By drug class, the targeted therapy APIs segment is expected to grow with the highest CAGR in the market during the studied years. Targeted therapies include tyrosine kinase inhibitors and PARP inhibitors. These drugs directly inhibit the effect of the desired protein or enzyme involved in cancer progression, thereby destroying cancer cells. They can be either small molecules or monoclonal antibodies to provide enhanced efficacy. From 2020 to January 2024, 12 FDA-approved ADCs were approved by the FDA for different types of cancer.

By manufacturing type, the captive/in-house manufacturing segment contributed the biggest revenue share of the market in 2024. The segmental growth is attributed to the presence of suitable manufacturing infrastructure and favorable incentives. Captive/in-house manufacturing provides manufacturers a complete control of their manufacturing operation, allowing them to take necessary steps. It reduces reliance on other companies, maintaining consistent quality. It also helps manufacturers to manage costs and enhance supply chain security.

By manufacturing type, the contract/outsourced manufacturing segment is expected to expand rapidly in the market in the coming years. Contract manufacturing organizations have a suitable manufacturing infrastructure and skilled professionals to perform complex experiments. They offer relevant expertise and customized solutions for diverse manufacturing problems. Several pharmaceutical startups lack the desired infrastructure, potentiating the need for contract manufacturing. Large companies also prefer contract manufacturing to focus on their core competencies.

By formulation use, the oral drugs segment accounted for the highest revenue share of the market in 2024. This is due to the widespread availability of oral drugs and ease of administration. Patients eliminate the need for skilled professionals to deliver drugs, enhancing medication adherence. The release of APIs in oral drugs can be modified by prescribing tablets and capsules. Oral drugs can be taken by people of all age groups.

By formulation use, the injectable drugs segment is expected to witness the fastest growth in the market over the forecast period. Injectable drugs offer numerous benefits, including 100% bioavailability and no first-pass metabolism. This eliminates systemic side effects and enhances efficacy. Several biologics are only provided through the injection route as they are unstable otherwise. Infusion of oncology drugs provides prolonged therapeutic effects.

By distribution channel, the direct supply to pharma companies segment led the market in 2024. Oncology API suppliers can directly supply APIs to pharma companies at considerable rates. This is possible due to the collaborations between pharma companies and API manufacturers. Pharma companies receive high-quality and regulatory-compliant APIs at affordable rates. API manufacturers ensure uninterrupted production through a robust supply chain resilience, allowing pharma companies to maintain their market presence and patient access.

By distribution channel, the contract development & manufacturing organizations (CDMOs/CMOs) segment is expected to show the fastest growth over the forecast period. CDMOs and CMOs produce a wide range of oncology APIs and supplies to various pharmaceutical and biotechnology companies. They have specialized infrastructure to manufacture small molecule APIs and HPAPIs. They can act as specialized suppliers of APIs by offering full-scale manufacturing services.

North America dominated the global market share 40% in 2024. The presence of key players, increasing cancer prevalence, and the availability of state-of-the-art research and development facilities are the major growth factors for the market in North America. Countries have favorable regulatory support to launch novel oncology medications, strengthening their biologics pipeline. Government and private organizations provide funding for developing manufacturing facilities.

Key players, such as Pfizer, Inc., Johnson & Johnson, and Eli Lilly & Co., provide high-quality oncology APIs not only to their U.S. clients but also to global clients. The American Cancer Society estimated over 2 million new cancer cases and 0.6 million new cancer-related deaths in the U.S. in 2025. In 2024, the U.S. FDA approved a total of 60 oncology drugs, including 11 first-in-class therapeutics.

Some Canadian researchers have predicted that new cancer cases will reach 248,700 in 2026, an increase from 244,000 in 2022.The Canadian Cancer Society estimated that the total cancer-related costs in Canada were $37.7 billion in 2024. Of this, 80% was paid by the Canadian healthcare system, and 20% by patients and caregivers.

Asia-Pacific is expected to grow at the fastest CAGR in the oncology API market during the forecast period. The market is driven by the expansion of manufacturing infrastructure, especially in China and India. Foreign players build their manufacturing infrastructure in Asia-Pacific countries due to an affordable workforce and suitable infrastructure. Favorable trade policies and government support contribute to market growth. The rapidly expanding pharma and biotech sectors and venture capital investments favor the market. People are becoming aware of early cancer diagnosis and the use of generic alternatives to reduce medical expenses.

China is a major exporter of APIs and pharmaceutical products in the world. As of June 2025, China accounted for approximately 20% of global API production, supplying API to more than 180 countries. China is home to over 1,500 manufacturers with a collective production capacity of 2 million tons annually, including more than 2,000 unique API drug products.

India is emerging as a global manufacturing hub of oncology APIs, with over 1,500 WHO-GMP and FDA certified API manufacturing plants. India exports APIs to more than 200 nations, including the U.S., EU, and Japan. The Indian government has launched a production-linked incentive PLI scheme to expedite domestic API production and reduce dependence on imports.

The research activities in oncology API refers to the development of novel APIs for common and rare cancer types. APIs are also developed to act with a novel mechanism of action.

Key Players: Dr. Reddy’s Laboratories, Optimus Drugs, AstraZeneca, and Granules India

APIs are the main ingredients of the finished dosage forms. Drug formulation involves the process of designing the composition of a cancer drug by combining APIs and excipients.

Patient support & services refers to providing comprehensive support services to patients undergoing treatment for complex, rare, and oncological conditions.

In June 2025, EVA Pharma and CHICO Pharmaceutical signed a Memorandum of Understanding (MoU) for technology transfer and localized synthesis of oncology API. Riad Armanious, CEO of EVA Pharma, commented that the company is committed to relieving the health and economic burden of cancer across the Middle East & Africa. He also stated that oncology APIs are critical to the pharmaceutical supply chain, encouraging the company to reprioritize resources to invest in sustainable, high-quality production.

By Product Type

By Drug Class

By Manufacturing Type

By Formulation Use

By Distribution Channel

By Region

February 2026

February 2026

February 2026

February 2026