RNA Analysis Market Size, Trends and Top Companies with Offering Insights

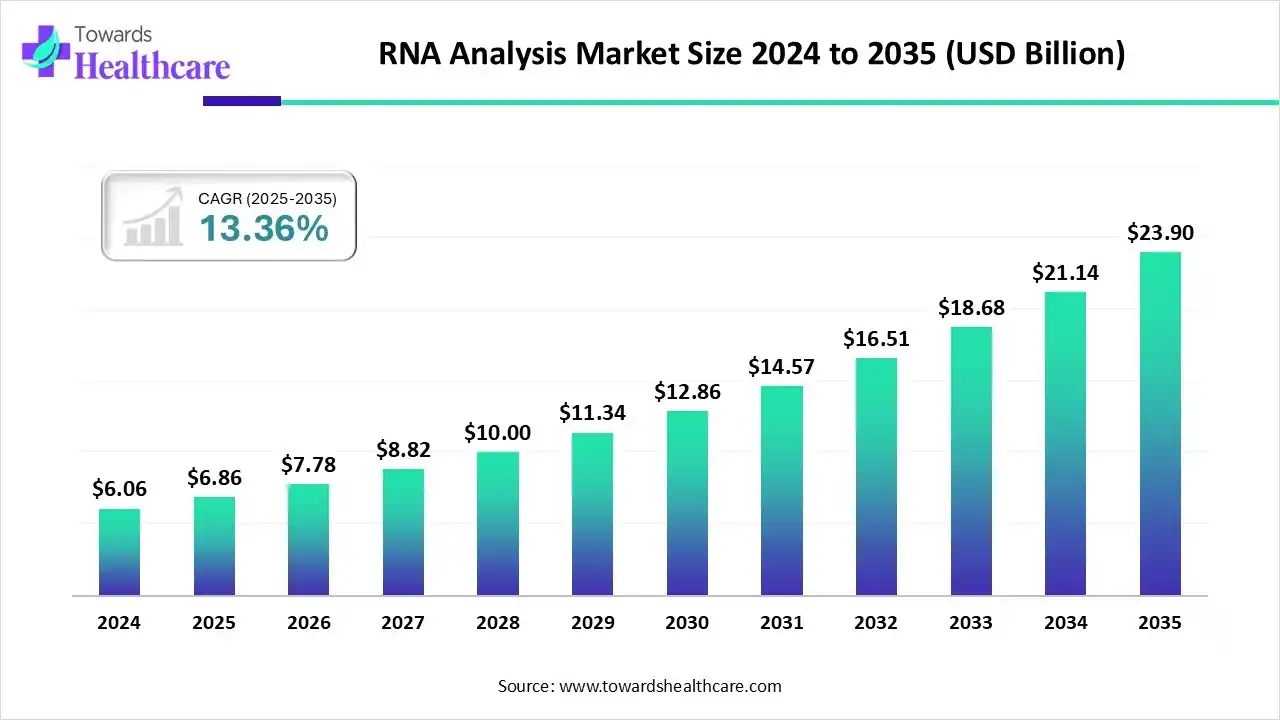

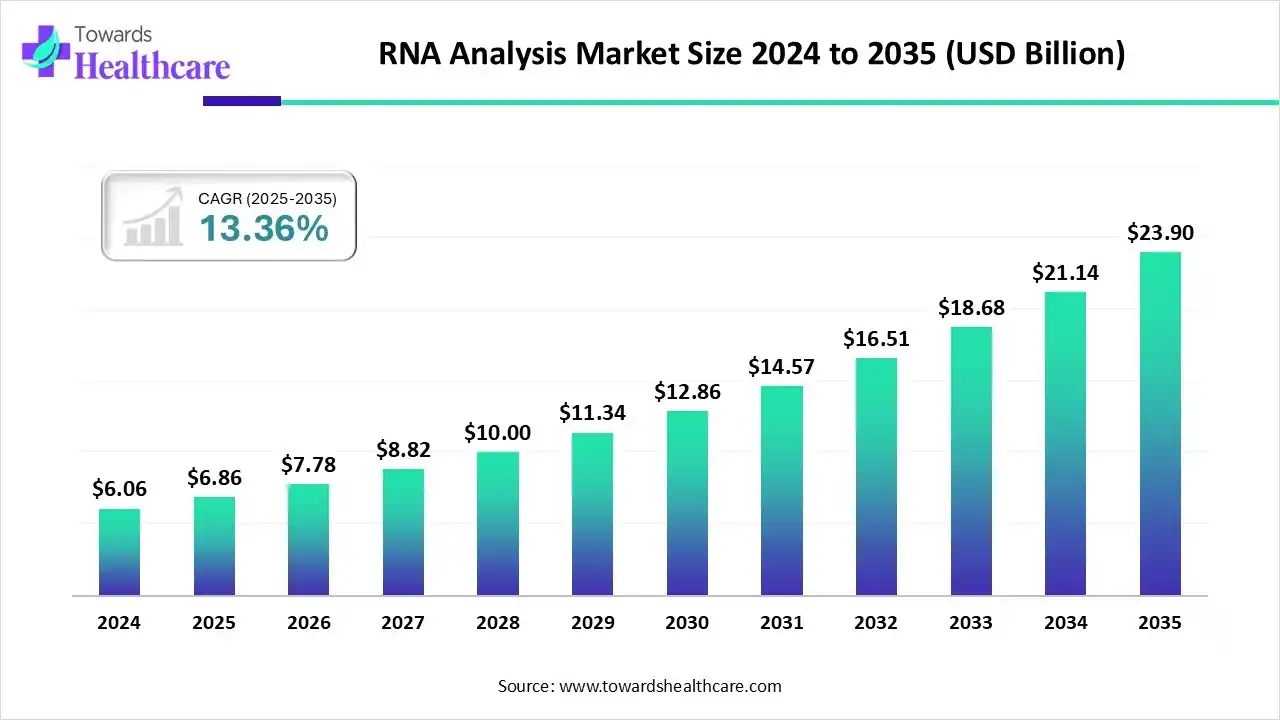

The global RNA analysis market size is calculated at US$ 6.86 billion in 2025, grew to US$ 7.78 billion in 2026, and is projected to reach around US$ 23.9 billion by 2035. The market is expanding at a CAGR of 13.36% between 2025 and 2034.

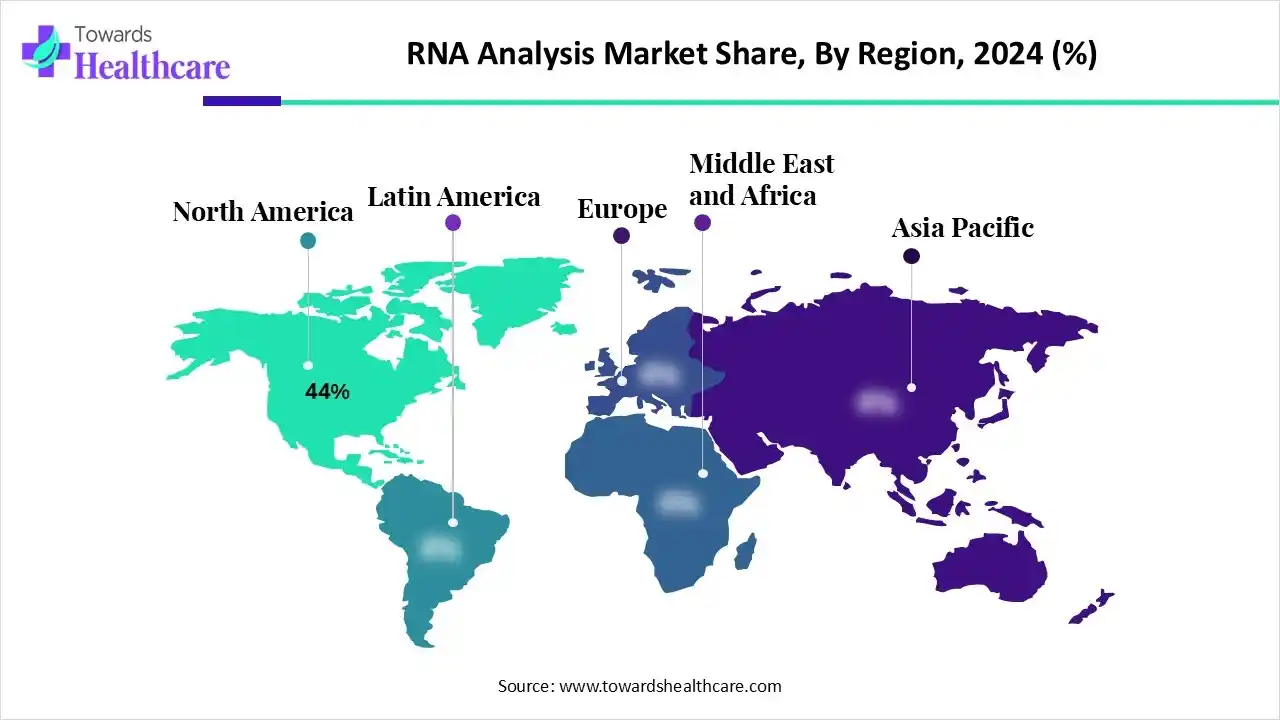

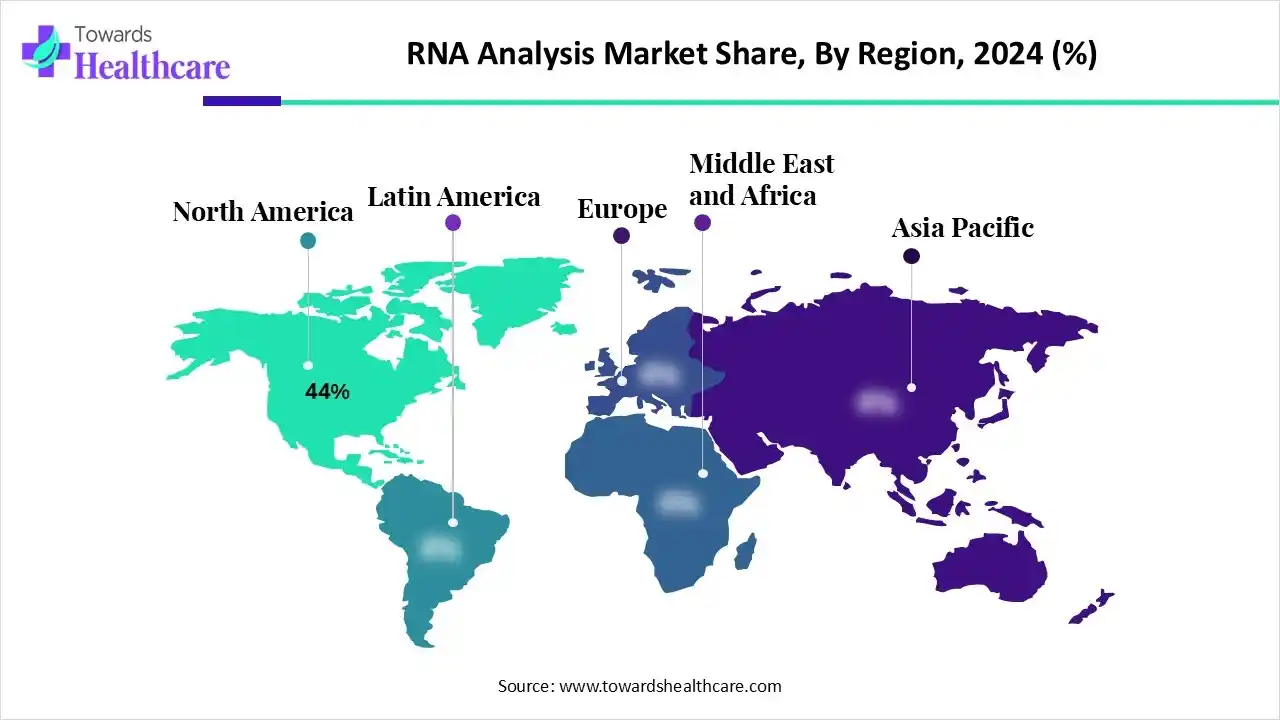

The RNA analysis market is expanding due to the continuous revolution in RNA analysis technologies, which have made them more precise, affordable, and accessible, driving wider adoption. North America is dominant in the market due to growing demand for personalized diagnostics and targeted therapies, while the Asia Pacific is the fastest-growing a presence number of pharmaceutical organizations and affordable manufacturing capabilities.

Key Takeaways

- RNA analysis sector pushed the market to USD 6.86 billion by 2025.

- Long-term projections show USD 23.9 billion valuation by 2035.

- Growth is expected at a steady CAGR of 13.36% in between 2026 to 2035.

- North America dominated the RNA analysis market in 2024, with a revenue of approximately 44%.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

- By technology/methodology, the RT-qPCR segment dominated the market with a revenue of approximately 30% in 2024.

- By technology/methodology, the single-cell RNA-seq segment is expected to grow at the fastest CAGR during the forecast period.

- By product/offering, the reagents & kits segment dominated the market with a revenue of approximately 42% in 2024.

- By product/offering, the software & bioinformatics/data analysis segment is expected to grow at the fastest CAGR during the forecast period.

- By application, the gene expression profiling & basic research segment dominated the RNA analysis market with a revenue of approximately 30% in 2024.

- By application, the biomarker discovery & translational research segment is expected to grow at the fastest CAGR during the forecast period.

- By sample type, the tissue/FFPE samples segment dominated the market with a revenue of approximately 36% in 2024.

- By sample type, the blood/plasma/PBMCs segment is expected to grow at the fastest CAGR during the forecast period.

- By end user, the pharmaceutical & biotechnology companies segment dominated the RNA analysis market with a revenue of approximately 34% in 2024.

- By end user, the clinical diagnostic laboratories & hospitals segment is expected to grow at the fastest CAGR during the forecast period.

Key Indicators and Highlights

| Table |

Scope |

| Market Size in 2025 |

USD 6.86 Million |

| Projected Market Size in 2035 |

USD 23.9 Million |

| CAGR (2026 - 2035) |

13.36% |

| Leading Region |

North America by 44% |

| Market Segmentation |

By Technology / Methodology, By Product / Offering, By End-User/Customer Segment, By Sample Type, By End User, By Region |

| Top Key Players |

Illumina, Inc., Thermo Fisher Scientific, Qiagen, Agilent Technologies, Bio-Rad Laboratories, Oxford Nanopore Technologies, 10x Genomics, PacBio, NEB (New England Biolabs), Takara Bio / Clontech, NanoString Technologies, PerkinElmer, BGI / MGI, Partek / Qlucore / Seven Bridges, Sartorius / Miltenyi Biotec, Roche Diagnostics, Fluidigm, Genuity Science / GENEWIZ, Strategic startups, Large CROs & clinical labs |

What is RNA Analysis?

The RNA Analysis Market covers instruments, consumables, software, and services used to detect, quantify, and characterize RNA molecules (mRNA, miRNA, lncRNA, circRNA, total RNA) across research, diagnostic, and industrial workflows. It includes technologies from RT-qPCR and digital PCR to bulk RNA-seq, single-cell RNA-seq, targeted RNA panels, microarrays, and emerging long-read / direct RNA sequencing. Applications span gene expression profiling, biomarker discovery, drug development, clinical diagnostics, transcript isoform analysis, and regulatory/quality control in biomanufacturing. Demand is driven by precision medicine, single-cell biology, RNA therapeutics/vaccines, liquid biopsy development, and falling sequencing costs coupled with advanced bioinformatics.

RNA Analysis Market Outlook

- Industry Growth Overview: The market is expected to increase rapidly between 2025 and 2034 due to growing research and development (R&D) in biopharmaceuticals, increasing demand for targeted medicine, and technological development in sequencing and other RNA analysis processes.

- Global Expansion: Many reasons cause the expansion of the market, such as increasing demand for personalized medicine, advancements in sequencing technologies, and expanded research and development (R&D) in the biopharmaceutical sector. North America currently holds the largest share of a highly developed healthcare system

- Startup Ecosystem: The RNA analysis market startup ecosystem is characterized by rapid technological advancement, growing spending, and strong demand driven by modified medicine, drug discovery, and genomics research. Major startups are focused on advancing cutting-edge technologies that enhance the accuracy, speed, and affordability of RNA analysis.

How AI is Revolutionizing the RNA Analysis Market?

AI in RNA analysis is converting RNA therapies by fast-tracking sequence design, improving delivery precision, and streamlining manufacturing. This technology is supportive in production procedures, early tracking of potential challenges, and expediting manufacturing. This supports reducing the expenses associated with large-scale production, making RNA therapies more accessible. AI-driven technology helps by analyzing the molecular profile of tissues and identifying which RNA sequences are most efficient in particular areas. This modern technology aids in designing more effective drug delivery systems by predicting the behavior of RNA molecules and forecasting their connections with delivery vehicles, like lipid nanoparticles (LNPs) or viral vectors the body.

Segmental Insights

Technology / Methodology Insights

Which Technology / Methodology is Dominating the Market?

The RT-qPCR segment accounted for approximately 30% of the RNA analysis market revenue in 2024, as RT-qPCR is used to detect and quantify RNA. In this process, RNA is primarily transcribed into complementary DNA (cDNA) by converse transcriptase from total RNA or messenger RNA (mRNA). RT-qPCR is a highly sensitive processes that identify tremendously low copy numbers of an RNA sequence, down to a single molecule.

Single-cell RNA-Seq (scRNA-seq)

The single-cell RNA-Seq segment is expected to grow at the fastest CAGR in the RNA Analysis Market during the 2025-2034 period, as snRNA‐seq solves the complexities associated with tissue preservation and cell isolation that are not effortlessly separated into single‐cell suspensions, appropriate for frozen samples, and lowers artificial transcriptional stress responses as compared to scRNA‐seq. SnRNA‐seq becomes useful in different types of tissue, like heart, muscle tissue, kidney, lung, pancreas, and different cancerous tissues.

Bulk RNA-Seq

The bulk RNA-seq segment is expected to grow at a significant CAGR during the forecast period, as bulk RNA sequencing offers an average gene expression profile in a population of cells. Bulk RNA-seq remains one of the most broadly applied processes for analyzing gene expression in various conditions, treatments, or tissues. Bulk RNA-seq endures to be a significant tool in genomics research.

Product/Offering Insights

What made the Reagents & Kits Segment Dominant in the Market in 2024?

The reagents & kits segment accounted for approximately 42% of the RNA analysis market revenue in 2024, as these reagents and kits are generally intended to extract RNA from particular sample types like blood, tissue, and plant, and are further categorized. It ensures optimum RNA integrity through the extraction process. The output is a consistent delivery of pure nucleic acids of the uppermost yield and quality.

Software & Bioinformatics / Data Analysis

The software & bioinformatics/data analysis segment is expected to grow at the fastest CAGR in the RNA Analysis Market during the 2025-2034 period, as it is rapidly applied to properly and quickly analyze, store, gather, and use relevant data for RNA therapy. Bioinformatics helps to remove the noise generated in the sequencing. Bioinformatics is a process of gathering and analyzing multifaceted biological information.

Instruments & Sequencers

The instruments & sequencers segment is expected to grow significantly during the forecast period as these instruments offer major benefits as growing speed, effectiveness, and the ability to handle large datasets in both healthcare therapy and manufacturing and genetics. They are used to detect mutations, substitute splicing, and gene fusions, and are more sensitive than outdated microarray processes for low-abundance transcripts.

Application Insights

How the Gene Expression Profiling & Basic Research dominate the Market in 2024?

The gene expression profiling & basic research segment dominated the RNA analysis market, accounting for approximately 30% of revenue in 2024, as gene expression profiling allows for exploring the effects of various situations on gene expression by varying the environment to which the cell is exposed, and identifying which genes are expressed. Gene expression profiling is also used in hypothesis generation.

Biomarker Discovery & Translational Research

The biomarker discovery & translational research segment is expected to grow at the fastest CAGR in the RNA analysis market during the 2025-2034 period, as RNA biomarkers have the many benefits of dynamic insights into cellular states and government processes than DNA. RNA offers a real-time picture of cellular physiology, presenting active biological states.

Clinical Diagnostics

The clinical diagnostics segment is expected to grow at a significant CAGR during the forecast period, as RNA analysis increases healthcare diagnostic rates and resolves alternatives of indeterminate implication. RNA sequencing (RNA‐seq) in diagnostic strategies as a high-throughput assay to accompany genomic information with functional evidence.

Sample Type Insights

Which Sample Type Dominated the Market in 2024?

The tissue/FFPE samples segment dominated the RNA analysis market, accounting for approximately 36% of revenue in 2024, as formalin-fixed, paraffin-embedded (FFPE) tissues for RNA-seq have advantages over fresh frozen tissue, with abundance and availability, assembly to rich healthcare information, and a relationship with patient results. FFPE-derived RNA is extremely degraded and chemically adapted, which affects its utility as a realistic source for biological inquiry.

Blood / Plasma / PBMCs

The blood/plasma/PBMCs segment is expected to grow at the fastest CAGR in the RNA Analysis Market during the 2025-2034 period, as it gives discriminating responses to the immune system and is the main cell in the human body's immunity. They contain various types of cells, like lymphocytes, macrophages, or monocytes.

Single Cells

The single cells segment is expected to grow at a significant CAGR during the forecast period as single-cell sequencing strategies enable researchers to define cell–type–specific gene expression and multi-omics data. It resolution the cellular heterogeneity that drives the expression patterns from bulk RNA-seq.

End User Insights

Which End User Dominated the Market?

The pharmaceutical & biotechnology companies segment dominated the RNA analysis market, accounting for approximately 34% of revenue in 2024, as RNA therapeutics spending has an improved chance of profitable success and allows better returns in a limited time for market participants. RNA analysis provides insight into diseases and mechanisms leading to death and could progress into a significant tool for the diagnosis of the cause of death in criminal pathology.

Clinical Diagnostic Laboratories and Hospitals

The clinical diagnostic laboratories & hospitals segment is expected to grow at the fastest CAGR during the forecast period as RNA-driven measurements have the possible for application in diverse regions of human health, contributing to disease diagnosis, prognosis, and therapeutic assortment. Healthcare applications include infectious diseases, transplant medicine, cancer, and fetal monitoring.

Academic & Research Institutes

The academic and research institutes segment is expected to grow at a significant CAGR in the RNA Analysis Market during the 2025-2034 period, as RNA provides dynamic services of which genes are vigorously functioning at any given moment, allowing scientists to investigate a broad range of biological processes in extraordinary detail.

Regional Insights

North America: Dominance in Offering Precise RNA Analysis?

North America dominated the RNA analysis market in 2024 with approximately 44% share, as it has advanced infrastructure, high research and development (R&D) services, a strong presence of key market players, and a favorable government policy and funding environment. Rising government investment, for instance, Agencies such as the U.S. National Institutes of Health (NIH) offer major grants for genomic and transcriptomic research, which contributes to the growth of the market.

For Instance,

- In August 2025, the Food and Drug Administration (FDA) approved Dawnzera, an RNA-targeted medicine, for prophylaxis to prevent attacks of hereditary angioedema (HAE) in patients aged 12 years and older. DAWNZERA is the first and only RNA-targeted medicine approved for HAE, designed to target plasma prekallikrein (PKK), a key protein that activates inflammatory mediators associated with acute attacks of HAE.

Growing Demand for Personalized Medicine: A Major Market Driver in the U.S.

In the U.S., growing research and development activity and an increasing demand for targeted medicine. Pharmaceutical and biotechnology organizations are growing their spending on RNA-driven drug discovery and therapeutics. Development in CRISPR-driven technologies, like CRISPR-Cas13, is being used for precise RNA identification and manipulation.

Why Asia Pacific is Fastest-Growing in the RNA Analysis Market?

Asia Pacific is estimated to host the fastest-growing RNA analysis market during the forecast period, as growing regulatory and business investments in biotechnology, an increasing prevalence of infectious and chronic diseases, and quick advancements in medical care technology. APAC has a huge and growing population, with a massive and increasing burden of chronic diseases such as cancer and diabetes, which contributes to the growth of the market.

For Instance,

- In October 2025, Novartis announced that it had agreed to acquire Avidity Biosciences, Inc., a San Diego-based biopharmaceutical company focused on a new class of therapeutics allowing RNA delivery to muscle. The acquisition will follow the separation of Avidity’s early-stage precision cardiology programs.

Strong Government Support and Investments in RNA Analysis in India

India has a massive and increasing patient population with diseases like cancer, infectious diseases, diabetes, and cardiovascular diseases. There is a growing worldwide and domestic shift toward targeted medicine, which uses a patient's genetic profile to tailor management.

For Instance,

- In October 2025, Bayosthiti AI, an innovator in AI-driven healthcare and molecular diagnostics, announced a strategic partnership with Narayana Health, one of the world's largest cardiac care networks, to develop AI models that predict cardiovascular disease in Indian patients. The study will analyze transcriptomic data from over 12,000 participants at Narayana Institute of Cardiac Sciences in Bengaluru.

Europe: Why Highly Focused on RNA Analysis?

Europe is expected to grow at a significant CAGR in the RNA analysis market during the forecast period, as Europe is a hub of major pharma and biotech organizations. Various countries, such as Germany, the United Kingdom, and France, have advanced academic institutions and research centers that are at the forefront of genomics and transcriptomics research.

Why Increasing Spending on Healthcare Services in the UK?

In the UK, demand for personalized medicine is a key driver, as RNA analysis offers a quick and precise process for analyzing gene variants and biomarkers for disease treatment and diagnosis. Growing spending in RNA analysis, for instance, the UK is set to strengthen its position in RNA therapeutics with the launch of a new specialized manufacturing facility, supported by £29.6m in government funding.

Technological Advancement in South America

South America is expected to grow significantly in the RNA Analysis Market during the forecast period, as Innovations in sequencing technologies, such as single-cell RNA-seq and nanopore long-read stages, are making RNA analysis more scalable, affordable, and precise.

For Instance,

- In June 2025, South America and the Caribbean advance mRNA vaccine development against influenza A(H5N1) with PAHO support. International experts visited the Argentine pharmaceutical company Sinergium Biotech to support the development of the messenger RNA (mRNA)-based vaccine against influenza A(H5N1).

Brazil RNA Analysis Market Analysis

In Brazil, the increasing requirement for customized analytic and treatment plans, specifically in cancer and rare diseases, is speeding up the adoption of RNA analysis technologies. Development in technologies such as single-cell RNA sequencing, high-throughput workflows, and nanopore long-read platforms. Increasing government support, for instance, in August 2025, the Brazilian Government launched the Brasil Soberano Plan to protect exporters and workers from the US tariff increase. The strategy is composed of actions distributed under three pillars: strengthening the productive sector, protecting workers, and commercial diplomacy.

Increased RNA sequencing adoption in the Middle East and Africa

The Middle East and Africa are expected to grow at a lucrative CAGR in the RNA Analysis Market during the forecast period, as increasing adoption of next-generation sequencing (NGS) and RNA sequencing skills across the medical care and pharmaceutical sectors for drug development, clinical diagnostics, and genomic research.

For Instance,

- In October 2025, Co-Diagnostics, Inc., a molecular diagnostics company with a unique, patented platform for the development of molecular diagnostic tests, today announced that it has entered into a definitive agreement with Arabian Eagle Manufacturing, a regional manufacturing and distribution company based in the Kingdom of Saudi Arabia to form a joint venture, CoMira Diagnostics, to research, develop, manufacture, assemble, distribute, and commercialize Co-Dx technologies and intellectual property, including the Company's upcoming Co-Dx PCR point-of-care platform, within KSA and 18 other countries throughout the Middle East and North Africa.

UAE’s Smart Healthcare Advantage

In the UAE, the expansion of genomics research and development, including the focus on whole-genome sequencing studies, directly involves the growth of the RNA analysis market. The UAE government helps the market growth through guidelines that promote biotechnology invention, genetic testing policies, and data protection protocols.

For Instance,

- In October 2025, Cisco, the worldwide leader in networking and security, and G42, the UAE-based global leader in artificial intelligence, announced a major expansion of their collaboration to advance secure AI infrastructure. This initiative is further evidence of Cisco's long-term commitment to driving digital advances across the region, building secure, trusted, and high-performance infrastructure for the AI era.

Company Landscape

Thermo Fisher Scientific, Inc.

Company Overview: The world leader in serving science, Thermo Fisher Scientific provides an unrivaled combination of innovative technologies, purchasing convenience, and pharmaceutical services. Its mission is to enable its customers to make the world healthier, cleaner, and safer.

Corporate Information, Headquarters, Year Founded, Ownership Type:

- Headquarters: Waltham, Massachusetts, U.S.

- Year Founded: 2006 (Formed by the merger of Thermo Electron and Fisher Scientific, with roots tracing back to 1902).

- Ownership Type: Publicly Traded, NYSE, TMO.

History and Background: The company was formed by the merger of Thermo Electron Corporation, founded in 1956, and Fisher Scientific International Inc., founded in 1902. This merger in 2006 created a leading global provider of laboratory equipment, consumables, reagents, and services. The company has since grown significantly through a strategy of continuous acquisitions and organic growth, expanding its capabilities across life sciences, diagnostics, and pharmaceutical services.

Key Milestones / Timeline:

- 2006: Merger of Thermo Electron and Fisher Scientific to form Thermo Fisher Scientific, Inc.

- 2014: Acquisition of Life Technologies, significantly expanding its life sciences tools and consumables portfolio, including products essential for RNA analysis, such as the Applied Biosystems brand.

- 2021: Acquisition of PPD, Inc., a leading contract research organization (CRO), broadening its clinical research and pharmaceutical services.

- 2023: Completed acquisition of Olink Holding, a key player in the proteomics space, enhancing its multi-omics capabilities.

- 2025 (October): Announced definitive agreement to acquire Clario Holdings, Inc., a provider of endpoint data solutions for clinical trials.

Business Overview: The company serves its customers, who are accelerating life sciences research, solving complex analytical challenges, increasing productivity in their laboratories, improving patient health through diagnostics, or developing and manufacturing life-changing therapies.

Business Segments / Divisions:

- Life Sciences Solutions: Includes reagents, instruments, and consumables for biological and biomedical research, including gene expression, RNA isolation, and Next-Generation Sequencing (NGS) preparation. This segment is a key contributor to the RNA analysis market.

- Analytical Instruments: Provides high-end analytical instruments like mass spectrometers and electron microscopes.

- Specialty Diagnostics: Offers a broad range of diagnostic test kits, reagents, and instruments for clinical and medical use.

- Laboratory Products and Biopharma Services: Includes laboratory consumables, chemicals, safety supplies (Fisher Scientific), and the pharmaceutical services business (Patheon, PPD).

- Geographic Presence: Global presence, with operations, sales, and distribution channels across North America, Europe, Asia Pacific, and the rest of the world. North America is the largest revenue contributor.

Key Offerings:

- RNA isolation and purification kits, Invitrogen, Applied Biosystems.

- Real-Time PCR (qPCR) systems, reagents, and assays, Applied Biosystems QuantStudio, TaqMan.

- Next-Generation Sequencing (NGS) instruments and consumables, Ion Torrent platform, for transcriptome sequencing.

- Microarrays and related consumables for gene expression profiling.

- Bioproduction and CDMO (Contract Development and Manufacturing Organization) services, for RNA-based therapeutics manufacturing.

- End-Use Industries Served: Government Institutes and Academic Centers, Pharmaceutical and Biotechnology Companies, Contract Research Organizations (CROs), Hospitals and Clinical Laboratories.

Key Developments and Strategic Initiatives:

- Mergers & Acquisitions: Announced acquisition of Clario Holdings, Inc. in October 2025 for $8.875 billion to expand clinical trial services and digital capabilities, completed acquisition of Solventum's Purification and Filtration Business in September 2025 for $4.1 billion.

- Partnerships & Collaborations: Strategic collaboration with OpenAI announced in October 2025 to accelerate life science breakthroughs using Artificial Intelligence. R&D partnership with AstraZeneca BioVentureHub announced in October 2025.

- Product Launches / Innovations: Launch of Industry-First Orbitrap Mass Detector for environmental and food safety testing in October 2025, launch of Next-Generation Microarray Solution in October 2025.

- Capacity Expansions / Investments: Opened Manufacturing Center of Excellence Site in North Carolina in August 2025.

- Regulatory Approvals: Received FDA approval for an NGS-Based Companion Diagnostic for a new Non-Small Cell Lung Cancer treatment in August 2025.

- Distribution channel strategy: Leverages its extensive direct sales force, e-commerce platforms like Fisher Scientific, and various distributors, offering purchasing convenience and a vast catalog of products, instruments, and services.

Technological Capabilities / R&D Focus:

- Core Technologies / Patents: Real-Time PCR (qPCR), Mass Spectrometry (Orbitrap technology), Next-Generation Sequencing (Ion Torrent), and various purification and analytical chemistry patents.

- Research & Development Infrastructure: Operates numerous R&D centers globally, focusing on continuous improvement of instruments, reagents, and software for multi-omics research.

- Innovation Focus Areas: High-throughput omics technologies (genomics, proteomics), digital and AI-powered tools for drug development, bioprocessing, and advanced analytical instrumentation.

Competitive Positioning:

- Strengths & Differentiators: Unmatched scale and breadth of offerings, the world's largest supplier in the life science tools industry, strong brand portfolio (Applied Biosystems, Invitrogen, Fisher Scientific, Patheon, PPD), and deep customer relationships across multiple sectors.

- Market presence & ecosystem role: A dominant force across the entire life science and clinical research value chain, from basic research to drug manufacturing, providing end-to-end solutions.

SWOT Analysis:

- Strengths: Broadest product portfolio, Global distribution and service network, Strong M&A track record.

- Weaknesses: High reliance on acquisition integration, Potential for complexity in managing diverse business segments.

- Opportunities: Expansion into multi-omics (proteomics via Olink acquisition), Growth in biopharma and CDMO services, Digital and AI integration in clinical trials.

- Threats: Intense competition in specific product segments, Regulatory changes and geopolitical tensions affecting global sales, Customer funding variability, such as NIH budget fluctuations.

Recent News and Updates:

- Press Releases: October 29, 2025, Thermo Fisher Scientific to Acquire Clario Holdings, Inc., October 22, 2025, Reports Third Quarter 2025 Results, with 5% revenue growth to $11.12 billion.

- Industry Recognitions / Awards: Secured R&D 100 Awards for innovations accelerating the discovery and development of therapies in August 2025.

Illumina, Inc.

Company Overview: Illumina is a global leader in DNA and RNA sequencing and array-based technologies. Its mission is to improve human health by unlocking the power of the genome, focusing on enabling customers to accelerate the development and adoption of genomic applications.

Corporate Information, Headquarters, Year Founded, Ownership Type:

- Headquarters: San Diego, California, U.S.

- Year Founded: 1998.

- Ownership Type: Publicly Traded, NASDAQ, ILMN.

History and Background: Founded in 1998, Illumina initially focused on developing high-throughput technologies for genetic analysis using bead array technology. A pivotal moment was the 2007 acquisition of Solexa, which brought the foundational sequencing-by-synthesis (SBS) technology, transforming Illumina into the dominant player in Next-Generation Sequencing (NGS) and making high-throughput RNA sequencing (RNA-Seq) commercially viable.

Key Milestones / Timeline:

- 2007: Acquisition of Solexa, which provided the sequencing-by-synthesis (SBS) technology that became the basis for its high-throughput sequencing platforms.

- 2014: Launch of the HiSeq X Ten, aiming to deliver the $1,000 genome, dramatically increasing sequencing throughput.

- 2020: Announced the intention to reacquire GRAIL, a decision that faced significant regulatory and shareholder scrutiny before eventually being divested.

- 2024: Launched the NovaSeq X Plus, offering the capability to sequence up to 20,000 whole genomes per year.

- 2025 (October): Announced the acquisition of SomaLogic, a leading multi-omics company, for $350 million in cash plus milestones, significantly expanding its proteomic and multi-omic capabilities.

Business Overview: The company develops, manufactures, and markets integrated systems for genetic and genomic analysis, specializing in applications that allow researchers and clinicians to perform sequencing, genotyping, and gene expression analysis, with RNA-Seq being a core application.

Business Segments / Divisions:

- Core Illumina: Focused on the sequencing and array technology, including instruments, consumables, and services for research and clinical markets, this segment directly drives the RNA analysis market.

- GRAIL: Previously a key division, it has been divested (completed June 2024) following regulatory pressure, enabling the company to refocus on its core genomics business.

- Geographic Presence: Global sales and service operations with primary markets in North America, Europe, China, and the Asia Pacific. North America is the largest market, but the company is heavily focused on expanding in the clinical markets globally.

Key Offerings:

- Next-Generation Sequencing (NGS) platforms, NovaSeq X Series, NextSeq, MiSeq, MiSeq i100 Series, which are the primary tools for transcriptome and single-cell RNA sequencing.

- Library Preparation Kits and Reagents, for a variety of RNA analysis applications, including total RNA-Seq, polyA-selected mRNA-Seq, and small RNA-Seq.

- Microarrays, for gene expression and genotyping analysis.

- Bioinformatics and Data Analysis Software, DRAGEN Bio-IT Platform, Illumina Connected Analytics (ICA), for processing and interpreting complex RNA-Seq data.

- End-Use Industries Served: Academic and Government Research Institutions, Pharmaceutical and Biotechnology Companies, Clinical Diagnostics, and Agricultural Genomics.

Key Developments and Strategic Initiatives:

- Mergers & Acquisitions: Announced the acquisition of SomaLogic in October 2025 for $350 million in cash plus milestones, to enhance its multiomics strategy with SomaLogic's established SOMAmer technology.

- Partnerships & Collaborations: Welcomed Alnylam Pharmaceuticals to the Alliance for Genomic Discovery (AGD), partnered with companies like Amgen and Roche to enhance drug discovery capabilities.

- Product Launches / Innovations: Launched MiSeq i100 Series, a new benchtop sequencer, in October 2024. Introduced Illumina Protein Prep to drive proteomic insights in 2025. Launched a 5-base solution to enable simultaneous genomic and epigenomic insights in Q3 2025.

- Capacity Expansions / Investments: Continuous investment in the NovaSeq X Series transition, with over 50 instrument placements reported in Q2 2025.

- Regulatory Approvals: Received FDA approval for its in vitro diagnostic TruSight Oncology Comprehensive test in August 2024.

- Distribution channel strategy: Primarily relies on a direct sales force for its sequencing instruments and high-volume consumables, supplemented by a network of distributors for wider market reach, especially in emerging regions.

Technological Capabilities / R&D Focus:

- Core Technologies / Patents: Sequencing-by-Synthesis (SBS) chemistry, XLEAP-SBS chemistry for faster and more accurate sequencing, Array technology, and the DRAGEN Bio-IT Platform for bioinformatics.

- Research & Development Infrastructure: Strong R&D focus on advancing sequencing chemistry and developing next-generation instruments to lower the cost and increase the speed of genomic analysis.

- Innovation Focus Areas: Transition to the NovaSeq X platform (lower cost per gigabase), expansion into multi-omics (proteomics, epigenomics), and the development of clinical applications and in vitro diagnostics (IVD).

Competitive Positioning:

- Strengths & Differentiators: Dominant market share in Next-Generation Sequencing (NGS), the lowest cost per gigabase with NovaSeq X, highly accurate and reliable sequencing technology, large installed instrument base drives recurring consumable revenue.

- Market presence & ecosystem role: Holds a near-monopoly position in high-throughput sequencing, serving as the foundational technology provider for the majority of global genomics and transcriptomics research, including RNA-Seq.

SWOT Analysis:

- Strengths: Leading NGS technology and market share, Strong recurring revenue from consumables, Global installed base of instruments.

- Weaknesses: Past regulatory challenges with GRAIL, High capital cost of instruments for some labs, Intense competition in benchtop and clinical sequencing markets.

- Opportunities: Expansion of the clinical genomics market (oncology, rare disease), Growth in multi-omics and single-cell analysis, Lowering the cost of sequencing to drive mass adoption.

- Threats: Competition from new sequencing technologies (e.g., Pacific Biosciences, Oxford Nanopore, Ultima Genomics), Geopolitical risks affecting China's business, and Funding uncertainty in the research sector.

Recent News and Updates:

- Press Releases: October 30, 2025, Reports Third Quarter 2025 Financial Results with $1.08 billion in revenue. October 2025, Announced acquisition of SomaLogic for $350 million.

- Industry Recognitions / Awards: Focus on clinical and research milestones, such as the FDA approval for the TSO Comprehensive test in 2024.

Top Vendors in the RNA Analysis Market & Their Offerings

- xFOREST Therapeutics Co., Ltd. In September 2025, xFOREST Therapeutics Co., Ltd. and Axcelead Drug Discovery Partners, Inc. announced the launch of a joint research collaboration aimed at developing RNA structure-targeted small molecule therapeutics for multiple diseases.

- Plasmidsaurus: In October 2025, Plasmidsaurus, the leading global Sequencing as a Service company, announced the launch of its new RNA-Seq service. Applying Plasmidsaurus's innovative approach to sequencing as a service to Illumina short read applications, Plasmidsaurus is bringing the same speed, convenience, and insights they pioneered for plasmid sequencing to gene expression analysis.

- Lexogen: In October 2025, Lexogen, a leader in RNA sequencing technologies, announced the launch of the miRVEL Profiling Small RNA-Seq Library Prep Kit, designed to facilitate small RNA research. The innovative kit integrates seamlessly into the miRVEL small RNA sequencing line and helps scientists achieve reliable results faster and with less hands-on work.

- Altamira Therapeutics Ltd. In May 2025, Altamira Therapeutics Ltd., a company dedicated to developing and commercializing RNA delivery technology for targets beyond the liver, announced that it had entered into a collaboration agreement with an undisclosed company to evaluate the potential use of Altamira’s proprietary CycloPhore platform for the delivery of circular RNA payloads under development by the partner company.

Top Companies in the RNA Analysis Market

- Illumina, Inc.

- Thermo Fisher Scientific

- Qiagen

- Agilent Technologies

- Bio-Rad Laboratories

- Oxford Nanopore Technologies

- 10x Genomics

- PacBio

- NEB (New England Biolabs)

- Takara Bio / Clontech

- NanoString Technologies

- PerkinElmer

- BGI / MGI

- Partek / Qlucore / Seven Bridges

- Sartorius / Miltenyi Biotec

- Roche Diagnostics

- Fluidigm

- Genuity Science / GENEWIZ

- Strategic startups

- Large CROs & clinical labs

Recent Developments in the RNA Analysis Market

- In October 2025, MilliporeSigma, the U.S. and Canada Life Science business of Merck KGaA, Darmstadt, Germany, a leading science and technology company, entered into a partnership with Promega Corporation, a global life science solutions and service leader based in Madison, Wisconsin, to co-develop novel technologies that advance drug screening and discovery.

- In July 2025, New England Biolabs announced the launch of the NEBNext Low-bias Small RNA Library Prep Kit, designed to minimize biased representation of small RNA species in sequencing data. This next-generation small RNA preparation method is faster, less biased, and has a broader input range than other commercially available kits.

- In June 2025, Molecular Instruments (MI), creators of the innovative HCR platform, and Alpenglow Biosciences, developers of the 3Di Hybrid Open-Top Light-Sheet (HOTLS) microscopy system, announced a strategic partnership to enable high-resolution, three-dimensional RNA imaging in intact tissues, organoids, embryos, and other complex biological specimens—without the need for physical sectioning.

- In May 2025, Biogen Inc. and City Therapeutics, Inc., a privately held biopharmaceutical company leading the future of RNA interference (RNAi)-based medicine, announced a strategic collaboration to develop select novel RNAi therapies. Through the collaboration, City Therapeutics will leverage its next-generation RNAi engineering technologies to develop an RNAi trigger molecule combined with proprietary drug delivery technology from Biogen.

Segments Covered in the Report

By Technology / Methodology

- RT-qPCR

- Bulk RNA-Seq

- Single-cell RNA-Seq

- Digital PCR

- Microarrays / Gene Expression Arrays

- Targeted RNA Panels

- Targeted RNA Panels

- Other

By Product / Offering

- Reagents & Kits

- Instruments & Sequencers

- Consumables

- Software & Bioinformatics / Data Analysis

- Software & Bioinformatics / Data Analysis

By End-User/Customer Segment

- Gene Expression Profiling & Basic Research

- Clinical Diagnostics

- Biomarker Discovery & Translational Research

- Drug Discovery / Pharmacogenomics

- Drug Discovery / Pharmacogenomics

- Agriculture & Industrial Biotechnology

- Others

By Sample Type

- Tissue / FFPE Samples

- Blood / Plasma / PBMCs

- Single Cells

- Cell Lines

- Other Matrices

By End User

- Pharmaceutical and Biotechnology Companies

- Academic and research Institutes

- Clinical Diagnostics Laboratories and Hospital

- CROs

- Agricultural/ Industrial R&D

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA