February 2026

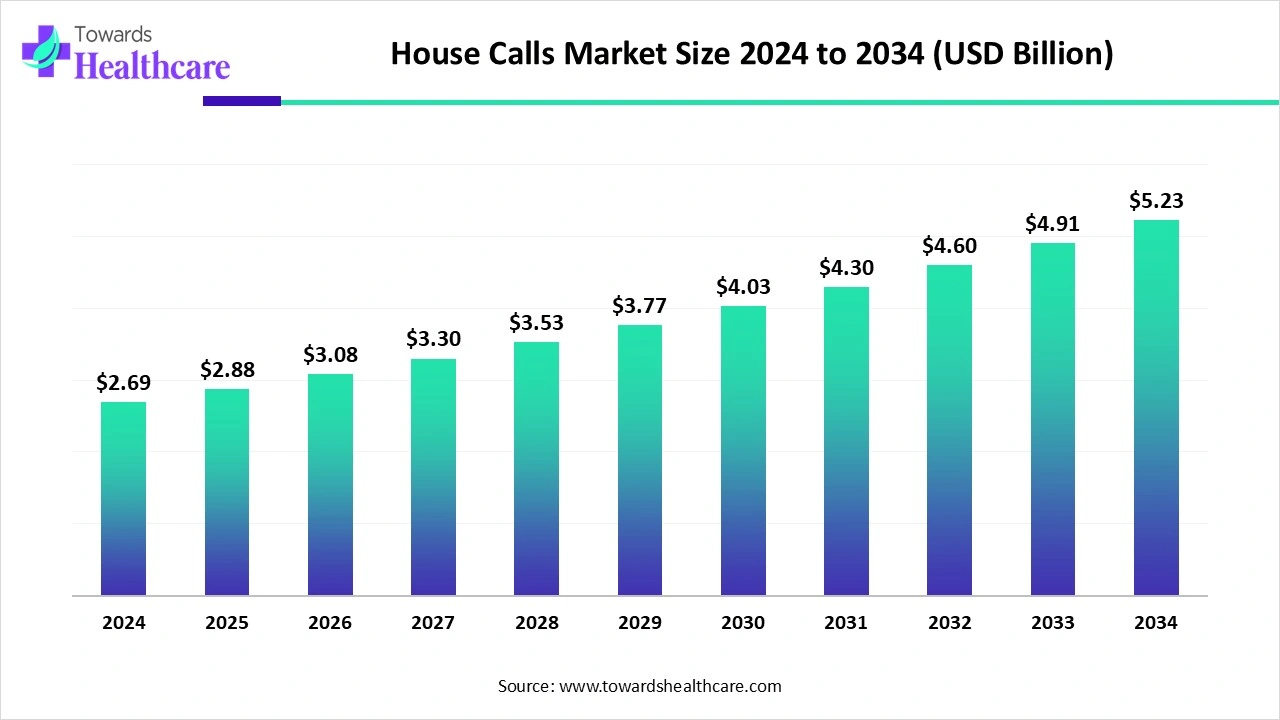

The global house calls market size reached US$ 2.69 billion in 2024 and is anticipate to increase to US$ 2.88 billion in 2025. By 2034, the market is forecasted to achieve a value of around US$ 5.23 billion, growing at a CAGR of 6.89%.

The house calls market is expanding rapidly as patients increasingly seek convenient, at-home healthcare services. Growth is driven by rising chronic disease prevalence, an aging population, and the integration of telemedicine and remote monitoring technologies. Healthcare providers are leveraging mobile care teams to deliver personalized, cost-effective services, reducing hospital visits and improving patient outcomes. Increasing awareness and demand for home-based care are further fueling market adoption globally.

| Table | Scope |

| Market Size in 2025 | USD 2.88 Billion |

| Projected Market Size in 2034 | USD 5.23 Billion |

| CAGR (2025 - 2034) | 6.89% |

| Leading Region | North America |

| Market Segmentation | By Service Type, By Care Model, By Patient Type, By Payment Model, By End-User Setting, By Provider Type, By Region |

| Top Key Players | AT HOME DOCTORS, DispatchHealth, Heal, Heally, HealWell24, Home Doctor 24h, House Call Doctor, Housecall Providers, Med2U Inc., MedHouseCall, My Doctor Medical Group, SOS Doctors, Teladoc Health, TruDoc HealthCare, Visiting Physicians Association |

The Global House Calls Market refers to healthcare services delivered at a patient’s residence by licensed medical professionals, including physicians, nurse practitioners, and allied health staff. These services cover primary care, chronic disease management, urgent care, diagnostic testing, preventive services, and post-operative support. House calls leverage traditional in-person visits and modern telehealth-enabled care models to improve access, reduce hospital readmissions, and provide personalized medical attention, especially for elderly, disabled, and homebound populations.

House calls are healthcare services provided by medical professionals directly at a patient's home, offering diagnosis, treatments, and monitoring without the need to visit a clinic or hospital. The house cells market is expanding as healthcare systems focus on patient-centered care and reducing hospital congestion. Rising awareness of the benefits of in-home treatment, such as comfort, safety, and personalized attention, is driving adoption. Technological advancements such as mobile diagnostics tools, wearable health devices, and integrated digital health platforms enable effective remote monitoring, making home-based care more feasible and efficient, which further accelerates the growth of the house calls market.

Partnerships & Collaborations- Expanding networks with insurance companies, senior living facilities, and pharmacies allows providers to scale services efficiently.

Pilot Home Care Programs- Governments are launching pilot initiatives in underserved regions to provide doorstep healthcare and assess scalability.

AI can transform the market by enabling predictive patient monitoring, personalized care plans, and remote diagnostics, reducing the need for frequent in-person visits. Machine learning algorithms can analyze patient data from wearable devices and electronic health records to identify early warning signs, optimize treatment, and prioritize urgent cases. Additionally, AI-driven virtual assistants and telehealth platforms streamline scheduling, patient communication, and care coordination, improving efficiency, reducing costs, and enhancing the overall quality and accessibility of home-based healthcare services.

Rising Demand for Convenient, at-home Healthcare Services

The growing preference for at-home healthcare is driving the house calls market as patients seek flexible, accessible care that fits their schedule. Home visits offer continuous monitoring and tailored intervention, improving adherence to treatment plans. Additionally, a busy lifestyle and limited mobility make in-clinic visits challenging, increasing the appeal of home-based services. Healthcare providers can also reduce operational strain on hospitals and clinics, making house calls a practical and scalable option, thereby boosting market growth.

For Instance,

High Operational costs for Home visits

High operational costs act as a restraint in the house calls market because managing a mobile workforce requires significant investment in vehicles, medical devices, and staff training. Repeated travel for individual patients reduces efficiency compared to centralized clinic care, increasing per-visit expenses. Additionally, insurance reimbursements for home visits are often limited, making it challenging for providers to maintain profitability. These financial and logistical hurdles slow expansion and limit the accessibility of house cell services, particularly in rural or low-income areas.

Telemedicine and Remote Patient Monitoring

Telemedicine and remote patient monitoring offer a significant future opportunity in the house calls market by expanding access to healthcare for patients in remote or underserved areas. These technologies reduce logistical challenges for both providers and patients, allowing real-time consultations and continuous health tracking. By enabling data-driven decision-making and proactive intervention, they enhance care quality and patient engagement. The scalability and cost-effectiveness of integrating these digital solutions make them a key growth driver for home-based healthcare services.

For Instance,

In 2024, the primary care visit segment dominated the market as it offered comprehensive, personalized care directly at patients' homes. Frequent monitoring of chronic conditions, vaccinations, and general health assessments made home visits by primary care providers highly sought after. The convenience and continuity of care provided by these services increased patient engagement and satisfaction, while reducing hospital visits. This consistent demand and broad applicability across patient populations secured the largest market share for primary care visits in the house cells sector.

The chronic disease management segment is projected to grow rapidly as healthcare providers increasingly focus on preventing complications and improving the quality of life for patients with long-term conditions. Home visits and remote monitoring allow for tailored treatment plans, medication adherence support, and timely interventions. Rising awareness among patients about proactive disease management, combined with technological innovations like mobile health apps and connected devices, is driving the adoption of house call services in this segment, resulting in accelerated market growth.

In 2024, the physician-led house calls segment dominated the market because physicians can deliver complex medical interventions and make informed clinical decisions on-site, which nurses or allied health professionals alone cannot provide. Their presence provides higher-quality care, immediate response to emergencies, and better management of chronic or acute conditions. This model also strengthens patient confidence and engagement, attracting more users, while integration with digital health tools and home diagnostics enhances service efficiency, securing the largest revenue share for this segment.

The telehealth-supported home visit segment is projected to grow rapidly as it addresses geographic and mobility barriers, enabling patients in remote or underserved areas to access quality care. By combining virtual consultation with occasional in-person visits, providers can optimize resource utilization and reduce operational costs. Advancements in connected health technologies, real-time data sharing, and integrated care platforms further enhance monitoring and treatment efficiency, making this hybrid model highly attractive and driving its fastest growth in the house calls market.

The geriatric patients segment captured the highest market shares as seniors often require specialized care, including post-surgical recovery, palliative support, and rehabilitation services, which are more effectively delivered at home. Many elderly individuals prefer the control and familiarity of their residence over institutional care,

Enhancing demand for house calls. Furthermore, family members and caregivers increasingly seek professional in-house medical support to ensure safety and prolong life for aging relatives, reinforcing this segment's leading position in the market.

The chronically ill patient segment is set to expand at the fastest CAGR because these individuals increasingly benefit from coordinated, multidisciplinary care that can be delivered more effectively at home. Services such as infusion therapies, wound care, and respiratory support are increasingly being adapted for in-home use, reducing dependency on hospitals. Advancements in portable medical devices and collaboration between healthcare providers and home-care agencies make it easier to manage complex conditions at home, fueling rapid growth in this segment.

In 2024, the private insurance segment held the largest market shares as insurance increasingly expanded coverage for house call service to meet rising patient demand for convenient at-home care. Private insurance plans often offer quicker approvals, broader service options, and better reimbursement compared to public programs, making them more attractive for both patients and providers. Additionally, the partnership between insurance and healthcare companies enhanced access to home-based care, further strengthening the dominance of the private insurance segment in the market.

The public insurance/government programs segment is projected to grow quickly as the focus is on strengthening community-based healthcare models and extending access to the underserved population. Governments are introducing funding for the underserved population. Governments are introducing funding schemes and pilot initiatives that reimburse home visits, particularly for vulnerable groups such as rural residents and disabled patients. By encouraging early interventions, these programs are gaining momentum. Increasing alignment between national health policies and home-care providers is expected to accelerate adoption, driving a higher CAGR in this segment.

The individual homes segment led the market in revenue shares as more families are opting for in-home medical support to avoid hospital-acquired infection and ensure consistent care for loved ones. This setting allows caregivers to be directly involved in treatment, improving adherence and outcomes. Additionally, the rise of personalized care plans, combined with flexible scheduling and affordability compared to institutional care, made individual homes the most preferred option, cementing their dominance in the house calls market.

The assisted living facilities segment is projected to grow faster as these settings are adopting advanced care models that blend wellness programs with regular in-home clinical visits. Many facilities are leveraging mobile diagnostic tools and telehealth to provide residents with timely medical assessments without disrupting their living environment. This approach not only improves convenience and resident satisfaction but also lowers emergency care dependency, making but also lowers emergency care dependency, making assisted living facilities increasingly attractive end-users for home care services during the forecast period.

In 2024, the home healthcare agency segment led the market as these organizations increasingly adopted digital health platforms and mobile diagnostics to expand service efficiency. Their structured operations allow better scheduling, standardized protocols, and consistent quality compared to independent providers. Agencies also cater to diverse patient groups, from post-surgical recovery to long-term illness management, making them a preferred choice. This scalability and ability to integrate innovative care models positioned home healthcare agencies at the forefront of market revenue share.

The telemedicine provider segment is set to grow quickly as patients increasingly favor hybrid care models that combine virtual check-ins with occasional in-person visits. This approach allows providers to manage larger patient volumes while maintaining continuity of care. Expanding broadband infrastructure and government initiatives supporting digital health adoption are further fueling growth. Additionally, telemedicine platforms are integrating with pharmacies and diagnostic labs, creating a seamless care ecosystem that strengthens their role and drives faster expansion during the forecast period.

North America led the market in 2024 as healthcare providers increasingly partnered with home healthcare agencies and technology firms to expand service delivery. Rising consumer awareness about the benefits of avoiding hospital-based infections and the convenience of home visits boosted adoption. Moreover, pilot programs launched by government and private players to integrate preventive care and chronic disease management into house calls further strengthened the region’s position, securing its dominant revenue share in the global market.

The U.S. market is expanding as more families seek continuity of care and closer patient–provider relationships outside traditional clinics. Growing preference for preventive health checkups at home, coupled with rising awareness about avoiding hospital-acquired infections, is fueling adoption. In addition, collaborations between healthcare startups, pharmacies, and senior living communities are broadening access to home visit services, making them an increasingly trusted and widely used option across the country.

The Canadian market is growing as patients increasingly prefer the convenience and comfort of receiving medical care at home. Rising chronic disease prevalence and a focus on preventive healthcare are boosting demand for home visits. Moreover, technological advancements in remote monitoring, telehealth integration, and mobile diagnostic tools are enabling healthcare providers to deliver efficient, high-quality care, accelerating the adoption of house call services across Canadian urban and rural regions.

Asia-Pacific is projected to grow rapidly as rising awareness of home-based care and increasing disposable incomes drive demand for convenient medical services. Expanding private healthcare networks, coupled with government initiatives to improve access in rural and underserved areas, are boosting adoption. Additionally, the region’s growing tech-savvy population and investment in digital health solutions, such as mobile health apps and remote monitoring devices, are enabling scalable house call services, fueling the fastest CAGR in the market.

In July 2024, Star Health Insurance launched Home Health Care services in over 50 Indian cities, providing personalized, cashless medical care at home. Partnering with Care24, Portea, CallHealth, and Athulya Homecare, the service covers conditions like fever, UTIs, and gastroenteritis. MD & CEO Anand Roy stated, “technology is a key enabler to fulfill evolving customer needs.” Services include nursing, elderly care, physiotherapy, diagnostics, and pharmacy, offering convenient, cost-effective care accessible via the Star Health mobile app or toll-free number 044-69006900.

By Service Type

By Care Model

By Patient Type

By Payment Model

By End-User Setting

By Provider Type

By Region

February 2026

February 2026

February 2026

February 2026