December 2025

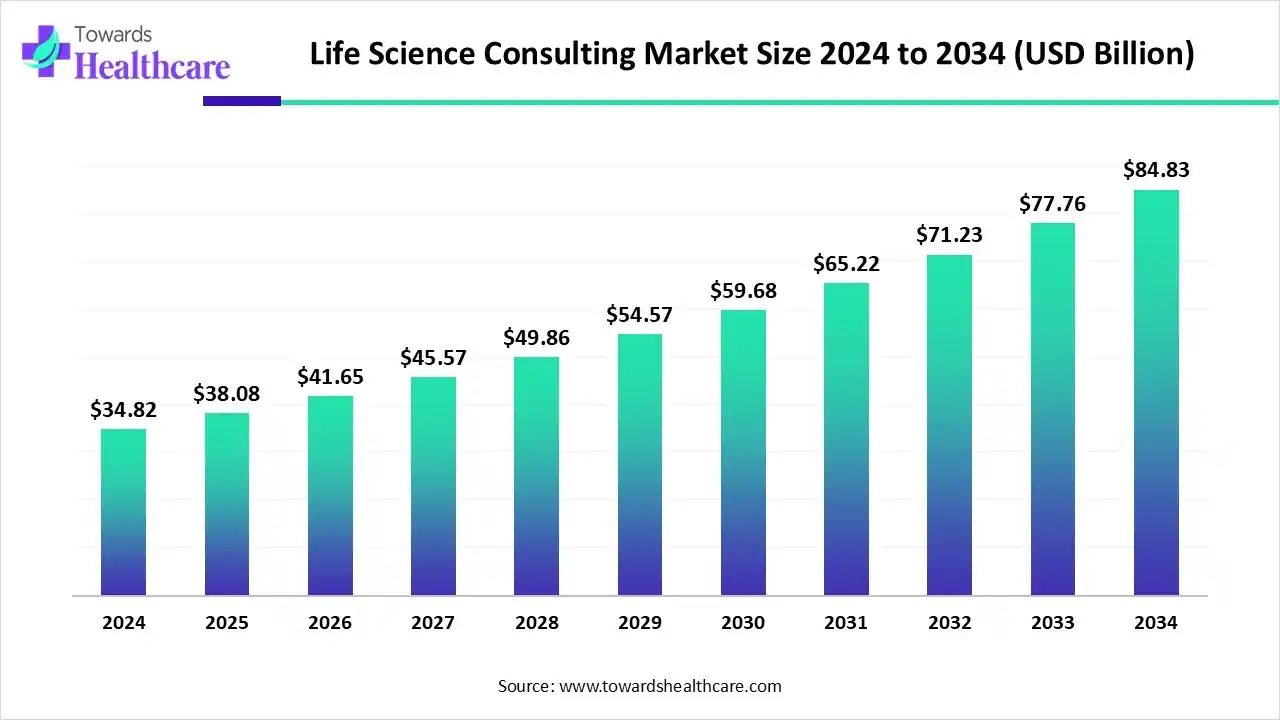

The global life science consulting market size is calculated at US$ 34.82 billion in 2024, grew to US$ 38.08 billion in 2025, and is projected to reach around US$ 84.83 billion by 2034. The market is expanding at a CAGR of 9.38% between 2025 and 2034.

Across India, China, and other developed countries, they are increasingly putting effort into drug discovery & development solutions. As well as enhancing the movement towards robust digital healthcare technology, mainly in the infectious and oncology sectors The global life science consulting market is further fostering emphasis on real-world evidence solutions by collaborating with leading consultancy firms in the various domains of life sciences. By leveraging AI-driven platforms, it is bolstering the seamless and integrated solutions in the arising regulatory complexities, particularly in pharmaceutical & biotechnology companies.

| Table | Scope |

| Market Size in 2025 | USD 38.08 Billion |

| Projected Market Size in 2034 | USD 84.83 Billion |

| CAGR (2025 - 2034) | 9.38% |

| Leading Region | North America |

| Market Segmentation | By Service Type, By Industry/End-User Type, By Application/Functional Area, By Therapeutic Area, By Region |

| Top Key Players | Boston Consulting Group (BCG), Bain & Company, EY, KPMG, ClearView Healthcare Partners, Parexel, PA Consulting, Cognizant |

The global life science consulting market facilitates the provision of expert guidance to pharmaceutical, biotechnology, and med-tech companies on plan, market access, regulatory compliance, and innovation. The market is fueled by the widening adoption of digital technologies, mainly AI and big data analytics, the rising demand for advanced therapies, and a significant focus on sustainability within the industry. In 2025, the market is bolstering real-world evidence (RWE), specialised consulting for advanced therapies like cell and gene therapy, and fostering patient engagement.

| Firm | Notable Steps |

| McKinsey & Company | McKinsey notes an acceleration in capital projects in the life sciences sector, with over $150 billion announced before 2030, and advises on establishing time-based capital plans to boost delivery speed and reliability. |

| Boston Consulting Group (BCG) | A February 2025 report by BCG and IPSO, reflecting the Indian CRDMO Sector 2025, emphasizes partnerships to scale India's workforce, invest in R&D, and expand manufacturing. |

| Accenture | In January 2025, AI Refinery™ for Industry, encompassing the collection of 12 "industry agent solutions" created to help organizations, like life science companies, build and deploy specialized AI agents. |

2025 is a major & emerging digital era across the globe, which is further impacting the respective market progress by its significant contribution. In the case of drug discovery processes & clinical trial operations, leading players, like Atomwise and Pfizer, are majorly involved in automating patient screening and robust site selection. At the same time, AI has been fostering its vital role in precision medicine, analysis of genetic data, content generation, and compliance assistance. Prominent players, including AstraZeneca, Google Health, and Microsoft, are actively collaborating with AI-focused companies for the development of novel AI-assisted solutions and applications.

In 2024, the market access & HEOR consulting segment accounted for the largest share of the market. The segment is mainly driven by an accelerating shift towards value-based care, complex regulatory frameworks, and the growing use of real-world evidence. Moreover, consultants are managing HEOR strategies to develop strong evidence of a product's value and affordable, helping payer negotiations and HTA submissions. These services are supporting bridge innovation and patient access, as well as implementing digital tools to leverage clinical and economic advantages, thereby expanding market entry for new therapies.

And, the real-world evidence (RWE) consulting segment is estimated to register the fastest growth during 2025-2034. Primarily, numerous pharmaceutical & biotech companies are applying RWE to demonstrate the performance and benefit-risk trade-offs of their products in real-world settings. Consulting services are supporting the creation of observational studies, prospective studies, and patient registries to gather specific RWE that are essential for several business needs.

The pharmaceutical companies segment held a major share of the life science consulting market in 2024. These companies are engaging consultants for strategic and operational support across areas, such as R&D, regulatory affairs, market access, and digital transformation. Companies are emphasizing data-driven insights from sources like Medicare claims for finding patient needs, the application of Generative AI for automated reporting and customer engagement, and stepping into more agile, tailored approaches.

Moreover, the biotechnology companies segment will expand rapidly. Continuous breakthroughs in biotechnology, the increasing demand for personalized medicine, and the development of novel therapies are demanding a robust consulting firm in the stricter regulatory guidelines. These firms are currently putting efforts into specializing in gene editing, mRNA, and cell therapies, with a raised focus on digital transformation, and AI/ML integration.

In the life science consulting market, the drug discovery & development segment captured a dominant share in 2024. To resolve issues regarding high expenses, long timelines, and complex regulations involved in this application, leading consulting services are employed. Major players, like IQVIA, Clarivate, and Accenture, are facilitating expertise in target identification, biomarker discovery, DMPK analysis, preclinical development, and regulatory strategy, and are widely utilizing sophisticated platforms and partnerships with AI companies, like NVIDIA.

However, the digital health & health tech segment will expand rapidly in the coming era. The widespread adoption of advanced technologies, specifically AI and wearables, the rising patient demand for personalized and remote care, and the post-COVID-19 expansion of virtual health adoption are impacting the segmental growth. Alongside, the market is focusing on the evolution of omnichannel patient ecosystems, the development of AI-enabled diagnostic tools, migration to cloud infrastructure, and integration with Electronic Health Records (EHRs).

The oncology segment registered dominance in the market in 2024. The growing cancer incidence, broader investments in advanced therapies, and the developing complexities of drug development are fueling the emergence of consulting approaches. The segmental expansion is boosted by its commercialization through services, which encompass biomarker readiness, value, and evidence generation for new therapies (like complex modalities like CAR-Ts and radiopharmaceuticals), and integration of AI in diagnostics and precision medicine for enhanced patient care.

Whereas the infectious diseases segment is estimated to expand rapidly. A rise in global disease burden, advances in diagnostic technology, and accelerated funding for public health initiatives are supporting the overall market progression. The latest approaches are exploring telehealth services coupled with AI for clinical decision support, consultancy on handling complex infections, including bird flu in poultry and humans, and global empowerment by organizations like the World Health Organization (WHO) to offer expertise on sepsis and infection prevention.

North America’s life science consulting market captured the biggest share in 2024. Ongoing major investments in biotechnology and pharmaceutical research, accelerating regulatory complexity, and the growing need for digital transformation are propelling the regional market growth. Alongside the presence of large consulting companies, such as McKinsey, Deloitte, and Accenture are offering services across strategic planning, digital transformation, and AI-assisted drug development.

For this market,

In August 2025, E.M.M.A. International Consulting Group, Inc. (EMMA International), a leading global consulting firm specialising in regulatory compliance, introduced its new Competitive Intelligence (CI) Services to assist life science companies in estimating competitive moves, preventing challenges, and enhancing supply chain resilience.

In January 2025, Akkodis, a global digital engineering company and Smart Industry player, acquired US-based Raland Compliance Partners, LLC (Raland), a specialist provider of quality and regulatory compliance services to the Life Sciences industry.

In the upcoming era, the Asia Pacific is anticipated to expand at a rapid CAGR in the life science consulting market. A crucial catalyst in this market is a rise in investment in the modernization of numerous and diverse healthcare infrastructure, comprising new medical facilities and sophisticated healthcare IT systems. Whereas the developed and developing pharmaceutical industries in this region are facing the accelerating pricing and reimbursement pressure by acquiring services, like health economics and outcomes research (HEOR), to leverage a drug's value proposition.

For instance,

In August 2025, Valkit.ai, an innovative Generation 2 digital validation platform, partnered with Life Science Consulting Pvt Limited, a Conval Group Company for India operations, to transform AI-enabled validation technology across Asia and Europe.

China’s life science consulting market is expanding its strategic alliances, regulatory navigation, and R&D investments, particularly with Deloitte. These kinds of companies have been facilitating robust services to support both local firms and Western pharmaceutical giants in the last few years. China is emphasizing self-reliance in manufacturing under the Made in China 2.0 initiative.

With a notable expansion, Europe is experiencing various developments in the life science consulting market under the EU AI Act. This act is leveraging a complete regulatory landscape for AI, mandating safety, transparency, and risk management. Additionally, major consulting firms, especially Capgemini and ZS, are guiding life science companies on compliance, segregating AI systems by risk level, and navigating the new rules to maintain a competitive benefit.

The global life science market size is calculated at US$ 88.2 billion in 2024, grew to US$ 98.63 billion in 2025, and is projected to reach around US$ 269.56 billion by 2034. The market is expanding at a CAGR of 11.82% between 2025 and 2034.

By Service Type

By Industry/End-User Type

By Application/Functional Area

By Therapeutic Area

By Region

December 2025

November 2025

October 2025

October 2025