January 2026

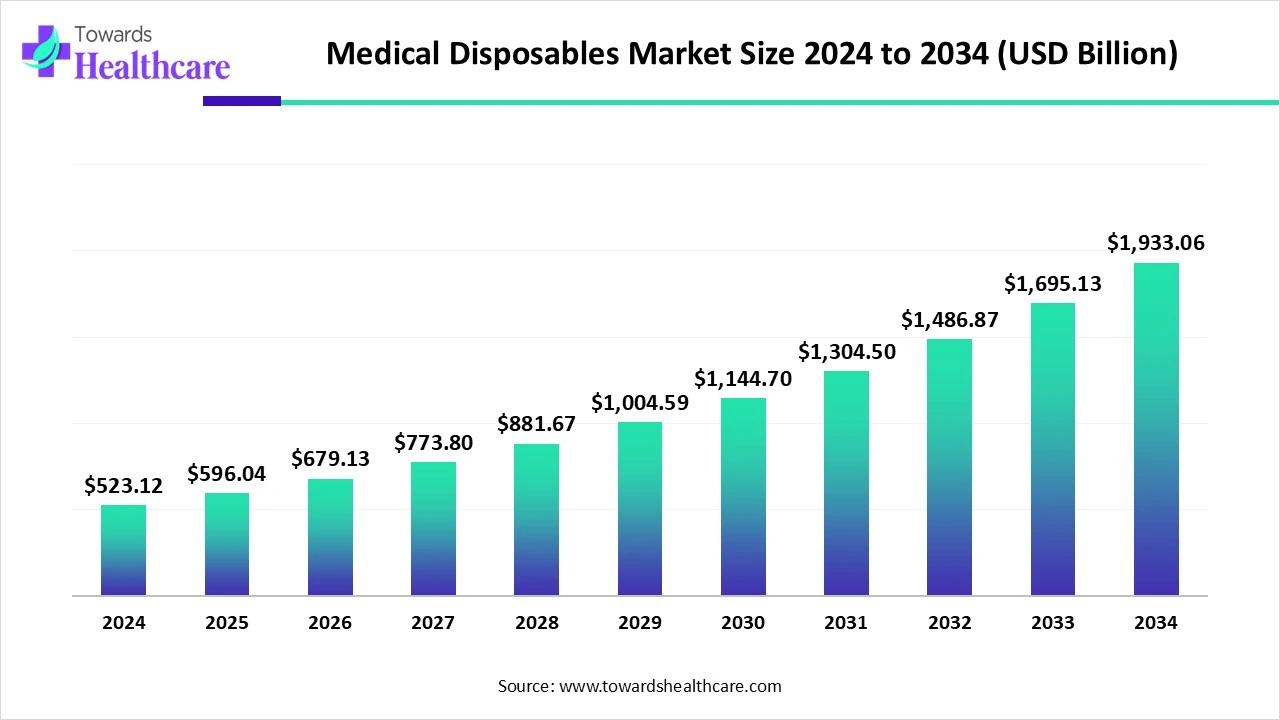

The global medical disposables market size is estimated at US$ 523.12 billion in 2024, is projected to grow to US$ 596.04 billion in 2025, and is expected to reach around US$ 1933.06 billion by 2034. The market is projected to expand at a CAGR of 13.94% between 2025 and 2034.

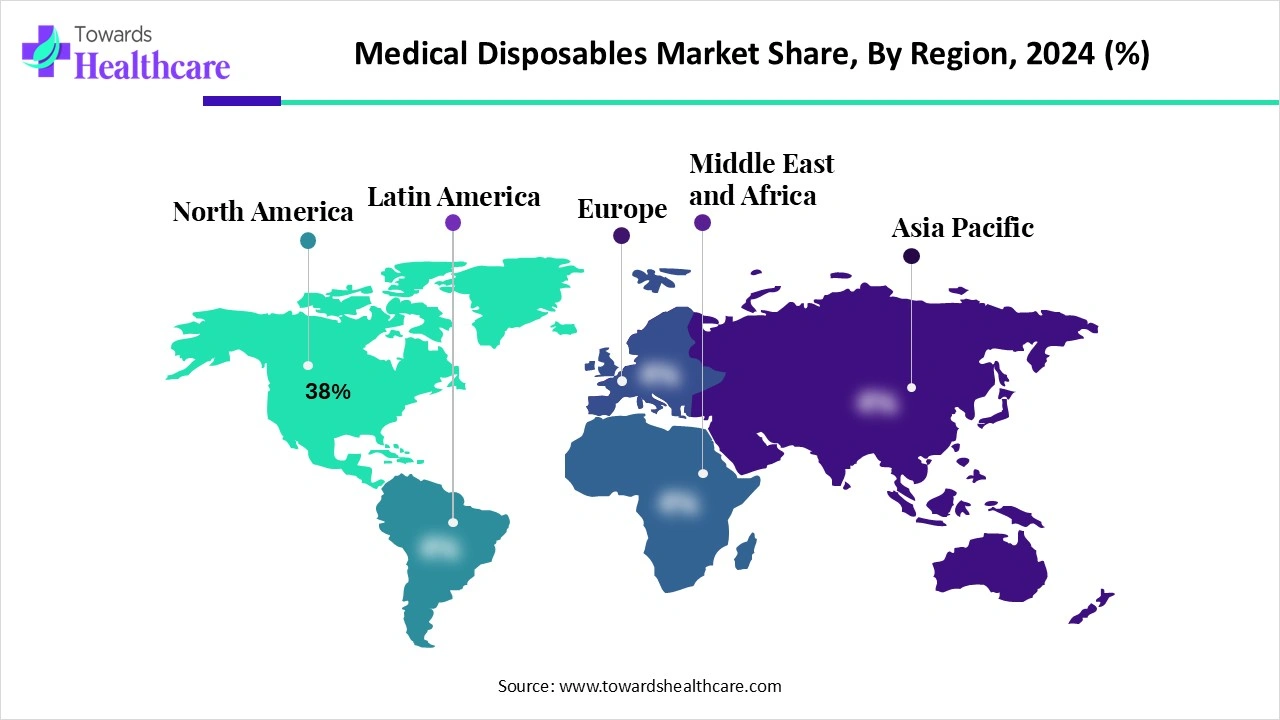

The medical disposables market is expanding rapidly due to increasing patient admissions in hospitals, growing advanced medical care, and increasing requirements for controlling infectious diseases. Increasing awareness of hospital-acquired infections and expansion in healthcare services drive the demand for medical disposables. North America is dominant in the market due to the rising prevalence of chronic diseases and technological advancement. Asia Pacific is the fastest-growing market due to increasing trends of home healthcare services.

| Table | Scope |

| Market Size in 2025 | USD 596.04 Billion |

| Projected Market Size in 2034 | USD 1933.06 Billion |

| CAGR (2025 - 2034) | 13.94% |

| Leading Region | North America Share 38% |

| Market Segmentation | By Product Category, By Material / Technology, By Care Setting / End User, By Sterility / Application, By Distribution Channel & Commercial Model, By Region |

| Top Key Players | 3M, Medline Industries, Cardinal Health, Becton, Dickinson & Company (BD), Baxter International, B. Braun Melsungen, Kimberly-Clark Health / Halyard Health, Ansell, Smiths Medical, Terumo Corporation, Mölnlycke Health Care, ConvaTec, Coloplast, Fresenius Kabi, Owens & Minor, Henry Schein, Nipro Medical, Teleflex, Cook Medical, Top regional manufacturers & private-label converters |

The medical disposables market comprises single-use consumables and accessories used across healthcare settings to deliver safe, sterile patient care and to support clinical workflows. Products include syringes & needles, IV/infusion sets, catheters, surgical drapes & gowns, sterile procedure kits, wound dressings, diagnostic disposables (such as swabs and collection tubes), in vitro diagnostic consumables (including cards and cartridges), single-use instruments, PPE, and single-use device components. Drivers are infection-prevention priorities, growth in procedure volumes, expansion of outpatient and home-care services, regulatory/quality compliance, and demand for supply-chain resilience and cost-efficient inventory models.

Increasing applications of medical disposables are significant in making patient care better and lowering infection, which drives the growth of the market.

For instance,

Increasing demand for medical disposables due to increasing healthcare demands, improving hygiene, lowering infection challenges, and enhancing efficiency drives the growth of the market.

For Instance,

Integration of AI in medical disposable drives the growth of the market, as AI-driven technology simplifies informed medical decision-making processes, therefore, hopeful developments such as rapid and more precise diagnoses, targeted treatment plans, and lower healthcare expenses. The incorporation of AI into medical consumable settings provides numerous advantages as AI holds the potential to improve diagnostic accuracy, streamline administrative responsibilities, and target treatment plans. By the analysis of wide healthcare data, AI-driven systems discern patterns and associations that elude human observation, leading to precise and proper interventions, which contribute to the growth of the market.

Increasing Disposable Medical Supplies

Disposable medical supplies provide more than convenience; they're crucial for maintaining high safety standards in healthcare. By choosing disposable items, healthcare professionals significantly lower the risk of cross-contamination and infection spread. Disposable medical supplies enable convenient use in field hospitals and emergencies, even in remote locations where sterilization isn't available. They can meet a wide range of medical needs, from basic exams to complex surgeries. This adaptability allows for effective healthcare delivery in various settings and scenarios. Disposable medical supplies streamline these processes by offering a safe, cost-effective solution, driving the growth of the medical disposable market.

Major Challenges of Medical Disposables

Manufacturers in the medical device industry must follow strict regulations to ensure the safety of their products. Since these products directly impact people's lives, the government has set specific safety standards for their manufacturing. As a result, the growth of the medical disposables market is somewhat limited.

Recent Advancements in Next-Generation Disposable Medical Products

Next-generation disposable medical products are used in a range of biomedical applications. However, reusable surgical instruments must undergo complete sterilization after each use. Although many hospitals do follow this practice, reusable instruments pose significant logistical and sterilization costs, reduced effectiveness over time, and the risk of infections due to ineffective sterilization. With the costs of medical device manufacturing steadily declining, healthcare institutions are now exploring disposable forceps, blades, and other instruments. Disposable instruments are also safer, pre-sterilized, and more cost-effective for hospitals and patients, presenting a growth opportunity for the medical disposables market.

For Instance,

By product category, the PPE & infection-control consumables segment led the medical disposables market, as it improves safety and efficiency to legal compliance and patient satisfaction. It reduces the exposure to dangers that cause severe workplace illnesses and injuries. These injuries may result from contact with radiological, chemical, electrical, physical, mechanical, or other workplace threats. PPE forms a barrier among healthcare employee, COVID-19, and different infectious viruses and bacteria, so they can continue to work safely and care for their patients.

On the other hand, the catheters & vascular access devices segment is projected to experience the fastest CAGR from 2025 to 2034. Catheters and vascular access devices, especially disposable types, are experiencing robust growth in the medical disposable market. This expansion is driven by factors like an aging global population, the increasing prevalence of chronic diseases (such as cancer and diabetes), the rising demand for minimally invasive procedures, and significant technological advancements in device safety and efficiency.

By material/technology, the single-use polymers/plastics segment is dominant in the medical disposables market in 2024, as it has a lower carbon footprint, requires less water, and fewer chemicals. It is mainly focused on patient safety. Each consumable is individually packaged and sterilized before use. This drastically lowers the challenges of contamination and microbes. Applications of single-use packaging for things such as pre-fillable syringes, medical devices, and diagnostics kits create a safer environment for the patient.

The advanced polymer dressings & hydrocolloids segment is projected to grow at the fastest CAGR from 2025 to 2034, as it has high exudate capacity, is non-adherent, easily detached from the wound, accelerates the healing, lowers pain and inflammation, is cost-effective, simple to develop, and handle. Polymer dressings provide benefits such as enhanced moisture management, elevation of autolytic debridement, and a high degree of flexibility to different types of wounds. It exhibits an extraordinary adaptability.

By care setting/end user, the hospitals & acute care segment led the medical disposables market in 2024, as by choosing disposable items, healthcare professionals significantly lower the challenges of cross-contamination and infection spread. Disposable medical supplies provide more convenience; they are essential to maintain high safety standards in medical care. Disposable medical supplies provide more convenience; they are needed to maintain high safety standards in medical settings.

The ambulatory surgery centers & outpatient clinics segment is projected to experience the fastest CAGR from 2025 to 2034, as ambulatory surgery centers & outpatient clinics use disposable healthcare devices to improve patient safety by removing the risk of patient-to-patient contamination as the item is discarded and not used by another patient. The most significant single-use devices are syringe needles, gauze, scalpel blades, and others. The aim of using single-use medical supplies is to stop germs and viruses from spreading from one patient to another, which is an important tool in infection control.

By sterility/application, the sterile procedural consumables segment led the medical disposables market in 2024, as using these disposable products removes the chance of contamination, and it saves time for healthcare workers who then focus more on patient care. Sterile services not only support maintaining instruments and materials free of pathogens, but also encourage rapid healing and recovery. Sterile compounding is significant for making injectable and infusible medications, confirming that these preparations are free from contamination and harmless for patient application.

On the other hand, the non-sterile patient care consumables segment is projected to experience the fastest CAGR from 2025 to 2034, as this type of consumable includes gloves and other non-sterile consumables that aid various purposes in hospitals and clinics. These products defend the integrity of the items they cover without guaranteeing sterility. Non-sterile healthcare devices are appropriate for tasks that do not include direct contact with internal body parts or open wounds.

By distribution channel and commercial model, the GPO/direct OEM contracts segment led the medical disposables market in 2024, as GPOs provide a further remote, cost-effective procurement solution. GPO contracts are more competitive, particularly in medicinal areas integrated with many agents with the same profiles and effective data. These contracts are the expenses savings achieved by cooperative buying power.

On the other hand, the e-commerce/B2B marketplaces segment is projected to experience the fastest CAGR from 2025 to 2034, as selling medical consumables online provides many advantages, like an extensive reach, convenience, and affordable. Healthcare and pharmaceutical producers and B2B distributors benefit from an e-commerce platform. E-commerce, the medical equipment manufacturers confirm a swift exchange of data, healthcare supplies, and facilities with the medical care providers, insurers, and patients.

North America is dominant in the market share 38% in 2024, as increasing demand for new and technically advanced healthcare devices drives the growth of the market. With the growing adoption of electronic health records and digitalization, there is a rising demand for medical devices that seamlessly integrate with these technologies. Medical consumable protects lives, enhance patient results, and support lowering the cost of healthcare, which drives the growth of the market.

For Instance,

U.S. leadership in the number of novel drugs and advanced medical devices gaining government approval. The country ranks at the top in scientific Nobel prizes per capita, increasing scientific impact in academia, and research and development spending per capita. Using disposable medical devices can lower infection rates while reducing costs. The U.S. depends on international suppliers for pharmaceuticals, medical disposables, and healthcare devices, which drives the growth of the market.

For Instance,

Growing Canadian medical care infrastructure, with its worldwide health system and presence of over 1,200 hospitals nationwide, is increasing infection control practices, which are important in improving disposable medical consumables. Increasing awareness of infection control among Canadian people drives the growth of the market.

Asia Pacific is the fastest-growing region in the medical disposable market in the forecast period, as the growing prevalence of chronic disease, strengthening medical care system, evolving MedTech start-ups, increasing funding opportunities, and growing alignment towards public health. Increasing income levels and an ageing population drive the demand for medical disposables. Increasing research and development of the manufacturing of medical disposables, which contribute to the growth of the market.

The R&D phase of medical disposables starts with an inspection of end-user requirements and technology potentials relevant to the medical device ideas. The early R&D phase lays the basic foundation for medical disposable product design efforts. By design, validation and verification testing confirm the medical device meets product needs and conditions.

Key Players: Medtronic, Abbott, Johnson & Johnson, Becton, Dickinson and Company (BD), Cardinal Health, Siemens Healthineers, 3M Company, and Stryker

Clinical trials of medical consumables include laboratory and animal research that appraise the medical device's safety and performance under controlled conditions. Phase I trials are important in the advancement of medical devices as they offer appreciated insights related to how the medical disposable interacts with the human body.

Key Players: IQVIA, Parexel, ICON, Syneos Health, and Charles River Laboratories

The most significant role of medical consumables is to enhance patient safety and the quality of care they receive. This is achieved when physicians have more access to accurate devices at the right time, enabling them to accomplish the inspections, diagnostic testing, and therapies indicated to the maximum standard.

Key Players: 3M, Johnson & Johnson, Medline Industries, and Abbott

In May 2025, Darin Hammers, Chief Executive Officer at Minerva Surgical, stated, “The HERizon Hysto-Kit is a practical extension to our portfolio, designed to support the growing demand for in-office hysteroscopy. By bundling essential single-use supplies into one streamlined kit, we’re helping to simplify setup and support procedural consistency for clinicians and their teams.”

By Product Category

By Material / Technology

By Care Setting / End User

By Sterility / Application

By Distribution Channel & Commercial Model

By Region

January 2026

January 2026

January 2026

January 2026