February 2026

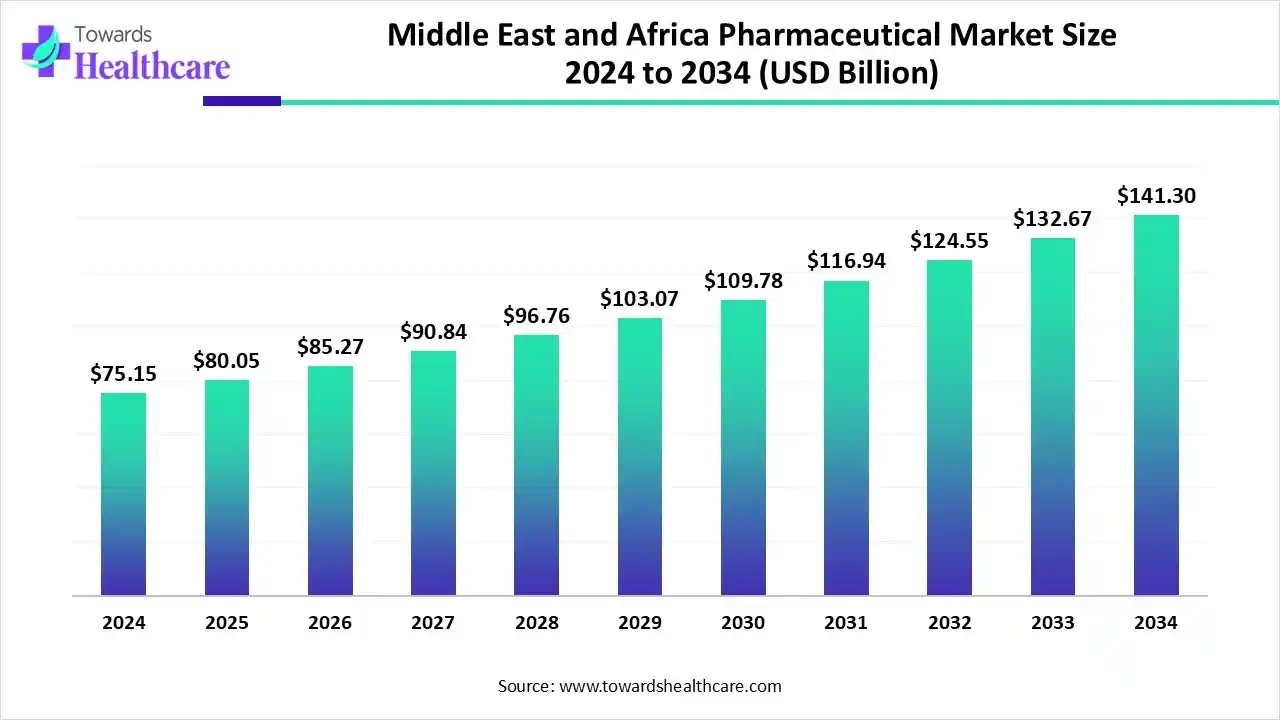

The Middle East and Africa pharmaceutical market size recorded US$ 75.15 billion in 2024, set to grow to US$ 80.05 billion in 2025 and projected to hit nearly US$ 141.3 billion by 2034, with a CAGR of 6.52% throughout the forecast timeline.

The Middle East and Africa pharmaceutical market is entering a change period, driven by increasing chronic disease burden, rising healthcare spend, and significant Government commitment to local drug manufacturing and healthcare infrastructure. Major growth drivers include access to medicines, the adoption of digital health, and more robust regulatory harmonization processes, such as the newly formed African Medicines Agency (AMA), to provide streamlined approvals of medicines. Nonetheless, challenges remain, including the fragmented regulation of medicines, high reliance on imported active pharmaceutical ingredients (APIs), and the high prevalence of substandard/falsified medicines, which pose systemic risks.

| Table | Scope |

| Market Size in 2025 | USD 80.05 Billion |

| Projected Market Size in 2034 | USD 141.3 Billion |

| CAGR (2025 - 2034) | 6.52% |

| Market Segmentation | By Product Type, By Therapeutic Area, By Channel / Distribution, By Business Model / Revenue Stream, By Buyer/Payer Type, By Country |

| Top Key Players | Pfizer, Sanofi, GlaxoSmithKline (GSK), Novartis, AstraZeneca, Johnson & Johnson / Janssen, Roche / Genentech, Merck & Co. (MSD), Bayer, Hikma Pharmaceuticals, Julphar (Gulf Pharmaceutical Industries), Tabuk Pharmaceuticals, SPIMACO, Neopharma, Pharco, Eva Pharma, Amoun Pharmaceutical, Aspen Pharmacare, Adcock Ingram, Biovac |

The Middle East and Africa pharmaceutical market involves a vast range of markets, extending from the well-established healthcare systems of the GCC countries to the emerging markets in sub-Saharan Africa. Although levels of maturity differ, several characteristics are evident: increased prevalence of chronic conditions (diabetes, hypertension, cardiovascular disease), large populations moving to urban areas, growth in government healthcare budgets, and the urgent need for access to medications and resilient supply chains.

In the GCC, as well as in North Africa, governments have advanced strategic visions, which aggressively pursue health authority self-sufficiency and capacity building. Meanwhile, many African countries are mired in inadequate infrastructure, regulatory mismatches, limited logistics, and the risk of contamination from substandard/falsified medicines in drug distribution. Therefore, if the global bio-pharma companies are to look beyond saturated Western markets, MEA offers both potential scale and diversification.

Artificial Intelligence (AI) presents a transformative opportunity in the MEA pharmaceutical ecosystem. In R&D and drug discovery, AI-assisted algorithms can help prioritize the right candidate molecules, screen an extensive range of chemical libraries, and expedite lead identification, all of which reduce time and cost. In regulatory and market intelligence, AI can enable harmonization of fragmented data across countries, predict demand, and identify compliance gaps. In supply chain & counterfeits detection, AI models integrated with spectroscopy or blockchain can provide traceability of drug origin and find discrepancies or anomalies.

Government Support & Initiatives

Governments are responding with national health insurance schemes, improving access to medications, and increasing contracted procurement from pharmaceutical wholesalers. Public health spending and infrastructure improvement, particularly in the GCC and in North Africa, are creating pressure for demand growth. In addition, publicly funded agendas, such as Saudi Vision 2030 and the UAE's industrial development plans, formally and institutionally promote the localization of pharmaceutical production, knowledge transfer, and the attraction of foreign direct investment in the Middle East and Africa pharmaceutical market.

Supply Chain Restraint

The next constraint is an over-reliance on imports of active pharmaceutical ingredients, or APIs, and excipients to be competitive on costs. Many MEA companies lack the capacity to synthesize raw materials, which exposes them to fluctuations in currency exchange rates, trade barriers, and disruptions in supply chains.

Supply Chain Improvement

While the sector faces challenges, there are also promising opportunities for regional manufacturing expansion and import substitution. Countries want to reduce the dependency on foreign-sourced products in favor of in-region development of active pharmaceutical ingredients (APIs) through to formulation and fill-finish operations. Companies willing to build and localize value chains will receive preferential access, tax incentives, and margins.

By product type, the generics & off-patent small molecules segment led the Middle East and Africa pharmaceutical market in 2024, with a revenue share of approximately 40%. This is due to their lower treatment costs in a region where patients frequently have to pay for healthcare out of pocket, and available funding for healthcare is limited. Governments are also encouraging generic substitution to control public spending on healthcare services, and local manufacturers are ramping up efforts at the production level to attract more of this market segment.

The specialty & advanced therapies segment is estimated to be the fastest-growing during the forecast period. Therapies such as biologics, monoclonal antibodies, gene therapies, and high-value injectables are quickly growing, particularly in the GCC. Greater investments in hospital infrastructure, increased insurance penetration, and highly publicized medical tourism hubs, such as those in the UAE, are moving the dial.

The infectious diseases & vaccines segment dominated the Middle East and Africa pharmaceutical market in 2024, with a revenue of approximately 24%. It remains the driving force behind pharmaceutical consumption in the MEA region, especially in sub-Saharan Africa, which is an endemic region for malaria, tuberculosis, HIV, and new viral diseases. Vaccination programs, frequently funded by international partnerships (such as GAVI) and donor procurement, guarantee considerable drug consumption. Polio eradication initiatives, programs to prevent Ebola through vaccination, and malaria vaccination programs further consolidate this infectious disease dominance.

Simultaneously, the specialty/biologic & rare disease therapies segment is estimated to be the fastest-growing therapeutic category in the Middle East and Africa pharmaceutical market during the forecast period. The rising incidence of cancer, autoimmune diseases, and genetic diseases will be most evident in urbanized, higher-income populations. In the GCC countries, which have the technology to adapt their healthcare system to expensive biologic therapy, the rise of expensive medications is becoming more prevalent due to available insurance coverage.

The retail community pharmacies segment led the Middle East and Africa pharmaceutical market in 2024, with a revenue of approximately 48%, and serves as the primary venue for most patients. In fragmented healthcare systems, community pharmacies often serve as the primary healthcare provider for patients, particularly in rural and semi-urban settings. The vast majority of retail pharmacy sales consist of generics, over-the-counter medicines, and basic chronic treatment.

The e-commerce/online pharmacies & direct-to-patient segment is estimated to be the fastest-growing distribution channel during the forecast period. Aligned with the COVID-19 pandemic, urban populations are now increasingly comfortable with online medicine delivery, particularly in cities such as Riyadh, Dubai, and Johannesburg. Patients prioritize convenience, transparency in pricing, and home delivery for their chronic prescriptions. Startups and established chain pharmacies are creating platforms to act on this consumer demand.

The local manufacturing & generic sales segment was the dominant segment in the Middle East and Africa pharmaceutical market in 2024, accounting for approximately 44% of the revenue. Generics fit neatly into the context of government-driven cost containment, as well as affordability for large segments of patient populations. Egypt, Jordan, and South Africa, for example, have robust generic industries that meet local and regional demand. In the GCC, national visions make an overt government commitment to the localization of medicines, with incentives for companies to manufacture and transfer technologies.

The specialty distribution & patient-support services segment is estimated to be the fastest growing in the Middle East and Africa pharmaceutical market during the forecast period, with patient-support services attached. As biologicals and high-cost therapies penetrate MEA markets, there is a tendency for companies to add wraparound services- including diagnostic testing, patient enrolment programs, adherence monitoring, and cost assistance. Specialty distributors also manage complex compliance around cold-chain logistics, so pharmacists and healthcare providers can be confident that the product arrives safely to the patient.

The out-of-pocket/private consumers segment dominated the Middle East and Africa pharmaceutical market in 2024, with a revenue of approximately 38%. The extent of insurance is low in many of these countries, and while some government reimbursement may occur, usually the private consumer is the primary buyer of drugs, pharma, especially generics, and OTC products. Even in wealthier markets, co-pays and direct buying are commonplace. This creates a consistent demand for low-cost generics and parallel imported medicines.

On the other hand, the NGOs/donor-funded procurement & global programs segment is estimated to be the fastest-growing in the Middle East and Africa pharmaceutical market during the forecast period. Global Fund, GAVI, PEPFAR, and other organizations buy in large volumes, at negotiated rates, and distribute in areas of need. These buyers play a disproportionately large role in delivery. They dictate industry standards on quality, baseline pricing, and access equity. The model is especially valuable in vaccine distribution, as donor engagement helps lower affordability thresholds for lower-income countries.

Saudi Arabia, the largest pharmaceutical market in the Middle East, is experiencing significant growth and evolution in its pharmaceutical sector, driven by its large population, robust healthcare infrastructure, and strong government initiatives, as outlined in Vision 2030. With an active push for the localization of pharmaceutical manufacturing, the country is working to build a sustainable life sciences ecosystem while simultaneously reducing its reliance on imports.

Dental multinationals are entering into joint ventures with local firms to expand generic and specialty drug production, offering production incentives such as tax incentives and expedited approvals. The expansion of insurance coverage and healthcare spending on a per capita basis also provides substantial market growth in Saudi Arabia. The Saudi Arabian Government is committed to establishing biotech hubs and modernizing regulations, aiming to attract global players and lead the development of innovative biopharmaceutical products in the Middle East and Africa pharmaceutical market.

Egypt is one of the largest and most dynamic pharmaceutical markets in Africa. Local companies, such as Eva Pharma and Pharco, dominate key therapeutic areas of generics, addressing local and regional demand. Egypt is also a key supplier of low-cost generic medicines to sub-Saharan Africa and the Middle East. The government is promoting local domestic companies and promoting the local production of medicines, while multinational companies enter into contracts with Egyptian companies for technology transfer and local manufacturing.

As local demand grows alongside the government's increasing burden of chronic disease and infectious disease, and potential public health strategies to enhance access to essential medicines, Egypt is on a path to emerge as a consumption and production hub for the Middle East and Africa pharmaceutical market, with a low-cost labor market, consumption options, and an increase in export capacity.

South Africa boasts a well-developed pharmaceutical market in sub-Saharan Africa, characterized by a robust regulatory system, a relatively strong healthcare system, and significant private sector involvement. South Africa is a major center for generics manufacturing and distribution across southern Africa, and is home to companies such as Aspen Pharmacare, which has gained international recognition, primarily in the fields of generics and vaccines, with significant exports.

Public sector procurement (largely funded through large tenders) remains a key driver of the market, for ARVs, for example, while the private sector contributes support for higher-value specialty medicines. Meanwhile, some e-commerce pharmacies and digital health platforms are emerging in the Middle East and Africa pharmaceutical market as well. As donor funding shifts, South Africa is directing funds toward strengthening local manufacturing and resiliency in the region's supply chain.

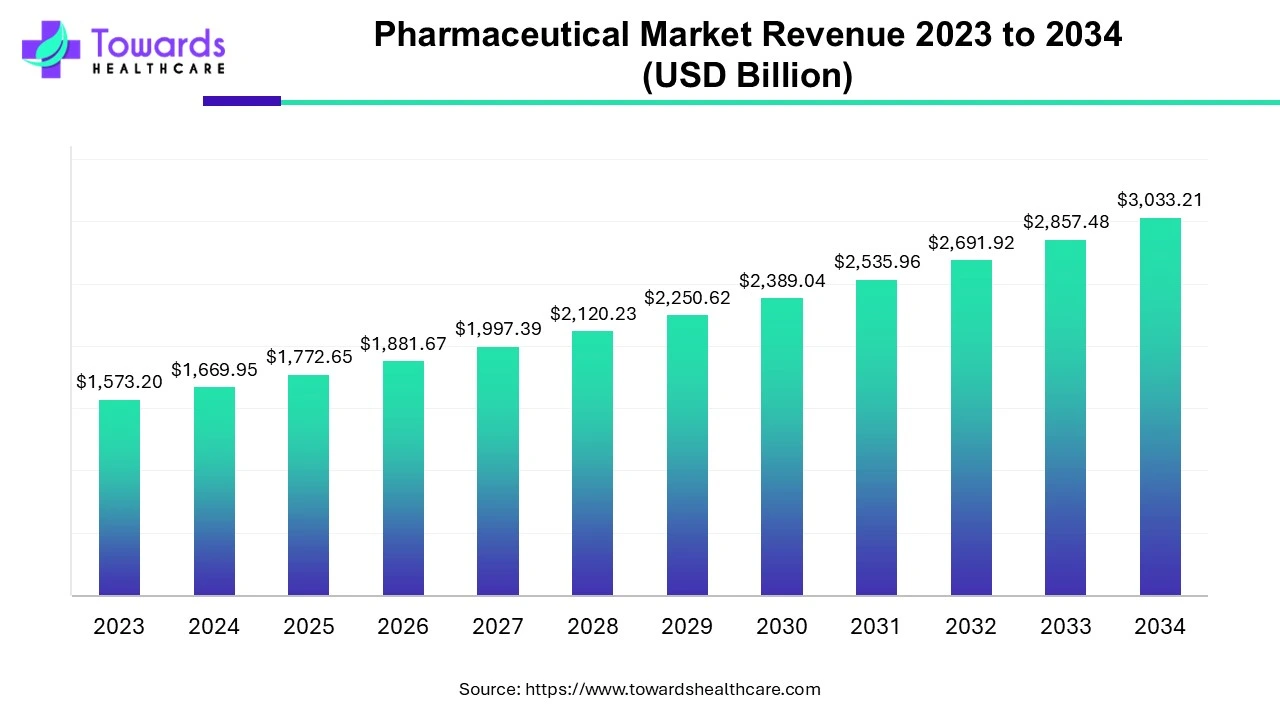

The global pharmaceutical market was valued at approximately USD 1,573.20 billion in 2023 and is expected to reach USD 3,033.21 billion by 2034, growing at a CAGR of 6.15% between 2024 and 2034.

By Product Type

By Therapeutic Area

By Channel / Distribution

By Business Model / Revenue Stream

By Buyer/Payer Type

By Country/Sub-region (revenue share, 2024 snapshot)

February 2026

February 2026

February 2026

February 2026