January 2026

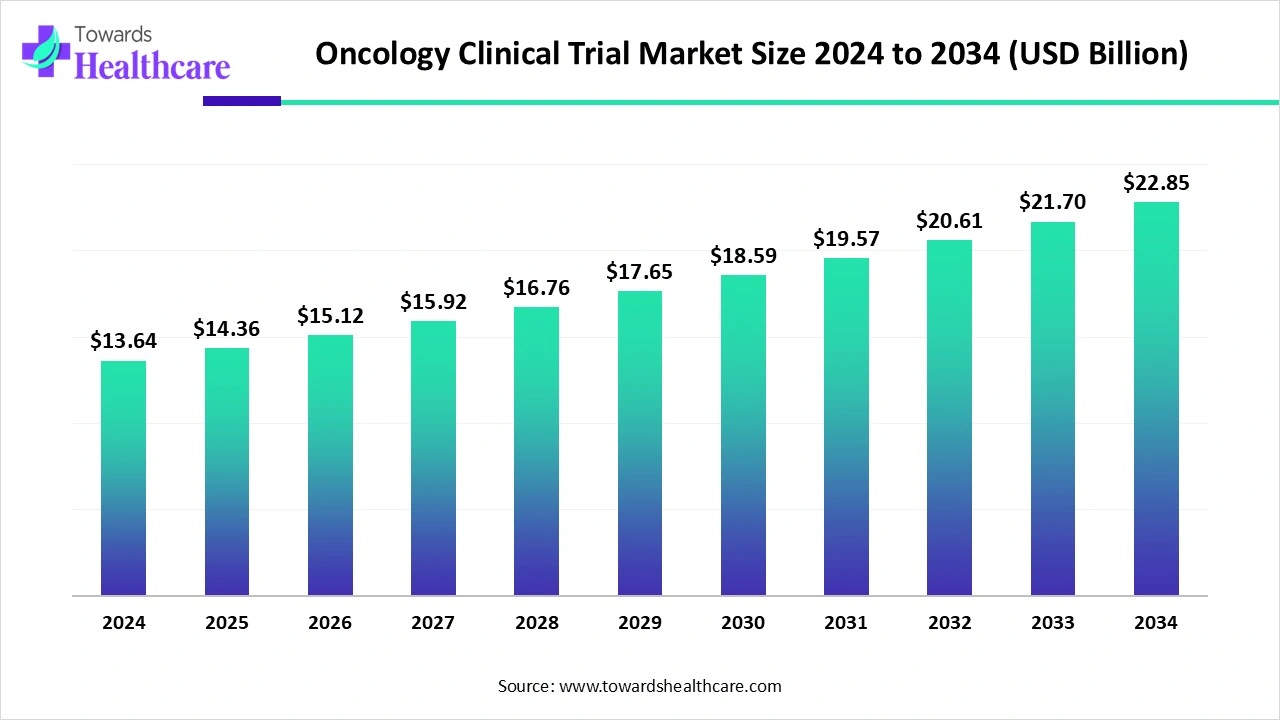

The global oncology clinical trial market size recorded US$ 14.36 billion in 2025, set to grow to US$ 15.12 billion in 2026 and projected to hit nearly US$ 24.07 billion by 2035, with a CAGR of 5.3% throughout the forecast timeline.

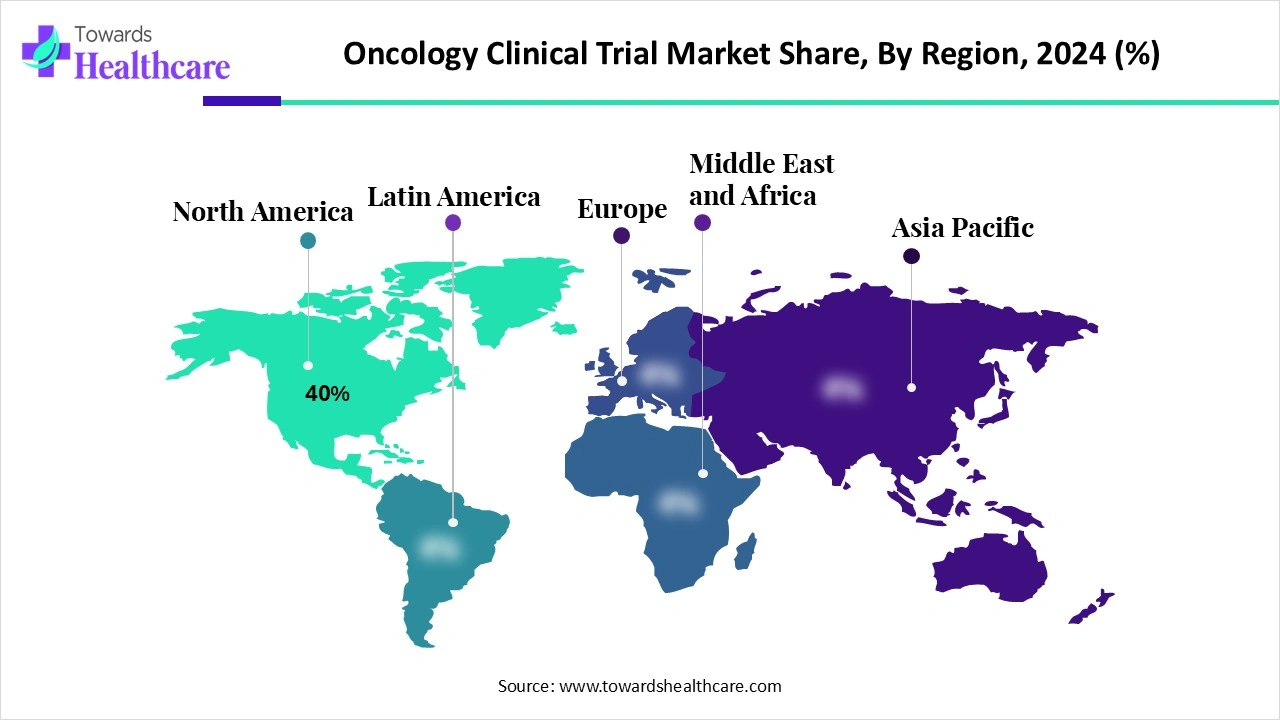

The oncology clinical trial market is witnessing significant growth, driven by rising cancer prevalence and the urgent need for innovative therapies. Advances in targeted therapies, immunotherapies, and precision medicine have expanded the scope and complexity of trials. North America dominates the market due to its robust healthcare infrastructure, strong presence of leading pharmaceutical and biotechnology companies, and supportive regulatory environment that accelerates trial approvals. Additionally, increasing investments, digital technologies, and optimized trial designs are enhancing the efficiency and effectiveness of oncology clinical research globally.

| Table | Scope |

| Market Size in 2026 | USD 15.12 Billion |

| Projected Market Size in 2035 | USD 24.07 Billion |

| CAGR (2026 - 2035) | 5.3% |

| Leading Region | North America 40% |

| Market Segmentation | By Phase, By Study Design, By Cancer Type, By Therapy Type, By Sponsor, By End User, By Region |

| Top Key Players | IQVIA, Syneos Health, ICON plc, PPD (Thermo Fisher Scientific), Parexel, Labcorp Drug Development, Medpace, PRA Health Sciences, Charles River Laboratories, Covance, Novartis Oncology Trials Division, Pfizer Oncology Trials, Merck & Co., Roche (Genentech), Bristol Myers Squibb, Johnson & Johnson (Janssen Oncology), AstraZeneca, Amgen, Eli Lilly, Gilead Sciences |

An oncology clinical trial is a structured research study conducted to evaluate the safety, efficacy, and optimal use of new treatments for cancer. These trials are essential for developing novel therapies, including chemotherapy, immunotherapy, targeted therapy, and personalized medicine approaches. They are conducted in multiple phases, starting with small groups to assess safety, followed by larger patient populations to evaluate effectiveness and side effects. Oncology clinical trials involve strict protocols, ethical approvals, and patient monitoring to ensure accurate results. They also provide critical insights into disease progression, treatment response, and potential biomarkers, advancing cancer care and improving patient outcomes.

The adoption of inorganic growth strategies has help to improve the oncology clinical trial market

In August 2025, IndiaAl's Independent Business Division (BD), in a significant effort to incorporate state-of-the-art technology into oncology, in the Cancer Al & Technology Challenge (CATCH) Grant has been announced in collaboration with the National Cancer Grid (NCG) Program. The program will expedite the creation and application of Artificial Intelligence (AI) solutions to enhance cancer screening, diagnosis, treatment assistance, and operational effectiveness throughout the nation's healthcare system. The program will award selected project teams grants of up to 250 lakh so they can test AI innovations throughout the extensive hospital network of the NCG. Together, CG and IndiaAl will provide funding.

AI integration can significantly enhance the by improving efficiency, accuracy, and patient outcomes. Artificial intelligence enables faster patient recruitment by analyzing medical records and identifying suitable candidates based on genetic, demographic, and clinical criteria. It streamlines data management, automates monitoring, and detects anomalies in real-time, reducing errors and operational costs. AI-driven predictive analytics can optimize trial design, forecast treatment responses, and identify potential adverse effects earlier. Additionally, machine learning algorithms facilitate personalized treatment strategies, improving the relevance and effectiveness of therapies. Overall, AI accelerates trial timelines, enhances decision-making, and supports the development of more precise and effective cancer treatments.

Rise In Prevalence of Cancer Patients

The rising prevalence of cancer drives the growth of the oncology clinical trial market by creating an urgent need for new and effective treatments. As more patients are diagnosed globally, pharmaceutical and biotechnology companies are motivated to develop innovative therapies such as targeted drugs, immunotherapies, and precision medicine. A larger patient population enables faster recruitment and more diverse trial participation, improving the reliability of results.

As of 2025, the World Health Organization (WHO) has not yet published specific global breast cancer prevalence data for that year. However, projections indicate a significant rise in breast cancer cases and deaths in the coming decades. According to a study published in Nature Medicine, if current rates continue, by 2050, there will be 3.2 million new breast cancer cases and 1.1 million breast cancer-related deaths per year.

Complex Trial Protocols & Long trial durations

The key players operating in the market are facing issue due to long trial duration and complex trial protocols. Multi-phase and specialized study designs make execution challenging. Extended timelines delay results and drug approvals. Strict guidelines and ethical approvals can slow trial initiation.

Advancement in Therapies & Innovation of New Treatments

Advancements in therapies are a major driver of growth in the oncology clinical trial market, as they create demand for the development and evaluation of innovative cancer treatments. Targeted therapies and precision medicines, designed to act on specific genetic or molecular markers, require specialized clinical trials to assess their safety and efficacy. The rise of immunotherapies, including checkpoint inhibitors and CAR-T cell treatments, further expands trial opportunities. Additionally, combination therapies and biologics necessitate complex trial designs. These therapeutic innovations, coupled with personalized medicine approaches, encourage more research, attract investments, and accelerate the expansion of the market.

The phase III segment dominates the market because it involves large-scale studies that confirm the safety and efficacy of investigational therapies in diverse patient populations, providing critical evidence for regulatory approvals. These trials are pivotal for demonstrating clinical benefits compared to standard treatments, making them essential for market entry and commercialization. The extensive data generated in Phase III trials also attracts significant investment from pharmaceutical and biotechnology companies.

The phase II segment is anticipated to be the fastest-growing in the market because it focuses on evaluating the efficacy and optimal dosing of new cancer therapies in a larger patient population after initial safety has been established. This phase enables quicker assessment of promising treatments, accelerating decision-making for progression to Phase III trials.

The interventional trials segment dominates the market because they actively evaluate the effects of new treatments, drugs, or therapies on cancer patients, providing critical evidence for safety, efficacy, and clinical outcomes. These trials are essential for the development of targeted therapies, immunotherapies, and combination regimens, which require controlled testing environments. Interventional studies allow precise monitoring of treatment responses, dose optimization, and adverse event management, ensuring regulatory compliance and scientific rigor.

The expanded access trials segment is estimated to be the fastest-growing segment in the oncology clinical trial market because it allows patients with advanced or treatment-resistant cancers to access investigational therapies outside standard clinical trials. These programs address unmet medical needs, providing early treatment options while generating additional real-world safety and efficacy data.

The breast cancer segment dominates the market due to its high global prevalence and the significant focus on developing innovative therapies for various subtypes. Advances in targeted treatments, hormone therapies, and immunotherapies have expanded clinical research in this area. A large patient population enables faster recruitment and more diverse trial participation, improving study reliability.

The lung cancer segment is estimated to be the fastest-growing in the oncology clinical trial market due to its high mortality rate and the urgent need for more effective treatments. Advances in targeted therapies, immunotherapies, and precision medicine have expanded clinical research opportunities, particularly for non-small cell and small cell lung cancers. Increasing patient awareness, improved diagnostic techniques, and identification of genetic biomarkers facilitate faster recruitment and more personalized treatment approaches.

The immunotherapy segment dominates the market due to its transformative potential in treating various cancers by harnessing the patient’s immune system. Therapies such as checkpoint inhibitors, CAR-T cells, and cancer vaccines have demonstrated significant efficacy, driving extensive research and clinical evaluation. High patient demand for advanced, targeted treatments, coupled with promising clinical outcomes, attracts substantial investments from pharmaceutical and biotechnology companies. Immunotherapy trials also address multiple cancer types, enabling broader applications and faster enrolment.

The cell & gene therapy segment is anticipated to be the fastest-growing in the oncology clinical trial market due to its potential to provide highly personalized and targeted cancer treatments. Innovations such as CAR-T cell therapy and gene-editing approaches enable precise destruction of cancer cells while minimizing damage to healthy tissue. Increasing investments from biotech firms, rapid technological advancements, and supportive regulatory frameworks are accelerating clinical development.

The pharmaceutical & biotechnology companies segment dominates the market due to their substantial financial resources, advanced R&D capabilities, and expertise in developing innovative cancer therapies. These companies lead the development of targeted drugs, immunotherapies, and cell and gene therapies, driving the initiation of large-scale trials. Strong regulatory knowledge, global networks, and access to diverse patient populations enable efficient trial execution.

The contract research organizations (CROs) segment is estimated to be the fastest-growing in the oncology clinical trial market due to the increasing outsourcing of clinical trial activities by pharmaceutical and biotechnology companies. CROs provide specialized expertise in trial design, patient recruitment, data management, regulatory compliance, and site monitoring, allowing sponsors to conduct complex oncology studies more efficiently and cost-effectively.

The dominates the market because these facilities provide essential infrastructure, experienced medical staff, and direct access to large patient populations. They play a critical role in patient recruitment, monitoring, and treatment administration, ensuring trials are conducted safely and efficiently. Additionally, hospitals and clinics often possess advanced diagnostic and treatment technologies, facilitating high-quality data collection and adherence to regulatory standards, reinforcing their dominant position in the market.

The clinical research organizations segment is anticipated to be the fastest-growing in the oncology clinical trial market due to increasing outsourcing by pharmaceutical and biotechnology companies seeking efficiency and cost-effectiveness. CROs offer expertise in trial design, patient recruitment, regulatory compliance, data management, and site monitoring, which is especially valuable for complex oncology studies involving immunotherapies, targeted therapies, and cell and gene therapies.

North America dominates the market due to its well-established healthcare infrastructure, advanced research capabilities, and strong presence of leading pharmaceutical and biotechnology companies. The region benefits from substantial government and private investments in cancer research, alongside supportive regulatory frameworks that facilitate faster approvals and efficient trial execution. High patient awareness, easy access to advanced diagnostic tools, and a large, diverse patient pool enable quicker recruitment and more representative study populations. Additionally, technological advancements in clinical trial management, data analytics, and personalized medicine further strengthen North America’s leading position in the global market.

The U.S. leads the North America oncology clinical trial market due to its well-established healthcare infrastructure, advanced research facilities, and strong presence of pharmaceutical and biotechnology companies. In 2024, the country initiated over 2,100 oncology trials, reflecting significant growth over the past decade. Approximately 35% of these trials focus on novel modalities, including cell and gene therapies, antibody-drug conjugates, and multispecific antibodies. The large patient population, high awareness, and access to advanced diagnostic tools enable faster recruitment and diverse participation, reinforcing the U.S. as the dominant hub for oncology clinical research globally.

Canada is a key player in oncology clinical trials, with over 3,100 ongoing trials reported in early 2025. Major provinces such as Ontario, Quebec, Alberta, and British Columbia serve as hubs for clinical research activities. Oncology trials account for around 26% of all ongoing studies, with a strong emphasis on rare cancers and innovative therapies. Collaboration between top pharmaceutical sponsors, academic institutions, and hospitals ensures efficient trial execution.

The Asia-Pacific region is the fastest-growing oncology clinical trial market in oncology clinical trials due to several key factors. Rapidly increasing cancer prevalence, particularly in China, India, and Southeast Asia, drives demand for innovative therapies. Growing investments from pharmaceutical and biotechnology companies, coupled with supportive government policies and regulatory reforms, facilitate faster trial approvals. The region offers large, treatment-naïve patient populations, improving recruitment efficiency and enabling diverse study cohorts. Additionally, the expansion of healthcare infrastructure, rising awareness about clinical trials, and adoption of advanced diagnostic technologies enhance trial quality.

Target ID/validation → assay dev & screening → hit-to-lead/lead opt → translational biology & biomarkers → in-vitro/in-vivo efficacy → GLP tox → IND-enabling CMC & GMP.

Organizations: Sponsors/biotech (Roche/Genentech, Novartis, Merck, BMS, AstraZeneca, Pfizer, Amgen, Gilead/Kite); Preclinical CROs (Charles River, WuXi AppTec, Eurofins); Diagnostics/biomarkers (Foundation Medicine, Guardant Health, Roche Diagnostics, Agilent/Dako, NeoGenomics, Caris); Tools (Illumina, Thermo Fisher Scientific); CDMOs (Lonza, Catalent, WuXi Biologics, Samsung Biologics).

Protocol design & feasibility → site selection/start-up (IRB/EC) → patient recruitment → conduct & monitoring (incl. DCT) → data mgmt/biostats & safety → CMC supply → regulatory submissions/approval.

Organizations: CROs (IQVIA, PPD/Thermo Fisher, Parexel, ICON, Syneos, Labcorp Drug Dev); Sites/Networks (MD Anderson, Memorial Sloan Kettering, Dana-Farber, Mayo Clinic, Tata Memorial; NCI NCTN centers); IRBs/ECs (WCG IRB, Advarra); Tech platforms (Medidata, Veeva, Oracle Health Sciences); DCT/enrollment (Medable, Science 37, TrialJectory, Antidote, Deep 6 AI); Imaging & ePRO (Clario, Median Technologies, YPrime); Central labs (Q2 Solutions, Labcorp Central Labs); Regulators (FDA—OCE/CDER/CBER, EMA, MHRA, PMDA, CDSCO).

Awareness & matching → navigation & consent support → logistics/travel & stipends → adherence/PROs & home visits → survivorship & financial aid.

Organizations: NCI Cancer Information Service; Advocacy & navigation (American Cancer Society, CancerCare, Leukemia & Lymphoma Society, Susan G. Komen, Patient Advocate Foundation); Travel/financial aid (Lazarex Cancer Foundation, PAN Foundation); Home nursing/logistics (PCM Trials, Marken/UPS Healthcare); PRO/engagement (Clario, Evidation/Health); Real-world evidence & follow-up (Flatiron Health).

In April 2025, Professor Grant McArthur, Chief Executive Officer at VCCC Alliance stated that the Cancer Council Victoria and Cancer Research Fellowships Victoria (CFRV) initiative has launched a new four-year cancer research fellowship program that offers up to 40 postdoctoral researchers in their mid-career and 24 early-career cancer researchers. Prof. McArthur praised the decision, saying it was good news for cancer patients in Victoria because it made a critical investment in researchers in their early to mid-career stages.

By Phase

By Study Design

By Cancer Type

By Therapy Type

By Sponsor

By End User

By Region

January 2026

December 2025

December 2025

December 2025