February 2026

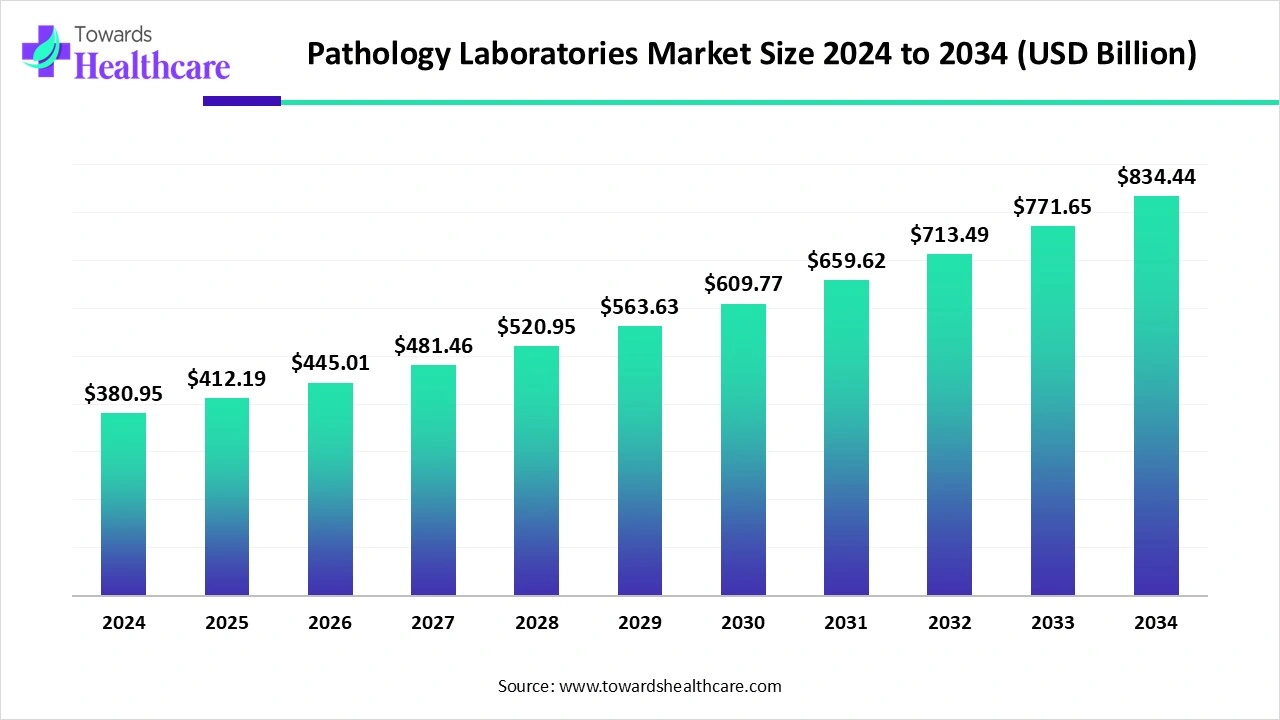

The pathology laboratories market size is calculated at US$ 380.95 billion in 2024, grew to US$ 412.19 billion in 2025, and is projected to reach around US$ 834.44 billion by 2034. The market is expanding at a CAGR of 8.2% between 2025 and 2034.

The pathology laboratories market is expanding rapidly, driven by the increased prevalence of infectious and chronic illnesses, the need for early and accurate diagnosis, and the use of cutting-edge technologies like automation, artificial intelligence, and digital pathology. Pathology labs are becoming a vital part of contemporary healthcare systems as a result of growing lab networks in emerging economies, encouraging government initiatives, and rising healthcare spending.

| Table | Scope |

| Market Size in 2025 | USD 412.19 Billion |

| Projected Market Size in 2034 | USD 834.44 Billion |

| CAGR (2025 - 2034) | 8.2% |

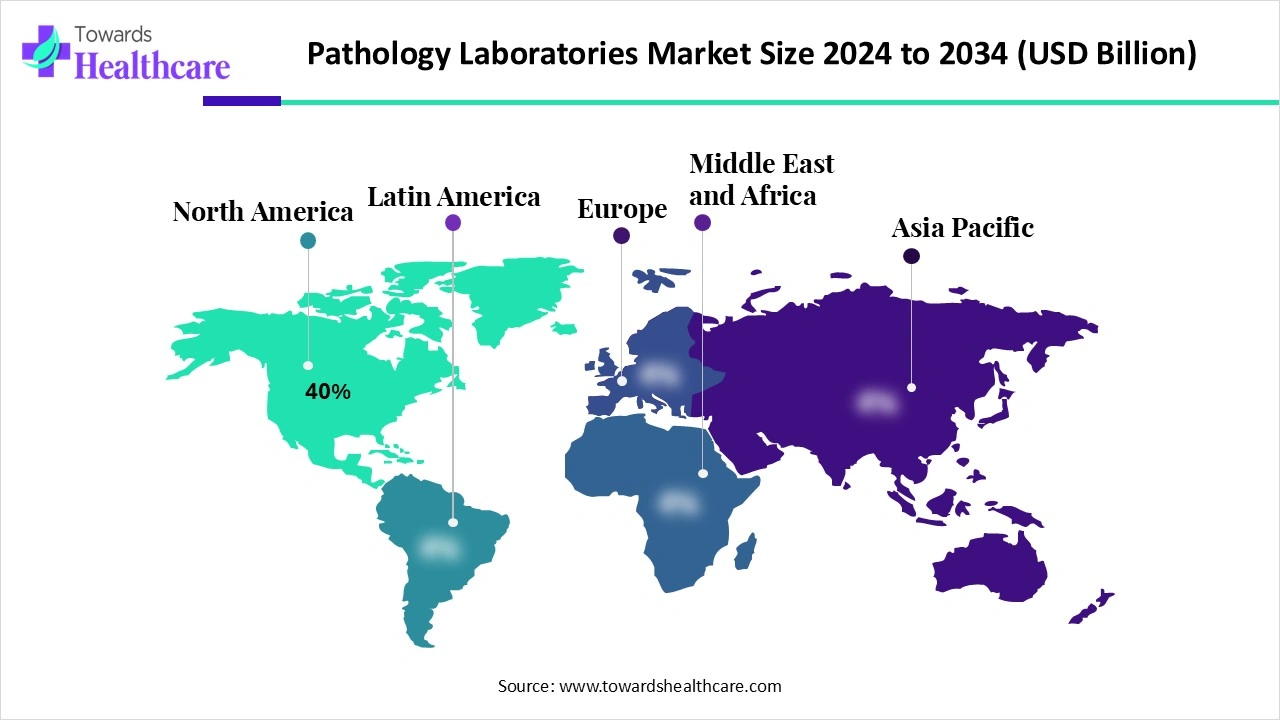

| Leading Region | North America by 40% |

| Market Segmentation | By Laboratory Type, By Test Type, By End User, By Technology Integration, By Geography |

| Top Key Players | Labcorp, Quest Diagnostics, BioReference Laboratories, Sonic Healthcare, Eurofins Scientific, Mayo Clinic Laboratories, ARUP Laboratories, Pathology Partners, Charles River Laboratories, ICON plc (Central labs), Thermo Fisher Scientific (Diagnostic services), Cerba Healthcare, SRL Diagnostics, Dr. Lal PathLabs, MedGenome Labs, Genoptix (Exact Sciences), Unilabs, CBLPath, Inc., Strata Pathology, Inovie Laboratories |

A pathology laboratory is a medical hub where highly skilled scientists and pathologists examine your blood, tissues, and other body samples to uncover the story behind your health. The pathology laboratories market is experiencing rapid expansion as the need for cutting-edge diagnostic services keeps growing. The pathology laboratories market is changing because of factors like the rise in infectious and chronic diseases, the need for early and precise disease detection, and the incorporation of technologies like digital pathology automation and artificial intelligence. Investments in contemporary laboratory configurations are also being driven by the growth of healthcare infrastructure, increased patient awareness, and favorable reimbursement schemes. All these factors combined are making pathology labs an essential part of healthcare delivery across the globe.

Digital imaging, sophisticated artificial intelligence (AI) algorithms, and computer-aided diagnostic techniques are just a few of the new tools being used to support, enhance, and empower computational histopathology and AI-enabled diagnostics in the field of diagnostic pathology, which has seen a dramatic transformation. Workflow changes and advancements in anatomical and clinical pathology can be made possible by AI tools.

Technological Advancements

Artificial intelligence, machine learning, automation, and other cutting-edge technologies are revolutionizing pathology labs by increasing diagnostic precision and decreasing human error. Labs can process tests more rapidly thanks to automated systems, which reduce turnaround times and improve operational effectiveness. Digital pathology and cloud-based data management also facilitate provider collaboration and accessibility. Modern imaging, robotic sample handling, and AI-assisted diagnostics are making it possible to detect illnesses more quickly and accurately, which is why technology is a major factor driving the pathology laboratories market expansion.

Workforce Adaptation is Challenging

Changes in staff roles and workflow are necessary for automation and AI because they are unfamiliar with the new systems or fear losing their jobs. Laboratory staff may be reluctant to adopt them, which calls for thorough training and change management techniques. Initially, the learning curve may cause productivity to decline. Some labs also struggle to keep talented employees on board as they make the switch to digital.

Rising Demand for Companion Diagnostics

The need for companion diagnostics is driving growth in the pathology laboratories market due to the rising incidence of rare diseases and cancer. As precision medicine becomes more prevalent, these tests aid in identifying the best course of action. When pathology labs collaborate with pharmaceutical companies, they can be extremely important for therapeutic drug monitoring and clinical trials. Companion diagnostics also makes labs important players in the drug development ecosystem and opens new revenue streams.

The hospital-based pathology laboratories segment dominates the market due to their incorporation into medical facilities, which provide inpatients and emergency patients with instant access to diagnostics. Large testing volumes, established infrastructure, and partnerships with interdisciplinary teams all help them provide faster and more precise diagnoses. Their dominance is further reinforced by their capacity to manage challenging exams, insurance support, and government funding.

The reference laboratories segment is a growing category, propelled by addressing wellness testing, preventive healthcare, and the growing demand for outpatient services. Patients who value convenience are drawn to them by their adaptable models, quicker turnaround times, and affordability. Digital report delivery, home sample collection services, and an increasing presence in semi-urban and rural areas all contributed to the growth.

The histopathology segment holds the largest share in the market in 2024 because it is the foundation of disease diagnosis, particularly in the case of chronic illnesses and cancer. It is essential for treatment planning due to its crucial function in tissue-based research and biopsy analysis. This market is kept at the forefront by established clinician trust and ongoing use in routine medical practice.

The molecular diagnostics segment is the fastest growing, driven by the growing need for genetic testing, infectious disease detection, and personalized medicine. Its capacity to offer accurate patient-specific insights improves early disease detection and targeted therapies. Growth is being further accelerated by developments in PCR, next-generation sequencing, and biomarker identification.

The hospitals & clinics segment dominates the pathology laboratories market, because they serve as the main locations of care for patients in need of diagnostic procedures. They are the most favored end user due to their strong insurance coverage integration with treatment facilities and access to large patient inflows. They increase their share by performing a variety of emergency and specialized tests.

The physicians & specialty clinics segment is the fastest growing, driven by the growing popularity of decentralized testing. These facilities provide closer patient interaction, quicker turnaround times for standard tests, and individualized care. Their growth is being driven by partnerships with diagnostic labs and the increasing use of point-of-care testing. More specialized diagnostic services are being used by doctors as a result of the shift toward precision medicine. The expansion of test portfolios by clinics is also being driven by growing awareness of preventive care.

The traditional pathology methods segment dominates the pathology laboratories market because they are widely accepted in healthcare systems, affordable, and have a proven role in routine diagnostics. Methods like traditional straining and manual microscopy are still essential, particularly in areas with limited resources and no digital infrastructure. Their accessibility and long-standing trust guarantee their dominance. Conventional techniques continue to be the most economical option for large-scale testing in developing countries. Many healthcare systems still mainly rely on traditional pathology despite the shift to digital, because of infrastructure and cost issues.

The digital pathology segment is the fastest-growing market, driven by cloud-based data sharing, telepathology solutions, and AI-powered image analysis. It improves the accuracy, speed, and cooperation of specialists worldwide in diagnosis. Healthcare systems are focusing on efficiency and remote diagnostic capabilities, which is increasing the demand for digital workflows. Digital pathology platform adoption is accelerating due to increased public and private investments. Furthermore, this market is expanding due to the increasing acceptance of virtual tumor boards and international consultations.

North America dominates the pathology laboratories market share by 40% owing to its robust investments in R&D, high adoption of digital pathology, and sophisticated healthcare system. The region's dominant position is a result of a high prevalence of chronic illnesses, the presence of major players, and advantageous reimbursement policies. The area is still at the forefront of early adoption of molecular diagnostics and AI-driven solutions. North America is the largest contributor of revenue due to ongoing technological advancements and government support for modernizing healthcare.

The U.S. market is experiencing steady growth, driven by a robust healthcare system, many tests, and an increase in the prevalence of chronic illnesses like heart disease and cancer. US clinics and hospitals. S. are incorporating digital pathology solutions more frequently, which allows for quicker turnaround times, AI-driven diagnostics, and remote consultations. The need for sophisticated molecular diagnostic tests has increased as a result of the focus on precision medicine and tailored care. Positive reimbursement policies and government funding for cancer screening initiatives are also bolstering market expansion. The U.S. is also changing because of strategic partnerships between technology companies' independent labs and hospitals. A. pathology ecosystem ranking among the most sophisticated in the world.

Asia Pacific is the fastest growing region in the pathology laboratories market during the forecast period, driven by government spending on healthcare infrastructure, which is increasing healthcare access, making more widely available and preventive diagnostics more widely recognized. Strong market expansion is being driven by the growing use of molecular diagnostics and quick digital health initiatives. The need for advanced pathology services is increasing due to factors like population density and the growing density and the growing prevalence of chronic illnesses. The region's momentum is being further accelerated by the growing trend toward digitization and remote diagnostics.

The market in India is rapidly expanding, bolstered by an increase in the penetration of diagnostic tests in both urban and semi-urban areas, a rise in the prevalence of diseases linked to a lifestyle, and a growing awareness of preventive healthcare. The success of independent and standalone laboratories in tier-2 and tier-3 cities can be attributed to their accessibility, affordability, and aggressive expansion strategies. In India's diagnostic industry, digital adoption is also accelerating, driven by home sample collection services and telepathology, which enhances patient convenience. The market is being significantly stimulated by private sector investments and government initiatives aimed at improving healthcare infrastructure. India is one of the pathology diagnostics markets with the fastest rate of growth due to the rising demand for reasonably priced yet sophisticated testing services.

The goals of R&D in pathology labs are automation, quicker turnaround, and increased diagnostic accuracy. Next-generation sequencing for personalized medicine, digital pathology, and AI-powered image analysis are important fields. To enhance disease detection, innovations also focus on biomarker discovery and molecular diagnostics.

Major players driving advancements are Roche, Philips, Thermo Fisher Scientific, Agilent Technologies, and Leica Biosystems.

Pathology labs undergo strict regulatory checks to ensure accuracy, safety, and compliance. Approvals from the FDA (U.S.), CE (Europe), and CDSCO (India) are vital, especially for AI-enabled and digital pathology systems. Clinical trials are essential to validate performance and data security, particularly in molecular and genetic testing.

Key companies focusing on regulatory-compliant solutions include Roche, Quest Diagnostics, Labcorp, Philips, and Thermo Fisher Scientific.

In pathology labs, patient support places an emphasis on improved results, trust, and ease of access. For disease monitoring, labs now provide telepathology digital reports, home sample collection, and AI-driven insights. Further improving accessibility are outreach initiatives in underserved areas and integration with hospital EHRs.

Key players providing strong patient support include Quest Diagnostics, Labcorp, Roche, Sonic Healthcare, and SRL Diagnostics

By Laboratory Type

By Test Type

By End User

By Technology Integration

By Geography

February 2026

February 2026

February 2026

February 2026