October 2025

The Pre-Dx oncology market is on an upward trajectory, poised to generate substantial revenue growth, potentially climbing into the hundreds of millions over the forecast years from 2025 to 2034. This surge is attributed to evolving consumer preferences and technological advancements reshaping the industry.

Guidelines recently included the use of Oncotype DX Recurrence Score (RS), one of the most popular multigene tests for evaluating indications for adjuvant chemotherapy, in women with early HR-positive HER2-negative breast cancer and up to three positive lymph nodes. These benefits boost the pre-dx oncology market expansion.

The pre-dx oncology market drivers are rising cancer incidence, emphasis on outcomes from early detection, advances in NGS and bioinformatics, regulatory pathways for screening tests, and payer interest in cost-effective population health interventions.

Pre-dx oncology encompasses technologies, tests, platforms, and services designed to detect cancer earlier than conventional diagnosis, including population screening, risk stratification, and pre-symptomatic detection. It includes blood-based liquid biopsies (ctDNA, CTCs), protein and metabolite biomarkers, advanced imaging with AI/quantitative analytics, multi-omics panels, and predictive digital health tools that identify high-risk individuals and detect molecular signatures of cancer at an early stage. Stakeholders include diagnostics companies, clinical labs, payers, healthcare systems, and population screening programs.

Industry Growth Overview: Between 2025 and 2034, the market is anticipated to grow rapidly due to developments in liquid biopsies, artificial intelligence (AI), early detection technologies, and next-generation sequencing (NGS). These new diagnostic techniques, which seek to enhance patient outcomes through early intervention, were developed and adopted in large part due to the rising incidence of cancer worldwide.

Major Investors: Large pharmaceutical and diagnostics companies, specialised venture capital (VC) firms, and government initiatives are among the major investors in the pre-dx oncology market. These organisations provide funding for early-stage cancer screening, diagnosis, and treatment planning research and development.

Startup Ecosystem: With an emphasis on early cancer detection, risk assessment, and prevention, the startup ecosystem in pre-diagnosis (pre-dx) oncology is expanding quickly. Startups are working to increase the precision, affordability, and accessibility of diagnostics before cancer has spread by utilising technologies like biomarker analysis, genomics, and artificial intelligence (AI). Significant investor interest is being shown in this market, particularly in nations like the US, Europe, and India.

The application of artificial intelligence (AI) algorithms to medical data analysis for early disease detection, often before symptoms are clinically evident is known as pre-diagnosis testing. AI improves treatment outcomes and preventive care by predicting a person's risk of contracting a disease by analysing large datasets from sources such as genetic sequencing, medical imaging, and electronic health records (EHRs).

By test/solution type, the liquid biopsy tests segment led the pre-dx oncology market in 2024, capturing a revenue of approximately 40%. In oncology, liquid biopsies have developed into cutting-edge diagnostic methods that offer non-invasive, real-time tracking of tumour dynamics. Compared to conventional tissue biopsies, they have a number of benefits, including being less invasive, more convenient, more indicative of tumour dynamics and heterogeneity, and more informative for directing individualised treatment choices.

By test/solution type, the multi-cancer early detection (MCED) tests segment is estimated to grow at the highest rate in the pre-dx oncology market during 2025-2034. MCED assays detect molecular alterations prior to the onset of symptoms and provide simultaneous screening for multiple cancers from a single liquid biopsy. In order to detect cancer and determine its cause, these tests evaluate DNA mutations, aberrant DNA methylation patterns, fragmented DNA, and other tumor-derived biomarkers. Furthermore, MCED assays have the potential to transform cancer screening and management by simultaneously detecting multiple cancers without the need for recommended screening protocols.

By technology, the next-generation sequencing (NGS) segment led the market in 2024, capturing a revenue of approximately 38%. In genomics research, NGS is a potent instrument. Millions of DNA fragments can be sequenced simultaneously by NGS, yielding comprehensive data on genetic variations, gene activity, genome structure, and behavioural changes. Recent developments have concentrated on better data analysis, lower costs, and quicker and more accurate sequencing.

By technology, the methylation profiling segment is estimated to grow at the highest rate during 2025-2034. Over the past few decades, there has been a steady increase in the scientific interest in DNA methylation and its value as a marker for early cancer detection and diagnosis. Since DNA methylation markers can provide information about physiology and pathology, they are currently a "hot topic" in scientific research.

By sample type, the blood segment led the pre-dx oncology market in 2024, capturing a revenue of approximately 60%. A liquid biopsy, which involves drawing blood, has a number of important benefits for oncology pre-diagnostic (pre-dx) testing. By detecting biomarkers released into the bloodstream by tumours, such as circulating tumour DNA (ctDNA) and circulating tumour cells (CTCs), these tests are used to screen for or detect cancer.

By sample type, the urine segment is estimated to grow at the highest rate during 2025-2034. Recently, a straightforward urine test was created, and these new findings represent an exciting next step in the development of a non-invasive early detection method. Particularly useful for identifying various analytes and cancer types, urine is a useful source of liquid biopsy for cancer.

By end-user, the clinical diagnostic laboratories segment led the pre-dx oncology market in 2024, capturing a revenue of approximately 40%. The laboratory's clinical diagnostic services business line, which performs hundreds of thousands of clinical diagnostic tests daily, works to guarantee that every patient, regardless of where they reside, has access to the most advanced and specialised methods for diagnosis, monitoring, and treatment choices.

By end-user, the primary care & screening centers segment is estimated to grow at the highest rate during 2025-2034. For cancer prevention, early detection, and successful long-term management, primary care physicians and specialised screening facilities must work together in oncology. While specialised centres offer sophisticated screening technologies and professional analysis, primary care physicians (PCPs) frequently act as the initial point of contact for patients.

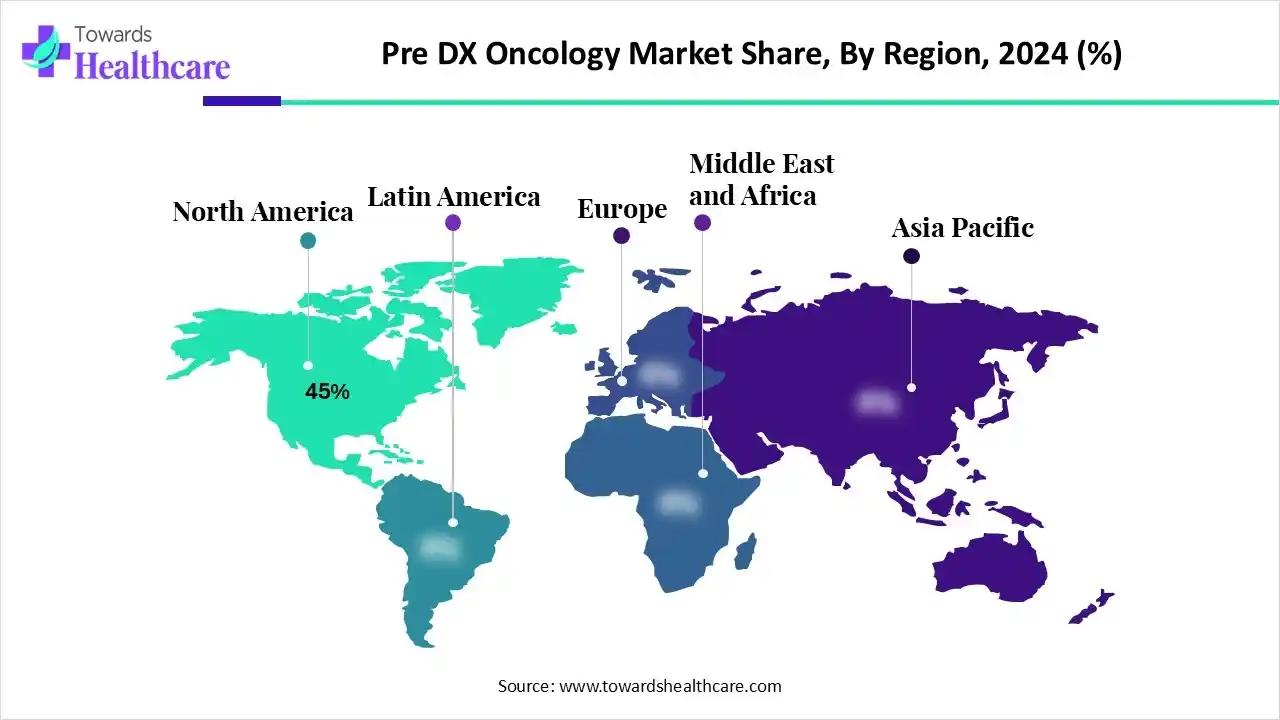

North America dominated the pre-dx oncology market share by 45% in 2024. Some of the largest pharmaceutical, biotechnology, and biomedical firms are based in the area. Cutting-edge technologies like robotic surgery and AI-driven diagnostics are becoming more widely used as a result of strong research institutions and growing federal funding. Significant growth is also being driven by the existence of reputable hospitals and cancer treatment facilities, which guarantee patients receive top-notch care. Government programmes that increase patient access to cutting-edge treatments and finance cancer research are two examples of how the market is expanding.

Despite some funding cuts brought on by the first Cancer Moonshot Initiative's sunset, the U.S. government invested billions of dollars in oncology in 2024, mostly through the National Cancer Institute (NCI) and the National Institutes of Health (NIH). A wide range of studies, clinical trials, and educational initiatives aimed at hastening the advancement of cancer were supported by ongoing funding.

About 925 grants totalling almost $583 million were funded by DCCPS in fiscal year 2024 to support work both domestically and abroad that aims to improve the quality of life for cancer survivors and lower the risk, incidence, and deaths from cancer. The SEER Programme is one of the $87 million in contracts that the division has funded.

Asia Pacific is estimated to host the fastest-growing pre-dx oncology market during the forecast period. A large number of patients seeking cancer treatment, aggressive investment by market leaders, rising cancer prevalence, rising government spending on healthcare, and rising patient disposable income have all improved access to cancer treatment in the area, and these factors are expected to drive the market's growth.

Rapid technological advancements, supportive government policies, and an increasing cancer burden are all contributing to the Chinese market's notable growth. The multi-cancer early detection (MCED) segment alone was worth $57.3 million in 2024, and by 2030, it is expected to have more than doubled in value.

Europe is expected to grow at a significant CAGR in the pre-dx oncology market during the forecast period. This is due to the growing technological improvements in the diagnosis of different types of cancer. Furthermore, it is projected that the growing number of cancer-related deaths and the rising incidence of cancer will encourage the growth of the European oncology market in the upcoming years

The UK government invested £118 million in five research hubs to expedite drug development and testing, and an additional £100 million to expand clinical trials through the new Cancer Research Centres (CRDCs), as part of a number of major investments in cancer research in 2024. These programmes are a component of a larger plan to update the NHS by incorporating new technology and enhancing patient access to cutting-edge therapies. An AI digital pathology data platform was also given £6.4 million by the government.

Pre-diagnosis (pre-dx) oncology research and development (R&D) aims to identify cancer early, frequently using non-invasive or minimally invasive techniques, so that treatment can begin before symptoms manifest. Compared to conventional cancer treatments, the R&D process for these diagnostic instruments is different.

A unique and extremely difficult clinical trial and regulatory approval process is involved in the development of "pre-diagnostic" or early cancer detection technologies, such as liquid biopsies and advanced imaging. To demonstrate that a screening technique is safe, accurate, and offers a clinical benefit without needless harm, pre-diagnostic trials must enlist a sizable number of healthy, asymptomatic participants, in contrast to therapeutic oncology, which tests treatments on patients who already have cancer.

Coordinated efforts to assist patients and their families in navigating the difficult and uncertain time leading up to a confirmed cancer diagnosis are essential components of pre-diagnosis oncology patient support and services. This entails attending to their logistical, financial, psychological, and medical requirements.

Offerings: Offers liquid biopsy tests for genomic profiling, recurrence monitoring, and early-stage cancer detection, including Guardant Reveal and Guardant360.

Pre-dx Contribution: creating blood tests to check for minimal residual disease in early-stage cancer and screen asymptomatic people.

Offerings: Blood tests for multi-cancer early detection (MCED) and the Cologuard test for colorectal cancer screening.

Pre-dx Contribution: Concentrating on multi-cancer early detection and non-invasive screening for several cancers before symptoms manifest.

Offerings: The Galleri multi-cancer early detection blood test screens for more than 50 cancer types using methylation-based technology.

Pre-dx Contribution: makes a major contribution to preventive oncology by early detection of multiple cancers in asymptomatic individuals.

Offerings: Signatera for cell-free DNA assays for early cancer detection (ECD) and molecular residual disease (MRD) testing.

Pre-dx Contribution: creating ECD assays and tissue-free MRD tests to track recurrence and identify cancer early.

Offerings: A broad range of diagnostic options, such as digital pathology, molecular, and sequencing methods for screening and risk assessment.

Pre-dx Contribution: Propels diagnostic innovation with an emphasis on risk assessment, digital pathology insights, and early cancer screening.

By Test/Solution Type

By Technology

By Sample Type

By End-User

By Region

October 2025

October 2025

October 2025

October 2025