January 2026

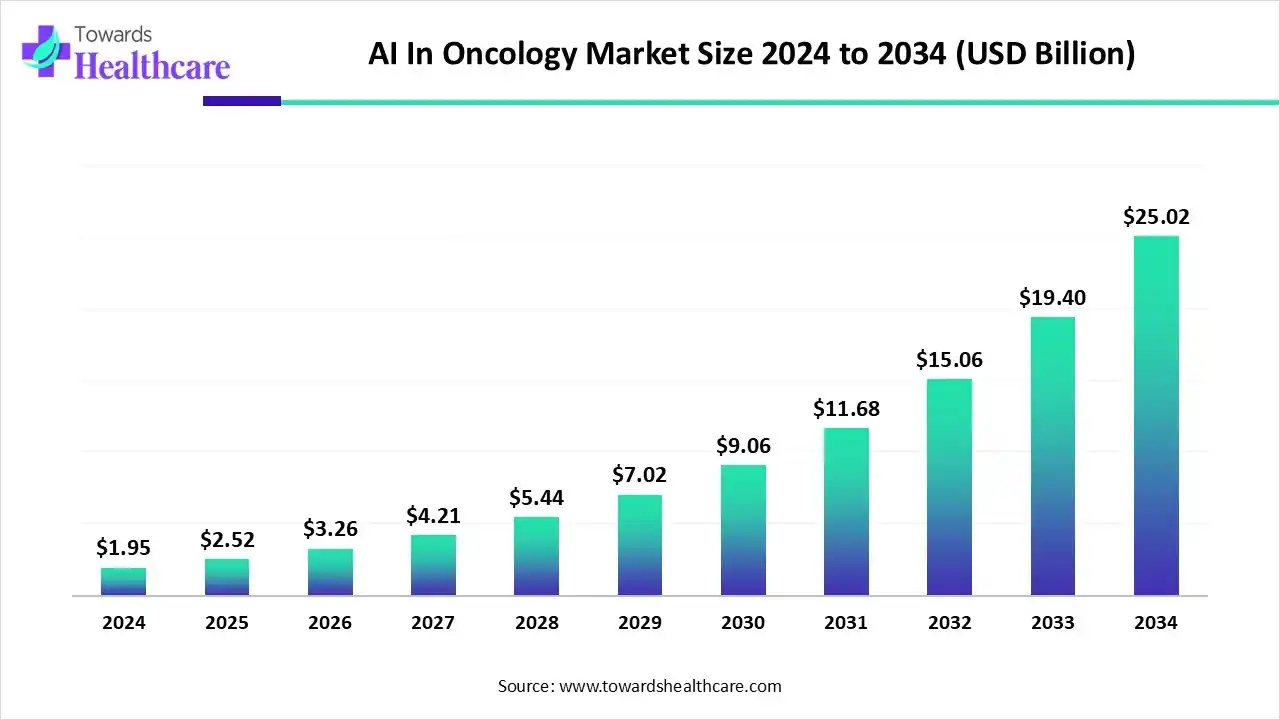

The global AI in oncology market size is estimated at US$ 1.95 billion in 2024 and is projected to grow to US$ 2.52 billion in 2025, reaching around US$ 25.02 billion by 2034. The market is projected to expand at a CAGR of 29.36% between 2025 and 2034.

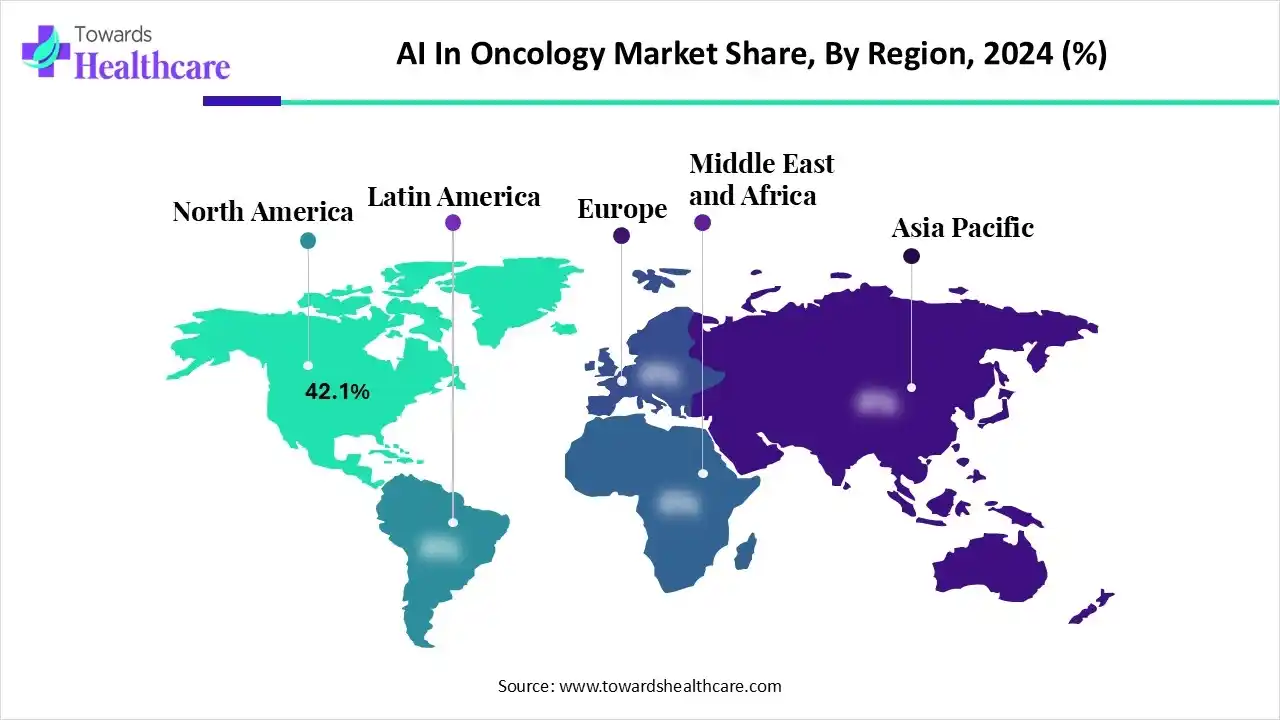

The AI in oncology market is growing because of the recent development in AI-based technology, such as big data, machine learning, and precision medicine. North America is dominated by the rising prevalence of cancer, increasing medical care data, and increasing demand for targeted treatment. Asia Pacific fastest-growing region as many players in the APAC are investing in AI-driven platforms and collaboration to improve clinical results.

| Table | Scope |

| Market Size in 2025 | USD 2.52 Billion |

| Projected Market Size in 2034 | USD 25.02 Billion |

| CAGR (2025 - 2034) | 29.36% |

| Leading Region | North America by 42.1% |

| Market Segmentation | By Component, By Application, By End-User, By Deployment Mode, By Region |

| Top Key Players | Siemens Healthineers, GE Healthcare, Medtronic, IBM Watson Health, NVIDIA Corporation, Philips Healthcare, Flatiron Health, PathAI, Azra AI, ConcertAI, Digital Diagnostics, Median Technologies, Radformation / Limbus AI, DeepMind Health, Intel Corporation, Canon Medical Systems, Oncora Medical, Paige AI, Imagia Cybernetics |

The AI in oncology market refers to the integration of artificial intelligence technologies, such as machine learning, deep learning, and natural language processing, into the field of oncology. These technologies are utilized to enhance various aspects of cancer care, including early detection, diagnosis, treatment planning, and personalized therapy. AI applications in oncology aim to improve clinical outcomes, reduce human error, and optimize healthcare resources by analyzing complex medical data, such as medical imaging, genomic data, and electronic health records.

| Company | Investment |

| Predictive Oncology | In October 2025, Predictive Oncology Inc. completed two private investment transactions totaling approximately $343.5 million. |

| Canopy | In October 2025, Canopy, an AI platform for oncology, presented findings at the American Society of Clinical Oncology (ASCO) Quality Care Symposium. |

In August 2025, IndiaAI Independent Business Division (IBD), in partnership with the National Cancer Grid (NCG), announced the launch of the Cancer AI & Technology Challenge (CATCH) Grant Program. This initiative supports the development and deployment of innovative Artificial Intelligence (AI) solutions to strengthen cancer screening, diagnostics, management support, and healthcare operations in India. The CATCH Grant Program will provide up to ₹50 lakh per project to selected teams comprising technology innovators and clinical institutions.

In May 2025, the Telangana Health Department proposed the launch of an AI-driven cancer screening program to improve early detection and treatment by high-resolution imaging and precision diagnostics, precision diagnostics, potentially identifying health irregularities with unprecedented precision.

By component, the software solutions segment led the AI in oncology market with approximately 64.34% share, as AI-driven software instantly understands how cancer cells become resistant to anticancer medicines, which supports improving drug development and adjusting drug application. This software is used by radiologists to map target areas or robotically plan radiation treatment programs. This software manages the use of chemotherapy drugs and detects the acceptance of chemotherapy medicines, so as to improve the chemotherapy treatment.

On the other hand, the services segment is projected to experience the fastest CAGR from 2025 to 2034, as this AI-driven service analyzes multifaceted datasets, leading to more precise diagnoses and rapid treatment initiation, which enhances the results of the patients. It helps targeted medicine by incorporating genetic and clinical information to tailor treatments. It predicts cancer challenges for preventive actions, streamlines screening programs, and supports patients through incessant monitoring and management of symptoms.

By applications, the breast cancer segment led the AI in oncology market in 2024 with approximately 28.23% share, as AI-driven technology has the strength to detect the location of cancer in a mammogram or other breast imaging that even an advanced-trained radiologist might miss. AI technology trained to scan imaging like MRIs to recognize and flag potential cancer-like structures in patients' scans with unbelievable efficacy. AI-driven technology transforms breast imaging, supporting in reading mammograms, assessment of biomarkers, lymph node identification, and outcome prediction.

On the other hand, the lung cancer segment is projected to experience the fastest CAGR from 2025 to 2034, as AI-driven technology quickens the precise staging of lung cancer and controls the time-consuming processes of reading pathology slides and CT scans. This technology supports clinicians in better decision-making by foreseeing treatment response, adverse effects, and prognosis prediction in healthcare treatment, radiotherapy, and surgery.

By end use, the hospitals segment led the AI in oncology market in 2024 with approximately 45% share, as AI technologies in hospitals have ushered in an era of supplementary efficient screening technology, improved treatment procedures, and enhanced patient results, marking an important leap forward in cancer care distribution. Predictive AI-driven tools learn patterns from training data to predict future results in novel states. This technology is concretely reshaping the field and horizons of oncology, creating new significant opportunities for enhancing the management of cancer patients.

On the other hand, the pharmaceutical companies segment is projected to experience the fastest CAGR from 2025 to 2034, as pharmaceutical organizations use AI-driven technology to develop improved diagnostics and biomarkers, to detect novel drug targets, and also to design new drugs. Usage of AI-driven technology in drug development and manufacturing lowers the late-stage failures, particularly when major cost-driven factors drive the management of diseases.

By deployment mode, the cloud-based segment led the AI in oncology market in 2024 with approximately 60% share, as cloud-based technology plays a significant role in the treatment of cancer big data by offering controlled processing, infinite storage, scalability, accessibility, and affordability of computational resources. Cloud AI drives automation, enhances resource use, and improves data security in cloud environments.

On the other hand, the on-premises segment is projected to experience a significant CAGR from 2025 to 2034, as on-premises AI-driven technology keeps patients’ information inside secure physical and network areas. This reduces the chance of data being stolen or retrieved without permission. On-premises technology offers a focused and advanced environment for these tasks. This supports physicians to get real-time data during patient cancer care.

North America is dominant in the market in 2024, with approximately 42.1% share, due to the healthy investments, progressive technological infrastructure, robust academic and commercial ecosystems, and a supportive government environment. North America is a worldwide leader in AI-driven healthcare innovation, with continuing development in deep learning, machine learning, and computing power. This technical foundation is significant for evolving sophisticated AI-based algorithms used in cancer diagnostics, treatment planning, and drug discovery, which contributes to the growth of the market.

For Instance,

The U.S. healthcare system has access to vast, diverse datasets from electronic health records (EHRs), healthcare genomics, and imaging. AI-driven technology booms on large, complicated datasets, allowing it to find novel patterns and insights.

The NCI received approximately $7.22 billion in funding for FY2024, and this same level is being maintained for FY2025. Organizations like the AACR are calling for significant increases in federal funding, with a specific request of $7.934 billion for the NCI in FY2026, to sustain scientific work and drive new breakthroughs.

Canada has made significant strategic advantages for evolving AI in healthcare. Growing initiatives in Quebec and various provinces, as well as government-funded research through the Canadian Institute for Advanced Research (CIFAR) and AI institutes such as Mila and the Vector Institute, are attentive on connecting the gap between research and clinical application, which drives the growth of the market.

In 2024, Canada is projected to see approximately 247,100 new cancer diagnoses and 88,100 cancer deaths. While overall age-standardized incidence and mortality rates are expected to continue a slight decline, the total number of cases and deaths is increasing due to Canada's aging and growing population.

Asia Pacific is the fastest-growing region in the market in the forecast period, due to the increasing rate of cancer, growing investment and supportive government regulations, quick digitization of medical care, and an increasing requirement for effective and accessible healthcare services. Public and private sectors are majorly investing in AI research and development for oncology, which contributes to the growth of the market.

China is the major countries for conducting AI-based healthcare research on AI-based lung cancer, reflecting a significant sector of focus for its oncology market. The presence of major tech giants such as Alibaba and Tencent is heavily investing in AI technologies for advanced healthcare.

In 2024, China had an estimated 4,909,585 new cancer cases, a correction from an initial report of 3,246,625, and an estimated 2,593,882 cancer deaths. The leading cancers for new cases are lung, breast, and colorectal, while the leading causes of cancer death are lung, liver, and esophageal.

Europe is notably growing in AI in the oncology market, as it has a massive aging population, which poses a great cancer challenge. This demographic trend drives demand for more efficient diagnostic devices and personalized treatment services that AI technology provides. A major project sponsored by the EU's Digital Europe Program, EUCAIM, is systematizing a pan-European digital infrastructure for cancer images and associated clinical data, which contributes to the growth of the market.

In Germany, strong government support, an advanced research ecosystem, and a growing startup scene focused on medical care technology. Increasing government initiative, this will offer researchers pseudonymized health data from 75 million insured patients, providing a massive dataset to train reliable AI models, which drives the growth of the market.

By Component

By Application

By End-User

By Deployment Mode

By Region

January 2026

January 2026

January 2026

January 2026