January 2026

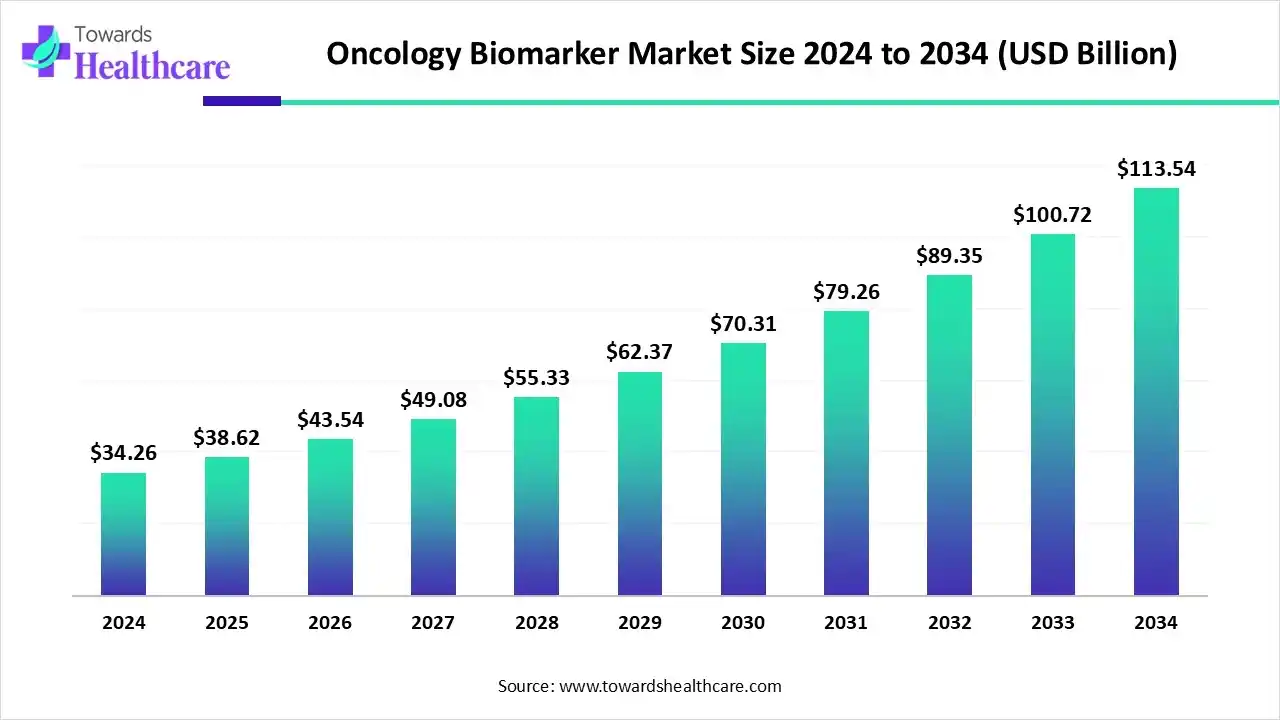

The global oncology biomarker market size is calculated at US$ 34.16 billion in 2024, grew to US$ 38.62 billion in 2025, and is projected to reach around US$ 113.54 billion by 2034. The market is expanding at a CAGR of 12.73% between 2025 and 2034.

Due to the growth in cancer cases globally, the use of oncology biomarkers for various purposes is increasing. The industries are using them to develop advanced diagnostics and support the development of novel treatment options, where they are also leveraging AI to advance biomarker discovery and development. Additionally, the growing innovations supported by the investment and increasing awareness are also driving their demand. Furthermore, the companies are investing, collaborating, developing, and launching various biomarker diagnostics tools and techniques, promoting the market growth.

| Table | Scope |

| Market Size in 2025 | USD 38.62 Billion |

| Projected Market Size in 2034 | USD 113.54 Billion |

| CAGR (2025 - 2034) | 12.73% |

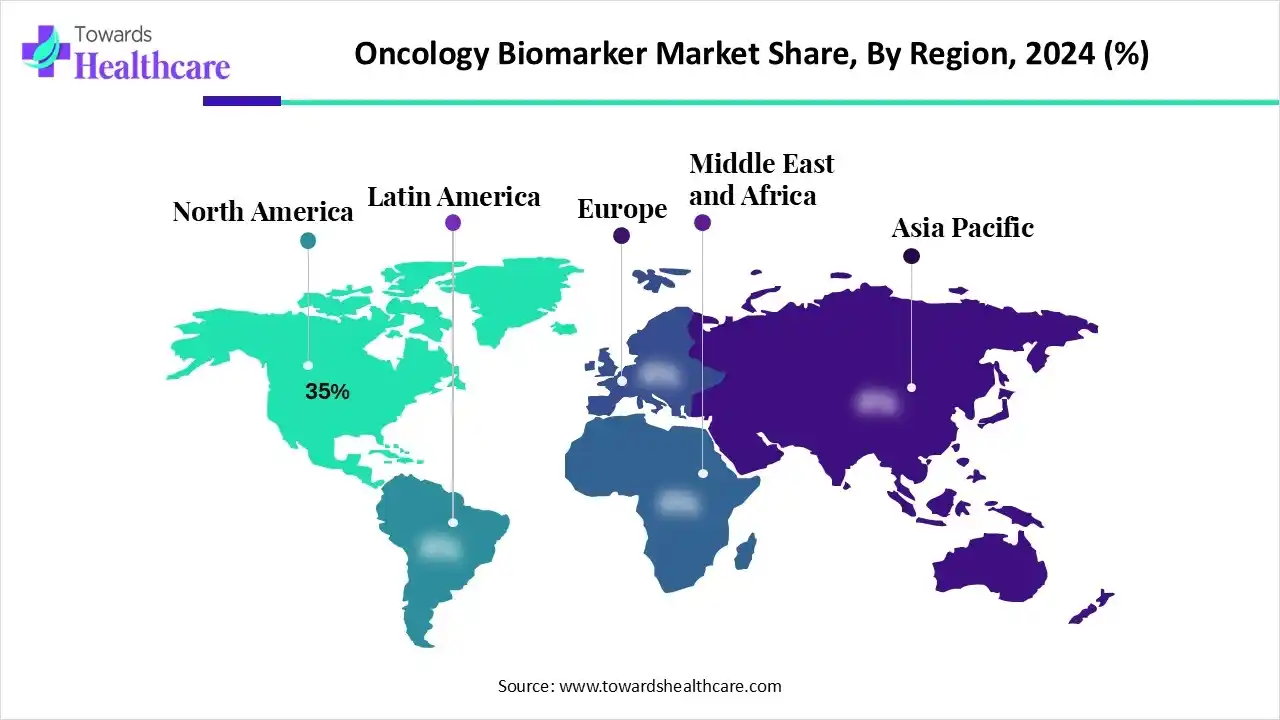

| Leading Region | North America by 35% |

| Market Segmentation | By Biomarker Type, By Application, By Cancer Type, By End-User, By Region |

| Top Key Players | F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific Inc., bioMérieux SA, Merck & Co., Inc., Hologic, Inc., Sino Biological Inc., Myriad Genetics, Inc., Caris Life Sciences, Guardant Health, Foundation Medicine, Inc., Exact Sciences Corporation, NeoGenomics Laboratories, Inc., Adaptive Biotechnologies Corporation, 23andMe, Inc., Quest Diagnostics Incorporated |

The oncology biomarker market is driven by the growing global cancer burden and the increasing shift towards personalized medicine. The oncology biomarker encompasses the development, validation, and application of biomarkers biological molecules found in blood, tissues, or other body fluids, that aid in the detection, diagnosis, prognosis, and treatment of various cancers. They play a crucial role in early cancer detection, monitoring disease progression, and assessing therapeutic responses, as well as in the development of personalized medicine.

The cancer diagnosis, treatment, and prognosis are being transformed, due to the growing impact of AI, as it helps to discover biomarker signatures important for early detection and treatment of cancer, enhancing the precision medicine development. Machine learning and deep learning diagnostics are being used to identify patterns in large datasets, promoting the development of biomarkers to provide accurate and effective therapies. Therefore, the use of AI in cancer biomarker discovery is increasing, enhancing early diagnosis, targeted therapy development, and patient outcomes.

For instance,

Growing R&D investments: To deal with the growing cancer cases, the industries are contributing to the increased oncology R&D to develop early and accurate detection kits and targeted treatment options, increasing the demand for biomarkers. Therefore, the investments from various sources are encouraging these developments.

For instance,

| Company | Platform | Application | Source |

| Bangkok Dusit Medical Services Public Company Limited (BDMS) | BDMS SPOT-MAS | Detects early-stage cancer cells of ten major cancer types - ovarian, breast, gastric, lung, head, liver, neck, oesophageal, pancreatic, colorectal, and endometrial cancers | BDMS Launches SPOT-MAS Early Cancer Screening Programme |

| Ataraxis AI and MEDSIR | Integrated artificial intelligence into multiple major international trials | Identify biomarkers and optimize treatment | MEDSIR and Ataraxis AI Launch Research Collaboration to Evaluate AI-Powered Platform as a Predictive Tool in Breast Cancer Randomized Clinical Trials |

| Exact Sciences Corp. | Cancerguard™ test | Analyze multiple biomarker classes and detect a wide range of cancers | Exact Sciences Launches Cancerguard™, First-of-Its-Kind Mul… |

| Biodesix and Association of Pulmonary Advanced Practice Providers (APAPP) | CME-accredited educational programs focused on diagnostic biomarkers in Lung Nodule and Lung Cancer patient programs | Address the critical need for improved lung cancer detection | Biodesix Launches First-Ever Lung Cancer Biomarker Education Program for APPs | BDSX Stock News |

| Metropolis Healthcare | TruHealth Cancer Screen 360 | Integrated Cancer Screening Panel | Metropolis Healthcare launches TruHealth cancer screen 360 to strengthen preventive oncology in India - Express Healthcare |

| Akoya Biosciences and Enable Medicine | Enable Pan-Cancer Atlas | Filter and analyze data by biomarker expression, clinical metadata, and tissue type | Breakthrough 100M-Cell Cancer Atlas Launches for Biomarker Discovery | AKYA Stock News |

| LuNGS Alliance | Free Lung NGS (Next Generation Sequencing) biomarker testing | To drive awareness about precision oncology as an essential, accessible, and affordable treatment plan for lung cancer treatment | LuNGS Alliance launches free lung NGS biomarker testing for lung cancer patients in India - Express Pharma |

By biomarker type, the genomic biomarkers segment led the market with approximately 35% share in 2024, as they helped in detecting cancer mutations. They were also used for the development of targeted therapies. Additionally, the growth in companion diagnostics has also increased their use.

By biomarker type, the proteomic biomarkers segment is expected to show the highest growth during the predicted time. Their use is increasing to identify the disease state in the body and the treatment responses as well. Moreover, they are also being used in liquid biopsies for early and easier cancer detection.

By application type, the diagnostic testing segment held the dominating share of approximately 50% in the market in 2024, driven by the increased use of oncology biomarkers in early cancer detection. Moreover, they were also used in the non-invasive diagnosis, as well as supported the development of personalized medicines. Similarly, their increased application in companion diagnostics also increased their use.

By application type, the prognostic testing segment is expected to show the fastest growth rate during the predicted time. In prognostic testing, the biomarkers are being used to predict disease outcomes and enhance the selection of personalized treatment options. It also helps in detecting the recurrence of cancer, ensuring optimal treatment for the patients.

By cancer type, the breast cancer segment led the market with approximately a 25% share in 2024, due to growth in its incidence rates. This increased the demand for biomarkers for their early and accurate diagnosis and prognosis. Additionally, growing awareness also promoted their use in testing and development of therapies.

By cancer type, the lung cancer segment is expected to show the highest growth during the upcoming years. The biomarkers are being used in the development of early diagnostic techniques for lung cancers. Moreover, the growing use of liquid biopsies and targeted therapies is also increasing their use.

By end user, the hospitals and diagnostic laboratories segment held the largest share of approximately 40% in the global market in 2024, as they are the primary point of patient care. Moreover, the large volume of patients increased the use of oncology biomarkers. Additionally, diverse cancer cases and advanced instruments contributed to their continuous use.

By end user, the research and academic institutes segment is expected to show the fastest growth rate during the upcoming years. The growing cancer R&D is increasing the use of oncology biomarkers for various applications. Additionally, the growing collaborations and government funding are promoting these advancements.

North America dominated the oncology biomarker market with 35% in 2024, due to the presence of a robust healthcare infrastructure, which increased the use of oncology biomarkers for the development of diagnostic technologies. Moreover, the growing incidence of cancer has increased their use for the early detection of cancer and development of personalized medicines, where their development and innovations are supported by investments and funding. Thus, this contributed to the market growth.

The growing cases of cancer in the U.S. are increasing the demand for oncology biomarkers for developing advanced diagnostic and treatment options. Moreover, the industries are also utilizing them to advance the development of personalized medicine, targeted therapies, and liquid biopsies. Additionally, the investments and funding are encouraging their development.

For instance,

The industries and institutes of Canada are increasing the use of oncology biomarkers due to growing research and development. This, in turn, is driving their clinical trials, where the innovations are supported by government funds. Additionally, increasing awareness is growing their use for early cancer detection.

Europe is expected to host a significantly growing oncology biomarker market during the forecast period, due to the growing cancer burden, which is increasing the use of biomarkers for early detection. At the same time, the growing technological advancements, along with government support, are increasing their use and making them more affordable. Similarly, the expanding healthcare sector is increasing its use for R&D, genomics, clinical trials, diagnostics, and precision medicine developments, promoting the market growth.

To discover, integrate, and validate new biomarkers for effective personalized cancer detection and treatment with the use of advanced multi-omics technologies, AI, and liquid biopsies are the main focus of the R&D of oncology biomarkers.

Key Players: F. Hoffmann-La Roche Ltd., Illumina, Inc., Thermo Fisher Scientific Inc., Abbott Laboratories, QIAGEN N.V.

The clinical trials and regulatory approval of oncology biomarkers consist of the validation of their ability to predict patient response to targeted therapies, along with the drug safety and effective use of the companion diagnostic devices.

Key Players: F. Hoffmann-La Roche Ltd., Illumina, Inc., Thermo Fisher Scientific Inc., Guardant Health, QIAGEN N.V.

The patient support and services of oncology biomarkers involve access to advocacy groups for emotional and practical guidance, comprehensive education, and counseling to help patients understand results and implications for treatment, and financial assistance to cover the testing and treatment costs.

Key Players: F. Hoffmann-La Roche Ltd., Illumina, Inc., Thermo Fisher Scientific Inc., Guardant Health, QIAGEN N.V.

By Biomarker Type

By Application

By Cancer Type

By End-User

By Region

January 2026

January 2026

January 2026

January 2026