February 2026

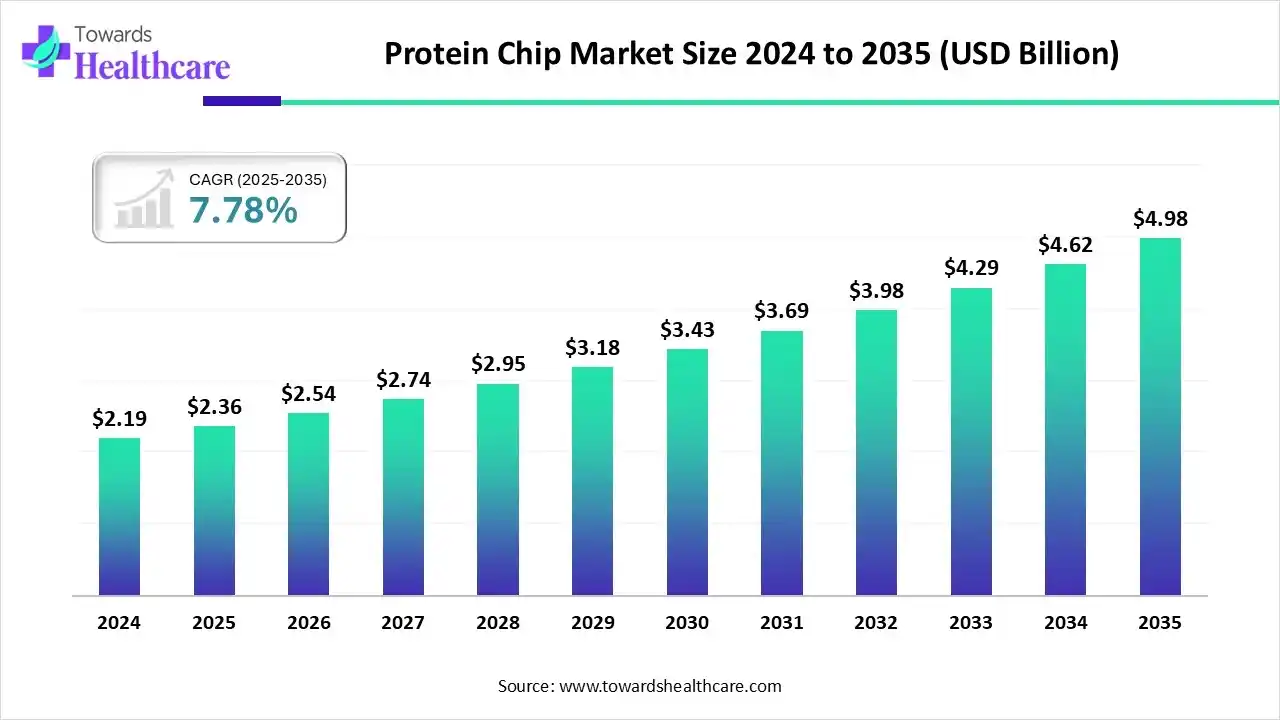

The protein chip market size marked US$ 2.36 billion in 2025 and is forecast to experience consistent growth, reaching US$ 2.54 billion in 2026 and US$ 4.98 billion by 2035 at a CAGR of 7.78%.

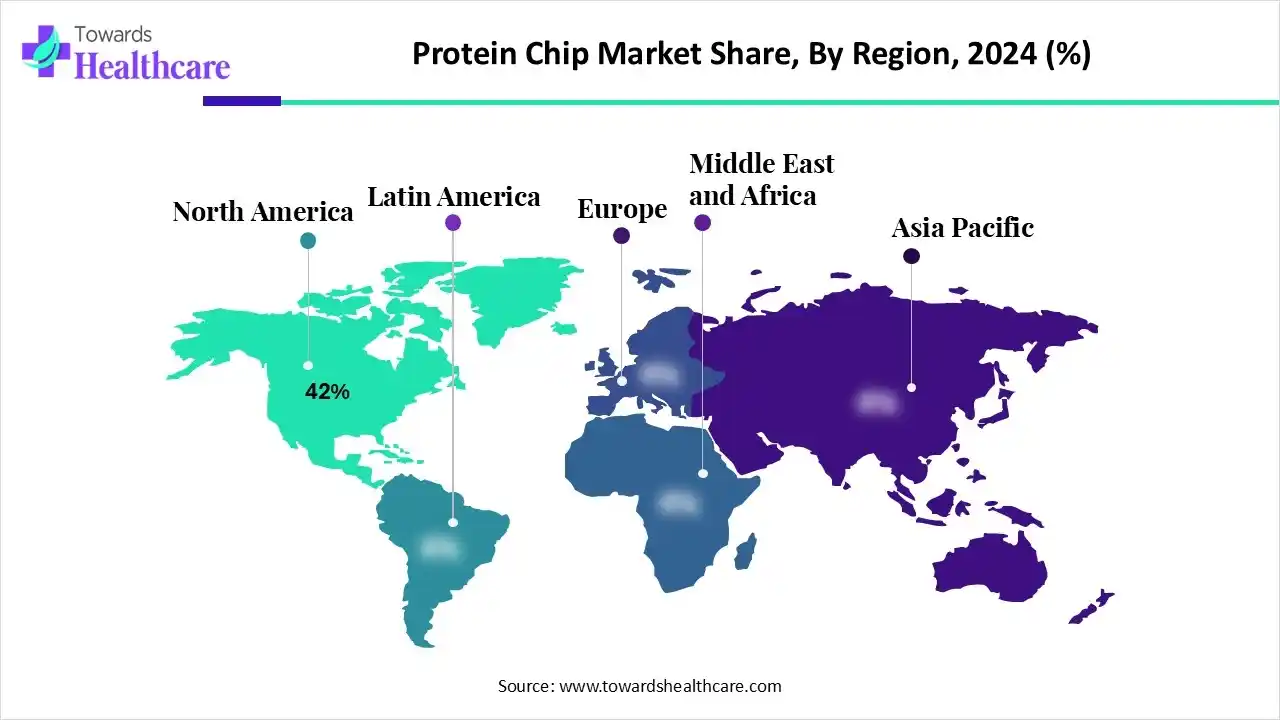

The global protein chip market is steadily growing due to advancements in proteomics, increasing demand for personalized medicine, and expanding uses in drug discovery and diagnostics. Protein chips allow high-throughput analysis, aiding biomarker discovery and disease profiling. North America dominates the market because of strong research infrastructure, significant R&D investments, and early adoption of advanced biotechnologies. Ongoing innovations, incorporation of artificial intelligence, and broader clinical applications are expected to further boost market growth in the coming years.

| Table | Scope |

| Market Size in 2025 | USD 2.36 Billion |

| Projected Market Size in 2035 | USD 4.98 Billion |

| CAGR (2026 - 2035) | 7.78% |

| Leading Region | North America by 42% |

| Market Segmentation | By Platform Type, By Application, By End User, By Detection Chemistry / Assay Type, By Product / Offering, By Region |

| Top Key Players | BioRad Laboratories, Merck KGaA, Illumina, Inc., RayBiotech Life, Inc., Arrayit Corporation, Roche Diagnostics, Danaher Corporation |

The protein chip market is fueled by rising demand for high-throughput proteomic analysis, advances in biotechnology, and the growing need for personalized medicine and biomarker discovery. Increasing research in drug development and disease diagnostics further drives its adoption. A protein chip, also known as a protein microarray, is a laboratory tool that allows for the simultaneous analysis of thousands of proteins on a single surface. It aids in studying protein interactions, functions, and expression patterns, supporting quick, accurate biomedical and pharmaceutical research.

The integration of artificial intelligence significantly improves the protein chip market by enhancing data analysis accuracy, speed, and interpretation. AI algorithms can efficiently process complex proteomic datasets, identifying subtle patterns and correlations critical for biomarker discovery, validation, and clinical diagnostics. In companion diagnostics, AI supports precise patient stratification and treatment response prediction. Machine learning models also enable automated image analysis, quality control, and real-time error detection, improving experimental reproducibility. Furthermore, AI-driven predictive modeling accelerates drug discovery and personalized medicine research, making protein chip technologies more powerful, cost-effective, and impactful across clinical and pharmaceutical applications.

Which Platform Dominates the Protein Chip Market in 2024?

The planar protein microarrays (glass slides, printed arrays) segment led the market with about 38% share in 2024. This is mainly because of their high-throughput screening ability, reliability, and ease of use. They enable the simultaneous analysis of thousands of protein interactions, making them ideal for biomarker discovery, disease diagnostics, and drug development. Their well-established technology and cost efficiency further support their widespread use.

The label-free biosensor arrays (SPR, photonic crystal, nanoplasmonic) segment is expected to grow at the fastest rate in the near future due to their ability to provide real-time, high-sensitivity detection without the need for fluorescent or radioactive labels. These platforms provide precise kinetic analysis, reduce sample preparation time, and support advanced clinical and pharmaceutical research.

The bead-based / suspension arrays (Luminex-style, flow-based) segment is expected to grow significantly in the coming period due to their high flexibility, multiplexing ability, and capacity to analyze multiple proteins at once. These arrays allow efficient quantitative analysis with minimal sample volume, making them valuable for biomarker discovery, immunoassays, and large-scale clinical research.

Why Did the Biomarker Discovery & Validation Segment Dominate the Protein Chip Market?

The biomarker discovery & validation segment dominated the market with a share of 30% in 2024, driven by rising demand for early disease detection, personalized medicine, and targeted therapy development. Protein chips facilitate high-throughput identification and analysis of disease-specific biomarkers, supporting efficient diagnostic and therapeutic research across oncology, neurology, and infectious disease applications.

The clinical diagnostics & companion diagnostics segment is expected to expand at the fastest CAGR in the coming years, fueled by the increasing need for personalized medicine and precise disease profiling. Protein chips enable rapid, multiplexed biomarker detection, improving diagnostic accuracy and treatment selection, particularly in oncology, autoimmune, and infectious disease management.

The drug target identification & pharmacodynamics segment is expected to grow notably in over the projection period due to its critical role in accelerating drug discovery and development. Protein chips support high-throughput screening of protein interactions, identification of therapeutic targets, and analysis of drug response mechanisms, enhancing efficiency, accuracy, and cost-effectiveness in pharmaceutical research and precision medicine.

What Made Pharmaceutical & Biotech Companies the Dominant Segment in the Protein Chip Market?

The pharmaceutical & biotech companies segment dominated the market with approximately 34% share in 2024 due to their extensive use of protein microarrays in drug discovery, biomarker identification, and therapeutic development. Their strong research infrastructure, high R&D investment, and focus on personalized medicine drive continuous innovation and large-scale adoption of protein chip technologies worldwide.

The clinical & diagnostic laboratories segment is expected to grow the fastest in the near future due to increasing demand for accurate, high-throughput diagnostic solutions. Protein chips allow for quick biomarker detection, disease profiling, and patient monitoring, supporting advancements in personalized medicine and improving efficiency in clinical testing and healthcare diagnostics.

The academic & research institutes segment is expected to grow significantly during the forecast period due to an increased focus on proteomics, biomarker research, and drug discovery. Rising government and institutional funding and collaborations with biotechnology firms boost the adoption of protein chips for advanced research, education, and innovation in life sciences.

Which Detection Chemistry / Assay Type Segment Leads the Protein Chip Market?

The label-based fluorescence/chemiluminescence assays segment dominated the market, accounting for approximately 45% share in 2024, due to their high sensitivity, accuracy, and ability to detect low-abundance proteins. These assays provide reliable quantitative and qualitative data, making them essential for biomarker analysis, clinical diagnostics, and drug discovery applications in both research and healthcare settings.

The label-free detection segment is expected to grow the fastest in the market because of its ability to deliver real-time, direct measurement of biomolecular interactions without needing chemical labels. This method improves data accuracy, shortens processing time, and maintains protein integrity, making it perfect for drug discovery, clinical diagnostics, and advanced proteomics research.

The enzyme-linked / colorimetric assay segment is notably expanding in the market due to its simplicity, cost-effectiveness, and compatibility with a wide range of biological samples. These assays deliver clear, visual results with reliable sensitivity, making them ideal for routine diagnostic testing, biomarker detection, and academic research in proteomics and molecular biology.

Which Product / Offering Segment Dominates the Protein Chip Market in 2024?

The protein chip kits & reagents segment led the market with about 36% share in 2024, owing to their crucial role in ensuring accurate and consistent experimental results. Growing demand for ready-to-use, standardized solutions promotes faster assay setup and greater reliability. Their widespread adoption across research institutions, diagnostic labs, and pharmaceutical companies fuels ongoing growth and revenue.

The software & data analysis tools segment is projected to grow at the highest CAGR in the market due to the rising demand for efficient management of complex proteomic data. Advanced analytical platforms provide accurate interpretation, visualization, and integration of results, supporting biomarker discovery, diagnostics, and drug development with greater precision and speed.

The array substrates & slides segment is likely to grow at a notable rate in the upcoming period due to ongoing advancements in surface chemistry, coating materials, and fabrication technologies. These improvements enhance protein binding efficiency, signal stability, and assay sensitivity, making them crucial components for reliable performance in research, diagnostics, and pharmaceutical applications.

North America dominated the protein chip market with about 42% of the share in 2024. This is mainly because of its strong biotech and pharmaceutical industries, advanced research facilities, and high investment in proteomics and personalized medicine. The region benefits from active government funding, solid clinical research, and quick adoption of new diagnostic technologies, fueling ongoing innovation and widespread use of protein chip solutions.

The U.S. is a major contributor to the North America protein chip market due to its strong biotechnology and pharmaceutical base, advanced research infrastructure, and extensive funding for proteomics. High adoption of personalized medicine, innovative R&D activities, and the presence of leading market players further strengthen its leadership position. The Asia-Pacific region is the fastest-growing in the protein chip market due to increasing investments in biotechnology research, expanding healthcare infrastructure, and rising adoption of advanced diagnostic technologies. Growing government funding, academic collaborations, and the presence of emerging biotech startups further drive innovation and market expansion across the region.

Asia Pacific is the fastest-growing region in the protein chip market, driven by increasing investments in biotechnology research, expanding healthcare infrastructure, and rising adoption of advanced diagnostic technologies. Growing government funding, academic collaborations, and the presence of emerging biotech startups further drive innovation and market expansion across the region.

China leads the Asia-Pacific protein chip market due to strong government support for biotechnology, expanding research infrastructure, and increasing investments in proteomics and personalized medicine. The presence of leading academic institutions, local biotech firms, and collaborations with global pharmaceutical companies further enhances innovation, production capacity, and adoption of protein chip technologies.

The Middle East and Africa offer significant growth opportunities in the market due to increasing healthcare modernization, rising investment in biotechnology research, and greater awareness of advanced diagnostic technologies. Expanding collaborations with global biotech companies and the development of clinical research centers are driving regional market growth.

The UAE protein chip market is steadily expanding, fueled by strong government efforts to promote biotechnology and precision medicine. Growing healthcare infrastructure, increased investment in clinical research, and collaborations with global biotech firms are encouraging the use of advanced proteomic tools for diagnostics, biomarker discovery, and personalized treatment.

The growth of the market in Europe is primarily driven by increasing investments in proteomics research, rising adoption of personalized and precision medicine, and a strong focus on early disease detection. Supportive government initiatives and funding for biomarker discovery and clinical diagnostics further boost market expansion. Additionally, the presence of advanced research infrastructure, collaborations between academic institutions and biotechnology companies, and growing demand for efficient diagnostic tools contribute to the region’s market growth.

Germany is a major contributor to the European protein chip market due to its strong biotechnology and pharmaceutical sectors, extensive research infrastructure, and high investment in life sciences innovation. The country’s focus on proteomics, personalized medicine, and advanced diagnostics, supported by government and academic collaborations, drives significant demand for protein chip technologies. Additionally, the presence of leading research institutions and biotech companies fosters continuous innovation and market growth.

The market in South America is growing due to increasing investments in healthcare infrastructure, expanding research in genomics and proteomics, and rising awareness of early disease detection and personalized medicine. Countries such as Brazil and Argentina are witnessing growth in biotechnology and clinical research, which supports the adoption of advanced diagnostic technologies like protein chips. Additionally, government initiatives to strengthen healthcare systems and collaborations with international research organizations further drive market development across the region.

Brazil is the major contributor to the South American protein chip market, driven by its growing biotechnology sector, expanding healthcare infrastructure, and increasing investments in biomedical research. The country’s strong focus on genomics, proteomics, and personalized medicine supports the adoption of advanced diagnostic technologies. Additionally, collaborations between research institutions, universities, and international organizations further enhance innovation and market growth in Brazil.

The research and development phase centers on creating innovative protein chip technologies, refining surface chemistries, and improving protein immobilization methods. It involves identifying biomarkers, developing high-throughput screening assays, and incorporating advanced detection techniques such as fluorescence, chemiluminescence, and label-free systems. R&D also includes validating protein–protein interactions and increasing chip sensitivity and reproducibility for clinical and research use.

Organizations:

Key organizations involved in this stage include major research institutions such as the National Institutes of Health (NIH), European Molecular Biology Laboratory (EMBL), and National Center for Biotechnology Information (NCBI). Leading biotechnology and life sciences companies like Thermo Fisher Scientific, Agilent Technologies, and Merck Group invest heavily in R&D to advance protein chip technologies and improve diagnostic performance.

After development, protein chips undergo rigorous clinical trials to assess analytical accuracy, sensitivity, and specificity for diagnostic and therapeutic applications. The process includes preclinical validation, multi-center trials, and comparative studies with standard diagnostic tools. Regulatory review follows, focusing on product safety, performance, and clinical utility before market authorization.

Organizations:

Clinical trials and approvals are managed by regulatory and clinical bodies such as the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and China’s National Medical Products Administration (NMPA). Clinical research organizations (CROs), hospitals, and diagnostic centers collaborate with biotechnology firms to ensure compliance with global quality and regulatory standards.

Once approved, the focus shifts to patient support, service, and post-market monitoring. This stage involves providing clinical laboratories with training, maintenance support, data analysis assistance, and continuous software updates. It also includes gathering real-world feedback to improve assay performance, ensure consistent results, and support personalized treatment approaches.

Organizations:

Key organizations offering patient support and service include Quest Diagnostics, Labcorp, and Mayo Clinic Laboratories, which facilitate the implementation of protein chip assays in clinical settings. These institutions work with biotechnology companies and healthcare providers to ensure accurate diagnostics, user training, and long-term operational reliability of protein chip platforms.

Corporate Information

Business Overview

Thermo Fisher is a global leader in lifesciences, analytical instruments, diagnostics, and biotech services. Its mission is to “enable our customers to make the world healthier, cleaner and safer.” It offers a broad range of products and services across research, diagnostics, biopharma manufacturing, and more. In the context of protein chips and proteomics, it provides microarrays, reagents, instruments, and integrated workflows for biomarker discovery, protein interaction studies, and high-throughput analysis.

Business Segments / Divisions

Geographic Presence

Thermo Fisher operates globally in more than 50 countries, with manufacturing, R&D, and commercial operations across North America, Europe, AsiaPacific, and emerging markets. For example, they have manufacturing and R&D centers in India (Mumbai, Bangalore, Nasik, and Ahmedabad) that support local markets.

Key Offerings

SWOT Analysis

Corporate Information : Headquarters: Santa Clara, California, U.S. | Year Founded: 1999 (spun off from HewlettPackard Company)

Business Overview

Agilent Technologies is a global leader in life sciences, diagnostics, and applied chemical markets, offering instruments, software, consumables, and services used in laboratories worldwide for research, testing, and diagnostics. The company supports applications ranging from proteomics and genomics research to diagnostics and applied materials analysis, positioning itself as a comprehensive solutions provider for the lab workflow ecosystem.

Business Segments / Divisions

Geographic Presence

Agilent operates in over 110 countries and maintains a global footprint with R&D, manufacturing, sales, and support operations across all major regions. Its broad presence enables it to serve markets in North America, Europe, AsiaPacific, and emerging geographies, supporting local labs and global customers.

Key Offerings

SWOT Analysis

| Vendor | Headquarters | Key Offerings / Highlights |

| PerkinElmer Inc. | U.S. | Screening arrays & microarray solutions for proteomics research and drugdiscovery applications. |

| BioRad Laboratories | U.S. | Immunoarray systems and reagent kits adapted for protein chip applications in research & diagnostics. |

| Merck KGaA | Germany | Researchgrade protein chips, slides/substrates and reagents for academic/industrial proteomics labs. |

| Illumina, Inc. | U.S. | Entry into proteogenomics and highplex protein microarrays leveraging genomics platforms. |

| RayBiotech Life, Inc. | U.S. | Specialized cytokine/antibody microarray kits focusing on biomarker discovery for immunology & inflammation. |

| Arrayit Corporation | U.S. | Custom microarray fabrication & kits for protein chips, niche/highcustomization solutions. |

| Roche Diagnostics | Switzerland | Clinical/diagnostic grade protein microarray platforms and companion diagnostics solutions. |

| Danaher Corporation | U.S. | Bioprocessing/Diagnostics arm (e.g., Cytiva): advanced protein array platforms and services. |

The global protein chip market is poised for robust expansion over the coming decade, underpinned by the accelerating adoption of high-throughput proteomics technologies and the paradigm shift toward precision and personalized medicine. The confluence of rising investments in biomarker discovery, translational research, and companion diagnostics is creating an unprecedented demand for multiplexed protein analysis platforms capable of delivering granular molecular insights.

Geographically, emerging markets in Asia-Pacific and Latin America represent significant greenfield opportunities, driven by expanding life sciences infrastructure and increasing R&D expenditures, while North America and Europe continue to consolidate market leadership through technological innovation and strategic partnerships. The market trajectory is further amplified by advancements in microarray chemistry, integrated bioinformatics, and automation workflows, which collectively enhance assay reproducibility, throughput, and analytical depth.

Consequently, the protein chip segment is uniquely positioned to capitalize on evolving therapeutic modalities, drug development pipelines, and diagnostic applications, representing a high-growth vertical within the broader molecular diagnostics and proteomics ecosystem.

By Platform Type

By Application

By End User

By Detection Chemistry / Assay Type

By Product / Offering

By Region

February 2026

February 2026

February 2026

February 2026