February 2026

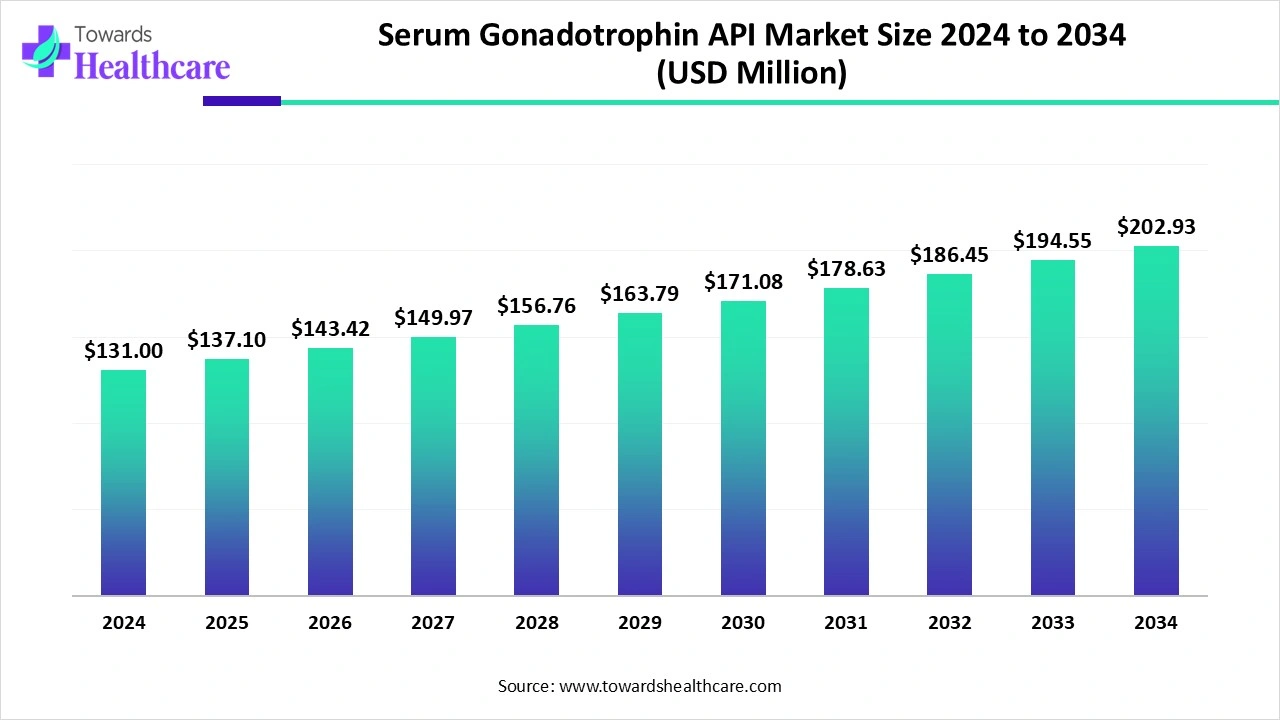

The global serum gonadotrophin API market size was estimated at US$ 131 million in 2024, projected to increase to US$ 137.1 million in 2025 and reach US$ 202.93 million by 2034, showing a healthy CAGR of 4.64% across the forecast years.

The serum gonadotrophin API market is witnessing steady growth driven by the increasing prevalence of infertility and rising adoption of assisted reproductive technologies. Growing awareness of fertility treatment options, advancements in reproductive medicine, and supportive healthcare infrastructure are further boosting demand. Additionally, the use of gonadotropins in veterinary applications for animal breeding enhances market expansion. With increasing R&D investments and broader acceptance of hormone-based therapies, the serum gonadotrophin API market is poised for significant growth in the coming years.

| Table | Scope |

| Market Size in 2025 | USD 137.1 Million |

| Projected Market Size in 2034 | USD 202.93 Million |

| CAGR (2025 - 2034) | 4.64% |

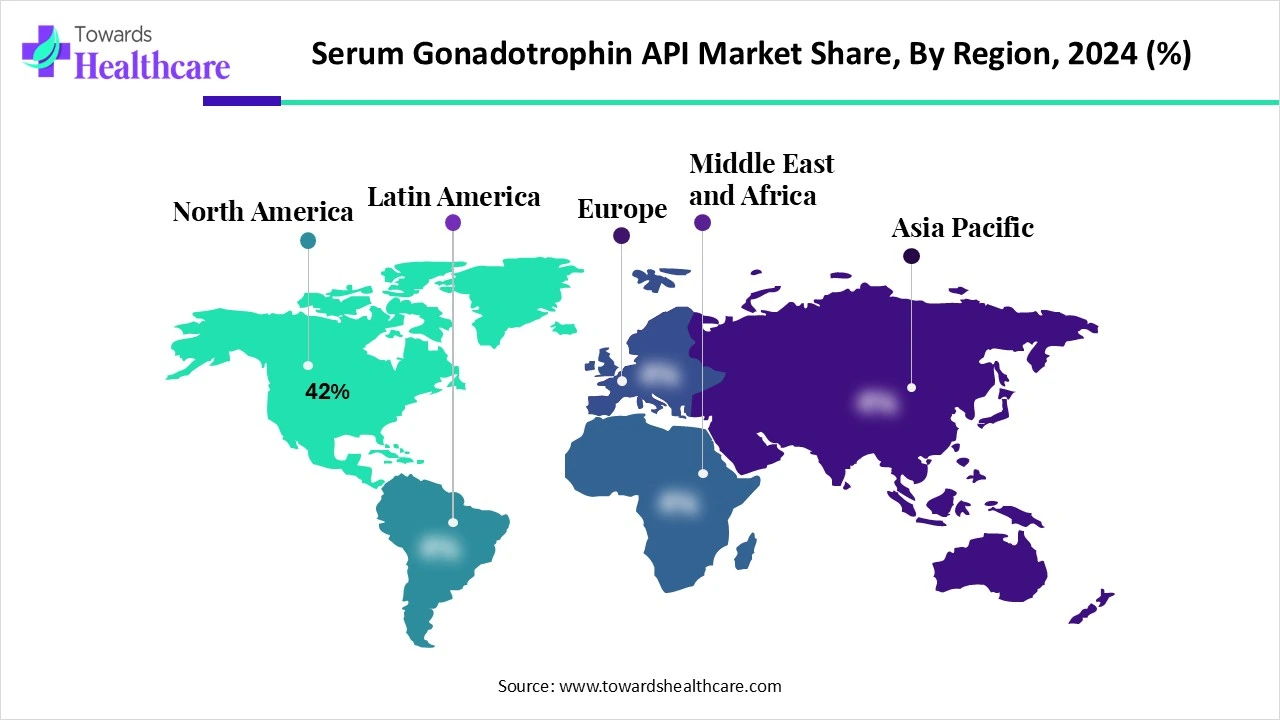

| Leading Region | North America 42% |

| Market Segmentation | By Product Type, By Source, By Application, By End User, By Region |

| Top Key Players | Merck KGaA, Ferring Pharmaceuticals, Sanofi Active Ingredients, Organon & Co., Sun Pharmaceutical Industries, Teva API, Cipla Ltd., Lupin Pharmaceuticals, Bharat Serums and Vaccines Ltd., Intas Pharmaceuticals, Aspen Pharmacare, Cadila Pharmaceuticals, Alembic Pharmaceuticals, Polypeptide Group, Gedeon Richter Plc, Jiangxi Boya Bio-Pharmaceutical, LG Chem Life Sciences, Shanghai Huilun Life Sciences, Serum Institute of India |

The Serum Gonadotrophin API (Active Pharmaceutical Ingredient) Market refers to the production and supply of active ingredients used in manufacturing therapeutic formulations of gonadotrophins, primarily sourced from animal serum or recombinant technologies. These APIs play a crucial role in reproductive medicine, fertility treatments, and veterinary applications, particularly for stimulating ovulation, improving livestock breeding, and managing reproductive disorders. The demand is driven by rising infertility rates, increasing use of assisted reproductive technologies (ART), and growing adoption of hormonal therapies in both human and veterinary healthcare.

The serum gonadotrophin API market is evolving with expanding applications beyond fertility, including hormonal research and animal health management. Increasing focus on personalized reproductive care is encouraging the development of tailored hormone therapies. Moreover, the rise of contract manufacturing and outsourcing is improving global supply chains, making APIs more accessible in cost-sensitive regions. Growing interest in sustainable and ethically sourced biological materials is also influencing production practices, reshaping the market direction, and opening new growth opportunities worldwide.

AI is set to influence the market by enabling advanced biomarker discovery and improving patient selection for hormone therapies. Its use in real-time monitoring and predictive analytics can enhance treatment success rates in fertility care. AI-driven automation in laboratories also reduces human error while increasing throughput in hormone analysis. Furthermore, integration of AI with digital health platforms supports remote patient management, offering new opportunities for tailored reproductive solutions and expanding the overall market potential.

Rising Infertility Rates Worldwide

The increasing prevalence of reproductive disorders, including hormonal imbalances and age-related fertility decline, is driving the serum gonadotrophin API market. Growing awareness of fertility treatment and rising accessibility to specialized clinics have led to higher adoption of ovulation-inducing therapies. Additionally, delayed childbearing and environmental factors affecting reproductive health have created a sustained need for gonadotropin-based interventions, further fueling demand for high-quantity APIs in both developed and emerging markets.

High Production Cost

The high production cost of serum gonadotrophin APIs restrains the market due to the need for sourcing large volumes of biological material and maintaining controlled manufacturing environments. Additionally, batch-to-batch variability and complex downstream processing increase operational expenses. These factors result in higher pricing for end-users, limiting widespread adoption in emerging markets and small clinics.

Expansion of Assisted Reproductive Technologies

The growing adoption of assisted reproductive technologies (ART) offers a promising opportunity for the serum gonadotrophin API market, as healthcare providers increasingly integrate advanced fertility treatments into routine care. Innovation in ART protocols, including personalized dosing and combination therapies, requires reliable and high-quality gonadotropin APIs. Additionally, rising government initiatives and insurance coverage supporting fertility treatment in several countries are expanding patient access, creating a broader market for serum-derived APIs and encouraging manufacturers to scale production and invest in new formulations.

The human chorionic gonadotrophin (hCG) segment leads the market in revenue because of its versatility beyond fertility treatment. It is increasingly used in therapeutic areas such as weight management, hormone replacement therapy, and certain metabolic disorders. Moreover, ongoing research and clinical application exploring long-acting and recombinant HCG formulations have enhanced its demand. Strong clinician preference, established manufacturing processes, and growing awareness of its multi-purpose benefits contribute to its dominant market share compared to other gonadotropin products.

The luteinizing hormone (LH) segment is projected to register the fastest CAGR due to increasing research on its role in targeted fertility therapies and emerging applications in reproductive endocrinology. Innovative in recombinant LH production, improved stability, and precise dosing options are enhancing its clinical adoption. Additionally, growing investments in specialty fertility clinics, combined with rising demand for combination hormone therapies that optimize treatment outcomes, are fueling rapid market growth, making LH a high-potential segment compared to other gonadotrophins.

The urinary-derived gonadotrophins segment dominates the serum gonadotrophin API market in 2024 because of its established production infrastructure and consistent supply across global markets. Many healthcare providers prefer these products due to their proven clinical outcomes over decades of use. Furthermore, ongoing improvements in purification techniques have enhanced their safety and potency, making them reliable for large-scale fertility treatments. The combination of affordability, accessibility, and sustained physician trust has enabled urinary-derived gonadotrophins to capture the largest revenue share compared to other sources.

The recombinant gonadotrophins segment is projected to grow fastest CAGR in the serum gonadotrophin API market due to advancements in biomanufacturing and increasing production for innovative fertility solutions. Its scalable production ensures consistent quality and batch-to-batch uniformity, appealing to clinics and patients seeking reliable outcomes. Additionally, the segment benefits from rising research into next-generation fertility treatments. Long-acting formulations and combination therapies. Expanding access in emerging markets, coupled with growing confidence among healthcare providers in the effectiveness and regulatory acceptance of recombinant products, further fuels their rapid adoption and market growth.

The human fertility treatment segment dominated the market in 2024 because of the rising focus on delayed parenthood and age-related fertility decline. Increasing government initiatives, insurance coverage for fertility therapies, and enhanced access to specialized clinics have encouraged more patients to seek treatment. Additionally, innovations in treatment protocols, combination hormone therapies, and personalized dosing strategies have improved success rates, boosting demand for gonadotropin APIs. These factors collectively contributed to the segment capturing the largest market share during the year.

The veterinary reproductive health segment is projected to grow rapidly due to increased investment in animal husbandry and livestock productivity worldwide. Rising demand for meat, dairy, and other animal-derived products has encouraged farmers to adopt reproductive interventions, including gonadotropin-based treatments. Additionally, advances in veterinary biotechnology, government support for breeding programs, and growing awareness of animal fertility management in emerging markets are fueling adoption, positioning veterinary reproductive applications as the fastest-growing segment in the serum gonadotrophin API market during the forecast period.

The pharmaceutical & biopharmaceutical companies segment led the market in 2024 because of their ability to meet growing global demand for gonadotropin APIs through large-scale, standardized production. Their focus on quality assurance, regulatory compliance, and advanced formulation development enables them to supply both domestic and international markets efficiently. Additionally, strategic collaborations, licensing agreements, and expansion into emerging markets have strengthened their distribution networks, allowing these companies to capture the largest revenue share compared to hospitals, clinics, or research institutions.

The fertility clinics segment is projected to grow at the fastest CAGR in the serum gonadotrophin API market due to the expansion of outpatient fertility services and rising patient preference for specialized care. Increased investments in clinic infrastructure, adoption of innovative treatment protocols, and integration of telemedicine for remote fertility consultations are boosting demand for gonadotropin APIs. Moreover, supportive government policies, insurance coverage for fertility treatments in select regions, and a growing focus on improving success rates in assisted reproductive technologies are driving the rapid growth of this end-user segment.

North America led the market share 42% in 2024 due to growing demand for advanced fertility solutions and rising prevalence of age-related infertility. The presence of major pharmaceutical and biotech companies, robust R&D infrastructure, and early adoption of recombinant gonadotropins contributed to strong market performance. Additionally, increasing government support for fertility programs, widespread clinical trials, and high consumer awareness about reproductive health enabled rapid uptake of gonadotropin APIs, securing the largest revenue share of the region compared to other global markets.

The U.S. market is driven by increasing focus on personalized fertility therapies and the adoption of cutting-edge reproductive technologies. Expansion of specialty fertility centers, government initiatives supporting reproductive health, and growing investments in biopharmaceutical manufacturing enhance API availability. Moreover, rising trends in delayed parenthood, along with greater awareness of male and female infertility treatments, are fueling demand. These factors position the U.S. as a leading market with significant growth potential in the global serum gonadotrophin API sector.

The API market is witnessing growth due to increasing focus on reproductive health and the rising prevalence of infertility among couples. The strong regulatory framework of the country ensures high-quality API production, while innovations in fertility treatments, including personalized hormone therapies, are boosting adoption. Additionally, collaborations between local biopharmaceutical companies and fertility clinics, coupled with growing awareness of assisted reproductive technologies, are expanding market penetration, positioning Canada as a promising and steadily growing market for serum gonadotrophin APIs.

Asia PAcic is projected to grow fastest because of the rising focus on outpatient and boutique fertility services that offer tailored treatment plans. Increased investments in clinic infrastructure, advanced diagnostic tools, and cutting-edge reproductive technologies are driving higher adoption of gonadotropin APIs. Furthermore, growing collaborations between clinics and biopharmaceutical companies, coupled with patient demand for faster and more effective fertility solutions, are accelerating market expansion, positioning fertility clinics as the most rapidly growing end-user segment in the forecast period.

Regulatory Approvals: Regulatory approval for serum gonadotrophin APIs varies by region but typically requires compliance with Good Manufacturing Practices (GMP). Manufacturers must submit a Drug Master File (DMF) to authorities such as the U.S. FDA or CDSCO of India, and may also need a Certificate of Suitability (CEP) for the European market. These approvals ensure product quality, safety, and consistency, enabling the API to be legally manufactured, distributed, and used in therapeutic applications across different markets.

Patient Support and Services: Serum gonadotrophin APIs themselves do not offer direct patient support, as they are raw materials used by drug manufacturers. Patient assistance is instead provided by pharmaceutical companies that formulate and supply finished gonadotropin medications, ensuring access, guidance, and support for individuals undergoing fertility or related treatments.

In May 2024, Serum Institute of India (SII) announced a strategic investment in IntegriMedical by acquiring a 20% stake to advance Needle-Free Injection System (N-FIS) technology. The collaboration aims to improve patient comfort, reduce needle-stick injuries, enhance compliance, and increase the effectiveness of liquid medications. SII CEO Adar Poonawalla stated that this investment aligns with the mission of SII to make healthcare accessible and could revolutionize vaccine delivery, offering a more comfortable experience for patients and healthcare providers.

By Product Type

By Source

By Application

By End User

By Region

February 2026

January 2026

December 2025

November 2025